Virgin Paper Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Virgin Paper Price Trend, Index and Forecast

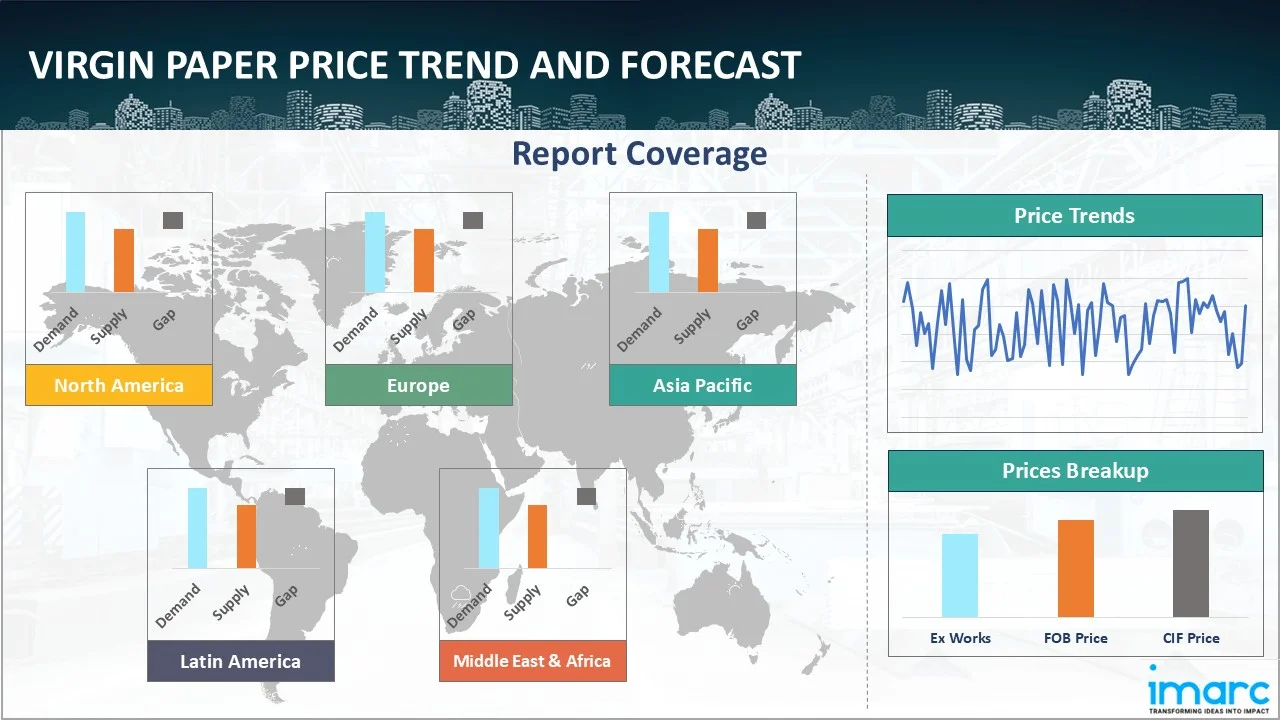

Track the latest insights on virgin paper price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Virgin Paper Prices Outlook Q3 2025

- USA: USD 1236/MT

- France: USD 1118/MT

- Spain: USD 1098/MT

- Thailand: USD 937/MT

- Brazil: USD 943/MT

Virgin Paper Price Chart

Get real-time access to monthly/quarterly/yearly prices Request Sample

During the third quarter of 2025, the virgin paper prices in the USA reached 1236 USD/MT in September. The upward price movement was largely influenced by stable downstream demand from packaging and hygiene sectors, which maintained steady procurement levels throughout the quarter. Higher operating costs linked to energy procurement and labor availability continued to support price firmness.

During the third quarter of 2025, the virgin paper prices in France reached 1118 USD/MT in September. Prices softened slightly due to subdued demand from printing and publishing sectors, where digital substitution continued to limit consumption growth. Adequate inventory levels across distribution channels reduced urgency among buyers, leading to negotiated price concessions.

