Vitamin Ingredients Market Size, Share, Trends and Forecast by Type, Form, Source, Application, and Region, 2025-2033

Vitamin Ingredients Market Size and Share:

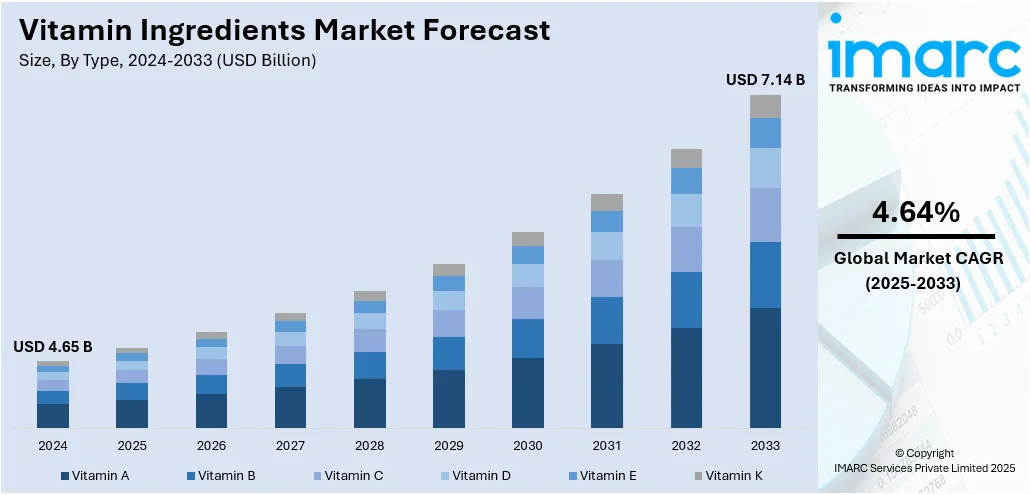

The global vitamin ingredients market size was valued at USD 4.65 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 7.14 Billion by 2033, exhibiting a CAGR of 4.64% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 39.8% in 2024. The dominance of the region is because of its growing population base, higher health consciousness, increasing disposable income, and rising demand for nutritional supplements. Expanding middle-class demographics and greater consumer focus on preventive healthcare also contributes to the region’s strong market position.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.65 Billion |

|

Market Forecast in 2033

|

USD 7.14 Billion |

| Market Growth Rate 2025-2033 | 4.64% |

The rising awareness about the significance of nutrition and preventive healthcare is catalyzing the demand for vitamin components. Individuals are progressively acknowledging the importance of vitamins in enhancing immunity, promoting energy levels, and averting chronic diseases, which is leading to higher supplement usage. Furthermore, vitamin shortages continue to be a significant health issue in numerous regions globally. Government and private sector efforts to address malnutrition are enhancing the incorporation of vitamins in food assistance initiatives, fortified items, and supplements, thus increasing the need for vitamin ingredients. Apart from this, improvements in vitamin formulation technologies, including microencapsulation, liposomal delivery, and nanoemulsion, are enhancing the stability, absorption, and flavor of vitamins. These advancements enhance the effectiveness and attractiveness of supplements to consumers, facilitating their adoption among a broader audience and various uses.

To get more information on this market, Request Sample

The United States represents a vital part of the market, propelled by the growing demand for supplements that are both child-friendly and easy to consume. Parents are looking for items that merge nutrition with convenience, tasty flavors, and transparent ingredient lists. This trend indicates an increasing emphasis on health during early life, immune function, and overall balanced growth. In 2024, LiveGood launched certified organic children's multivitamin gummies containing 20mg of Vitamin C, zinc, and other essential nutrients to support brain, immune, and bone development. The citrus-flavored, vegan gummies were designed for easy consumption with minimal added sugar. Besides this, the advanced retail and e-commerce environment in the country ensures that vitamin products are readily available. E-commerce sites and health-centric retailers provide numerous choices, enhancing consumer exposure and purchase frequency.

