Wood Pellet Market Size, Share, Trends, and Forecast by Feedstock Type, Application, and Region, 2026-2034

Wood Pellet Market Size and Share:

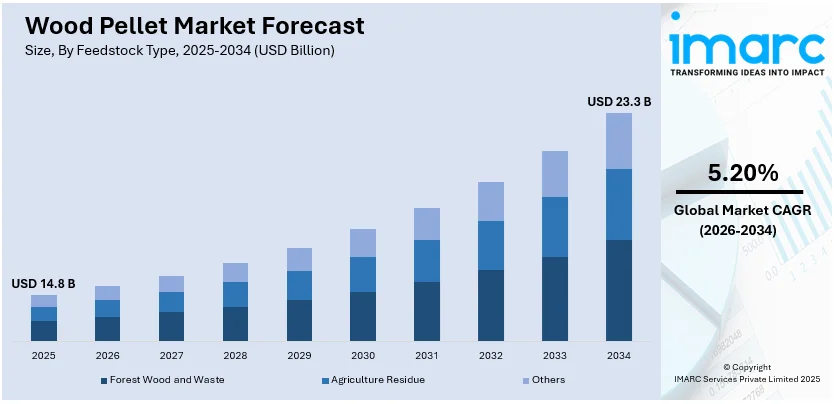

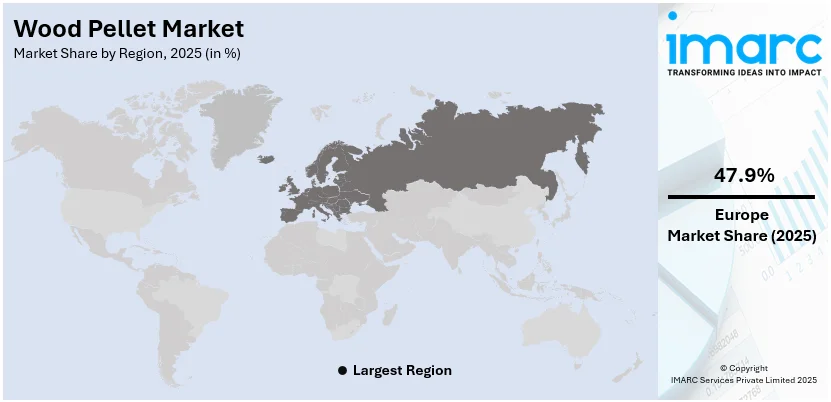

The global wood pellet market size was valued at USD 14.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 23.3 Billion by 2034, exhibiting a CAGR of 5.20% during 2026-2034. Europe currently dominates the market, holding a significant market share of over 47.9% in 2025. The need for renewable energy sources, numerous government initiatives that elevate awareness of reducing carbon emissions, increasing biomass power generation, and the rise of wood pellets in existing residential and industrial applications are expected to increase the market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 14.8 Billion |

| Market Forecast in 2034 | USD 23.3 Billion |

| Market Growth Rate (2026-2034) | 5.20% |

The wood pellet market is growing due to the rising demand for renewable energy sources mainly driven by environmental concerns and policies promoting carbon neutrality. For instance, in October 2024, PT Bukit Asam Tbk launched a Wood Pellet Pilot Plant in Tanjung Enim, South Sumatra. The plant, producing 200 kg of biomass from Red Kaliandra per hour aims to support coal co-firing in power plants and contribute to emission reduction efforts aligning with government sustainability goals. Increasing product usage in power generation and residential heating, coupled with advancements in pellet production technology supports market expansion. The cost-effectiveness and high energy efficiency of wood pellets as compared to fossil fuels enhance their appeal. Additionally, government incentives, such as subsidies and tax benefits, for adopting bioenergy solutions further boost market adoption across various regions.

To get more information on this market Request Sample

The United States wood pellet market is driven by the growing demand for renewable energy and stricter carbon emission regulations. The widespread adoption of wood pellets for co-firing in power plants and residential heating systems supports market growth. Export demand particularly from Europe for renewable energy compliance is also acting as a significant growth driver. Technological advancements in pellet production and government incentives for bioenergy projects further boost the market growth. Key trends include the rise of sustainable forestry practices, expansion of production facilities and innovations aimed at improving pellet efficiency and reducing production costs. According to industry reports, United States wood pellet exports surged to 9.5 million metric tons in 2023, valued at $1.75 billion, contributing to sustainable energy.

