Virtual Data Room Market Size, Share, Trends and Forecast by Component, Deployment Type, Enterprise Size, Business Function, Vertical, and Region, 2026-2034

Virtual Data Room Market Size and Share:

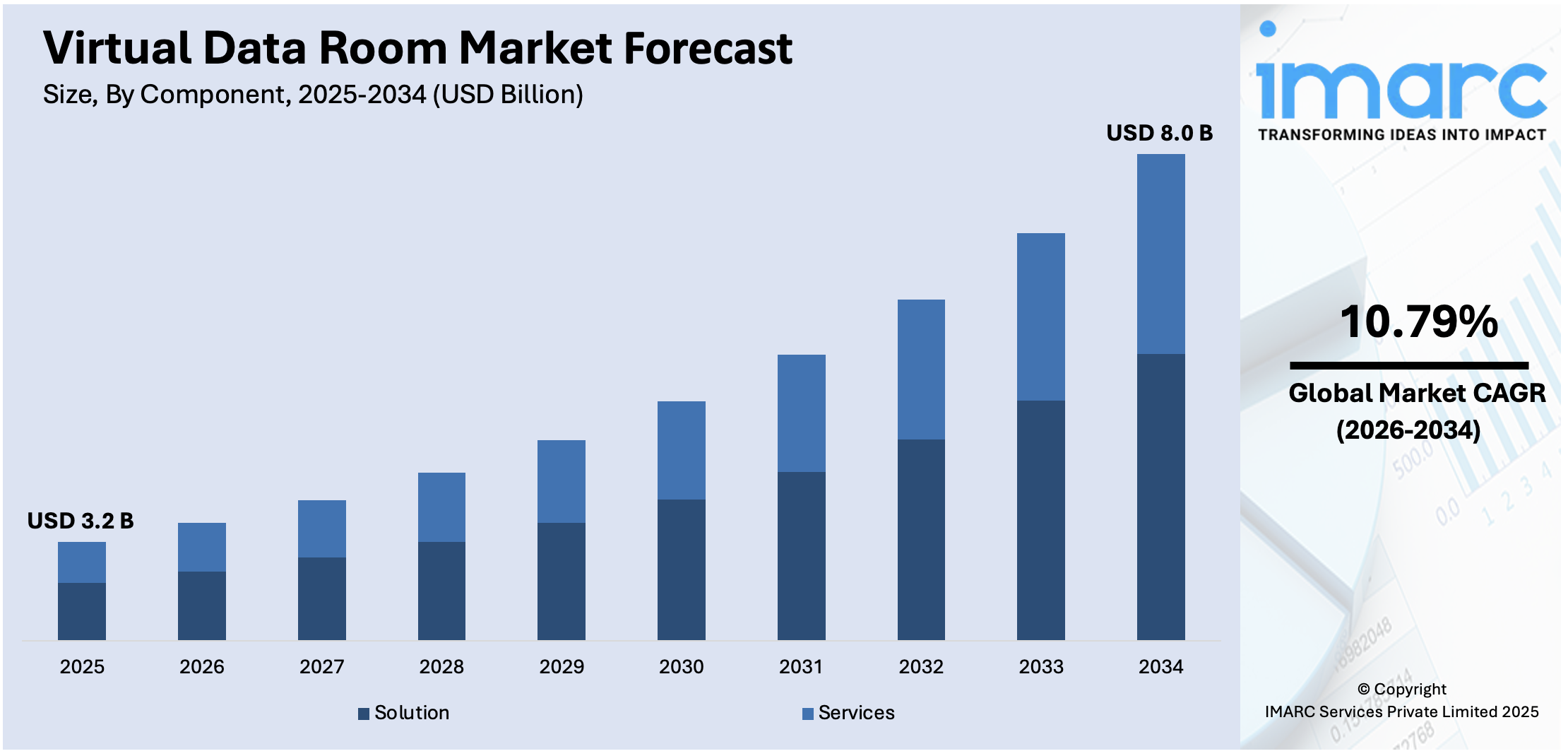

The global virtual data room market size was valued at USD 3.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 8.0 Billion by 2034, exhibiting a CAGR of 10.79% during 2026-2034. North America currently dominates the market, holding a significant market share of over 41.2% in 2025. Some of the primary factors driving the virtual data room market are the increasing acceptance of cloud-based solutions, a rising number of m-banking apps, and the growing inclination for online shopping.

