Abrasives Market Report by Product Type (Bonded Abrasives, Coated Abrasives, Super-abrasives, and Others), End-Use (Machinery, Metal Fabrication, Automotive, Electronics, Construction, and Others), Material Type (Natural Abrasives, Synthetic Abrasives), and Region 2025-2033

Abrasives Market Size:

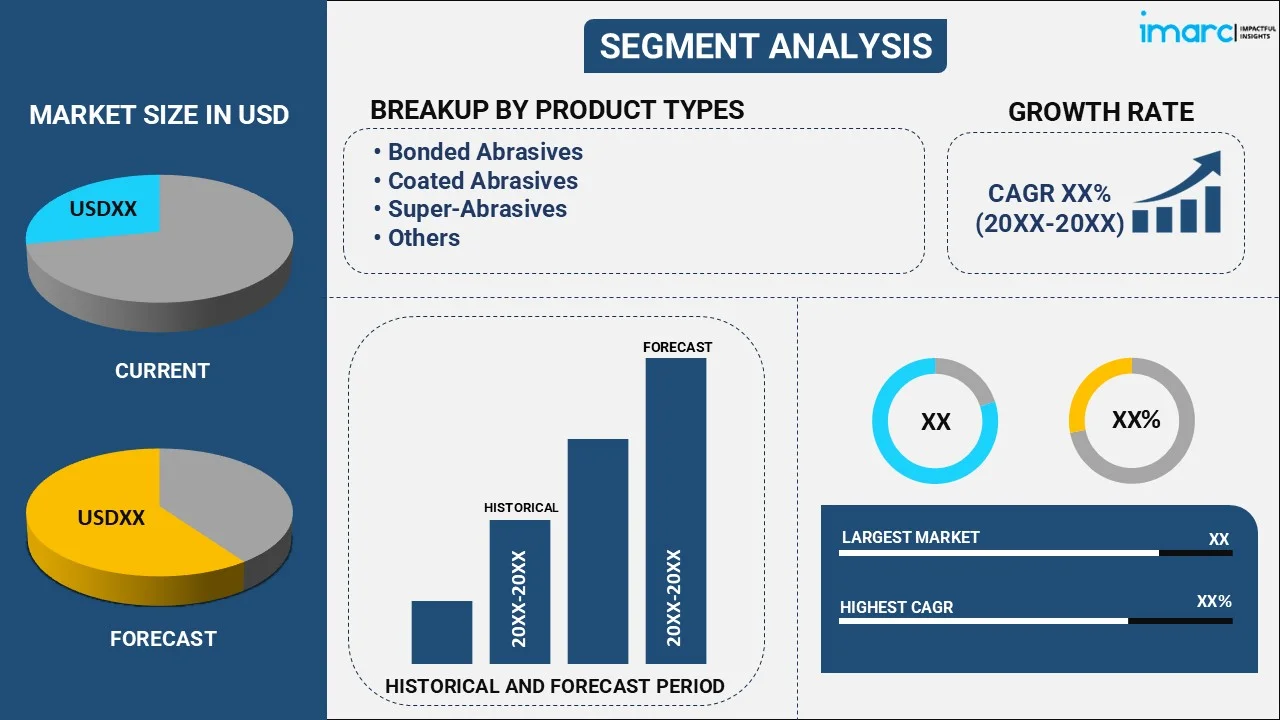

The global abrasives market size reached USD 49.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 74.4 Billion by 2033, exhibiting a growth rate (CAGR) of 4.31% during 2025-2033. Europe enjoys the leading position owing to its strong industrial base, advanced manufacturing capabilities, and high demand in sectors like automotive and construction. Moreover, the rising product demand from the automotive and manufacturing sectors, ongoing technological advancements, increasing industrial activities, expanding infrastructural development, and the need for precision and efficiency in various applications are some of the key factors contributing to the market growth.

Market Size & Forecasts:

- Abrasives market was valued at USD 49.9 Billion in 2024.

- The market is projected to reach USD 74.4 Billion by 2033, at a CAGR of 4.31% from 2025-2033.

Dominant Segments:

- Product Type: Bonded abrasives hold the largest share of the industry owing to their wide range of applications in heavy-duty tasks that require durability and efficacy.

- End-Use: Automotive represents the leading market segment driven by the extensive use of abrasives in various manufacturing and maintenance processes.

