Aerospace Insurance Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Aerospace Insurance Market Size and Share:

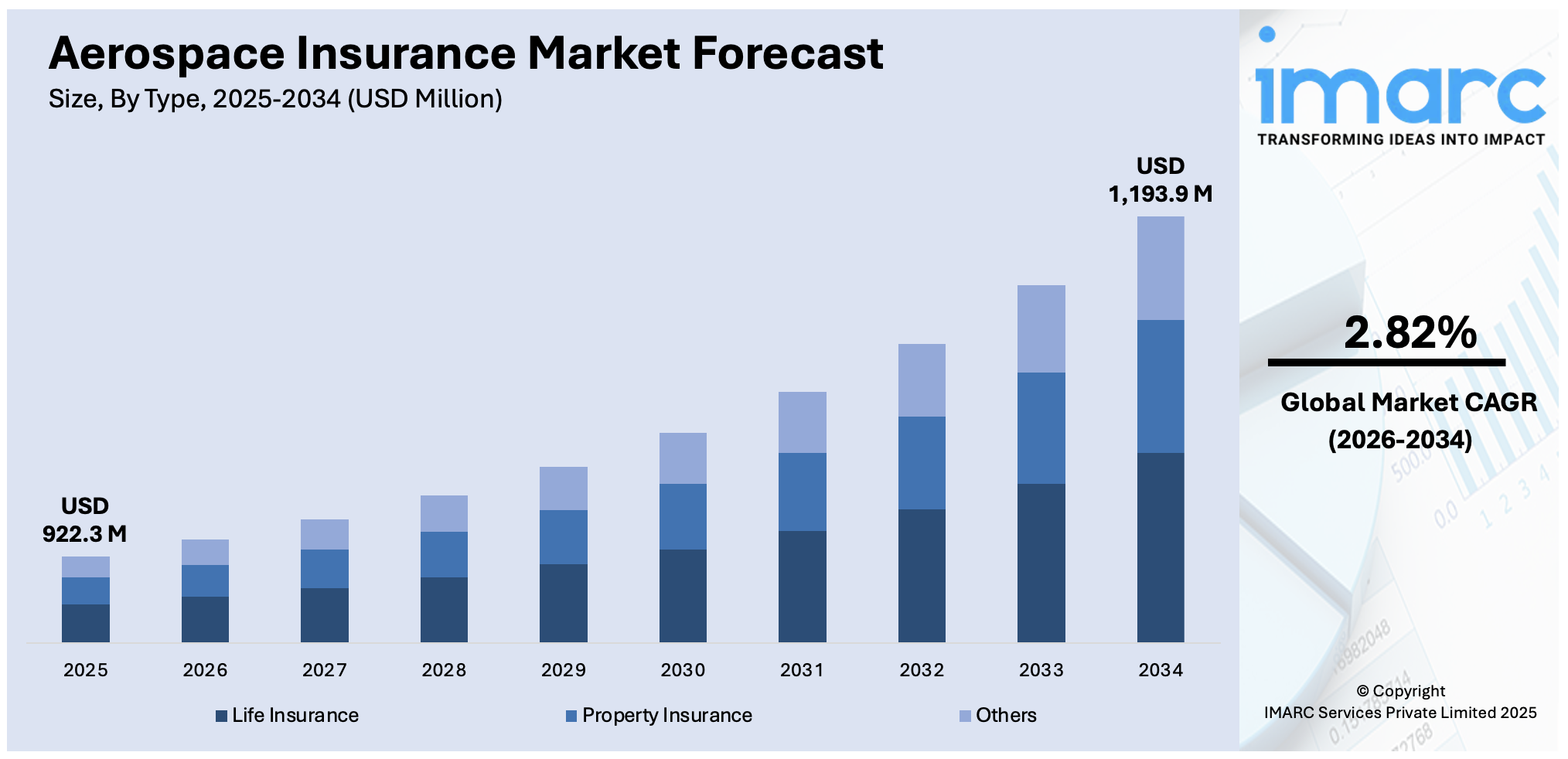

The global aerospace insurance market size was valued at USD 922.3 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,193.9 Million by 2034, exhibiting a CAGR of 2.82% from 2026-2034. North America currently dominates the market, holding a market share of 40.0% in 2025. The market is stimulated by factors including rising global air travel, growing commercial aviation fleets, and aerospace technology advancements. Increased aircraft manufacturing, coupled with mounting threats from environmental sources, accidents, and cyber attacks, drives demand. Regulatory needs for insurance and requirements for extensive risk management approaches in the aviation industry also drive the aerospace insurance market share. Space exploration and satellite technology breakthroughs also add to the industry's growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 922.3 Million |

|

Market Forecast in 2034

|

USD 1,193.9 Million |

| Market Growth Rate 2026-2034 | 2.82% |

One of the key drivers in the aerospace insurance industry is the ongoing expansion of air travel across the world. In 2024, the International Air Transport Association (IATA) reported a 10.4% rise in total air traffic over 2023, exceeding pre-pandemic levels by 3.8%. This increase is a sign of increasing demand for commercial aircraft and increased flight operations, which greatly enhances the demand for overall insurance coverage. Airlines, manufacturers, and maintenance providers all look for solid policies to prevent risks like accidents, damage, and liability. The increasing numbers of international and regional flights further complicate insurance needs, promoting demand for custom solutions. The greater regulatory attention to passenger safety and operational quality also fuels aerospace insurance market growth.

To get more information on this market Request Sample

The U.S. aerospace insurance industry is a top-performing sector, fueled by the expansion of commercial aviation, technological innovation, and the growing demand for specialized insurance. As airlines and aerospace companies increase their fleets, the demand for insurance policies that cover risks like accidents, damages, and liabilities increases. Furthermore, new risks like cybersecurity attacks and unmanned aerial vehicles (UAVs) generate new insurance demands. Regulatory updates, especially the ones involving security standards, the climate, and technology, determine policy options and risk management models, thereby creating more shape for the market. The industry development is also stimulated by advances in space travel and commercial space travel.