| Report Attribute | Key Statistics |

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.2 Billion |

|

Market Forecast in 2034

|

USD 8.0 Billion |

| Market Growth Rate (2026-2034) | 10.79% |

Key drivers of the global virtual data room (VDR) market include the increasing need for secure data management, particularly during mergers and acquisitions (M&A), regulatory compliance, and due diligence processes. The growing volume of sensitive business data across industries fuels demand for secure document sharing and storage solutions. Additionally, the emergence of digital transformation as well as remote work has highlighted the importance of accessible, cloud-based solutions. The need for resilient security features, such as advanced encryption, avail control, and real-time collaboration, further propels market growth, particularly in sectors like finance, legal, and healthcare.

To get more information on this market Request Sample

The United States is a dominant player in the global VDR market, driven by its advanced technological infrastructure and high demand for secure data management solutions. The country's robust M&A activities, regulatory compliance requirements, and large-scale financial transactions contribute to the growing adoption of VDRs. For instance, according to the Bureau of Economic Analysis, during Q3 2024, total transactions in financial assets reached USD 201.9 Billion, depicting ongoing net acquisition of U.S. assets since the Q4 2022. The main contributor was portfolio investment, particularly in investment funds and equities, followed by direct investment in equity. Key industries, including finance, legal, healthcare, and real estate, extensively use VDRs for secure document sharing, due diligence, and transaction management. The presence of leading VDR providers and increasing reliance on cloud-based solutions further strengthens the market position of the U.S. in the global VDR landscape.

Virtual Data Room Market Trends:

Increasing Deployment of Cloud-Based Solutions

One of the major virtual data room market trends is the growing acceptance of cloud-based solutions in small and medium-scale enterprises (SMEs) to maintain business data efficiently and secure documentation management effectively. According to reports, end-user cloud spending to increase 21.5% globally to USD 723 Billion in 2025. Moreover, the rising adoption of VDRs in the banking, financial services and insurance (BFSI) industry to store and share financial statements, tax returns, and other documentation required for loan processing securely, is posing as another critical growth-influencing factor. They also aid in enhancing efficacy, lowering expenditure, and guaranteeing adherence with regulatory needs. This, along with the magnifying utilization of m-banking apps, is further propelling the virtual data room market growth. For instance, Oracle backed European data privacy and sovereignty needs with the new European Union sovereign cloud. EU Sovereign Cloud provides Oracle Cloud Infrastructure with the same service level agreements and competitive pricing as its commercial cloud regions. Fully located within the EU and distinct from Oracle's other cloud regions, it provides customers enhanced control over their data.

Rising Focus on Security And Compliance

The increasing application of VDRs in the e-commerce industry to share supply chain management information like supplier contracts, inventory data, and logistics information, is augmenting the market. For instance, the logistics industry is responsible for approximately 12% of global GDP. Additionally, the growing utilization of VDRs for sharing confidential information, such as product catalogs, pricing information, and sales data for e-commerce platforms is also contributing to the market growth. This, along with the rising preference for online shopping among the masses on account of hectic schedules, considerable reliance on smartphones, and increasing penetration of high-speed internet connectivity, is influencing the market positively. Furthermore, the increasing number of startups is catalyzing the demand for VDRs to help share confidential information and control sensitive documents for due diligence. For instance, IBM and Cohesity partnered to cater to the enterprises’ magnified data robustness as well as safety in hybrid cloud ecosystems. Incorporating data management, data protection, and cyber resilience abilities from both firms, IBM introduced the IBM Storage Defender service, encompassing Cohesity's data protection as a requisite component of the solution. IBM Storage Defender is developed to aid both event monitoring and AI across several platforms for storage via a single glass pane to safeguard data layers of enterprises from risks, mainly including human anomalies, ransomware, and sabotage.

