Vietnam Running Gear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2025-2033

Vietnam Running Gear Market Overview:

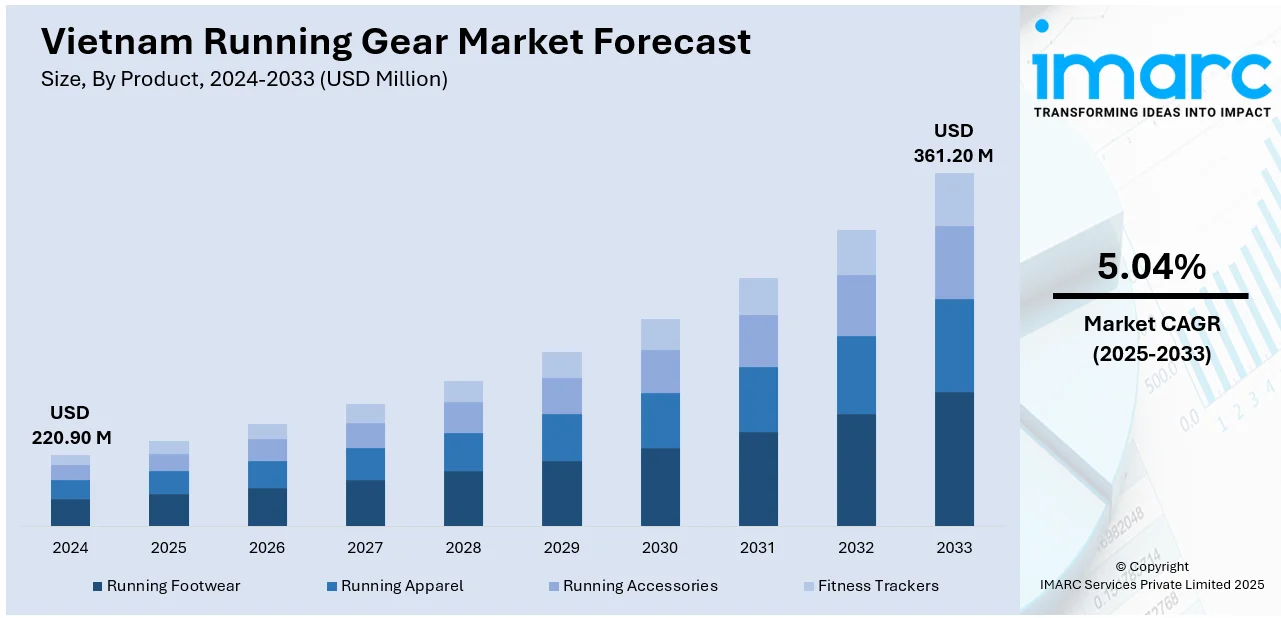

The Vietnam running gear market size reached USD 220.90 Million in 2024. Looking forward, the market is projected to reach USD 361.20 Million by 2033, exhibiting a growth rate (CAGR) of 5.04% during 2025-2033. The market is driven by widespread adoption of running among Vietnam’s urban youth, motivated by wellness goals and social identity. Public infrastructure upgrades and mass running events are accelerating visibility and first-time gear purchases. Expansion of local and regional brands tailored to price-sensitive consumers is further augmenting the Vietnam running gear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 220.90 Million |

| Market Forecast in 2033 | USD 361.20 Million |

| Market Growth Rate 2025-2033 | 5.04% |

Vietnam Running Gear Market Trends:

Youth-Led Fitness Adoption and Urban Lifestyle Shift

Vietnam’s growing urban youth population is increasingly embracing running as a popular, cost-effective form of fitness. With more than half the population under 35, fitness consciousness is rising, driven by social media, influencers, and widespread smartphone use. Cities like Ho Chi Minh City and Hanoi have seen a surge in early-morning and evening runners, especially among office workers and students. Government campaigns promoting physical activity and national fitness challenges have further popularized running as part of a modern, health-oriented lifestyle. The trend aligns with broader societal shifts, rising disposable incomes, time-flexible employment, and expanding wellness awareness. Runners actively seek shoes with impact support, moisture-wicking clothing, and lightweight accessories suited for Vietnam’s tropical climate. Vietnam’s athletic footwear market is projected to reach USD 114.26 Million in 2025 and grow to USD 163.67 Million by 2029, with an annual growth rate of 9.4%. The user base is expected to increase to 6.1 Million by 2029, raising penetration from 5.1% to 6.1%. Average revenue per user is estimated at USD 24.26. Brands that cater to breathable fabrics and UV-protection are gaining traction among these climate-aware consumers. Participation in urban marathons, fun runs, and corporate wellness events has grown, introducing new runners to technical gear markets. With fitness increasingly associated with personal achievement and social identity, young Vietnamese consumers are prioritizing function, aesthetics, and value in their gear purchases. This enthusiastic adoption of active lifestyles is a key force driving Vietnam running gear market growth, supported by a tech-savvy and aspirational youth segment.