During the third quarter of 2025, the virgin paper prices in Spain reached 1098 USD/MT in September. The market experienced moderate price improvement driven by stable demand from food packaging and consumer goods manufacturers. Seasonal restocking activity supported procurement volumes, while limited domestic production capacity helped maintain supply tightness. Input cost pressures related to pulp sourcing and transportation remained influential, encouraging suppliers to maintain firm pricing positions.

During the third quarter of 2025, the virgin paper prices in Thailand reached 937 USD/MT in September. Price gains were supported by improving domestic demand from the packaging and logistics sectors, driven by regional trade activity. Controlled production rates and maintenance-related output limitations restricted supply availability. Additionally, higher imported pulp costs influenced local production economics, prompting suppliers to adjust pricing.

During the third quarter of 2025, the virgin paper prices in Brazil reached 943 USD/MT in September. The upward trend was primarily driven by steady demand from food packaging and agricultural export sectors. Domestic producers benefited from consistent operating rates, while logistical challenges limited rapid inventory movement, supporting price stability. Export demand from Latin American markets improved, reducing domestic oversupply risks.

Virgin Paper Prices Outlook Q2 2025

- USA: USD 1196/MT

- France: USD 1136/MT

- Spain: USD 1086/MT

- Thailand: USD 917/MT

- Brazil: USD 928/MT

During the second quarter of 2025, the virgin paper prices in the USA reached 1196 USD/MT in June. As per the virgin paper price chart, the closures of pulp and paper mills had a noticeable impact on virgin paper prices, primarily through shifts in the fiber supply chain. As mills closed, the reduced demand for pulpwood from the woods left landowners with fewer outlets for their timber, disrupting timber management plans in affected areas. This created a ripple effect in the market, where the supply of raw materials needed for virgin paper production was constrained, ultimately leading to upward pressure on prices.

During the second quarter of 2025, the virgin paper prices in France reached 1136 USD/MT in June. The demand for virgin fiber remained strong, particularly in the packaging, board, and tissue sectors. This sustained demand, coupled with limited availability of sustainable fiber due to competition from other industries, contributed to upward pressure on virgin paper prices.

During the second quarter of 2025, virgin paper prices in Spain reached 1086 USD/MT in June. The Spanish paper packaging market, a significant segment of the country's paper industry, faced challenges during this period. The industry grappled with the effects of mill closures and raw material shortages. These factors contributed to increased production costs, which were reflected in the prices of paper packaging products.

During the second quarter of 2025, the virgin paper prices in Thailand reached 917 USD/MT in June. Local mills benefited from a consistent fiber supply and steady operational efficiency, which helped balance production expenses. However, rising energy and transportation costs exerted slight upward pressure on prices. Additionally, growing interest in eco-friendly and biodegradable paperboard alternatives, in line with domestic sustainability initiatives, enhanced competitiveness in regional export markets.

During the second quarter of 2025, the virgin paper prices in Brazil reached 928 USD/MT in June. One of the key drivers of fluctuating prices was the rising cost of raw materials, particularly wood fiber. This rise in fiber costs was partly due to heightened demand, increased transportation distances, and higher labor expenses. The surge in wood fiber prices exceeded global averages, putting pressure on pulp and paper manufacturers to adjust their cost structures.

Virgin Paper Prices Outlook Q1 2025

- USA: USD 1170/MT

- France: USD 1100/MT

- Spain: USD 1055/MT

- Thailand: USD 905/MT

- Brazil: USD 920/MT

During the first quarter of 2025, the virgin paper prices in the USA reached 1170 USD/MT in March. As per the virgin paper price chart, prices in the USA were influenced by a combination of factors, including rising raw material costs (pulp), trade disruptions, and overall market demand.

During the first quarter of 2025, virgin paper prices in France reached 1100 USD/MT in March. Shortages of fiber and rising transportation costs put upward pressure on the overall cost of production, leading to fluctuating prices for virgin paper. Besides, the demand for packaging, particularly from the fast-moving consumer goods (FMCG) and online retail sectors, also served as a key driver of price changes.

During the first quarter of 2025, the virgin paper prices in Spain reached 1055 USD/MT in March. Changes in the cost of wood pulp, the primary raw material for virgin paper, directly impacted the final price of the product. Besides, increases in other production costs, such as labor or transportation, also contributed to price changes.