Integration With Advanced Technologies

The use of artificial intelligence (AI), machine learning (ML), and two-factor authentication in VDRs to evaluate documents and detect possible hazards or compliance concerns is facilitating the growth of the market. For instance, AI investment surges to USD 142.3 Billion in 2023 typically because of escalating corporate interest as well as startup funding. These advanced technologies enable administrators to immediately identify possible concerns and conduct risk-mitigation steps, as well as provide an extra layer of protection beyond typical login and password authentication. Moreover, AI-powered capabilities like document classification, predictive analytics, and anomaly detection may help users manage, analyze, and get insights from their data. For instance, Amelia showcased the newest version of its Conversational AI platform at Enterprise Connect 2024. This version utilizes generative AI as well as deterministic abilities, which allow organizations to implement virtual agents for consumer care applications that offer the most efficient resolutions to customers’ both transactional and informational requests. For another instance, CallCabinet introduced advanced version of its AI-driven Conversation Analytics, featuring enhanced generative AI integration, an optimized interface, and greater customization options. This update empowers businesses to tailor analytics to their strategic goals, boosting efficiency and fostering cross-departmental engagement with intuitive data insights.

Virtual Data Room Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global virtual data room market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on component, deployment type, enterprise size, business function, and vertical.

Analysis by Component:

- Solution

- Services

Solution stand as the largest component in 2025, holding around 75.0% of the market. Cloud-based VDRs meet the demands of a variety of industries by providing scalability, accessibility, and comprehensive security. Their subscription-based pricing strategy appeals to organizations of all sizes since it eliminates upfront infrastructure expenditures. Advanced features like AI integration, smartphone optimization, and compliance certifications add to their attractiveness. With the global move toward remote work and rising data security concerns, cloud-based VDRs remain the market leaders, acting as essential solutions for safe data management, communication, and compliance in a variety of industries throughout the world. For example, Accenture and Google Cloud proliferated their global alliance to help organizations safeguard critical assets and enhance security against ongoing cyber threats. Together, they are delivering the necessary technology and security expertise to strengthen trusted infrastructures, enabling businesses to develop comprehensive security programs and maintain confidence in their preparedness.

Analysis by Deployment Type:

- Cloud-based

- On-premises

On-premises lead the market in 2025. While cloud-based solutions have gained popularity, on-premises virtual data rooms (VDR) solutions continue to account for a sizable portion of the industry. On-premises VDRs are especially popular in areas with high data security and compliance requirements, such as banking and healthcare, since they provide enterprises more control over their data by keeping it within their physical infrastructure. Despite the advent of cloud-based alternatives, on-premises solutions are still chosen by enterprises desiring total control over sensitive data. However, as cloud technology progresses and security issues are addressed, the mix of on-premises and cloud-based VDR systems may vary in the future. The demand for on-premises VDRs is expected to remain strong in industries with stringent security needs. The market dynamics will evolve as hybrid solutions gain traction in response to shifting enterprise preferences.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises lead the market with around 65.7% of market share in 2025. With their enormous data management requirements, complicated workflows, and rigorous security requirements, major organizations rely significantly on VDRs for safe document exchange, due diligence procedures, M&A operations, and compliance responsibilities. These firms frequently emphasize features such as robust encryption, granular access restrictions, and integration capabilities in order to expedite operations and maintain data security. As the digital transition continues and data becomes more valuable, major companies will continue to drive demand for sophisticated VDR solutions suited to their requirements and challenges. The scale of large enterprises ensures that their VDR demands will shape the market’s future direction. They are the primary consumers of the most advanced VDR technologies.