Wood Pellet Market Trends

Increasing demand for renewable energy

The need for energy generation from renewable sources has been continuing to grow due to the growing world economy. This is an important factor fueling the growth of the global wood pellet market. Climate change is wreaking havoc, and reducing greenhouse gas emissions is essential. According to NOAA, atmospheric CO2 is now 50% higher than pre-industrial levels. 2022 was the 11th consecutive year CO2 increased by more than 2 ppm, the highest sustained rate of CO2 increases in the 65 years since monitoring began. Phasing out fossil fuels by governments is gaining popularity on the market. Wood pellets can be an attractive option because they are renewable. The product is most commonly made from compressed biomass, such as sawdust and wood shavings. Since the renewable energy industry, including bioenergy produced from wood, is spreading rapidly as countries scramble to diversify their energy sources and become carbon neutral, the wood pellet market opportunities may be promising. According to a report published by the World Bioenergy Association in 2021, the world produced 1.9 billion m3 of wood fuel and wood pellets are one of the bioenergy sectors, which is growing at the quickest rate in the world.

Government initiatives and policies

Government policies are also helping to increase the wood pellet market base. The regulatory bodies of many countries are promoting the use of wood pellets under their renewable energy goals. For instance, the implementation of the European Union Renewable Energy Directive has triggered exponential growth in trading of pelletized wood fibers. The support in the form of subsidies, rewards, and policies suitable for both the producer and consumer of wood offers assistance in the growth of the market. Furthermore, regulatory bodies set renewable energy targets due to pollution and take steps to reduce their dependence on non-renewable energy, helping boost the market. Policies on waste management and deforestation, designed to enable the use of timber leftovers and enhance wood pellet production, are also increasing the market. Therefore, the pressure from regulatory bodies and the support in the form of policies significantly affect the price of wood biomass pellets, making it more affordable and accessible to many countries.

Government incentives and sustainable policies are significantly influencing the wood pellet market price, encouraging its growth and accessibility worldwide. For instance, the implementation of the Home Efficiency Rebate program, also known as the Clean Air program, in the US encourages the installation of biomass-fed heating systems, including those that run on wood pellets. By incentivizing households to swap out their old heating systems for biomass-fed systems, the program seeks to increase the market for wood pellets and improve the domestic wood pellet sector.

Escalating environmental concerns

Increasing environmental awareness among people regarding climate changes and air quality, coupled with the need to replace finite fossil fuel sources with clean fuel sources, creates a highly favorable market for wood pellets. The urgent need for nations to commit to reducing greenhouse gas emissions by 42% by 2030 and 57% by 2035, as outlined in the UN Environment Programme’s (UNEP) Emissions Gap Report 2024 is a significant driver in the market. This commitment is essential to maintaining the Paris Agreement's 1.5°C target and avoiding catastrophic temperature rises of 2.6–3.1°C, which could severely impact ecosystems, economies, and human livelihoods. Wood pellets are carbon-neutral because the CO2 emitted during combustion is compensated by CO2 absorbed during the biomass’s growth. This carbon-neutral property significantly boosts the market, as wood pellets are an attractive option for climate-conscious customers and industries. The steady growth of the market is driven by the application of wood pellets as a fuel, which minimizes traditional combustion, reduces the dependence on finite fossil fuel sources, and lessens air pollution, thereby enhancing air quality and promoting environmental sustainability. Wood pellet market statistics reflect significant growth, driven by escalating environmental concerns and a shift towards sustainable energy solutions.

Ongoing technological advancements

Technological advancements are increasing the efficiency and viability of the wood pellet market. Innovations in pellet manufacturing processes, such as improved pelletizing machinery and automation, have led to increased production capacity and cost-effectiveness. In confluence with this, continuous advancements in technologies facilitating the development of high-quality pellets with consistent energy content, making them more attractive for various applications, including residential heating, industrial processes, and power generation are aiding in market expansion. In addition, Canada’s Clean Fuels Fund is meant to support the energy transition through a $1.1 billion investment for the development of innovative technologies. Such favorable support has been a significant driver in the market.

Extensive research and development (R&D) in pellet combustion technologies have resulted in cleaner and more efficient burning, addressing concerns related to emissions and promoting the wider adoption of wood pellets as a mainstream energy source, thereby propelling the market forward. Technological advancements are positively impacting the future of the wood pellet market by enhancing production efficiency. As per a publication made by the U.S. Department of Agriculture’s Forest Service in 2023, the Wood Innovations and Community Wood Energy programs is providing funds to assist creative wood product and renewable wood energy initiatives that will improve local economies and sustainable forest management.

Wood Pellet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global wood pellet market, along with forecasts at the global, regional, and country levels from 2026-2034. The report has categorized the market based on feedstock type, application and region.

