Vietnam Pro AV Market Size, Share, Trends and Forecast by Solution, Distribution Channel, Application, and Region, 2025-2033

Vietnam Pro AV Market Overview:

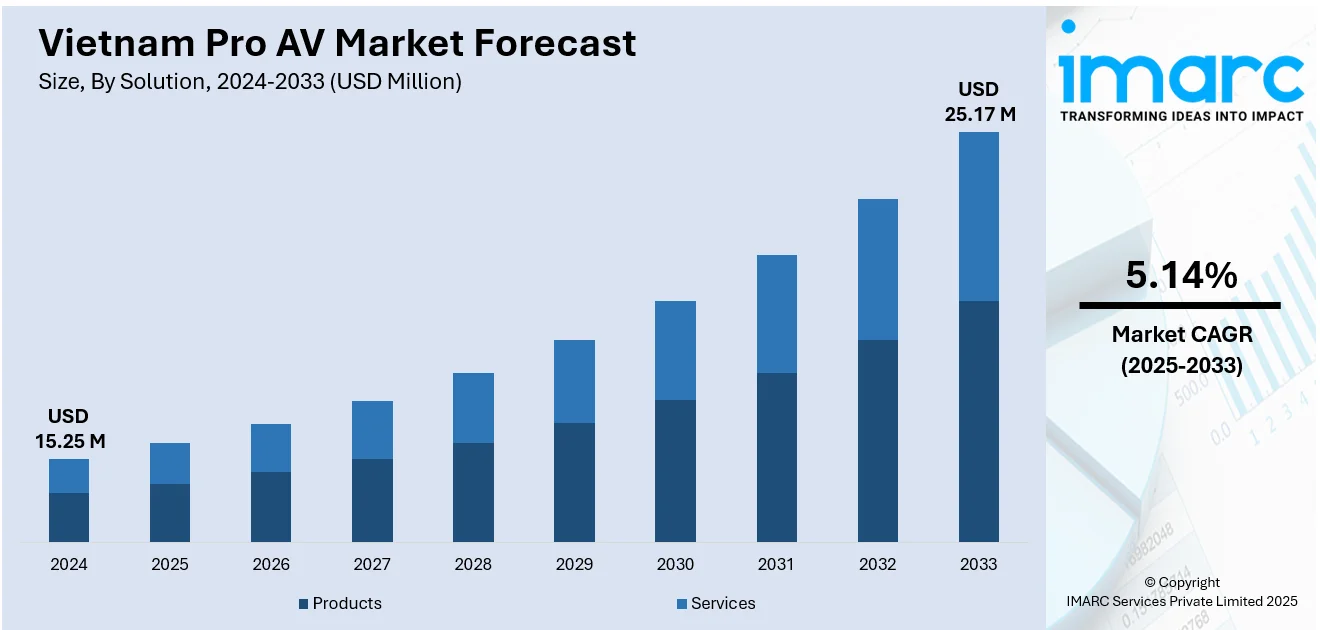

The Vietnam Pro AV market size reached USD 15.25 Million in 2024. The market is projected to reach USD 25.17 Million by 2033, exhibiting a growth rate (CAGR) of 5.14% during 2025-2033. The market is expanding due to the increasing use of advanced AV systems across hospitality, education, and government sectors. Moreover, growing demand for smart classrooms, high-end conference setups, and tourism-driven AV upgrades continues to support Vietnam Pro AV market share across public and private applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.25 Million |

| Market Forecast in 2033 | USD 25.17 Million |

| Market Growth Rate 2025-2033 | 5.14% |

Vietnam Pro AV Market Trends:

Rising Demand from Hospitality Sector

The Vietnam Pro AV market growth is being significantly driven by the growing demand for high-quality audiovisual solutions in the hospitality and tourism sectors. There has been a significant surge in investments from hotels, resorts, and convention centers in enhancing guest experience as well as backing events as the nation becoming a major destination for global tourists. Advanced audio-visual equipment like LED video walls, immersive sound systems, and centralized control solutions are being sought after by these institutions. In urban centers such as Ho Chi Minh City, Hanoi, and Da Nang, there is a growing demand for adopting cutting-edge technology for conferences, conventions, and live events, which in turn fuels the demand for Pro AV products. Efforts by the government to encourage tourism and business events also drive this growth. The growing popularity of hybrid and virtual conferences further enhances the demand for professional AV installations. As Vietnam's hospitality industry continues to grow, it is anticipated that the market for innovative AV solutions will increase exponentially. In addition, developments in energy-efficient and space-saving AV technology have made these systems more attractive to venues concerned with contemporary design aesthetics. The hospitality industry continues to be one of the key drivers of growth in Vietnam's Pro AV market.

