1-Decene Market Size, Share, Trends and Forecast by Derivative, Grade, Application, and Region, 2025-2033

1-Decene Market Size and Share:

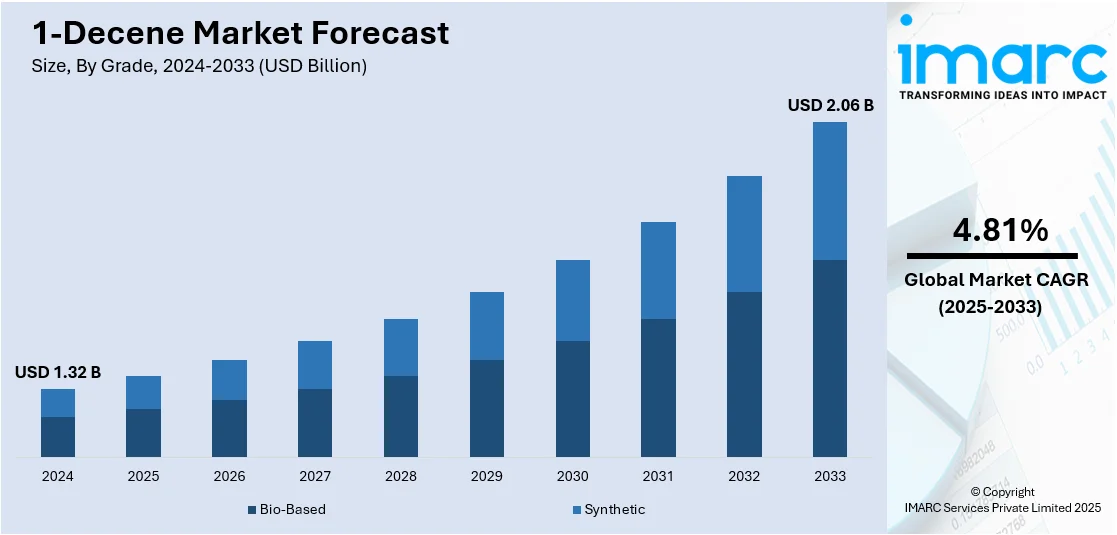

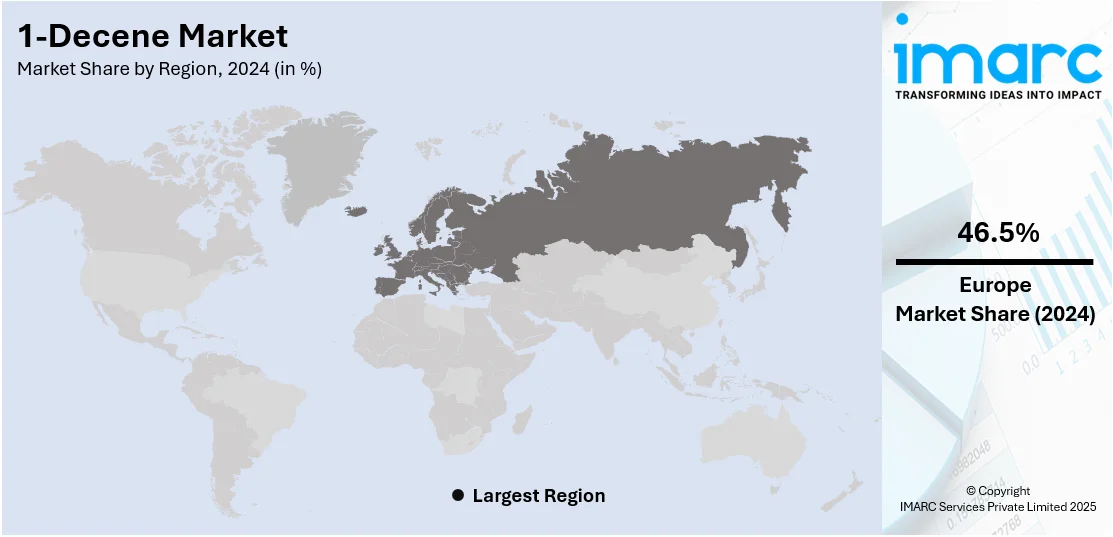

The global 1-decene market size was valued at USD 1.32 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.06 Billion by 2033, exhibiting a CAGR of 4.81% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 46.5% in 2024. The market is experiencing significant growth, driven by the increasing application of its products in high-performance lubricants, automotive oils, and packaging materials. Moreover, technological advancements in production processes and a shift towards sustainable bio-based feedstocks are further enhancing the 1-decene market share, positioning it for long-term expansion across key industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.32 Billion |

