Yogurt Market Size, Share, Trends and Forecast by Product Type, Flavor, Distribution Channel, and Region, 2025-2033

Yogurt Market Size and Share:

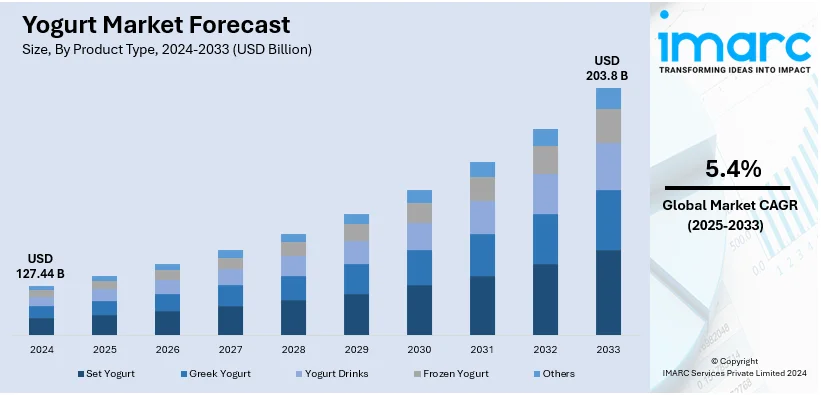

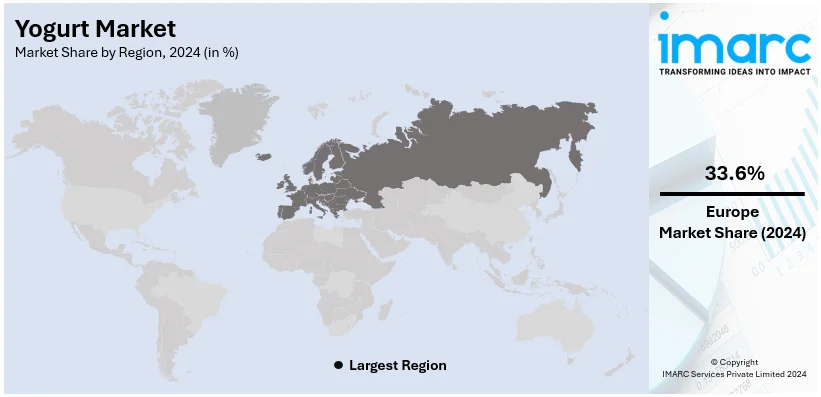

The global yogurt market size was valued at USD 134.55 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 203.8 Billion by 2033, exhibiting a CAGR of 5.4% during 2025-2033. Europe currently dominates the market, holding a market share of over 33.6% in 2024. The increasing awareness regarding the importance of gut health, sudden inclination towards high protein diets, and the growing consumption of ready to eat (RTE) food products are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2025 | USD 134.55 Billion |

| Market Forecast in 2033 | USD 203.8 Billion |

| Market Growth Rate (2025-2033) | 5.4% |

The global yogurt market share is expanding significantly due to the increasing health consciousness among consumers that is influencing dietary preferences and boosting the demand for nutrient-rich and functional foods like yogurt. As per a survey, 93% of Americans said that they feel compelled to eat healthy, at least some of the time. While 63% of them accepted that they are trying to eat healthy most of the time. Yogurt is widely regarded as a healthy option because of its high protein content, probiotic benefits, and rich assortment of essential vitamins and minerals. As individuals focus on improving gut health, immunity, and overall wellness, yogurt consumption is on the rise. Probiotics in yogurt are associated with enhanced digestion and a stronger immune response, aligning with the needs of health-conscious consumers. Additionally, yogurt appeals to those seeking low-fat or fat-free options, with many variants designed to support weight management goals.

To get more information on this market, Request Sample

United States is a major market disruptor with a share of 81.60% in North America. This is driven by the demand for functional foods like yogurt. According to the International Food Information Council's (IFIC) 2023 survey, 75% of Americans prioritize health benefits when choosing food, with a particular focus on digestive health and immunity. Probiotic-rich foods, including yogurt, are particularly popular, as probiotics are consumed by over 50% of adults aiming to improve gut health. Additionally, the push for healthier lifestyles is further supported by government initiatives like the Dietary Guidelines for Americans, emphasizing the role of dairy and alternatives in balanced diets.

