Window Film Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Window Film Market Size and Share:

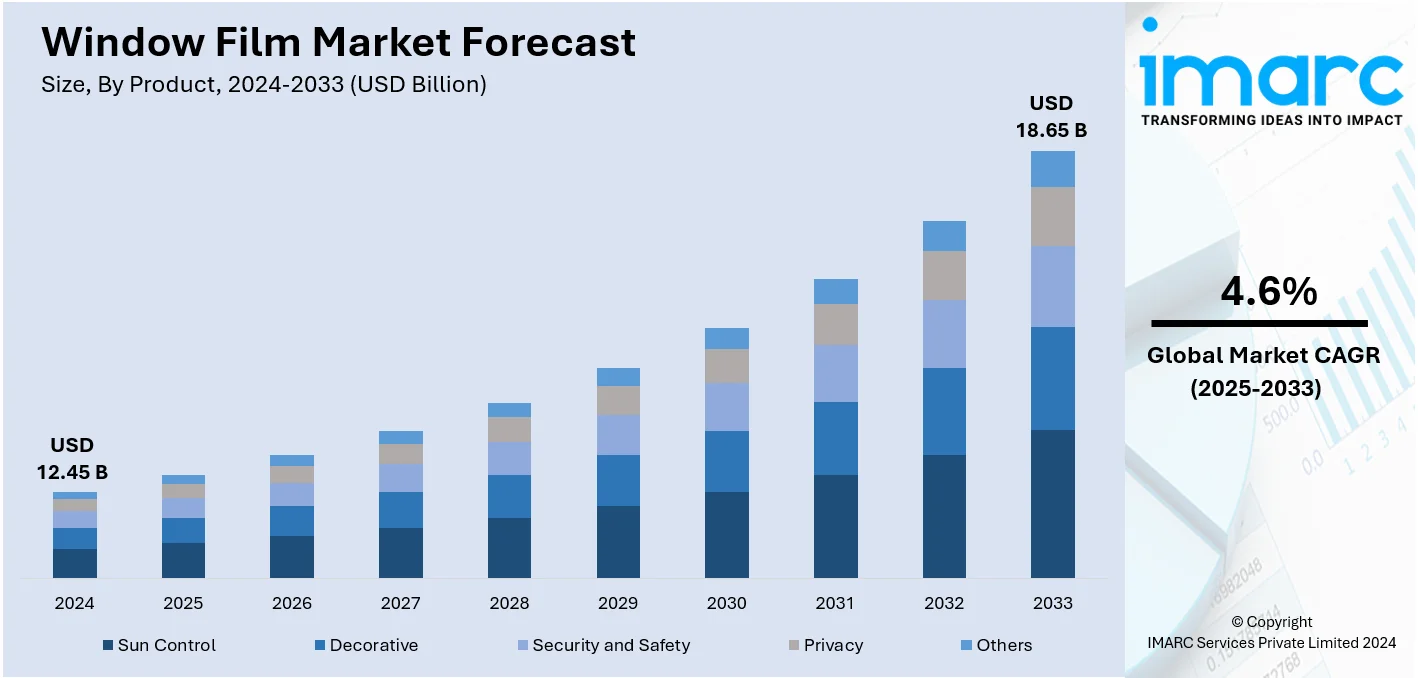

The global window film market size was valued at USD 12.45 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 18.65 Billion by 2033, exhibiting a CAGR of 4.6% during 2025-2033. North America currently dominates the market with 33.8% share. The increasing awareness of energy savings, escalating concern about ultraviolet (UV) exposure, rising demand for enhanced privacy and security, imposition of stringent government regulations, rapid advancements in material science, and the emerging architectural trends are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.45 Billion |

| Market Forecast in 2033 | USD 18.65 Billion |

| Market Growth Rate (2025-2033) |

4.6%

|

The growing emphasis on sustainability and eco-friendly practices has contributed significantly to the rise in popularity of window films. As consumers and businesses become more conscious of their environmental impact, they are seeking ways to reduce their carbon footprint. For instance, U.S. energy-related carbon dioxide (CO2) emissions reached 134 million metric tons (MMmt) in 2023. Window films contribute to sustainability in several ways. By improving energy efficiency, they help reduce the need for excessive heating and cooling, lowering energy consumption and, in turn, reducing greenhouse gas (GHG) emissions. Additionally, many window film manufacturers are adopting eco-friendly production practices, using materials that are non-toxic, recyclable, and environmentally responsible. For individuals and businesses seeking green building solutions, window films are an affordable and effective option. This increasing awareness of sustainability, along with a desire to reduce environmental impact, is driving people to invest in window films as part of their efforts to create more eco-friendly living and working spaces.