| Market Forecast in 2033 | USD 2.06 Billion |

| Market Growth Rate 2025-2033 | 4.81% |

The international market for 1-decene is on the rise, driven by factors such as surging demand for polyalphaolefins (PAOs) in industries like automotive, lubricants, and packaging. The unique features of 1-decene render it a top choice raw material in all these uses. As more industries focus on efficiency and sustainability, demand for high-quality lubricants and additives has increased exponentially. Additionally, 1-decene plays a crucial role in the production of polyethylene, which has contributed to its high demand for use in plastic products. The increasing automotive industry, particularly in developing countries, has played a major role in the expansion of the global 1-decene market. In addition, there is an increasing demand for green and biodegradable products, which has helped stimulate demand for 1-decene in several environmentally friendly applications. Technological advances in the United States have significantly contributed to the production of 1-decene, making the manufacturing process more efficient and environmentally friendly.

To get more information on this market, Request Sample

Advances in cutting-edge catalytic cracking methodologies have enabled U.S. producers to enhance production efficiency and the quality of 1-decene. These developments have been instrumental in boosting production while reducing costs, with the ultimate goal of optimizing industrial processes. This has enabled manufacturers to meet the growing demand for 1-decene, particularly in the automotive and chemical sectors. Furthermore, a shift in preference for utilizing bio-based feedstocks has occurred in the United States, thereby decreasing dependency on conventional petroleum-based feedstocks.

1-Decene Market Trends:

Rising Demand for 1-Decene Drives Expansion

The growing demand for polyalphaolefins (PAO) is contributing positively to the expansion of the 1-decene market. PAO, a synthetic lubricant, is widely used in the automotive and manufacturing sectors for applications such as transmission fluids, compressor oils, gear oils, and lube oil additives. This trend is closely linked to the robust growth of the automotive industry, as evidenced by the 7.3% increase in domestic vehicle sales reported by the Society of Indian Automobile Manufacturers, highlighting the sector's ongoing expansion. Furthermore, the rising demand for packaged food products is also fostering 1-decene consumption, as it is essential for producing polyethylene polymers used in packaging. Additionally, 1-decene serves as a key ingredient in food additives, glazing agents, and polishing agents, driving further adoption in the food and beverage sector. The natural food additive market in Europe, projected to grow at an annual rate of 6.2% until 2030, is expected to fuel this demand further. Beyond food packaging, 1-decene is a crucial chemical intermediate in the production of detergents and industrial surfactants, contributing to its widespread use in various industries. Moreover, factors such as increasing consumer spending power, declining raw material costs, and continued growth in the automotive sector are expected to further drive 1- decene market growth.

Sustainability Drives Bio-Based 1-Decene Growth

The market is undergoing a significant shift toward sustainability as industries increasingly focus on bio-based alternatives to traditional fossil-derived chemicals. This trend is being driven by the increasing demand for environmentally friendly products across various sectors, including automotive and consumer goods. As sustainability becomes a critical priority, more industries are investing in renewable raw materials and green technologies that reduce environmental impacts. The pressure to meet global carbon reduction targets has also fueled innovation in chemical manufacturing processes. In line with this, the development of cyclodextrin-mediated hydroformylation processes in January 2025 had a significant impact on the 1-decene market. This innovation focuses on enhancing the catalyst's efficiency and recycling capabilities, ensuring a more sustainable production method while maintaining high product yields. As a result, industries are more inclined to adopt bio-based platform chemicals, leading to a heightened demand for 1-decene. Furthermore, the ability to improve sustainability and reduce waste aligns with the global emphasis on a circular economy, reinforcing the long-term growth prospects of bio-based chemicals, such as 1-decene, in various applications, including lubricants, polymers, and detergents. Furthermore, these developments reflect the latest 1-decene market trends, highlighting the shift towards more sustainable and eco-friendly alternatives.

