Xenon Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Xenon Price Trend, Index and Forecast

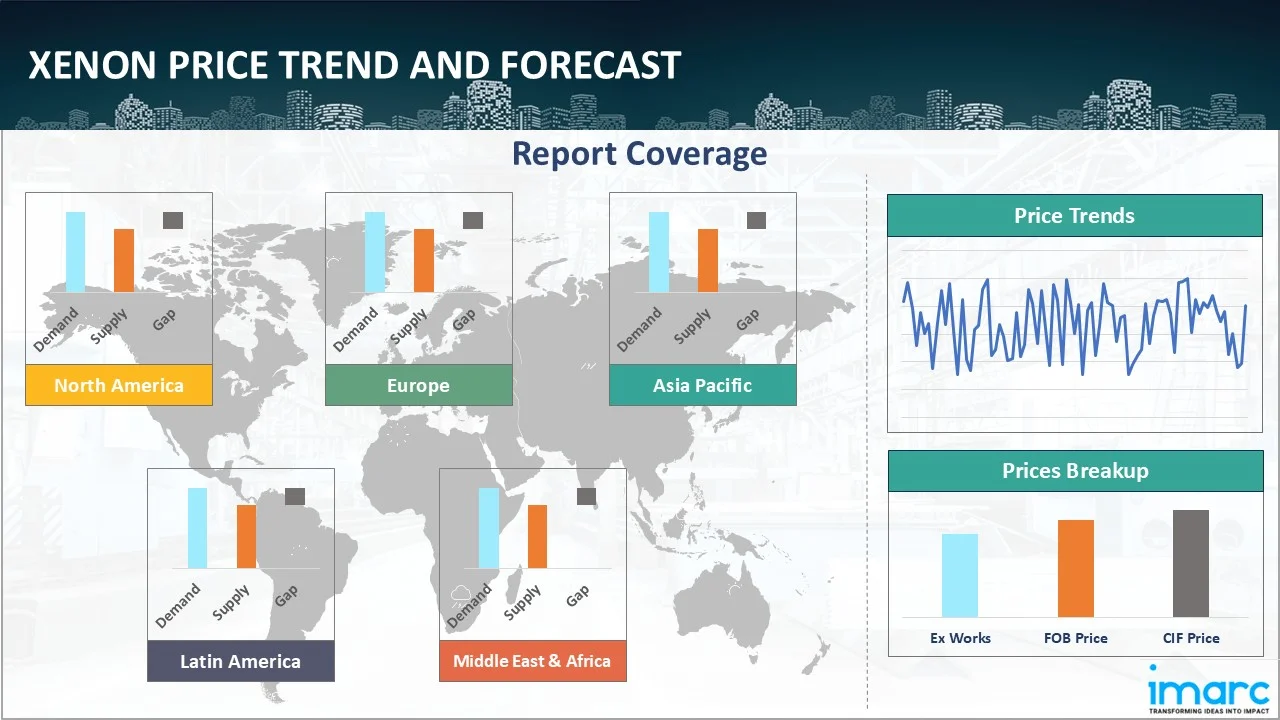

Track the latest insights on xenon price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Xenon Prices Outlook Q2 2025

- USA: US$ 2,966/MT

- China: US$ 838/MT

- South Korea: US$ 3,188/MT

- Russia: US$ 1,118/MT

- France: US$ 2,158/MT

Xenon Price Chart

Get real-time access to monthly/quaterly/yearly prices, Request Sample

During the second quarter of 2025, xenon prices in the USA reached 2,966 USD/MT in June. In the USA, xenon prices in Q2 2025 stayed on the higher side due to constrained supply from air separation units and sustained demand from the semiconductor and medical imaging industries. Import reliance also added to cost pressures, with logistics and procurement expenses influencing the final price. The market remained tight, with limited new supply entering the system.

During the second quarter of 2025, xenon prices in China reached 838 USD/MT in June. In China, xenon prices exhibited firm market sentiment during Q2 2025. The country faced limited domestic production due to controlled outputs from air separation facilities. Steady demand from chip manufacturing and healthcare sectors, combined with supply constraints, kept xenon prices elevated. Export opportunities were limited due to domestic consumption taking priority.

