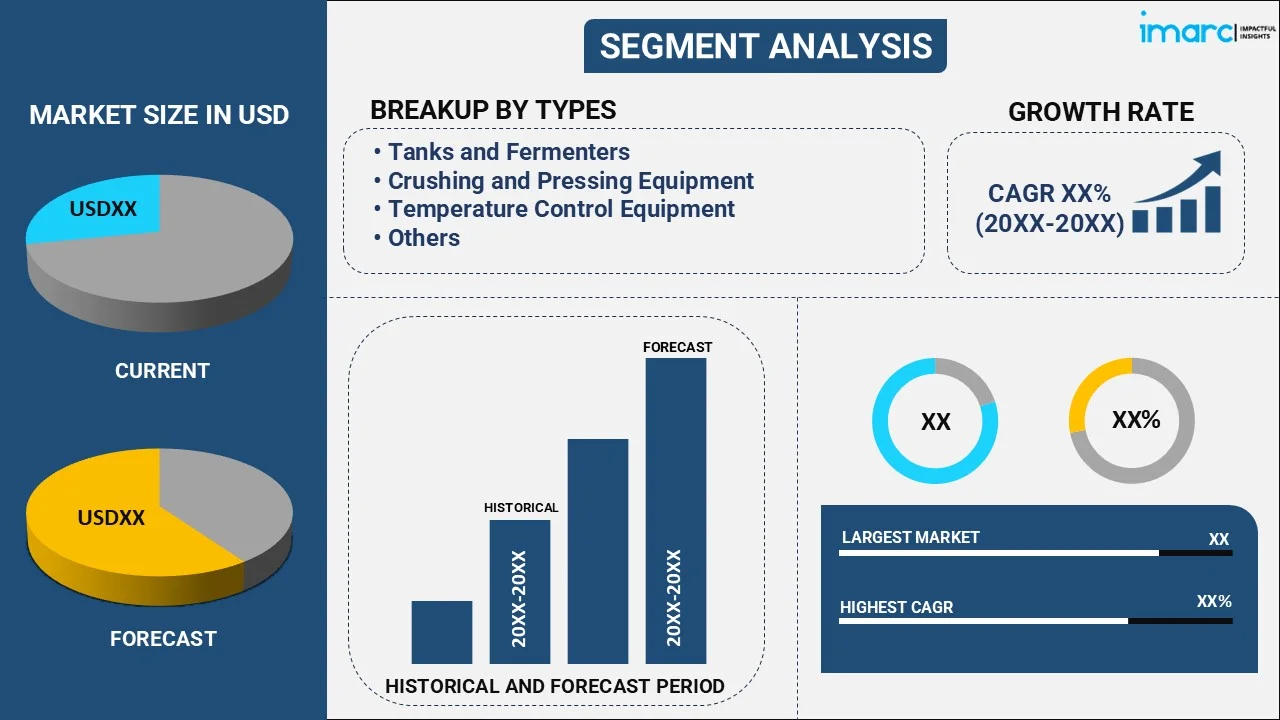

Wine Production Machinery Market by Type (Tanks and Fermenters, Crushing and Pressing Equipment, Temperature Control Equipment, Filtration Equipment, and Others), Application (Farm Winery, Urban Winery, Micro-Winery, and Others), and Region 2025-2033

Wine Production Machinery Market Size:

The global wine production machinery market size reached USD 2.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.4 Billion by 2033, exhibiting a growth rate (CAGR) of 3.73% during 2025-2033. The market is expanding rapidly, due to the increasing consumption of wine across the globe, recent technological advancements, rising investments in wineries, imposition of stringent quality standards, and the growing demand for organic and biodynamic wines.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.4 Billion |

|

Market Forecast in 2033

|

USD 3.4 Billion |

| Market Growth Rate 2025-2033 | 3.73% |

Wine Production Machinery Market Analysis:

- Major Market Drivers: According to the wine production machinery industry report, the growing product demand is fueling the need for modern machinery that enhances both production capacity and quality. Furthermore, the increasing technology improvements, such as automation and the Internet of Things (IoT) integration, combined with rising expenditures in winery expansions, are boosting the demand for cutting-edge production equipment.

