Wine Corks Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

Wine Corks Market Size and Share:

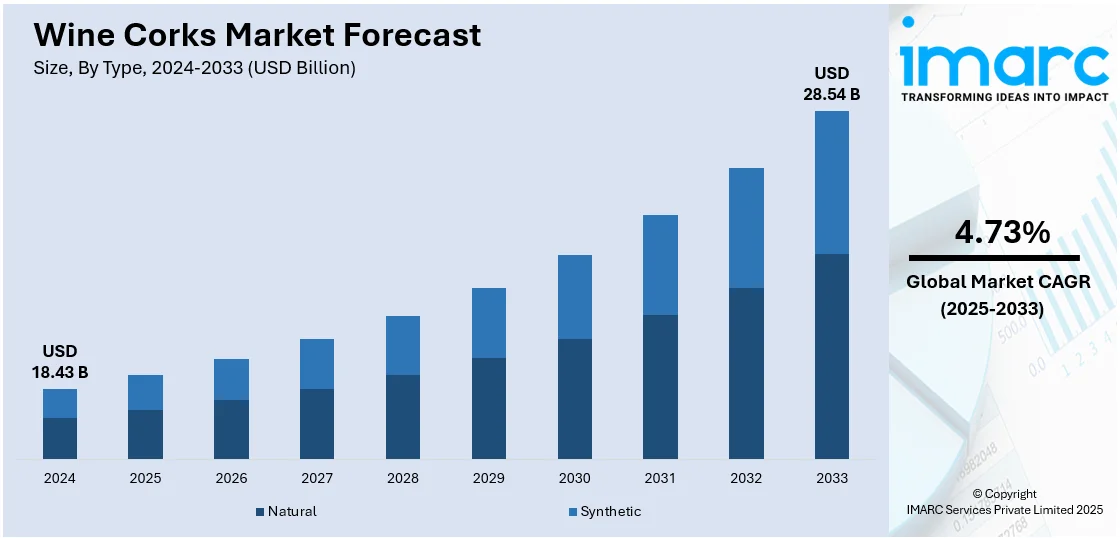

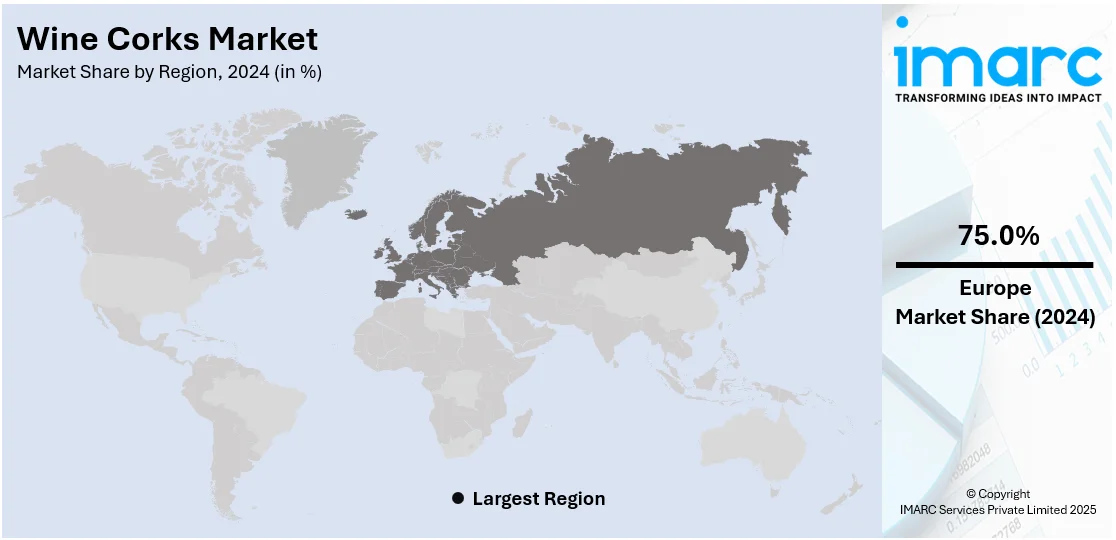

The global wine corks market size was valued at USD 18.43 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 28.54 Billion by 2033, exhibiting a CAGR of 4.73% during 2025-2033. Europe dominated the market in 2024. Increased wine production and demand worldwide, growing wine exports, and a strong preference for natural cork closures by major wine-producing regions, which are favored for their quality and sustainability, are some of the key factors contributing to the wine corks market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18.43 Billion |

