Water Treatment Chemicals Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Water Treatment Chemicals Market 2024, Size and Trends:

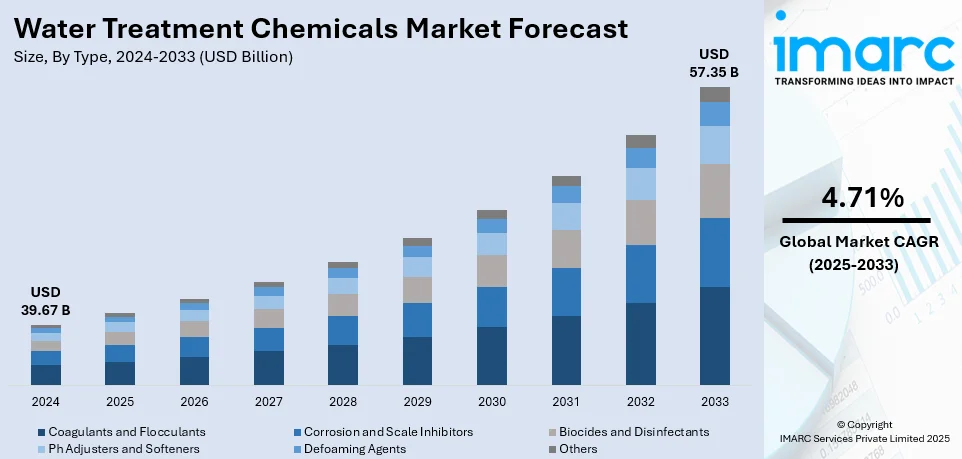

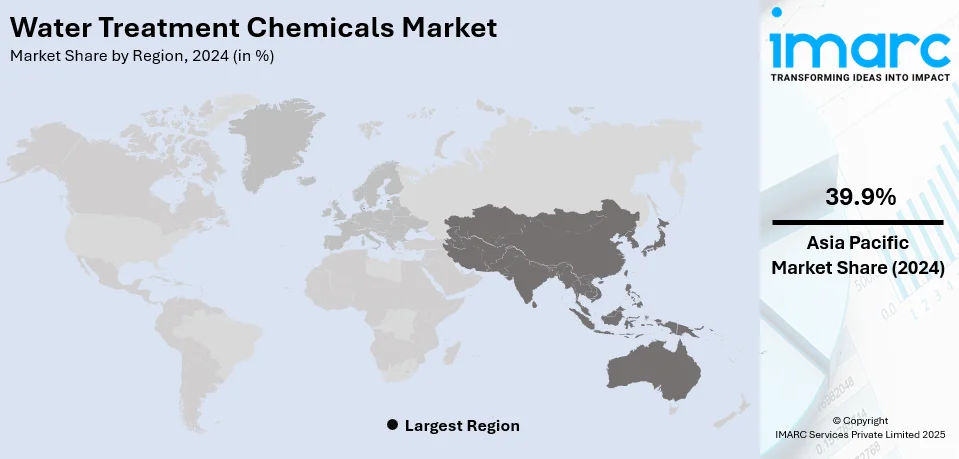

The global water treatment chemicals market size was valued at USD 39.67 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 57.35 Billion by 2033, exhibiting a CAGR of 4.71% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 39.9% in 2024. The increasing consumption of water, the scarcity of freshwater resources, the deteriorating quality of available water sources, and the implementation of stringent environmental regulations concerning water quality are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 39.67 Billion |

| Market Forecast in 2033 | USD 57.35 Billion |

| Market Growth Rate (2025-2033) | 4.71% |

The water treatment chemicals market growth is driven by an increasing demand for clean water due to rapid urbanization, population growth, and industrialization. Rising environmental awareness and stringent government regulations on wastewater discharge propel the market. Key industries like power generation, pharmaceuticals, food and beverage, and oil and gas heavily rely on water treatment solutions to ensure process efficiency and regulatory compliance. Additionally, the scarcity of freshwater resources has intensified the need for water reuse and recycling, boosting chemical demand. Technological advancements in treatment processes, such as membrane filtration and advanced oxidation, also influence market growth. The expansion of municipal water treatment facilities, particularly in emerging economies, contributes significantly to adopting these chemicals for safe water supply.