Analysis by Business Function:

- Marketing and Sales

- Legal

- Finance

- Workforce Management

Finance leads the market in 2025. Given the industry's high-stakes transactions, tight rules, and sensitive data handling, VDRs are critical in enabling safe document sharing, due diligence, mergers and acquisitions, and financing. Finance organizations prefer VDR capabilities such as strong encryption, compliance certifications, and audit trails to protect private information and maintain regulatory compliance. As financial transactions shift to digital platforms, the need for VDR solutions suited to the specific demands of the finance industry grows, cementing its position as a key driver of market development. The finance sector’s dominance in VDR adoption will continue as it faces increasing regulatory pressure and digital transformation. Market growth will be driven by a continued focus on security and compliance in financial transactions.

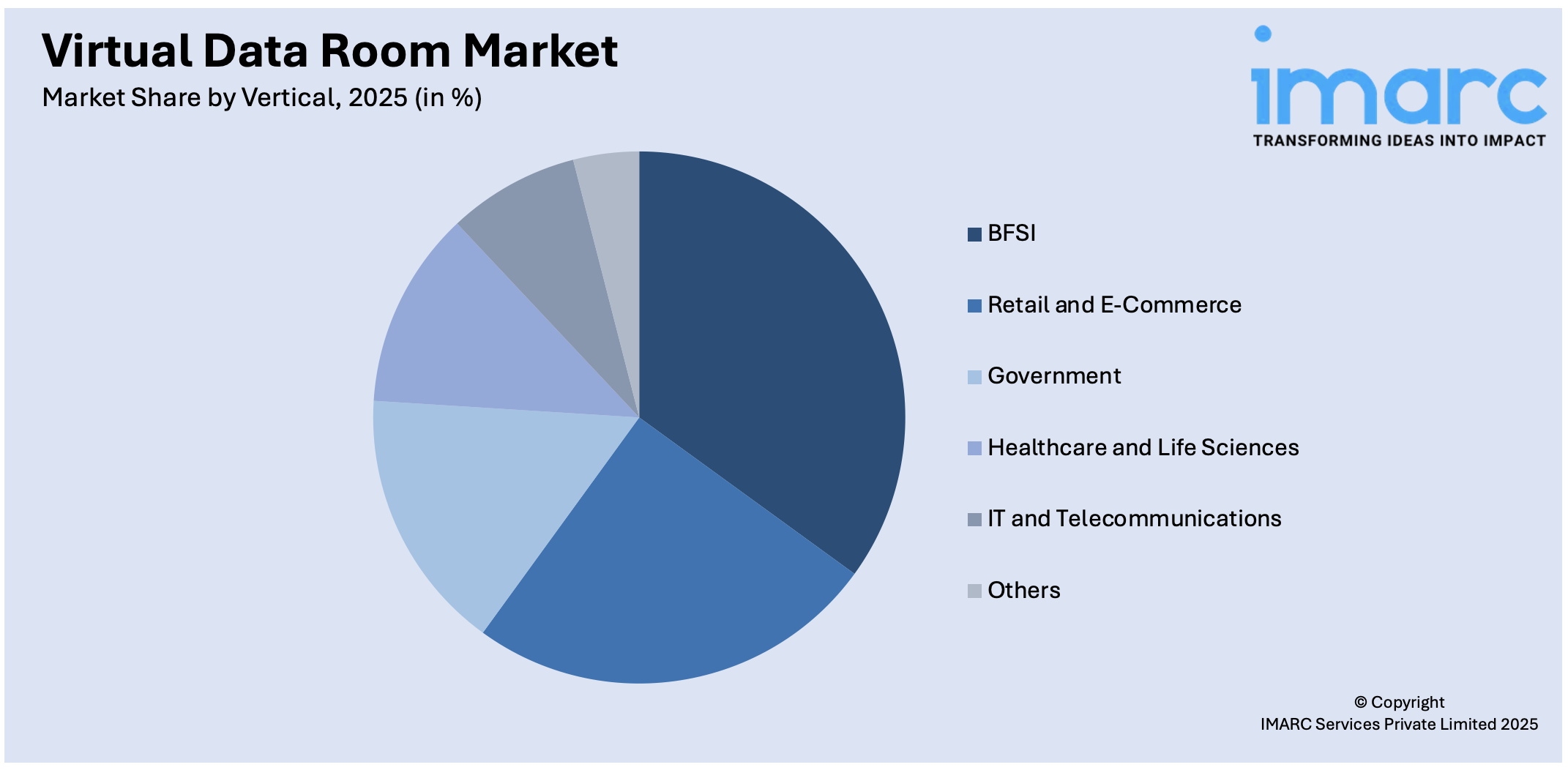

Analysis by Vertical:

Access the comprehensive market breakdown Request Sample

- BFSI

- Retail and E-Commerce

- Government

- Healthcare and Life Sciences

- IT and Telecommunications

- Others

BFSI leads the market with around 34.0% of market share in 2025. Given the industry's crucial requirement for safe data management, compliance, and secret transactions, VDRs play an important role in supporting mergers and acquisitions, due diligence, financing, and regulatory compliance procedures. BFSI companies choose VDR systems that have sophisticated security features, regulatory certifications, and seamless integration capabilities to improve operations and assure data integrity. As the BFSI industry embraces digital transformation and worldwide development, the need for solid VDR solutions adapted to its unique needs remains strong, resulting in considerable market growth. For instance, with a notable emphasis on constructing leading-edge VDR services, crucial industry players, mainly encompassing Firmex, Intralinks, Inc., Ansarada Pty Ltd, and Datasite, are actively targeting at offering AI-based solutions. This AI-backed virtual data room service fosters clients to avail insights in real-time regarding the beavior of the bidder’s and their target zones. In addition, AI-based solutions significantly lower users’ time utilization in arranging documents and managing the reporting by transforming it automated.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 41.2%. Some of the major factors impacting the North America virtual data room market expansion encompass escalating automation deployment, rapid increase in mergers and acquisitions (M&A) efforts, technological enhancements, etc. This dominance is due to the region's excellent technology infrastructure, strong regulatory frameworks, and mature financial and legal industries. With a large frequency of mergers, acquisitions, and fundraising operations, North American enterprises in a variety of sectors rely on VDRs for safe document exchange, due diligence, and compliance. As the area continues to lead in digital innovation and data-driven business practices, demand for VDR solutions customized to North American market demands remains high, fueling the sector's sustained expansion. For instance, as per the European Federation of Pharmaceutical Industries and Associations reports, North America, encompassing the United States and Canada, held the largest share of the global pharmaceutical market at 49%, surpassing Japan, Europe, and China. The region's elevated requirement for pharmaceuticals has driven a substantially elevated level of investment in drug manufacturing, discovery, as well as development compared to other regions. This trend is anticipated to boost the adoption of cloud services, contributing to growth in the North American market throughout the study’s forecast period.

Key Regional Takeaways:

United States Virtual Data Room Market Analysis

In 2024, United States accounted for 84.50% of the market share in North America. The increasing use of virtual data rooms (VDRs) is being strongly influenced by the growing shift toward cloud-based solutions, particularly in regions with advanced technological infrastructure. According to survey, 98% of U.S. organizations have adopted cloud technology for business operations. This adoption is fuelled by the significant benefits of enhanced security, scalability, and ease of access provided by cloud environments. As more businesses move their operations to the cloud, VDRs are being recognized for their ability to securely store and share sensitive documents in a virtual space, ensuring real-time collaboration while mitigating data risks. As the demand for cloud solutions continues to expand, VDRs have become integral tools for organizations involved in mergers and acquisitions, fundraising, and various high-stakes business activities. This trend is evident across various sectors, as companies seek solutions that facilitate more efficient document management and collaboration, while aligning with modern data storage and sharing needs.