The United States is a major market disruptor as its government regulations and incentives are playing a significant role in driving the window film market. As part of efforts to reduce energy consumption and promote sustainability, the US government is implementing stricter building codes and regulations regarding energy efficiency. In some regions, new buildings are required to meet specific energy standards, and the installation of energy-efficient window films can help achieve compliance with these regulations. Additionally, various governments offer incentives such as tax breaks, rebates, and grants to encourage the adoption of energy-saving technologies, including window films. To assist states, localities, tribal nations, and their partners in implementing revised energy rules for commercial and residential buildings, the U.S. Department of Energy (DOE) announced competitive awards worth over $90 million in September 2024. By lowering energy costs for American families and businesses, cutting harmful greenhouse gas emissions, and promoting environmental justice, these prizes will enable 25 new projects nationwide ensure buildings meet the most recent energy efficiency standards. These initiatives make the upfront cost of window film installation more affordable, boosting its adoption among homeowners, businesses, and institutions.

Window Film Market Trends:

The increasing awareness of energy savings

The growing awareness of energy savings is a significant driver propelling the window film market. Residential and commercial building owners are looking for sustainable solutions to reduce their energy consumption. According to PwC, consumers are placing greater emphasis on sustainability in their purchasing decisions, with nearly 85% reporting that they are personally feeling the disruptive effects of climate change. Additionally, 46% of consumers are choosing to buy more sustainable products to help mitigate their environmental impact. Window films serve this purpose effectively by regulating the transfer of heat, thereby improving energy efficiency and decreasing the requirement for heating and cooling systems. Furthermore, this energy efficiency provides long-term savings to homeowners, which can offset the initial investment required for the installation of window films. Moreover, organizations seeking to meet sustainability goals find that window films offer a relatively simple yet effective way to reduce their carbon footprint. As a result, the role of energy-efficient products, such as window films, is being recognized and promoted by organizations and governments across the globe.

The escalating concerns about ultraviolet (UV) exposure

The growing concern over ultraviolet (UV) exposure and its detrimental effects on health, including skin cancer and premature aging, is an important factor driving the market growth. According to the WHO, skin cancers were the most commonly diagnosed cancer type globally, with an estimated 1.5 million new cases in 2022. Window films provide enhanced UV-blocking capabilities, which act as an extra layer of protection. In addition, the importance of these films is further underscored by the endorsements from health organizations across the globe that actively promote UV protection as a preventive measure against various health conditions. Moreover, window films not only protect human health but also extend the lifespan of furnishings and interior materials that are often susceptible to UV-induced fading and degradation. Besides this, the healthcare and wellness sectors are actively advocating for window films as part of a holistic approach to health and well-being.

The rising demand for enhanced privacy and security

The increasing demand for privacy and security, especially in densely populated urban areas, is a key factor stimulating the window film market. The World Bank reports that approximately 56% of the global population, or 4.4 billion people, reside in urban areas. Cities are becoming more crowded, and the need for personal space and security has intensified. In line with this, window films that provide varying degrees of opacity can significantly increase privacy without sacrificing natural light. Additionally, they are designed to hold shattered glass in place, offering an extra layer of protection against break-ins, vandalism, and even natural disasters, such as hurricanes. Furthermore, organizations that handle sensitive information and high-value items are adopting window films as a cost-effective and unobtrusive security measure. Moreover, these films offer a dual benefit of aesthetic appeal and functional utility, making them a sought-after choice for modern buildings and vehicles.

Window Film Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global window film market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and application.

Analysis by Product:

- Sun Control

- Decorative

- Security and Safety

- Privacy

- Others

Sun control stand as the largest product in the market, holding a share of 47.8% in 2024. Sun control window films significantly reduce heat gain, thereby decreasing the reliance on air conditioning systems and resulting in energy cost savings. Furthermore, they block harmful ultraviolet (UV) rays, which can fade furniture, harm skin, and degrade interior materials over time. Additionally, the escalating awareness about climate change is facilitating the demand for energy-efficient solutions, including sun control window films. Besides this, the imposition of various policies by governments across the globe encouraging or mandating the use of energy-efficient products is acting as another growth-inducing factor. Apart from this, sun control window films reduce glare and improve comfort, making them a popular choice for residential and commercial buildings, as well as automotive applications. Moreover, aggressive marketing and educational campaigns about the benefits of sun control films to raise public awareness and drive sales are fueling the market growth.

