Vietnam Shrimp Market Size, Share, Trends and Forecast by Environment, Species, Shrimp Size, Distribution Channel, and Region, 2025-2033

Vietnam Shrimp Market Overview:

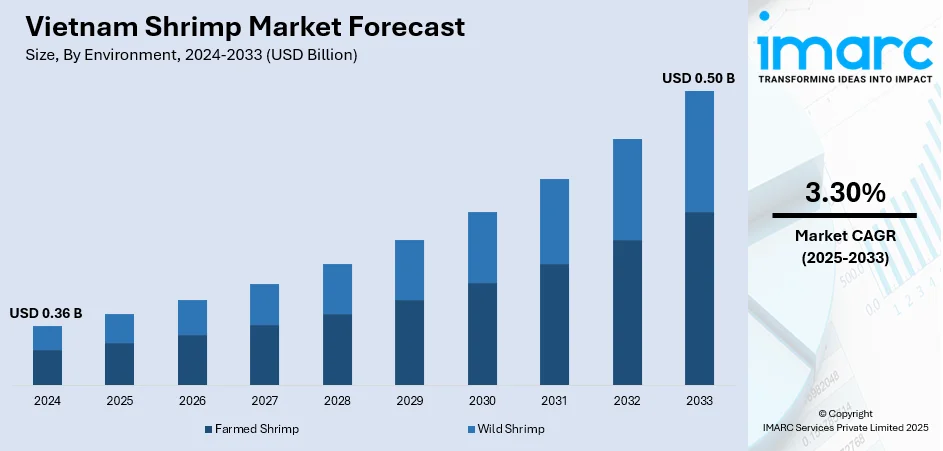

The Vietnam shrimp market size was valued at USD 0.36 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 0.50 Billion by 2033, exhibiting a CAGR of 3.30% during 2025-2033. Southern Vietnam dominated the market in 2024. Increasing global demand for seafood, favorable domestic conditions for shrimp farming, government support for sustainable practices, international trade agreements, escalating environmental concerns, and evolving consumer preferences represent some of the key factors contributing to the Vietnam shrimp market share

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.36 Billion |

| Market Forecast in 2033 | USD 0.50 Billion |

| Market Growth Rate 2025-2033 | 3.30% |

The expansion of the market is fueled by rising global demand, with major exports going to the US, EU, Japan, and China. The country benefits from cost advantages such as low labor costs, competitive feed prices, and a favorable farming climate. Supportive government policies and trade agreements like the EVFTA and CPTPP have improved access to international markets. Producers are increasingly adopting international certifications like ASC, BAP, and GLOBALG.A.P., meeting sustainability and traceability standards demanded by importers. Investments in aquaculture technology, improved farming methods, and disease control have enhanced productivity and product quality. The shift toward value-added processing also helps Vietnamese exporters stay competitive. Despite challenges like raw material shortages and environmental risks, Vietnam remains one of the leading shrimp exporters due to its adaptability, infrastructure, and focus on export-driven growth.

To get more information on this market, Request Sample

A recent industry event highlighted advances in technology, sustainability, and farming practices across Vietnam’s shrimp sector. It brought together producers, researchers, policymakers, and students, encouraging stronger ties between science and production. The focus on collaboration and knowledge sharing signals growing momentum toward more efficient and responsible shrimp farming methods. For instance, the VietShrimp 2025 Expo took place from March 26–28, featuring over 200 booths from nearly 150 domestic and international businesses and organizations. Four seminar sessions were held on March 26–27, bringing together policymakers, aquaculture experts, Mekong Delta shrimp and seafood farmers, industry leaders, and hundreds of students. The expo served as a premier platform for showcasing innovation, fostering technological advancements, and promoting sustainable Vietnam shrimp market growth.

Vietnam Shrimp Market Trends:

Rising Influence of Shrimp Farming

Shrimp farming holds a central role in Vietnam’s aquaculture sector, with growing recognition for its contribution to the national economy. Vietnam shrimp market trends show a shift toward more controlled and intensive cultivation methods to improve yields and reduce risks from disease outbreaks. Key production regions are shifting away from small-scale operations toward larger, better-managed systems. Exporters are increasingly focused on meeting the quality expectations of international buyers, especially in premium markets across Asia, Europe, and North America. Supportive government policies and expanded trade partnerships are encouraging further development. The shift toward higher-efficiency farming and global market alignment signals a steady move toward modernization across the shrimp supply chain, creating more consistent and competitive outcomes for producers and exporters alike. The aquaculture industry is recognized as one of Vietnam's leading economic sectors, contributing a significant 4-5% to the nation's GDP.