| Market Forecast in 2033 | USD 28.54 Billion |

| Market Growth Rate (2025-2033) | 4.73% |

The market is primarily driven by the global rise in wine consumption, especially in emerging markets where wine is gaining popularity. A growing preference for premium and vintage wines has increased demand for natural corks due to their ability to support proper aging and preserve flavor. Consumers and winemakers also lean toward eco-friendly and sustainable packaging solutions, making natural corks, harvested without harming trees, an appealing option. The tactile and visual appeal of corks contributes to brand image and consumer experience, especially in the luxury wine segment. Moreover, efforts to reduce plastic use and increase recyclability in packaging favor cork adoption. Technological improvements in cork processing have also reduced issues like cork taint, further supporting the wine corks market growth. across both traditional and new wine-producing regions.

In the United States, wineries are increasingly embracing circular practices by repurposing used closures into sustainable products like playground materials and decor elements. These efforts support waste reduction and highlight a growing focus on environmental responsibility within packaging and post-consumption processes in the global wine industry. For instance, in April 2025, Appassionata Estate, a winery in Oregon, US, partnered with Cork Collective, a sustainability initiative focused on recycling wine corks. Through this collaboration, used corks from the winery are collected and repurposed into eco-friendly products, such as playground materials and sustainable design elements. The partnership aims to reduce cork waste and promote circular sustainability in the wine industry.

Wine Corks Market Trends:

Rising Wine Demand

Worldwide wine demand has shown a notable increase, which directly influences the market, as cork remains the preferred choice for sealing wine bottles, especially in regions with a strong winemaking heritage such as Europe. According to Worldmetrics, it is forecasted that the global market for wine corks market is anticipated to attain a value of USD 2.77 Billion by 2025. This surge in wine interest is supported by a Winecap survey, which found that 94% of wealth managers expect demand for fine wine to increase, up from 84% in 2024, highlighting a sustained upward trend in luxury wine consumption. Moreover, corks are favored for their ability to allow wine to age and mature properly, enhancing the overall quality of the wine. As more people globally indulge in wine, the demand for high-quality cork closures naturally increases, supporting the growth of the market in response to rising consumer preferences and consumption patterns.

Increased Wine Production

According to Eurostat, the European Union's sold production of wine, which includes sparkling wine, port, and grape must, totaled 16.1 Billion Liters in 2022. For instance, Italy and Spain were the leading wine producers, each generating close to 5.0 Billion Liters, collectively making up 62% of the EU's total wine production. Moreover, France followed with a production of 3.4 Billion Liters, accounting for 20% of the total. Germany, Portugal, and Hungary were also significant contributors, producing 4%, slightly over 2%, and slightly under 2% of the EU total, respectively. Besides this, the top three producers were responsible for 83% of wine production within the EU. Furthermore, based on the wine corks market outlook, the increase in wine production is a crucial factor propelling product demand. Various vineyards in Europe continue to use natural cork closures, favoring their traditional appeal and proven effectiveness in wine preservation. This preference aligns with the global perception of quality associated with cork-sealed bottles, providing a positive wine corks market outlook. According to a survey, as of 2025, Australians consume 24 bottles of wine per capita annually, with 80% being table wine, underlining a shift toward regular, everyday wine consumption that supports the need for high-volume cork sealing solutions.

Growing Global Wine Exports

According to the World Integrated Trade Solution, the leading exporters of champagne and sparkling wine included the European Union, which exported USD 5,731,452.75 Thousand worth, totaling 599,468,000 Liters in 2023. Moreover, France followed with exports valued at USD 4,898,519.94 Thousand for 209,973,000 Liters. Besides, Italy exported USD 2,396,586.80 Thousand worth of goods, amounting to 500,146,000 Liters, while Spain and Singapore also made significant contributions with USD 536,888.93 Thousand for 167,993,000 Liters and USD 456,792.93 Thousand for 10,010,900 Liters, respectively. The year 2023 saw a substantial increase in global wine exports. The fact that 70% of these exports utilize natural cork significantly amplifies the demand for cork closures. Notably, Wine Intelligence reported that Italian wine exports in January 2025 reached EUR 578.6 Million, a +7.5% increase in value, and 153.5 Million Liters, reflecting a +1.9% rise in volume compared to January 2024. The wine corks market forecast indicates that as international markets expand and more wines are exported across the globe, the need for reliable sealing solutions like cork continues to influence market growth.

