Activated Carbon Fiber Market Report by Raw Material (Synthetic, Natural), Application (Water Treatment, Food and Beverage Processing, Pharmaceutical and Medical, Automotive, Air Purification, and Others), and Region 2026-2034

Activated Carbon Fiber Market Size:

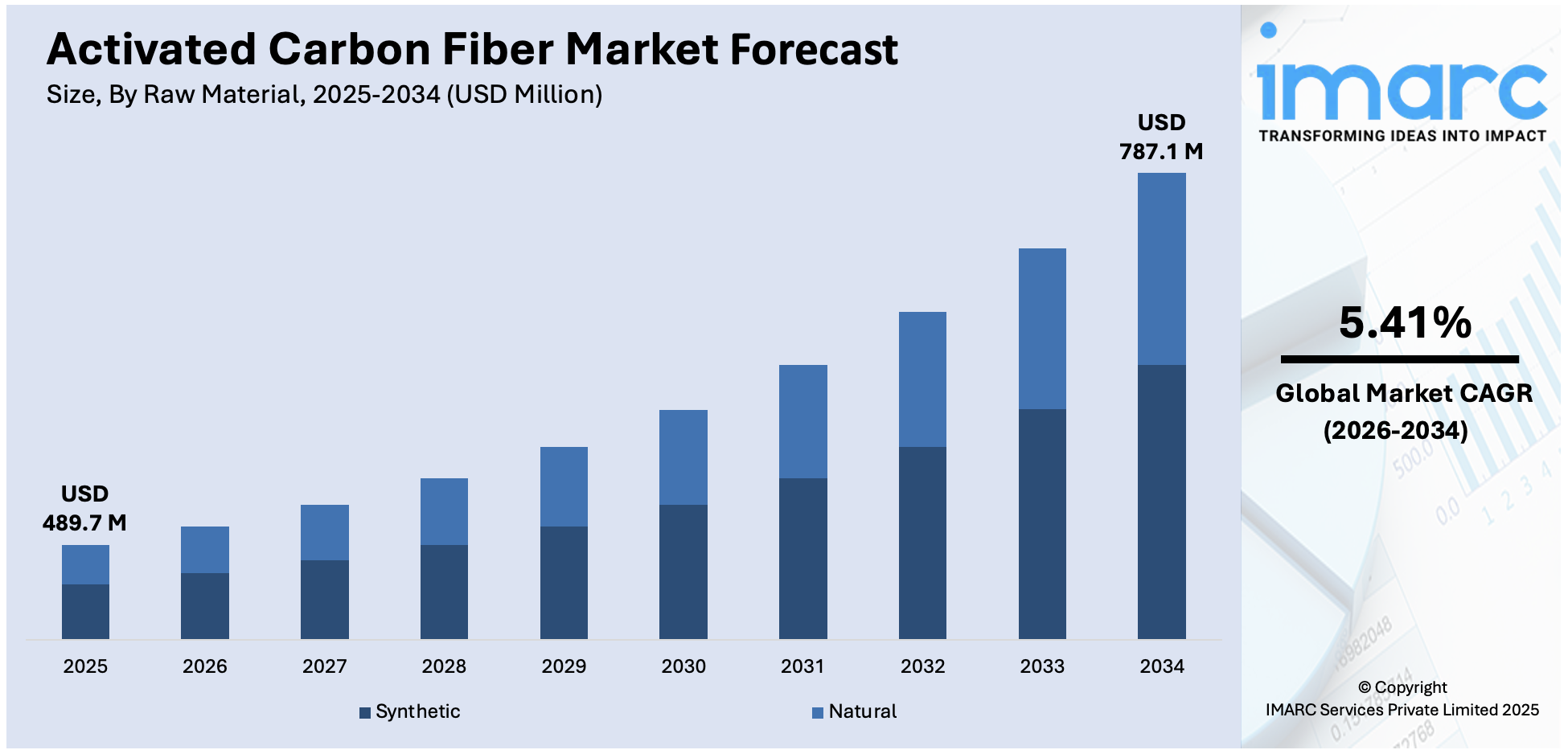

The global activated carbon fiber market size reached USD 489.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 787.1 Million by 2034, exhibiting a growth rate (CAGR) of 5.41% during 2026-2034. The market is experiencing steady growth driven by expanding applications in numerous end-use industries, rising consumer awareness regarding health and environmental issues, augmenting demand for water and air purifiers due to rising pollution, and continuous technological advancements in manufacturing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 489.7 Million |