Analysis by Feedstock Type:

- Forest Wood and Waste

- Agriculture Residue

- Others

Forest wood and waste stand as the largest feedstock type in 2025, holding around 33.6% of the market. Forest wood and waste dominate the wood pellet market due to their widespread availability and cost-effectiveness as raw materials. Residues, such as sawdust, wood chips, and tree trimmings from forestry operations and wood processing industries, serve as sustainable inputs for pellet production. According to industry reports, in 2024, Vietnam exported 2.6 million tons of wood pellets worth $345.5 million reflecting a 25.9% volume and 4.6% value increase year-on-year. Major markets Japan and South Korea represented 92% of exports with pellets made from by-products of the wood processing industry. Utilizing these materials reduces waste while supporting a circular economy approach. Forest waste is abundant in regions with significant forestry activities, ensuring a steady supply for pellet manufacturing. Additionally, the lower carbon footprint of using forest residues compared to virgin timber aligns with global environmental goals, further solidifying their position as a primary resource in the wood pellet industry.

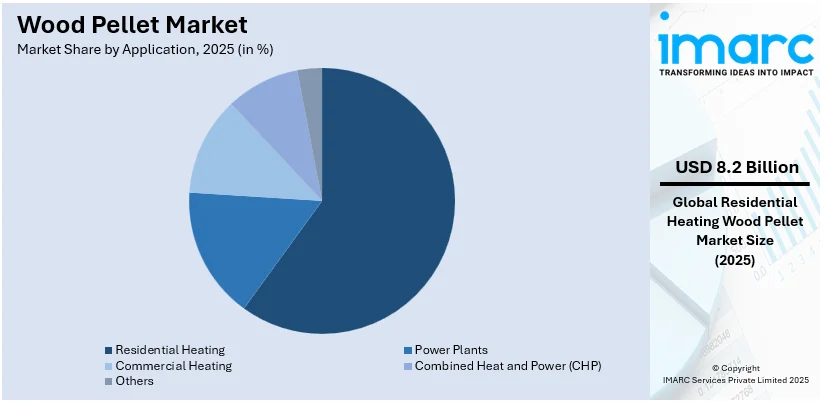

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Power Plants

- Residential Heating

- Commercial Heating

- Combined Heat and Power (CHP)

- Others

Residential Heating leads the market with around 58.4% of market share in 2025. Among the factors that contribute to the growing demand for residential heating using wood pellets is an increasing aspiration for cleaner and environmentally sustainable fuel sources. Wood pellets are used as a convenient and environmentally friendly replacement for traditional fossil fuels when heating houses. Furthermore, there is a rising emphasis on green practices and energy efficiency in areas where people live, which has aided the growth of the global wood pellet market in the residential sector. As per the USDA in 2021, the EU wood pellet consumption set a new record of 23.1 million metric tons (MMT) mainly caused by increased residential use in Germany and the co-firing of wood pellets with coal in the Netherlands. Additionally, advancements in pellet stove technology and improved distribution networks have made wood pellets more accessible and cost-effective for residential consumers. The cold climate in many European countries also drives demand as wood pellets provide an efficient heating solution. Government subsidies and tax incentives for adopting renewable energy solutions further encourage households to switch to wood pellet heating systems thereby boosting the market's growth.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Europe accounted for the largest market share of over 47.9%. Europe’s dedication to renewable energy and carbon neutrality has driven the wood pellet market toward growth in the continent. Consideration of the tough environmental regulations in the various states, incentives from the government, and integrated policies targeting renewable targets have steered the utilization of wood pellets for heating and power generation, hence triggering market expansion. Additionally, the continent's commitment to reducing greenhouse gas emissions and transitioning away from fossil fuels has improved the market demand for wood pellets, making Europe one of the significant determinants of the global wood pellet market. In 2022, the European Union (EU) utilized 24.8 million metric tons of wood pellets as per the data submitted to the Global Agricultural Information Network of the USDA Foreign Agricultural Service. This strong demand is further supported by Europe's advanced infrastructure for pellet production and distribution ensuring a steady supply chain. Moreover, increasing investment in sustainable forestry and biomass energy projects continues to solidify Europe's leadership in the global wood pellet market.

Key Regional Takeaways:

North America Wood Pellet Market Analysis

The North American wood pellet market is growing steadily mainly driven by abundant forest resources, strong production capabilities and rising renewable energy adoption. The region benefits from well-established infrastructure particularly in the United States and Canada which facilitates efficient production and distribution. North America's wood pellet exports are fueled by the increasing demand from Europe and Asia as these regions focus on reducing carbon emissions. Government incentives promoting renewable energy along with the co-firing of pellets with coal in power plants are key drivers. In Canada, the growing use of wood pellets in residential and commercial heating supports domestic consumption. The region's focus on sustainability and innovative biomass utilization further enhances its position in the global wood pellet market.

