Advanced Process Control Market Size, Share, Trends and Forecast by Component, End Use Industry, and Region, 2025-2033

Advanced Process Control Market Size and Share:

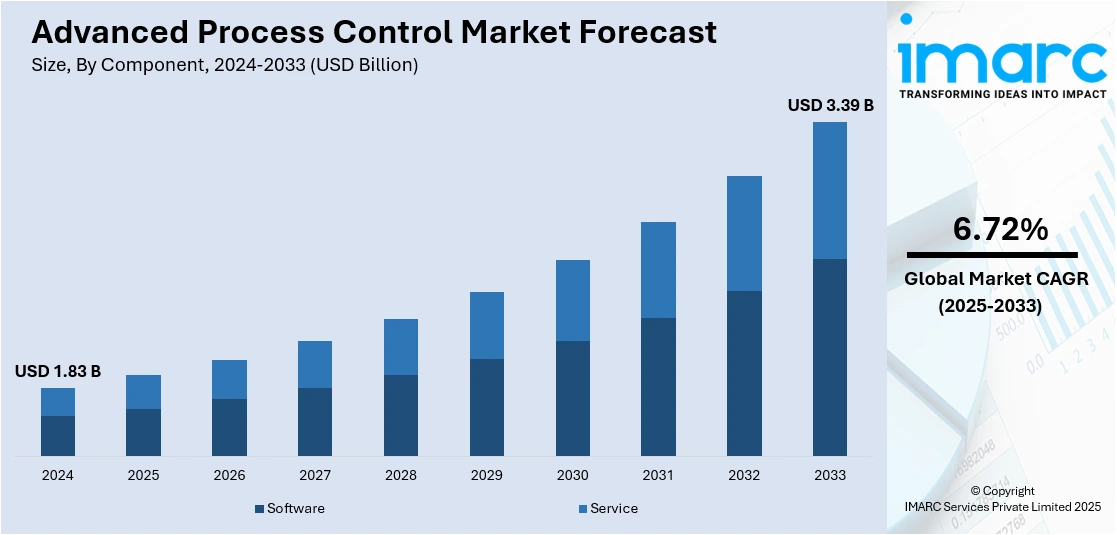

The global advanced process control market size was valued at USD 1.83 Billion in 2024. The market is projected to reach USD 3.39 Billion by 2033, exhibiting a CAGR of 6.72% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of 36.9% in 2024. At present, regulatory compliance and sustainability goals are encouraging industries to employ technologies that help lower emissions while maintaining productivity, driving the demand for advanced process control systems. Besides this, the growing use of the Internet of Things (IoT) is contributing to the expansion of the advanced process control market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.83 Billion |

|

Market Forecast in 2033

|

USD 3.39 Billion |

| Market Growth Rate 2025-2033 | 6.72% |

At present, the market is growing due to the rising demand for improved production efficiency, cost reduction, and optimized energy usage across industries. As manufacturers are working to enhance productivity and maintain consistent quality, they are adopting advanced control systems to manage complex processes more effectively. Industries, such as oil and gas, chemicals, power, and pharmaceuticals, continue to rely on these technologies to decrease variability and refine throughput. The ability of advanced process control systems to integrate real-time data, predict outcomes, and adjust operations dynamically supports better decision-making. Moreover, increasing employment of automation and digitalization is stimulating the market growth.

The United States has emerged as a major region in the advanced process control market owing to many factors. The growing emphasis on sustainability is offering a favorable advanced process control market outlook. As US manufacturers are focusing on compliance with regulatory standards, they are employing process control solutions to monitor and optimize emissions and waste. Industries, such as chemicals, food and beverages (F&Bs), and power generation, are seeking to improve productivity and reduce operational costs. Advanced process control systems help manage complex operations, optimize resource use, and decrease energy utilization. The presence of leading technology providers and high adoption of digital tools are supporting wider integration of these systems. The rise of Industry 4.0, big data analytics, and real-time monitoring is further accelerating the usage of advanced control technologies, making them vital for achieving operational excellence in the competitive US industrial landscape. As per the IMARC Group, the United States Industry 4.0 market size is projected to exhibit a growth rate (CAGR) of 19.54% during 2025-2033.

