Wine Market Size, Share, Trends and Forecast by Product Type, Color, Distribution Channel, and Region, 2025-2033

Wine Market Size and Share:

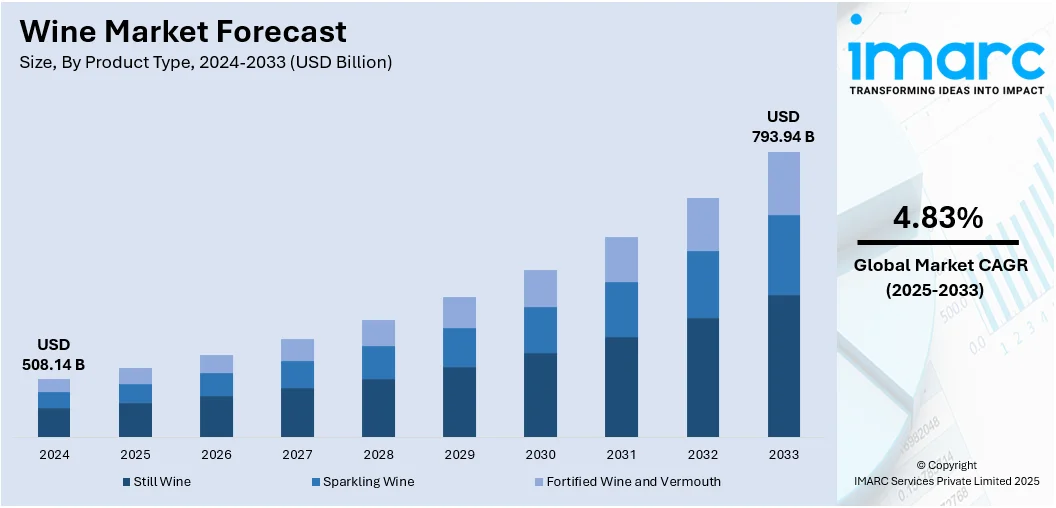

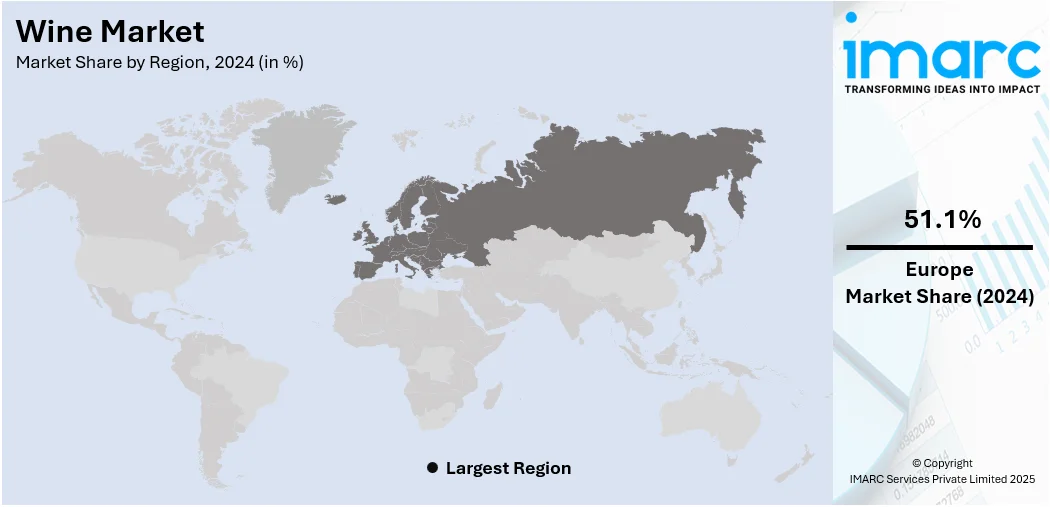

The global wine market size was valued at USD 508.14 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 793.94 Billion by 2033, exhibiting a CAGR of 4.83% during 2025-2033. Europe dominated the market, holding a significant market share of 51.1% in 2024. The increasing product premiumization, the introduction of innovative product variants, the widespread adoption of Western culture and cross-cultural trends, and the growing product availability on e-commerce platforms are some of the major factors contributing to the wine market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 508.14 Billion |

| Market Forecast in 2033 | USD 793.94 Billion |

| Market Growth Rate 2025-2033 | 4.83% |

The market is shaped by multiple factors that together encourage steady growth worldwide. Rising disposable incomes and urban lifestyles have increased the willingness of consumers to spend on premium beverages. Health-conscious buyers are also drawn to wine, as moderate consumption is often associated with benefits for heart health and longevity. Producers are innovating with new flavors, blends, and packaging formats, making wine more accessible to younger audiences. Tourism, especially in regions known for vineyards, has boosted wine culture and global demand. Expanding distribution channels, from supermarkets to online platforms, ensures wider availability and convenience. Emerging markets in Asia Pacific and Latin America are showing rapid adoption, adding to global expansion. Altogether, these wine market trends highlight wine’s shift from a luxury to a lifestyle choice.

