White Cement Market Size, Share, Trends and Forecast by Type, Application, and Region 2025-2033

White Cement Market Size and Share:

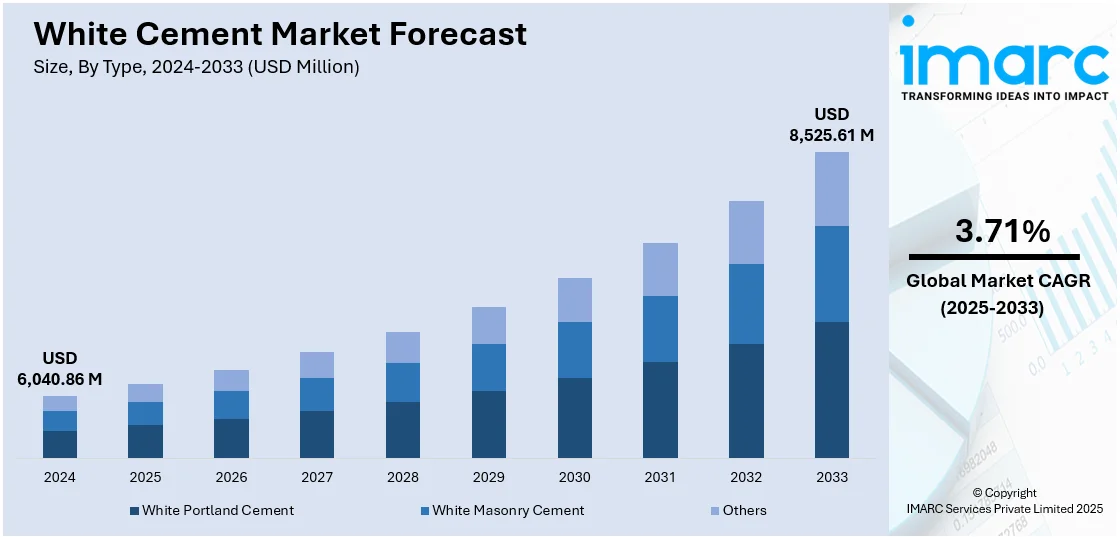

The global white cement market size was valued at USD 6,040.86 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,525.61 Million by 2033, exhibiting a CAGR of 3.71% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 75.9% in 2024. The market is dominated by growing need for architectural and decorative applications due to its enhanced aesthetic value. Rapid urbanization and growing construction activities, particularly in residential and commercial areas, are other significant driving factors. The reflective and heat-insulating quality of white cement makes it perfectly suitable for eco-friendly building technology. Technological innovations in manufacturing and expanding demand for luxury interior and exterior finishes also favor growth of the white cement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6,040.86 Million |

| Market Forecast in 2033 | USD 8,525.61 Million |

| Market Growth Rate 2025-2033 | 3.71% |

The white cement industry is influenced by rapid urbanization and the expansion of infrastructure, as visually appealing and long-lasting construction materials are in greater demand. The aesthetic value of white cement makes it a popular choice for decorative uses, such as facades, flooring, and ornamentation. Moreover, growing attention toward the application of sustainable building techniques has fostered growing interest in using white cement, based on its reflecting characteristics that support mitigating heat island conditions around cities. Apart from this, the development of modern manufacturing technologies enhanced the quality as well as competitiveness of white cement, opening ways for broader implementation across a multitude of building endeavors. All these factors are expected to spur the white cement market growth throughout the next few years.

The United States stands out as a key market disruptor, driven by its sophisticated building industry and robust focus on architectural beauty. Commercial and residential building demand for luxury finishes is also driving the adoption of white cement for its use in decorative concrete, precast panels, and interior design features. Moreover, the US market is extremely sensitive to innovation, prompting manufacturers to invest in new formulations and eco-friendly production methods that meet green building standards. The increasing trend of urban renewal and high-end housing projects in cities such as New York, Los Angeles, and Chicago are also driving white cement demand. In addition, the existence of several large players and technologically sophisticated plants in the US improves supply chain effectiveness and product quality, which makes the country a global leader in product innovation and customization.