- Material Type: Synthetic abrasives exhibit a clear dominance in the market owing to their superior performance, consistency, and versatility compared to natural abrasives.

- Region: Europe leads the market due to its robust industrial base, advanced manufacturing technologies, and strong automotive and construction sectors.

Key Players:

- The leading companies in the market include Robert Bosch Power Tools GmbH, DuPont de Nemours, Inc., Fujimi Inc., Saint-Gobain Group, Henkel AG & Co. KGaA, 3M, Asahi Diamond Industrial Co., Ltd., Carborundum Universal Limited., TYROLIT Schleifmittelwerke Swarovski KG, NIPPON RESIBON CORPORATION, Krebs & Riedel Schleifscheibenfabrik GmbH & Co. KG, Abrasiflex Pty Ltd., Noritake Co., Limited, DEERFOS.COM, Sankyo-Rikagaku Ltd., etc.

Key Drivers of Market Growth:

- Growing Industrialization: High growth in the industrial sector in developing economies is propelling steady demand for abrasives in manufacturing, metal working, and construction industries.

- Rise in Innovation in Automotive Sector: The automotive sector is progressively employing abrasives for uses like surface finishing, polishing, and cutting, fueling steady growth in the market.

- Increasing Demand for Precision Tools: Increasing focus on high-performance machining and precision engineering is encouraging the use of advanced abrasive technologies in various industries.

- Advances in Technology: Ongoing advances in abrasive materials, such as the creation of superabrasives and nanostructured abrasives, are enhancing efficiency, longevity, and range of applications.

- Increase in Construction Operations: Continuing infrastructure development projects, especially in developing economies, are bolstering increased applications of abrasives in operations such as floor polishing, concrete cutting, and surface preparation.

Future Outlook:

- Strong Growth Outlook: The abrasives market is poised to continue with high growth, driven by growing industrial activity, technological advancements, and expanding application diversity.

- Market Evolution: The industry is shifting towards the creation of specialized and application-specific abrasives, meeting the transformed needs of sectors like aerospace, electronics, and automotive.

The global abrasives industry is experiencing dynamic growth due to a mixture of industrial, technological, and economic forces. Digital technologies are increasingly becoming important for enhancing operational effectiveness along the abrasives value chain. Companies are embracing smart manufacturing systems, predictive maintenance, and real-time quality monitoring to streamline output and minimize defects. The convergence of artificial intelligence (AI) and data analytics is facilitating enhanced forecasting, inventory control, and customer service. Furthermore, e-commerce sites are becoming dominant in the distribution of abrasives, providing people with greater access to information about products, prices, and customization. This digital transformation is facilitating market transparency and simplicity of end users in identifying and acquiring most appropriate abrasive solutions.

To get more information on this market, Request Sample

Abrasives Market Trends:

Increasing Manufacturing and Industrial Activity

The market for abrasives is witnessing noteworthy growth as a result of the sustained rise in manufacturing and industrial activity in different parts of the world. While industries like metal fabrication, machine shops, and foundry work are raising their output levels, they are continually using abrasives to grind, cut, polish, and surface condition. This need is also increasing as plants are implementing modern machines and automation systems that demand high-performance abrasive products to maintain steady throughput and component quality. Developing economies, especially in Asia-Pacific, are spending on industrial infrastructure, enticing multinational firms and enhancing domestic manufacturing capabilities. All these are causing an upsurge in consumption of abrasives throughout production lines. Moreover, industries are focusing on cost efficiency and process improvement, which is promoting the use of abrasives with durable and precision-built qualities. In 2024, A start-up supported by IIT Madras created India's first abrasive waterjet machine, capable of cutting flammable materials without producing heat, and it can significantly impact the semiconductor, aviation, defense, and diamond sectors. It was considered revolutionary since the machine was projected to be only one-third the price of those available in the market.

Increased Automotive Manufacturing and Maintenance Demand

The automotive sector is constantly generating demand for abrasives from its widespread use of grinding, polishing, and finishing equipment in manufacture and maintenance operations. Motor vehicle manufacturers are increasingly adding abrasives to applications like engine component machining, body panel sanding, and surface finishing. As worldwide automotive manufacturing increases owing to heightened need, particularly in emerging markets, original equipment manufacturers (OEMs) are relying on abrasives to increase quality control, decrease defects during production, and sustain high-performance levels. More broadly, the electric vehicle (EV) market is employing cutting-edge materials like aluminum alloys and composites, which need to be processed safely and efficiently using highly specialized abrasive tools. Concurrently, the collision repair and vehicle restoration aftermarket is experiencing constant demand for abrasive items like grinding wheels, sandpapers, and polishing pads. The shift to more sophisticated car designs and materials is also promoting the use of specialized abrasives that have to adhere to strict tolerance and safety standards. IMARC Group predicts that the global passenger cars market is projected to attain USD 3.4 Trillion by 2033. This is expected to further increase the need for sophisticated abrasives.

