Vietnam Small Cell Power Amplifier Market Size, Share, Trends and Forecast by Type, Category, Application, and Region, 2026-2034

Vietnam Small Cell Power Amplifier Market Summary:

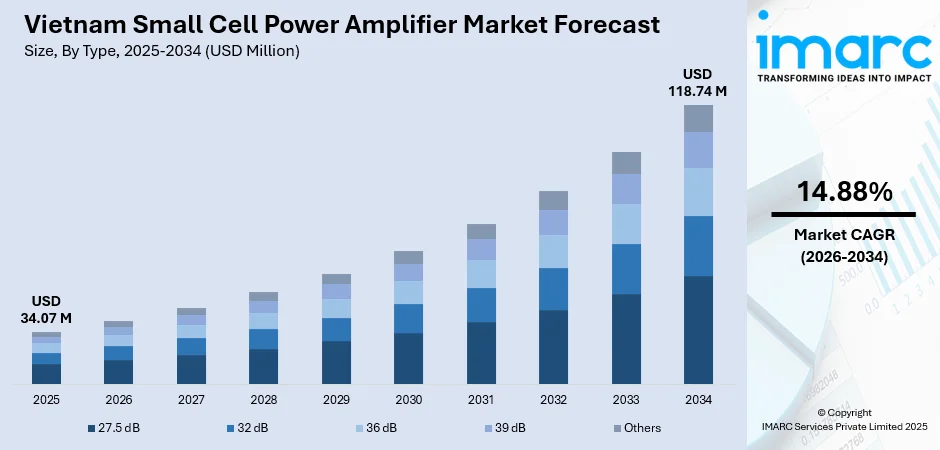

The Vietnam small cell power amplifier market size was valued at USD 34.07 Million in 2025 and is projected to reach USD 118.74 Million by 2034, growing at a compound annual growth rate of 14.88% from 2026-2034.

The market is experiencing steady growth driven by expanding mobile data usage, rising 4G densification, and early preparations for broader 5G deployment. Increasing demand for compact, energy efficient network equipment is encouraging operators to adopt small cells for improved coverage and capacity in urban and indoor environments. Advancements in RF technologies, growing enterprise digitalization, and ongoing telecom infrastructure upgrades further support the market’s positive outlook.

Key Takeaways and Insights:

- By Type: 36 dB dominates the market with a share of 28% in 2025, establishing itself as the preferred power level for optimal signal amplification and coverage efficiency in Vietnam's expanding small cell infrastructure.

- By Category: Microcell leads the market with a share 45% in 2025, driven by its balanced coverage range and capacity capabilities suitable for urban commercial areas and high-traffic public venues.

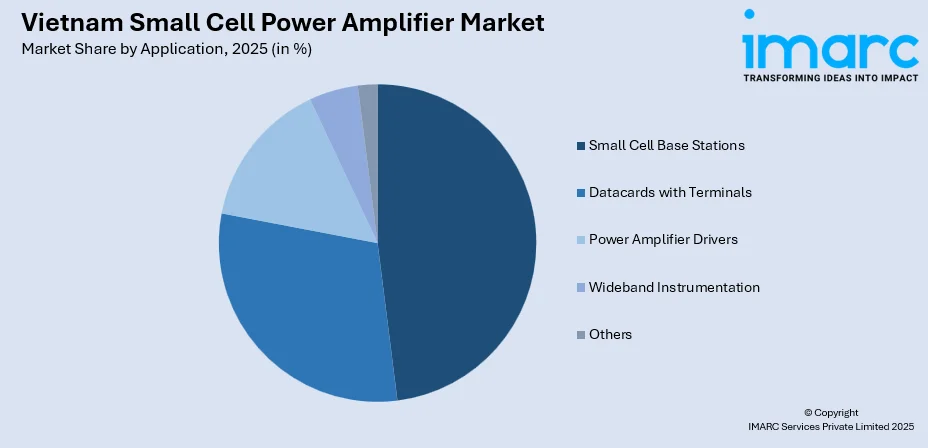

- By Application: Small cell base stations represent the largest segment with a market share of 48% in 2025, reflecting the accelerated deployment of network densification solutions across Vietnam's major metropolitan areas and industrial corridors.

- Key Players: The Vietnam small cell power amplifier market exhibits moderate competitive intensity, with global semiconductor manufacturers and RF component specialists competing alongside regional distributors. Market participants are focusing on technological innovation, energy efficiency improvements, and strategic partnerships with telecommunications operators to capture market opportunities.