To get more information on this market, Request Sample

In the United States, winemakers are leaning into artistic expression, merging traditional craftsmanship with visual storytelling. Recent releases highlight extended aging, multi-appellation blending, and creative inspiration beyond the vineyard. This approach reframes wine as both a sensory and aesthetic experience, celebrating diversity of terroir while positioning each bottle as a collectible piece of art. For instance, in May 2025, Aperture Cellars introduced Collage, its most artistic and luxurious release, blending wines from five Sonoma appellations. The 2022 White and 2021 Red wines reflected meticulous craftsmanship, extended ageing, and visual storytelling inspired by photography. Founder Jesse Katz aimed to elevate winemaking into an expressive art form, celebrating diversity and terroir.

Wine Market Trends:

Growing Consumer Demand for Health and Well-being

Consumers are increasingly adopting healthier lifestyles, with many regarding moderate consumption of wine as part of a healthy diet. A recent industry report projects that wine continues to be the preferred beverage for the 55-and-over demographic, with nearly twice as many individuals in that age group favoring wine compared to those under 35. With greater interest in health and well-being, this trend is influencing wine drinking habits, thereby supporting the wine market growth. Studies pointing to the possible cardiovascular advantages of some types of wine, especially red wine, are serving to reinforce the image of wine as a healthy drink when drunk responsibly. Wineries are stepping up by creating low-sugar, organic, and low-alcohol wines to address health-conscious consumers. Further, increased demand for fewer additives, preservatives, and chemicals is encouraging wineries to use more natural and organic production techniques. This emphasis on health-conscious wine is also expanding the market for a new category of wellness-oriented wines, marketed with ingredients that support well-being. With consumers constantly focusing on health, wine is further positioned as a moderate, pleasurable drink choice in the context of an overall healthy lifestyle. In 2024, Casillero del Diablo introduced a pair of wines that are lower in alcohol and calories, addressing consumer preferences. Every glass holds 65 calories and features an alcohol content of 8.5%. The Be Light Sauvignon Blanc featured a light yellow hue and a citrus fragrance accompanied by notes of herbs and white peach. The Be Light Rosé presents aromas of blackberry and strawberry.

Increasing Trend for Premium Wines

As per the wine market analysis, increased demand for premium wines is fueling the market growth, as consumers are focusing on quality rather than quantity. This trend is particularly resilient among upscale customers and connoisseurs who crave exceptional, distinctive, and quality wine experiences. As per the wine market forecast, with rising disposable incomes in emerging economies, consumers are expected to spend money on high-end wine brands, single-vintage labels, and limited-production bottles. Wineries are meeting this demand by creating small-batch, premium wines that focus on craftsmanship, uncommon grape varieties, and terroir-driven features. Furthermore, the growing popularity of wine tasting and experience is contributing to increased appreciation for fine wine, further driving the demand for premium. Wine drinkers are also seeking provenance and authenticity, with numerous consumers willing to pay a premium for wines expressing the tradition of a particular region or the heritage of a winery. As a result, companies are manufacturing high-quality authentic wines to fulfil the demand. For example, in 2025, Grover Zampa Vineyards, a locally established brand in India's wine sector, unveiled Grover Essence De Cabernet Sauvignon, their highly anticipated limited-edition wine. The wine reveals a strong scent of cocoa, rich dark fruits, and aromatic violet blossoms when opened. The palate of Grover Essence De Cabernet Sauvignon reveals layers of black plum, dark cherries, and vanilla, enveloped in rich cocoa and savory earthiness. The wine's smooth texture, along with refined tannins, showcases a harmonious balance that is daring yet soft, culminating in a sophisticated lingering finish.

