Active Geofencing Market Size, Share, Trends and Forecast by Type, Organization Size, End Use Industry, and Region, 2025-2033

Active Geofencing Market Size and Share:

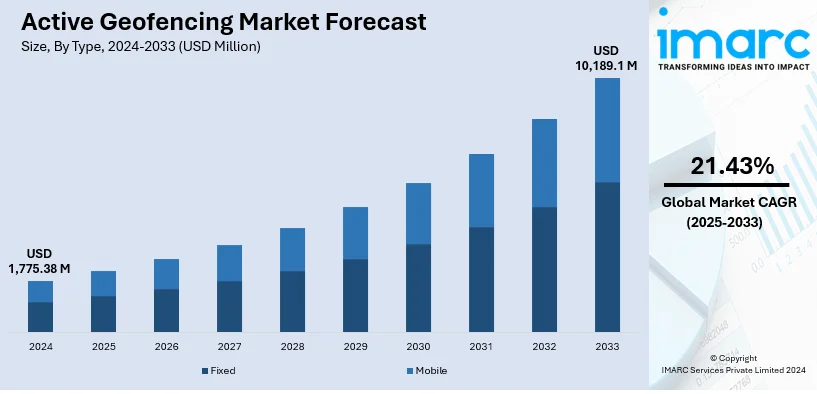

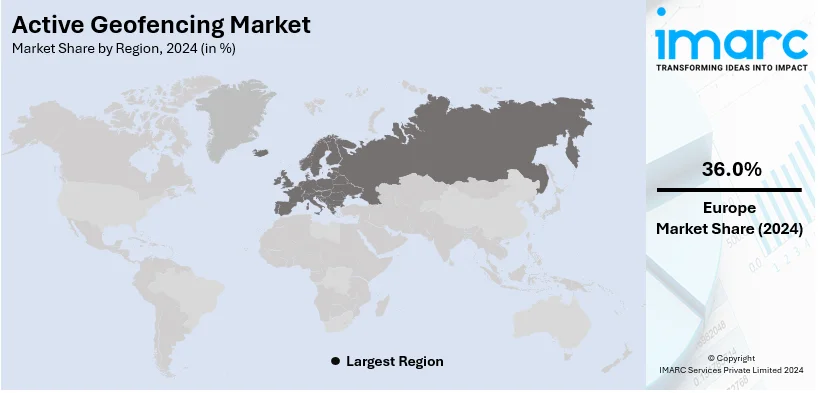

The global active geofencing market size was valued at USD 1,775.38 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 10,189.1 Million by 2033, exhibiting a CAGR of 21.43% from 2025-2033. Europe currently dominates the market, holding a market share of over 36.0% in 2024. The growth of the European region is driven by advanced technology adoption, strong retail and logistics sectors, and supportive regulatory frameworks.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,775.38 Million |

| Market Forecast in 2033 | USD 10,189.1 Million |

| Market Growth Rate 2025-2033 | 21.43% |

The widespread reliance on location-based services for precise targeting in marketing campaigns, real-time navigation, and client behavior analysis is encouraging the adoption of geofencing technologies across industries. Additionally, innovations in the internet of things (IoT)-enabled devices and their integration with geofencing solutions are enhancing automation capabilities, improving connectivity, and enabling real-time location tracking for smarter business operations and individual applications. Apart from this, retailers and advertisers are leveraging geofencing technology to deliver hyper-personalized promotions and location-based offers, enhancing client experiences and boosting engagement rates. Furthermore, favorable regulations surrounding the use of location-based technologies, along with the growing concerns over privacy and security, are encouraging businesses to adopt geofencing with enhanced compliance measures.