Wine Corks Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global wine corks market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and distribution channel.

Analysis by Type:

- Natural

- Synthetic

Natural stood as the largest type in 2024. Natural corks are favored for their traditional appeal and superior sealing properties, which are crucial for the aging process of wine. This preference stems from their ability to provide optimal conditions for long-term wine storage, allowing wines to mature and develop complexity over time. As such, natural corks are extensively used by wineries worldwide that aim to maintain the highest quality and authenticity in their products. Hence, key players are introducing advanced product variants to meet these needs. For instance, in September 2024, ReCORK, a leading wine cork recycling company, together with footwear brand SOLE, repurposed over half a million used corks into a new line of fall/winter sneakers, using 52 corks for each pair. Additionally, ReCORK actively engages in the collection and recycling of used natural wine corks through a network that spans vineyards, municipalities, restaurants, and grocery stores across the US and Canada. As the largest endeavor of its kind, ReCORK has amassed over 132 Million corks to date. These collected corks are transformed into high-performance composite materials and components for various uses.

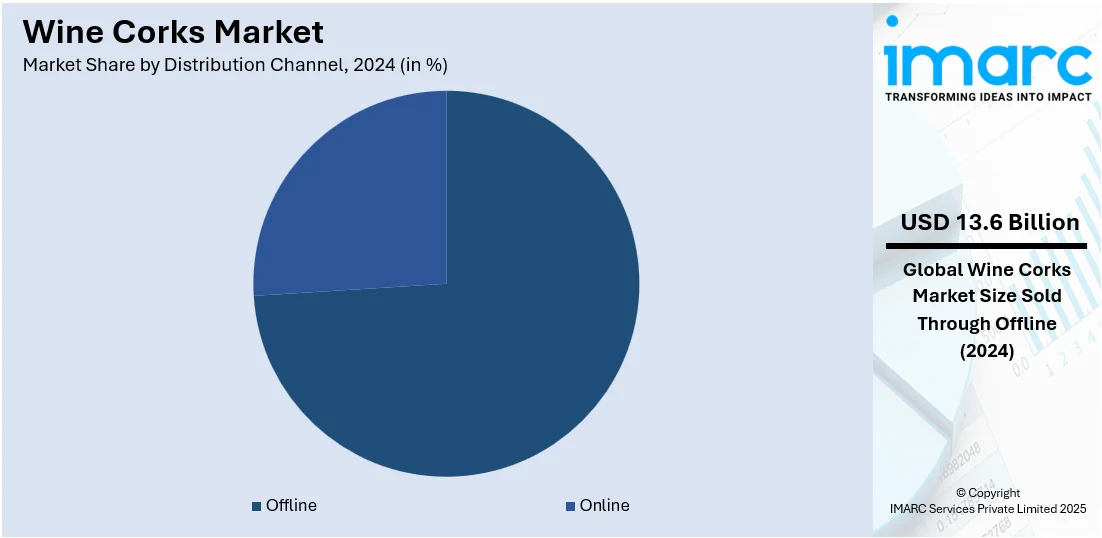

Analysis by Distribution Channel:

- Offline

- Online

Offline led the market in 2024. Offline channels include specialty stores, supermarkets, and hypermarkets, where consumers can physically examine the quality of corks, a crucial factor in their purchasing decision. These offline outlets are preferred due to the tactile buying experience they offer, which is particularly important in the wine industry where tradition and quality are highly valued. Moreover, the personal interaction and expert advice available at these venues further reinforce consumer preferences toward purchasing through offline channels, thus propelling the wine corks market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share. This leadership stems from its deep-rooted wine culture, with its substantial wine production and consumption rates. In addition, consumers' preference for wines sealed by traditional methods, especially natural cork, provides strong demand in the market. Moreover, the Europe market is further strengthened with major wine-producing countries such as France, Italy, and Spain, which significantly contribute to global wine production. At the same time, Europe preserves the tradition of using cork closures to preserve the excellence and long life of its wines. This set of promises, based on the idea of tradition and quality in winemaking, plays an important role in the dynamics of the wine corks market. For instance, in September 2023, the subsidiary of Corticeira Amorim-Amorim Florestal introduced a partnership with Caixa Geral de Depósitos (Caixa) to deploy the first ESG-focused credit line in the cork industry. The activity is expected to increase its commitment to sustainability and forest preservation. The new credit line, tailored specifically for raw-material cork suppliers, offers favorable terms that are tied to meeting sustainability objectives. Moreover, cork suppliers working with Corticeira Amorim would have the opportunity to receive a reduced interest rate spread from Caixa, determined by their ESG rating and their certification by the Forest Stewardship Council (FSC).