To get more information on this market Request Sample

The Vietnam small cell power amplifier market is expanding as telecom operators accelerate network enhancement to meet rising data consumption and connectivity expectations. The Vietnam video streaming market size reached USD 419.2 Million in 2024, and is projected to reach USD 738.9 Million by 2033, further intensifying demand for denser, high-capacity networks. Power amplifiers enable stronger signal transmission, improved coverage, and efficient handling of heavy traffic loads across indoor and outdoor environments. Vietnam’s transition toward advanced 4G networks and phased 5G rollout is boosting requirements for compact, energy efficient amplifiers that support multi band operation. Growing investments in enterprise connectivity, smart manufacturing, and digital infrastructure are widening adoption across commercial, industrial, and public sector deployments. As network modernization advances, the market is expected to sustain strong momentum.

Vietnam Small Cell Power Amplifier Market Trends:

Rising 5G Network Expansion

The expansion of 5G networks across Vietnam is strengthening demand for high-efficiency small cell power amplifiers that support dense and high-capacity deployments. Telecom operators are increasing small cell installations to improve indoor coverage, enhance data speeds, and reduce network congestion in crowded urban locations. In July 2025, Vietnam's major mobile operators deployed 11,000 5G base stations, covering about 26% of the population. Viettel aims for 10 million subscribers and plans 20,000 additional stations, while VNPT and MobiFone focus on expanding in key locations. The government expects base stations to nearly double by the end of 2025. This trend is driving investments in compact, reliable, and energy-efficient amplifiers that can support higher frequency bands and meet the performance needs of next-generation mobile networks.

Growing Shift Toward Energy-Efficient Architectures

Energy-efficient system design is becoming a core focus as operators seek to lower operational expenses and improve long-term sustainability. Small cell power amplifier manufacturers are prioritizing solutions that deliver higher power output with reduced heat, lower energy consumption, and longer service life. This trend encourages adoption of advanced semiconductor materials, integration of intelligent power-management features, and development of compact amplifier architectures that support greener, cost-effective, and scalable telecom infrastructure.

Increasing Adoption of IoT and Smart City Infrastructure

Vietnam’s expanding IoT environment and rising investment in smart city initiatives are increasing the need for dense, reliable, and low-latency connectivity. Việt Nam prioritizes urban development as a national strategy, emphasizing coordinated efforts and resource mobilization at the Việt Nam Urban Summit 2025. Deputy Minister Nguyễn Tường Văn highlighted challenges like rapid urbanization and climate change, calling for innovations in governance, infrastructure, and community engagement to achieve sustainable, smart cities. Small cells are essential for supporting high device density, which boosts demand for compact, robust, and efficient power amplifiers. This trend is driving the development of scalable amplifier modules that support continuous connectivity, stable network performance, and flexible deployment across urban, industrial, and public infrastructure to enable large-scale digital transformation.

Market Outlook 2026-2034:

The Vietnam small cell power amplifier market is expected to experience steady growth as telecom operators accelerate 5G deployments and enhance network density to support rising data demand. Increasing urban connectivity needs, combined with expanding IoT and smart city initiatives, are reinforcing the role of compact, high-efficiency amplifiers in strengthening mobile coverage. Ongoing investments in energy-efficient architectures and advanced semiconductor technologies further support market expansion, positioning small cell power amplifiers as vital components in Vietnam’s evolving telecom infrastructure. The market generated a revenue of USD 34.07 Million in 2025 and is projected to reach a revenue of USD 118.74 Million by 2034, growing at a compound annual growth rate of 14.88% from 2026-2034.

Vietnam Small Cell Power Amplifier Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | 36 dB | 28% |

| Category | Microcell | 45% |

| Application | Small Cell Base Stations | 48% |

Type Insights:

- 27.5 dB

- 32 dB

- 36 dB

- 39 dB

- Others

The 36 dB dominates with a market share of 28% of the total Vietnam small cell power amplifier market in 2025.

The 36 dB segment dominates the Vietnam small cell power amplifier market as operators prioritize balanced signal strength for dense urban deployments. This amplification level offers an optimal blend of power efficiency, coverage stability, and heat management, making it suitable for both indoor and outdoor small cell installations. Its compatibility with multi-band architectures and advanced modulation techniques strengthens demand among telecom providers seeking reliable performance in compact footprint networks. As data traffic rises, this segment continues to expand steadily.

