Wearable Injectors Market Size, Share, Trends and Forecast by Type, Technology, Application, End Use, and Region, 2025-2033

Wearable Injectors Market Size and Share:

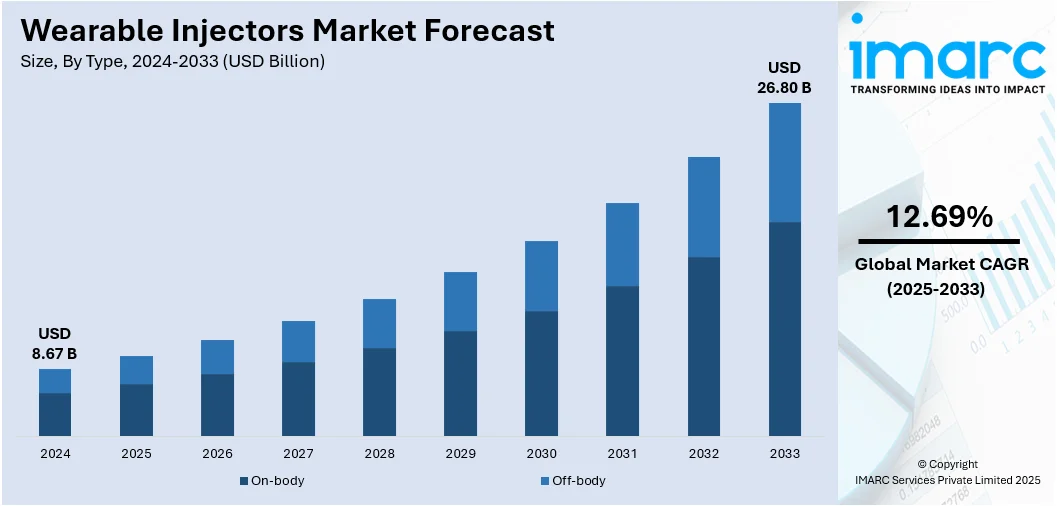

The global wearable injectors market size was valued at USD 8.67 Billion in 2024. Looking forward, the market is projected to reach USD 26.80 Billion by 2033, exhibiting a CAGR of 12.69% from 2025-2033. North America currently dominates the market, holding a market share of 34.2% in 2024. The market is witnessing steady growth driven by the growing demand for advanced drug delivery solutions, especially for chronic disease management. These devices offer convenience, precision, and improved patient compliance through self-administration. Technological innovations, coupled with an increasing shift toward home-based healthcare, are further boosting adoption. Expanding applications across biologics and personalized medicine continue to strengthen the wearable injectors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.67 Billion |

| Market Forecast in 2033 | USD 26.80 Billion |

| Market Growth Rate (2025-2033) | 12.69% |

The wearable injectors market is being driven by several key factors including the increasing incidence of chronic illnesses like diabetes, cancer, and autoimmune conditions that necessitate consistent and accurate drug delivery. The latest International Diabetes Federation Diabetes Atlas (2025) reveals that 590 million people globally have diabetes, with 11.1% of adults (20-79 years) affected. By 2050, this figure could rise to 853 million, or 1 in 8 adults, largely due to urbanization, aging populations, and rising obesity rates. There is also a rising demand for solutions that support home-based treatments and allow for self-administration which drives the need for convenient and portable devices. Innovations in biologics and large-molecule pharmaceuticals further highlight the importance of effective delivery methods. Furthermore, advancements in technology, better patient adherence, and a trend towards personalized healthcare are contributing to significant global wearable injectors market growth.

To get more information on this market, Request Sample

In the United States, the market for wearable injectors is influenced by the rising prevalence of chronic diseases and a shift toward advanced drug delivery systems intended for home care. A report from the American Cancer Society projects that in 2025, the United States will see 2,041,910 new cancer cases and 618,120 cancer-related deaths. As healthcare costs continue to climb, both patients and providers are increasingly seeking options that minimize hospital visits while ensuring effective treatment. Developments in the design of wearable injectors such as enhanced connectivity and comfort features are improving patient compliance. Additionally, the growing use of biologics and personalized therapies is driving demand positioning wearable injectors as a crucial component of contemporary healthcare in the US.