Sustainability and Ethical Production Trends

On the basis of the wine industry market research, the increasing focus on sustainability and ethical manufacturing processes is a major driver for the wine industry. The consumers are increasingly focusing on green products and are actively looking for wines produced with the least possible environmental footprint. As reported, consumers are willing to spend an average of 9.7% more on sustainably produced or sourced goods. Wineries are embracing green farming practices, lowering carbon prints, and conserving water to catch up with consumer needs for greener products. This is shaping the wine market outlook. The growth of organic, biodynamic, and vegan wine is an indication of this trend, with producers seeking lower levels of chemical, pesticide, and additive use in their vineyards. Sustainability is also going beyond production methods to packaging, with lighter bottles, recyclable materials, and different packaging like bag-in-box or cans being preferred by many wineries. These actions connect with eco-friendly consumers, especially among younger generations who are more aware of the need for ethical and sustainable consumption. In 2024, Albertsons Companies, Inc. unveiled Bee Lightly, the latest entry in the company's Own Brands wine collection, recognized for its distinctive flat bottle made entirely from 100% recycled polyethylene terephthalate (PET). This groundbreaking method of wine packaging represents a first in the US market, highlighting a dedication to recycled packaging options while maintaining the quality and taste of wine that consumers anticipate.

Wine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global wine market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, color, and distribution channel.

Analysis by Product Type:

- Still Wine

- Sparkling Wine

- Fortified Wine and Vermouth

Still wine stood as the largest product type in 2024, holding around 85.9% of the market. Still wine, which includes both red and white varieties, has a long and storied history that dates back centuries. It has been a part of many cultures and traditions, making it a well-established and familiar choice for consumers. This deep-rooted tradition contributes to its popularity. Besides, still wine is versatile and can be used in various settings, from casual gatherings to formal occasions. It pairs well with a wide range of foods, making it a versatile and adaptable choice for both everyday meals and special celebrations. It also offers a diverse range of flavor profiles, from the rich and bold characteristics of red wines to the crisp and refreshing qualities of white wines. This diversity appeals to a wide spectrum of tastes, ensuring there's a still wine option for virtually every palate.

Analysis by Color:

- Red Wine

- Rose Wine

- White Wine

Red wine led the market with around 44.2% of market share in 2024. Red wine's flavor profile, characterized by notes of dark fruits, spices, and often oak, tends to appeal to a wide range of consumers. It offers a pleasing balance of sweetness, acidity, and tannins that many people find enjoyable. Besides, red wine's versatility when it comes to food pairing is a significant factor in its popularity. It complements a variety of dishes, including red meats, pasta, cheeses, and Mediterranean cuisine. This adaptability enhances the dining experience and encourages consumers to choose red wine when dining out or at home. Moreover, many red wines have the capacity to improve with age. Wine enthusiasts often appreciate the complexity and development of flavors that aged red wines offer. This encourages collectors and connoisseurs to invest in red wine for long-term cellaring.

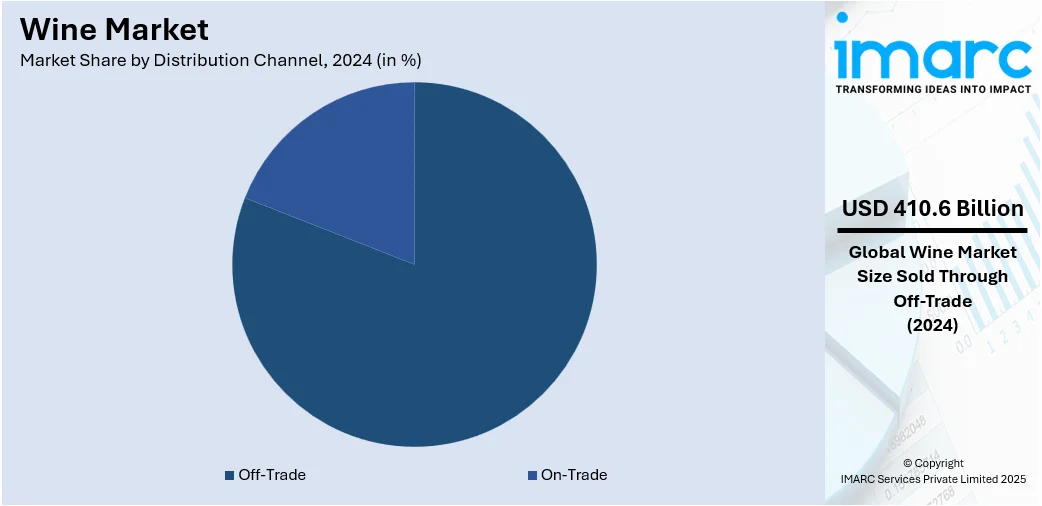

Analysis by Distribution Channel:

- Off-Trade

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

- On-Trade

Off-trade led the market with around 80.8% of market share in 2024. Off-trade channels provide consumers with a convenient and easily accessible way to purchase wine. People can buy wine along with their regular groceries or make planned purchases during store visits, saving them time and effort. Besides, retail stores and supermarkets have a widespread presence, making them easily accessible to a broad consumer base. This extensive reach ensures that wines are available to a wide range of customers, including those in urban and rural areas. Moreover, off-trade channels typically offer a diverse selection of wines, including different varietals, regions, and price points. Consumers can browse through a wide range of options and make informed choices based on their preferences and budgets.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of 51.1%. Winemaking in Europe traces back thousands of years, with a rich tradition deeply rooted in its culture and heritage. Regions like Bordeaux and Burgundy in France, Tuscany in Italy, Rioja in Spain, and the Mosel Valley in Germany have been producing wine for centuries. This rich heritage has solidified Europe's reputation as a wine-producing powerhouse. Besides, Europe has a long and storied history of winemaking that dates back thousands of years. Regions like Bordeaux and Burgundy in France, Tuscany in Italy, Rioja in Spain, and the Mosel Valley in Germany have been producing wine for centuries. This rich heritage has solidified Europe's reputation as a wine-producing powerhouse. Moreover, European countries have well-established appellation systems that regulate wine production and labeling. These systems, such as the AOC (Appellation d'Origine Contrôlée) in France and the DOC (Denominazione di Origine Controllata) in Italy, ensure the quality and authenticity of wines produced in specific regions.

Key Regional Takeaways:

United States Wine Market Analysis

In 2024, the US accounted for 77.80% of the market share in North America. The United States wine market is witnessing steady expansion, driven by evolving consumer preferences and the premiumization trend. A notable shift is occurring among younger demographics, who are increasingly exploring diverse wine varieties and favoring lower-alcohol options for social consumption. A recent survey revealed a significant rise in alcohol consumption among Gen Zers aged 21–27, increasing from 46% to 70% in just six months, signaling a growing engagement with wine among new consumers. The rise of experiential and occasion-based drinking is also influencing market dynamics, with consumers seeking wines that align with lifestyle and wellness trends. The emergence of digital platforms and e-commerce is further shaping purchasing behavior, enhancing access to a wide array of wine offerings. Moreover, the integration of wine into culinary culture through pairing experiences at home and in hospitality settings is contributing to increased consumption. Technological advancements in packaging and product innovation, such as the availability of single-serve formats and organic alternatives, are appealing to urban consumers seeking convenience and sustainability. A maturing wine-drinking population and growing interest in artisanal selections position the US wine market for sustained growth through innovation and lifestyle integration.

Europe Wine Market Analysis

The European wine market remains robust, supported by a deep-rooted cultural affinity for wine and ongoing shifts in consumption patterns. While traditional wine-drinking habits continue to thrive, there is an observable increase in interest toward unconventional blends and biodynamic varieties, especially among younger consumers. An industrial report highlights that 71.2% of adults in the UK consume alcohol at least once a week, underscoring wine’s continued relevance in everyday life and social settings. The growing preference for eco-conscious and ethically produced wines is influencing both production and purchasing decisions. Changing dining habits and the rise of informal drinking occasions are also reshaping the demand landscape, with consumers seeking wines that offer a balance between flavor and health consciousness. Direct-to-consumer sales channels, including wine subscriptions and tasting events, are gaining traction, enhancing brand loyalty and consumer education. As wine continues to play a central role in European culinary and social settings, the market is evolving to reflect diverse palates and contemporary lifestyle values, ensuring resilience and adaptability across varied consumption segments.

Asia Pacific Wine Market Analysis

The Asia Pacific wine market is growing rapidly due to shifting lifestyles, increased disposable income, and a rising preference for Western dining culture. Wine is increasingly viewed as a symbol of sophistication and is gaining traction among younger, urban consumers who are exploring international tastes. A 2024 Culinary Tourism Market Report states that Asia Pacific commands a 37.8% share of the global market in culinary tourism, a factor that is significantly boosting wine engagement through travel and gastronomy experiences. The expansion of wine bars and upscale dining venues is driving demand for a broader variety of wines. Local festivals, lifestyle events, and digital platforms are also playing a role in promoting wine culture across metropolitan regions. In addition, the growing health consciousness is encouraging moderate alcohol consumption, positioning wine as a preferred alternative to other beverages. With a strong appetite for premium and diverse wine options, the Asia Pacific region is emerging as a dynamic market characterized by experimentation and expanding consumer knowledge.

Latin America Wine Market Analysis

The Latin America wine market is witnessing steady growth influenced by evolving dining preferences and greater exposure to global wine trends. Urban consumers are increasingly incorporating wine into casual and social occasions, moving beyond traditional consumption settings. According to a 2024 report by the Brazilian Ministry of Tourism, culinary tourism in the country has grown by over 40% in the past five years, reflecting increased consumer interaction with wine through immersive food experiences. The popularity of wine-tasting events and local wine festivals is stimulating interest in various wine styles and encouraging consumer engagement. Rising middle-class income levels and growing access to premium food and beverage outlets are also contributing to market expansion. These developments are fostering a vibrant wine culture in urban centers, supporting the sustained growth of the regional market.

