UK EdTech Market Report by Sector (Preschool, K-12, Higher Education, and Others), Type (Hardware, Software, Content), Deployment Mode (Cloud-based, On-premises), End User (Individual Learners, Institutes, Enterprises), and Region 2025-2033

UK EdTech Market Overview:

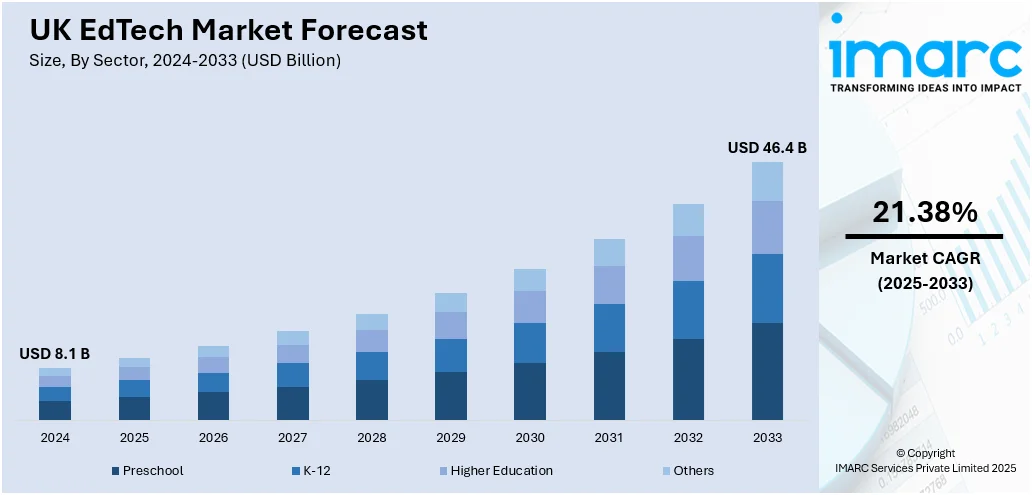

- The UK EdTech market reached USD 8.1 Billion in 2024.

- It is expected to grow to USD 46.4 Billion by 2033, exhibiting a CAGR of 21.38% during 2025-2033.

- Some prominent market drivers include government support for digital learning initiatives, rising demand for personalized and adaptive learning experiences, technological integration such as AI, VR/AR, gamification, and learning analytics, and increased investments in infrastructure modernization and teacher training.

- The market supports both cloud-based and on-premises deployment models. Cloud-based solutions are gaining more traction due to scalability, cost efficiency, and remote access capabilities.

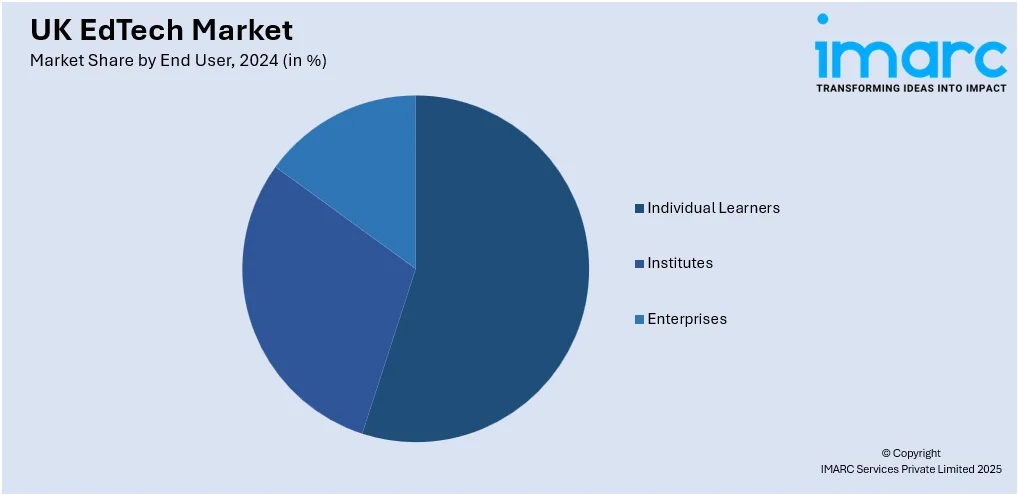

- Key end users include individual learners, institutes, and enterprises. Increasing use of EdTech for upskilling and workforce training is driving adoption among enterprises.

To get more information on this market, Request Sample

UK EdTech Market Trends:

Government Initiatives and Funding

The UK EdTech market is majorly supported by government policy and funding driving the integration of technology in education institutions. The recent EdTech Strategy launches set forth a commitment to leveraging digital technologies in shaping the teaching-learning environment. This prompts and supports the innovation of educational technologies. Additionally, specific funding programs target the development of educational technologies that support personalized learning environments, thus catering to diverse learning needs and improving educational outcomes. This trend not only supports the growth of local education technology companies UK but also attracts global edtech investors, helping bolster the UK's position as a hub for educational innovation. With digital solutions becoming increasingly crucial for remote learning and administrative efficiency being taken up by schools and universities, support from the government is essential for accelerated growth and stability in the market. The rise of online learning platforms UK reflects the demand for scalable educational solutions that meet the needs of modern learners. As a result, edtech UK has become a key area of focus for businesses and investors alike.