Shift in Shrimp Export Focus

Shrimp exports from Vietnam saw a major boost in early 2025, driven by soaring demand from regional markets. A sharp rise in lobster purchases played a big role, with one neighboring market now outpacing traditional destinations like the US, Japan, and the EU. This shift has changed the export landscape, with nearly a third of total shipments now headed to this fast-growing region. Exporters are adjusting their strategies, prioritizing high-value varieties and aligning supply with evolving preferences. The reallocation of trade flows reflects a clear response to stronger margins and quicker turnaround in markets showing more consistent demand and growth potential. As per the Vietnam shrimp market forecast, this momentum is setting a new direction for Vietnam’s shrimp industry. For example, in the first four months of 2025, Vietnam’s shrimp exports to China and Hong Kong hit USD 389 Million, marking a 103% surge. These markets now account for nearly 30% of Vietnam’s total shrimp exports. The sharp rise is largely fueled by booming demand for Vietnamese lobster in China, making the country the leading destination for Vietnam’s shrimp, ahead of traditional markets like the US, Japan, and the EU.

Growing Preference for Organic Shrimp Domestically

Interest in organic food is gaining ground among Vietnamese consumers, with a clear willingness to pay more for healthier and safer options. Shrimp producers targeting the local market are starting to respond by adopting cleaner farming practices and eco-certified inputs. Consumer surveys show strong intent to choose organic even at a higher price, creating new space for premium-positioned products. This shift is shaping the Vietnam shrimp market outlook, encouraging more domestic players to move beyond export-oriented models and explore value-added opportunities at home. As awareness around food safety and environmental impact continues to grow, demand for responsibly farmed shrimp is expected to rise within Vietnam’s own borders. Vietnamese consumers are willing to pay a premium for organic products. The Rakuten survey in 2023 revealed that 45% would spend up to 25% more on organic versus conventional foods.

Vietnam Shrimp Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam shrimp market, along with forecasts at the regional levels from 2025-2033. The market has been categorized based on environment, species, shrimp size, and distribution channel.

Analysis by Environment:

- Farmed Shrimp

- Wild Shrimp

Farmed shrimp stood as the largest environment in 2024. The country's warm climate, long coastline, and established aquaculture infrastructure make it ideal for shrimp farming, especially vannamei (whiteleg shrimp), which now dominates production. Rising global demand, especially from the US, Japan, and China, has encouraged Vietnamese farmers to scale up. Compared to wild-caught shrimp, farmed shrimp ensures a more consistent supply and quality, which is critical for export contracts. Government incentives and investments in disease control, hatcheries, and feed technology have further improved productivity. As smallholders adopt intensive farming techniques, yields per hectare are rising. This makes farmed shrimp not just the largest segment, but the primary growth engine for Vietnam’s shrimp exports.

Analysis by Species:

- Penaeus Vannamei

- Penaeus Monodon

- Macrobrachium Rosenbergii

- Others

Penaeus vannamei led the market in 2024 due to its higher survival rates, faster growth cycle, and better adaptability to intensive farming systems. Compared to black tiger shrimp (Penaeus monodon), vannamei is more cost-efficient and yields greater output per hectare. Vietnamese farmers are increasingly shifting to vannamei to meet large-scale export demand, especially from markets like the US, EU, and China, which favor its consistent quality and stable supply. Supportive government policies, investment in hatcheries, improved feed, and disease management have further boosted vannamei production. As a result, vannamei now accounts for the majority of farmed shrimp in Vietnam, making it the dominant species shaping the country's export volumes and aquaculture development.

Analysis by Shrimp Size:

- <21

- 21-25

- 26-30

- 31-40

- 41-50

- 51-60

- 61-70

- >70

41-50 led the market with around 21.8% of market share in 2024, owing to its strong demand in key export destinations. This size offers a balance between portion control and visual appeal, making it ideal for foodservice and retail sectors in the US, Japan, and Europe. It’s easier to handle, process, and package, which suits bulk buyers and value-added product manufacturers. Farmers prefer producing this size because it requires a moderate grow-out period, reducing risks from disease and weather. It also fetches favorable prices while maintaining efficient feed conversion rates. As Vietnam focuses on boosting exports through standardized, high-quality output, the 41-50 count size has emerged as a preferred category among both producers and international buyers.