Wearable Injectors Market Trends:

Rising Incidence of Chronic Diseases

The market for wearable injectors is witnessing high growth as a result of the rise in the incidence of chronic diseases like diabetes, cardiovascular diseases, cancer, and autoimmune diseases. As per the American Cancer Society, in 2025, it is expected that 2,041,910 new cancer cases and 618,120 cancer-related deaths will take place in the United States. Since these conditions need long-term management and repeated administration of drugs, wearable injectors are offering a patient-friendly and convenient option. Healthcare systems are constantly focusing on homecare and outpatient management to minimize dependence on clinical visits. This transition is favorably positioning wearable injectors, particularly for diseases that require high-viscosity biologic drug administration. Further, as world demographics are becoming aged, the population of patients with chronic conditions is growing, thereby putting additional pressure on self-administered drug delivery systems. Formulations adapted for wearable injectors are also being invested in by the pharma industry to support therapy compliance and efficacy.

Technological Progress in Biologics and Large-Volume Drug Formulations

The wearable injectors market is driven by the expanding pipeline of biologics and large-molecule drugs that tend to need subcutaneous delivery in high volumes. Traditional modes of delivery, like manual injections or intravenous infusion, are becoming increasingly impractical for biologics because of their complicated administration and possible patient discomfort. Wearable injectors are countering this dilemma by providing a simple, automated system that allows for high-viscosity and large-volume drug delivery without professional guidance. Pharma firms are coming up with more therapies with longer dosing intervals, which wearable injectors can support, thus enhancing patient compliance and minimizing treatment burden. Drug firms are also partnering with injector makers early in product development to facilitate device compatibility and regulatory effectiveness. These biologic therapeutic advancements are ongoing in driving the demand for novel delivery technologies such as wearables injectors, making them a key component of next-generation drug delivery strategies in all therapeutic categories. In 2024, LTS LOHMANN Therapie-Systeme AG (“LTS”), a prominent pharmaceutical technology firm, revealed that its client Coherus BioSciences, Inc (“Coherus”) has introduced its UDENYCA® on-body injector (OBI) using the LTS SorrelTM wearable drug delivery system.

In-Increase Demand for Home Healthcare and Self-Administration

The market for wearable injectors is experiencing robust growth due to the increasing demand for home healthcare solutions as well as patient self-administration. Healthcare systems around the world are shifting towards value-based care models that focus on cost-saving, decreased hospitalization times, and enhanced patient experience. Wearable injectors are moving towards aligning with these objectives by enabling patients to self-administer drugs in the comfort of their homes, avoiding repeated clinic visits and related healthcare expenditures. Chronically ill patients are increasingly opting for self-management devices that are convenient and autonomous, and wearable injectors are making this change possible by coupling user-friendly interfaces and safety measures. Moreover, the continued digital health revolution is making remote monitoring of drug administration more accessible, hence the growing popularity of at-home treatments. With both public and private healthcare players backing decentralization of care, wearable injectors are becoming crucial in terms of maintaining continuity of treatment, especially for underserved or rural population segments with poor access to healthcare infrastructure. IMARC Gorup predicts that the global home healthcare market is projected to attain USD 816.4 Billion by 2033.

Wearable Injectors Market Growth Drivers:

Technological Advances in Drug Delivery Systems

The market for wearable injectors is developing at a fast pace owing to ongoing technological advances in drug delivery systems. New designs are coupling microelectronics, intelligent sensors, and wireless connectivity to advance device capability, safety, and patient interaction. These innovations are making real-time dosage accuracy monitoring, adherence tracking, and early warning of device failure possible. The integration of feedback systems is also aiding in enhanced patient confidence and usage accuracy. Companies are targeting miniaturization and ergonomic design to make the injectors easy, convenient, and suitable for wear over an extended period, solving one of the biggest hurdles for adoption. Increasing use of connectivity features is making data sync with digital health platforms possible, helping healthcare professionals monitor treatment remotely. These technological advancements are not only increasing patient satisfaction but are also supporting regulatory approval procedures by promoting higher standards of safety and efficacy.