Advanced Process Control Market Trends:

Growing production of petrochemicals

Increasing production of petrochemicals is leading to a greater requirement for efficiency, safety, and process optimization, driving the demand for advanced process control systems. As per industry reports, approximately 2.3 Billion Metric Tons of petrochemicals were manufactured worldwide in 2023. The petrochemical industry involves continuous production systems that require precise control of variables, such as temperature, pressure, and flow rates. Advanced process control systems help in maintaining stability across these operations, enabling better yield and energy savings. With the rising demand for plastics, fertilizers, and synthetic materials, petrochemical plants need to scale up production while minimizing waste and emissions. Advanced process control aids in real-time monitoring and predictive maintenance, lowering downtime and refining safety. The industry’s focus on energy efficiency is further boosting the use of intelligent control solutions. As petrochemical companies are expanding and modernizing their facilities, the need for automated, data-based process optimization continues to grow, making advanced process control a vital tool in achieving competitiveness.

Rising concerns about industry-generated emissions

Rising concerns about industry-generated emissions are among the major advanced process control market trends. According to the US EPA, as of March 2025, industrial emissions ranked as the third-largest contributor to direct emissions. Regulatory compliance and sustainability goals are leading industries to adopt technologies that help lower emissions while maintaining productivity. Advanced process control systems optimize operations by adjusting process parameters in real time, minimizing waste, and reducing energy utilization. These systems enable industries to track emission levels accurately, respond quickly to deviations, and ensure compliance with environmental standards. In sectors like oil and gas, chemicals, and power generation, where emission levels are closely regulated, advanced process control plays a significant role in achieving cleaner operations. By improving process efficiency and lowering excess fuel use, these systems support both environmental and economic goals.

Increasing utilization of IoT

Rising IoT adoption is impelling the advanced process control market growth. As per industry reports, the worldwide IoT market was expected to expand, with the number of connected IoT devices anticipated to rise by 13% in 2024, hitting 18.8 Billion by the end of the year. With IoT devices being integrated into manufacturing systems, industries are gaining deeper visibility into operations and can quickly identify inefficiencies and deviations. This constant data flow supports advanced process control systems in making faster and more accurate adjustments. IoT also facilitates predictive maintenance by detecting equipment issues before they lead to failures, helping minimize downtime. In addition, connected devices allow remote access and control, making operations more flexible and responsive. As industries are adopting digital technologies to stay competitive, the combination of IoT and advanced process control is creating smarter and more automated environments.

Advanced Process Control Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global advanced process control market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component and end use industry.

Analysis by Component:

- Software

- Service

Service represented the largest segment in 2024. It plays a critical role in ensuring the effective deployment and functioning of advanced process control systems. Industries depend on service providers for system integration, regular maintenance, performance tuning, and troubleshooting. As advanced process control solutions are becoming more sophisticated, companies require specialized expertise to manage installations, updates, and system customizations. Service ensures minimal downtime, optimal output, and consistent process quality, which are crucial in high-value industries like oil and gas, chemicals, and power. With the rising adoption of smart manufacturing and digital transformation, the demand is growing for services, such as remote monitoring, data analytics support, and predictive maintenance. Service also includes training and technical support, helping clients operate systems efficiently and adapt to evolving technologies. In addition, service offerings allow industries to focus on core operations while outsourcing complex technical tasks.

