Wearable Medical Devices Market Size, Share, Trends and Forecast by Device Type, Product, Application, Distribution Channel, and Region, 2025-2033

Wearable Medical Devices Market Size and Share:

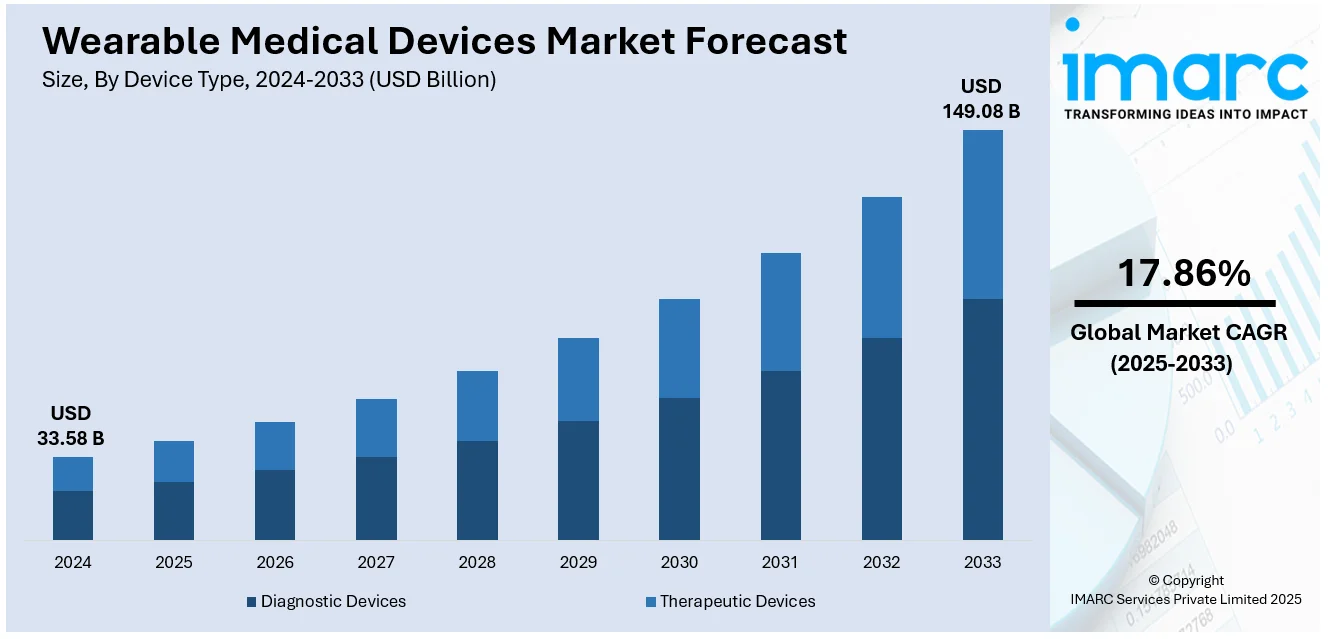

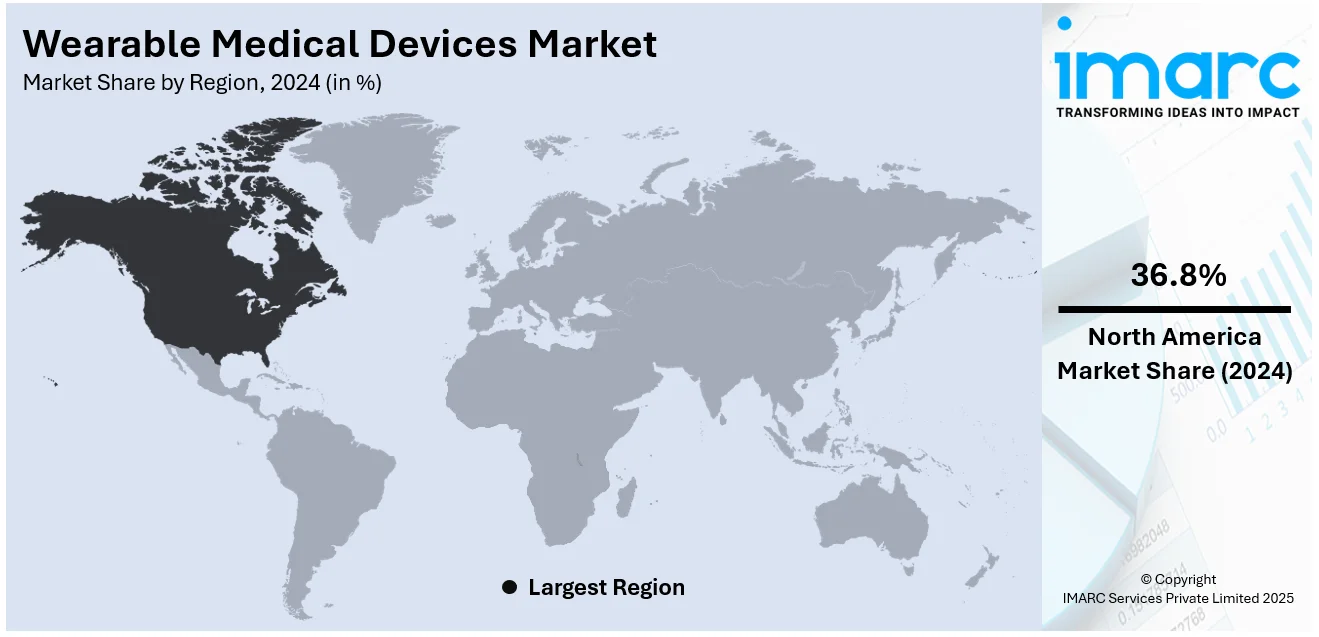

The global wearable medical devices market size was valued at USD 33.58 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 149.08 Billion by 2033, exhibiting a CAGR of 17.86% from 2025-2033. North America currently dominates the market with 36.8% of the market share. The rising prevalence of chronic diseases, the increasing shift toward remote patient monitoring and telehealth services, and rapid advancements in technology, particularly in sensors, wireless connectivity, and miniaturization, are some of the major factors facilitating the expansion of the wearable medical devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 33.58 Billion |

|

Market Forecast in 2033

|

USD 149.08 Billion |

| Market Growth Rate (2025-2033) | 17.86% |

Wearable medical devices are becoming extremely important because of the increase in the occurrence of chronic diseases among the masses. These devices mainly comprise smartwatches, biosensors, fitness trackers, and remote monitoring devices, which are essential for preventive and personalized healthcare. The integration of these devices into daily life is increasing owing to the high demand for real-time health monitoring and the convergence of healthcare and technology, majorly referred to as the digital health revolution. With an aging global population, heightened healthcare costs, and the need for remote patient monitoring, wearable medical devices are becoming a critical component of modern healthcare solutions. The wearable medical devices market forecast indicates significant growth, driven by advancements in sensor technology, artificial intelligence, and wireless connectivity, enhancing continuous health tracking and early disease detection.

The United States has emerged as a major region in the wearable medical devices market owing to several factors. The US is among the globe's most advanced and developed health care markets and has consistently been a leader in embracing wearable medical technologies. From smartwatches to advanced health monitoring systems and intricate biosensors, all have gained acceptance from patients, healthcare providers, and insurance firms. The incorporation of wearable medical devices into the healthcare industry has occurred rapidly, mainly driven by the demand for personalized and preventive treatment, the growing awareness of health and fitness among individuals, and the necessity to track patients remotely. Technological innovations are significantly contributing to the expansion of the market. Improvements in the sensor technology, downsizing, wireless communication, and data analysis have resulted in the production of highly advanced devices that are both precise and easy to use. For instance, in 2024, Ultrahuman established a manufacturing plant for wearable rings in the US. The firm allocated $35 million to assist in the progression of the facility in Indiana.

