5G Infrastructure Market Size, Share, Trends and Forecast by Communication Infrastructure, Network Technology, Network Architecture, Frequency, End User, and Region, 2025-2033

5G Infrastructure Market Size and Share:

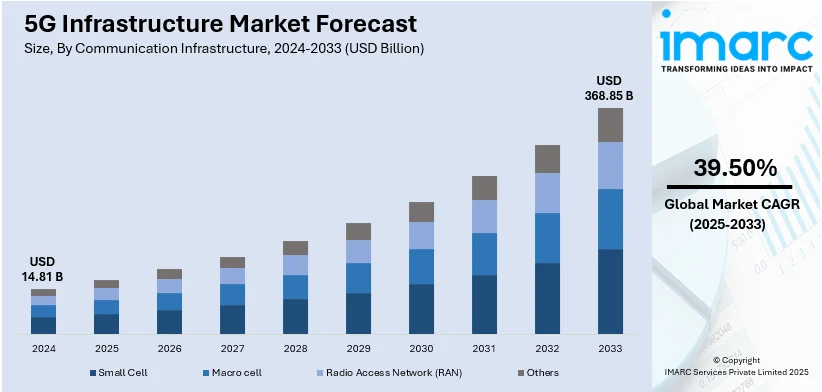

The global 5G infrastructure market size was valued at USD 14.81 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 368.85 Billion by 2033, exhibiting a CAGR of 39.50% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 62.0% in 2024. The market is experiencing steady growth driven by the escalating demand for high-speed internet with low latency, increasing automation of industrial operations to improve efficiency, and stringent implementation regulations and policies to improve connectivity situations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 14.81 Billion |

|

Market Forecast in 2033

|

USD 368.85 Billion |

| Market Growth Rate (2025-2033) | 39.50% |

The global 5G infrastructure market has experienced accelerated growth driven by rising mobile data consumption, extensive government support for network expansion, and increasing demand for faster, more reliable connectivity. Investment in emerging technologies and next-generation wireless standards has spurred the development of innovative solutions, which also represents one of the key 5G infrastructure market trends. Moreover, enhanced connectivity is fueling advancements in sectors including industrial automation, transportation, and healthcare, which require robust and scalable networks. Telecom operators and technology providers are also forming strategic partnerships to expand network coverage and improve service quality in response to evolving consumer and enterprise requirements.

The United States 5G infrastructure market is expanding due to regulatory policies, public-private investments, and rising consumer demand for high-speed connectivity. For instance, in July 2024, the U.S. Department of Defense signed a Statement of Intent (SOI) with the Singapore Ministry of Defense to enhance collaboration on data, analytics, and AI. This partnership highlights the critical role of 5G infrastructure in supporting real-time data processing, secure communications, and rapid technological advancements within defense applications Additionally, the drive to meet growing consumer demands and to support advanced applications in smart cities and critical communications has further increased market momentum. Furthermore, economic stimulus measures and policy reforms contribute to a favorable investment climate, positioning the nation to lead in high-speed wireless connectivity and network innovation. Investor confidence strongly supports rapid market advancements nationwide, thereby facilitating the 5G infrastructure market demand.

5G Infrastructure Market Trends:

Increasing Data Demands

The rise in data consumption is propelling the growth of the market. The modern digital landscape is marked by an ever-increasing demand for high-speed and low-latency connectivity. This demand is fueled by a myriad of factors, including the proliferation of smart devices, the rapid expansion of Internet of Things (IoT) applications, and the adoption of data-intensive technologies like augmented reality (AR) and virtual reality (VR). Smartphones, tablets, and wearable devices have become integral parts of our lives, and they rely heavily on seamless connectivity. Moreover, the IoT ecosystem continues to expand as more devices become interconnected, from smart home appliances to industrial sensors. These devices create massive amounts of data that need to be transmitted swiftly and reliably, driving the need for robust 5G infrastructure. Additionally, AR and VR technologies are gaining traction in various industries, such as gaming, healthcare, and education. These applications demand high bandwidth and ultra-low latency to provide users with immersive experiences. As a result, the capabilities of 5G are indispensable in meeting these performance requirements. In 2023, the number of 5G connections worldwide hit over 1.5 billion, as estimated by GSMA, reflecting increasing dependence on 5G technology to meet this rising demand for high-speed and low-latency connectivity. Such mass adoption signals the central position of 5G in dictating the direction of digital transformation in industries moving forward.