Vitamin Ingredients Market Trends:

Growing Demand for Age-Related Nutritional Support

The swiftly increasing elderly population worldwide is a major factor propelling the vitamin ingredients market growth. The World Health Organization (WHO) estimated that by 2050, the worldwide population of people aged 60 and above will reach 2.1 billion, which is double the 1 billion recorded in 2020. With the increase in the population of older adults, there is a rise in the demand for specific nutritional solutions that focus on health issues related to aging, including bone health, cognitive abilities, and immune support. Elderly people frequently encounter higher risks of vitamin deficiencies because of alterations in metabolism, absorption, and eating patterns. This demographic change encourages producers to create specific vitamin products designed for the distinct requirements of seniors, fostering healthy aging and enhanced quality of life. As a result, the increasing elderly population is catalyzing the demand for vitamin ingredients that promote longevity and health.

Innovation in Product Formulation

Ongoing innovation in product formulation is offering a favorable vitamin ingredients market outlook, as consumers progressively seek holistic health solutions that match their values and lifestyle. Modern consumers seek supplements that offer various health advantages via thoroughly studied, multifunctional nutrients, preferably derived from natural, organic, and plant-based sources. The increasing demand for clean-label, vegan, and allergen-free items is encouraging producers to create innovative formulations that attract diverse age groups and dietary choices. For example, in 2025, New Chapter introduced its initial liquid multivitamin containing 22 vital nutrients, such as fermented B vitamins, Vitamin C, Vitamin K, and superfoods. Created for all family members (ages 2+), it promotes heart, brain, bone, and immune wellness. The product fulfills consumer demands for openness and cleanliness, being vegan, non-GMO, and certified organic. These innovations are crucial for addressing changing consumer needs and strengthening the market growth.

Advancements in Delivery Formats

With consumers looking for more convenient, enjoyable, and effective methods to ingest supplements, brands are expanding beyond traditional pills and capsules to provide options like soft chews and fortified snacks. These innovations not only elevate the user experience but also boost nutrient absorption and adherence, especially in children, the elderly, and those with swallowing challenges. By providing vitamins in recognizable, attractive formats, businesses are broadening their audience and addressing varied tastes. This emphasis on accessible delivery systems enhances product differentiation in a competitive landscape, while also increasing consumer interaction and long-term brand loyalty. In 2024, Kappa Bioscience launched seven new K2VITAL Vitamin K2 MK-7 white-label products at Vitafoods Europe in Barcelona. These ready-to-launch concepts, developed with partners like ConCordix, Milsing, and Nutrinovate, targeted bone and heart health using innovative delivery formats. The products included soft chews, choco bars, gels, and film strips for diverse consumer needs.

Vitamin Ingredients Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global vitamin ingredients market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, form, source, and application.

Analysis by Type:

- Vitamin A

- Vitamin B

- Vitamin C

- Vitamin D

- Vitamin E

- Vitamin K

Vitamin B represents the largest segment, accounting 27.5% market share, owing to its wide array of health advantages and crucial functions in supporting overall bodily operations. In contrast to individual vitamins, the B-complex group comprises eight distinct vitamins, such as B1, B2, B3, B6, B9, and B12, each providing specific benefits for energy metabolism, cognitive function, red blood cell production, and nervous system wellness. This extensive usefulness makes Vitamin B supplements highly favored among diverse age groups, particularly those experiencing high stress, vegetarians, seniors, and pregnant women, who frequently need increased or specific consumption. Additionally, heightened awareness about lifestyle-related deficiencies and the growing need for preventive healthcare are encouraging the consumption of B-complex vitamins. The flexible use of Vitamin B in enriched foods, energy drinks, dietary supplements, and functional beverages expands its market presence. Moreover, ongoing product innovation and the rise of plant-based and vegan substitutes are fostering its growth in both advanced and developing markets.