Wearable Medical Devices Market Trends:

The Increasing Prevalence of Chronic Diseases

Chronic diseases such as diabetes, cardiovascular diseases, respiratory disorders, hypertension, and obesity, often require continuous monitoring and management to ensure optimal control and prevent complications. Wearable medical devices offer the ability to monitor vital signs, physiological parameters, and other health metrics continuously. Moreover, these devices can assist in the early detection of health issues related to chronic diseases. They can detect deviations from normal ranges or identify patterns that indicate the onset of complications by continuously monitoring relevant health parameters. According to NIH, chronic diseases such as heart disease, diabetes, cancer, and associated risk factors such as smoking and inactivity, drastically increase the chance of severe morbidity and mortality from COVID-19. The cost of chronic diseases will be estimated to be around 47 trillion by 2030. Besides, wearable medical devices facilitate remote patient monitoring, allowing healthcare providers to track patients' health data from a distance. This is particularly valuable for individuals with chronic diseases who may need regular check-ups or adjustments to their treatment plans.

Various Technological Advancements

Technological advancements have led to the miniaturization of sensors, processors, and other components, making wearable medical devices smaller and more portable, thereby impelling the wearable medical devices market growth. This allows individuals to wear the devices comfortably and conveniently throughout the day, without hindering their daily activities. An industry report indicates that leadless pacemakers typically last around 16.7 years, making it possible for one pacemaker to endure throughout the lives of many patients, eliminating the need for replacement surgeries. In comparison, the initial pacemakers operated on batteries and lasted merely hours. The compact size of these devices has increased their acceptability and integration into everyday life. Moreover, wearable medical devices are equipped with wireless connectivity options such as Bluetooth, Wi-Fi, and cellular technologies. This enables seamless communication between the device and other devices like smartphones, tablets, or computers. Wireless connectivity facilitates real-time data transmission, allowing individuals to monitor their health continuously and healthcare professionals to access patient data remotely, thus contributing to market growth. In January 2024, Sennheiser partnered with Polar Electro to release the Momentum Sport earbuds, the first time Polar's bio-sensing capabilities have been applied outside of its own product lines. These German-designed earbuds not only offer high-quality sound but also bring Polar's fitness technology onboard, which includes a Photoplethysmography (PPG) heart rate sensor to monitor hydration levels during exercise and a body temperature sensor. The wearable medical devices market outlook is projected to further transform due to increasing adoption of advanced healthcare technologies.

The Growing Emphasis on Preventive Healthcare

Wearable devices enable individuals to monitor and track various aspects of their health and wellness. These devices can track physical activity, heart rate, sleep patterns, calories burned, and other vital signs. Moreover, these devices provide personalized health data based on individual measurements and activity levels, thereby offering a favorable wearable medical devices market outlook. This data allows individuals to better understand their own health status and identify areas for improvement. By tracking trends and patterns over time, individuals can make adjustments to their behaviors and take proactive steps to maintain good health. Besides, wearable devices enhance communication and collaboration between individuals and healthcare providers. The collected health data can be easily shared with healthcare professionals, facilitating more informed discussions, personalized recommendations, and preventive care planning. This enables individuals to actively participate in their healthcare decisions and promotes a collaborative approach to health management. According to World Health Organization (WHO), between 2020 and 2050, population aged 60 and above will double to 2.1 billion in 2050. In the year 2050, there will be 426 billion people aged 80 and over.

Wearable medical devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global wearable medical devices market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on device type, product, application, and distribution channel.

Analysis by Device Type:

- Diagnostic Devices

- Vital Sign Monitoring Devices

- Sleep Monitoring Devices

- Electrocardiographs and Obstetric Devices

- Neuromonitoring Devices

- Therapeutic Devices

- Pain Management Devices

- Insulin Delivery Devices

- Rehabilitation Devices

- Respiratory Therapy Devices

Diagnostic wearable devices hold 62.0% of the market share. Diagnostic wearable devices are aimed at detecting and monitoring specific diseases or conditions. These devices can collect many types of biometric data, including heart rate, blood pressure, blood glucose levels, and oxygen saturation. They enable early detection of abnormalities or changes in the parameters of health that might require timely intervention and treatment. They also offer insights to patients and medical practitioners to better manage chronic diseases, improve treatment plans, and make necessary adjustments. In addition, diagnostic wearable devices also enable remote patient monitoring, where healthcare providers can monitor and track the health conditions of their patients from a distance, which in turn increases the sales of these devices. The convenience and non-invasive nature of diagnostic wearable devices are another major advantage. Traditional methods of diagnosis, such as lab tests or in-clinic monitoring, involve frequent visits to healthcare facilities and are often time-consuming, inconvenient, and expensive. In contrast, wearable devices enable patients to observe their health from the comfort of their homes or on the go without any invasive procedures or repeated clinical appointments.