Industry 4.0 and Automation

The adoption of Industry 4.0 practices and the pursuit of automation across industries are supporting the market growth. Industry 4.0, often referred to as the fourth industrial revolution, is characterized by the addition of digital technologies into various industrial processes. 5G plays a pivotal part in enabling the tenets of Industry 4.0, which include real-time data analytics, remote monitoring, and automation. These capabilities are instrumental in enhancing operational efficiency and productivity across diverse sectors, including manufacturing, logistics, and agriculture, thereby contributing to the 5G infrastructure market growth. In manufacturing, for instance, 5G facilitates the implementation of smart factories where machines and devices are interconnected and communicate seamlessly. This connectivity enables predictive maintenance, reducing downtime and optimizing production processes. Real-time data analysis ensures that decisions can be made swiftly, improving overall efficiency and product quality. Furthermore, in the logistics and supply chain management sector, 5G supports remote monitoring and tracking of goods and vehicles. It enables real-time updates on shipment status, enhancing transparency and enabling more efficient routes and delivery schedules. In agriculture, the integration of 5G allows for precision farming, where sensors and drones collect data on soil conditions, weather, and crop health in real-time. This data-driven approach enhances crop yield and reduces resource wastage. A significant illustration of growing dependency on new-generation technologies is the agreement between Becker Mining Systems AG and Ericsson. The two entities, in October 2022, inked a multi-nation reselling arrangement whereby Ericsson was appointed the partner 5G network provider for Private 5G (EP5G) as well as private network solutions to a number of nations including Canada, the United States of America, Mexico, Chile, France, Germany, and Poland. This collaboration highlights the growing significance of 5G in revolutionizing different sectors, such as mining, and reflects how new age technologies are being combined to improve operations around the world.

Government Initiatives and Regulations

Governments worldwide are actively promoting the deployment of 5G infrastructure due to its strategic importance. Recognizing its potential to drive economic growth, innovation, and competitiveness, governments are implementing initiatives to support its expansion. These initiatives often include spectrum allocation, financial incentives, and regulatory frameworks that facilitate 5G network deployment. Governing agencies of various countries are also taking steps to streamline the permitting and approval processes for the installation of 5G infrastructure, reducing barriers for telecom companies and infrastructure providers. These favorable conditions encourage investment in 5G networks and contribute significantly to market growth. Moreover, some countries are using 5G deployment to advance their technological leadership and establish themselves as global leaders in connectivity. This competitive drive among nations further accelerates the adoption of 5G infrastructure. In India, to provide an impetus to Digital India, Make in India, and Smart Cities & Smart Village missions, the government initiated the 5G India 2020 forum, reiterating its determination to build a robust 5G ecosystem. Moreover, governments of several nations are planning to construct smart cities, which heavily rely on high-speed internet connectivity for various aspects.

5G Infrastructure Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global 5G infrastructure market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on communication infrastructure, network technology, network architecture, frequency, and end user.

Analysis by Communication Infrastructure:

- Small Cell

- Macro cell

- Radio Access Network (RAN)

- Others

Radio access network (RAN) leads the market with around 67.1% of market share in 2024. The radio access network (RAN) is the largest and fundamental segment of the communication infrastructure, serving as the interface existing between mobile devices and the core network. RAN includes both small cells and macro cells and is responsible for managing wireless connections, signal transmission, and data traffic. RAN is a pivotal component in the 5G ecosystem, as it facilitates the deployment of advanced features like beamforming, network slicing, and low-latency communication. The significance of RAN lies in its ability to provide seamless connectivity, reduce latency, and support a multitude of devices, making it the cornerstone of modern wireless communication networks. It enables the deployment of 5G services, internet of things (IoT) connectivity, and innovative applications, driving the 5G infrastructure market growth.

Analysis by Network Technology:

- Software-Defined Networking

- Network Function Virtualization

- Others

Network function virtualization leads the market in 2024. Network function virtualization (NFV) represents a paradigm shift in network infrastructure. NFV involves replacing traditional hardware-based network appliances with virtualized instances running on standard servers and cloud-based platforms. This approach allows for the virtualization of network functions like firewalls, load balancers, and routers, making networks more agile and cost-effective. NFV is especially appealing for telecom operators and service providers aiming to reduce capital expenditures, accelerate service deployment, and increase network scalability. Its impact extends beyond telecommunications, with applications in cloud computing, edge computing, and internet of things (IoT), contributing to the growth of the 5G infrastructure market share.

