Vietnam Recycled Plastics Market Size, Share, Trends and Forecast by Material, Application, and Region, 2025-2033

Vietnam Recycled Plastics Market Size and Share:

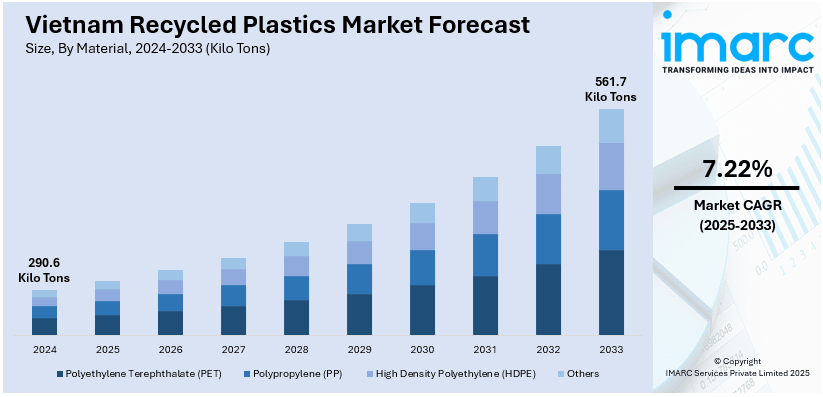

The Vietnam recycled plastics market size was valued at 290.6 Kilo Tons in 2024. Looking forward, IMARC Group estimates the market to reach 561.7 Kilo Tons by 2033, exhibiting a CAGR of 7.22% during 2025-2033. Southern Vietnam dominated the market in 2024 due to its dense industrial base, high urban population, and established waste collection systems. The region hosts key manufacturing hubs and export zones, driving consistent demand for recycled inputs. Its infrastructure and access to ports also support efficient processing and cross-border material movement, further contributing to Vietnam recycled plastics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

290.6 Kilo Tons |

|

Market Forecast in 2033

|

561.7 Kilo Tons |

| Market Growth Rate 2025-2033 | 7.22% |

Key drivers of the Vietnam recycled plastics market include growing environmental concerns over unmanaged waste and rising landfill pressures, prompting a shift toward sustainable material use. Government initiatives promoting a circular economy, such as targets for increased recycling rates and restrictions on single-use plastics, are pushing both public and private sectors to adopt recycled alternatives. Industrial demand is increasing as manufacturers seek cost-effective and eco-friendly raw materials to meet green production goals and comply with emerging regulations. International trade dynamics, especially cross-border demand for recycled inputs, are also contributing to market growth. Additionally, rising awareness among consumers about sustainability, encouraging greater participation in waste segregation and recycling efforts, is one of the major factors propelling the Vietnam recycled plastics market growth. Advancements in local recycling infrastructure and technology are further improving collection, processing efficiency, and overall material recovery across the plastic value chain.

Southeast Asia is increasingly emphasizing the development of recycling policies, with a focus on extended producer responsibility (EPR) programs and cross-border trade of recycled plastics. This shift is set to drive sustainable waste management practices, promoting regional collaboration and regulatory advancements in the recycling sector. For instance, the 4th ASEAN Circular Plastics Summit, scheduled for May 29–30, 2025, in Ho Chi Minh City, will focus on Southeast Asia's recycling policies, including extended producer responsibility (EPR) programs and cross-border trade of recycled plastics.

Vietnam Recycled Plastics Market Trends:

Policy Push toward Circular Use

Vietnam is advancing toward a circular use model as plastic waste generation far outpaces recycling capacity. With most waste ending up in landfills, national efforts are now centered on boosting recovery rates, encouraging eco-friendly substitutes, and limiting non-biodegradable plastics in key areas. Government targets for 2025 reflect a shift in priorities, aiming to strengthen recycling infrastructure, cut marine litter, and increase public participation in responsible plastic management. Based on a study published in April 2025, Vietnam generates 3.1 million tons of plastic waste annually, with a recycling rate of about 20%. Due to inadequate infrastructure, 70% of plastic waste ends up in landfills. The government is focusing on a circular economy and has set targets for 2025, including increasing recycling, replacing single-use plastics with eco-friendly alternatives, banning non-biodegradable plastics in tourist areas, and reducing marine plastic litter by 85%.