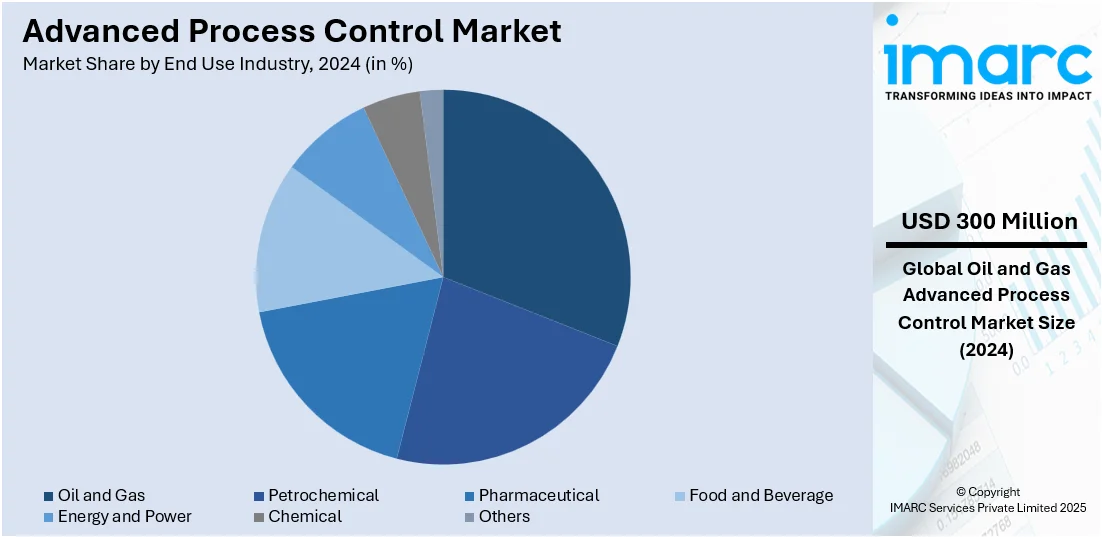

Analysis by End Use Industry:

- Oil and Gas

- Petrochemical

- Pharmaceutical

- Food and Beverage

- Energy and Power

- Chemical

- Others

Oil and gas hold 16.2% of the market share. This industry involves highly complex, continuous operations that demand precise control and optimization. It needs to improve efficiency, reduce operational costs, and maintain safety, making advanced process control systems essential. These systems help in monitoring and adjusting process variables in real time, ensuring optimal output and minimal waste. In both upstream and downstream operations, advanced process control enhances performance by improving flow rates, pressure control, and chemical dosing. The sector is also dealing with volatile energy prices and stringent environmental regulations, further creating the need for efficient and reliable control systems. Additionally, aging infrastructure and the need for predictive maintenance are encouraging the adoption of advanced control technologies. According to the advanced process control market forecast, with increasing investments in innovations and automation, oil and gas will continue to be in the leading position.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for a share of 36.9%, enjoys the leading position in the market. The region is noted for its rapidly expanding industrial base, strong focus on automation, and increasing demand for efficiency across sectors. Countries like India, Japan, and South Korea are wagering on manufacturing, chemicals, oil and gas, power, and pharmaceuticals, driving the demand for advanced process control systems. Industries in the region are aiming to reduce costs, enhance productivity, and ensure consistent product quality, which is encouraging the utilization of smart control technologies. Besides this, rising artificial intelligence (AI) adoption is enabling smarter decision-making, predictive analytics, and real-time process optimization. The Global Online Safety Survey, held from July 19 to August 9, 2024, surveyed 15,000 participants (teenagers and adults) across 15 countries and revealed that India was at the forefront of AI usage for tasks, such as refining workplace efficiency and supporting students. Additionally, the presence of a large population and rising energy needs are motivating companies to optimize resources and minimize waste by employing advanced process control.