Analysis by Network Architecture:

- Standalone

- Non-Standalone

Standalone 5G network architecture represents a fully independent and self-contained infrastructure, where both the 5G core (5GC) and the 5G new radio (NR) are deployed as standalone networks. SA architecture offers the complete set of 5G features and capabilities, enabling the full potential of 5G technology. It is particularly suited for scenarios where a greenfield deployment of 5G is feasible or in cases where a complete network overhaul is required. SA architecture provides lower latency and enhanced performance compared to NSA, making it ideal for applications demanding the utmost reliability and efficiency, such as autonomous vehicles and critical internet of things (IoT) services.

Non-standalone 5G network architecture is an initial implementation of 5G that relies on existing 4G LTE infrastructure for certain functionalities. In NSA, the 5G NR is deployed alongside the existing LTE network, utilizing the LTE core network for control signaling. NSA architecture serves as an interim solution to quickly introduce 5G services while leveraging the existing LTE infrastructure. It allows for faster 5G deployment and offers compatibility with existing LTE devices.

Analysis by Frequency:

- Sub-6 Ghz

- Above 6 Ghz

Sub-6 Ghz leads the market with around 84.5% of market share in 2024. Sub-6 GHz frequency bands encompass the range below 6 GHz, including spectrum in the mid-band (around 3.5 GHz) and the low-band (below 1 GHz). Sub-6 GHz 5G networks offer a good balance between coverage and capacity, making them appropriate for widespread deployment, including in rural and suburban areas. They provide improved data speeds and capacity compared to 4G networks while requiring fewer base stations for coverage. Sub-6 GHz 5G is a key driver for enhanced mobile broadband, supporting applications like high-definition video streaming, online gaming, and general internet access, making it the go-to choice for network operators aiming to deliver 5G services to a broad user base.

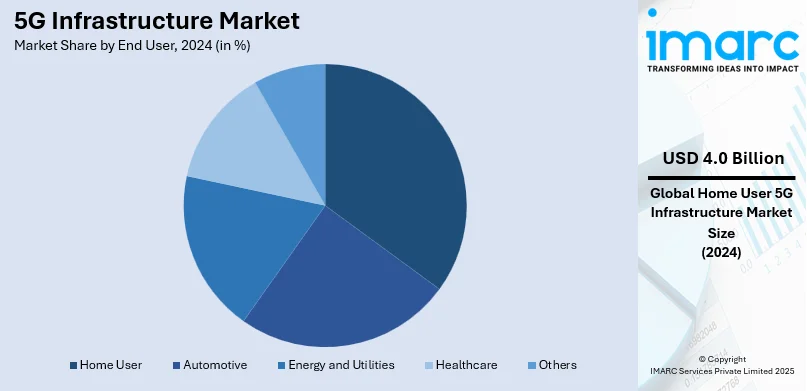

Analysis by End User:

- Automotive

- Energy and Utilities

- Healthcare

- Home User

- Others

Home user leads the market with around 26.7% of market share in 2024, influenced by rising demand for high-speed connectivity, low-latency use cases, and smart home technology. Growth in remote work, online learning, and streaming services has fueled 5G adoption among household consumers. Fixed Wireless Access (FWA) is also increasing broadband penetration in urban and rural areas, lessening reliance on traditional fiber infrastructure. Furthermore, the increasing adoption of IoT-based home automation systems and cloud-based entertainment platforms is driving 5G infrastructure spending. As the coverage of the network increases, home users will remain key drivers of growth in the 5G market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 62.0%, driven by substantial investments in technology development and infrastructure expansion. Countries such as China, Japan, and South Korea lead in 5G deployment, benefiting from advanced telecommunications networks and government support. The region's large population, high mobile penetration, and increasing demand for high-speed connectivity further accelerate 5G adoption. Additionally, the rapid expansion of industrial sectors such as manufacturing, automotive, and healthcare is spurring robust 5G infrastructure market demand. Furthermore, the continuous innovation and strategic partnerships within Asia Pacific further solidify its leadership in the global 5G market.

Key Regional Takeaways:

United States 5G Infrastructure Market Analysis

In 2024, United States accounted for 92.90% of the market share in North America. The United States 5G infrastructure market is growing fast, fueled by escalating usage of Fixed Wireless Access (FWA) and growing 5G smartphone penetration. Industry reports suggest that FWA, now the second-largest 5G use case, reached approximately 9 million connected business and residential premises in the U.S. in Q1 2024. This reflects the increasing dependence on 5G for broadband connectivity, particularly in rural and unserved markets. 59 percent of North American smartphone subscriptions are 5G-enabled, and 53 percent of U.S. subscribers have already moved to 5G, as per the 2024 industry report. This increase in adoption reflects high consumer appetite for faster and more stable mobile networks. Telecom operators are significantly investing in 5G infrastructure expansion, rolling out new spectrum bands, and increasing network capacity to support increasing data consumption. With the advancements in ultra-low latency and high-speed connectivity, the U.S. 5G market will see further growth, driving innovation in various sectors.