|

Market Forecast in 2034

|

USD 787.1 Million |

| Market Growth Rate 2026-2034 | 5.41% |

Activated Carbon Fiber Market Analysis:

- Major Market Drivers: According to the activated carbon fiber market report, increasing demand for water and air purifiers due to growing pollution levels and stringent environmental regulations are major factors driving the market.

- Key Market Trends: The use of activated carbon fibers in emerging industries such as electronics, energy storage, and biomedical fields is a key trend shaping the market. These industries leverage the superior properties of activated carbon fibers for advanced applications, driving their demand.

- Geographical Trends: Asia-Pacific is the largest market for industrial carbon fibers, driven by rapid industrialization and urbanization in countries such as China and India Strict environmental regulations in these countries also contribute to increased demand for purification solutions. North America and Europe are also important markets due to the presence of well-established technological groups and greater environmental awareness. These regions are witnessing increased adoption of advanced purification technologies and energy storage solutions.

- Competitive Landscape: The activated carbon fiber market analysis suggests that the competitive scenario in the market is characterized by many key players investing in R&D to increase product performance and reduce costs If companies focus on expanding their product range and exploring new areas of implementation to gain competitive advantage.

- Challenges and Opportunities: Rising prices and availability of new storage options pose challenges to the growing market. However, advances in industrial production are expected to reduce costs and improve availability. The widespread use of activated carbon fibers in emerging industries offers huge growth opportunities. Continuous exploration of new uses and the development of innovative products tailored to specific applications are driving market expansion.

To get more information on this market Request Sample

Activated Carbon Fiber Market Trends:

Growing demand for water and air purification

The escalating demand for water and air purification is driving the activated carbon fiber market value of activated carbon fiber. Industrialization and urbanization are causing pollution in water and air bodies, and artificial purification is required for these elements. Along with this, the demand for advanced purification technologies is rising as governments across the globe impose tighter standards and regulations in terms of water and air quality, thus creating ample opportunities for companies that have solutions to decontaminate raw materials accustomed to various segments with chemical products Moreover, increasing awareness of health concerns related to indoor air quality and environmental issues such as automotive exhaust and wastewater treatment plant odors is propelling the activated carbon fiber demand in residential as well as commercial filtration systems. Additionally, the accelerating popularity of activated carbon fiber in processes such as pharmaceuticals, food, and beverage industries is the key factor that leads to the growth of the activated carbon fiber market. Moreover, increasing population and demand for clean water and air are the global shifting trends that are propelling the market.

Advancements in manufacturing technologies

Substantial development in the manufacturing processes of activated carbon fiber is favoring the growth of the market. Advanced production methods are resulting in the creation of new activated carbon fibers that are faster, cheaper, and higher performing. Such advances in technology are aiding manufacturers develop polymers that can lead to fibers with unique characteristics that are perfect for certain applications, making them more flexible and effective. Furthermore, surface modification of activated carbon fibers has advanced as well (chemical activation and physical activation), which facilitates the promotion of its pore structure, resulting in improvements relative to its specific surface area and hence overall adsorption capacity. This supports the global sustainability objective and green and sustainable production procedure with which the global environmental influence can be lessened. According to the activated carbon fiber market forecast, it is anticipated with the advancement of these technological improvements, production costs will decrease, and the accessibility of activated carbon fibers will increase.