Demand for 36 dB amplifiers is supported by their ability to maintain strong uplink and downlink performance in areas with fluctuating network loads. Their efficiency in supporting high user density environments allows operators to enhance service quality without significant increases in energy consumption. The segment is also benefiting from upgrades to 4G and early 5G deployments, where mid-range gain amplifiers are preferred for cost-effective densification. This positions 36 dB solutions as a practical choice for scalable network expansion.

Category Insights:

- Femtocell

- Picocell

- Microcell

The microcell leads with a share of 45% of the total Vietnam small cell power amplifier market in 2025.

Microcells lead the market due to their ability to deliver wider coverage than femtocells and picocells, making them essential for improving network capacity across commercial zones, transport corridors, and dense residential clusters. Their integration with high-performance power amplifiers enhances signal reliability and supports seamless connectivity in areas with surging data demands. As operators focus on bridging coverage gaps and strengthening mobility experiences, microcells remain a preferred choice for balancing deployment cost, range, and system efficiency.

The microcell segment is growing as Vietnam accelerates 5G-ready infrastructure development, requiring solutions capable of handling larger user bases and higher throughput. Microcells equipped with advanced power amplifiers deliver strong performance in congested environments, supporting both indoor and outdoor requirements. Their scalability and compatibility with multi-band small cell networks further drive adoption among telecom operators focused on long-term capacity expansion. As enterprise digitalization rises, microcells continue to gain importance in delivering dependable, high-quality connectivity.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Small Cell Base Stations

- Datacards with Terminals

- Power Amplifier Drivers

- Wideband Instrumentation

- Others

The small cell base stations exhibit a clear dominance with a 48% share of the total Vietnam small cell power amplifier market in 2025.

Small cell base stations dominate the market as operators expand localized coverage zones to relieve network congestion and enhance data speeds. Power amplifiers play a critical role in enabling efficient signal transmission, improved link reliability, and stable performance in high-density urban environments. With Vietnam experiencing rapid growth in mobile data usage, small cell base stations are increasingly deployed across commercial, residential, and public infrastructure. This strengthens demand for amplifiers designed to deliver compact, high-output, and energy-efficient performance.

The segment benefits from the ongoing transition to 5G, where small cell base stations serve as foundational elements for supporting low-latency, high-capacity networks. In October 2024, Ericsson and VNPT announced a partnership to deploy 5G technology in Vietnam. This initiative aims to enhance digital infrastructure in major cities, improving connectivity for VNPT’s subscribers. VNPT’s CEO emphasized that 5G will drive economic growth and digital transformation in the country. Telecom operators prioritize power amplifiers that enable multi-band operation and maintain consistent signal strength across varied deployment conditions. As indoor connectivity requirements rise across enterprises, malls, hotels, and transportation hubs, the role of small cell base stations becomes even more crucial. This sustained expansion reinforces high amplifier consumption within this application category.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Northern Vietnam shows rising deployment of small cell power amplifiers as operators strengthen coverage across expanding urban zones and industrial corridors. Increasing data traffic, growing enterprise connectivity needs, and ongoing digital infrastructure upgrades support steady adoption across both indoor and outdoor network enhancement projects.

Central Vietnam is witnessing growing small cell power amplifier usage as tourism hubs, commercial centers, and developing economic zones require better connectivity. Operators are enhancing network density to manage rising data consumption and support digital transformation initiatives across public, enterprise, and community environments.

Southern Vietnam experiences strong demand for small cell power amplifiers driven by dense population clusters, high mobile data usage, and rapid 4G and early 5G expansion. Increasing reliance on video streaming, online services, and enterprise communication is accelerating network densification across the region.

Market Dynamics:

Growth Drivers:

Why is the Vietnam Small Cell Power Amplifier Market Growing?

Rising Mobile Data Consumption and Urban Network Load

Growing smartphone penetration, higher video streaming usage, and increased reliance on real time digital applications are intensifying network pressure across major Vietnamese cities. In early 2025, Vietnam had 127 million active cellular mobile connections (126% of the population), with 79.8 million internet users (78.8% penetration) and 76.2 million social media identities (75.2% of the population). To maintain seamless connectivity, operators are accelerating small cell deployments supported by advanced power amplifiers that enhance signal strength and service consistency. These amplifiers help boost network capacity, reduce congestion, and improve user experience in dense environments. As data traffic continues to rise, the demand for efficient small cell power amplifier solutions is expected to strengthen.