Favorable Regulatory Framework and Industry Alliances

The wearable injectors market is supported by an increasingly conducive regulatory climate and coordinated industry alliances. Regulatory bodies like the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) are increasingly setting clear definitions for combination drug-device products, making the development and approval process smooth. This regulatory clarity is prompting pharmaceutical companies to invest in drug formulation with wearable injector compatibility as early as in the development stage. Meanwhile, partnerships among pharmaceutical companies and medical device manufacturers are aiding the co-development of bundled therapeutic solutions with reduced time-to-market and improved coordination among drug characteristics and delivery systems. The alliances are also driving innovation by sharing resources and technical capabilities, thereby allowing scalable and patient-driven solutions. In addition, government policies encouraging patient-focused healthcare and personalized medicine are indirectly contributing to the growth of wearable injectors by cultivating innovation in self-treatment and home treatment.

Increasing Interest in Patient-Centric Models of Healthcare

The market for wearable injectors is growing as healthcare systems worldwide are emphasizing more patient-centric models of care. This shift in paradigm is focusing more on treatments that improve quality of life, enhance compliance with treatment, and minimize patient burden. Wearable injectors are at the forefront of enabling this shift by providing tailored, adaptive, and minimally invasive drug delivery. The capacity of these devices to be integrated with mobile apps and cloud platforms is enabling patients to be reminded, monitor therapy, and exchange data with medical professionals. This networked strategy is enabling greater engagement, improved results, and empowerment for patients with long-term conditions. In addition, pharmaceutical manufacturers are integrating patient input into device design for usability and comfort. As clinicians focus on shared decision-making and individualized treatment pathways, wearable injectors are being more closely considered as key devices that are part of the larger movement toward individualized, outcomes-oriented care delivery.

Wearable Injectors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global wearable injectors market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, technology, application, and end use.

Analysis by Type:

- On-body

- Off-body

The demand for on-body type of wearable injectors in the market is primarily driven by its convenience, ease of use, and potential for improved treatment adherence. These devices are designed to be worn directly on the body, providing patients with a discreet and hands-free solution for medication delivery. By eliminating the need for manual injections and offering customizable dosing schedules, On-body wearable injectors empower patients to conveniently self-administer medications without interrupting their daily activities. Additionally, the integration of advanced features such as dose monitoring and connectivity enhances patient engagement and allows for remote monitoring by healthcare providers, further driving the adoption of On-body wearable injectors in the market. For instance, MEDTRONIC launched an infusion set in April 2021 that allows for the transport of insulin from the pump to the body, showcasing advancements in on-body wearable injector technology. This innovation doubles the length of time an infusion set can be worn so that patients can safely continue on insulin pump therapy with fewer interruptions and insertions while also enjoying greater convenience and comfort in their diabetes management routine.

Analysis by Technology:

- Spring-based

- Motor-driven

- Rotary Pump

- Expanding Battery

- Others

Spring-based leads the market with 35.8% of market share in 2024, driven by its well-known feature of simplicity, reliability, and affordability. These medications are dispensed using spring-type mechanical mechanisms that make them independent on complex electronics or power sources. This elimination does reduce the production costs and improves the resistance and reliability of the wearable injectors such that they are applicable for long term use. Moreover, the perfect precision and certainty of spring injectors in the delivery of the drugs, eliminates drug level errors and maximizes the therapeutic outcome of patients. The devices stand out from the perspective of both patients and health care providers due to their simple design and long-term proven results as spring-base wearable injectors. For instance, BECTON DICKINSON (U.S.-based company) is a well-known innovator, and the spring-based injector offered by BD (Libertas) is one such innovation. This advanced drug delivery system is a unique spring-based power generator that saves batteries or eliminates the removal of heavy metals through discharge.

Analysis by Application:

- Oncology

- Infectious Diseases

- Cardiovascular Diseases

- Autoimmune Diseases

- Others

Oncology leads the market with 29.5% of market share in 2024, driven by the increasing requirements for patients to be comfortable and convenient, and to adhere to the treatment programme. Most individuals battling with oncology diseases (cancer) are often expected to take the chemotherapy drugs for long periods and in frequent doses; a situation that is both physically and emotionally exhausting. Approximately 1,806,590 new cancer cases were diagnosed, and 606,520 deaths caused by cancer happened in the USA in the year of 2020 alone as stated by the NATIONAL CANCER INSTITUTE. Prostate cancer, lung cancer, and colon cancer are the leading types, followed by other cancer types, taking up a significant percentage of new cancer diagnoses. Wearable injectors can offer a user-friendly solution by ensuring the drug is continuously and controlled delivered for patients and allowing them to receive their treatments outside the hospital environment, such as patients with cancer whose IVs will run for hours. Patients' quality of life, besides improving also facilitates treatment adherence which enables patients to take their medications regularly; hence they have better outcomes from these anti-cancer measures.