Key Regional Takeaways:

United States Wine Corks Market Analysis

The United States wine corks market is witnessing consistent growth driven by increasing consumer preference for premium wines and a rising trend of wine consumption among millennials. The expanding wine tourism sector is also contributing to higher demand for natural corks, as wineries seek to enhance the authenticity of their product packaging. Furthermore, growing awareness about sustainable and biodegradable materials encourages the use of eco-friendly cork closures over synthetic alternatives. The market also benefits from a surge in artisanal and boutique wineries, which often favor traditional corks to reinforce brand heritage and perceived quality. According to Wine Intelligence, the demand for bottled wines remains robust, with American consumers continuing to favor premium, ready-to-drink wine offerings. Sparkling wine also saw positive growth in 2024, with import value rising by 1.3% and volume increasing by 11%, further amplifying the need for reliable cork closures that preserve product integrity. In addition, innovations in cork processing technologies are enabling enhanced preservation qualities, attracting a broader consumer base. The rise in home wine-making activities and gifting culture around wine is boosting secondary packaging demand, further supporting market growth.

Europe Wine Corks Market Analysis

The Europe wine corks market is marked by strong demand due to the continent's deep-rooted wine culture and extensive vineyard coverage. A significant driver is the rising inclination toward organic and biodynamic wines, which often prioritize natural corks to align with their eco-conscious production ethos. According to reports, 36% of wine drinkers in France regularly consume organic wine, a notable increase from previous years, underscoring the growing shift toward sustainability in consumer preferences. Simultaneously, increased investments in wine preservation techniques have highlighted cork’s advantages in aging and oxygen management. The resurgence of interest in vintage wine collections and cellarable wines is fostering a preference for cork closures that support long-term storage. Additionally, evolving consumer aesthetics and emphasis on traditional craftsmanship in wine presentation are enhancing the cork’s appeal. Regional events, wine fairs, and technological advancements in cork sterilization and quality control are promoting the authenticity of artisanal winemaking, while their renewable properties appeal to environmentally conscious consumers.

Asia Pacific Wine Corks Market Analysis

The Asia Pacific wine corks market is gaining momentum due to the rapid growth of the wine industry and evolving consumer palates favoring Western-style beverages. Increased exposure to global cuisines and lifestyle trends is encouraging wine consumption, especially in urban areas, which in turn boosts demand for traditional cork closures. The rise of premium wine imports and expanding luxury retail infrastructure are positioning corks as desirable packaging elements that reflect quality and status. Notably, Australian wine exports surged by 41% in value to USD 2.64 Billion in one year, ending March 2025, underscoring the region’s intensifying role in the global wine trade and the corresponding growth in cork usage. The market is also benefiting from the increasing popularity of wine-related social occasions and dining experiences, where presentation and packaging play a critical role. Educational initiatives and digital wine retailing platforms are influencing purchasing behavior and expanding access to cork-sealed wines, bolstering the market's upward trajectory.

Latin America Wine Corks Market Analysis

Latin America's wine corks market is experiencing expansion supported by growing domestic wine production and regional branding efforts aimed at premium positioning. The rising number of boutique vineyards focusing on quality and traditional methods is propelling the use of corks to communicate authenticity. According to the Observatory of Economic Complexity (OEC), Brazil imported USD 523 Million worth of wine in 2024, reflecting the region’s increasing engagement with premium wine offerings, many of which utilize cork closures to preserve quality and enhance consumer appeal. The rise of enotourism and wine-centric festivals in the region is boosting the popularity of cork-sealed wines, enhancing consumer engagement. Additionally, cultural emphasis on craftsmanship and artisanal products supports cork adoption as a natural, heritage-rich choice.