To get more information on this market, Request Sample

Rise of Local Brands and Regional Market Adaptation

Vietnam’s running gear market is increasingly influenced by the emergence of domestic and regional brands that tailor their offerings to local needs. Unlike premium international labels that dominate in metropolitan malls, homegrown companies offer cost-competitive products adapted to Vietnamese body types, climate conditions, and aesthetic preferences. Local brands emphasize affordability, comfort, and lightweight materials in running shoes and apparel, prioritizing value while maintaining functional design. The growing number of marathons and charity runs across provinces has encouraged both beginners and experienced athletes to invest in performance apparel and footwear, and affordable options appeal to first-time runners and students with modest budgets, allowing greater market inclusion. Vietnam is projected to reach USD 44 Billion in garment exports in 2024. In parallel, regional brands from South Korea, Thailand, and China have expanded aggressively, leveraging Vietnam’s ASEAN trade benefits and retail penetration in Tier 2 and Tier 3 cities. Social media commerce and livestream shopping platforms are proving especially effective for brand visibility and community engagement. Vietnam’s younger consumers are responsive to digital-first brands that highlight authenticity, user-generated content, and performance feedback. Additionally, sustainability narratives—such as recycled fabrics and ethical sourcing—are beginning to resonate, especially among eco-conscious Gen Z shoppers. As domestic and regional brands innovate and localize more aggressively, price-sensitive consumers are shifting away from generic, unbranded gear. This localization of supply and retail strategy is solidifying a competitive, accessible, and high-growth environment in Vietnam’s running apparel and footwear ecosystem.

Vietnam Running Gear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, gender, and distribution channel.

Product Insights:

- Running Footwear

- Running Apparel

- Running Accessories

- Fitness Trackers

The report has provided a detailed breakup and analysis of the market based on the product. This includes running footwear, running apparel, running accessories, and fitness trackers.

Gender Insights:

- Male

- Female

- Unisex

The report has provided a detailed breakup and analysis of the market based on gender. This includes male, female, and unisex.

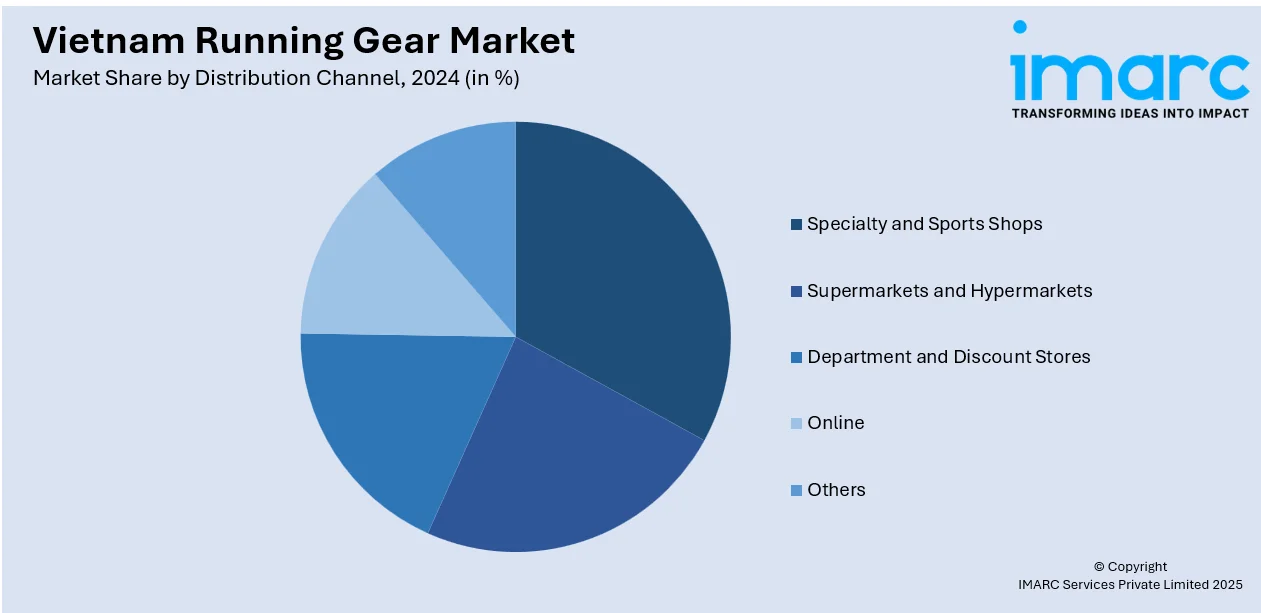

Distribution Channel Insights:

- Specialty and Sports Shops

- Supermarkets and Hypermarkets

- Department and Discount Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes specialty and sports shops, supermarkets and hypermarkets, department and discount stores, online, and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Running Gear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Running Footwear, Running Apparel, Running Accessories, Fitness Trackers |

| Genders Covered | Male, Female, Unisex |

| Distribution Channels Covered | Specialty and Sports Shops, Supermarkets and Hypermarkets, Department and Discount Stores, Online, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam running gear market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam running gear market on the basis of product?

- What is the breakup of the Vietnam running gear market on the basis of gender?

- What is the breakup of the Vietnam running gear market on the basis of distribution channel?

- What is the breakup of the Vietnam running gear market on the basis of region?

- What are the key driving factors and challenges in the Vietnam running gear market?

- What is the structure of the Vietnam running gear market and who are the key players?

- What is the degree of competition in the Vietnam running gear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam running gear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam running gear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam running gear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)