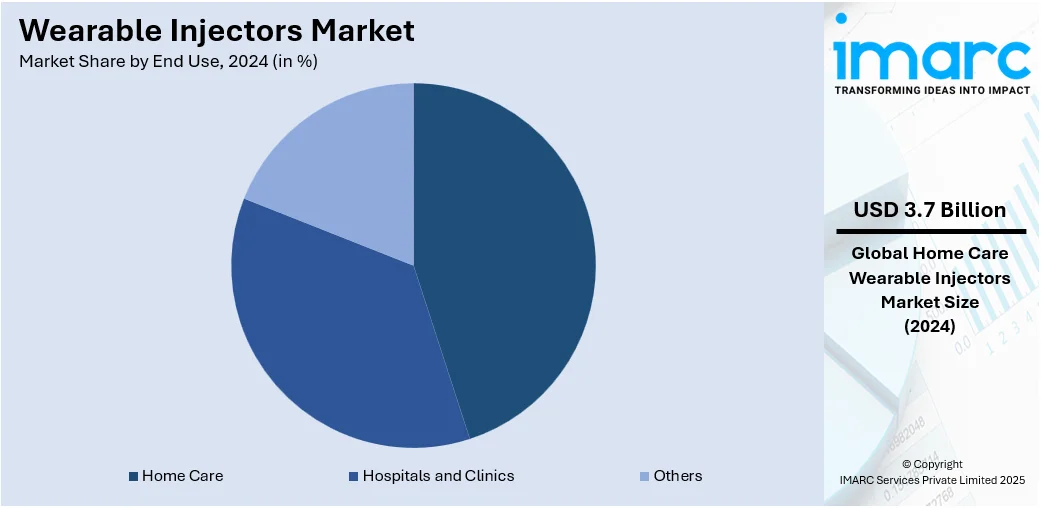

Analysis by End Use:

- Hospitals and Clinics

- Home Care

- Others

Home care leads the market with 42.7% of market share in 2024. The growing trend of home care settings for the use of wearable injectors is notable among the patient-centric healthcare delivery techniques and the increasing demands for the use of easy and cost-effective treatment approaches. Personal assistance, which enables patients to control medical conditions in a home environment, provides comfort and autonomy. Wearable injectors come in handy as they help with self-administration of drugs, which prevents a patient from having to keep hospital visits due to the nature of his/her treatment. Moreover, injector devices that incorporate dose monitoring and connectivity equipment constitute another innovation in wearable technology which has important implications for the sense of security the patient can feel and enables remote monitoring by healthcare providers, only which further increase their popularity in home care.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 34.2%, driven by its advanced healthcare infrastructure and high uptake of innovative medical technologies. The region is home to several major pharmaceutical and device manufacturers, which contributes to its significant market share. A robust reimbursement framework and a supportive regulatory environment facilitate the swift integration of wearable injectors into patient care. The increasing incidence of chronic conditions such as diabetes, cancer, and autoimmune disorders is fueling the need for accessible drug delivery solutions. Furthermore, the increasing reliance on biologics and personalized medicine is accelerating adoption rates. Ongoing research and development investments, along with collaborations between healthcare providers and technology firms, are enhancing device capabilities, thereby creating a positive wearable injectors market outlook.