Innovation in Production Methods Boosts 1-Decene Demand

The 1-decene market is being significantly influenced by innovations in production techniques that enhance the manufacturing process's efficiency and scalability. As industries aim to meet growing demand while optimizing production costs, the focus has shifted to advanced technologies that can enhance output without compromising quality. For instance, Verbio's development of the world's first large-scale ethenolysis plant in Bitterfeld is poised to revolutionize 1-decene production. Set to commence operations in 2026, this plant will produce 17,000 tonnes of 1-decene annually. The technology, which relies on rapeseed oil methyl ester, utilizes cutting-edge catalytic processes to convert raw materials into bio-based specialty chemicals efficiently. This new plant aligns with the growing need for industrial solutions that can produce high-quality 1-decene in larger volumes to meet increasing market demands. As the market for high-performance lubricants and other specialty chemicals continues to expand, such technological advancements will enable manufacturers to scale production without relying on traditional petrochemical inputs. Consequently, the growth of large-scale, innovative plants is set to increase the global supply of 1-decene, further accelerating its adoption across various industries.

1-Decene Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global 1-Decene market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on derivative, grade, and application.

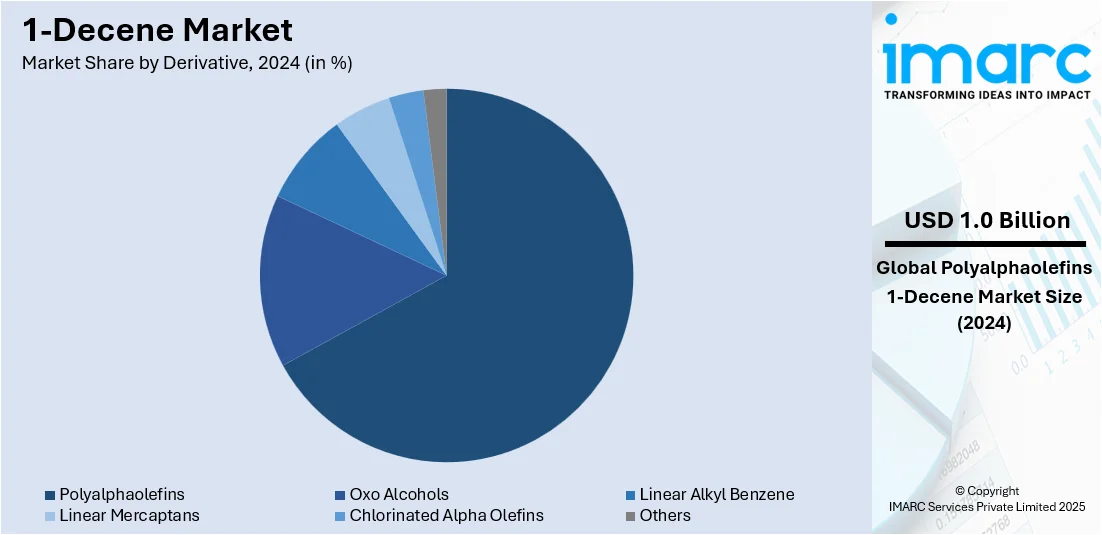

Analysis by Derivative:

- Polyalphaolefins

- Oxo Alcohols

- Linear Alkyl Benzene

- Linear Mercaptans

- Chlorinated Alpha Olefins

- Others

As per the 1-decene market outlook, in 2024, the polyalphaolefin segment led the market, accounting for 67.2% of the total market share driven by the increasing demand for high-quality lubricants in automotive, aerospace, and industrial sectors. Polyalphaolefins (PAOs) produced from 1-decene offer superior thermal stability, oxidation resistance, and low volatility, making them ideal for use in engine oils, transmission fluids, and other high-performance applications. The trend towards longer oil change intervals and improved fuel efficiency in modern vehicles is also fueling the demand for PAOs. Furthermore, the growing automotive industry in emerging economies is expected to continue driving the demand for polyalphaolefin-based lubricants, further solidifying their dominant position in the market.

Analysis by Grade:

- Bio-Based

- Synthetic

In 2024, the synthetic segment led the 1-decene market, driven by the increasing demand for high-performance, durable synthetic lubricants across various industries, particularly automotive and industrial sectors. Synthetic 1-decene is highly valued for its superior properties such as enhanced temperature stability, reduced friction, and longer operational life. These benefits make it ideal for advanced applications where efficiency and reliability are paramount. As industries focus on sustainability and reducing maintenance costs, the demand for synthetic oils and lubricants derived from 1-decene continues to rise. Moreover, the growing shift towards eco-friendly and energy-efficient products further boosts the demand for synthetic 1-decene in global markets.