The water treatment chemicals market in the United States is driven by increasing industrialization and strict environmental regulations on wastewater treatment. The growing demand for clean water across industries, such as power generation, oil and gas, pharmaceuticals, and food and beverages, fuels the need for effective treatment solutions. Aging water infrastructure and the need for modernization further bolster chemical adoption to ensure water quality and compliance with safety standards. Rising concerns over water scarcity and wastewater reuse are also key factors. Additionally, urban population growth has increased the demand for municipal water treatment. Advancements in chemical formulations and a focus on sustainable water management practices further represent key water treatment chemicals market trends in the U.S. For instance, in November 2024, the U.S. EPA announced the launch of a new, free technical assistance program to lower exposure to emerging pollutants, such as perfluoroalkyl and polyfluoroalkyl substances (PFAS), in underserved or tiny areas. EPA's Water Technical Assistance (WaterTA) program includes this endeavor.

Water Treatment Chemicals Market Trends:

The increasing consumption of water

Chemicals used in water treatment are necessary to clean and prepare water from different sources so that it can be used for industrial uses, drinking, and other purposes. The water treatment chemicals demand is driven by the increasing requirement for water treatment, thereby propelling the water treatment chemicals market growth. Furthermore, there is a greater chance of water contamination and pollution with increased water use. Water quality declines as a result of inappropriate wastewater disposal, agricultural runoff, and industrial discharges. In order to address the particular impurities and guarantee the delivery of clean and safe water, water treatment chemicals are used. In addition, water treatment facilities frequently have to use increasingly sophisticated treatment procedures for satisfying the rising demand for clean water as water supplies become more limited. According to a report posted by the UN Environment Programme in 2021, due to a lack of data, the water quality of their rivers, lakes, and groundwater is unclear, putting nearly 3 million people at risk for illness. This further encouraged governments to focus on water treatment processes.

Industrial growth and increased water usage

The water treatment chemicals market revenue is projected to experience steady growth due to increasing demand for clean water and stringent regulatory standards. Water is essential to many industrial sectors, including manufacturing, mining, oil and gas, chemicals, and power generation. Because of the growing use of water, there is a larger need for chemicals used in water treatment to make sure the water utilized in these businesses is sufficiently treated and satisfies quality standards. Chemicals for water treatment are used to treat industrial water sources of pollutants, impurities, and other impurities so that the water is fit for a variety of industrial uses. Environmental rules that safeguard water resources and reduce pollution also apply to industrial operations. Industries are frequently forced to use effective water treatment systems and technologies to comply with these restrictions. Chemicals used in water treatment are essential for businesses to comply with these regulations and implement sustainable water management strategies, which, in turn, is facilitating the water treatment chemicals market demand. As per the UN World Water Development Report 2021, around 380 Billion m3 water can be recovered from the annual volumes of wastewater produced.

The implementation of stringent environmental regulations

Strict environmental laws place a strong emphasis on reducing and preventing pollution. Businesses must put policies in place to reduce the amount of pollution and other toxins that leak into waterways. Chemicals used in water treatment are essential for lowering the pollution levels in wastewater and guaranteeing that the water discharged satisfies regulations. In order to efficiently remove or neutralize pollutants, water treatment chemicals are in high demand due to the focus on pollution prevention and reduction. According to the WWF, approximately 1.1 Billion individuals globally face a lack of access to water, while an additional 2.7 Billion experience water scarcity for at least one month each year. Furthermore, there is an increase in the emphasis on reducing the usage of dangerous chemicals and switching to safer substitutes. This includes creating chemicals for water treatment that are non-toxic, biodegradable, and ecologically friendly. Stricter restrictions push the industry to offer more environment friendly solutions, which spurs innovation and growth in the water treatment sector. For example, Genesis Water Technologies launched Zeoturb, which is a bio-organic flocculant for wastewater processing.

Water Treatment Chemicals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global water treatment chemicals market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, and end user.

