Vietnam UPS Market Size, Share, Trend and Forecast by Capacity, Type, Application, and Region, 2026-2034

Vietnam UPS Market Size and Share:

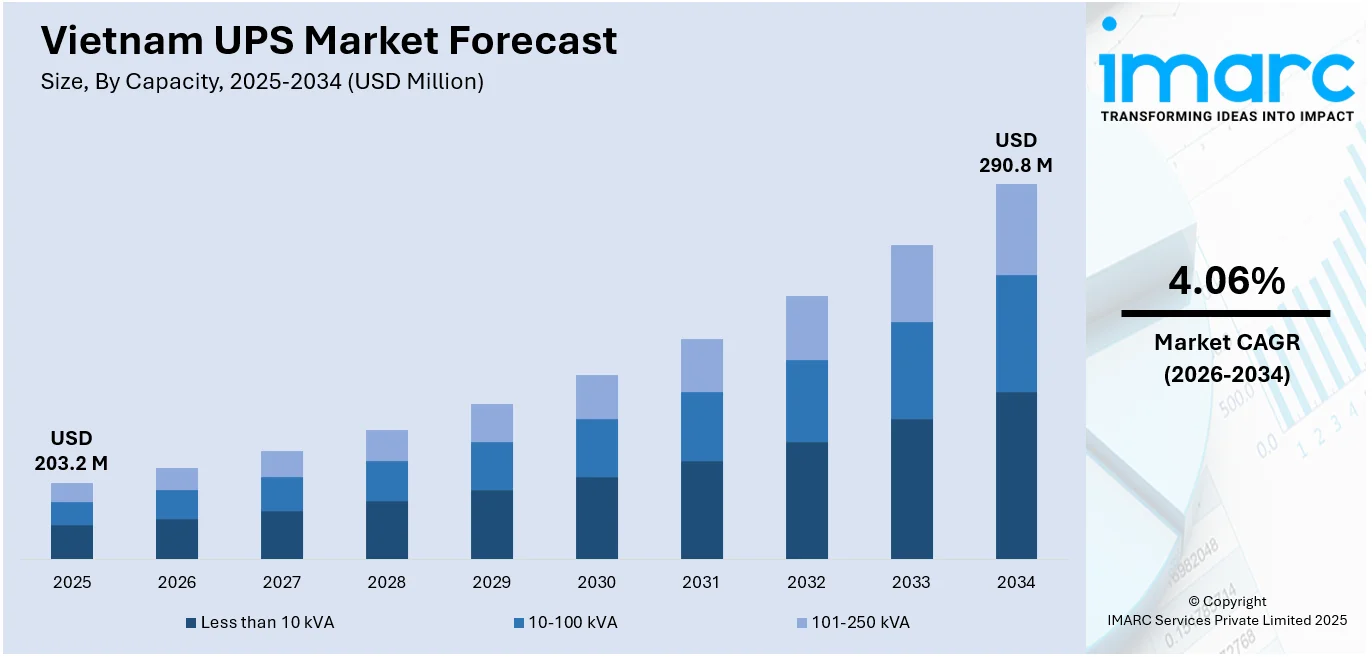

The Vietnam UPS market size was valued at USD 203.2 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 290.8 Million by 2034, exhibiting a CAGR of 4.06% during 2026-2034. Southern Vietnam currently dominates the market, holding a significant market share of 40.0% in 2025. This leadership is driven by the region’s rapid industrial growth, increasing demand for a reliable power supply in various sectors, and urbanization. The presence of major industries and infrastructure development contributes significantly to the overall Vietnam UPS market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 203.2 Million |

|

Market Forecast in 2034

|

USD 290.8 Million |

| Market Growth Rate 2026-2034 | 4.06% |

The market is being driven by the rapid industrialization and urbanization occurring across the country. As businesses expand, there is a growing need for reliable power backup to protect critical infrastructure and machinery in sectors like manufacturing, healthcare, and telecommunications. The rise in industrial hubs, particularly in southern Vietnam, fuels the demand for uninterrupted power supply systems to avoid operational disruptions and ensure business continuity. Additionally, the rapid development of infrastructure, including smart cities and large-scale construction projects, increases the need for consistent power, thus driving the adoption of UPS systems in both commercial and residential sectors.