Yogurt Market Trends:

Increase in health consciousness

The growing health consciousness among the masses represents one of the key factors impelling the yogurt market growth. Individuals are becoming aware of the advantages of a balanced diet, where yogurt acts as a healthy alternative to snacks. Yogurt has essential nutrients, proteins, calcium, and probiotics, which help to support gut health. Many individuals are adopting a healthier lifestyle, which is leading to the adoption of yogurt, particularly with low sugar and fat content. Additionally, on the basis of the 2022 Food and Health Survey conducted by the International Food Information Council, popular dietary trends include clean eating (16%), mindful eating (14%), calorie counting (13%), and plant-based diets (12%). These eating patterns reflect a growing awareness and emphasis on health, sustainability, and mindful consumption among individuals. This showcases that the yogurt market business opportunity lies in innovation to cater to the health-conscious consumer segment.

Rise in environmental concerns

The increasing concern about environment and sustainability among individuals is driving the demand for food products with smaller carbon footprint, thereby expanding the yogurt market share. As per the 2022 Food and Health Survey, conducted by the International Food Information Council, 39% of Americans prioritize environmental sustainability in food purchases. Over half (52%) believe their food choices affect the environment, especially Millennials, parents, graduates, and higher earners. Additionally, 59% feel their generation is more environmentally conscious. Moreover, yogurt production is seen as less resource intensive compared to meat and other protein sources. This perspective is catalyzing the demand for yogurt among eco-conscious consumers. Furthermore, there is a rise in the consumption of organic and locally sourced yogurt, which not only offers better flavor and quality, but also appeals to those who are environmentally conscious.

Growing number of e-commerce platforms

The rising emergence of various e-commerce platforms is making it easier for buyers to purchase yogurt. Individuals can buy their preferred varieties and tastes or discover new options with only a few clicks. Moreover, the advent of subscription-based models and home delivery services are making it easier to access yogurt products from the comfort of their homes. Additionally, the strategic placement of yogurt products in eye-catching displays and refrigerated sections of physical stores to encourage impulse buying, is contributing to the market growth. In addition, the yogurt market price analysis reveals a competitive landscape in e-commerce, highlighting opportunities for strategic pricing and online retail expansion. As per the IMARC Group, the global e-commerce market size reached USD 21.1 Trillion in 2023 and is estimated to reach USD 183.8 Trillion by 2032, exhibiting a growth rate (CAGR) of 27.16% during 2024-2032.

Yogurt Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global yogurt market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, flavor, and distribution channel.

Analysis by Product Type:

- Set Yogurt

- Greek Yogurt

- Yogurt Drinks

- Frozen Yogurt

- Others

Yogurt drinks stand as the largest component in 2024, holding around 35.7% of the market. Yogurt drinks are liquid yogurts that are typically sold in bottles or cartons. They are often flavored and can contain added sugar or artificial sweeteners. Yogurt drinks are also convenient for on-the-go consumption and can be a quick way to obtain the nutritional benefits of yogurt. The IMARC group states that the global drinkable yogurt market size reached USD 38.3 Billion in 2023. It also estimates that the market will reach USD 60.8 Billion by 2032, exhibiting a growth rate (CAGR) of 5.26% during 2024-2032.

Analysis by Flavor:

- Strawberry Blend

- Vanilla

- Plain

- Strawberry

- Peach

- Others

Plain leads the market with around 68.5% of market share in 2024. This dominance is because of plain yogurt’s versatility and health-centric appeal. Consumers increasingly favor plain yogurt as a base for various culinary applications, like smoothies, desserts, and savory dishes, owing to its neutral flavor profile. This segment also attracts health-conscious buyers seeking products with minimal additives, as plain yogurt typically contains lower sugar levels compared to flavored alternatives. The rise of home cooking and personalized flavoring trends has further boosted the demand for plain yogurt, enabling consumers to customize it with fresh fruits, granola, or spices.