During the first quarter of 2025, the virgin paper prices in Thailand reached 905 USD/MT in March. The continued expansion of e-commerce drove demand for packaging materials also influencing pricing patterns. Besides, Thailand's economy saw growth driven by government stimulus measures, which indirectly impacted paper demand.

During the first quarter of 2025, the virgin paper prices in Brazil reached 920 USD/MT in March. Higher raw material and energy costs, particularly for fiber and electricity, put upward pressure on prices. Additionally, strong demand from the packaging sector in Brazil, coupled with signs of recovery in domestic consumption, influenced pricing.

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing virgin paper prices.

Europe Virgin Paper Price Trend

Q3 2025:

During the third quarter of 2025, virgin paper price index trends in Europe reflected mixed pricing dynamics across the region. Demand remained uneven, with packaging applications providing support while publishing sectors continued to underperform. Supply availability was adequate, but producers maintained disciplined output to avoid oversupply. Import competition influenced pricing in Western Europe, while Southern European markets benefited from seasonal demand.

Q2 2025:

In the second quarter of 2025, virgin paper prices in Europe experienced upward pressure due to a combination of mill closures, rising raw material costs, and shifting market dynamics. Several European paper mills ceased operations in mid-2025. These closures reduced the supply of virgin paper, particularly in the graphic paper sector, where demand was already declining. The shutdowns led to concerns about supply shortages, prompting buyers to secure available stocks, thereby driving prices higher. Concurrently, the cost of virgin fiber inputs, such as Northern Bleached Softwood Kraft (NBSK) pulp, increased. However, these declines were tempered by strong demand from the e-commerce sector, which maintained upward pressure on prices.

Q1 2025:

As per the virgin paper price index, in Q1 2025, prices in Europe were influenced by a mix of factors, including rising input costs, particularly for pulp, and fluctuations in raw material and energy prices. While some segments, like kraft paper, saw a mild price increase due to strong e-commerce demand, other areas experienced price volatility.

This analysis can be extended to include detailed virgin paper price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Virgin Paper Price Trend

Q3 2025:

Virgin paper price index in North America indicated modest upward momentum, reflecting a structurally balanced market environment. Stable demand from packaging and hygiene sectors continued to underpin consumption, particularly from food-grade and household product manufacturers. Producers maintained supply discipline by aligning operating rates closely with order volumes, preventing excess availability. Controlled inventory levels across distribution channels limited price competition and supported firmer offers.

Q2 2025:

As per the virgin paper price index, in the second quarter of 2025, several factors significantly influenced virgin paper prices in North America, reflecting a complex interplay between supply chain disruptions, fiber availability, and changes in mill capacity. Besides, the pulp and paper industry faced growing demand for fiber as paper consumption continued to fluctuate. As mills closed or scaled back operations, the competition for available fiber resources intensified, further driving up prices for virgin paper products. Another significant influence was the shift in mill capacity towards recycled fiber processing. Many US pulp and paper mills converted from using wood-based fibers to processing 100% recycled materials. These conversions were part of a broader industry trend to capitalize on the lower cost of recycled feedstocks, thus impacting virgin paper prices.

Q1 2025:

The scarcity of raw materials, particularly fiber, and increased global prices for pulp pushed up production costs for virgin paper producers. Besides, new tariffs on imported goods, including paper products, created uncertainty and were cited as a reason for price hikes. Moreover, strong e-commerce activity and consistent demand for packaging materials, like kraft paper, supported higher prices in some segments.

Specific virgin paper prices and historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Virgin Paper Price Trend

Q3 2025:

As per the virgin paper price chart, the prices in the Middle East and Africa fluctuated due to a complex interplay of factors, primarily driven by supply chain disruptions, seasonal demand shifts, and geopolitical influences.

Q2 2025:

The report explores the virgin paper trends and virgin paper price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

In addition to region-wise data, information on virgin paper prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Virgin Paper Price Trend

Q3 2025:

Asia Pacific markets experienced bullish virgin paper pricing, driven by cost-side pressures and stable demand fundamentals. Elevated feedstock costs, influenced by global vegetable oil market conditions, continued to impact production economics across the region. Demand from industrial lubricants, electronics chemicals, and specialty manufacturing sectors remained consistent, supporting steady consumption levels. Import-dependent countries faced higher procurement costs as international suppliers maintained firm pricing amid controlled output.