During the second quarter of 2025, xenon prices in South Korea reached 3,188 USD/MT in June. South Korea experienced a stable-to-firm xenon price trend in Q2 2025, driven by steady demand from semiconductor fabrication plants. Domestic xenon supply was limited, and the country relied heavily on imports, making it vulnerable to disruptions in the global supply chain.

During the second quarter of 2025, xenon prices in Russia reached 1,118 USD/MT in June. In Russia, xenon prices remained relatively stable but high in the second quarter of 2025. Local production met some industrial needs, but export challenges and restricted availability from air separation units tightened supply. Demand from aerospace and specialized sectors kept prices from softening, despite fluctuations in raw material extraction.

During the second quarter of 2025, xenon prices in France reached 2,158 USD/MT in June. In France, xenon prices stayed firm throughout Q2 2025 due to limited production and strong demand from medical, lighting, and semiconductor sectors. The European market's dependence on a few key suppliers kept availability tight, while supply chain inefficiencies further influenced price stability with an upward bias.

Xenon Prices Outlook Q1 2025

- USA: US$ 2930/Kg

- France: US$ 2125/Kg

- China: US$ 820/Kg

- South Korea: US$ 3050/Kg

- Russia: US$ 1100/Kg

During the first quarter of 2025, xenon prices in the USA reached 2930 USD/Kg in March. Xenon prices rose moderately during the first quarter of 2025, supported by strong demand from aerospace (satellite ion propulsion), semiconductor fabrication, and medical imaging applications. Rising energy, production, and logistics costs exerted upward pressure, but domestic air separation capacity and contract-based sourcing helped temper volatility. The U.S. market remains resilient, with a firm pricing backdrop reflecting balanced supply conditions and increasing industrial utilization.

During the first quarter of 2025, the xenon prices in France reached 2125 USD/Kg in March. Xenon prices remained stable to slightly firm in early 2025, supported by a balanced supply from well-established air separation units and consistent demand from semiconductor, aerospace, and medical imaging sectors. Low volatility persisted as decarbonization initiatives bolstered local production, while energy-cost pressures added marginal upward influence. Overall, the French market reflected a steady outlook, with cautious procurement and healthy inventory levels keeping pricing sentiment neutral to positive.

During the first quarter of 2025, the xenon prices in China reached 820 USD/Kg in March. Xenon prices rose modestly in Q1 2025, driven by higher energy costs, trade tariff impacts, and increased satellite launch schedules. Domestic supply remained strong due to expanded air separation capacity, but upstream cost pressures and logistics delays added marginal price firming. Demand from semiconductor fabs and space propulsion projects supported steady consumption, with cautious restocking reflecting balanced inventory levels.

During the first quarter of 2025, the xenon prices in South Korea reached 3050 USD/Kg in March. South Korea saw stable to slightly firm xenon prices. Growing demand for semiconductor lithography and aerospace propulsion was offset by regional oversupply from new purification facilities. Energy and export costs exerted mild upward pressure, while long‑term contracts and high inventories kept spot price volatility low. Overall, pricing sentiment remained balanced amid strong sector fundamentals.

During the first quarter of 2025, the xenon prices in Russia reached 1100 USD/Kg in March. Xenon prices remained largely stable in early 2025. Strong domestic production and well-established air separation networks ensured reliable supply. Rising export demand—especially from Europe and Asia—combined with energy cost fluctuations placed slight upward pressure. However, contract-based pricing and government support for rare-gas industries helped keep volatility in check, maintaining a steady pricing environment for domestic and international buyers.

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing the xenon prices.

Global Xenon Price Trend

The report offers a holistic view of the global xenon pricing trends in the form of xenon price charts, reflecting the worldwide interplay of supply-demand balances, international trade policies, and overarching economic factors that shape the market on a macro level. This comprehensive analysis not only highlights current price levels but also provides insights into historical price of xenon, enabling stakeholders to understand past fluctuations and their underlying causes. The report also delves into price forecast models, projecting future price movements based on a variety of indicators such as expected changes in supply chain dynamics, anticipated policy shifts, and emerging market trends. By examining these factors, the report equips industry participants with the necessary tools to make informed strategic decisions, manage risks, and capitalize on market opportunities. Furthermore, it includes a detailed xenon demand analysis, breaking down regional variations and identifying key drivers specific to each geographic market, thus offering a nuanced understanding of the global pricing landscape.