- Key Market Trends: The heightened consumer demand for organic and biodynamic wines that lead to increased investment in sustainable and eco-friendly machinery is stimulating the market growth. Furthermore, the growing use of modern temperature control systems and automation technologies, as well as a greater emphasis on small-scale and artisanal production, are accelerating the growth of this industry.

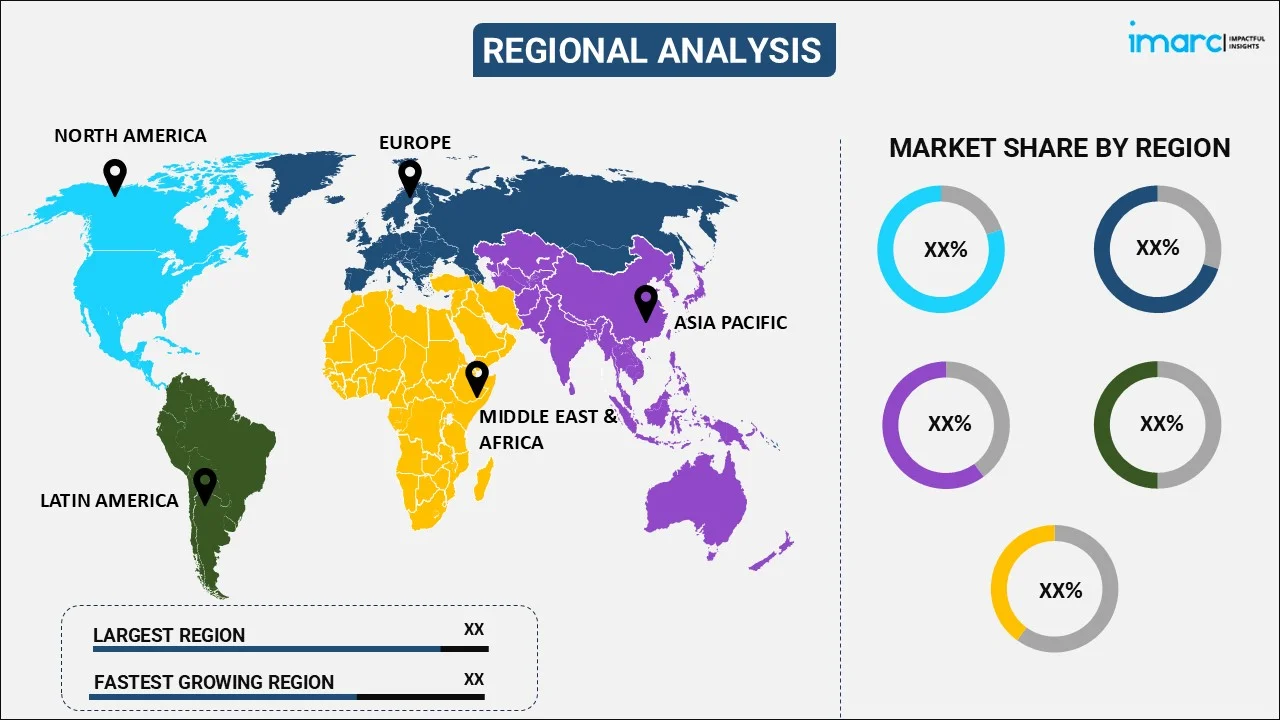

- Geographical Trends: Europe is dominating the market, reflecting its leadership in global wine production and investment in cutting-edge equipment. Other regions are also displaying significant potential, spurred by the rising wine demand and the establishment of new wineries.

- Competitive Landscape: Some of the major market players in the wine production machinery industry include Agrovin, Criveller Group, Della Toffola Pacific, Grapeworks Pty Ltd., GW Kent Inc, Love Brewing Limited, Northern Brewer LLC, Paul Mueller Company, Vitikit Limited, among many others.

- Challenges and Opportunities: The wine production machinery industry outlook shows that high initial investment costs and the necessity to comply with demanding quality and safety regulations are impeding the market expansion. However, the increased demand for premium and sustainable wines, which drives the need for specialized technology, is opening up new market prospects.