Middle East and Africa Wine Corks Market Analysis

The Middle East and Africa wine corks market is growing steadily, fueled by a niche yet expanding wine consumer base and the development of upscale hospitality sectors. According to IMARC Group, the Middle East wine market is expected to reach USD 41.1 Billion by 2033, exhibiting a growth rate (CAGR) of 8.10% during 2025-2033. High-end hotels and restaurants are increasingly offering premium wine selections, which drives demand for natural corks associated with exclusivity. The rise of wine appreciation clubs and tasting events in urban centers is also shaping consumer expectations around authenticity and presentation. Moreover, increased importation of high-quality wines from established regions is promoting familiarity with cork-sealed packaging, encouraging market penetration. According to the USDA, independent stores and chains account for approximately 73% of total revenue in the consumer foodservice sector in Saudi Arabia, indicating a robust retail and hospitality infrastructure that further supports the distribution of cork-sealed wines across the region.

Competitive Landscape:

The key players in the wine corks market are actively pursuing strategies to bolster market growth by focusing on sustainability and innovation. Additionally, several manufacturers are investing in eco-friendly production processes to appeal to environmentally conscious consumers, which is becoming increasingly important as the market faces scrutiny over the environmental impact of cork harvesting. Besides, these companies are enhancing their product offerings by introducing technological advancements such as customizable corks and corks designed to better preserve wine quality and extend shelf life. Furthermore, partnerships and expansions into new geographic markets are also prevalent strategies, allowing them to tap into emerging wine regions beyond traditional European markets. These efforts collectively strengthen their market position and respond to the evolving preferences of wine producers and consumers.

The report provides a comprehensive analysis of the competitive landscape in the wine corks market with detailed profiles of all major companies, including:

- Allstates Rubber & Tool Corp.

- Amorim Cork

- Bangor Cork

- Corksribas

- Jelinek Cork Group

- M.A. Silva Usa Llc

- PrecisionElite limited company

- Waterloo Container Company

- WE Cork Inc

- WidgetCo Inc.

- Wine Enthusiast Companies

- Zandur

Latest News and Developments:

- April 2025: Casa Cork, in partnership with Cork Collective and Corticeira Amorim, showcased the versatility of wine corks in design at an exhibition during Milan Design Week. It featured cork-based structures and furnishings, highlighting cork's sustainability and aesthetic appeal.

- March 2025: ABK6, renowned for its single estate Cognacs, expanded into white wines with two 2024 Bordeaux blends. Both wines are available with cork stoppers or screw caps.

- January 2025: Brooks Winery partnered with Revino to launch a reusable bottle program, including incentives for returning natural wine corks. Participants can earn Green Loyalty Points, i.e., 10 per cork and up to 100 corks per visit, to promote cork recycling.

- January 2025: Diam Bouchage launched new cork closures at the 2025 Unified Wine and Grape Symposium, expanding its bio-based Diam Origine range with the Diam Origine 3. It also introduced the Diam Collection, featuring a high-precision cork closure with improved oxygen control, enhancing wine aging while maintaining consistency and eliminating cork taint.

Wine Corks Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Natural, Synthetic |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allstates Rubber & Tool Corp., Amorim Cork, Bangor Cork, Corksribas, Jelinek Cork Group, M.A. Silva Usa Llc, PrecisionElite limited company, Waterloo Container Company, WE Cork Inc, WidgetCo Inc., Wine Enthusiast Companies, Zandur, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wine corks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global wine corks market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wine corks industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wine corks market was valued at USD 18.43 Billion in 2024.

The wine corks market is projected to exhibit a CAGR of 4.73% during 2025-2033, reaching a value of USD 28.54 Billion by 2033.

The wine corks market is driven by growing global wine consumption, increasing demand for premium wines, and preference for sustainable, natural cork materials. Rising awareness of cork's recyclability and its role in wine aging also supports demand. Additionally, branding and aesthetics in packaging further boost cork usage among vintners.

Europe dominated the wine corks market in 2024, driven by major wine-producing countries and Portugal’s dominance in cork production. Strong demand for natural corks in premium wines supports its regional dominance.

Some of the major players in the wine corks market include Allstates Rubber & Tool Corp., Amorim Cork, Bangor Cork, Corksribas, Jelinek Cork Group, M.A. Silva Usa Llc, PrecisionElite limited company, Waterloo Container Company, WE Cork Inc, WidgetCo Inc., Wine Enthusiast Companies, Zandur, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)