Increasing applications in emerging industries

The escalating use of activated carbon fiber in growing industries is vital to propelling the market to expand. Activated carbon fibers are widely used in electronics, energy storage, and biomedical fields as a result of the high surface area, chemical stability, and electrical conductivity of ACFs. One of the applications of activated carbon fibers in the electronics sector is to be used as electrodes in supercapacitors (energy storage) and batteries, allowing the development of more efficient and smaller-sized energy devices. Along with this, they are used in various applications, especially in the biomedical sector once they exhibit improved biocompatibility and adsorption efficiency properties: wound dressings, drug delivery systems, and blood purification. In addition, the development of renewable energy technologies such as fuel cells and hydrogen storage has provided new opportunities for activated carbon fibers. Investigations on their applications as highly sophisticated textile materials, catalysts, and adsorbents for environmental remediation.

Activated Carbon Fiber Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global activated carbon fiber market report, along with forecasts at the global, regional and country levels from 2026-2034. Our report has categorized the market based on raw material and application.

Breakup by Raw Material:

- Synthetic

- Pitch-Based

- PAN-Based

- Phenolic-Based

- Viscose-Based

- Others

- Natural

Synthetic accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes synthetic (pitch-based, pan-based, phenolic-based, viscose-based, and others), and natural. According to the report, synthetic represented the largest segment.

Synthetic materials hold the activated carbon fiber market share within the market as a result of their properties such as hardness and malleability. These materials are typically composed of polyacrylonitrile (PAN) and phenolic resin provide high tensile strength, a large surface area, and tunable pore structures for a myriad of applications ranging from water and air purification to energy storage and biomedical applications. Additionally, the ability to maintain consistent quality and control production gives synthetic materials a major point in their favor, as it ensures that these materials will be able to reliably perform in highly demanding situations. Moreover, progress in synthetic material technology has allowed for a variety of high-performance activated carbon fibers with greater adsorptive capacity demand. Growing demand for cost- and long-term-effective industry solutions is creating a positive activated carbon fiber market outlook.