Analysis by Distribution Channel:

.webp)

- Hypermarkets and Supermarkets

- Convenience Stores

- Hotels and Restaurants

- Online Sales

- Others

Hotels and restaurants led the market with around 32.3% of market share in 2024. As Vietnam continues to develop as a regional tourism and business hub, the hospitality industry is expanding rapidly. High-end hotels and premium restaurants are increasingly sourcing quality seafood, especially shrimp, to cater to international guests and urban consumers who expect diverse and fresh menus. This shift has boosted domestic consumption of shrimp, which was previously more export focused. Chefs and food service providers prefer shrimp for its versatility, short preparation time, and consistent taste, making it a staple in both Vietnamese and fusion cuisine. The growing number of foodservice outlets amplifies this demand, supporting sustained growth in the local shrimp supply chain.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

In 2024, Southern Vietnam accounted for the largest market share due to its ideal natural and economic conditions for aquaculture. Provinces like Ca Mau, Bac Lieu, Soc Trang, and Ben Tre have warm climates, extensive coastlines, and access to both brackish and freshwater, making them suitable for year-round shrimp farming. These areas are also home to well-established infrastructure, including hatcheries, feed mills, and processing plants, which support large-scale production and efficient export operations. Local governments have promoted shrimp farming through investment incentives, training, and disease control programs. Farmers in the region have adopted intensive and super-intensive farming techniques, boosting yields. In addition, Southern Vietnam benefits from established logistics networks and proximity to key export ports, strengthening its role as the center of the country’s shrimp production and trade.

Competitive Landscape:

Vietnam shrimp industry is seeing a surge in product innovations, partnerships, and sustainability efforts. The Shrimp Tech Vietnam project, a Dutch–Vietnamese initiative, is piloting net-zero shrimp farming using solar energy, probiotics, and biofloc systems. Large farms are adopting technologies like RAS, nano-bubble aeration, and digital farming tools. The government is actively promoting sustainable practices through policies, certifications (ASC, BAP, organic), and FTA-linked export incentives. Events like VietShrimp 2025 are connecting producers with global tech and R&D partners. Collaboration and research-driven advancements are now the most common practices, with a strong push from both the public and private sectors toward cleaner, more efficient shrimp production.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam shrimp market with detailed profiles of all major companies, including:

- Ca Mau Seafood Processing and Service Joint Stock Corporation

- Minh Phu Seafood Joint Stock Company

- Quoc Viet Co. Ltd.

- Sao Ta Foods Joint Stock Company

- Seaprimexco Vietnam

Latest News and Developments:

- May 2025: Vietnam expanded high-tech shrimp farming cooperation with Cuba, supporting a model in Camagüey that yielded 20 Tons in its first cycle. Vietnamese engineers transferred modern aquaculture technologies, boosting productivity and enabling Cuba to scale operations. The initiative created jobs, addressed food security, and strengthened bilateral agricultural cooperation.

- June 2025: The US Department of Commerce (DOC) imposed a preliminary anti-dumping duty of 35% on shrimp exported by 24 Vietnamese companies. This decision stems from the DOC’s 19th administrative review, which examined frozen warmwater shrimp imports from Vietnam between February 1, 2023, and January 31, 2024.

Vietnam Shrimp Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Environments Covered | Farmed Shrimp, Wild Shrimp |

| Species Covered | Penaeus Vannamei, Penaeus Monodon, Macrobrachium Rosenbergii, Others |

| Shrimp Sizes Covered | <21, 21-25, 26-30, 31-40, 41-50, 51-60, 61-70, >70 |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Hotels and Restaurants, Online Sales, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Companies Covered | Ca Mau Seafood Processing and Service Joint Stock Corporation, Minh Phu Seafood Joint Stock Company, Quoc Viet Co. Ltd., Sao Ta Foods Joint Stock Company, Seaprimexco Vietnam, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam shrimp market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Vietnam shrimp market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam shrimp industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The shrimp market in Vietnam was valued at USD 0.36 Billion in 2024

The Vietnam shrimp market is projected to exhibit a CAGR of 3.30% during 2025-2033, reaching a value of USD 0.50 Billion by 2033.

Vietnam shrimp market is driven by strong global demand, especially from the US, EU, and China, cost advantages from cheap labor and feed, government support through trade agreements, and rising adoption of sustainable practices with certifications like ASC and BAP. Technology and feed innovations also boost efficiency and output.

Southern Vietnam accounted for the largest share of the market in 2024 due to its favorable climate, extensive coastline, developed aquaculture infrastructure, and concentration of processing facilities supporting large-scale production and export activities

Some of the major players in the Vietnam shrimp market include Ca Mau Seafood Processing and Service Joint Stock Corporation, Minh Phu Seafood Joint Stock Company, Quoc Viet Co. Ltd., Sao Ta Foods Joint Stock Company, and Seaprimexco Vietnam, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)