Analysis by Type:

- Coagulants and Flocculants

- Corrosion and Scale Inhibitors

- Biocides and Disinfectants

- Ph Adjusters and Softeners

- Defoaming Agents

- Others

Coagulants and flocculants stand as the largest component in 2024, holding around 36.3% of the market. Coagulants and flocculants play a crucial role in the removal of suspended solids from water. Water treatment facilities use coagulants to break loose suspended particles for aggregation and flocculants to create bigger settlement-friendly flocs. Efficient suspended solids elimination through coagulants and flocculants produces better water clarity along with enhanced quality which makes these products indispensable for water treatment methods that operate in different sectors and water treatment systems. Water treatment facilities in municipalities and industries use these coagulants and flocculants to purify water and operate inside wastewater facilities, specifically in mining operations and oil and gas facilities. Their versatility and ability to address a wide range of water treatment challenges contribute to their leading position in the market. For example, in 2021, the Government of India in collaboration with states and urban local bodies (ULBs), pledged to eliminate waste from all cities and to make sure that all used water, including fecal sludge, is safely contained, transported, processed, and disposed of. This is especially important in smaller cities, where untreated and dangerous fecal sludge and used water can contaminate the ground or water bodies.

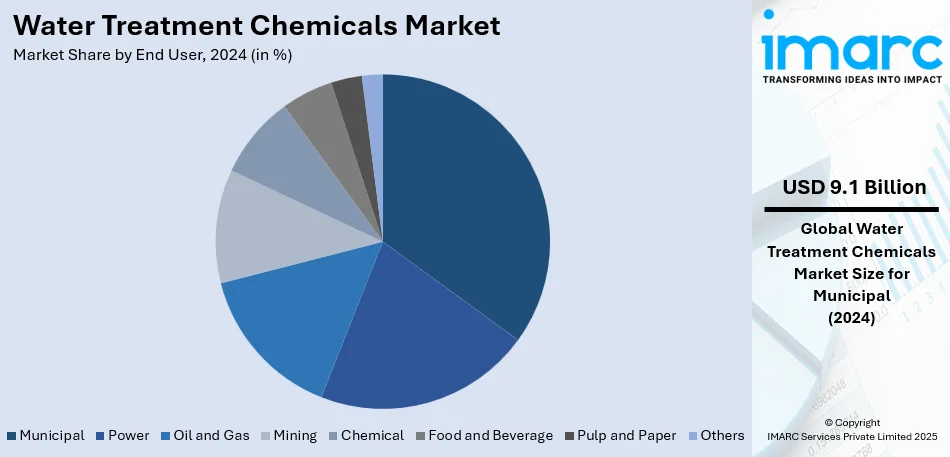

Analysis by End User:

- Municipal

- Power

- Oil and Gas

- Mining

- Chemical

- Food and Beverage

- Pulp and Paper

- Others

Municipal leads the market with around 23.0% of the market share in 2024. The purification and treatment of public water supply alongside wastewater treatment constitutes Municipal water treatment processes. The municipal water treatment facility utilizes water treatment chemicals to deliver uncontaminated drinking water to people and to properly treat wastewater before environmental discharge. On the basis of the information provided by the World Health Organization (WHO), in 2022, globally approx. 1.7 Billion people consumed water from sources contaminated with faeces.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 39.9%. The water treatment chemicals market statistics reveal a dynamic landscape in the Asia Pacific region. The Asia Pacific region contains a substantial percentage of the global population along with highly dense populations of China and India, among other countries. The rising number of residents and quick population density growth produce higher water requirements coupled with wastewater output throughout the region where water treatment chemicals remain essential. Asia Pacific contains specific locations that suffer from water shortage due to population density exceeding available freshwater supplies while climate changes add to the stress. Water management plus treatment techniques must be efficient to achieve higher water access while reducing all wastage. Water treatment chemicals play a crucial role in treating and reusing water resources, making them indispensable in water-stressed regions, thereby offering a favorable water treatment chemicals market outlook.

Key Regional Takeaways:

North America Water Treatment Chemicals Market Analysis

The North American water treatment chemicals market is fueling due to industrial development, expanded regulative standards and enhanced pollution awareness. The market is influenced by the rising customers need for safe drinking water and the expansion of wastewater treatment plants. Sustainable water management initiatives from the government along with strong implementation of water quality standards, encourage increased usage of treatment chemicals. The water treatment chemical market receives its primary demand from operational requirements of power generation industries, oil & gas operators, food processors and pharmaceutical manufacturers who need them for both efficiency and regulatory compliance. Market expansion occurs due to the rising usage of advanced treatment technologies such as membrane filtration and biological treatment. The growing concerns about water scarcity and climate change encourage businesses to enhance their water recycling operations and this rising interest in recycled water management creates more demand for hydrochemical treatment products. With growing awareness and the push for sustainable solutions, North America’s water treatment chemicals market is expected to continue its steady growth.