Analysis by Product:

- Activity Monitors

- Smartwatches

- Patches

- Smart Clothing

- Hearing Aids

- Others

Smartwatches contain many features that are not exactly health monitoring functions. They merely extend the phone's capabilities such as receiving and reading notifications, sending messages, controlling music play, and numerous other smart operations. The multiplicity of task execution apart from health monitoring capabilities makes smartwatches more suitable for a much larger consumer demographic, thus making the market share enormous. In addition, smartwatches have improved sensors and complex algorithms for recording health and fitness. They can track heart rate, activity levels, sleep patterns, calories burned, and sometimes even track specific exercises. They also provide comprehensive health and fitness data, enabling individuals to monitor their well-being, set fitness goals, and make informed decisions about their lifestyle. The portability and accessibility of smartwatches contribute significantly to their value. Unlike smartphones or other electronic devices, smartwatches are lightweight, compact, and worn directly on the wrist, making them easy to carry and use throughout the day. Their always-on displays provide quick access to time, notifications, or health metrics with just a glance, ensuring that users stay informed without interrupting their activities.

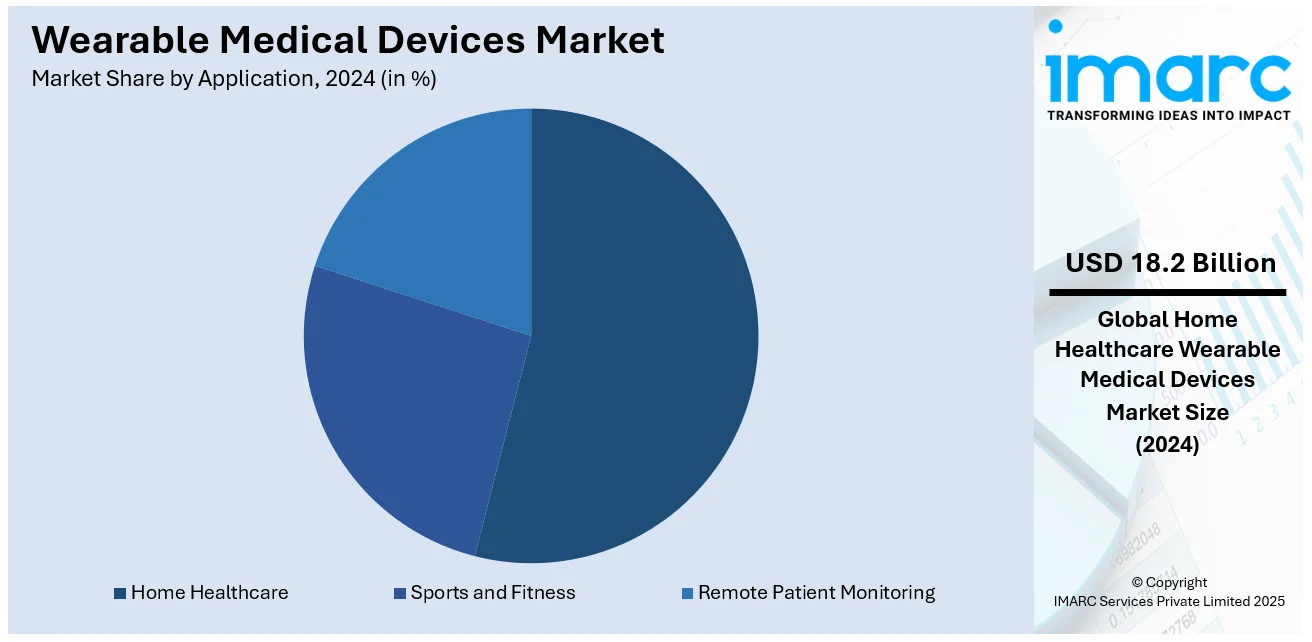

Analysis by Application:

- Sports and Fitness

- Remote Patient Monitoring

- Home Healthcare

Home healthcare holds 54.2% of the market share. Wearable devices enable remote patient monitoring, which is crucial for home health care. These devices can continuously monitor vital signs, activity levels, and other health parameters, allowing healthcare professionals to remotely track and assess patients' health conditions. Wearable devices provide real-time data that facilitates timely interventions and helps prevent hospital readmissions. Many individuals receiving home health care services have chronic diseases or conditions that require ongoing monitoring and management. Wearable devices, such as smartwatches or specialized medical wearables, can collect data related to these conditions, including heart rate, blood pressure, glucose levels, or oxygen saturation. This data assists healthcare professionals in managing chronic diseases effectively and making necessary adjustments to treatment plans, thus increasing the market share. Home health care is especially beneficial for elderly individuals, as it supports aging in place. Many seniors like to stay in the premises of their own homes instead of moving to assisted living facilities or nursing homes. Home health care enables them to do so by providing essential medical and non-medical support, such as medication management, wound care, physical therapy, and help with everyday activities, such as meal preparation, bathing, and dressing.

Analysis by Distribution Channel:

- Offline

- Online

Offline account for 65.0% of the market share. Offline channels, such as healthcare clinics, hospitals, and medical supply stores, have well-established networks with healthcare providers. These providers play a critical role in prescribing and recommending wearable medical devices to patients based on their specific needs. Healthcare professionals can assess patients' conditions, offer personalized advice, and provide necessary support during the selection and fitting process, which is often facilitated through offline channels. Moreover, these devices often require proper fitting and customization to ensure accurate measurements and optimal performance. Offline channels provide opportunities for face-to-face consultations with healthcare professionals who can assess individual needs, guide patients in selecting the most suitable device, and ensure proper fitting. This personalized consultation and fitting process contribute to the effectiveness and user satisfaction of wearable medical devices.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds 36.8% of the market share. North America has a well-developed and advanced healthcare infrastructure that supports the adoption and integration of wearable medical devices. The region has a robust network of hospitals, clinics, research institutions, and healthcare professionals who are at the forefront of adopting and implementing innovative healthcare technologies. Moreover, the prevalence of chronic diseases like cardiovascular conditions, diabetes, and obesity, is high in North America. Wearable medical devices play a crucial role in monitoring and managing these chronic conditions. The increasing focus on preventive healthcare and the need for continuous monitoring contribute to the wearable medical devices market demand in the region. One of the primary drivers of the market in North America is the rising prevalence of chronic diseases such as diabetes, cardiovascular conditions, and respiratory disorders. According to the Centers for Disease Control and Prevention (CDC), six in ten adult individuals in the United States have at least one chronic disease, while four in ten suffer from two or more. Managing these conditions often requires continuous monitoring of vital health parameters such as blood glucose levels, heart rate, and blood pressure.

Key Regional Takeaways:

United States Wearable Medical Devices Market Analysis

The United States hold 87.6% share in North America. The United States wearable medical devices market is expected to grow at a significant rate during the forecast period, primarily driven by the growing prevalence of chronic conditions and consumer demand for health monitoring solutions. By 2035, 35.66% of the U.S. adult population aged 50 and older will have at least one chronic condition, hence increasing the demand for wearable devices that allow continuous health monitoring and early detection of health issues according to the NIH. According to an American Academy of Sleep Medicine report in 2023, 35% of the Americans said that they used electronic sleep tracking, while more people seem to take a particular interest in wearables as a form of tracking of key health indicators. These trackers reach not only seniors with chronic illness but also are of keen interest to any fit and conscious healthy being. The combination of an aging population, increasing chronic disease burden, and greater consumer engagement in personal health management drives the wearable medical devices market in the U.S.