To get more information on this market, Request Sample

Wine Production Machinery Market Trends:

Increasing Consumption of Wine Across the Globe

The increasing consumption of wine across the globe is one of the major factors driving the wine production machinery market growth. For instance, in 2024, the per capita consumption of wine is expected to be 4.5 liters, and the total consumption is estimated to be 17,800 million liters in the U.S. Additionally, the evolving consumer tastes towards premium and diverse options as wine becomes an integral part of culinary culture and social gatherings is fueling the market growth. According to industry reports, 57% of US millennial regular wine drinkers (RWDs) drink wine on two or more days a week, and 73% say they enjoy trying new or different styles of wine on a regular basis. This shift is driving wineries to expand their production capabilities to meet the growing demand.

Rapid Technological Advancements in Machinery

The wine production machinery market revenue is majorly influenced by rapid technological innovations that improve efficiency, reduce labor costs, and enhance the quality of wine. In line with this, the introduction of advanced machinery equipped with automation, precision control, and data analytics to streamline operations is favoring the market growth. For instance, Della Toffola Pacific launched its new line of automated wine production systems, which are designed to reduce labor costs and improve consistency. The new systems include a wide range of services like grape crushing, fermentation, bottling, and labeling. Furthermore, the integration of the Internet of Things (IoT), augmented reality (AR), and artificial intelligence (AI) in machinery is stimulating the market growth.

Rising Investments in Wineries and Vineyards

Significant investments in the development and expansion of wineries and vineyards are driving the wine production machinery demand. The increasing consumption of wine is prompting both new and established players in the industry to upgrade their production facilities. In the European Union (EU), 16.1 billion liters of wine were produced and sold in 2022. This has created the need for the acquisition of state-of-the-art machinery to enhance production capacity and efficiency. Moreover, the growing investment in boutique wineries and vineyard expansions, fueled by increased tourism and the appeal of wine-tasting experiences is boosting the market growth. These investments include the purchase of advanced machinery that can produce high-quality wines on a smaller scale while maintaining artisanal values.

Wine Production Machinery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type and application.

Breakup by Type:

- Tanks and Fermenters

- Crushing and Pressing Equipment

- Temperature Control Equipment

- Filtration Equipment

- Others

Temperature control equipment accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes tanks and fermenters, crushing and pressing equipment, temperature control equipment, filtration equipment, and others. According to the report, temperature control equipment represented the largest segment.

The wine production machinery market analysis and trends indicate that temperature control equipment accounted for the largest share, driven by its critical role in ensuring the quality and consistency of wine. Moreover, it is essential throughout the wine production process as it directly influences the flavor, aroma, and overall quality of the final product. Additionally, the introduction of advanced temperature control systems that allow wineries to precisely manage the conditions under which wine is produced, preventing spoilage and ensuring optimal fermentation is boosting the wine production machinery market size.

Breakup by Application:

- Farm Winery

- Urban Winery

- Micro-Winery

- Others

Farm winery holds the largest share of the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes farm winery, urban winery, micro-winery, and others. According to the report, farm winery accounted for the largest market share.

Based on the wine production machinery market forecast and insights, farm wineries accounted for the largest market, reflecting the growing trend of small-scale and boutique wine production. Farm wineries are family-owned or artisanal operations that focus on producing high-quality and locally sourced wines with a strong emphasis on craftsmanship and sustainability. Moreover, the increasing consumer preference for unique and terroir-specific wines that offer a distinct alternative to mass-produced varieties is enhancing the market growth. Along with this, the heightened investment by farm wineries in specialized machinery that allows them to manage every aspect of production on-site, including grape crushing and bottling, is positively influencing the wine production machinery market dynamics.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe leads the market, accounting for the largest wine production machinery market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe represents the largest regional market for wine production machinery.