Key Regional Takeaways:

United States Advanced Process Control Market Analysis

The United States is witnessing an uptick in advanced process control adoption due to the expanding energy and power sector. For instance, in 2024, power generation rose by 2.9%, driven by a 9% increase in renewable energy output, which was three times the enhancement in natural gas (3.3%). In 2024, renewables (wind, solar, hydro, biomass, and geothermal) accounted for over 25% of the total electricity generation in the US, up from 24% in 2023. As the demand for efficient grid management, power generation optimization, and renewable integration is growing, industries are shifting towards automated control systems for real-time data analysis and predictive maintenance. This transition is improving operational reliability and energy optimization, reducing waste and downtime. The energy and power sector's focus on digital transformation and decarbonization is enabling control system upgrades across thermal, hydro, and alternative energy sources. Integration with smart grid technologies and scalable infrastructure is further supporting market expansion.

Europe Advanced Process Control Market Analysis

Europe is seeing increased utilization of advanced process control owing to the expansion of the F&B processing sector. For instance, at the beginning of 2025, in Europe, there were 2 Million companies operating within the F&B service activities sector. As user preferences are shifting towards personalized and health-oriented products, manufacturers are adopting flexible control solutions to ensure consistency, compliance, and traceability. The F&B processing industry’s demand for optimized throughput, waste reduction, and energy optimization is leading to smart manufacturing utilization. Stringent food safety regulations and the need for real-time quality assurance are further driving implementation. Automation supports clean-in-place procedures, allergen control, and packaging consistency, ensuring compliance without compromising speed. Producers are also focusing on decreasing operational costs and enhancing sustainability across supply chains.

Asia-Pacific Advanced Process Control Market Analysis

The Asia-Pacific region is experiencing rising demand for advanced process control, fueled by the robust expansion of the pharmaceutical sector. According to the Ministry of Chemicals and Fertilizers, India's pharmaceutical sector for FY 2023-24 was estimated at USD 50 Billion, comprised of USD 23.5 Billion for domestic usage and USD 26.5 Billion for exports. With heightened focus on precision manufacturing, compliance, and product quality, pharmaceutical companies are integrating control technologies to enhance production consistency and reduce cycle times. The region's increased investments in drug manufacturing, biosimilars, and vaccine development are creating the need for process automation that ensures tighter control over variables and real-time monitoring. Stringent regulatory frameworks necessitate reliable systems for traceability, which advanced process control efficiently supports. Pharmaceutical sector growth is also driven by population needs and increasing healthcare spending, promoting the employment of scalable and reliable operations.

Latin America Advanced Process Control Market Analysis

Latin America is witnessing increasing advanced process control integration due to technological advancements and the expansion of the chemical industrial base. For instance, the chemical industry was projected to have contributed 2.5% to Brazil's GDP in 2024, based on data from the IMF. Companies are also focusing on maximizing output and ensuring safety in refining and chemical processing operations. The petrochemical sector's investments in modernization and energy efficiency are catalyzing strong demand for automated control systems that deliver better process insights and optimization.

Middle East and Africa Advanced Process Control Market Analysis

The Middle East and Africa region is experiencing heightened advanced process control usage, driven by the growing number of oil and gas sector projects. For instance, according to OPEC data, in 2023, Saudi Arabia possessed approximately 17% of the globe's confirmed oil reserves and 22% of the proved reserves held by OPEC. The region’s expansion in upstream and downstream operations requires greater process stability, safety, and cost management. In this context, advanced control systems enable precise monitoring, flow regulation, and equipment maintenance.

Competitive Landscape:

Key players are offering innovative solutions, investing in research and development (R&D) activities, and expanding their working presence. These companies provide advanced software and hardware systems that help industries optimize operations, improve quality, and reduce costs. They work closely with clients to customize solutions that meet specific industrial needs, which boosts adoption across sectors like oil and gas and manufacturing. Key players are also focusing on integrating emerging technologies, such as AI and real-time data analytics, into their offerings, making their systems more intelligent and reliable. Through strategic partnerships, acquisitions, and training services, they are supporting digital transformation and skill development in industries. Their continuous innovations aid industries in meeting evolving requirements, thereby stimulating the growth of the market. For instance, in January 2025, Onto Innovation enhanced its process control suite for 3D interconnects by unveiling 3Di™ technology on the Dragonfly® G3 system and introducing the EchoScan™ system for detecting sub-1µm voids in wafer bonding. The solutions facilitated instant defect evaluation via sophisticated process management, secured initial contracts from leading manufacturers, and sought to tackle significant yield issues in high bandwidth memory and hybrid bonding scenarios.