Europe Wearable Medical Devices Market Analysis

The prevalence of heart and circulatory diseases and an aging population will make the Europe wearable medical devices market gain much over the next coming years. According to the British Heart Foundation, August 2022, there are around 7.6 million people in the UK that are currently living with heart and circulatory diseases. It has continued growing because of the aging population and further improved survival from heart and circulatory events. An increased level of chronic health conditions means more people would want wearable devices for monitoring their heart rate, blood pressure, and oxygen levels so that such health conditions are caught early on and monitored consistently. In addition, people are taking the initiative of healthy and healthy-living awareness thus demanding the increase of health tracking wearables. The aging population, increasing prevalence of chronic diseases, and awareness among consumers regarding the management of health are the main factors driving the adoption of wearable medical devices in Europe, hence contributing to market growth.

Asia Pacific Wearable Medical Devices Market Analysis

The Asia Pacific market for wearable medical devices is growing at a tremendous pace because of the increasing incidence of chronic diseases, increasing health consciousness, and the rapid growth of health and fitness clubs in that region. International Health, Racquet & Sportsclub Association (IHRSA) Media Report 2021 records that China dominated the region by having 27,000 clubs as of the year 2020, yet Australia had as high as 3,715, which is quite a trend where health and fitness awareness is increased. This spiking fitness habit calls for individuals to use medical wearables tracking vital features such as heartbeat, steps covered, and rest hours. In January 2021, OnePlus launched the first fitness band in India, which marked rising demand for relatively affordable wearable technology in the country. With continued investments in health and fitness technologies, an emerging number of fitness-conscious consumers and the growth in fitness infrastructure across the region, the Asia-Pacific market for medical wearables would expand significantly during the next five years.

Latin America Wearable Medical Devices Market Analysis

Brazil has the second highest number of health clubs in the region, at 29,525, according to the health and fitness association. The increasing number of health and fitness clubs shows the growing health consciousness among the Brazilian population, which is creating demand for wearable medical devices. As more individuals engage in fitness, the demand for devices that track important health parameters, for example, heart rate, sleep patterns, and physical activity, is on the increase. Moreover, wearable medical devices offer the benefit of continuous health monitoring, allowing the user to be informed about their targets in fitness and detect potential health problems at an early stage. Increasingly better health and fitness infrastructure, increased awareness of managing personal health: Brazil is looking to be at the forefront among the Latin America markets for the wearable medical device market. Gaining health monitor trend among consumers in Brazil fosters the increase in the expansion of wearable medical devices in general.

Middle East and Africa Wearable Medical Devices Market Analysis

The other most important trends which are contributing to the wearable medical devices market in the Middle East and Africa region are beneficial government initiatives. In the case of Saudi Arabia, launching the Saudi Vision 2030 Quality of Life Objectives was very crucial to support the main sports projects under the auspices of the Ministry of Sports, the Saudi Olympic and Paralympic Committee, and the different federations affiliated to them. The above initiatives aim at improving the health and fitness levels of the population, thus creating a demand for wearable medical devices that can monitor health metrics in real time. Increasing health and fitness awareness and an active lifestyle by the government increases the need for devices that track vital signs, activity levels, and overall wellness. This trend, coupled with growth in the exercise infrastructure and surging interest in preventative healthcare, would drive the market for wearable medical devices in the Middle East and Africa region greatly.

Competitive Landscape:

The competitive environment of the wearable medical devices market is vibrant and marked by the existence of various major firms and new entrants. Currently, major players are putting resources into research and development (R&D) efforts to improve their product lines. They are concentrating on tech improvements, sensor precision, data analysis skills, and intuitive interfaces to grow their customer base. For example, in 2024, KORE and mCare Digital announced the introduction of the mCareWatch 241. This device thoroughly tracks patients in their residences or different medical establishments. They are also purchasing businesses that possess relevant technologies, intellectual property, and a solid customer base to improve product offerings and speed up market entry. In addition, collaboration has emerged as a fundamental strategy for numerous major participants in the wearable medical devices sector. Key stakeholders are collaborating with technology firms, healthcare providers, research institutions, and insurance companies to enhance their product capabilities and broaden their market reach. For instance, Fitbit has collaborated with healthcare institutions and insurance firms to integrate its devices into wellness initiatives and remote patient monitoring schemes, helping both users and healthcare providers in monitoring health metrics more effectively.