Key Regional Takeaways:

United States Wearable Injectors Market Analysis

In 2024, United States accounted for 88.60% of the wearable injectors market in North America. United States is witnessing increased adoption of wearable injectors driven by the rising prevalence of chronic illnesses. For instance, 6 out of 10 Americans have one chronic disease and four out of 10 have two or more chronic diseases that account for 90% of the USD 4.5 Trillion annual health care costs in the nation. With an upsurge in conditions like cardiovascular disorders, autoimmune diseases, and hormonal imbalances, patients are increasingly seeking convenient, at-home treatment options. Wearable injectors offer minimally invasive administration and reduce the need for hospital visits, which supports demand in outpatient settings. Pharmaceutical companies are focusing on improving drug delivery mechanisms to support patient compliance. Healthcare providers and insurers are also recognizing the cost-effectiveness of wearable injectors for chronic illnesses. Technological advancements in connectivity and patient monitoring further enhance usability. Integration of digital health tools has increased acceptance among patients with chronic illnesses, making wearable injectors a favourable choice for long-term therapy management in the United States.

Asia Pacific Wearable Injectors Market Analysis

Asia-Pacific is experiencing a notable increase in wearable injectors adoption fuelled by the rising number of diabetes cases. For example, diabetes has emerged as a significant health concern in India, with around 101 million individuals currently diagnosed and an estimated 136 million more classified as pre-diabetic. Rapid urbanization, dietary transitions, and lifestyle changes are contributing to escalating diabetes prevalence across the region. The demand for discreet, user-friendly insulin delivery systems has made wearable injectors a viable solution for diabetes management. As awareness of diabetes care expands, more patients are transitioning to home-based therapies. Medical device manufacturers are focusing on compact and intuitive designs tailored for diabetes patients. Additionally, wearable injectors enable continuous and accurate delivery of medication, improving treatment adherence. Healthcare practitioners are encouraging the use of wearable injectors due to their potential to streamline diabetes care.

Europe Wearable Injectors Market Analysis

Europe has seen a rise in wearable injectors adoption, primarily supported by the increasing geriatric population. The World Health Organization indicates that the number of individuals aged 60 and above is increasing quickly in the European Region. In 2021, there were 215 million older adults; this number is expected to rise to 247 million by 2030, and to over 300 million by 2050. As the elderly demographic expands, age-related ailments requiring regular injectable therapies such as arthritis, osteoporosis, and neurodegenerative conditions have surged. Wearable injectors offer ease of use, enabling older adults to self-administer medications without clinical assistance. Their ergonomic design and pre-programmed dosing support consistent treatment, which is essential for elderly care. Home-based treatment options are becoming increasingly important due to mobility challenges faced by the geriatric population. This growing demand aligns with healthcare systems aiming to reduce inpatient burdens. Innovations in wearable injectors are increasingly tailored to suit the needs of older users.

Latin America Wearable Injectors Market Analysis

Latin America is witnessing increased demand for wearable injectors due to the growing burden of cancer and genetic disorders. For instance, in Brazil, it is estimated that there will be 704,000 new cases of cancer during the period from 2023 to 2025. Patients require frequent injectable therapies, and wearable injectors provide a more convenient and controlled delivery method. As cancer and genetic disorders continue to rise, patients and healthcare systems are turning to innovative drug delivery devices that allow for home-based treatment, enhancing therapy adherence and comfort across Latin America.

Middle East and Africa Wearable Injectors Market Analysis

Middle East and Africa are showing rising adoption of wearable injectors supported by expanding healthcare facilities. For instance, in 2025, the UAE is currently home to over 150 hospitals and has more than 5,000 healthcare facilities. With increasing investment in medical infrastructure and patient-centric care models, hospitals and clinics are integrating advanced drug delivery solutions. Wearable injectors enable efficient treatment management and align with the modernization of healthcare services in Middle East and Africa.

Competitive Landscape:

The market for wearable injectors is fiercely competitive, with companies emphasizing innovation, customization of products, and enhanced convenience for patients to boost their market presence. Developments in device design, such as more compact sizes, improved safety features, and connectivity for remote monitoring, are influencing the competitive environment. Manufacturers are focusing on creating user-friendly interfaces, broad drug compatibility, and cost-effectiveness to meet the needs of patients and healthcare providers alike. To broaden their capabilities and market reach, strategic partnerships, mergers, and technology collaborations have become prevalent. According to wearable injectors market forecast, increasing demand for self-administration and home-based treatments will keep fueling competition, compelling industry players to provide more efficient, reliable, and patient-centered solutions.