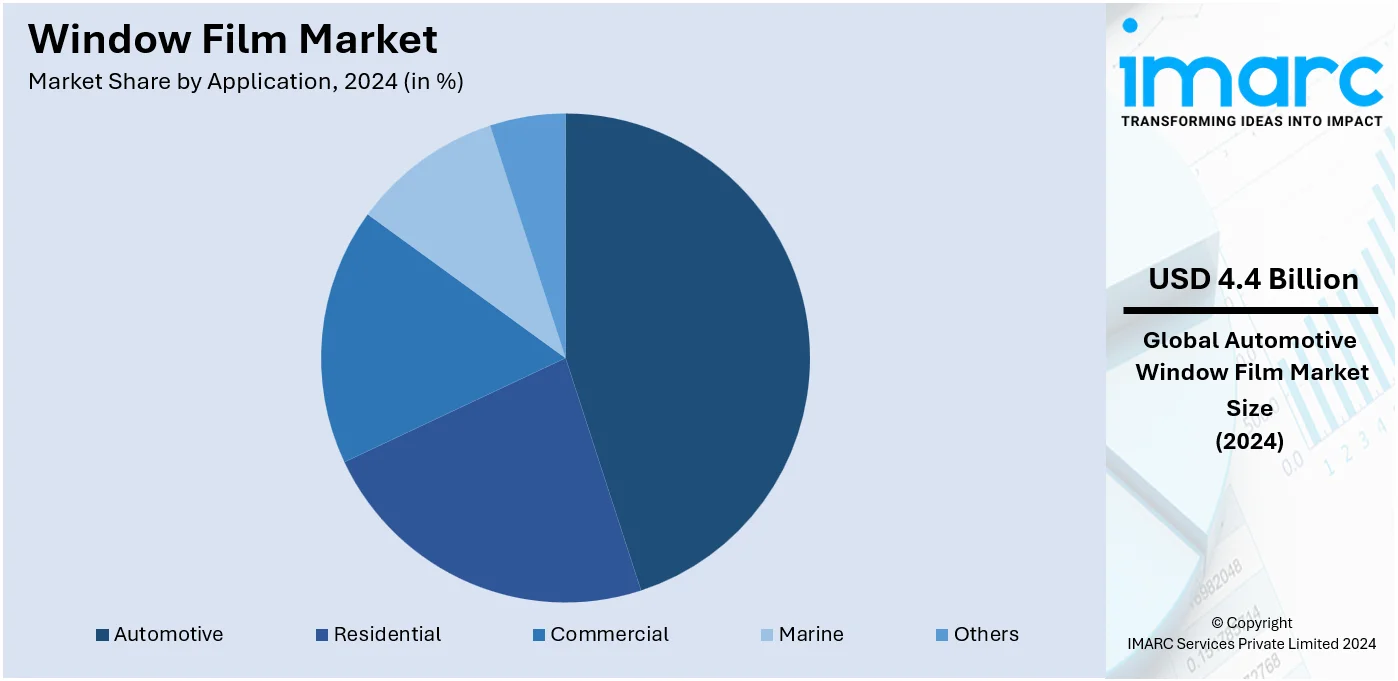

Analysis by Application:

- Automotive

- Residential

- Commercial

- Marine

- Others

Automotive leads the market with 35.4% share in 2024. Window films are widely used in the automotive industry to protect cars and passengers from harmful ultraviolet (UV) radiation. Additionally, they can significantly reduce heat gain inside a car, leading to less reliance on air conditioning and, consequently, better fuel efficiency. Furthermore, driving with reduced glare improves driver comfort and safety, making window films a popular choice among vehicle owners. Besides this, customized window films also add to the visual appeal of cars, which is facilitating the product demand. They also provide an extra layer of security by holding shattered glass in place during accidents or attempted break-ins. Moreover, the implementation of strict regulatory guidelines mandating the installation of window films on personal vehicles and public transportation to enhance safety is contributing to the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America held the 33.8 percentage of market shares. Strong economy within this region increases consumers' and businesses' dispositions towards financial investment on window films for aesthetic, security, and energy-saving purposes. Additionally, the slowly but steadily gained exposure and awareness among the entire population regarding the benefits of window films on ultraviolet (UV) protection, glare reduction, and energy-saving features has a positive influence on market growth. The established companies within North America that continue investment in research and innovation on producing high-quality products also serve as another defining growth catalyst. On the other side, enforcement of government policies that encourages adoption of energy-efficient materials is speeding the market growth. Along with this, a very strong automotive sector that drives a high product demand from original equipment manufacturers and aftermarket industries in North America is strengthening the region's market dominance.