To get more information on this market Request Sample

The increasing reliance on IT and electronic devices also contributes significantly to the demand for UPS systems. With businesses shifting to digital platforms and adopting cloud services, there is a higher need to protect sensitive equipment, such as servers, data centers, and other network infrastructure, from power surges, outages, and voltage fluctuations. Moreover, the expansion of e-commerce and the growing tech startup ecosystem further increases the demand for UPS systems. The government’s push toward digital transformation and renewable energy adoption also supports Vietnam UPS market growth. For instance, as per industry reports, Vietnam is significantly boosting its renewable energy goals to meet growing electricity demand. It now targets 73 GW of solar and 38 GW of onshore wind capacity by 2030, substantial increases from earlier goals. By 2050, solar and wind are expected to reach 296 GW and 230 GW, respectively. Solar will contribute 31% and wind 16% of the energy mix by 2030. As the country’s economy becomes more reliant on technology, the requirement for dependable and efficient power backup systems continues to rise, bolstering the growth of the Vietnam UPS market.

Vietnam UPS Market Trends:

Industrial Growth and Infrastructure Development

Rapid industrialization and modernization efforts are major drivers of the increasing demand for reliable power solutions in Vietnam. As of November 2024, Vietnam's Industrial Production Index (IIP) saw a 1.6% month-on-month growth, up from 1.1% in October, signaling a robust industrial expansion. In addition to industrial growth, large-scale infrastructure projects, including the construction of residential buildings, are contributing to the surge in UPS system adoption. The Vietnamese government is planning a nearly 40% increase in infrastructure investment this year, reaching USD 36 Billion. This focus on infrastructure is aimed at improving power reliability across the country, particularly as industrial and residential sectors require stable power to sustain their operations, further driving the demand for UPS systems. These factors are key contributors to Vietnam UPS market trends, as businesses and households alike seek uninterrupted power solutions to support the country's rapid economic development.

Power Expansion and Energy Sustainability

Vietnam's ambitious energy development plans are also fueling the UPS market's growth. According to the Private Infrastructure Development Group, Vietnam's Power Development Plan 8 (PDP8) necessitates an investment of USD 135 Billion by 2030 to enhance electricity generation capacity. Alongside this, the country's ongoing efforts to upgrade its electrical grid and telecommunication infrastructure highlight the need for uninterrupted power supply systems. Additionally, the rising adoption of renewable energy sources like solar and wind is a key driver, as these systems rely heavily on UPS systems for efficient operation and energy storage. The shift toward modular UPS systems, offering better scalability, maintenance, and reduced operational costs, is another significant factor creating a lucrative Vietnam UPS market outlook.

Vietnam UPS Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Vietnam UPS market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on capacity, type and application.

Analysis by Capacity:

- Less than 10 kVA

- 10-100 kVA

- 101-250 kVA

Less than 10 kVA stand as the largest capacity in 2025, holding around 55.7% of the market. This trend can be attributed to the increasing demand for reliable power backup in smaller commercial and residential applications. As businesses and homes become more reliant on sensitive electronic equipment, the need for compact yet efficient UPS systems has risen. Additionally, smaller UPS systems are more cost-effective, making them an attractive choice for businesses and consumers looking for affordable power solutions without compromising reliability. With advancements in technology, these systems are also offering better energy efficiency and enhanced features, further driving their adoption across various sectors.

Analysis by Type:

- Standby UPS System

- Online UPS System

- Line-interactive UPS System

Online UPS system leads the market with around 60.7% of market share in 2025. This dominance can be attributed to the superior performance and reliability offered by online UPS systems, which provide continuous power supply by converting incoming AC power to DC and then back to AC. This ensures a seamless transition during power outages, making them highly desirable for critical applications such as data centers, hospitals, and industrial operations where power stability is essential. The growing need for uninterrupted power in sensitive and mission-critical environments is driving the preference for online UPS systems. Additionally, advancements in technology, energy efficiency, and remote monitoring capabilities are further bolstering the adoption of online UPS systems.