White Cement Market Trends

The rapid urbanization and infrastructure development

Rapid urbanization is a major driver for the white cement market due to increasing infrastructure development in both developed and developing countries. In line with this, the expansion of urban areas leads to the construction of new residential, commercial, and public infrastructure, such as roads, bridges, buildings, hospitals, schools, malls, railway stations, airports, and other public spaces. By 2050, 68% of the world's population is expected to reside in cities, according to the UN. This tendency indicates a constant need for infrastructure and, by extension, white cement. White cement is extensively used in these structures due to its superior aesthetic appeal, strength, and durability. It is employed in aesthetic and decorative concrete, ornamental designs, and precast concrete units to enhance the visual appeal of the urban landscape. Furthermore, infrastructure refurbishment projects in mature and well-developed regions also demand white cement for repair and renovation purposes. As more people are shifting to urban settings, the prospects for sustained infrastructure development and consequent demand for white cement remain strong.

The increasing product demand for decorative and premium quality applications

The rising demand for decorative and premium quality applications is a significant factor transforming the white cement market outlook. Consumer preferences are shifting toward aesthetically pleasing interiors and exteriors in residential and commercial spaces. As per IMARC Group, the India interior design market is expected to reach USD 71.0 Billion by 2033, exhibiting a growth rate (CAGR) of 8.50% during 2025-2033. White cement is extensively used in creating decorative tiles, designer flooring, terrazzo, and mosaics, due to its color and quality consistency. In addition, it is compatible with color pigments, which allow users to select a wide range of color options, further expanding its use in decorative applications. Besides this, the increasing number of high-end real estate projects, luxury hotels, and commercial spaces that prefer white cement for a premium look and high-quality finish is boosting the market growth. Moreover, improving living standards and increasing focus on interior and exterior aesthetics is anticipated to drive the market growth for decorative and premium applications.

The rising adoption of sustainable construction practices

The growing focus on sustainable construction practices due to escalating environmental concerns is boosting the demand for sustainable materials, such as white cement. Its high reflectivity aids in reducing the heat island effect in urban areas, as it reflects more sunlight and absorbs less heat than darker materials. This can lead to energy savings in buildings because less cooling is required. According to the International Finance Corporation, buildings account for 19% of energy-related greenhouse gas emissions and utilize 40% of global electricity, with the built environment projected to increase by 2050. Additionally, the visibility of cracks in white cement structures allows early detection of potential structural issues, facilitating timely repairs and increasing building longevity. Furthermore, white cement's low iron content makes it more resistant to sulfate attack, enhancing the durability of structures and reducing the need for replacements. As a result, the ongoing global shift toward sustainability will continue to favor materials, such as white cement, that contribute to energy efficiency and durability in construction.

White Cement Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global white cement market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- White Portland Cement

- White Masonry Cement

- Others

White Portland cement stands as the largest component in 2024, holding around 39.5% of the market. White Portland cement is the most popular type, according to the white cement market forecast, due to its great properties that suit a wide range of applications. It has great strength and endurance, making it an excellent choice for building projects that require high-strength concrete. Furthermore, its capacity to maintain a brilliant, constant white color even when blended with other elements has enabled designers to employ it extensively in architectural and ornamental applications, resulting in market development. Furthermore, it is a highly adaptable substance that is utilized in the manufacture of precast concrete, mortars, and grouts, which is increasing its appeal. Furthermore, environmental restrictions requiring reduced carbon dioxide (CO2) emissions have favored White Portland cement due to its lower clinker concentration compared to typical gray cement. Furthermore, increased investment in infrastructure and urban development is a growth driver.