To get more information on this market, Request Sample

Integration in Government and Education

The integration of audiovisual solutions within the government and educational sectors is playing a pivotal role in shaping the Pro AV market in Vietnam. In education, the country’s push towards digital transformation has led to the widespread adoption of interactive displays, video conferencing tools, and lecture capture systems across schools and universities. These institutions are equipping classrooms with smart technology to facilitate online learning, distance education, and improved classroom interaction. Similarly, the Vietnamese government is investing heavily in digital infrastructure for smart cities, with Pro AV solutions being used in traffic control centers, public safety command posts, and government meeting rooms. These initiatives are creating demand for secure, high-definition communication systems and advanced AV technologies that can support critical public sector operations. The trend of digitizing public services is also reflected in the need for modern AV systems for broadcasting and information dissemination in public spaces. Moreover, training programs focused on the operation and maintenance of Pro AV systems are being introduced to build a skilled workforce capable of managing these technologies. As these sectors evolve, the demand for Pro AV solutions in Vietnam is expected to continue growing, further solidifying the role of government and education as key drivers in the country's AV market.

Vietnam Pro AV Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on solution, distribution channel, and application.

Solution Insights:

- Products

- Display

- AV Acquisition and Delivery Products

- Projectors

- Sound Reinforcement Products

- Conferencing Products

- Others

- Services

- Installation Services

- Maintenance Services

- IT Networking Services

- System Designing Services

- Others

The report has provided a detailed breakup and analysis of the market based on the solution. This includes products (display, AV acquisition and delivery products, projectors, sound reinforcement products, conferencing products, and others) and services (installation services, maintenance services, IT networking services, system designing services, and others).

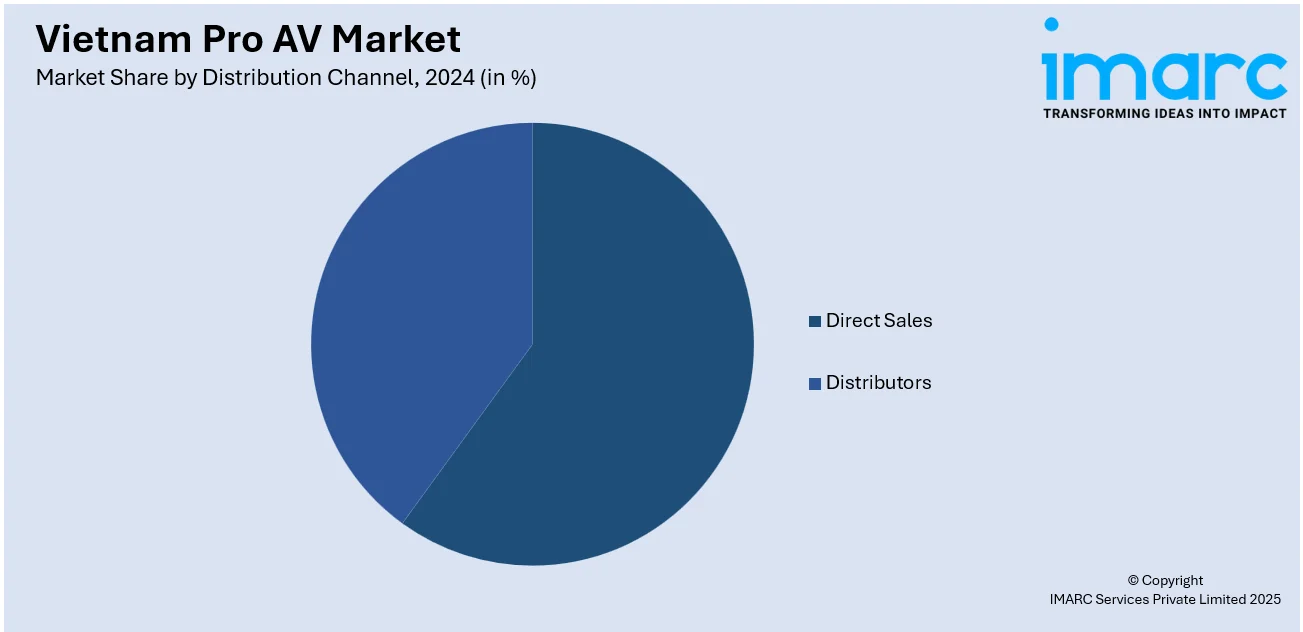

Distribution Channel Insights:

- Direct Sales

- Distributors

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales and distributors.

Application Insights:

- Home Use

- Commercial

- Education

- Government

- Hospitality

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes home use, commercial, education, government, hospitality, and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Pro AV Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Distribution Channels Covered | Direct Sales, Distributors |

| Applications Covered | Home Use, Commercial, Education, Government, Hospitality, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam pro AV market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam Pro AV market on the basis of solution?

- What is the breakup of the Vietnam Pro AV market on the basis of distribution channel?

- What is the breakup of the Vietnam Pro AV market on the basis of application?

- What is the breakup of the Vietnam Pro AV market on the basis of region?

- What are the various stages in the value chain of the Vietnam Pro AV market?

- What are the key driving factors and challenges in the Vietnam Pro AV market?

- What is the structure of the Vietnam Pro AV market and who are the key players?

- What is the degree of competition in the Vietnam Pro AV market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam Pro AV market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam Pro AV market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam Pro AV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)