Aerospace Insurance Market Trends:

Increasing demand for commercial air travel

The growing need for business air travel is driving the market's growth. In 2024, total air traffic for the year was up 10.4% compared to last year, according to the International Air Transport Association (IATA). International air traffic grew by 13.6%, and domestic air traffic grew by 5.7%. This demand is due to several reasons, such as economic growth, globalization, and increasing middle-class population. When economies grow, individuals earn more disposable income, and this is what results in increasing demand for business and leisure travel. Airlines are increasing their fleets and routes to support this increased demand. In addition, the aerospace sector is experiencing a significant increase in passenger traffic and frequency of flight. Though this expansion is promising, it brings a greater degree of risk. Aerospace insurance helps to absorb these risks by providing insurance for a broad array of things that might go wrong, such as accidents involving aircraft, liability claims, and destruction of property or cargo. Aerospace insurers offer full-coverage policies to airlines, manufacturers of aircraft, and other parties involved in the industry to guarantee that they are able to fly safely and be sustainable. This involves insurance for the hull insurance to safeguard the physical plane, liability insurance to protect against possible legal action, and insurance for aviation risks, including hijacking or terrorism.

Technological advancements and new aircraft

Technological innovations in the aerospace sector are driving the growth of the market. The ongoing innovation in aircraft technology and design is creating new risks and complexities that have to be managed through insurance coverage. Advanced aircraft have advanced systems, such as autonomous flight features, complex control systems, and sophisticated avionics. According to a report released by the IMARC Group, the global autonomous aircraft market is anticipated to reach USD 48.34 Billion by 2033 at a CAGR of 16.25% during 2025-2033. Though these advancements make operations more efficient and safe, they also create possible vulnerabilities like cybersecurity attacks. Aerospace insurers are evolved to offer specialized coverage against such new risks to keep airlines and aircraft manufacturers ready. Another field of technological development in the aerospace industry is the creation of environment-friendly and fuel-saving airplanes, e.g., electric or hybrid-electric aircraft. The insurers are actively engaged in assessing the risks involved in using these new technologies and adapting insurance products to ensure any setbacks or liabilities resulting from their use.