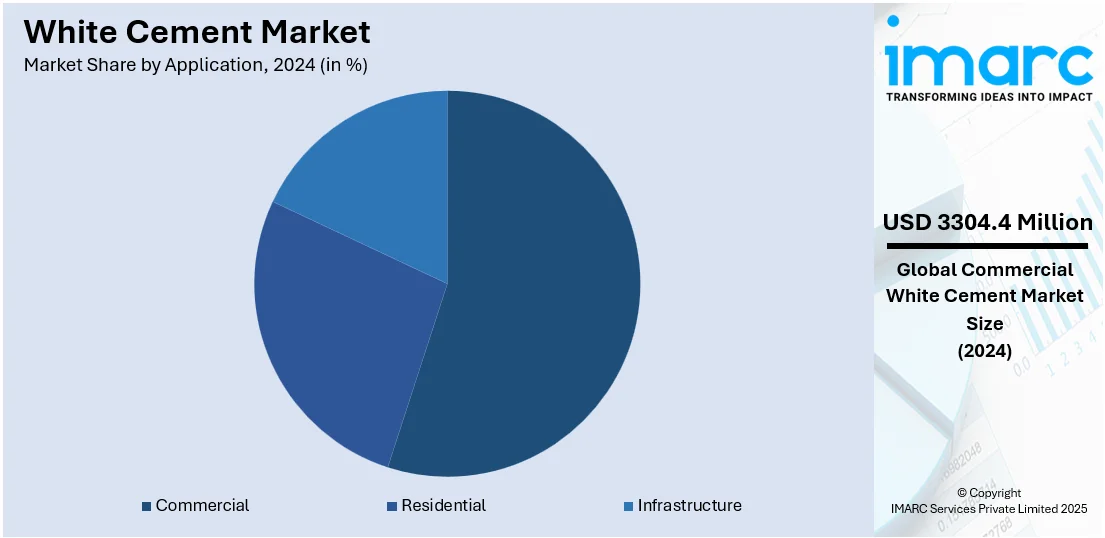

Analysis by Application:

- Residential

- Commercial

- Infrastructure

Commercial leads the market with around 54.7% of market share in 2024. The commercial industry is the primary application segment for the white cement market, stimulated by its demand for beauty and strength in heavily used areas. White cement is preferred by designers and architects for making visually impressive facades, elaborate moldings, and polished interiors in commercial properties like office buildings, shopping centers, and hospitality facilities. Its capability to produce vibrant colors and silky finishes makes it suitable for decorative concrete uses, such as terrazzo flooring and precast pieces. The growing trend of luxury and branded commercial environments also fuels this trend, as companies try to create an upscale atmosphere. Moreover, the versatility of white cement in diverse decorative methods, such as stamped concrete and dry mix mortars, increases its popularity in the commercial building industry. This emerging trend underlines the central position of white cement in defining contemporary commercial architecture.

Regional Analysis:

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- North America

- United States

- Canada

- Latin America

- Brazil

- Mexico

- Others

- Middle East & Africa

In 2024, Asia-Pacific accounted for the largest market share of 75.9%. Asia Pacific is dominating the white cement market due to a combination of factors. The region is undergoing rapid urbanization and industrialization, leading to substantial growth in construction and infrastructure projects. Additionally, the regional countries have a large and growing middle class that demands more aesthetically pleasing buildings and homes, and white cement fits the demand perfectly owing to its superior aesthetic appeal compared to traditional grey cement. Moreover, Asia Pacific also houses several leading white cement manufacturers, which contributes to the readily available supply and competitive pricing. Apart from this, the regional governments are investing heavily in infrastructure development, which is further propelling the demand for white cement.

Key Regional Takeaways:

United States White Cement Market Analysis

In 2024, the United States accounted for over 76.80% of the white cement market in North America. The United States white cement market is experiencing steady growth, driven primarily by the rising demand for architectural concrete with premium aesthetic appeal. Increasing investments in urban beautification projects, including parks, pedestrian zones, and decorative pavements, are fostering demand for white cement in structural applications. The growing inclination toward minimalist and modern construction styles that emphasize brightness and clean finishes is further accelerating product adoption. Additionally, the focus on energy-efficient buildings has led to the increased use of white cement in cool roofing systems, enhancing solar reflectivity. Technological advancements in surface finishing and pre-cast concrete applications are also expanding the usage of white cement across commercial and residential construction. Furthermore, the integration of white cement in sustainable infrastructure initiatives is being favored for its environmental compatibility in LEED-certified projects. Notably, a report states that the federal government's allocation of USD 62 Billion for infrastructure development in 2025 is a game-changer creating substantial opportunities for white cement demand in large-scale civic and urban renewal projects. The renovation of public spaces, particularly in urban areas, continues to provide momentum for the market. Consumer preference for durable, aesthetically pleasing exteriors and interiors is driving market expansion, while prefabricated and modular construction segments are bolstering white cement consumption in the US.

Europe White Cement Market Analysis

The Europe white cement market is growing due to its focus on heritage preservation, artistic construction, and the integration of white cement into recycled materials. The region's circular economy principles and architectural innovation in public infrastructure, such as cultural centers and transportation hubs, have also boosted demand for white cement due to its visual purity and adaptability. The transition toward low-carbon building materials has made white cement a favorable choice in sustainable design frameworks. According to the U.S. Green Building Council (USGBC), Europe hosts over 6,000 LEED-certified projects spanning nearly 113 million gross square meters, highlighting the continent's accelerating commitment to green buildings, an environment where white cement plays a pivotal role. The rise of urban landscaping projects and vertical gardens in densely populated cities is also supporting market growth. With changing lifestyle preferences and increased attention to interior aesthetics, white cement continues to gain favor in high-end residential and commercial architecture throughout Europe.

Asia Pacific White Cement Market Analysis

The Asia Pacific white cement market is expanding due to urban infrastructure development and evolving consumer design preferences. The region's middle-class population and disposable income have led to increased use of decorative building materials, with white cement playing a key role in interior and exterior finishing. Precast construction technology enhances the product's appeal due to consistent coloration and finish. Climate-conscious construction practices are also boosting demand for heat-reflective surfaces, where white cement finds application. In India, for example, the India Brand Equity Foundation emphasizes that the nation is dedicated to improving its infrastructure to achieve its 2025 economic growth goal of USD 5 Trillion, thereby boosting the demand for adaptable construction materials such as white cement. Moreover, the increased emphasis on individualized home design and premium flooring solutions has broadened the market's consumer base. As the pace of urbanization accelerates in emerging economies, the demand for aesthetically appealing and functional construction materials, such as white cement, is expected to maintain a strong upward trajectory across the Asia Pacific region.

Latin America White Cement Market Analysis

The white cement market in Latin America is experiencing growth due to increased investment in cultural infrastructure projects and time-efficient construction trends. Additionally, its application in local artisan crafts and surface finishes in hospitality architecture has added a unique demand segment. Overall cement consumption is also on the rise, as a report states that the cement consumption in Brazil increased by 5.4% in January 2025, with SNIC noting domestic sales of 5.174Mt compared to 4.911Mt in January 2024. This uptick reflects a broader regional trend toward construction activity, which supports white cement demand. Growing awareness about light-reflective materials to reduce urban heat islands is further enhancing product relevance. White cement is gaining popularity in contemporary construction due to cleaner finishes and design-led development, gaining a niche in Latin America's exterior facades and interior designs.

Middle East and Africa White Cement Market Analysis

The Middle East and Africa white cement market is growing due to luxury architecture, high-visibility projects, urban expansion, and tourism-centric zones, enhancing architectural contrasts and finishes. A report states that as property investment turnover is projected to rise by 27% to USD 952 Billion in 2025 and is expected to surpass USD 1 Trillion by 2026, the MENA region is primed to capitalize on this upward momentum. This surge in investment is likely to drive increased adoption of white cement in premium commercial and residential projects. White cement's heat-reflective properties align with regional building exterior requirements, and its popularity in custom moldings, facades, and decorative cladding in upscale commercial developments demands visual impact and material performance.