Analysis by Application:

- Surfactants

- Plasticizers

- Synthetic Lubricants

- Polyethylene

- Others

In 2024, the synthetic lubricants segment led the 1-decene market, driven by the increasing need for high-performance oils and lubricants in industries such as automotive, manufacturing, and machinery. Synthetic lubricants, derived from 1-decene, offer benefits like extended engine life, better fuel economy, and reduced emissions, aligning with global sustainability trends. Their superior properties, such as resistance to oxidation and high thermal stability, make them highly suitable for extreme conditions. The automotive sector, in particular, is driving the demand for synthetic lubricants due to the rise in the production of high-efficiency vehicles with low emissions. These factors combined have led to a continuous surge in demand for synthetic lubricants, ensuring their dominance in the 1-decene market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the Europe segment led the 1-decene market, accounting for 46.5% of the total market share, driven by the region’s strong automotive, industrial, and chemical sectors. Europe is home to some of the world’s largest manufacturers of automotive lubricants and chemicals, which heavily rely on 1-decene-derived products. Additionally, Europe’s commitment to sustainability and stringent environmental regulations is encouraging the adoption of high-performance lubricants and materials produced from 1-decene, especially in energy-efficient and low-emission vehicle technologies. The strong presence of key market players, along with significant investments in R&D for eco-friendly solutions, further drives the demand for 1-decene in the region. These factors position Europe as the leading market for 1-decene in 2024.

Key Regional Takeaways:

United States 1-Decene Market Analysis

In 2024, the United States accounted for 78.90% of the 1-decene market in North America, driven by multiple factors. The U.S. 1-decene market is experiencing consistent growth, primarily driven by rising investments in advanced polymer production and the growing demand for synthetic lubricants across industrial sectors. The U.S. Industrial Lubricants Market is projected to grow from USD 7.8 Million in 2024 to USD 10.5 Million by 2033, at a CAGR of 3.3% during 2025-2033. The mature automotive and aerospace industries in the region are pivotal to the expansion of high-performance polyalphaolefin (PAO) production, a major application of 1-decene. Furthermore, the trend toward lightweight, fuel-efficient materials in the transportation sector is boosting demand for 1-decene-based polyethylene derivatives. Technological improvements in production processes, as well as the integration of automation in chemical manufacturing, are enhancing operational efficiencies. Regulatory support for energy-efficient materials is stimulating the market for low-viscosity lubricants reliant on 1-decene. Additionally, demand from electronics and packaging industries for high-performance plastics is accelerating market growth. The U.S. benefits from a well-established supply chain, robust logistics, and solid infrastructure, with R&D on performance materials further driving demand for 1-decene.

Europe 1-Decene Market Analysis

The 1-decene market in Europe is growing due to sustainable chemical manufacturing, strong regulatory frameworks, and a focus on circular economy practices. These factors are driving the demand for cleaner raw materials, especially in plasticizers and detergent intermediates. The growth of end-user industries like personal care and pharmaceuticals is also contributing to the regional demand. The construction and automotive sectors in Europe are increasingly adopting advanced synthetic materials, many of which rely on 1-decene derivatives. The European Commission’s Clean Industrial Deal, which aims to mobilize over USD 108 billion to support EU-made clean manufacturing, is reinforcing the shift toward sustainable industrial practices and driving demand for high-purity chemical inputs like 1-decene. Additionally, growing awareness about environmental compliance is prompting a move towards more efficient, high-performance polymers. Europe’s collaborative industrial clusters, along with a focus on clean production processes, are further supporting market growth. Advancements in next-generation chemical technologies and recycling infrastructure are expanding 1-decene applications, benefiting from both public and private investment in sustainable material innovation.

Asia Pacific 1-Decene Market Analysis

The Asia Pacific 1-decene market is experiencing robust growth driven by rapid urbanization and industrialization, which are increasing the demand for high-performance plastics and lubricants. The use of polyethylene derivatives in consumer goods and packaging applications is expanding the market across developing economies. According to the India Brand Equity Foundation, the Government of India aims to boost the plastic industry from USD 37.8 billion in 2025 to USD 126 billion over the next four to five years, highlighting significant growth potential in the region. The rising demand for advanced materials in electronics and telecommunications is further driving market expansion. Additionally, infrastructure development and increased construction activities are fueling the need for specialty polymers derived from 1-decene. The growth of domestic chemical production and favorable government policies are boosting regional manufacturing capabilities. Furthermore, the expansion of applications in cosmetics and household care is driving the consumption of 1-decene in the region. Increasing environmental awareness and a shift toward cleaner alternatives are also contributing to market demand.