Regulatory changes and risk management

Regulatory reforms and the growing focus on risk management in the aerospace sector are supporting the market growth. Aviation regulators across the globe are continuously reviewing safety and operational requirements to maintain the highest possible level of passenger safety and environmental stewardship. For example, in October 2024, the International Air Transport Association (IATA) introduced IATA Connect, which created an accredited community of professionals in aviation operations, safety, security, and compliance within airlines, regulatory bodies, and auditors. Members of the IATA Connect network will be able to access and use the platform to share information securely, exchange safety documents, and collaborate to foster future safety improvements in the aerospace sector. Airlines and aerospace firms are being scrutinized more intensely to meet these changing regulations. Increased emphasis on compliance requires broader insurance coverage. Aerospace insurance companies provide specific policies that meet the current regulation requirements, allowing their clients to comply with required standards. Also, risk management techniques are being incorporated into the aerospace industry. Airlines and aviation manufacturers are now actively evaluating and reducing potential hazards related to their operations. Aerospace insurance is a crucial part of this risk management solution, offering financial coverage against unexpected events like accidents, natural disasters, or supply chain interruptions.

Cybersecurity threats

With the aerospace sector more digitalized and aircraft systems and airline operations becoming more technology-dependent, cybersecurity threats are increasing. Cyberattacks, data compromise, and system weakness are a major threat to aviation security and operations. In 2023, about 68% of organizations globally reported a cyberattack, according to the International Telecommunication Union (ITU). Aerospace insurers are addressing this changing threat landscape by creating expert cyber insurance solutions that are bespoke to the particular needs of the industry. Aerospace cyber insurance covers potential loss stemming from cyber losses, such as business interruption, data breach response, and third-party claim-triggered liability. With the aerospace industry increasingly using digital technology to operate, demand for cybersecurity insurance products is one of the strong market drivers that guarantee aviation players are safeguarded against the economic impact of cyber attacks.

Natural disasters and extreme weather events

The rising frequency and intensity of natural disasters, like hurricanes, fires, and adverse weather conditions, create tremendous dangers to the aviation sector. To give an example, in the year 2024, there were 61,685 fire incidents documented across the United States that involved a total of 8,851,142 burned acres of land, as determined by the National Centers for Environmental Information. This may result in the destruction of aircraft, airports, and aeronautical infrastructures, entailing massive amounts of financial damage. Aerospace insurers offer coverage to mitigate such risks, allowing aviation stakeholders to recover from the financial effects of natural disasters. Climate change challenges, such as increased frequency and severity of weather events, are creating increased demand for insurance solutions that cover environmental and weather-related risks in the aerospace industry. As climate-related perils keep changing, aerospace insurers are evolving their products to respond to the emerging needs and challenges of the sector.

Aging aircraft fleets

Airlines also tend to fly older planes because of budget considerations or operational requirements. Although older planes can be safe and reliable, they tend to need maintenance and repairs more frequently, resulting in higher expenses. Accordingly, the international aircraft component maintenance, repair and overhaul (MRO) industry is poised to grow at a CAGR of 4.06% from 2025-2033 and will be worth USD 30.7 Billion in 2033, according to a report released by the IMARC Group. Aerospace insurance providers offer niche insurance coverage to mitigate the specific risks involved with older planes, enabling airlines to better control their operations. This insurance can also cover against probable mechanical breakdown, structural faults, and the added risk of unanticipated maintenance needs. As carriers weigh the maintenance difficulties and economics of operating aged fleets, risk solutions specifically for these particular hazards become critical, and thus the aging aircraft fleets become a force behind the aerospace insurance industry.