The United States is a key region in the market, driven by the rise of e-commerce platforms and logistics operations, which requires geofencing to optimize delivery routes, improve fleet management, and ensure timely order fulfillment. Moreover, many businesses are adopting geofencing for effective real-time monitoring of workforce activities, asset tracking, and ensuring compliance with safety regulations. Besides this, the introduction of geofencing-enabled devices tailored for niche markets, such as child safety, enhances market growth by addressing unique user needs and expanding application areas. In 2024, WatchinU launched the Nickelodeon-branded NickWatch smartwatch in the United States as a Walmart exclusive, featuring geofencing, GPS tracking, and child-friendly tools like games and secure communication. Parents can monitor their children’s location, set geofences, and communicate securely. The device is designed for children aged 5-10.

Active Geofencing Market Trends:

Rising Adoption in Retail Sector

Active geofencing is rapidly being adopting in the retail industry to improve customer engagement and boost sales. Retailers leverage this technology to send personalized notifications and promotions to customers’ electronic devices as they approach the store, enhancing the shopping experience. According to CBRE, retail store foot traffic has recovered to 81% of pre-pandemic 2019 levels. Furthermore, foot traffic is projected to surpass pre-pandemic levels by 2025. Consequently, the elevation of in-store shopping despite the proliferation of e-commerce segment will substantially propel the demand for advanced technologies like active geofencing to manage store purchases and consumer demands. This trend is further bolstered by the escalating importance of targeted marketing and the requirement for standing out in a competitive landscape. The ability to track customer preferences and movements allows retailors to personalize their offerings, leading to elevated conversion rates and customer positive feedback.

Advancements in Active Geofencing Technology

Significant technological advancements and innovations are substantially elevating market revenue. Such innovations include enhancements in battery efficiency, accuracy, and incorporation of geofencing with other technologies. Improved Bluetooth and GPS capabilities are facilitating more accurate location tracking, while innovations in machine learning (ML) and artificial intelligence (AI) are allowing for more predictive and smarter geofencing applications. For instance, in April 2024, Samsung launched Bespoke AI, a new range of AI appliances featuring built-in AI chips and integrated AI-geofencing technology. IBM reports that 34% of businesses currently utilize AI, while an additional 42% are investigating its possibilities. This innovation allows users to receive notifications and manage their appliances remotely. Additionally, such advancements aid businesses to optimize numerous operations like supply chain management, logistics, or personalized marketing, and offer better user experience by guaranteeing relevant and timely interactions based on real-time data.

Increasing Expansion in Transportation and Logistics

Market report underscores that the transportation and logistics industry is witnessing substantial growth in leveraging this technology for enhancing operational efficiency and fleet management. Major players in this sector are currently deploying geofencing to manage routes, monitor vehicle locations, and ensure timely deliveries. Furthermore, this technology facilitates the fuel costs reduction, delivery times improvement, and overall fleet management enhancement. For instance, in August 2023, BCAA partnered with Simon Fraser University to introduce and manage its Evolve e-bikes fleet across the campus. It comes with Evo app and geofencing technology to begin and terminate e-bikes trips at designated parking locations around the campus. According to Institute for Transportation & Development Policy (ITDP), the global e-bike market accounts for approximately 15% of the total electric vehicle market and is expected to continue growing. This trend is also boosted by the heightening demand for real-time monitoring and asset management, as well as the requirement for adherence with regulatory protocols associated with vehicle safety and operations.

Active Geofencing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global active geofencing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, organization size, and end use industry.

Analysis by Type:

- Fixed

- Mobile

Fixed stand as the largest component in 2024, holding 68.2% of the market share. Fixed type accounts for the largest segment in the global market, driven by its extensive adoption in end use industries like transportation, retail, and logistics. Fixed active geofencing technology provides dependable, location-based services for designated areas, improving customer engagement and operational efficiency. For instance, in June 2024, Transport Malta introduced geofencing system in the designated areas to improve traffic safety and flow by preventing Y-plate vehicles to park and wait in these designated areas. Its applications include asset tracking, inventory management, and targeted marketing, which further amplify its global demand. Businesses prefer fixed type for its ability to offer real-time, consistent updates and accurate location-based data, resulting in enhanced decision-making and tactical planning. This preference contributes to a positive market outlook.