Competitive Landscape:

The leading companies are investing in capacity expansion and technological upgrades in their production facilities to increase production output and meet the growing demand for white cement. Furthermore, several key players are also exploring mergers and acquisitions to increase their market share, access new markets, and diversify their product portfolios. Additionally, the increasing emphasis on research and development (R&D) efforts to introduce better-quality products and create more durable, weather-resistant, and environmentally friendly versions is positively influencing the market growth. Moreover, top companies are forming strategic partnerships with other stakeholders to leverage each other's strengths, capabilities, and networks. Apart from this, the increasing global focus on sustainability has prompted companies to adopt more environmentally friendly practices in their operations, including efforts to reduce carbon emissions and waste.

The report provides a comprehensive analysis of the competitive landscape in the white cement market with detailed profiles of all major companies, including:

- Cementir Holding N.V.

- Aditya Birla (UltraTech Cement Limited)

- JK Cement Ltd

- CEMEX

- Sotacib

- Ras Al Khaimah Cement Company

- Federal White Cement

- Saveh Cement Company

Latest News and Developments:

- February 2025: Mannok introduced Ultra White Cement, a high-brightness, high-reflectance product designed for architectural and decorative applications. Ideal for precast concrete, masonry, flooring, and tiles, it offers optimal whiteness and aesthetic appeal and enhances Mannok's cement range.

- February 2025: Cemento Yura, a Peruvian cement manufacturer, launched a premium white cement in Peru targeting the growing demand for architectural and decorative applications. With a production capacity of 300,000 tons per year, the company intends to provide a steady supply to both domestic and foreign markets.

- January 2025: JK Cement, a grey and white cement maker, has signed a Memorandum of Understanding (MoU) with Department for Promotion of Industry and Internal Trade (DPIIT) to support India's manufacturing innovation. Through this collaboration, startups will receive access to JK Cement's extensive infrastructure, cutting-edge manufacturing and R&D facilities, mentorship programs, university resources, pilot projects and including those in the white cement segment.

- November 2024: Cementos Yura, a subsidiary of the Gloria Group, inaugurated a new cement plant in the Ica region of Peru. The USD 4 million facility spans 11,000 m² and includes a 1,655 m² warehouse and a 4,900 m² maneuvering yard. This expansion aims to strengthen the company's regional presence and meet the growing demand for cement, including white cement.

- April 2024: Amsterdam-based Cementir Group introduced D-Carb, a white cement with 15% reduced CO₂ emissions, in Europe. D-Carb achieves emissions reduction without compromising brightness by utilizing pure, light limestone, which enhances whiteness and rheology, making it ideal for applications like self-compacting concrete.

White Cement Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD, Million Tons |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | White Portland Cement, White Masonry Cement, Others |

| Applications Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Asia-Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, United States, Canada, Brazil, Mexico |

| Companies Covered | Cementir Holding N.V., Aditya Birla (UltraTech Cement Limited), JK Cement Ltd, CEMEX, Sotacib, Ras Al Khaimah Cement Company, Federal White Cement, Saveh Cement Company etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the white cement market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global white cement market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the white cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The white cement market was valued at USD 6,040.86 Million in 2024.

The white cement market is projected to exhibit a CAGR of 3.71% during 2025-2033, reaching a value of USD 8,525.61 Million by 2033.

The white cement market is driven by rising demand for aesthetically appealing construction materials, especially in decorative and architectural applications. Increased urbanization, infrastructure development, and preference for sustainable building solutions contribute significantly. Its reflective properties and use in high-end finishes make white cement a popular choice across global markets.

Asia Pacific currently dominates the white cement market, driven by rapid urbanization, increased disposable incomes, and a growing preference for aesthetic and durable construction materials. Countries like China and India are investing heavily in infrastructure and residential projects, leading to a higher demand for premium building materials. Additionally, the region's expanding tourism and hospitality sectors further boost the need for decorative and high-quality finishes, making white cement a preferred choice.

Some of the major players in the white cement market include Cementir Holding N.V., Aditya Birla (UltraTech Cement Limited), JK Cement Ltd, CEMEX, Sotacib, Ras Al Khaimah Cement Company, Federal White Cement, Saveh Cement Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)