Latin America 1-Decene Market Analysis

The Latin American 1-decene market is expanding due to increasing demand from the personal care and home cleaning sectors, where 1-decene is used in the production of surfactants and detergent intermediates. The growing focus on hygiene and wellness, especially in urban areas, is driving the demand for products containing 1-decene-based components. The Brazil industrial and institutional cleaning chemicals market, valued at USD 2.2 billion in 2024, is projected to grow to USD 3.5 billion by 2033 at a CAGR of 4.6% from 2025 to 2033, further increasing the demand for 1-decene in cleaning formulations. Additionally, the food packaging industry in Latin America is witnessing significant growth, which boosts the need for high-performance polymers. Localized chemical manufacturing and regional value addition are also driving market momentum. The expansion of agriculture-related polymer use, and improved material performance standards are contributing to the market's positive trajectory.

Middle East and Africa 1-Decene Market Analysis

The 1-decene market in the Middle East and Africa is witnessing gradual growth, primarily driven by the rising demand for synthetic lubricants used in the energy and mining industries. As these sectors require materials capable of withstanding extreme conditions, the role of 1-decene in enhancing lubricant performance is becoming increasingly critical. The Saudi Arabian industrial lubricants market, expected to grow at a CAGR of 2.76% from 2025 to 2033, reflects broader regional trends favoring increased lubricant consumption. Additionally, the rapid development of infrastructure across emerging urban centers is driving the need for durable plastic products made from 1-decene derivatives. Expanding petrochemical processing capabilities and an increased focus on technological modernization in industrial zones are contributing to the adoption of specialty chemicals like 1-decene. As the region continues to evolve and industrialize, the demand for 1-decene-based materials is poised for steady growth.

Competitive Landscape:

Leading companies in the 1-decene market are investing heavily in R&D to develop improved formulations with enhanced performance and minimal environmental impact, reflecting the industry's shift towards more sustainable and efficient solutions. Expansions through acquisitions, partnerships, and global collaborations are driving the 1-decene market forecast, allowing companies to tap into new markets and technologies. Regulatory compliance and sustainable production practices remain top priorities, underscoring their commitment to upholding high standards of quality, safety, and environmental responsibility.

The report provides a comprehensive analysis of the competitive landscape in the 1-decene market with detailed profiles of all major companies, including:

- Angene Chemicals

- Chevron Phillips Chemical Company LLC

- INEOS Group Limited

- Merck Life Science

- SABIC

- Spectrum Laboratory Products Inc.

- Thermo Fisher Scientific Inc

- Tokyo Chemical Industry (India) Pvt. Ltd

1-Decene Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Derivatives Covered | Polyalphaolefins, Oxo Alcohols, Linear Alkyl Benzene, Linear Mercaptans, Chlorinated Alpha Olefins, Others |

| Grades Covered | Bio-Based, Synthetic |

| Applications Covered | Surfactants, Plasticizers, Synthetic Lubricants, Polyethylene, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Angene Chemicals, Chevron Phillips Chemical Company LLC, INEOS Group Limited, Merck Life Science, SABIC, Spectrum Laboratory Products Inc., Thermo Fisher Scientific Inc, Tokyo Chemical Industry (India) Pvt. Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the 1-Decene market from 2019-2033.

- The 1-Decene market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the 1-Decene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The 1-decene market was valued at USD 1.32 Billion in 2024.

The 1-decene market is projected to exhibit a CAGR of 4.81% during 2025-2033, reaching a value of USD 2.06 Billion by 2033.

Key factors driving the 1-decene market include its growing demand for high-performance lubricants, automotive oils, and packaging applications. Technological advancements in production efficiency, the adoption of bio-based feedstocks, and a rising emphasis on sustainability and eco-friendly practices are further boosting market growth.

In 2024, Europe dominated the 1-decene market accounting for 46.5% of the total market share, driven by strong demand from the automotive, lubricant, and packaging industries. Technological advancements, a focus on sustainable production, and stringent environmental regulations further contributed to this market leadership.

Some of the major players in the global 1-decene market include Angene Chemicals, Chevron Phillips Chemical Company LLC, INEOS Group Limited, Merck Life Science, SABIC, Spectrum Laboratory Products Inc., Thermo Fisher Scientific Inc, Tokyo Chemical Industry (India) Pvt. Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)