Aerospace Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Aerospace Insurance market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type and application.

Analysis by Type:

- Life Insurance

- Property Insurance

- Others

Property insurance holds the largest market share of 53.2% owing to the high cost and critical nature of aerospace assets. Aircraft, manufacturing plants, and supporting infrastructure are huge investments and therefore protection against damage, theft, or loss is highly critical. Physical damage to aircraft, hangars, terminals, and other major assets is part of the coverage. The increasing global air industry, fleet size increases, and infrastructure development drive the requirement for property insurance. Environmental damage risks, natural calamities, and accidents are further driving demands. Property insurance covers usually expand to new emerging technologies such as satellite systems that also need robust coverage. Dominance in this sector is dominated by the demand for comprehensive insurance to protect valuable assets throughout the aerospace industry.

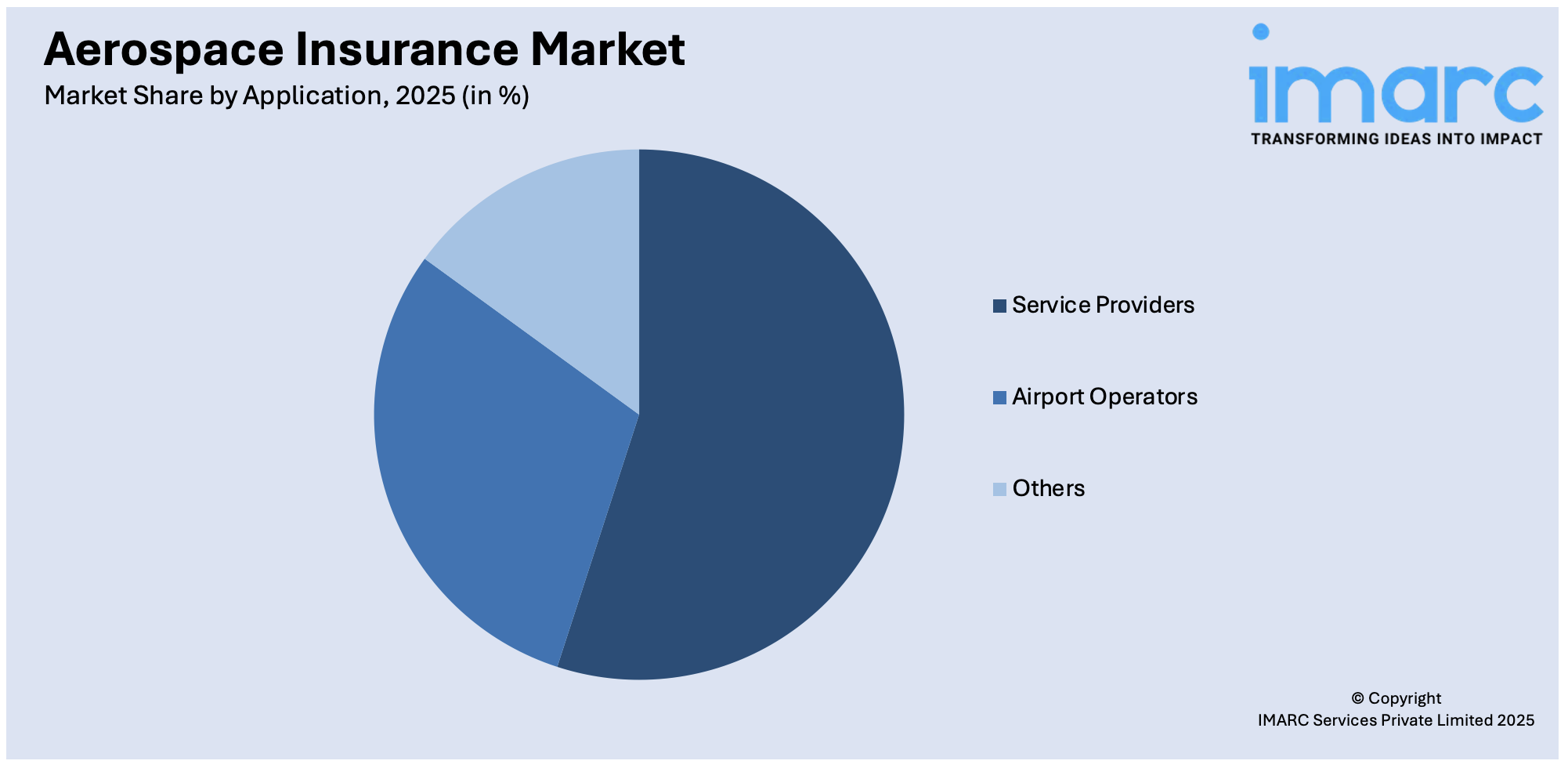

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Service Providers

- Airport Operators

- Others

Based on the aerospace insurance market forecast, the airport operators hold most shares in the aerospace insurance sector as they have broad exposure to a wide range of operational risks. These encompass passenger safety liability, ground handling of aircraft, terminal operations, and third-party property damage. Since airports are main infrastructure centers, they have to deal with huge traffic volumes and are exposed to accidents, natural catastrophes, equipment failure, and attacks. Airport operators' insurance usually covers property damage, business interruption, public liability, and acts of terrorism. Increased worldwide demand for air transport has prompted airport expansions and upgrading, which boosts their insurance requirements. Moreover, regulatory demands and the need to ensure safe, compliant operations further propel demand for full-coverage insurance, which reinforces their leading position in the market.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