Analysis by Form:

- Tablets and Capsules

- Powder

- Others

Tablets and capsules dominate the market, holding a share of 63.2%, owing to their convenience, stability, and accurate dosing. These formats are simple to produce, store, and transport, which makes them increasingly favored by consumers and manufacturers alike. Tablets and capsules provide extended shelf life, regulated release, and the capacity to mix various components in one dose, improving adherence and attractiveness to consumers. Their popularity is boosted by rising demand for dietary supplements, especially among older adults and health-focused individuals looking for easy, convenient options for everyday nutrition. Moreover, progress in encapsulation technologies and coating techniques are enhancing the bioavailability and absorption of active vitamin components, boosting their efficacy. Regulatory agencies prefer these types due to their reliability and safety. As a result, the market remains dominated by tablets and capsules due to their widespread availability, consumer recognition, and continuous advancements in formulation and delivery methods.

Analysis by Source:

- Natural

- Synthetic

Natural comprises vitamins obtained from plant, animal, or microbial origins without any synthetic processing. The increasing consumer inclination towards clean-label, organic, and plant-based products significantly contributes to the rising demand for natural vitamin ingredients. This segment is regarded as safer and more advantageous because of its bioavailability and compatibility with holistic health movements. The growing trend of health-oriented living and heightened worries about synthetic additives are increasing the appeal of vitamins derived from natural sources.

Synthetic includes vitamins that are produced in labs through chemical processes to mimic the molecular structure of vitamins found in nature. This segment is renowned for its affordability, scalability, and reliable quality. Synthetic vitamin provides manufacturers with increased versatility in formulation and production, making them ideal for large-scale pharmaceutical and fortified food uses. Its consistent shelf life and regulated strength also make them a favored option in both clinical and commercial environments.

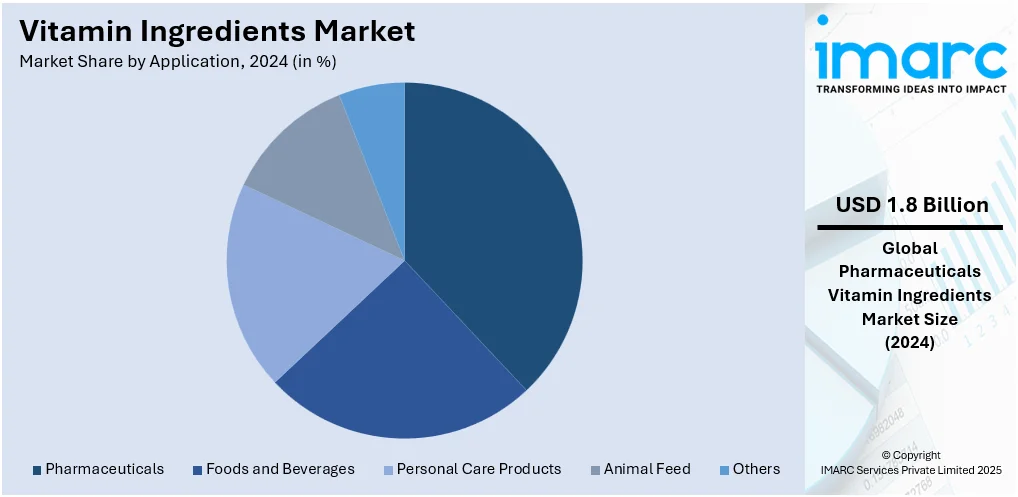

Analysis by Application:

- Pharmaceuticals

- Foods and Beverages

- Personal Care Products

- Animal Feed

- Others

Pharmaceuticals represent the largest segment, holding a share of 37.8%, because vitamins are essential in preventing, treating, and managing multiple health issues. Vitamins are commonly incorporated into pharmaceutical formulations to correct deficiencies, bolster immune function, aid recovery, and enhance general health outcomes. The growing worldwide prevalence of chronic illnesses, aging demographics, and heightened awareness about preventive health are catalyzing the demand for vitamin-based medicinal products. Moreover, improvements in drug delivery methods and formulation technologies are increasing the bioavailability and stability of vitamins, making them more effective for therapeutic use. Supportive regulations and guidelines for incorporating essential vitamins into medical therapies further support the expansion in this sector. Additionally, the rising inclination towards evidence-based supplements and vitamin-enriched medications among healthcare professionals and patients are bolstering the pharmaceutical industry's dominance in the market, establishing it as the primary application for vitamin components worldwide.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for a share of 39.8%, attributed to its substantial and expanding population, heightened health awareness, and growing need for nutritional supplements among diverse demographics. The region's increasing middle class and growing disposable incomes are resulting in a rise in the use of health and wellness products, such as fortified foods and dietary supplements. A significant shift towards preventive wellness and comprehensive nutrition persists in shaping buying habits, as consumers look for clean-label, plant-based options. Health agencies and governments are actively raising awareness about micronutrient deficiencies, increasing the demand for products enriched with vitamins. Moreover, significant funding in research, innovation, and local manufacturing from both local and foreign firms is bolstering the region’s market leadership. For example, in 2025, Amway India introduced Nutrilite Triple Protect, a plant-derived supplement aimed at enhancing immunity, decreasing inflammation, and promoting gut and skin wellness. With components such as Acerola Cherry and Turmeric, it provides 100% RDA of Vitamin C, meeting the increasing consumer interest in natural, scientifically-supported health options.

Key Regional Takeaways:

United States Vitamin Ingredients Market Analysis

The market for vitamin ingredients in the United States holds a share of 83.20%. It is propelled by increasing consumer health awareness, supported by heightened knowledge regarding preventive healthcare, immunity enhancement, and wellness lifestyles. This is awareness is driving the need for vitamins in multiple functional nutrition items, especially enriched foods and drinks, along with dietary supplements. The Council for Responsible Nutrition reports that in 2024, 75% of people in the United States frequently took dietary supplements, with the average monthly spending on these items hitting USD 50. Millennials and Gen Z, especially, are looking for clean-label, plant-derived, and sustainably sourced vitamin components, leading producers to provide vegan, non-GMO, and organic options. Additionally, an expanding elderly demographic is raising the need for nutrition-focused products rich in vitamins that promote bone health, cognitive abilities, and heart wellness. Furthermore, advancements in technology for improving bioavailability, like microencapsulation and liposomal delivery methods, are facilitating greater effectiveness and consumer attraction to high-quality products. Regulatory shifts and heightened enforcement are enhancing transparency and quality benchmarks, encouraging manufacturers to invest in high-purity, clinically validated vitamin components. Furthermore, sustainability pledges throughout the supply chain, encompassing ingredient sourcing and manufacturing methods, are shaping industry strategies and consumer approval, fostering broad utilization.

Europe Vitamin Ingredients Market Analysis

The expansion of the European vitamin ingredients market is primarily driven by rising consumer interest in proactive health maintenance and lifestyle enhancement via nutrition. As the population ages, there is higher emphasis on nutritional approaches for health issues related to aging, including bone health, cognitive ability, and immune function. The demographic of individuals aged 60 and above is quickly increasing in the WHO European Region. In 2021, the total was 215 million; it is estimated to reach 247 million by 2030. Additionally, the sports nutrition and active lifestyle sector is growing, with vitamins crucial for recovery, performance, and stamina, thus driving the need for tailored formulations. Moreover, tighter EU regulations concerning ingredient safety, traceability, and quality are encouraging manufacturers to embrace high-quality, clean-label, and clinically verified vitamin sources. Environmental and ethical factors are also shaping ingredient selections as plant-based, non-GMO, and sustainably sourced vitamins become more popular. Moreover, the growing trend of personalized nutrition, bolstered by digital health platforms and direct-to-consumer approaches, is encouraging manufacturers to provide tailored blends. Besides this, the robust presence of pharmaceutical and nutraceutical firms in Europe is fostering innovation and swift product development, strengthening the market industry growth.