Europe Xenon Price Trend

Q2 2025:

Xenon prices in Europe during Q2 2025 continued to face upward pressure, driven by restricted supply and steady demand across healthcare, lighting, and semiconductor sectors. The region’s dependence on air separation units for noble gas production, combined with reduced operating rates at some facilities, limited xenon output. Market participants also cited supply chain inefficiencies and geopolitical factors as contributing elements to price firmness. Overall, European xenon prices maintained a stable to elevated trend throughout the quarter.

Q1 2025:

As per the xenon price index, Europe witnessed a stable to slightly firm trend in early 2025, supported by steady demand from the aerospace, semiconductor, and medical imaging sectors. Supply remained sufficient due to established air separation infrastructure, though rising energy costs in Western Europe added mild upward pressure. Export demand and ongoing investments in rare gas purification sustained market momentum, while cautious restocking behavior kept short-term volatility low. Overall sentiment remained balanced with upward bias.

This analysis can be extended to include detailed xenon price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Xenon Price Trend

Q2 2025:

In North America, xenon prices in Q2 2025 followed a moderately firm trend. The semiconductor industry’s ongoing demand for xenon in chip manufacturing supported price stability. At the same time, constrained global supply conditions, including production limitations at air separation facilities, kept the market tight. Imports played a crucial role in meeting domestic needs; however, logistical costs and supply chain complexities added upward pressure on prices.

Q1 2025:

In North America, xenon prices saw a slight uptick, supported by steady demand from the aerospace, semiconductor, and medical sectors. Rising energy and logistics costs contributed to firming prices, though domestic production and long-term contracts helped limit volatility. The U.S. market remained stable, with consistent procurement from satellite and defense programs. Overall, pricing sentiment was firm but measured, reflecting balanced supply conditions and moderate industrial activity.

Specific xenon historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Xenon Price Trend

Q2 2025:

The report explores the xenon trends and xenon price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

Q1 2025:

The report explores the xenon trends and xenon price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Xenon Price Trend

Q2 2025:

In the Asia Pacific region, xenon prices in Q2 2025 remained firm, primarily due to limited supply and steady demand from the semiconductor manufacturing, medical imaging, and aerospace sectors. Additionally, fluctuations in production costs and procurement challenges from major exporters contributed to elevated price levels. Overall, the regional market maintained a tight supply-demand balance, keeping xenon prices stable with an upward bias.

Q1 2025:

In Asia-Pacific, xenon prices remained steady in early 2025 amid moderate demand and sufficient regional supply. Key markets like China, South Korea, and Taiwan saw minor fluctuations driven by semiconductor cycles and aerospace needs. Export-oriented suppliers faced pricing pressure due to competition from low-cost imports and stable contract volumes. Elevated production costs were offset by cautious restocking and high inventories. Limited demand from the industrial and lighting sectors was partially balanced by steady uptake in healthcare and niche applications across Southeast Asia.

This xenon price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Xenon Price Trend

Q2 2025:

Latin America's xenon market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in xenon prices. Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting the region's ability to meet international demand consistently. Moreover, xenon index, economic fluctuations, and currency devaluation are critical factors that need to be considered when analyzing xenon pricing trends in this region.

Q1 2025:

Latin America's xenon market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in xenon prices. Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting the region's ability to meet international demand consistently. Moreover, the xenon price index, economic fluctuations, and currency devaluation are critical factors that need to be considered when analyzing xenon pricing trends in this region.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Xenon Price Trend, Market Analysis, and News

IMARC's latest publication, “Xenon Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the xenon market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of xenon at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents a detailed xenon price trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting xenon pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Xenon Industry Analysis

The global xenon market size reached US$ 289.1 Million in 2024. By 2033, IMARC Group expects the market to reach US$ 461.14 Million, at a projected CAGR of 5.10% during 2025-2033.