United States Wood Pellet Market Analysis

The United States accounts for 82.5% of the market share in North America. The United States wood pellet market is also driven by a combination of abundant raw materials, growing renewable energy adoption, and strong export demand. According to the US Industrial Pellet Association (USIPA), US wood pellet exports have increased rapidly over the past decade, reaching 9.5 million metric tons in 2023, valued at $1.75 billion. This growth underscores the expanding role of sustainable wood pellets in the global energy transition. As one of the leading producers and exporters of wood pellets, the U.S. benefits from its vast forest resources and well-established production infrastructure. Government incentives supporting renewable energy projects, along with increased utilization of biomass for industrial heating and power generation, are significant drivers. For instance, the Wood Products Infrastructure Assistance Program is a key initiative funded by the Bipartisan Infrastructure Law, designed to support facilities that process byproducts of ecosystem restoration projects. This funding can be applied toward establishing, reopening, retrofitting, expanding, or improving sawmills or other wood-processing facilities near federal or Indian lands requiring ecological restoration.

Asia Pacific Wood Pellet Market Analysis

The Asia-Pacific market is experiencing robust growth, primarily driven by the rising demand for renewable energy in countries like Japan, South Korea, and China. Moreover, the government of various nations in the region mandate to reduce dependency on fossil fuels, combined with efforts to achieve carbon neutrality, have increased investments in biomass power plants. Also, growing public awareness and concern for environmental issues are key drivers for the wood pellet market and other renewable energy initiatives. For instance, in 2023, the Ministry for the Environment (the Ministry) engaged The Research Agency (TRA) to conduct audience research on New Zealanders' attitudes and awareness regarding environmental issues. The findings revealed that environmental concerns remained the fourth most pressing issue for New Zealanders, following more immediate challenges such as the cost of living, crime, and housing. Notably, public awareness of environmental issues saw a significant increase, rising from 20 percent in 2022 to 25 percent in 2023. Besides this, according to UNECE, beyond the UNECE region Japan and the Republic of Korea are the largest importers of wood pellets (by value and weight) outside the ECE region with imports of 4.4 and 3.9 million tonnes, respectively. Thus, the growing imports of wood pellet is further driving the market growth.

Latin America Wood Pellet Market Analysis

The development of the wood pellet industry in Latin America is gaining momentum, driven by increasing collaboration and knowledge sharing among key stakeholders. A recent webinar brought together leading experts from the Chilean Biomass Association, Pellet Mx, Andritz, and Prodesa Group, providing valuable insights into the region's evolving pellet production landscape. Highlighting advancements in technology, infrastructure, and market potential, these discussions are fostering growth and innovation, positioning Latin America as an emerging player in the global wood pellet market. Moreover, the region's abundant biomass resources and growing focus on renewable energy are further accelerating industry development. Apart from this, wood pellet market in Latin America is witnessing robust growth, driven by an 83% increase in wood pellet exports through Brazil’s Rio Grande Container Terminal (RS) during the first eight months of 2024 compared to the same period in 2023, as reporter by Wilson Sons, a leader in port and maritime logistics in Brazil. This significant surge, amounting to 2,748 TEUs (38,529 tons), highlights the rising demand for renewable energy solutions.

Middle East and Africa Wood Pellet Market Analysis

The wood pellet market in the Middle East and Africa is still in its early stages but is gaining momentum due to increasing awareness of sustainable energy solutions. Although the region has limited production capacities, the demand for imported wood pellets is on the rise, particularly for industrial applications and power generation. In Africa, wood pellets are emerging as a sustainable response to the rapid depletion of forest resources, with an alarming loss of 3.9 million hectares annually over the past decade, according to ESI Africa. To address this challenge, wood and biomass pellets, produced from agricultural, crop, and timber residues, are playing a crucial role in generating bio-energy. This not only helps meet growing energy demands but also strengthens local economies while preserving the region’s remaining forests. Countries such as Cameroon, the Central African Republic, the Democratic Republic of the Congo, the Republic of the Congo, Equatorial Guinea, and Gabon collectively possess 216 million hectares of tropical rainforest reserves. With their high dependency on wood pellets for energy needs, these nations offer significant opportunities for wood pellet manufacturers to expand their operations and contribute to the region’s energy sustainability goals.