Key Regional Takeaways:

United States Window Film Market Analysis

The United States window film market has grown because of the heightened concerns over energy efficiency, environmental sustainability, and the need for improved aesthetics of buildings. According to the Skin Cancer Foundation, over 9,500 people are diagnosed with skin cancer every day that lead to increased awareness over the ill effects of UV radiation, thus creating the demand for UV blocking window films. These films are known to block harmful rays from the sun, decrease glare, and ensure enhanced comfort. Therefore, these window films are often favored for residential as well as commercial usage. Demand for energy-efficient solutions is also on the rise in buildings since window films directly aid heat reduction and end up lowering the need for air-conditioning and, concurrently, energy consumption. Introduction of energy-saving innovations that come along with government regulations and building codes for promoting effective energy usage are also on the rise. Besides, continuous demands are seen from the automotive industry for window films, as these feature UV protection as well as privacy and heat reduction. Technology developments have additionally moved the industry towards the making of high-performance films that offer better heat rejection, with durability. As such, the US market seems to rove in furtherance as both consumers and businesses grow increasingly conscious of their energy savings, comfort, and protection from UV radiation.

Asia Pacific Window Film Market Analysis

The Asia-Pacific (APAC) window film market is expanding rapidly due to the region's booming construction industry, rising disposable incomes, and growing urbanization. As per the census, in 2021, over 64% of Chinese and 37% Indians lived in urban areas, fueling the demand for residential and commercial buildings. As urbanization increases, there is a rising need for energy-efficient solutions, which drives the adoption of window films. These films help reduce energy consumption by improving thermal insulation, blocking excessive heat, and offering UV protection. Additionally, the automotive industry in APAC contributes significantly to market growth, driven by rising car ownership and the growing preference for privacy, UV protection, and heat reduction. Consumer awareness regarding health and environmental concerns further supports the demand for window films. Technological advancements in film materials, offering better performance and durability, continue to bolster market expansion, positioning APAC as a key region for window film growth.

Europe Window Film Market Analysis

The European window film market is driven by several key factors that are shaping its growth trajectory. For example, available data indicates that about 71% of the European consumers have shown interest in sustainable products. The consumers have shifted their interest towards eco-friendly solutions that include window films. In addition, strict energy performance and environmental regulations on buildings have increased the demand for window films, especially in the commercial and residential sectors. Governments all over Europe are promoting green building initiatives as part of their efforts in boosting such growth. Moreover, the rising concerns about UV radiation and its effects on damaging the skin and interior materials is also favoring the introduction or incorporation of window films. Furthermore, increasing customizations for UV protection, glare reduction, and improved looks of the vehicle are some of the main driving forces for the growth of this market. Alongside this, the European countries continue to adopt and expand the market through innovations in technology in the design and performance of window films, such as those improving durability, heat rejection, and ease of installation.

Latin America Window Film Market Analysis

The increasing demand for window films across Latin America is rising because of rapid urbanization. The projections of BBVA Research indicate that around 80% of the population in Latin American countries now live in urban areas, increasing the need for energy-efficient solutions in residential and commercial sectors. Window films improve energy efficiency by regulating temperatures, glare, and UV blocking. Also, the boosting automotive sector with increased vehicle ownership is creating the need for window films as consumers are now more concerned with privacy, heat reduction, and UV shielding. The trend of urban growth plays a significant role in driving window film adoption across the region.

Middle East and Africa Window Film Market Analysis

Multiple driving forces facilitate the market for window films across the Middle East and Africa (MEA). The high varying climatic regime of the region that requires heat-reducing films to provide comfortable indoor living and reduce cooling expenses is a major factor. According to reports released by PwC, over 70% of the population in the Middle East reside in urban areas, hence creating a demand for energy-efficient solutions in these developments. Rapid urbanization and infrastructure development mainly in UAE, Saudi Arabia, and South Africa are escalating the adoption trend of window films across these countries. In addition, the concerns regarding UV radiations have contributed to the increasing popularity of window protective films in both the residential and automotive sectors.