The report provides a comprehensive analysis of the competitive landscape in the wearable injectors market with detailed profiles of all major companies, including:

- Becton Dickinson and Company

- CeQur SA

- Debiotech SA

- Dexcom Inc.

- Enable Injections Inc.

- Gerresheimer AG

- Insulet Corporation

- Tandem Diabetes Care Inc.

- West Pharmaceutical Services Inc.

- Ypsomed AG

Latest News and Developments:

- July 2025: BD (Becton, Dickinson and Company) (NYSE: BDX), a prominent global medical tech firm, reveals the inaugural pharma-sponsored clinical trial for a combination product utilizing the BD Libertas™ Wearable Injector for subcutaneous administration of complex biologics. The choice of the BD Libertas™ Wearable Injector for this pharma-sponsored trial is based on successful results from over 50 BD-led pre-clinical and clinical studies, which include a device clinical study showing outstanding performance, with 100% of participants indicating they would probably use the BD Libertas™ Wearable Injector if it were prescribed.

- June 2025: CeQur achieved a milestone by replacing 10 Million mealtime insulin injections with its Simplicity wearable injectors, underscoring the device’s role in simplifying diabetes care since its pilot commercial launch in 2021. The company highlighted that the discreet wearable injectors helped overcome the challenges of multiple daily injections, improving patient compliance and convenience.

- February 2025: The FDA approved Onapgo as the first wearable injectors-based subcutaneous apomorphine infusion device for treating motor fluctuations in advanced Parkinson’s disease, providing continuous daytime therapy and set for launch in Q2 2025 with dedicated nurse support.

- February 2025: Supernus Pharmaceuticals announced FDA approval of ONAPGO™, a wearable injectors-based subcutaneous apomorphine infusion device, as the first of its kind for treating motor fluctuations in advanced Parkinson’s disease; ONAPGO provided continuous daytime treatment and will be available in the U.S. in Q2 2025.

- April 2025: INCOG BioPharma Services, a contract manufacturing and development organization (CDMO) focused on sterile injectable biopharmaceuticals, has revealed plans for strategic expansion projects in 2025. These initiatives involve the physical growth of its Fishers facilities, enhancing core filling capabilities, incorporating substantial new finishing capabilities, and strategically hiring to attract high-quality talent. The expansion of the 113,000-square-foot facility will allow the company to offer device assembly capacity for autoinjectors, pens, wearable injectors, and syringe accessories.

- January 2025: BD showcased its latest drug delivery innovations at Pharmapack 2025 in Paris, highlighting wearable injectors such as BD Libertas™ and BD Evolve™ to support self-care and subcutaneous delivery of complex biologics, while emphasizing patient-centric solutions and collaborative advancements in biologic formulation challenges.

Wearable Injectors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | On-body, Off-body |

| Technologies Covered | Spring-based, Motor-driven, Rotary Pump, Expanding Battery, Others |

| Applications Covered | Oncology, Infectious Diseases, Cardiovascular Diseases, Autoimmune Diseases, Others |

| End Uses Covered | Hospitals and Clinics, Home Care, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Becton Dickinson and Company, CeQur SA, Debiotech SA, Dexcom Inc., Enable Injections Inc., Gerresheimer AG, Insulet Corporation, Tandem Diabetes Care Inc., West Pharmaceutical Services Inc., Ypsomed AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wearable injectors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global wearable injectors market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wearable injectors industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wearable injectors market was valued at USD 8.67 Billion in 2024.

The wearable injectors market is projected to exhibit a CAGR of 12.69% during 2025-2033, reaching a value of USD 26.80 Billion by 2033.

The wearable injectors market is driven by rising demand for convenient drug delivery, growth in biologics, increasing prevalence of chronic diseases, and advancements in self-administration technologies, enabling improved patient compliance and reducing hospital visits.

North America currently dominates the wearable injectors market, accounting for a significant share due to advanced healthcare infrastructure and strong adoption of innovative drug delivery solutions.

Some of the major players in the wearable injectors market include Becton Dickinson and Company, CeQur SA, Debiotech SA, Dexcom Inc., Enable Injections Inc., Gerresheimer AG, Insulet Corporation, Tandem Diabetes Care Inc., West Pharmaceutical Services Inc., Ypsomed AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)