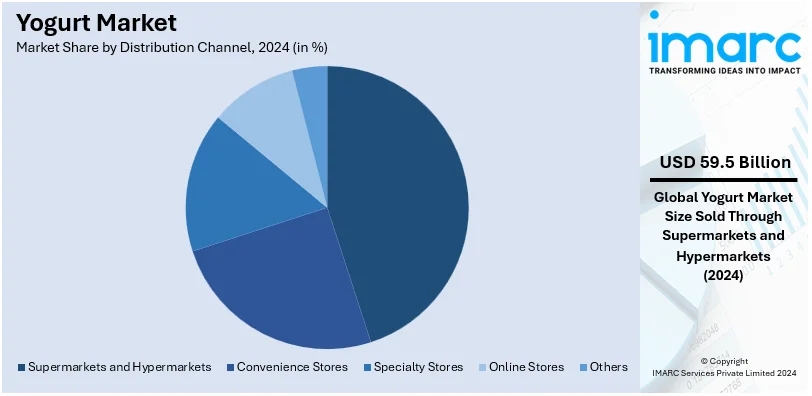

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

In 2024, supermarkets and hypermarkets held a dominant 46.7% of the market. Supermarkets and hypermarkets are expansive retail establishments that provide a vast array of yogurt varieties and tastes. They make it feasible to have an extensive yogurt area where customers can choose from a variety of brands and sizes, ranging from single-serving cups to enormous family-sized containers. Regular grocery consumers frequently pick supermarkets and hypermarkets because of their wide selection and frequent sales. Furthermore, according to the National Retail Federation (NRF), retail sales in 2023 are expected to reach between USD 5.13 Trillion and USD 5.23 Trillion, a 4% to 6% rise from 2022.

Regional Analysis:

- Asia Pacific

- European Union

- North America

- Eastern Europe

- Latin America

- Others

In 2024, Europe accounted for the largest market share of over 33.6%. Europe is the leading regional market for yogurt because of its high per capita consumption and a deep-rooted cultural inclination for dairy products. Countries like France, Germany, and Greece are leading contributors, driven by strong demand for traditional and premium yogurt varieties, including Greek and Skyr. The region's preference for clean-label, organic, and locally sourced products also aligns with the growing trend toward health-conscious and sustainable food choices. European consumers additionally exhibit a high inclination toward probiotic-rich yogurts, valued for their digestive health benefits. Moreover, innovation in flavors and packaging by regional leaders has sustained consumer interest and market growth. The widespread availability of yogurt in supermarkets, hypermarkets, and convenience stores, combined with robust marketing strategies emphasizing health and tradition, further cements Europe's position as the largest market segment.

Key Regional Takeaways:

North America Yogurt Market Analysis

North America is witnessing robust growth in the yogurt market due to changing consumer perceptions toward healthy, protein-rich, and probiotic foods. The U.S. is still leading in the region, with Greek yogurt being a staple, both in terms of its high protein content and creamy nature. Furthermore, innovations in plant-based yogurts are gaining momentum as dairy-free consumers seek alternatives to cater to their lactose-intolerance and veganism. Convenience has also fueled massive growth in single-serve and drinkable yogurt, especially among the Millennials and busy professionals. Moreover, major regional players have been developing clean-label products and a variety of flavors in response to the fast-changing market. E-commerce platforms and targeted digital marketing campaigns are additionally said to complement and improve the already high accessibility of yogurt, thus ensuring steady growth in North America's yogurt market.