Middle East and Africa Wine Market Analysis

The Middle East and Africa wine market is gradually expanding, supported by changing lifestyle trends and an emerging interest in gourmet food culture. Increasing urbanization and a growing expatriate population are influencing beverage preferences, creating niche opportunities for wine consumption in select settings. A recent regional policy announcement stated that Saudi Arabia will permit the sale and consumption of alcoholic beverages in about 600 designated locations starting in 2026, signaling a shift that could unlock new market potential. Social occasions and luxury hospitality experiences are becoming important channels for wine introduction and sampling. The rise of specialty retail outlets and online platforms is improving product accessibility and awareness. These evolving patterns are contributing to the region’s slow but steady wine market development.

Competitive Landscape:

The wine market is actively reshaping itself through a blend of innovation, collaboration, and adaptation. Producers are increasingly launching new product lines, often experimenting with styles that appeal to changing consumer preferences. Partnerships and distribution agreements are widely used to broaden reach and strengthen positioning, especially in competitive regions. Collaborations between vineyards, hospitality groups, and retailers are common, creating new experiences that link wine more closely with lifestyle and tourism. Alongside this, investment continues to flow into research and development, with many focusing on sustainability, climate resilience, and production efficiency. Government initiatives support modernization and exports, but the most frequent and visible activity at present is the formation of partnerships and collaborations to scale presence and diversify offerings.

The report provides a comprehensive analysis of the competitive landscape in the wine market with detailed profiles of all major companies, including:

- Accolade Wines

- Asahi Group Holdings Ltd.

- Bacardi Limited

- Bronco Wine Company

- Castel Frères

- Chapel Down Group PLC

- Constellation Brands Inc.

- E. & J. Gallo Winery

- Foley Family Wines

- Pernod Ricard

- The Wine Group

- Treasury Wine Estates Limited

Latest News and Developments:

- July 2025: Wine Paris announced the launch of Be No, a dedicated segment for alcohol-free drinks debuting in 2026. This expansion reflected growing demand for non-alcoholic alternatives. Be No complemented Be Spirits and Wine Paris, while the revamped V d’Or awards recognised innovation, sustainability, and education in the evolving wine and spirits sector.

- July 2025: Meghan Markle launched her first rosé under her As Ever brand, sourced from Kunde Family Winery but marketed as Napa Valley wine. The release, featuring notes of stone fruit and minerality, marked her entry into the celebrity wine space amid increasing consumer interest in lifestyle-driven wine offerings.

- June 2025: WX Brands launched Here By Chance, a Paso Robles Cabernet Sauvignon celebrating spontaneity and emotional storytelling. Crafted by Kip Lorenzetti, the wine embodied bold flavours and vibrant terroir. The brand targeted modern consumers seeking meaningful connections through wine, combining quality with an experiential narrative rooted in serendipity and discovery.

Wine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still Wine, Sparkling Wine, Fortified Wine and Vermouth |

| Colors Covered | Red Wine, Rose Wine, White Wine |

| Distribution Channels Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accolade Wines, Asahi Group Holdings Ltd., Bacardi Limited, Bronco Wine Company, Castel Frères, Chapel Down Group PLC, Constellation Brands Inc., E. & J. Gallo Winery, Foley Family Wines, Pernod Ricard, The Wine Group, Treasury Wine Estates Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global wine market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wine market was valued at USD 508.14 Billion in 2024.

The wine market is projected to exhibit a CAGR of 4.83% during 2025-2033, reaching a value of USD 793.94 Billion by 2033.

Rising disposable incomes, urbanization, and premiumization trends are driving wine market growth. Increasing awareness of health benefits from moderate wine consumption, product innovation in flavors and packaging, expanding distribution channels, tourism influence, and growing demand from emerging markets also fuel the industry’s global expansion.

Europe dominated the wine market in 2024, accounting for a share of 51.1% through centuries of tradition, fertile land, and refined production techniques, establishing regions like France, Italy, and Spain as global leaders in quality, volume, and cultural influence.

Some of the major players in the wine market include Accolade Wines, Asahi Group Holdings Ltd., Bacardi Limited, Bronco Wine Company, Castel Frères, Chapel Down Group PLC, Constellation Brands Inc., E. & J. Gallo Winery, Foley Family Wines, Pernod Ricard, The Wine Group, Treasury Wine Estates Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)