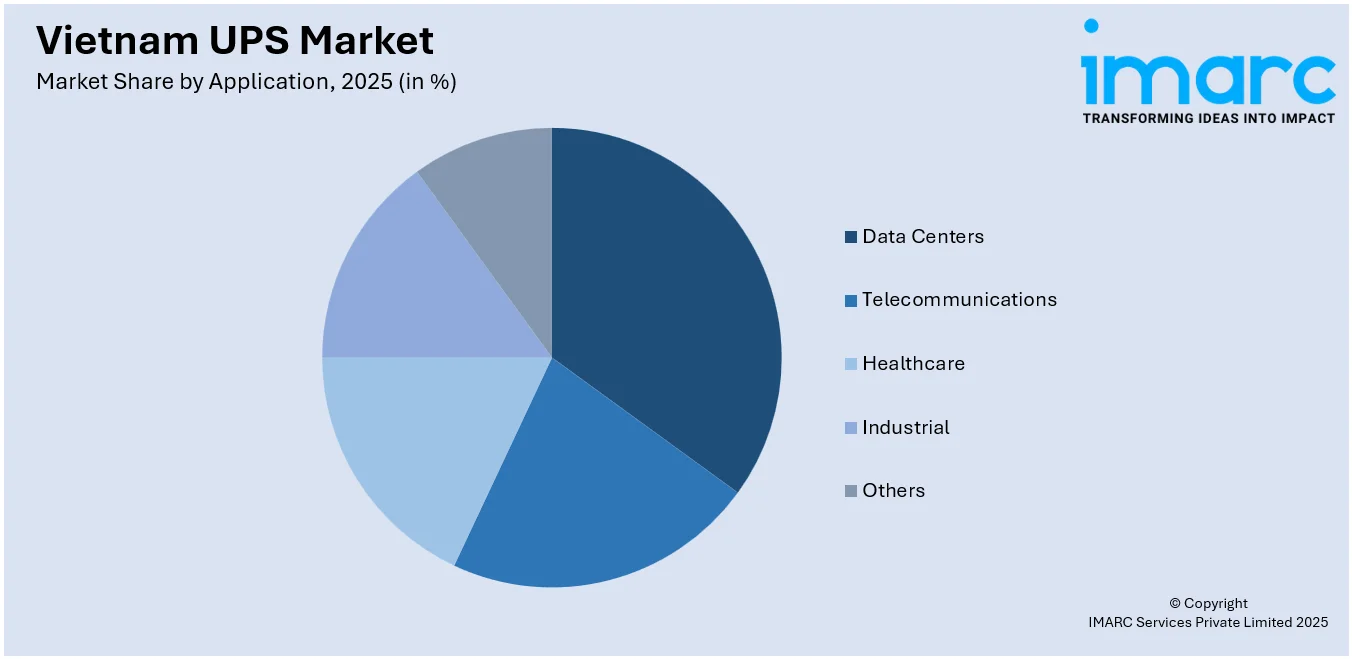

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Data Centers

- Telecommunications

- Healthcare

- Industrial

- Others

Data centers lead the market with around 32.2% of market share in 2025. This dominance is driven by the rapid growth in data-driven services, cloud computing, and digital transformation, which require reliable, uninterrupted power supply to maintain operations. Data centers house critical IT infrastructure, including servers, storage, and network equipment, making them highly dependent on UPS systems for safeguarding against power disruptions. The increasing reliance on data services and the rising demand for data storage, processing, and transfer capabilities further elevate the need for robust and efficient UPS solutions. As data centers continue to expand globally, particularly with the growing trend of edge computing, the demand for high-capacity, reliable UPS systems is set to grow significantly in this sector.