Asia Pacific Vitamin Ingredients Market Analysis

The vitamin ingredients market in the Asia Pacific is growing due to higher disposable incomes, greater health consciousness, and evolving dietary habits among city dwellers. For example, in India, the disposable income per person hit USD 2.54 Thousand in 2023 and is projected to reach USD 4.34 Thousand by 2029, according to the India Brand Equity Foundation (IBEF). With middle-class consumers focusing on wellness, there is an increase in the need for foods, drinks, and personal nutrition supplements enriched with vitamins. Additionally, South Asia serves as the worldwide hub for undernourished teenage girls, comprising 65% of the global population of underweight girls and 41% of those who are anemic. This significant nutritional issue is catalyzing the demand for vital vitamin supplements, especially to address deficiencies in iron and Vitamin A. Conventional markets are merging with contemporary wellness movements, increasing focus on immunity, digestive health, and beauty-from-within products that incorporate vitamins like B complex, C, and E, along with collagen-related nutrients. Moreover, local producers are progressively allocating resources to clean-label, plant-based, and sustainably sourced vitamin components to align with consumer demands and regulatory requirements. New delivery formats like effervescent tablets, gummies, and powder sachets are offering attractive, convenient choices for hectic lifestyles, thereby boosting the market expansion.

Latin America Vitamin Ingredients Market Analysis

The market for vitamin ingredients in Latin America is influenced by rising government efforts to address nutritional deficiencies via food fortification and public health initiatives. In May 2025, the Food and Agriculture Organization of the United Nations (FAO) along with the Government of Brazil launched the project ‘Strengthening the Regional Food Systems Agenda for the Urban-Rural Continuum in Latin America and the Caribbean’ under the Brazil-FAO International Cooperation Program. The initiative seeks to enhance access to healthy food for the most at-risk communities throughout Chile, Colombia, Costa Rica, Cuba, and Peru. With regional health systems prioritizing prevention, the demand for budget-friendly vitamin ingredients in essential foods and community nutritional items is increasing. The economic growth in emerging markets is facilitating greater access to health supplements, which is contributing to the vitamin ingredients market growth.

Middle East and Africa Vitamin Ingredients Market Analysis

The vitamin ingredients market in the Middle East and Africa is seeing expansion owing to the rising prevalence of lifestyle-related illnesses like obesity and diabetes, which is leading to a transition towards health-oriented diets and supplements. As malnutrition becomes more common, especially with micronutrient shortages, the need for vitamin supplements is increasing. As per UNICEF, 13 million children are projected to suffer from malnutrition in Eastern and Southern Africa by 2025, emphasizing the critical demand for nutritional programs. With governing authorities and health organizations advocating for nutrition awareness campaigns, many consumers are incorporating vitamin-fortified products into their daily habits. Urbanization and evolving eating patterns are catalyzing the demand for convenient nutritional options, while vitamin-enhanced personal care and cosmetic items are rising in popularity in the area, promoting overall industry growth.

Competitive Landscape:

Major participants in the industry are actively engaging in strategic efforts to strengthen their market presence and respond to evolving consumer demands. A significant emphasis is placed on research activities to produce more efficient, stable, and bioavailable formulations that address contemporary health needs. Businesses are increasing production capabilities and enhancing supply chains to ensure consistent product availability. Strategic mergers, acquisitions, and collaborations are being utilized to expand international presence and diversify product lines. There is a rise in focus on clean-label components, sustainability, and compliance with regulatory requirements. In 2024, Balchem launched Vital Trio, a triad supplement concept merging vitamin K2, D3, and magnesium bisglycinate, aimed at promoting bone, heart, and immune wellness. This advancement, backed by patented microencapsulation technology, enhanced ingredient stability and synergy. Such advancements illustrate how market leaders are using science-driven solutions to deliver targeted health benefits and gain a competitive edge.