Analysis by Organization Size:

- Small-scale and Medium-scale Businesses

- Large-scale Businesses

Small-scale and medium-scale businesses leverage active geofencing technology to improve localized user engagement and marketing operations. As highlighted in the market overview, this technology aids these businesses to send targeted notifications and promotions to nearby consumers, amplifying foot sales and traffic. This cost-efficient solution enables small and medium enterprises (SMEs) compete with major players by enhancing operational efficiency and offering personalized experiences, consequently solidifying market presence as well as client loyalty.

Large-scale businesses deploy active geofencing technology to improve their individual services, optimize logistics, and implement refined marketing strategies. Such enterprises profit from this technology by enhancing management of supply chain, tracking assets, and offering real-time updates to consumers. The ability to evaluate location-based data permits large companies to upgrade their market strategies, escalate operational efficiency, and offer individualized client experiences, subsequently maintaining competition and supporting market growth.

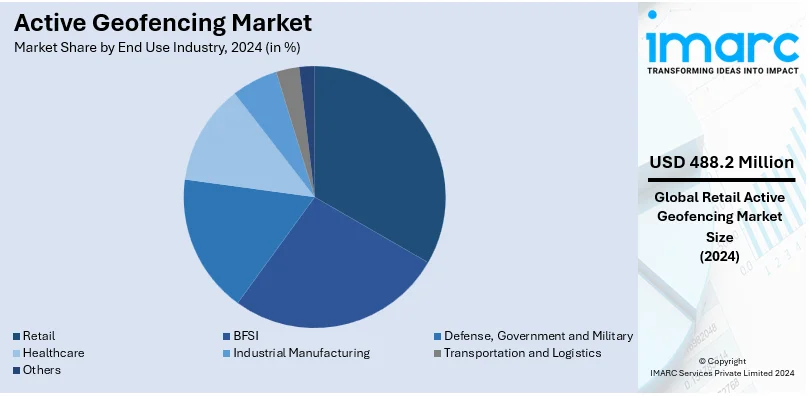

Analysis by End Use Industry:

- BFSI

- Retail

- Defense, Government and Military

- Healthcare

- Industrial Manufacturing

- Transportation and Logistics

- Others

Retail leads the market with 27.5% of market share in 2024. According to the market forecast, the retail industry is anticipated to remain the leading segment, driven by its capability of enhancing personalized marketing strategies and customer engagement. Retailers leverage active geofencing system to target customers with location-based endorsements, enhancing in-store sales and traffic. The technology’s efficacy in delivering relevant and timely advertisements has positioned it as an indispensable technology for retail tasks. For instance, in December 2023, McDonald's, a food service retail chain operator, announced the expansion of its Ready on Arrival Pilot mobile pickup technology to its top 6 markets by 2025. This technology leveraged geofencing to notify staff when a mobile order customer is approaching the restaurant, enabling them to prepare the order in advance. The company reported that the deployment of this geofencing technology has resulted in a 62-second reduction in customer wait times. In addition, active geofencing facilitates the effective security and management of inventory, further strengthening its importance in the retail segment.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of 36.0%. Europe is the dominant region in the market, driven by extensive adoption of advanced mobility solutions and strict environmental protocols. The region’s adherence to emissions reduction has propelled the implementation of active geofencing technology, especially in urban areas with low emission zones (LEZs). Additionally, recent developments like superior infrastructure development and substantial government support establish Europe as the dominant region in the global market dynamics. Furthermore, new features and launches are aiding the key player in sustaining their leadership in this highly competitive and evolving regional market. For example, in June 2023, Toyota, a prominent automobile manufacturer, introduced its latest C-HR C-segment SUV in Europe, featuring a newly integrated active geofencing function that enables automatic transition to EV mode when the vehicle enters a low emission area. This geofencing feature helps optimize battery consumption during an extended journey.