North America dominates the aerospace insurance market growth along with share of 40.0% due to its mature aviation and aerospace sectors, where key players such as Boeing, Lockheed Martin, and major commercial airlines have headquarters located within the region. High air traffic volume, vast airport infrastructure, and ongoing technological advancement drive greater demand for comprehensive insurance coverage. Moreover, the area boasts a developed regulatory environment that requires stringent safety and liability regulations, leading operators to obtain comprehensive insurance policies. Expansion of industries like commercial space travel, drone flights, and military aviation also fuels specialized insurance requirements. Strong investment in aerospace development and high insurer concentration with specialized solutions maintain North America's dominance in the global aerospace insurance market outlook.

Key Regional Takeaways:

United States Aerospace Insurance Market Analysis

The United States aerospace insurance market is primarily driven by expanding commercial aviation activities, increasing satellite launches, and evolving regulatory and cybersecurity landscapes. Growth in air travel demand has led airlines and fleet operators to enhance coverage for hull, liability, and passenger risks. According to the Bureau of Transportation Statistics, in January 2025, airline traffic in the United States increased by 1.0% in comparison to January 2024, carrying 60.4 million domestic passengers and 10.4 million international passengers. Simultaneously, the rapid increase in space-based ventures, including satellite constellations for broadband, earth observation missions, and commercial space tourism, is increasing demand for specialized space insurance. Military modernization and procurement of advanced aircraft and drones are also contributing substantially to industry expansion. Moreover, technological advancements, while boosting operational efficiency, have heightened concerns around cyber threats and system vulnerabilities, prompting insurers to design products addressing cyber liability and digital infrastructure protection. Additionally, the emergence of electric vertical takeoff and landing (eVTOL) aircraft and unmanned aerial vehicles (UAVs) is reshaping risk profiles, encouraging innovation in underwriting and policy structuring. Regulatory oversight from the FAA and insurance compliance for new entrants into space and drone aviation are further impacting demand patterns.