North America 5G Infrastructure Market Analysis

North America's 5G infrastructure sector demonstrates significant growth driven by substantial investments in modernizing network capabilities and rising consumer demand for high-speed connectivity. For instance, as per industry reports, in the US, 5G low-band covers 90% of the population, with 5G mid-band serving 210–300 million people, underscoring the ongoing expansion of 5G networks. Additionally, telecom operators and technology firms are forming alliances to deploy innovative solutions that enable advanced applications in sectors such as industrial automation, healthcare, and smart cities. Moreover, government initiatives, regulatory frameworks, and public-private partnerships bolster competitive dynamics while enhancing network resilience and cybersecurity. Furthermore, emphasis on energy efficiencyF and cost management further propels progress, while sustained investor confidence underscores the region's leadership in wireless communications evolution.

Europe 5G Infrastructure Market Analysis

The market for Europe 5G infrastructure is experiencing remarkable growth, with the driving factor being heightened network deployments and heightened 5G adoption. Telekom Deutschland GmbH, in January 2024, expanded its 5G network, which covered 96% of Germany's population. Such moves are boosting market demand and enhancing connectivity throughout the region. Western Europe accounted for an estimated 226 million 5G mobile subscriptions in 2024, up from 143 million in the last year, according to industry reports. Industry reports say telecom operators in Europe are heavily investing in building out their 5G networks, launching new spectrum bands, and enhancing infrastructure to host next-generation applications such as smart cities, autonomous vehicles, and industrial automation. As governments and companies keep emphasizing the adoption of 5G on a broad scale, Europe's market is poised for continuous growth, triggering innovation in other industries.

Asia Pacific 5G Infrastructure Market Analysis

Growing investments, surging mobile connectivity, and state policies are driving the swift buildup of 5G infrastructure in the Asia-Pacific region. 5G connections in the region are expected to reach 41% by 2030, a major upsurge from 4% in 2022, as per GSMA's The Mobile Economy Asia Pacific 2023 report. Such a surge indicates the region's aggressive adoption of 5G deployment to fuel industry digitalization. China, one of the key drivers of 5G expansion, has progressed impressively. According to GSMA's The Mobile Economy China 2023 report, China had more than 2.3 million 5G base stations at the end of 2022, with 887,000 new stations in a single year. This widespread deployment is fueling smart city development, industrial automation, and IoT take-up. With governments and telecommunication companies heavily investing in 5G infrastructure, the Asia-Pacific region is likely to drive the world's progress in high-speed connectivity, which will lead to more robust digital ecosystems, economic development, and innovation.

Latin America 5G Infrastructure Market Analysis

The Latin America 5G infrastructure market is expected to grow significantly with rising mobile data consumption and increasing network deployments. Total mobile data traffic in the region will increase threefold from 2024 to 2030, with a year-on-year growth rate of 19%, as per industry reports. Mobile traffic volumes will increase year on year every year, showing the growing need for high-speed connectivity and new digital services. Latin American telecom companies are picking up the pace of 5G deployments in order to cater to this growing data appetite, investing in spectrum management, fiber backhaul, and small-cell sites, as per industry reports. Growing smartphone penetration and Fixed Wireless Access expansion are also driving demand for 5G infrastructure further. While governments and the private sector keep fueling digital change, 5G technology will become vital to deepening connectivity, empowering smart cities programs, and driving regional economic development.

Middle East and Africa 5G Infrastructure Market Analysis

Middle East and Africa (MEA) 5G infrastructure market is projected to see huge growth, fueled by the rise in the number of mobile internet subscribers and the increased need for high-speed connectivity. Based on industry reports, the MENA region's mobile internet users are projected to hit approximately 422 million by 2030, from 327 million in 2023. This growth in internet users is likely to drive the demand for 5G networks, as customers look for faster and more stable connectivity for data-hungry applications. In addition, region governments are making significant investments in digital infrastructure, with projects focused on deepening 5G penetration and enhancing network performance. The fast pace of smart device adoption, combined with the increasing urbanization trend, will keep fueling the demand for reliable 5G networks. Consequently, telecom operators are expanding their 5G launches to facilitate this digital revolution and improve user experience in different industries, such as healthcare, entertainment, and manufacturing.