United States Water Treatment Chemicals Market Analysis

In 2024, the United States accounted for the largest water treatment chemicals market share of over 87.30% in North America. The water treatment chemicals market in the United States is primarily driven by stringent environmental regulations, growing industrialization, and the increasing demand for clean water. The Environmental Protection Agency (EPA) has implemented robust standards for water quality, which compels industries to adopt efficient water treatment solutions. Rapid urbanization and population growth further heighten the demand for municipal water treatment as water scarcity becomes a pressing concern. Additionally, according to the USDA, the U.S. agricultural sector accounted for 22.1 Million full- and part-time jobs in 2022, representing 10.4% of total U.S. employment. This sector significantly contributes to water demand and wastewater treatment needs, as its focus on improving irrigation systems and managing wastewater drives the adoption of water treatment chemicals. The industrial sector, particularly manufacturing, also faces heightened pressure to implement effective wastewater management due to growing environmental concerns. Furthermore, rising awareness regarding waterborne diseases and contamination has led to a surge in water purification systems for both commercial and residential use. The market is also supported by the growing emphasis on recycling and wastewater treatment, with industrial plants opting for water reuse to reduce operational costs and environmental impact. Investments in research and development continue to foster the introduction of innovative water treatment solutions, addressing complex challenges in water management.

Europe Water Treatment Chemicals Market Analysis

The water treatment chemicals market in Europe is driven by an increasing focus on environmental sustainability, stringent regulations, and the need for improved water quality. European Union regulations, such as the EU Water Framework Directive, enforce strict standards on water quality, requiring industries and municipalities to employ advanced water treatment solutions. Industrialization, particularly in sectors like chemicals, power, and textiles, further intensifies the need for effective wastewater treatment to minimize pollution. Additionally, according to reports, agricultural labor input in the EU was the equivalent of 7.6 Million full-time workers in 2023, highlighting the significant role agriculture plays in water demand and wastewater management. As the agricultural sector expands, the need for efficient irrigation systems and wastewater management solutions increases, driving the demand for water treatment chemicals. The region is also focused on water scarcity, particularly in Southern Europe, where water desalination and reclamation projects are gaining momentum. Aging infrastructure, especially in Eastern and Western Europe, has led to the renovation and upgrading of water treatment systems, further boosting the market for water treatment chemicals. Moreover, Europe's emphasis on eco-friendly solutions and sustainable practices has spurred the development of innovative, low-impact chemical products, positioning the region as a leader in environmentally conscious water treatment technologies.

Latin America Water Treatment Chemicals Market Analysis

In Latin America, the water treatment chemicals market is driven by urbanization, industrial growth, and the need for improved water quality. The mining sector, a significant contributor to the region's economy, accounted for 6.6% of total global mining production in 2019, according to World Mining Data. This industrial activity contributes to increased water demand and wastewater treatment needs. Additionally, growing awareness of waterborne diseases and pollution is pushing governments and industries to invest in water purification technologies. Water reuse and recycling, particularly in agriculture and mining, are further driving the demand for water treatment chemicals in the region.

Middle East and Africa Water Treatment Chemicals Market Analysis

The water treatment chemicals market in the Middle East and Africa is primarily driven by water scarcity and rapid industrial growth. With limited freshwater resources, countries in the region increasingly rely on desalination and wastewater treatment to meet potable water demand. The oil and gas industry also plays a significant role, with the UAE oil and gas market projected to exhibit a growth rate (CAGR) of 6.30% from 2025 to 2033. This industrial growth contributes to higher water treatment needs, especially for wastewater management. Governments are implementing regulations to improve water quality, boosting the adoption of water treatment chemicals.