Asia Pacific Aerospace Insurance Market Analysis

The Asia Pacific aerospace insurance market is expanding due to rapid growth in commercial aviation, rising defense budgets, and expanding space exploration initiatives across key economies such as China, India, Japan, and Australia. Numerous regional governments are investing heavily in defense aviation programs, including the acquisition of advanced fighter jets and surveillance drones, fueling demand for military-specific insurance products. For instance, overall, the Union Budget of India made a provision of Rs 6.81 lakh crore for Financial Year (FY) 2025-26 for the Ministry of Defence (MoD), as per the Press Information Bureau (PIB). This allocation is 9.53% more than the budgetary estimate of FY 2024-25 and accounts for 13.45% of the Union Budget. Moreover, out of the defense budget, Rs 48,614 Crore was allocated for aircraft and aero engines. Besides this, the region is also becoming more active in satellite launches and private space ventures, prompting insurers to develop tailored policies for launch, in-orbit, and post-mission risks.

Europe Aerospace Insurance Market Analysis

The Europe aerospace insurance market is experiencing robust growth, fueled by rising air cargo traffic, advancements in aerospace manufacturing, and the increasing emphasis on sustainable aviation solutions. Growth in e-commerce and global supply chains has significantly increased the volume of air freight, driving insurers to expand coverage for cargo aircraft and related ground operations. According to the International Air Transport Association (IATA), air cargo carriers in Europe experienced an 11.2% increase in demand annually in 2024, with capacity increasing by 7.8% year-on-year. Moreover, Europe’s strong presence in aerospace manufacturing, with companies such as Airbus and Rolls-Royce leading innovation in engines, airframes, and propulsion systems, is creating new insurance needs tied to product liability and testing phases. In parallel, the European Union’s aggressive climate targets are increasing investment in green aviation technologies such as hydrogen-powered aircraft and sustainable aviation fuels (SAFs), which introduce emerging risks and require customized insurance products. Furthermore, the integration of artificial intelligence (AI) and automation in air traffic control and flight operations is raising liability questions that demand more sophisticated underwriting. The increasing use of simulation-based pilot training and advanced maintenance systems is also influencing insurer evaluations of operational safety. Insurers are responding to these shifts by refining actuarial models to accommodate new risk classes and by collaborating with aerospace firms to develop tailored policies, encouraging innovation and growth in the market.

Latin America Aerospace Insurance Market Analysis

The Latin America aerospace insurance market is significantly influenced by the growing adoption of unmanned aerial vehicles (UAVs), the expansion of cargo aviation, and international partnerships in aerospace development. UAVs are being increasingly used for applications in mining, infrastructure inspection, and disaster management, prompting insurers to offer customized policies for drone operators. The expansion of e-commerce and logistics demand is driving air cargo operations, requiring coverage for goods in transit, aircraft, and ground handling services. As a result, the demand for air cargo carriers in Latin America increased by 10.9% in December 2024, recording the highest growth globally, with capacity increasing by 8.4%, as per the International Air Transport Association (IATA). Besides this, collaborations between Latin American aviation firms and global aerospace companies are fostering technology transfers and joint ventures, creating complex risk-sharing arrangements that are prompting the development of specialized insurance solutions.

Middle East and Africa Aerospace Insurance Market Analysis

The Middle East and Africa aerospace insurance market is being increasingly propelled by expanding commercial aviation networks, strategic defense acquisitions, and rising investment in aviation infrastructure. Gulf countries such as the UAE and Saudi Arabia are growing their fleets to support tourism and international travel hubs, creating sustained demand for hull, liability, and passenger coverage. For instance, 17.5 million international tourists visited Saudi Arabia from January to July 2024, recording a growth of 10% in comparison to January-July 2023. At the same time, several nations in North and Sub-Saharan Africa are upgrading military air capabilities, requiring tailored insurance solutions for defense aircraft and operations. The development of new airports and air traffic control systems across the region is further boosting insurance needs tied to construction risks and aviation technology deployment.