Expansion of Indoor Coverage Solutions Across Enterprises

Businesses in Vietnam are increasingly prioritizing strong indoor connectivity to support digital operations, cloud applications, and uninterrupted communication. Offices, malls, healthcare facilities, and industrial sites require high quality network performance, driving wider adoption of small cells equipped with reliable, high efficiency power amplifiers. These systems help eliminate coverage gaps, improve signal penetration, and ensure consistent performance across complex indoor spaces. With enterprises moving toward more data intensive workflows, the need for robust indoor small cell power amplifier solutions continues to grow rapidly.

Increasing Focus on Network Densification by Operators

Vietnamese telecom operators are intensifying investments in network densification strategies to manage growing data demand and ensure stable service delivery. Small cells supported by advanced power amplifiers are central to this approach, enabling localized high capacity coverage in congested areas. These amplifiers enhance spectral efficiency, support stronger signal transmission, and facilitate seamless connectivity for users. Viettel Group launched Vietnam's first 5G network on October 15, 2024, coinciding with its 20th anniversary of mobile service. With over 6,500 BTS stations, the network offers speeds up to 1 Gbps. Viettel aims to enhance connectivity and introduce innovative services for individuals and enterprises across the country. As operators prioritize boosting capacity, reducing latency, and improving overall network resilience, the deployment of efficient small cell power amplifiers becomes increasingly essential.

Market Restraints:

What Challenges the Vietnam Small Cell Power Amplifier Market is Facing?

High Deployment and Integration Costs

The Vietnam small cell power amplifier market faces challenges due to high initial deployment and integration expenses. Operators must invest in site acquisition, installation, backhaul connectivity, and power amplifier upgrades, which increases overall network rollout costs. Limited budgets among smaller operators further slows deployment. These cost pressures make large scale densification difficult, delaying small cell expansion in several regions and restraining wider adoption of advanced power amplifier technologies.

Complex Regulatory and Site Approval Processes

Lengthy regulatory procedures, complex site approval norms, and municipality level restrictions on installing telecom equipment create delays in small cell deployment. Securing permits for urban poles, building interiors, and public infrastructure slows installation timelines, affecting amplifier demand. Inconsistent local regulations add further operational hurdles for operators. These administrative challenges hinder the pace of network densification, reducing the speed at which high performance small cell power amplifiers can be deployed across the country.

Thermal Management and Power Efficiency Limitations

Small cell power amplifiers often face performance challenges related to heat dissipation, energy loss, and reduced efficiency under continuous high load. In compact small cell units, inadequate thermal management can lead to overheating, shortened component lifespan, and higher maintenance requirements. These technical constraints limit amplifier reliability and increase operating costs for telecom operators. As networks become denser, managing power efficiency and thermal stability becomes increasingly difficult, posing a key restraint for market expansion.

Competitive Landscape:

The Vietnam small cell power amplifier market is moderately competitive, shaped by a mix of global telecom equipment providers and specialized RF component manufacturers. Competition centers on delivering compact, energy-efficient, and high-output amplifier solutions tailored for dense 5G and indoor coverage deployments. Companies focus on innovation in semiconductor materials, thermal management, and multi-band support to meet operator requirements for performance and reliability. Pricing pressure remains significant as telecom operators seek cost-efficient solutions for large scale network densification. Partnerships with network integrators and local infrastructure providers continue to influence market positioning and long-term growth prospects.

Vietnam Small Cell Power Amplifier Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | 27.5 dB, 32 dB, 36 dB, 39 dB, Others |

| Categories Covered | Femtocell, Picocell, Microcell |

| Applications Covered | Small Cell Base Stations, Datacards with Terminals, Power Amplifier Drivers, Wideband Instrumentation, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Vietnam small cell power amplifier market size was valued at USD 34.07 Million in 2025.

The Vietnam small cell power amplifier market is expected to grow at a compound annual growth rate of 14.88% from 2026-2034 to reach USD 118.74 Million by 2034.

The 36 dB segment held the largest share, driven by its balanced power output, strong signal amplification capabilities, and suitability for dense small cell deployments. Its efficiency and compatibility with multi-band networks support widespread adoption across operators.

Key factors driving the Vietnam small cell power amplifier market include rising 4G and 5G densification needs, increasing mobile data consumption, expanding indoor coverage requirements, and growing adoption of small cells to enhance network capacity, signal quality, and operational efficiency.

Major challenges include high deployment and maintenance costs, complexities in network integration, and limited availability of skilled technical resources. Interference issues, power efficiency concerns, and operator budget constraints can also slow widespread adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)