- The global xenon gas market is experiencing steady growth driven by its expanding applications in high-tech sectors. With its unique chemical inertness and high atomic weight, xenon is used extensively in semiconductor manufacturing, space propulsion systems, and advanced medical imaging. A key driver of xenon demand is its use in excimer lasers for photolithography, an essential technology in the manufacturing of semiconductor chips. As chipmakers in Asia—particularly South Korea, Taiwan, and China—ramp up manufacturing capacity, regional demand for xenon has increased sharply. The rising number of satellite launches and development of electric propulsion systems for spacecraft also continue to elevate xenon’s strategic importance in the aerospace sector.

- The medical segment is another growth area, particularly in anesthesia and imaging. Xenon’s neuroprotective properties and low toxicity profile have made it an attractive option for high-end medical procedures. Its application in nuclear medicine remains steady, although high production costs continue to constrain significant growth. Lighting applications, once a core demand area for xenon, are declining due to the widespread adoption of LED and laser-based systems. However, niche lighting applications like cinema projection, flash lamps, and lighthouse beacons still contribute to steady consumption.

- Beyond its traditional industrial domains, xenon is gradually finding new, performance-oriented applications in areas once considered unrelated to industrial gases. Recent innovations point to its potential in human performance optimization, particularly in environments involving extreme conditions such as high altitudes or low oxygen levels. Researchers and commercial pioneers are exploring xenon’s role in pre-acclimatization protocols, endurance enhancement, and even recovery optimization, hinting at future demand from fields like sports science, extreme adventure tourism, and specialized training programs. While these use cases are still nascent, they reflect a clear shift toward diversifying xenon’s relevance beyond conventional scientific and industrial applications, reinforcing its reputation as a versatile, high-value gas.

Xenon News

The report covers the latest developments, updates, and trends impacting the global xenon industry, providing stakeholders with timely and relevant information. This segment covers a wide array of news items, including the inauguration of new production facilities, advancements in xenon production technologies, strategic market expansions by key industry players, and significant mergers and acquisitions that impact the xenon price trend.

Latest developments in the xenon industry:

- May 2025: EFC Gases & Advanced Materials, a Massachusetts-based specialist in high-purity rare gas technology company, secured a five-year contract with NASA to support xenon gas reprocessing needs. Valued at up to USD 5 million, the agreement includes the shipment, handling, and processing of approximately 500,000 liters of recovered xenon gas mixtures for use in space and propulsion research.

- September 2024: POSCO Holdings and Zhongtai Cryogenic Technology launched POSCO Zhongtai Air Solution, a joint venture focused on high-purity rare gas production. The plant will supply rare gases, including neon, xenon, and krypton, to leading semiconductor companies such as Samsung Electronics, SK Hynix, and Intel.

- April 2024: Air Liquide broke ground on a new production plant for high-purity krypton and xenon in South Korea. The facility will reinforce Air Liquide’s capabilities in supplying advanced materials to the semiconductor or space industries and contribute to strengthening Korea’s high-tech industrial ecosystem.

Product Description

Xenon is a rare, odorless, and colorless noble gas found in trace amounts in Earth's atmosphere. Chemically inert, xenon is used in specialized lighting, medical imaging, and aerospace applications due to its unique physical and chemical properties. It emits brilliant white-blue light when electrified, making it ideal for high-intensity discharge (HID) lamps, such as those in car headlights, projectors, and UV sterilizers.

In the medical sector, xenon serves as a safe, non-toxic anesthetic with neuroprotective effects, often used in advanced diagnostic imaging like xenon-enhanced CT scans. Its high atomic number also makes it valuable in radiation detection and ion propulsion systems for spacecraft. Though costly due to its scarcity, xenon's exceptional stability and performance in extreme environments make it indispensable across high-tech industries, from scientific research to cutting-edge medical and aerospace technologies.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Xenon |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Ammonia Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, Peru* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of xenon pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting xenon price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The xenon price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)