Competitive Landscape:

Major players in the 5G infrastructure are actively involved in various strategic endeavors. They are investing significantly in research and development (R&D) activities to enhance 5G technology, with a focus on enhancing network infrastructure, spectral efficiency, and creating new use cases. Leading players are also developing the coverage of 5G networks to offer flawless connectivity to larger users. Besides, they are actively collaborating with sectors such as automotive, healthcare, and manufacturing to leverage the complete capabilities of 5G in supporting revolutionary applications. For instance, in February 2025, AT&T announced expansion of its multi-year partnership with Nokia to enhance 5G network automation, including Voice over New Radio (VoNR) and Nokia’s Digital Operations software, driving faster deployments, operational efficiencies, and improved services. Furthermore, 5G participants are meeting security needs and adhering to regulatory requirements to maintain the dependability and credibility of their networks and services, contributing to the positive 5G infrastructure market outlook.

The report provides a comprehensive analysis of the competitive landscape in the 5G infrastructure market with detailed profiles of all major companies, including:

- Airspan Networks Inc.

- AT&T Inc.

- Cisco Systems Inc.

- Comba Telecom Systems Holdings Limited

- Hewlett Packard Enterprise Company

- Huawei Technologies Co. Ltd.

- Mavenir Systems Inc. (Comverse Technology)

- NEC Corporation

- Nokia Oyj

- Oracle Corporation

- Telefonaktiebolaget L M Ericsson

- ZTE Corporation

Latest News and Developments:

- February 2024: Italy-based network operator Wind Tre completed the acquisition of fixed wireless access provider (Linkem) OpNet. The strategic acquisition will be expected to facilitate the growth of both businesses while being in full compliance with regulations. It also reinforces Wind Tre's holdings of spectrum, especially in relation to 5G, for increased network capacity.

- January 2024: T-Mobile partnered with Cisco to launch a new managed service, the Connected Workplace. The service is aimed at supporting medium-sized enterprises that have operations spread over multiple locations, and T-Mobile's move marks an attempt to establish a new position in the Enterprise landscape.

- January 2024: Telekom Deutschland GmbH launched an extension of its 5G network, reaching 96% population coverage, as it further builds out its nationwide 5G coverage.

- December 2023: AT&T Inc. announced plans to collaborate with Ericsson to lead the United States in commercial scale open radio access network (Open RAN) deployment and build a more robust ecosystem of network infrastructure providers and suppliers.

- January 2023: Airspan Networks Inc. announced plans to expand its 5G Innovation Lab initiative in Tokyo to incorporate accelerating network adoption and scaling in the Asia-Pacific region.

5G Infrastructure Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Communication Infrastructures Covered | Small Cell, Macro Cell, Radio Access Network (RAN), Others |

| Network Technologies Covered | Software-Defined Networking, Network Function Virtualization, Others |

| Network Architectures Covered | Standalone, Non-Standalone |

| Frequencies Covered | Sub-6 Ghz, Above 6 Ghz |

| End Users Covered | Automotive, Energy and Utilities, Healthcare, Home User, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Airspan Networks Inc., AT&T Inc., Cisco Systems Inc., Comba Telecom Systems Holdings Limited, Hewlett Packard Enterprise Company, Huawei Technologies Co. Ltd., Mavenir Systems Inc. (Comverse Technology), NEC Corporation, Nokia Oyj, Oracle Corporation, Telefonaktiebolaget L M Ericsson, ZTE Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the 5G infrastructure market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global 5G infrastructure market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the 5G infrastructure industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The 5G infrastructure market was valued at USD 14.81 Billion in 2024.

IMARC estimates the global 5G infrastructure market to reach USD 368.85 Billion in 2033, exhibiting a CAGR of 39.50% during 2025-2033.

The market is primarily driven by the increasing demand for high-speed, low-latency connectivity to support emerging technologies like IoT, autonomous vehicles, and smart cities. Additionally, growing investments from telecom companies, government initiatives, and the need for more efficient network capabilities are key factors contributing to the market’s rapid expansion.

Asia Pacific currently dominates the market, holding a market share of over 62.0% in 2024. This leadership is driven by substantial investments from major telecom providers, government-backed initiatives, and a growing demand for advanced connectivity solutions. Countries such as China, Japan, and South Korea lead in 5G deployment, fostering innovation and setting the pace for the global market’s growth.

Some of the major players in the 5G infrastructure market include Airspan Networks Inc., AT&T Inc., Cisco Systems Inc., Comba Telecom Systems Holdings Limited, Hewlett Packard Enterprise Company, Huawei Technologies Co. Ltd., Mavenir Systems Inc. (Comverse Technology), NEC Corporation, Nokia Oyj, Oracle Corporation, Telefonaktiebolaget L M Ericsson, ZTE Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)