Key Regional Takeaways:

United States Active Geofencing Market Analysis

North America accounted for the largest market share of 72.50% in 2024. The US market is observing significant growth owing to the extensive application of digital technologies and strong internet connectivity. A survey by the Pew Research Center revealed that 95% of adults in the US access the internet, and 90% have a smartphone, while 80% have a home subscription for high-speed internet. This wide-ranging connectivity offers a solid ground for the expansion of the geofencing market, allowing businesses to utilize the technology for location-based services and expanding its consumer base. The retail industry, especially, is employing geofencing for focused promotions, in-store interactions, and customer loyalty initiatives. According to CBRE, retail store foot traffic has recovered to 81% of pre-pandemic 2019 levels. Furthermore, foot traffic is expected to exceed pre-pandemic figures by 2025. Moreover, the increasing dependence on mobile apps and the incorporation of IoT devices are also enabling the application of geofencing in various sectors including logistics, healthcare, and automotive. Apart from this, the rising government's funding for smart cities and infrastructure initiatives is also enhancing the demand for geofencing solutions, especially in areas such as traffic management, urban planning, and public safety.

Europe Active Geofencing Market Analysis

In the European countries, the rising demand for location-based services across various end-use industries verticals including retail, transportation, and urban management is significantly bolstering the market growth. According to the European Environment Agency, electric vehicles made up 22.7% of new car registrations and 7.7% of new van registrations in 2023. This shift towards EVs is a key factor that has been propelling the growth of active geofencing in the automotive sector. Besides this, geofencing solutions are also widely adopted in retail, where businesses use the technology for operational efficiency, targeted promotions, as well as enhanced customer engagement. Furthermore, the European Union's emphasis on data privacy and security, particularly with GDPR regulations, is also shaping the market by encouraging the development of secure and compliant geofencing solutions. According to EDPB, in 2019, the EEA Supervisory Authorities recorded more than 144,000 inquiries and complaints* as well as over 89,000 data breaches. Apart from this, the integration of IoT devices and the rise of connected infrastructure are also accelerating the demand for geofencing technologies across Europe, enabling enhanced operational efficiency and better customer experiences.

Asia Pacific Active Geofencing Market Analysis

The active geofencing market in the APAC region is witnessing strong growth being driven by the rising use of mobile devices and the expanding internet access throughout the area. As reported by the World Bank, internet accessibility in the East Asia & Pacific region reached 79% in 2023, establishing a strong ground for the growth of location-based services. Countries such as China, India, and Japan are leading this trend, owing to the rising adoption of active geofencing technology by end-use industries such as retail, logistics, Page 1 of 2 and e-commerce to improve client experiences and optimize operations. Apart from this, rising investment by players in the automotive industry is also aiding in growth, as geofencing is being incorporated self driving cars for better route optimization and enhanced safety. For example, it was reported in 2024 that the Chinese firm, BYD intends to invest 100 billion yuan (USD 13.8 billion) in sectors connected to autonomous driving. These factors are collectively driving the need for geofencing technology in the APAC region.

Latin America Active Geofencing Market Analysis

The active geofencing market in Latin America is expanding due to the increasing penetration of mobile internet and smartphones. As reported by GSMA, by the end of 2021, mobile internet users were recorded as 380 Million people, accounting for 60% of the population. This widespread connectivity is driving the adoption of geofencing technologies across various sectors in the region. Additionally, the rise of e-commerce and government investments in smart city projects are also contributing to the market's growth, with geofencing playing a vital role in urban management and public safety.

Middle East and Africa Active Geofencing Market Analysis

In the Middle East, geofencing market is driven by rising integration of the application in smart city initiatives, particularly in the UAE and Saudi Arabia, where governments are allocating funds toward digital infrastructure. For instance, various government initiatives including Saudi Arabia's Vision 2030 and the UAE’s Smart Dubai project are leveraging technology-driven solutions, including geofencing, to enhance urban mobility, reduce traffic congestion and improve public safety. The rapid growth of mobile penetration is further driving the adoption of geofencing for security and surveillance applications. As reported by Ericsson, smartphone penetration is rising at 5 percent annually. These solutions are increasingly used for real-time monitoring and crime prevention in urban centers, aligning with the region’s push toward smarter, safer cities and enhanced operational productivity.