Asia Pacific Virtual Data Room Market Analysis

The adoption of virtual data rooms is witnessing a notable rise due to the growing presence of small and medium-scale enterprises (SMEs) in emerging markets. According to India Brand Equity Foundation, the number of MSMEs in the country is projected to grow from 6.3 crore to around 7.5 crore at a CAGR of 2.5%. These businesses are increasingly recognizing the advantages of digital transformation tools that streamline operations, improve collaboration, and ensure secure data handling. VDRs provide SMEs with cost-effective and reliable solutions to manage sensitive information, especially as these companies expand their business operations and enter new markets. The need for secure, easily accessible document sharing has become critical in industries such as finance, legal services, and real estate. With digital infrastructures improving across the region, VDRs are becoming essential tools for managing business-critical information, fostering growth, and facilitating smoother communication and transactions between SMEs and their partners.

Europe Virtual Data Room Market Analysis

The growth of virtual data rooms is largely driven by the increasing demand from the banking, financial services, and insurance (BFSI) sector. According to reports, there were 784 bank branches that were foreign in the European Union during the year 2021, out of which 619 were from other member states across the EU and 165 from third nations. As financial institutions continue to expand their digital offerings, the need for secure, cloud-based solutions to handle sensitive data, including contracts, financial records, and compliance documents, has risen dramatically. The BFSI sector is particularly focused on enhancing operational efficiency, minimizing data risks, and improving the overall customer experience through digital tools like VDRs. By enabling secure document management and facilitating seamless collaboration between institutions and clients, VDRs support the sector's digital transformation. These solutions also offer critical features like audit trails, role-based access control, and compliance management, addressing the growing regulatory and security requirements in the sector.

Latin America Virtual Data Room Market Analysis

The rise of retail and e-commerce in various regions is driving the growing adoption of virtual data rooms, as businesses seek efficient ways to manage large volumes of sensitive data. According to reports, the Latin America market currently boasts over 300 Million digital buyers. Retailers and e-commerce companies are increasingly looking for secure document-sharing platforms to streamline their operations, handle sensitive customer information, and ensure safe transactions. Virtual data rooms provide a reliable solution for managing contracts, supplier data, customer records, and other critical information. As businesses in the retail and e-commerce sectors scale and expand their operations, the demand for secure, flexible data storage and management solutions like VDRs continues to increase, helping companies maintain compliance, safeguard data, and enhance customer trust.

Middle East and Africa Virtual Data Room Market Analysis

The Middle East and Africa are witnessing rapid growth in the IT and telecommunications sector, leading to a surge in demand for virtual data rooms. For instance, overall expenditure on information and communications technology across the Middle East, Türkiye, and Africa (META) will top USD 238 Billion during the year 2024, an elevation of 4.5% over 2023. With significant investments in infrastructure and the growing need for secure, cloud-based solutions, VDRs are becoming integral in managing sensitive data in this evolving sector. Telecommunications companies require secure data management platforms to handle contracts, regulatory documents, and other confidential information, especially as they expand their service offerings. Virtual data rooms offer these companies the necessary security, flexibility, and scalability to manage their documents securely while adhering to regional regulations. This adoption is expected to continue rising as the IT and telecom industries in the region grow and digital transformation accelerates.

Competitive Landscape:

The market is exhibiting robust competition, with several established players dominating the landscape. Key companies are actively offer comprehensive, secure data-sharing solutions for industries such as finance, real estate, legal, and healthcare. For instance, in September 2024, IDBI Bank announced to grant access to approved bidders for the bank’s virtual data room, post RBI's approval in July. This highlights the first tactical disinvestment of a bank with substantial government ownership, targeting for completion in FY2024. The competition is further driven by the continuous innovation in security features, ease of use, and integration capabilities. Companies are increasingly focusing on providing cloud-based VDRs, mobile access, and AI-driven tools to enhance user experience. Tactical collaborations, acquisitions, and regional expansions are common strategies for gaining market share and catering to a growing global demand.

The report provides a comprehensive analysis of the competitive landscape in the virtual data room market with detailed profiles of all major companies, including:

- Ansarada Pty Ltd.

- Brainloop AG (Diligent Corporation)

- CapLinked

- Citrix Systems Inc.

- Datasite Global Corporation

- DealRoom Inc.