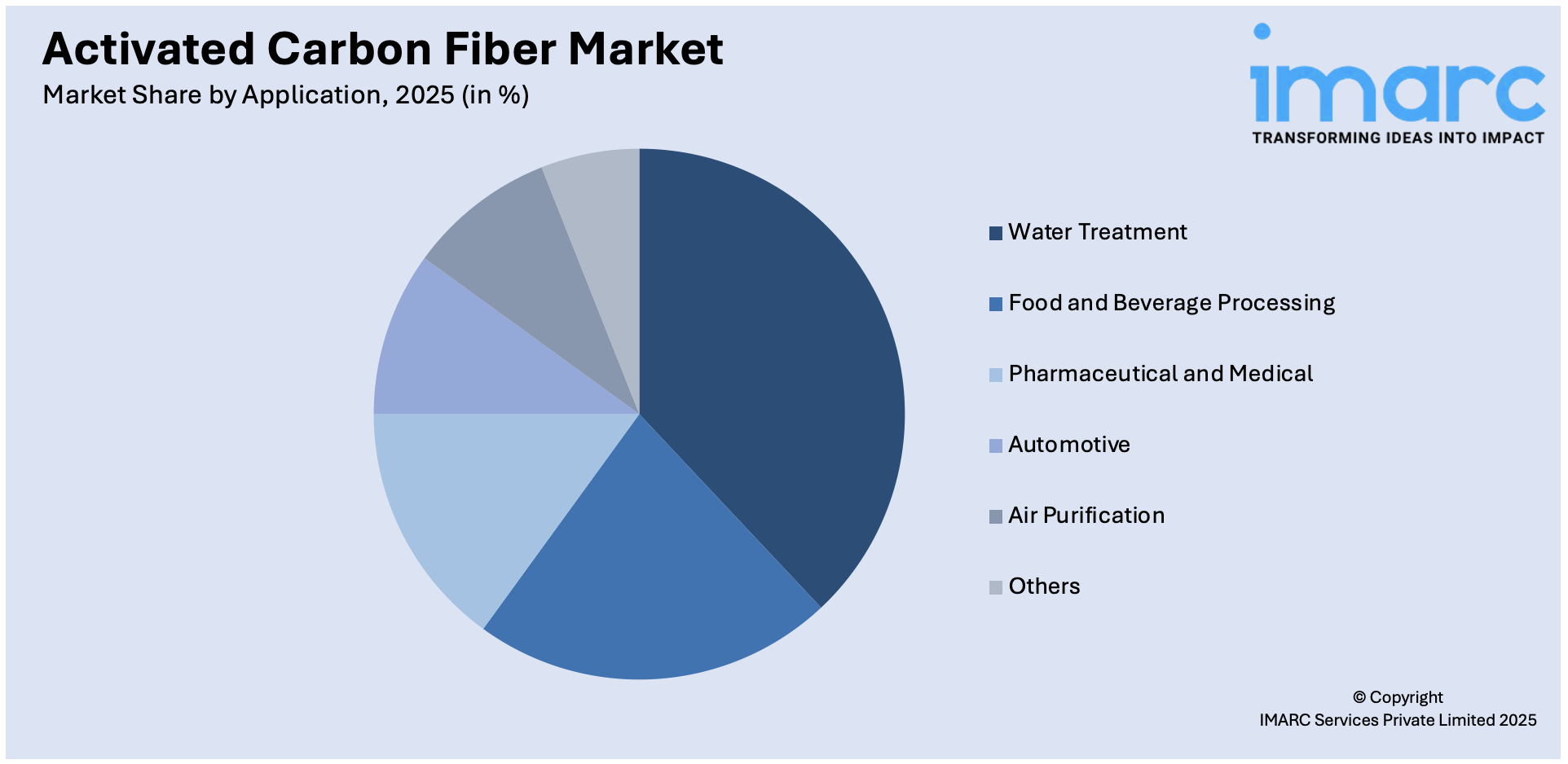

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Water Treatment

- Food and Beverage Processing

- Pharmaceutical and Medical

- Automotive

- Air Purification

- Others

Water treatment holds the largest share of the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes water treatment, food and beverage processing, pharmaceutical and medical, automotive, air purification, and others. According to the report, water treatment accounted for the largest market share.

The water treatment application remains the largest in the global market, as safe and clean water becomes critical across industrial and residential sectors. Carbon fibers when activated possess high adsorption properties along with a vast surface area, making them excellent substances in water consumables to remove impurities such as organic compounds, chlorine, and heavy metals. This feature makes them suitable for municipal water treatment plants, industrial wastewater treatment systems, and home water purifiers. Extensive advancements in water treatment technologies are another factor boosting the demand for advanced water treatment solutions due to increasing degrees of strictness in environmental regulations and standards worldwide. In addition, increased consumer knowledge regarding the health-related dangers of contaminated water is leading to the adoption of activated carbon fiber-based filters. With the global crises of water shortages and contamination becoming increasingly severe, activated carbon fibers are also being used to guarantee water quality, which is offering activated carbon fiber market scope.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific leads the market, accounting for the largest activated carbon fiber market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific represents the largest regional market for activated carbon fiber.

The Asia-Pacific region is the largest market, driven by increasing industrialization, urbanization, and stringent environmental regulations in countries such as China, India, and Japan. The prevalence of polluted water and air in these nations has led to a significant demand for advanced purification technologies among the populace. Advancing industrial sectors such as electronics, chemicals, and pharmaceuticals, have driven the need for activated carbon fibers in applications such as water treatment, air purification, and energy storage. Moreover, the rising consumer awareness related to health issues and the environment in the region drives activated carbon fiber market growth. In addition, growing government initiatives and investments in such sustainable and clean technologies are also fueling the demand for activated carbon fibers. The Asia-Pacific region is the largest regional market, as it economically and industrially advances with a requirement for high-performance purification and filtration solutions.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the activated carbon fiber industry include:

- Awa Paper & Technological Company, Inc.