Competitive Landscape:

Major participants in the market are improving their technologies to boost location precision and instant responsiveness. They are concentrating on merging geofencing with IoT platforms, AI, and data analytics to deliver more dynamic and automated solutions. Investments in research and development focus on creating tailored geofencing features for various sectors including retail, logistics, and security. Firms are likewise establishing strategic alliances to enhance their service ecosystems and boost compatibility among devices and platforms. As the regulatory environment evolves, enhancing data security and privacy measures is becoming increasingly crucial. In 2024 , Dealerware introduced Advanced Geofencing & Alerts to improve fleet security and efficiency for dealerships, providing customizable geofence limits, real-time SMS alerts, and a responsive alerts system. These instruments seek to tackle vehicle theft, improper usage, and issues in fleet management operations.

The report provides a comprehensive analysis of the competitive landscape in the active geofencing market with detailed profiles of all major companies, including:

- Bluedot Innovation Pty Ltd

- ESRI India Technologies Private Limited

- Google LLC (Alphabet Inc.)

- Infillion

- LocationSmart

- Radar Labs Inc.

Latest News and Developments:

- May 2024: E-SMART partnered with K&B Transportation to equip its fleet of over 700 trucks with E-SMART’s technology. This system utilizes advanced positioning to manage speed based on posted limits, significantly reducing speeding events by over 90%. In addition to speed management, E-SMART includes features like low bridge collision avoidance, active geofencing, and remote vehicle immobilization.

- April 2024: DS Automobiles introduced Geofencing on its DS 4 E-TENSE, DS 7 E-TENSE, and DS 9 E-TENSE models with the DS IRIS SYSTEM. This feature automatically activates Electric mode when entering Low Emission Zones (LEZs) in Europe, optimizing energy use and reducing environmental impact.

- April 2024: Samsung introduced a range of AI-powered appliances in India, branded as Bespoke AI. This collection including refrigerators, air conditioners, microwaves, and washing machines, is equipped with advanced AI features, including active geofencing capabilities.

Active Geofencing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed, Mobile |

| Organization Sizes Covered | Small-scale and Medium-scale Businesses, Large-scale Businesses |

| End Use Industries Covered | BFSI, Retail, Defense, Government and Military, Healthcare, Industrial Manufacturing, Transportation and Logistics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bluedot Innovation Pty Ltd, ESRI India Technologies Private Limited, Google LLC (Alphabet Inc.), Infillion, LocationSmart, Radar Labs Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the active geofencing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global active geofencing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the active geofencing industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Active geofencing is a technology that uses GPS, RFID, Wi-Fi, or cellular data to create virtual boundaries and monitor the movement of devices or objects. It triggers specific actions or notifications when these boundaries are crossed. It is widely used in marketing, logistics, and security.

The active geofencing market was valued at USD 1,775.38 Million in 2024.

IMARC estimates the global active geofencing market to exhibit a CAGR of 21.43% during 2025-2033.

The global active geofencing market is driven by the growing adoption of location-based services, rising demand for real-time tracking, and advancements in IoT and mobile technologies. Increased use in industries, such as retail, logistics, and security, are further propelling the market growth.

In 2024, fixed represented the largest segment by type, driven by its reliability, widespread use in permanent installations, and strong demand in retail, transportation, and security applications.

Retail leads the market by end use industry owing to its extensive adoption of location-based marketing, personalized customer engagement strategies, and efficient inventory and foot traffic management through geofencing technology.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global active geofencing market include Bluedot Innovation Pty Ltd, ESRI India Technologies Private Limited, Google LLC (Alphabet Inc.), Infillion, LocationSmart, Radar Labs Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)