United States Yogurt Market Analysis

United States has almost 81.60% of the market share in North America. It is growing really fast because of consumers search for health-minded, functional food alternatives. The awareness of probiotics health benefits is one of the factors boosting the expansion. According to the 2021 Food and Health Survey by IFIC, 67 percent of the respondents familiarized themselves with probiotics, and 32 actively looked for consumption, showing the interest that base towards gut health and immunity. With this, yogurt as a totally natural source of probiotics is made more popular among health-conscious people. Additionally, high protein intake is often a requirement among fitness lovers and weight-conscious individuals, further expanding market growth. Given the fact that yogurt can be taken with a number of meals and snacks, combined with the innovations provided in low-sugar, high-protein, and plant-based categories, this has further enhanced its reach. Single-serving and on-the-go formats are also designed for fast-paced lifestyles and are much easier to find in retail and online shopping channels. High purchasing power has also translated to some healthy interest in yogurt premium offerings, making it more a staple in the American diet. All these, coupled with marketing efforts, constantly drive the yogurt market in America.

Asia Pacific Yogurt Market Analysis

The yogurt market in Asia Pacific is booming fast due to greater health awareness and changing consumers' preferences toward healthy foods. The expanding middle class, a significant demand driver, is a key factor in growing this market. According to the World Economic Forum, 35 Billion Asians are estimated to be part of the middle class by 2030, up from 2 Billion in 2020, which implicitly implies the possibility of progress toward increased purchasing power and demand for premium goods. Today, yogurt is also well-known in China, Japan, and India as the product that is consumed for its digestive and immune-boosting properties due to probiotics. New trends towards healthy snacking and increasing adoption of plant-based alternatives is catering to vegan and lactose intolerant consumers alike. With innovations in flavors, low-fat formulations, and fortified variants, yogurt is becoming more appealing to health-conscious consumers. Additionally, with the growing influence of modern retail and e-commerce platforms, yogurt's accessibility has improved, solidifying its role in the region's evolving dietary habits.

Europe Yogurt Market Analysis

The yogurt market across Europe is developing steadily due to the rising health consciousness among people and consequent changes in the perception of functional products-clean label products. Probiotics along with the digestive and immune health characteristics associated with them have made yogurt a big hit. There are also highly demanding plant-based consumer alternatives. According to ProVeg International, 28 percent of Europeans consume at least one plant-based food alternative per week, an increase from 21 percent in 2021, suggesting preference moving toward vegan, vegetarian, and lactose-free diets. Innovation in dairy-free yogurt products comes into a larger consumer base along with this trend. Yogurt versatility fits in this across meals, snacks, and desserts. More and more consumers are now leaning toward low-fat, low-sugar, organic and fortified varieties of yogurt with their inclination on leading healthy lifestyles. Easy single serve and drinkable yogurts satisfy the busy lifestyles and premium and unique exotic flavor innovations captivate hedonistic consumers. Additionally, e-commerce and modern retail channels have enhanced accessibility, further driving consumption. These factors collectively position yogurt as a preferred choice among European consumers seeking health, convenience, and dietary flexibility.

Latin America Yogurt Market Analysis

Digestive and other benefits of yogurt along with the rising probiotic demand have fueled its consumption in Latin America. Higher disposable income is also a key driver, especially in Brazil, where average income per person increased by 11.5% in 2023, as per the Brazilian Institute of Geography and Statistics (IBGE). This has created a market for premium and healthier yogurts. Besides, the growing arrays of plant-based alternatives are putting the market within reach of increasingly wider audiences across the area.

Middle East and Africa Yogurt Market Analysis

The introduction and adoption of healthier dietary habits and increasing health awareness in the Middle East and Africa have been the drivers of the yogurt market. This coupled with high demand for functional foods such as probiotics has made yogurt widely consumed considering digestive and immunity benefits. Furthermore, the region has a high lactose intolerance prevalence drawing in with estimates by PMC that state about 70% of the population is affected, hence increasing need for lactose-free and plant-based yogurt products. Improving flavors, packaging, and rising disposable income further influence the urban scenography market development and diversification.