- Evertech Envisafe Ecology Co. Ltd.

- Hangzhou Nature Technology Co., Ltd

- HPMS Graphite

- Jiangsu Sutong Carbon Fiber Co., Ltd

- Jiangsu Tongkang Activated Carbon Fiber

- Kuraray Co. Ltd.

- Nantong Yongtong Environmental Technology Co. Ltd.

- Taiwan Carbon Technology Co., Ltd.

- TOYOBO MC Corporation

- Unitika LTD

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Major stakeholders in the market are improving their presence and internationally expanded businesses to maintain and increase the productivity of activated carbon fiber worldwide. Manufacturers are significantly investing in R&D activities to introduce highly cost-efficient products integrated with multiple adsorption capacities and application-specific nature. Furthermore, they are increasing their production capabilities and forming new plants to accommodate demand, especially in the Asia-Pacific market. In addition, companies are partnering or engaging in mergers and acquisitions to widen their product offerings and increase activated carbon fiber market revenue.

Activated Carbon Fiber Market News:

- April 6, 2023: Toyobo Co., Ltd and Mitsubishi Corporation announced that they have launched a new joint venture company called Toyobo MC Corporation specializing in the planning, development, manufacturing, and sales of functional materials. These include photo-functional materials and fine chemicals, engineering plastics, water treatment membranes, environmental solution devices, activated carbon products, and activated carbon filters as well as spun-bond nonwoven fabrics, lifestyle materials, and high-performance fibers operations.

- March 31, 2023: Osaka Gas Co., Ltd. and Mitsubishi Heavy Industries, Ltd. (MHI) signed an agreement to conduct a feasibility study on a project to develop a CO2 value chain for CCUS (Carbon Capture, Utilization, and Storage), which involves transporting CO2 captured in Japan to be utilized overseas, such as, for producing e-methane using it as methanation feedstock gas and storing underground.

Activated Carbon Fiber Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered |

|

| Applications Covered | Water Treatment, Food and Beverage Processing, Pharmaceutical and Medical, Automotive, Air Purification, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Awa Paper & Technological Company, Inc., Evertech Envisafe Ecology Co. Ltd., Hangzhou Nature Technology Co., Ltd, HPMS Graphite, Jiangsu Sutong Carbon Fiber Co., Ltd, Jiangsu Tongkang Activated Carbon Fiber, Kuraray Co. Ltd., Nantong Yongtong Environmental Technology Co. Ltd., Taiwan Carbon Technology Co., Ltd., TOYOBO MC Corporation, Unitika LTD, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the activated carbon fiber market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global activated carbon fiber market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the activated carbon fiber industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global activated carbon fiber market was valued at USD 489.7 Million in 2025.

We expect the global activated carbon fiber market to exhibit a CAGR of 5.41% during 2026-2034.

The widespread adoption of activated carbon fiber in water filters, surface treatment liquid cleaning, purification of polluted gaseous streams, etc., as it provides high stiffness, tensile strength, density packaging, etc., is primarily driving the global activated carbon fiber market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary halt in numerous production activities for activated carbon fiber.

Based on the raw material, the global activated carbon fiber market has been segregated into synthetic and natural, where synthetic currently holds the largest market share.

Based on the application, the global activated carbon fiber market can be bifurcated into water treatment, food and beverage processing, pharmaceutical and medical, automotive, air purification, and others. Currently, water treatment exhibits clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global activated carbon fiber market include Awa Paper & Technological Company, Inc., Evertech Envisafe Ecology Co. Ltd., Hangzhou Nature Technology Co., Ltd, HPMS Graphite, Jiangsu Sutong Carbon Fiber Co., Ltd, Jiangsu Tongkang Activated Carbon Fiber, Kuraray Co. Ltd., Nantong Yongtong Environmental Technology Co. Ltd., Taiwan Carbon Technology Co., Ltd., TOYOBO MC Corporation, and Unitika LTD.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)