Yttrium Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

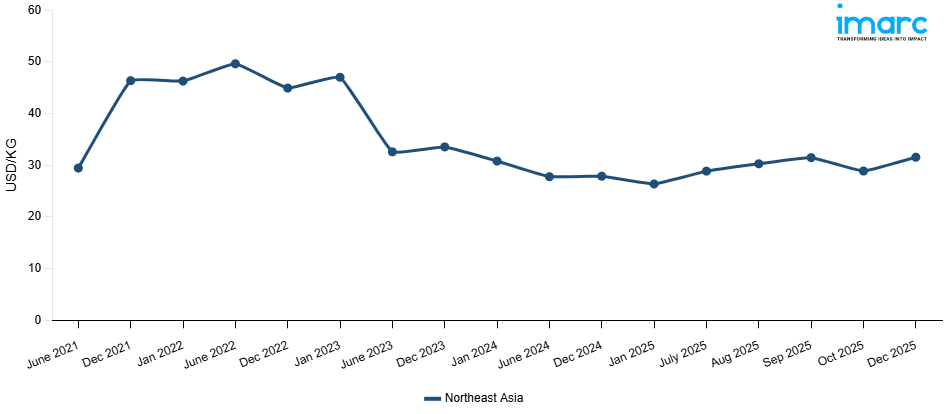

Yttrium Price Trend, Index and Forecast

Track real-time and historical yttrium prices across global regions. Updated monthly with market insights, drivers, and forecasts.

Yttrium Prices January 2026

| Region | Price (USD/Kg) | Latest Movement |

|---|---|---|

| Northeast Asia | 32.72 | 3.7% ↑ Up |

Yttrium Price Index (USD/KG):

The chart below highlights monthly yttrium prices across different regions.

Get Access to Monthly/Quarterly/Yearly Prices, Request Sample

Market Overview Q3 Ending September 2025

Northeast Asia: The upward trend was mainly driven by strong demand from the electronics and rare-earth magnet industries, particularly in China. International shipping bottlenecks and higher port handling fees in China and South Korea added incremental costs, while fluctuations in the Chinese yuan against the US dollar influenced export competitiveness. Demand remained resilient from applications in phosphors, ceramics, and catalysts, and new investments in renewable energy storage further supported buying activity. However, downstream manufacturers faced higher compliance costs associated with traceability and sustainability certifications for rare-earth materials. These combined supply and demand pressures reinforced a bullish pricing outlook for yttrium across Northeast Asia during the quarter.

Yttrium Price Trend, Market Analysis, and News

IMARC's latest publication, “Yttrium Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the yttrium market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of yttrium at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed yttrium prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting yttrium pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Yttrium Industry Analysis

The global yttrium industry size reached 11.81 Thousand Tons in 2025. By 2034, IMARC Group expects the market to reach 15.0 Thousand Tons, at a projected CAGR of 2.57% during 2026-2034. The market is driven by the growing demand from electronics and renewable energy sectors, rising applications in aerospace and defense for superalloys, and increasing use of yttrium in medical imaging and phosphors.

Latest developments in the Yttrium Industry:

- April 2025: Pentixapharm announced the signing of a contract manufacturing agreement with Eckert & Ziegler Radiopharma GmbH (EZR), a wholly owned unit of Eckert & Ziegler SE. Under the agreement, EZR will produce and distribute patient-specific doses of Yttrium-90 PentixaTher (Y90-PentixaTher) under GMP conditions for use in Pentixapharm’s clinical trials.

Product Description

Yttrium is a silvery-white metallic element classified within the rare-earth group, though chemically it behaves more like the transition metals. It occupies a critical position in the global materials hierarchy due to its role in enabling high-performance technologies. Its key properties include stability, high-temperature resistance, and strong phosphorescent qualities. Industrially, yttrium is used in phosphors for LED and CRT displays, in advanced ceramics for thermal stability, and in superalloys that strengthen aerospace components. It also plays a vital role in medical imaging as part of yttrium-90 radioisotopes and in renewable technologies, where yttrium-based compounds improve magnet efficiency in wind turbines and electric vehicles.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Yttrium |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Yttrium Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of yttrium pricing, covering global and regional trends, spot prices at key ports, and a breakdown of ex-works, FOB, and CIF prices.

- The study examines factors affecting yttrium price trend, including supply-demand shifts and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The yttrium price charts ensure our clients remain at the forefront of the industry.

Key Questions Answered in This Report

The yttrium price in January 2026 was 32.72 USD/KG in Northeast Asia.

The yttrium pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for yttrium prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)