Competitive Landscape:

The water treatment chemicals market is highly competitive, featuring key players like BASF SE, Ecolab Inc., Kemira Oyj, Solenis LLC, and Kurita Water Industries Ltd. Companies focus on innovation, expanding product portfolios, and strategic mergers and acquisitions to strengthen their market positions. Rising demand for eco-friendly and high-performance chemicals has prompted significant R&D investments. Regional players cater to specific local needs, intensifying competition. Additionally, the adoption of digital solutions for monitoring water treatment efficiency differentiates market leaders. Government regulations, environmental concerns, and the push for sustainability further drive competition, with players striving to align with evolving industry standards and consumer demands.

The report has also analysed the competitive landscape of the market with some of the key players being:

- BASF SE

- Ecolab Inc.

- Kemira OYJ

- Solenis LLC

- Akzo Nobel N.V.

- Baker Hughes Incorporated

- Lonza

- The DOW Chemical Company

- Snf Floerger

- Suez S.A.

Latest News and Developments:

- April 2024: Gradiant has introduced CURE Chemicals, a specialized product line comprising over 300 formulations designed for water treatment processes. The range includes corrosion and scale inhibitors, biocides, antiscalants, and coagulants, engineered to improve treatment efficiency and minimize environmental impact.

- June 2024: Kurita Water Industries Ltd. has established Kurita AquaChemie India Private Limited (KAIL) in Chennai, Tamil Nadu, to expand its water treatment chemicals business in India. Operations are set to begin following the completion of business launch procedures. Aligned with its medium-term management plan, Pioneering Shared Value 2027 (PSV-27), Kurita aims to enhance its global presence and deliver solutions addressing societal and customer challenges across regions, including Asia, EMEA, and the Americas.

- November 2023: Kemira expanded its ferric sulfate water treatment chemicals production at Goole, UK, by 70,000 Tons, with operations set to begin in Q3 2025. This expansion was driven by rising demand due to stricter UK wastewater regulations. Kemira produced over 350,000 Tons of water treatment chemicals annually across its four UK sites, including Goole, where significant investments had been made in recent years.

- May 2022: ChemREADY has introduced a Legionella-focused water treatment chemical program, offering testing, remediation, and secondary disinfection solutions to control water-borne pathogens in building water systems. The program includes specialized chemicals for Legionella control in cooling towers, hot water tanks, and other water systems, alongside consulting for Water Management Plans to ensure compliance with safety regulations.

- November 2021: Kemira completed its capacity expansion for ferric-based water treatment chemicals at its Goole facility in the UK, increasing annual production by over 100,000 tons. This followed a 30,000-ton increase in aluminum-based chemicals at Ellesmere Port in 2021.

Water Treatment Chemicals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Coagulants and Flocculants, Corrosion and Scale Inhibitors, Biocides and Disinfectants, Ph Adjusters and Softeners, Defoaming Agents, Others |

| End Users Covered | Municipal, Power, Oil and Gas, Mining, Chemical, Food and Beverage, Pulp and Paper, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, Ecolab Inc., Kemira OYJ, Solenis LLC, Akzo Nobel N.V., Baker Hughes Incorporated, Lonza, The DOW Chemical Company, Snf Floerger, Suez S.A, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the water treatment chemicals market from 2019-2033.

- The water treatment chemicals market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the water treatment chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The water treatment chemicals market was valued at USD 39.67 Billion in 2024.

The water treatment chemicals market is projected to exhibit a CAGR of 4.71% during 2025-2033, reaching a value of USD 57.35 Billion by 2033.

Key factors driving the global water treatment chemicals market include increasing water scarcity, industrialization, urbanization, and stringent environmental regulations. Rising demand for clean water in industries like power, oil and gas, and food processing, along with advancements in treatment technologies and a growing focus on water reuse and sustainability, further boost market growth.

Asia Pacific currently dominates the water treatment chemicals market, accounting for a share of 39.9%. Rapid industrialization, urbanization, water scarcity, strict regulations, rising wastewater treatment, and increasing demand for clean water create a positive water treatment chemicals market outlook.

Some of the major players in the global water treatment chemicals market include BASF SE, Ecolab Inc., Kemira OYJ, Solenis LLC, Akzo Nobel N.V., Baker Hughes Incorporated, Lonza, The DOW Chemical Company, Snf Floerger, Suez S.A, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)