Advances in Abrasive Technology

Technological advancement is at the forefront of propelling the abrasives industry by increasing product functionality and expanding application potential. Companies are constantly evolving advanced abrasive products, including superabrasives such as cubic boron nitride (CBN) and synthetic diamonds, that are providing greater hardness, thermal stability, and wear life. Such advancements are making possible extended tool life, increased cutting speeds, and enhanced performance in high-stress applications like aerospace and automobile manufacturing. Also, precision-engineered grains, nano-structured abrasives, and hybrid bonding technologies are being combined in next-generation products enabling greater control of surface finishes and less material waste. Technological progress also underpins the manufacture of abrasives tailored to specific materials and processes, thereby increasing operating efficiency across industries. In 2024, Weiler Abrasives introduced its new Precision Express program, reducing the lead times for gear grinding wheels from months to just a few days. The initiative aims to assist gear producers in sectors like automotive, energy, and aerospace to enhance quality, boost consistency, and ensure timely delivery to their clients for greater reassurance.

Abrasives Market Growth Drivers:

Increased Demand from Construction

The abrasives market is experiencing steady growth with the global construction market continuing to innovate, particularly in rapidly urbanizing and developing emerging markets. Abrasives are finding widespread applications in concrete grinding, smoothing of surfaces, tile cutting, and polishing of floors, and thus they have become key equipment at construction sites. Government programs related to infrastructure upgradation, such as roads, bridges, and public buildings, are continuously driving the demand for long-lasting and effective abrasive products. In addition, the growing application of advanced building materials like engineered stone and high-strength concrete is driving the use of specialty abrasives that can manage more aggressive surfaces. With green construction becoming more popular, contractors are shifting to high-performance abrasives that aid sustainable construction through better material efficiency and minimizing energy consumption.

Growing Demand for Precision Engineering and Tooling

The growth of precision engineering in industries like aerospace, electronics, healthcare equipment, and defense is catalyzing the demand for highly specialized abrasive products. Those manufacturers are dealing with intricate components from difficult-to-machine materials, and they need abrasive tools that deliver high accuracy, consistency, and control. Abrasives are utilized in micro-grinding, lapping, and fine polishing operations to realize close tolerance dimensions and surface finishes to precise regulatory and functional requirements. With product miniaturization and materials development becoming the norm, manufacturers are turning to abrasives that provide reliable results without weakening component integrity. The move toward individualization and low-volume, high-accuracy manufacturing is also boosting the role of specialized abrasives that can be used to match one-of-a-kind manufacturing requirements. As industries challenge the limits of engineering performance, the abrasives market is reacting by creating enhanced solutions that answer the high standards set within precision manufacturing environments.

Sustainability and Environmental Regulations Shaping Market Dynamics

Environmental sustainability is driving the abrasives market, with regulatory agencies and end-users putting more value on environmentally conscious manufacturing processes as well as product performance. Abrasives manufacturers are counteracting this with the creation of waterborne bonding agents, recyclable products, and low-volatile organic compound (VOC) products that reduce environmental effects. These green options are becoming popular among companies looking to lower their carbon footprint and satisfy more stringent emissions and waste disposal regulations. Concurrently, manufacturers are investing in closed-loop equipment and lean production processes that conserve abrasive material waste and save energy. The move towards sustainable construction and automotive practices is also promoting the application of abrasives that enhance green activities through energy-efficient processing and extended tool life. With corporate environmental responsibility becoming a cross-industry strategic priority, demand for sustainable abrasive solutions is progressively rising. This trend is influencing product development, supply chain management, and customer buying behavior, ensuring that sustainability is a major mover in the market's continued evolution.

Abrasives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional for 2025-2033. Our report has categorized the market based on product type, end use, and material type.

Breakup by Product Type:

- Bonded Abrasives

- Coated Abrasives

- Super-abrasives

- Others

Bonded abrasives hold the largest share of the industry

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes bonded abrasives, coated abrasives, super-abrasives, and others. According to the report, bonded abrasives accounted for the largest market share.