Regional Analysis:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

In 2025, Southern Vietnam accounted for the largest market share of over 40.0%. This dominance is primarily due to the region's rapid industrialization, which includes the expansion of manufacturing hubs, data centers, and commercial infrastructure. Key cities like Ho Chi Minh City are witnessing increased investments in sectors such as technology, manufacturing, and e-commerce, all of which require reliable power supply solutions to ensure smooth operations. For instance, in December 2024, ABB launched the PowerValue 11T G2, a compact and efficient UPS system tailored for small IT and critical single-phase applications. Introduced in Ho Chi Minh City, it offers advanced double-conversion technology with up to 95% efficiency and supports scalable runtime via external battery modules. Designed for sectors like healthcare, banking, and industry, it ensures uninterrupted power and reduces energy waste. With a user-friendly interface, remote monitoring, and sustainability features, it reinforces ABB’s commitment to reliable power and operational resilience across vital systems. Additionally, the region's robust infrastructure development, coupled with the growing adoption of renewable energy, is driving the demand for UPS systems. As the commercial and industrial sectors continue to expand in Southern Vietnam, the need for uninterrupted power, especially in critical applications, will further fuel UPS market growth in the region.

Competitive Landscape:

The market’s competitive landscape includes the presence of numerous global and regional players providing a variety of products, from small capacity systems to large industrial solutions. Key factors driving competition include technological innovation, energy efficiency, and the ability to offer customized solutions that meet specific industry needs. Companies are focusing on enhancing product reliability, reducing operational costs, and integrating advanced features such as remote monitoring, predictive maintenance, and scalability. Additionally, there is a growing emphasis on sustainability, with manufacturers developing eco-friendly UPS systems that minimize emissions and maximize energy efficiency. The Vietnam UPS market forecast indicates strong competition in terms of pricing, customer service, and support, with companies vying to establish strong relationships in various sectors such as data centers, industrial applications, and telecommunications. For instance, in December 2024, Vertiv launched the PowerUPS 9000, a compact, energy-efficient UPS system for IT applications ranging from traditional to high-density environments. Available globally with 250–1250kW capacity, it offers up to 97.5% efficiency, 32% smaller footprint, and supports multiple battery types including lithium and VRLA. Key features include hot-swappable modules, fault isolation, AI-powered Vertiv Next Predict for maintenance, and robust testing for durability and seismic integrity. Designed to minimize complexity and maximize uptime, it supports next-gen data centers and AI workloads.

The report provides a comprehensive analysis of the competitive landscape in the Vietnam UPS market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: INVT announced that it would be enhancing its global service network, focusing on UPS systems, by partnering with Vietnam's DAT to expand coverage across Southeast Asia. This initiative aims to provide faster technical support, efficient spare parts supply, and reliable maintenance for critical power infrastructure.

- September 2023: Best Power Equipments (BPE), an Indian UPS manufacturer, formed strategic partnerships with IDC Group (Vietnam), Eternal Asia (China), and BPEIP (Philippines) to distribute its IoT-enabled UPS systems across Southeast Asia, including Singapore, Malaysia, Indonesia, the Philippines, and Vietnam. These collaborations aim to meet the region's growing demand for reliable, sustainable power solutions.

Vietnam UPS Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Capacities Covered | Less than 10 kVA, 10-100 kVA, 101-250 kVA |

| Types Covered | Standby UPS System, Online UPS System, Line-interactive UPS System |

| Applications Covered | Data Centers, Telecommunications, Healthcare, Industrial, Others |

| Regions Covered | Northern Vietnam, Central Vietnam, Southern Vietnam |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Vietnam UPS market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Vietnam UPS market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Vietnam UPS industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Vietnam UPS market was valued at USD 203.2 Million in 2025.

The Vietnam UPS market is projected to exhibit a CAGR of 4.06% during 2026-2034, reaching a value of USD 290.8 Million by 2034.

Key factors driving the Vietnam UPS market include rapid digitalization, rising data center investments, industrial automation, growing demand for power reliability, and frequent grid instabilities. Additionally, government support for digital infrastructure, increasing adoption of cloud services, and expansion of healthcare and banking sectors are boosting UPS demand nationwide.

Southern Vietnam accounted for the largest share, holding around 40.0% of the market in 2024 due to its robust industrial base, rapid urbanization, and concentration of data centers. The region's strong manufacturing sector, expanding IT infrastructure, and higher adoption of digital technologies also drive significant demand for reliable power backup solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)