Competitive Landscape:

The yogurt market is largely driven by the key players that focus on the product innovations, clean-label products, and targeted marketing for competitive advantage. They are manufacturing healthier products including a low-fat, high-protein, and sugar-free yogurt to satisfy the increasing health consciousness among consumers. The plant-based yogurt lines have grown significantly, with almond, oat, and coconut among the most popular. These brands are also investing in uniqueness to cater to diverse taste preferences as they improve the various flavor profiles and fortified products enriched with probiotics, vitamins, and other nutrients. Digital marketing and e-commerce strategies, including influencer partnerships and personalized advertising, are going to play very big roles as companies reach out to the younger demographic and expand customer bases. Sustainability is the other subject area considered by most key players adopting green packaging and sourcing practices when it comes to environmental issues. They also laid focus on regional customization, as flavors and forms tailored to specific markets are rolled out, greatly broadening the hold on the market as well as consumer loyalty.

The report provides a comprehensive analysis of the competitive landscape in the yogurt market with detailed profiles of all major companies, including:

- China Mengniu Dairy Company Limited

- Chobani, LLC

- Danone

- FAGE International S.A

- FrieslandCampina

- Lactalis American Group, Inc.

- Nestlé S.A

- Saputo Foodservice

- The Hain Celestial Group Inc.

- Yakult Honsha Co. Ltd

Latest News and Developments:

- November 2024: LALA® has launched LALA Gold, a high-protein yogurt available in drinkable and spoonable forms. While the 5.3 oz spoonable cups include 20g of protein and active probiotics, the 10 oz drinkable version has 25g of protein, 6g of fiber, and no added sugar. The product is designed to meet the nutritional needs of health-conscious consumers.

- October 2024: Chobani has launched a high-protein Greek yogurt line, offering 20 grams of protein per cup and 15, 20, or 30 grams per drink. The new products cater to the growing demand for high-protein, lower-sugar options, providing affordable, flavorful, and functional choices made with natural ingredients.

- April 2024: Danone North America has launched Remix, a yogurt and dairy snack line featuring mix-in toppings. The range includes flavors from Oikos, Too Good & Co., and Light + Fit, such as coco almond chocolate, strawberry cheesecake, and banana dark chocolate almond.

- January 2024: Nature's Fynd has launched the world’s first dairy-free, fungi-based yogurt at Whole Foods Market. Made with Fy, a sustainable fungi protein, it offers a unique alternative to traditional plant-based yogurts. Available in strawberry, peach, and vanilla flavors, Fy Yogurt contains 8g of protein, 4g of fiber, and is free from nuts, soy, gluten, and artificial additives.

- January 2024: Yoplait has launched Yoplait Protein, a high-protein yogurt offering 15g of protein and 3g of sugar per serving. Available in Vanilla, Strawberry, and Key Lime Pie flavors, it is the brand’s highest protein and lowest sugar yogurt, providing a convenient option for meeting protein goals without sacrificing taste.

Yogurt Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Set Yogurt, Greek Yogurt, Yogurt Drinks, Frozen Yogurt, Others |

| Flavors Covered | Strawberry Blend, Vanilla, Plain, Strawberry, Peach, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, European Union, North America, Eastern Europe, Latin America, Others |

| Companies Covered | China Mengniu Dairy Company Limited, Chobani, LLC, Danone, FAGE International S.A, FrieslandCampina, Lactalis American Group, Inc., Nestlé S.A, Saputo Foodservice, The Hain Celestial Group Inc., Yakult Honsha Co. Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the yogurt market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global yogurt market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the yogurt industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The yogurt market size was valued at USD 134.55 Billion in 2025.

The yogurt market is projected to exhibit a CAGR of 5.4% during 2025-2033, reaching a value of USD 203.8 Billion by 2033.

The market is primarily driven by the rising health awareness, growing demand for probiotic-rich and functional foods, increasing popularity of plant-based and flavored options, expanding consumption in emerging markets, and innovation in packaging for convenience.

Europe currently dominates the market, accounting for a share of over 33.6%, driven by rising health consciousness, diverse product innovations, increasing disposable incomes, growing demand for probiotic-rich foods, and expanding urbanization in emerging economies.

Some of the major players in the yogurt market include China Mengniu Dairy Company Limited, Chobani, LLC, Danone, FAGE International S.A, FrieslandCampina, Lactalis American Group, Inc., Nestlé S.A, Saputo Foodservice, The Hain Celestial Group Inc., Yakult Honsha Co. Ltd, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)