The report provides a comprehensive analysis of the competitive landscape in the advanced process control market with detailed profiles of all major companies, including:

- ABB Ltd.

- Aspen Technology Inc.

- Azbil Corporation

- Emerson Electric Co.

- FLSmidth & Co. A/S

- General Electric Company

- Honeywell International Inc.

- Onto Innovation

- Panasonic Corporation

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corporation

Latest News and Developments:

- May 2025: Asamaka Industries Ltd initiated its Advanced Automation Technology & Robotics Training Program to tackle Ontario’s technical skill deficit by providing practical education in robotics, industrial automation, and advanced process control. The initiative focused on underprivileged communities and offered mentorship, job preparedness, and practical training overseen by certified experts.

- March 2025: onsemi launched its Hyperlux™ ID series, the first real-time indirect time-of-flight (iToF) sensor in the industry, providing advanced process control through high-precision 3D imaging and depth measurements reaching up to 30 meters. This innovative sensor improved efficiency and safety in industrial settings by combining monochrome imaging with real-time depth processing in a compact design.

- March 2025: Valmet introduced the Valmet High Yield Pulping Optimizer, an advanced process control system designed to enhance pulping yield in the production of chemical brown pulp. The optimizer streamlined cooking and refining processes, allowing mills to increase pulp production, decrease wood utilization by up to 1%, and maintain quality while tackling high raw material expenses and improving operational sustainability.

- January 2025: FourKites launched its Intelligent Control Tower™, enhancing supply chain automation by combining real-time data, digital twins, and sophisticated process control via AI-based workflows. The platform facilitated proactive choices and independent actions while streamlining operations through customized AI solutions like Supplier Connect AI and PO Connect AI.

Advanced Process Control Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Service |

| End Use Industries Covered | Oil and Gas, Petrochemical, Pharmaceutical, Food and Beverage, Energy and Power, Chemical, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Aspen Technology Inc., Azbil Corporation, Emerson Electric Co., FLSmidth & Co. A/S, General Electric Company, Honeywell International Inc., Onto Innovation, Panasonic Corporation, Rockwell Automation Inc., Schneider Electric SE, Siemens AG and Yokogawa Electric Corporation. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the advanced process control market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global advanced process control market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the advanced process control industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The advanced process control market was valued at USD 1.83 Billion in 2024.

The advanced process control market is projected to exhibit a CAGR of 6.72% during 2025-2033, reaching a value of USD 3.39 Billion by 2033.

As industrial processes are becoming more complex, companies are seeking smarter control systems to manage variability, optimize resource use, and maintain consistent output. Besides this, the rising adoption of automation and digital technologies, including real-time data monitoring and predictive analytics, is supporting the integration of advanced control systems. Moreover, industries such as oil and gas, chemicals, and pharmaceuticals continue to rely on these solutions to meet production targets while ensuring safety and regulatory compliance.

Asia-Pacific currently dominates the advanced process control market, accounting for a share of 36.9% in 2024, driven by rapid industrialization activities, high demand for automation, and strong investments in manufacturing and energy sectors. Supportive government policies and rising focus on efficiency and sustainability are also encouraging widespread adoption across the region.

Some of the major players in the advanced process control market include ABB Ltd., Aspen Technology Inc., Azbil Corporation, Emerson Electric Co., FLSmidth & Co. A/S, General Electric Company, Honeywell International Inc., Onto Innovation, Panasonic Corporation, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Yokogawa Electric Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)