The report provides a comprehensive analysis of the competitive landscape in the vitamin ingredients market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Archer Daniels Midland Company

- BASF SA

- Bluestar Adisseo Company

- Btsa Biotecnologías Aplicadas S.L.

- Farbest-Tallman Foods Corp.

- Glanbia Plc

- Koninklijke DSM N.V.

- Lonza Group

- Nestlé S.A.

- Pfizer Inc.

- Rabar Pty Ltd.

- The Wright Group

Latest News and Developments:

- March 2025: The Louis Dreyfus Company launched its new plant-based vitamin E ingredients at the 2025 Food Ingredients China exhibition, strengthening its position in the plant-based ingredients sector. The company plans to offer a broad variety of superior plant-based vitamin E solutions, such as mixed tocopherols, acetate products, and succinate products, to meet the diverse demands of various applications.

- January 2025: Jubilant Ingrevia Limited opened a new cGMP-compliant production plant in Bharuch, Gujarat, for the manufacturing of dietary ingredients and nutraceuticals. The new plant is expected to strengthen the company’s production capabilities for vitamin B3 ingredients.

- December 2024: Louis Dreyfus Company announced plans to acquire BASF’s Food and Health Performance Ingredients division, a manufacturer of plant-based food performance ingredients, including vitamin ingredients. This includes three application labs outside of Germany as well as a production facility and cutting-edge R&D center in Illertissen, Germany.

- October 2024: dsm-firmenich launched its novel Dry Vitamin A Palmitate for Early Life Nutrition. This novel product is an innovative, clean-label solution that addresses the stability problems of conventional vitamin A ingredients while improving the nutritional content of baby formula.

Vitamin Ingredients Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Vitamin A, Vitamin B, Vitamin C, Vitamin D, Vitamin E, Vitamin K |

| Forms Covered | Tablets and Capsules, Powder, Others |

| Sources Covered | Natural, Synthetic |

| Applications Covered | Pharmaceuticals, Foods and Beverages, Personal Care Products, Animal Feed, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Archer Daniels Midland Company, BASF SA, Bluestar Adisseo Company, Btsa Biotecnologías Aplicadas S.L., Farbest-Tallman Foods Corp., Glanbia Plc, Koninklijke DSM N.V., Lonza Group, Nestlé S.A., Pfizer Inc., Rabar Pty Ltd. and The Wright Group |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the vitamin ingredients market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global vitamin ingredients market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the vitamin ingredients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vitamin ingredients market was valued at USD 4.65 Billion in 2024.

The vitamin ingredients market is projected to exhibit a CAGR of 4.64% during 2025-2033, reaching a value of USD 7.14 Billion by 2033.

The key factors driving the vitamin ingredients market include the growing health consciousness, rising need for dietary supplements, and an expanding aging population. Additionally, lifestyle changes, preventive healthcare focus, and expanding applications in food and beverages, and cosmetics contribute to the market growth. Technological advancements in formulation and increasing disposable incomes also support the rising global demand.

Asia Pacific currently dominates the vitamin ingredients market, accounting for a share of 39.8%. The dominance of the region is because of its substantial population base, heightened health awareness, increasing disposable income, and rising demand for nutritional supplements. Expanding middle-class demographics and greater consumer focus on preventive healthcare also contribute to the region’s strong market position.

Some of the major players in the vitamin ingredients market include Abbott Laboratories, Archer Daniels Midland Company, BASF SA, Bluestar Adisseo Company, Btsa Biotecnologías Aplicadas S.L., Farbest-Tallman Foods Corp., Glanbia Plc, Koninklijke DSM N.V., Lonza Group, Nestlé S.A., Pfizer Inc., Rabar Pty Ltd., The Wright Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)