Growing Focus on Waste Recovery and Reuse

Based on the Vietnam recycled plastics market outlook, with plastic waste becoming a major environmental concern, Vietnam is witnessing increasing attention on material recovery and reuse. The shift is driven by mounting pressure on landfills, tightening environmental policies, and a broader move toward sustainability. Industries are gradually adopting recycled inputs in manufacturing, especially in packaging and everyday products. Local processing capabilities are expanding to support this transition, while public and private stakeholders alike are recognizing the need for stronger recycling infrastructure. This evolving landscape is shaping demand for recycled plastics across multiple sectors, reflecting a broader push toward responsible production and waste reduction. For instance, with more than 8,000 tons of plastic waste generated per day (WWF Viet Nam, 2021), Vietnam is one of the top ten countries in the world.

Low Recovery Rates Driving Market Shifts

The limited collection of plastic waste for recycling in Vietnam is prompting renewed focus on scaling recovery efforts. With a significant portion of used plastic left unmanaged, stakeholders are pushing for better waste segregation, expanded collection networks, and stronger community engagement. This gap in recycling efficiency is creating space for new entrants and innovations in sorting, processing, and reuse technologies. Industrial users are also beginning to seek more reliable sources of recycled materials to meet environmental standards. The Vietnam recycled plastics market forecast indicates a shift toward more structured and accountable systems for plastic reuse and recovery as regulatory frameworks continue to develop. According to a study, only 10 to 15 percent of plastic waste is currently collected for recycling in Vietnam.

Vietnam Recycled Plastics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam recycled plastics market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on material and application.

Analysis by Material:

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- High Density Polyethylene (HDPE)

- Others

Polyethylene terephthalate (PET) stood as the largest material in 2024 due to the growing demand for sustainable and eco-friendly packaging solutions. PET, commonly used in beverage bottles and food containers, has high recyclability, making it a preferred choice for recycling initiatives. In Vietnam, the increasing awareness about environmental issues, coupled with government regulations promoting recycling, has further fueled the adoption of PET recycling. The rise in consumer preference for recycled PET (rPET) products, driven by sustainability trends, supports the market's growth. Additionally, recycled PET is cost-effective compared to virgin PET, which provides significant advantages for manufacturers in Vietnam’s packaging industry, further driving the demand for PET recycling and boosting the market.

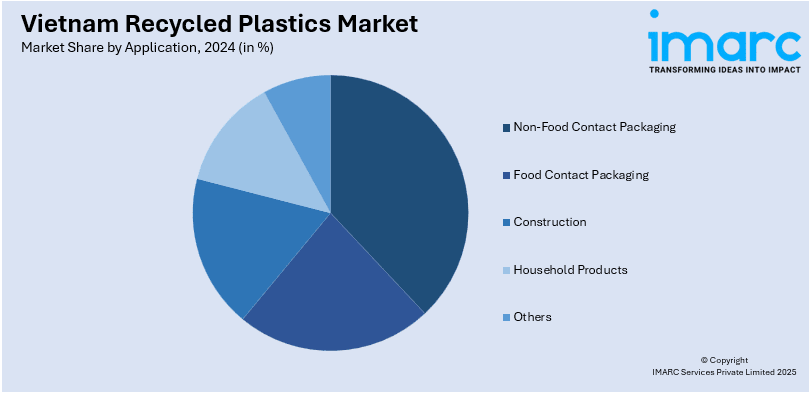

Analysis by Application:

- Non-Food Contact Packaging

- Food Contact Packaging

- Construction

- Household Products

- Others

Non-food contact packaging led the market in 2024, owing the increasing demand for eco-friendly packaging solutions in industries like retail, cosmetics, and electronics. Non-food packaging, such as plastic containers, bottles, and wrapping materials, can be easily recycled and reused, making it a key focus for sustainability efforts. As Vietnam's industries are increasingly shifting toward circular economy models, the emphasis on recycling plastics from non-food contact packaging has grown. This shift is driven by both consumer preferences for sustainable products and government policies promoting waste reduction. Additionally, recycled plastics from non-food contact packaging are less regulated compared to food-grade plastics, leading to a higher availability of materials for recycling, thus supporting the growth of the market.

Regional Analysis:

- Southern Vietnam

- Northern Vietnam

- Central Vietnam

In 2024, Southern Vietnam accounted for the largest market because of its industrial and economic prominence. This region is home to key manufacturing hubs, including Ho Chi Minh City, which is a focal point for plastics production, recycling, and consumption. The high concentration of industries such as packaging, electronics, and textiles in Southern Vietnam generates a significant volume of plastic waste, which creates a steady supply of recyclable materials. Moreover, Southern Vietnam's well-developed infrastructure, including ports and logistics networks, facilitates efficient collection and processing of recycled plastics. Additionally, local government initiatives promoting environmental sustainability and waste management programs further support the growth of the recycling sector in this region, driving the overall market expansion in Vietnam.