According to the wine production machinery market outlook and research report, Europe holds the largest market share, driven by its rich winemaking heritage and its status as a leading wine producer. Moreover, the centuries-old vineyards and well-established wineries in the region that continuously seek to enhance their operations with modern machinery are fostering the market growth. Besides this, the heightened demand for premium wines in domestic and international markets, prompting European wineries to invest in advanced production equipment that can meet stringent quality standards and improve efficiency, is positively impacting the wine production machinery market share.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the wine production machinery industry include Agrovin, Criveller Group, Della Toffola Pacific, Grapeworks Pty Ltd., GW Kent Inc, Love Brewing Limited, Northern Brewer LLC, Paul Mueller Company, Vitikit Limited, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The leading wine production machinery companies are focusing on technological innovation, sustainability, and strategic collaborations to maintain their competitive edge. They are investing in research and development (R&D) to introduce advanced machinery that offers greater efficiency, precision, and automation. This includes the integration of the Internet of Things (IoT) and artificial intelligence (AI) technologies for real-time monitoring and control, which helps wineries optimize production processes and improve wine quality. Additionally, major players are developing eco-friendly machinery that aligns with the growing demand for sustainable wine production practices.

Wine Production Machinery Market News:

- In October 2023, Criveller Group announced the launch of the revolutionary C51 High Solids Cross Flow Filtration System. This cutting-edge system represents a significant advancement in winemaking technology, offering enhanced performance and efficiency for the wine industry. It is engineered to meet the evolving needs of winemakers by providing key innovations like stainless steel membrane technology, high solids handling capability, exceptional flow rates, user-friendly interface, and eco-friendly design, among many others.

- In April 2024, Agrovin launched Ultrawine Perseo, a unique solution for wineries that need to harvest grapes early to obtain lower alcohol content without compromising the polyphenol and polysaccharide content. Its technology allows extracting the maximum potential of the grape by using high power and low-frequency ultrasound while helping to mitigate the effects of climate change on the grape ripening lag, controlling the alcohol content, and enhancing the quality of the grape. It is an eco-sustainable system that helps in reducing the use of energy and resources in the winemaking process without sacrificing quality. Compared to the traditional maceration method, Ultrawine Perseo reduces maceration time by up to 50% and energy savings by 15%.

- In April 2023, G.W. Kent Inc. became part of the newly formed Lotus Beverage Alliance through the simultaneous merger of six companies by Ronin Equity Partners in New York City. The new group has 75 years of combined experience, and is a partnership of Alpha Brewing Operations, G.W. Kent, Twin Monkeys, Stout Tanks and Kettles, Brewmation, and Automated Extractions. Lotus’ more than 1,500 products and services cover canning systems, automation and control systems, turn-key brewhouse construction, packaging, thermal processes, tanks, and sanitation equipment.

Wine Production Machinery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tanks and Fermenters, Crushing and Pressing Equipment, Temperature Control Equipment, Filtration Equipment, Others |

| Applications Covered | Farm Winery, Urban Winery, Micro-Winery, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agrovin, Criveller Group, Della Toffola Pacific, Grapeworks Pty Ltd., GW Kent Inc, Love Brewing Limited, Northern Brewer LLC, Paul Mueller Company, Vitikit Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wine production machinery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global wine production machinery market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wine production machinery industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global wine production machinery market was valued at USD 2.4 Billion in 2024.

We expect the global wine production machinery market to exhibit a CAGR of 3.73% during 2025-2033.

The rising integration of robotics and automation in winemaking to monitor crop health, minimize grape picking time, and accelerate the process of sorting, fermentation, bottling, and packaging that maximizes productivity, reduces human errors, and delivers consistent quality, is primarily driving the global wine production machinery market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary halt in numerous production activities for wine, thereby negatively impacting the global market for wine production machinery.

Based on the type, the global wine production machinery market has been segregated into tanks and fermenters, crushing and pressing equipment, temperature control equipment, filtration equipment, and others. Among these, temperature control equipment currently holds the largest market share.

Based on the application, the global wine production machinery market can be bifurcated into farm winery, urban winery, micro-winery, and others. Currently, farm winery exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa, where Europe currently dominates the global market.

Some of the major players in the global wine production machinery market include Agrovin, Criveller Group, Della Toffola Pacific, Grapeworks Pty Ltd., GW Kent Inc, Love Brewing Limited, Northern Brewer LLC, Paul Mueller Company, Vitikit Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)