- EthosData

- Firmex Inc

- FORDATA sp. z o.o.

- iDeals Solutions Group

- Intralinks Holdings Inc. (SS&C Technologies)

- SecureDocs Inc.

- ShareVault (Pandesa Corporation)

- SmartRoom (BMC Group)

Latest News and Developments:

- November 2024: Bite Investments has launched its Virtual Data Room 2.0 (VDR) as part of the Bite Stream platform, streamlining workflows and improving security for the alternative investments industry. The integrated solution enhances collaboration and eliminates inefficiencies, allowing professionals to manage the full investor lifecycle without switching between systems.

- September 2024: Bloomberg has launched a new Virtual Data Room (VDR) to streamline the evaluation of its Bulk Data License content. Hosted in Python-based Jupyter Notebooks, the VDR allows customers to quickly explore Bloomberg's extensive datasets before subscribing, enhancing decision-making processes. This innovation substantially lowers the resources as well as duration needed for investment research and operational workflows.

- July 2024: Debitos, a leading European online marketplace for debt and receivables, has launched an AI-powered searchable data room service. This innovative feature enhances the Virtual Data Room (VDR) experience, improving data management and retrieval for both buyers and sellers. Available within premium subscription plans, it streamlines operations and boosts efficiency.

- March 2024: Virtual Incision Corporation, MIRA Surgical System developer, announced the showcasing of MIRA at NVIDIA GTC, global AI conference that is gravitated on navigating future prospects of autonomous machines, machine learning, AI, computer graphics, and data science, and across major sectors.

- March 2024: ServiceNow, the leading digital workflow company strengthened its generative AI (GenAI) capabilities with the latest enhancements in its Washington, D.C. platform release. These new features improve the Now Assist GenAI experiences, integrating responsible, intelligent automation into the ServiceNow platform. The updates include Now Assist for IT Operations Management (ITOM) AIOps, enhanced capabilities for the Virtual Agent, and ServiceNow Impact AI Accelerators. These innovations expand ServiceNow’s AI offerings, driving productivity improvements and accelerating the value of AI investments for organizations.

Virtual Data Room Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Types Covered | Cloud-based, On-premises |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| Business Functions Covered | Marketing and Sales, Legal, Finance, Workforce Management |

| Verticals Covered | BFSI, Retail and E-Commerce, Government, Healthcare and Life Sciences, IT and Telecommunications, and Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ansarada Pty Ltd., Brainloop AG (Diligent Corporation), CapLinked, Citrix Systems Inc., Datasite Global Corporation, DealRoom Inc., EthosData, Firmex Inc, FORDATA sp. z o.o., iDeals Solutions Group, Intralinks Holdings Inc. (SS&C Technologies), SecureDocs Inc., ShareVault (Pandesa Corporation), SmartRoom (BMC Group), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the keyword virtual data room from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global virtual data room market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the virtual data room industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The virtual data room market was valued at USD 3.2 Billion in 2025.

IMARC estimates the virtual data room market to reach USD 8.0 Billion by 2034, exhibiting a CAGR of 10.79% during 2026-2034.

Key factors driving the market expansion encompass the increasing requirement for safe data storage, magnifying M&A activities, the emergence of remote work, regulatory adherence needs, and the requirement for effective document management and collaboration tools across segments like finance, legal, and healthcare.

North America currently dominates the virtual data room market, accounting for a share exceeding 41.2%. This dominance is fueled by innovative technological infrastructure, elevated adoption rates across major sectors, and resilient foothold of key industry players.

Some of the major players in the virtual data room market include Ansarada Pty Ltd., Brainloop AG (Diligent Corporation), CapLinked, Citrix Systems Inc., Datasite Global Corporation, DealRoom Inc., EthosData, Firmex Inc, FORDATA sp. z o.o., iDeals Solutions Group, Intralinks Holdings Inc. (SS&C Technologies), SecureDocs Inc., ShareVault (Pandesa Corporation), SmartRoom (BMC Group), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)