Competitive Landscape:

The market is experiencing significant growth due to recent developments in various sectors. Product launches and collaborations between companies are common, aimed at enhancing recycling technologies and increasing the adoption of eco-friendly materials. Partnerships and agreements between private companies and local governments have also been instrumental in advancing recycling infrastructure. Government initiatives, such as stricter regulations on waste management and plastic usage, play a vital role in promoting sustainability. Research and development efforts are focused on improving recycling efficiency and developing innovative plastic alternatives, while funding support is increasing to drive market expansion and technological advancement.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam recycled plastics market with detailed profiles of all major companies, including:

- Vinh Thanh Corporation

- Trinh Nghi Joint Stock Company

- Import and Export Joint Stock Company Suwon Vina

- Quynh Quyen Hung Yen Trading & Production Company Limited

- Trang Yen Plastic Trading Company Limited

- Hung Phu Plastic Investment Company Limited

- Tran Thanh Phat Company

- Tin Thanh Plastic Production - Trading Co. Ltd

- Hiep Phat Plastic Trading Manufacturing Co. Ltd.

- Thien Phuoc Production & Trading Co. Ltd.

Latest News and Developments:

- April 2025: UNDP Viet Nam and the Norwegian Embassy signed a new agreement to support circular and sustainable waste management. The project will promote waste separation at source, establish a Material Recovery Facility, and co-process non-recyclable waste in cement kilns. It will also pilot a Deposit Return Scheme for plastic packaging.

- April 2025: Singapore-based recycler Circular Plastics (CPC) will launch its second facility in Ba Ria–Vung Tau, Vietnam, in late May. The plant will produce 25,000 t/yr of rPET flakes and 14,000 t/yr of rPET pellets, expanding CPC’s capacity alongside its existing Myanmar facility.

- November 2023: Stavian Recycling is developing the Stavian Recycled Plastic Plant in northern Việt Nam to promote a circular economy. The project aims to address plastic waste pollution and conserve natural resources. Using advanced European technology, it ensures high-quality rPET resin production. The plant will establish a safe and efficient recycling supply chain.

- March 2023: ALBA Group Asia and VietCycle signed an agreement to develop Vietnam’s largest food-grade PET/HDPE plastic recycling plant. The project aims to enhance waste management and recycling in the country. Officials from Vietnam and Germany endorsed the initiative. It supports Vietnam’s fight against environmental pollution.

Vietnam Recycled Plastics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | ‘000 Tons |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Materials Covered | Polyethylene Terephthalate (PET), Polypropylene (PP), High Density Polyethylene (HDPE), Others |

| Applications Covered | Non-Food Contact Packaging, Food Contact Packaging, Construction, Household Products, Others |

| Regions Covered | Southern Vietnam, Northern Vietnam, Central Vietnam |

| Companies Covered | Vinh Thanh Corporation, Trinh Nghi Joint Stock Company, Import and Export Joint Stock Company Suwon Vina, Quynh Quyen Hung Yen Trading & Production Company Limited, Trang Yen Plastic Trading Company Limited, Hung Phu Plastic Investment Company Limited, Tran Thanh Phat Company, Tin Thanh Plastic Production - Trading Co. Ltd, Hiep Phat Plastic Trading Manufacturing Co. Ltd. and Thien Phuoc Production & Trading Co. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam recycled plastics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Vietnam recycled plastics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the recycled plastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The recycled plastics market in Vietnam was valued at 290.6 Kilo Tons in 2024.

The Vietnam recycled plastics market is projected to exhibit a CAGR of 7.22% during 2025-2033, reaching a value of 561.7 Kilo Tons by 2033.

The Vietnam recycled plastics market is driven by increasing environmental awareness, government regulations promoting waste management, rising demand for sustainable packaging, and growing consumer preference for eco-friendly products. Additionally, the expansion of the recycling infrastructure and technological advancements in plastic processing further support market growth.

Some of the major players in the Vietnam recycled plastics market include Vinh Thanh Corporation, Trinh Nghi Joint Stock Company, Import and Export Joint Stock Company Suwon Vina, Quynh Quyen Hung Yen Trading & Production Company Limited, Trang Yen Plastic Trading Company Limited, Hung Phu Plastic Investment Company Limited, Tran Thanh Phat Company, Tin Thanh Plastic Production - Trading Co. Ltd, Hiep Phat Plastic Trading Manufacturing Co. Ltd., Thien Phuoc Production & Trading Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)