Competitive Landscape:

The major players in the market are dedicating a lot of effort into developing new products, diversifying their product lines, and increasing their worldwide presence. Prominent businesses are spending money on research and development (R&D) to launch cutting-edge window film solutions, such smart films and multipurpose films that provide improved glare reduction, UV protection, and heat rejection. Some companies have focused on incorporating technology into their products, such as films that can automatically adjust to changing lighting conditions. These businesses are also increasing their production capacity in developing regions like Asia-Pacific, where construction and urbanization are increasing. Another trend is strategic alliances and acquisitions, as businesses seek to improve their product lines and solidify their market positions. Additionally, major players are focusing on eco-friendly and sustainable solutions, responding to the growing demand for green building materials.

The report provides a comprehensive analysis of the competitive landscape in the window film market with detailed profiles of all major companies, including:

- 3M Company

- American Standard Window Films

- Armolan

- Avery Dennison Corporation

- Eastman Chemical Company

- Johnson Window Films Inc.

- LINTEC Corporation

- Nexfil Co. Ltd.

- Saint-Gobain Performance Plastics Corporation (Compagnie de Saint-Gobain S.A.)

- Toray Plastics (America) Inc. (Toray Industries Inc.)

Latest News and Developments:

- June 2024: Onyx Coating launched Vunyx Ceramic Window Films, which reject up to 98% of infrared heat, enhancing comfort and fuel efficiency. These durable, scratch-resistant films offer clear visibility and easy installation, maintaining performance and appearance over time.

- April 2024: Hyundai Motor Company introduced Nano Cooling Film, a vehicle window film designed to improve interior cooling by using a nanostructure for enhanced heat dissipation. Tested in Lahore, Pakistan, where temperatures exceed 50°C, the film blocks external heat while maintaining visibility. Its three-layer design reflects and radiates heat, reducing interior temperatures. Nano Cooling Film can also be paired with conventional window films for added cooling in regions with fewer tint regulations.

- March 2024: Contra Vision launched Contra Vision Advance, a PVC-free, polyester-based perforated window film. Available in 30% and 40% transparency, it reduces solar heat gain and carbon emissions. Already used in UK installations, it offers a sustainable alternative to PVC films with a three-year lifespan and safer disposal.

- February 2023: Eastman Chemical Company acquired Ai-Red Technology (Dalian) Co., Ltd., a manufacturer of paint protection and window films for the automotive and architectural markets in the Asia Pacific region. This acquisition enhanced Eastman’s capacity to meet growing demand and strengthens its position in the Performance Films market. It also expands the company’s operations in China and the broader Asia Pacific region, supporting continued growth and innovation in automotive and architectural films. Terms of the deal were not disclosed.

- April 2022: Avery Dennison Graphics Solutions introduced its Dusted Crystal decorative architectural window film, available in matte and luster finishes. The film provided privacy and a translucent light effect, ideal for marking designated spaces. It featured a first-to-market, wet-apply quick-release adhesive that allowed for easy repositioning during installation and removal without residue. The adhesive also prevented sticking to itself, ensuring a smoother application process.

Window Film Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Sun Control, Decorative, Security and Safety, Privacy, Others |

| Applications Covered | Automotive, Residential, Commercial, Marine, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, American Standard Window Films, Armolan, Avery Dennison Corporation, Eastman Chemical Company, Johnson Window Films Inc., LINTEC Corporation, Nexfil Co. Ltd., Saint-Gobain Performance Plastics Corporation (Compagnie de Saint-Gobain S.A.), Toray Plastics (America) Inc. (Toray Industries Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the window films market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global window films market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the window films industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global window film market was valued at USD 12.45 Billion in 2024.

IMARC Group estimates the market to reach USD 18.65 Billion by 2033, exhibiting a CAGR of 4.6% during 2025-2033.

The key factors driving the global window film market include rising demand for energy efficiency, increasing awareness of UV protection, enhanced aesthetic appeal, growing safety and security concerns, government regulations promoting sustainability, technological advancements, and a shift towards eco-friendly building solutions for residential and commercial spaces.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global Window Film market include 3M Company, American Standard Window Films, Armolan, Avery Dennison Corporation, Eastman Chemical Company, Johnson Window Films Inc., LINTEC Corporation, Nexfil Co. Ltd., Saint-Gobain Performance Plastics Corporation (Compagnie de Saint-Gobain S.A.), Toray Plastics (America) Inc. (Toray Industries Inc.), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)