The report provides a comprehensive analysis of the competitive landscape in the wearable medical devices market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Dexcom Inc.

- Garmin Ltd.

- GE HealthCare

- Medtronic plc

- Omron Corporation

- Samsung Electronics Co., Ltd

- VitalConnect

- Wellue

- Ypsomed AG

Latest News and Developments:

- November 2024: Aktiia introduced its continuous blood pressure monitoring (CBPM) wristband in Canada following approval from Health Canada. The apparatus employs Optical Blood Pressure Monitoring (OBPM) for continuous cuff-free tracking, allowing for as many as 800 measurements monthly. Insights are shared with doctors via a companion app for better cardiovascular health management.

- September 2024: Abbott introduced Lingo, a continuous glucose monitor available over-the-counter that received FDA approval in June. Lingo, created for individuals not using insulin, offers continuous glucose monitoring and practical health information through a biosensor and a mobile application.

- July 2024: SoundHealth introduced SONU, the first FDA-approved, AI-powered wearable for alleviating nasal congestion caused by allergic and non-allergic rhinitis. SONU employs acoustic resonance therapy to alleviate symptoms without the use of drugs. The firm obtained $7 million in initial funding to aid marketing and broaden applications for children’s use and sleep disorders.

- July 2024: Samsung introduced the Galaxy Ring, its inaugural smart ring featuring AI-enhanced health and fitness capabilities. The ring provides continuous health monitoring, sleep assessment, heart rate notifications, and menstrual cycle tracking. It costs $399, comes in three colors, and has a battery life of seven days with a charging case.

- March 2024: Empatica introduced EpiMonitor, an FDA-approved epilepsy watch designed for seizure detection in both adults and children over six years old. The device features a 98% accurate smart algorithm, seven-day battery life, and caregiver alerts.

- February 2024: London-based Samphire Neuroscience raised €2.1 million in pre-seed funding to introduce Nettle, a neurostimulation wearable for PMS and menstrual pain. Nettle uses transcranial direct current stimulation (tDCS) to target brain regions involved in pain and mood regulation. The device aims to provide a safe, non-invasive alternative to traditional menstrual pain treatments.

- January 2024: Nanowear received FDA 510(k) clearance for its SimpleSense platform, the first cuffless, non-invasive, continuous blood pressure monitor and diagnostic tool. The AI-enabled innovation enhances hypertension management and builds on its cardiopulmonary diagnostics capabilities.

- January 2024: Garmin Ltd. has unveiled the Lily 2 series smartwatches with metal cases, patterned lenses, and health features including sleep score tracking and dance fitness activity tracking. The fashionable models - with up to five days of battery life, support also includes Garmin Pay.

Wearable Medical Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered |

|

| Products Covered | Activity Monitors, Smartwatches, Patches, Smart Clothing, Hearing Aids, Others |

| Applications Covered | Sports and Fitness, Remote Patient Monitoring, Home Healthcare |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Dexcom Inc., Garmin Ltd., GE HealthCare, Medtronic plc, Omron Corporation, Samsung Electronics Co., Ltd, VitalConnect, Wellue, Ypsomed AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wearable medical devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global wearable medical devices market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wearable medical devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wearable medical devices market was valued at USD 33.58 Billion in 2024.

IMARC estimates the wearable medical devices market to exhibit a CAGR of 17.86% during 2025-2033.

The wearable medical devices market is driven by rising prevalence of chronic diseases, increasing demand for remote patient monitoring, technological advancements in sensors and AI, growing consumer health awareness, integration with telehealth platforms, and the aging population requiring non-invasive, real-time health tracking for personalized and preventive care.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market because of the rising cases of chronic diseases.

Some of the major players in the wearable medical devices market include Abbott Laboratories, Dexcom Inc., Garmin Ltd., GE HealthCare, Medtronic plc, Omron Corporation, Samsung Electronics Co., Ltd, VitalConnect, Wellue, Ypsomed AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)