Technological Advancements and Integration

The use of advanced technologies, such as adaptive learning technologies, cloud-based educational platforms, and AI-driven tools, is another major driver for the education technology UK market. This integration supports a more data-driven approach to education, where insights gathered through technology are used to optimize teaching methods and educational outcomes. AI and VR are increasingly being used for the creation of interactive and immersive learning experiences, making complex subjects accessible and meaningful to students. These technological integrations improve the quality of education while at the same time scaling up to reach more consumers. The EdTech startups UK are contributing to the ever-growing online demand, with new solutions that ensure sustainable growth and transformation in the sector.

Artificial Intelligence (AI) in Personalised Learning

EdTech investment in AI is playing a transformative role in the UK EdTech market by enabling the development of personalized learning paths tailored to individual student needs. AI-powered platforms analyze real-time data on student performance, learning pace, and engagement patterns to adjust content delivery accordingly. This adaptive learning model ensures that students receive material at the appropriate difficulty level, reinforcing understanding and improving retention. AI also assists educators by automating administrative tasks such as grading and feedback, allowing them to focus more on student interaction. As institutions increasingly seek efficient, data-driven educational outcomes, the demand for AI-integrated solutions continues to rise, making AI a key driver of innovation and growth in the UK education technology sector.

Immersive Learning (AR/VR)

The integration of augmented reality (AR) and virtual reality (VR) technologies is significantly enhancing immersive learning experiences in the UK EdTech sector. AR/VR tools enable students to engage with educational content in interactive 3D environments, allowing for better visualization of complex concepts across subjects such as science, history, and engineering. For instance, VR field trips and virtual science labs offer safe and cost-effective ways to experience real-world scenarios without physical constraints. This approach improves knowledge retention and deepens understanding by making learning more experiential. As schools and higher education institutions seek to increase student engagement and motivation, immersive learning tools are gaining momentum as an essential component of digital education strategies across the UK.

Gamification in Education

Gamification is emerging as a powerful pedagogical strategy in the UK EdTech market, using game-based mechanics—such as points, levels, leaderboards, and rewards—to boost student engagement and motivation. This approach transforms traditional lessons into interactive experiences, encouraging participation and reinforcing positive learning behaviors. Platforms leveraging gamification are especially effective in enhancing learning outcomes for younger students and in skill development programs. Game elements provide immediate feedback, foster competition, and allow students to progress at their own pace, all of which support continuous improvement and goal setting. As educational institutions and content providers focus on increasing learner retention and satisfaction, gamification is becoming a widely adopted feature within digital learning environments in the UK.

UK EdTech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on sector, type, deployment mode, and end user.

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes preschool, K-12, higher education, and others.

Type Insights:

- Hardware

- Software

- Content

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes hardware, software, and content.

Deployment Mode Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes cloud-based and on-premises.

End User Insights:

- Individual Learners

- Institutes

- Enterprises

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual learners, institutes, and enterprises.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Top Edtech Company in UK:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK EdTech Market News:

- In June 2025, the UK's Department for Education (DfE) released new guidance to help schools incorporate artificial intelligence (AI) into their practices. This guidance aims to reduce teacher workload and improve learning experiences, while maintaining human oversight. Additionally, the DfE has announced a £1 million investment to support the development of AI tools for tasks like grading and providing personalized feedback. This initiative is part of the broader effort to integrate AI into UK schools and enhance educational outcomes.

- In June 2025, the Scottish Government launched a £5 million funding initiative to support university tech spin-outs. The investment will aid in commercializing research, with a focus on supporting students and university researchers in becoming entrepreneurs. Key projects include a Proof of Concept Fund to help develop prototypes and attract investors, a Spinout Pipeline Project to share commercialization expertise, and the Entrepreneurial Campus Blueprint to teach business skills. An additional £141,000 will train computing teachers in Scotland to meet increasing demand.

- April 09, 2024: UK-based tech company Multiverse bought AI talent software firm Searchlight to assist companies in filling skill gaps. The company closes critical skill gaps using a new kind of apprenticeship, harnessing the best of human-centered coaching, AI, and tech to deliver a measured, applied, guided, and equitable approach to learning.

- November 14, 2023: GoStudent launched its virtual reality language learning platform for tuition services provider in the UK. Tutors led an immersive VR group language learning experience open to students 13+. For the sessions, students practice their foreign language proficiency in 'real-life' settings. The tutors join in from desktops while students may engage either through a VR headset or a desktop. A maximum of seven students can attend any class.

UK EdTech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK edtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK edtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK edtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UK EdTech market reached a value of USD 8.1 Billion in 2024.

The market is expected to grow to USD 46.4 Billion by 2033, exhibiting a growth rate (CAGR) of 21.38% during 2025-2033.

Key growth drivers include increasing demand for online learning platforms, advancements in AI and immersive technologies, government support for digital education, rising adoption of personalized learning, and growing investments from EdTech investors in the development of innovative educational tools and platforms.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)