The rising popularity of bonded abrasives owing to their widespread use and versatility across various applications is boosting abrasives market revenue. The product finds a wide range of applications in heavy-duty tasks that require durability and efficacy. They are commonly used in industries such as automotive, metalworking, and construction for cutting, grinding, and finishing operations. Bonded abrasives are suitable for demanding environments because strong bonding materials, like resins, ceramics, and metal bonds ensure that they can withstand high pressures and temperatures. Their broad applicability and performance consistency catering to both industrial and consumer needs contribute to their increasing demand.

Breakup by End-Use:

- Machinery

- Metal Fabrication

- Automotive

- Electronics

- Construction

- Others

Automotive represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes machinery, metal fabrication, automotive, electronics, construction, and others. According to the report, automotive represented the largest segment.

Abrasives market insights show that demand for abrasives across the automotive sector is driven by their extensive use in various manufacturing and maintenance processes. They are crucial for tasks such as grinding, polishing, and finishing automotive parts, including engines, brakes, and body panels. They help achieve precise dimensions, smooth surfaces, and high-quality finishes, which are essential for performance and aesthetics. The need for abrasives is further fueled by the automotive industry's steady growth with rising vehicle production and the need for high-performance components. Apart from this, abrasives are also finding new uses in specialized applications due to continuous improvements in automotive technology and the popularity of electric vehicles (EVs), which are strengthening the market growth.

Breakup by Material Type:

- Natural Abrasives

- Synthetic Abrasives

Synthetic abrasives exhibit a clear dominance in the market

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes natural abrasives and synthetic abrasives. According to the report, synthetic abrasives accounted for the largest market share.

The abrasives market highlights synthetic abrasives as the most preferred material owing to their superior performance, consistency, and versatility compared to natural abrasives. It is composed of engineered materials such as silicon carbide, aluminum oxide, and CBN and offers exceptional hardness, durability, and uniformity. These properties make them ideal for a wide range of applications, from precision grinding to heavy-duty cutting. Their ability to maintain sharp cutting edges and resist degradation under high temperatures and pressures further enhances their appeal in demanding industrial environments. Furthermore, synthetic abrasives can be tailored to specific needs through variations in grain size and bonding materials, allowing for customization across diverse applications and thus boosting their market demand.

Breakup by Region:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

Europe leads the market, accounting for the largest abrasives market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, Latin America, and the Middle East and Africa. According to the report, Europe represents the largest regional market for abrasives.

Abrasives market analysis revealed Europe as the leading region due to its robust industrial base, advanced manufacturing technologies, and strong automotive and construction sectors. The region’s well-established infrastructure leads to significant demand for abrasives in metalworking, precision grinding, and surface finishing. Europe is also home to major abrasives manufacturers and innovation hubs, contributing to the development of advanced abrasive products. Additionally, stringent regulatory standards and high-quality requirements in European industries drive the need for premium abrasives. The growth of key industries, coupled with increasing investments in technological advancements and sustainable practices, further fosters market expansion.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the abrasives industry include Robert Bosch Power Tools GmbH, DuPont de Nemours, Inc., Fujimi Inc., Saint-Gobain Group, Henkel AG & Co. KGaA, 3M, Asahi Diamond Industrial Co., Ltd., Carborundum Universal Limited., TYROLIT Schleifmittelwerke Swarovski KG, NIPPON RESIBON CORPORATION, Krebs & Riedel Schleifscheibenfabrik GmbH & Co. KG, Abrasiflex Pty Ltd., Noritake Co., Limited, DEERFOS.COM, Sankyo-Rikagaku Ltd., etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Based on the abrasives market research report, the competitive landscape is marked by the presence of several key players, ranging from global giants to regional specialists. Leading players are dominating the market with their extensive product portfolios and advanced technologies. These leaders leverage strong research and development (R&D) capabilities to innovate and enhance abrasive performance, often securing a competitive edge through superior product quality and technological advancements. Besides this, the market features numerous smaller and niche players who focus on specific segments or geographic regions, offering specialized solutions tailored to local needs. The market also sees a trend of consolidation and partnerships as companies seek to expand their market presence and capabilities through mergers, acquisitions, and strategic alliances.

