Vietnam Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

Vietnam Steel Tubes Market Overview:

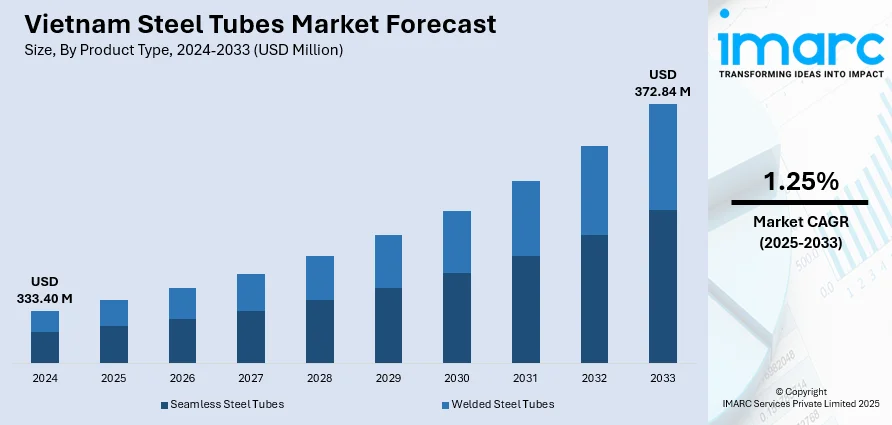

The Vietnam steel tubes market size reached USD 333.40 Million in 2024. The market is projected to reach USD 372.84 Million by 2033, exhibiting a growth rate (CAGR) of 1.25% during 2025-2033. The market is evolving rapidly, propelled by rising infrastructure investments, industrial expansion, and increasing demand from automotive and energy sectors. Domestic producers and international firms are advancing product quality and broadening applications by integrating innovative materials and fabrication methods. Supply chains are shifting toward regional sourcing to reduce lead times and support resilience. With heightened focus on sustainable manufacturing practices and regulatory alignment, Vietnam is positioning itself as a competitive hub. Overall, emerging trends underscore growing prominence in the Vietnam steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 333.40 Million |

| Market Forecast in 2033 | USD 372.84 Million |

| Market Growth Rate 2025-2033 | 1.25% |

Vietnam Steel Tubes Market Trends:

Domestic Production Momentum

Vietnam’s steel production surged in 2024, with the sources projecting total iron and steel output at million tonnes an indicator of strong industrial momentum. As construction and infrastructure activity revives, finished steel output supports a broad base for tube manufacturing, providing additional That intervention reflects feedstock and demand stability. Recent government infrastructure planning and urban development policies underpin ongoing demand, enabling tube producers to operate in a high‑utilization environment. Against this backdrop, manufacturers are aligning production toward longer, seamless, or welded tubes for infrastructure, mechanical, and industrial use. The increase in domestic raw steel supply helps ensure capacity resilience for steel tube lines, while also reinforcing the alignment between broader steel sector recovery and tube segment continuity. With upstream raw material availability more assured, downstream tube production is better positioned to serve expanding internal demand. In this context, domestic production strength underpins structural readiness and sets the stage for industry resilience. Vietnam steel tubes market growth is being supported by solid base level recovery in upstream steel manufacturing.

To get more information on this market, Request Sample

Export Pressures Shape Premium Shift

In 2025, Vietnam imposed temporary anti‑dumping tariffs on certain Chinese steel imports, with customs data showing nearly million tonnes of hot‑rolled material imported in the prior period, pressuring domestic supply dynamics. This measure reflects protection of local production and export positioning under trade defense scrutiny. These measures shift the domestic tube industry’s export strategy: rather than pursuing high volume commodity exports, suppliers emphasise technical specifications, tighter grade control, and specialty tubing applications. Higher‑quality benchmarks help sustain pricing and market positioning amid tightening international trade conditions. Export attention is thus moving toward custom orders, corrosion-resistant tube alloys, or specialized dimensions tailored to infrastructure and engineering clients. By prioritizing specification and precision, Vietnam’s steel tube exporters can maintain relevance despite trade barriers that dampen broad export volume. That realignment captures evolving strategic focus and prioritises differentiation over scale-driven ambition. Vietnam steel tubes market trends increasingly depend on premium specification and value orientation amid export environment tightening.

Regional Demand Shifts Favor Specialized Tube Use

By mid‑2025, domestic demand trends point to a tilt toward high‑spec industrial and infrastructure projects that require precise tube tolerances and materials. Government infrastructure announcements indicate rising investments in rail, power distribution, and high‑rise buildings, all of which demand seamless or high‑pressure steel tubes. Local trade bulletins have highlighted that rolled steel capacity in Vietnam now exceeds 30 million tonnes annually, while hot‑rolled coil imports continue to comprise a notable portion of local consumption. That trend intensifies the focus on upgrading domestic tube fabrication moving away from basic profiles toward valued segments like precision mechanical tubing. Imported raw materials remain high but policy strategies now emphasize domestic downstream value capture through more advanced tube production capabilities. As regional demand shifts toward reliability, customization, and technical compliance, Vietnam’s producers lean into advanced tube lines capable of tighter tolerances and diversified alloy usage. This enables continued alignment with evolving infrastructure needs while shielding from import and commodity risks.

Vietnam Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

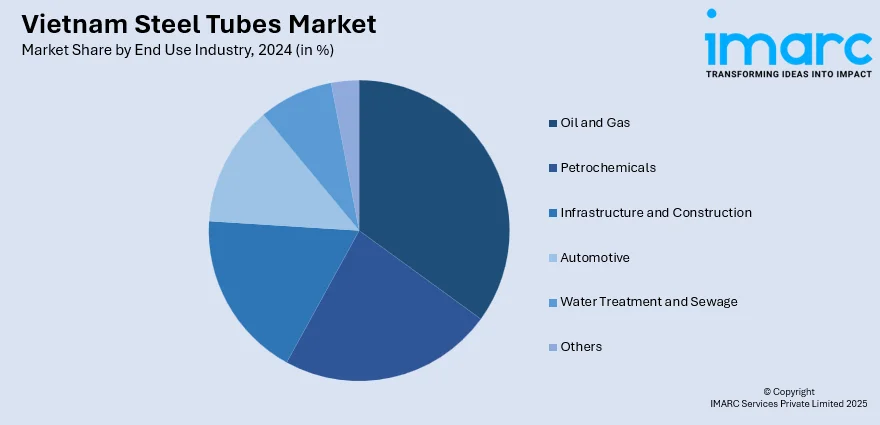

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northern Vietnam, Central Vietnam, and Southern Vietnam.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Vietnam Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Type Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Type Covered | Carbon Steel, Stainless Steel, Alloy Steel, Other |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Vietnam steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Vietnam steel tubes market on the basis of product type?

- What is the breakup of the Vietnam steel tubes market on the basis of material type?

- What is the breakup of the Vietnam steel tubes market on the basis of end use industry?

- What is the breakup of the Vietnam steel tubes market on the basis of region?

- What are the various stages in the value chain of the Vietnam steel tubes market?

- What are the key driving factors and challenges in the Vietnam steel tubes market?

- What is the structure of the Vietnam steel tubes market and who are the key players?

- What is the degree of competition in the Vietnam steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)