Q2 2025:

The Asia-Pacific region faced significant challenges related to raw material availability and logistics. Fluctuations in wood pulp and recovered paper supply, combined with environmental restrictions in key producing countries, impacted mill operations and increased production costs. These disruptions contributed to price volatility in virgin paper products, including kraft and fine paper grades. Trade tensions, particularly between the United States and China, introduced uncertainties into the pulp market. Chinese paper manufacturers, facing unpredictable pricing due to potential US tariffs, became hesitant to commit to long-term purchases. This cautious approach led to reduced demand for imported pulp, exerting downward pressure on virgin paper prices in the region.

Q1 2025:

In the first quarter of 2025, virgin paper prices in the Asia Pacific region experienced fluctuations due to a combination of factors, including increased raw material costs, supply chain disruptions, and shifting trade dynamics. Specifically, transportation pressures and trade tensions contributed to rising raw material costs, impacting production and sales strategies for paper mills.

This virgin paper price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Virgin Paper Price Trend

Q3 2025:

Virgin paper prices in Latin America strengthened slightly, supported by stable domestic consumption and improving export opportunities. Demand from food packaging, agricultural exports, and consumer goods manufacturing remained consistent, providing a reliable demand base. Export activity to neighboring regions and overseas markets improved, helping to reduce domestic supply pressure. Logistical constraints, including transportation bottlenecks and infrastructure limitations, restricted rapid material movement, indirectly supporting price firmness.

Q2 2025:

As per the virgin paper price index, virgin paper prices in Latin America experienced upward pressure due to a combination of factors affecting both supply and demand. A significant driver of price increases was the rising costs of raw materials and energy. Besides, trade dynamics also played a role in influencing virgin paper prices. In Mexico, for instance, the introduction of new trade tariffs affected the cost and availability of paper and paper-related products.

Q1 2025:

As per the virgin paper price index, increased demand and supply chain disruptions pushed up pulp and energy prices, which are key components in paper production. Besides, tariffs and trade volatility, particularly related to the Mexican economy, affected the cost and availability of paper and paper-related products in the region.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Virgin Paper Pricing Report, Market Analysis, and News

IMARC's latest publication, “Virgin Paper Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the virgin paper market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of virgin paper at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed virgin paper prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting virgin paper pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Virgin Paper Industry Analysis

The global virgin paper market size reached 210.6 Million Tons in 2025. By 2034, IMARC Group expects the market to reach 286.2 Million Tons, at a projected CAGR of 3.47% during 2026-2034. The market is primarily driven by the rising demand from packaging and hygiene sectors, growing preference for sustainable and high-quality paper products, and supply chain efficiencies that balance production, distribution, and cost pressures globally.

Latest News and Developments:

- October 2025: Orient Paper and Industries Limited launched a range of colored virgin tissue paper, starting with its premium red variant. The company highlighted that this launch reflected careful planning, strong teamwork, and sustained technical efforts across R&D, production, and sales.

Product Description

Virgin paper is a type of paper made entirely from fresh, unused wood pulp that has not been previously processed or recycled. Derived directly from trees through mechanical or chemical pulping, it contains no post-consumer or pre-consumer recycled fibers. This results in a product that is typically stronger, whiter, and more durable than recycled paper, making it ideal for applications requiring high-quality printability, hygiene, and structural integrity.

Commonly used in food packaging, medical supplies, premium printing, and tissue products, virgin paper is valued for its cleanliness and consistency. Its production allows manufacturers greater control over fiber composition, brightness, and strength, which is especially important for packaging that comes in direct contact with food or sensitive goods.

However, concerns about deforestation and environmental impact have prompted the industry to shift toward sustainable forestry practices. Many virgin paper producers now source pulp from certified, responsibly managed forests and invest in renewable energy and water-efficient processes.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Virgin Paper |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Ammonia Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, Peru* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of virgin paper pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting virgin paper price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The virgin paper price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)