Abrasives Market News:

- July 2025: Ahlstrom, a frontrunner in sustainable fiber-based specialty materials, announced that it has received a definitive proposal for its Abrasives business unit from Munksjö, a prominent global producer of decor paper solutions. The possible divestment would lead to Munksjö obtaining Ahlstrom's stake in the Arches facility in France, currently co-managed by both firms, along with the Abrasives business division, encompassing all related operations and staff.

- June 2025: Medical Manufacturing Technologies (MMT), a portfolio firm of Arcline Investment Management and a top global supplier of automated, process-focused medical device manufacturing solutions, revealed the acquisition of Comco, a distinguished leader in the micro-precision sandblasting industry. This strategic decision aims to greatly improve MMT's abrasive technology products while substantially broadening its microblasting features.

- June 2025: Generational Group, a top advisory firm for mergers and acquisitions in privately held companies, announced the sale of UK Abrasives, Inc. to GNPGraystar, a division of SurfacePrep. The purchase was finalized on May 9, 2025.

- March 2025: Sundara Partners, LLC, a private investment firm, revealed that it has finalized the sale of its portfolio company, Airbrasive Jet Technologies, a frontrunner in the micro-abrasive blasting sector, to Airbrasive, LLC located in Green Lane, PA (the “Buyer”).

- January 2025: SurfacePrep, a top distributor of surface finishing equipment and abrasive products, is excited to announce the purchase of Precision Abrasives, a well-known supplier of abrasive products and solutions. This purchase aims to improve SurfacePrep’s product lineup and broaden its presence in the surface preparation sector.

- January 2025: SNAM Abrasives Pvt. Ltd., a leader in producing silicon carbide grains (SiC) with more than forty years of experience, is excited to introduce its newest innovation: SNAM High Purity Silicon Carbide (HP SiC), boasting a purity level of up to 4N SiC (99.99%). Created to fulfill the rigorous demands of advanced applications, this innovative product highlights SNAM Abrasives' dedication to providing quality and remaining at the forefront of the constantly changing industrial environment.

Abrasives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Bonded Abrasives, Coated Abrasives, Super-Abrasives, Others |

| End-Uses Covered | Machinery, Metal Fabrication, Automotive, Electronics, Construction, Others |

| Material Types Covered | Natural Abrasives, Synthetic Abrasives |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Robert Bosch Power Tools GmbH, DuPont de Nemours, Inc., Fujimi Inc., Saint-Gobain Group, Henkel AG & Co. KGaA, 3M, Asahi Diamond Industrial Co., Ltd., Carborundum Universal Limited., TYROLIT Schleifmittelwerke Swarovski KG, NIPPON RESIBON CORPORATION, Krebs & Riedel Schleifscheibenfabrik GmbH & Co. KG, Abrasiflex Pty Ltd., Noritake Co., Limited, DEERFOS.COM, Sankyo-Rikagaku Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the abrasives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global abrasives market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the abrasives industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global abrasives market was valued at USD 49.9 Billion in 2024.

Sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary closure of numerous end-use industries for abrasives.

We expect the global abrasives market to exhibit a CAGR of 4.31% during 2025-2033.

The growing adoption of super-abrasives, such as industrial diamonds for precision grinding and cutting of hard metals, represents one of the factors catalyzing the global abrasives market.

Based on the product type, the global abrasives market can be segmented into bonded abrasives, coated abrasives, super-abrasives, and others. Currently, bonded abrasives account for the majority of the total market share.

Based on the end-use, the global abrasives market has been divided into machinery, metal fabrication, automotive, electronics, construction, and others. Among these, the automotive sector currently exhibits a clear dominance in the market.

Based on the material type, the global abrasives market can be bifurcated into natural abrasives and synthetic abrasives. Currently, synthetic abrasives represent the largest market share.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America, where Europe currently dominates the global market.

Some of the major players in the global abrasives market include Robert Bosch Power Tools GmbH, DuPont de Nemours, Inc., Fujimi Inc., Saint-Gobain Group, Henkel AG & Co. KGaA, 3M, Asahi Diamond Industrial Co., Ltd., Carborundum Universal Limited., TYROLIT Schleifmittelwerke Swarovski KG, NIPPON RESIBON CORPORATION, Krebs & Riedel Schleifscheibenfabrik GmbH & Co. KG, Abrasiflex Pty Ltd., Noritake Co., Limited, DEERFOS.COM, and Sankyo-Rikagaku Ltd.etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)