Competitive Landscape:

The Wood Pellet market is highly competitive dominated by major players who leverage large-scale production and extensive distribution networks to maintain market leadership. These companies invest heavily in sustainable sourcing and advanced manufacturing technologies to enhance efficiency and meet stringent environmental standards. Additionally, emerging competitors are focusing on niche markets and regional expansion to gain market share. Innovation in pellet quality and the development of value-added products also intensify competition. For instance, Drax Group plc, in July 2024, reported increased wood pellet production volumes and margins in the first half of 2024. The company also reported progress with bioenergy with carbon capture and storage (BECSS) projects in both the U.K. and abroad. Drax’s pellet division produced 2 million metric tons of wood pellets during the first half of this year, up from 1.9 million metric tons during the same period of 2023. Margins were also improved, with adjusted EBITDA of £65 million, up from £43 million during the first half of last year. The company said increased production supported both U.K. power generation and sales to third parties. Strategic partnerships, mergers, and acquisitions further shape the competitive landscape, while fluctuating raw material prices and regulatory policies pose ongoing challenges. Overall, the market is driven by a blend of established dominance and dynamic new entrants striving for growth.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Asia Biomass Public Company Limited

- Drax Group

- Enviva LLC

- Fram Fuels

- Groupe Savoie

- I.C.S. (Lacroix) Lumber Inc.

- Lauzon

- Lignetics Group

- Sinclar Group Forest Products

- Stora Enso

- Svenska Cellulosa Aktiebolaget SCA (publ)

- Vermont Wood Pellet Company

Latest News and Developments:

- October 2024: BKtech announced a significant expansion of its wood pellet production capacity, reinforcing its commitment to meeting the growing global demand for sustainable energy solutions. This expansion aligns with the increasing reliance on wood pellets for renewable energy in industrial applications and power generation.

- October 2024: East German energy company Leag signed a purchase agreement to acquire Swedish wood pellet producer Scandbio AB and its subsidiaries. This strategic acquisition marks Leag's entry into the Scandinavian market, expanding its footprint in sustainable biomass production. By integrating Scandbio’s capabilities, Leag aims to strengthen its position in the renewable energy sector and align its operations with the growing demand for sustainable energy solutions across Europe.

- May 2023: Andritz AG introduced a range of new and proven technologies, such as the world’s first autonomous logyard crane, the ANDRITZ PM30-6 pellet mill designed for biomass, and an adjustable plug screw feeder.

- January 2023: Andritz AG announced its collaboration with Stora Enso Oyj to deliver an integrated solution for the conversion of the Oulu pulp and paper mill in Finland, including a new debarking line with Smart Wood Processing, an EcoFluid biomass power boiler, and re-causticizing plant upgrades.

- November 2021: Lignetics Inc. announced it had been acquired by EagleTree Capital, acting on behalf of its private equity fund, EagleTree Partners V.

Wood Pellet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Feedstock Types Covered | Forest Wood and Waste, Agriculture Residue, Others |

| Applications Covered | Power Plants, Residential Heating, Commercial Heating, Combined Heat and Power (CHP), Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Asia Biomass Public Company Limited, Drax Group, Enviva LLC, Fram Fuels, Groupe Savoie, I.C.S. (Lacroix) Lumber Inc., Lauzon, Lignetics Group, Sinclar Group Forest Products, Stora Enso, Svenska Cellulosa Aktiebolaget SCA (publ), Vermont Wood Pellet Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the wood pellet market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global wood pellet market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the wood pellet industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Wood pellet is a type of compressed biofuel created from biomass materials, such as sawdust, wood shavings, and agricultural residues. These pellets serve as a renewable energy source widely used for residential heating, power generation, and industrial applications.

The wood pellet market was valued at USD 14.8 Billion in 2025.

IMARC estimates the global wood pellet market to exhibit a CAGR of 5.20% during 2026-2034.

The market is driven by rising demand for renewable energy, stricter carbon emission regulations, government incentives, and advancements in pellet production technology.

In 2025, forest wood and waste represented the largest segment by feedstock type, driven by its cost-effectiveness and abundant availability.

Residential heating leads the market by application owing to its convenience and environmental sustainability.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global Wood Pellet market include Asia Biomass Public Company Limited, Drax Group, Enviva LLC, Fram Fuels, Groupe Savoie, I.C.S. (Lacroix) Lumber Inc., Lauzon, Lignetics Group, Sinclar Group Forest Products, Stora Enso, Svenska Cellulosa Aktiebolaget SCA (publ), Vermont Wood Pellet Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)