Competitive Landscape:

Market leaders in the insurance industry are strategically moving to keep pace with evolving customer demands and technological changes. They are heavily investing in digitalization, leveraging artificial intelligence (AI) and data analytics to enhance underwriting accuracy, claims handling efficiency, and customer interactions. Additionally, market leaders are diversifying their product offerings to address emerging perils like cybersecurity and climate change. Several insurers are adopting green practices and integrating environmental, social, and governance (ESG) factors into their investment portfolio and insurance products to meet changing customer needs and regulatory demands. They are also venturing into collaborations with Insurtech start-ups to remain innovative and competitive in a fast-changing industry environment.

The report provides a comprehensive analysis of the competitive landscape in the aerospace insurance market with detailed profiles of all major companies, including:

- Allianz SE

- American International Group Inc.

- Global Aerospace Inc.

- Hallmark Financial Services Inc.

- Marsh LLC

- China Life Insurance (Overseas) Company Limited

- Travers & Associates

- Malayan Insurance

- Axa S.A.

- ING Group

- Old Republic Aerospace

- Hiscox Ltd.

- Wells Fargo & Company

- Avion Insurance

Latest News and Developments:

- April 2025: Apollo and Moonrock launched a novel drone, eVTOL, and aviation innovation insurance facility. The facility will offer up to USD 22.5 million in property damage coverage and up to USD 100 million in liability coverage. The innovative insurance program is designed to satisfy the needs of eVTOL and various other aerospace innovation sectors, as well as to safeguard intricate operations involving everything from a single drone to bigger fleets.

- April 2025: Relation Insurance Services successfully completed the acquisition of True-Course Aviation Insurance Services Inc. With this acquisition, Relation Insurance Services aims to significantly expand its service offerings, particularly in the aerospace sector, with True-Course’s expertise in working with aviation companies.

- March 2025: Rokstone announced the launch of a mid-market aviation insurance program. The program, which is backed by Lloyd's insurer Tokio Marine Kiln's A-rated capabilities, will provide insurance for airport liability, general aviation, aircraft general liability, and product manufacturers' liability in every US state.

- December 2024: Redline Underwriting, in partnership with Allianz Commercial, announced the launch of its General Aviation Insurance product. The solution, which was created especially for the Latin American and Caribbean markets, offers extensive protection for fixed and rotor-wing aircraft used for business, pleasure, and private aviation.

Aerospace Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Life Insurance, Property Insurance, Others |

| Applications Covered | Service Providers, Airport Operators, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Allianz SE, American International Group Inc., Global Aerospace Inc., Hallmark Financial Services Inc., Marsh LLC, China Life Insurance (Overseas) Company Limited, Travers & Associates , Malayan Insurance, Axa S.A., ING Group, Old Republic Aerospace, Hiscox Ltd., Wells Fargo & Company, Avion Insurance, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aerospace insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global aerospace insurance market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aerospace insurance industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aerospace insurance market was valued at USD 922.3 Million in 2025.

The aerospace insurance market is projected to exhibit a CAGR of 2.82% during 2026-2034, reaching a value of USD 1,193.9 Million by 2034.

Key factors driving the aerospace insurance market include the growth of global air travel, rising aircraft fleets, and increasing demand for liability and property coverage. Emerging risks such as cyber threats, UAV operations, and space tourism, along with evolving safety regulations, further boost the need for specialized aerospace insurance solutions.

North America currently dominates the Aerospace Insurance market, accounting for a share of 40.0% driven by its advanced aviation infrastructure, high aircraft fleet size, and presence of major aerospace companies. Strong regulatory frameworks, increasing air travel demand, and innovations in commercial space and UAV sectors further strengthen the region’s leading market position.

Some of the major players in the Aerospace Insurance market include Allianz SE, American International Group Inc., Global Aerospace Inc., Hallmark Financial Services Inc., Marsh LLC, China Life Insurance (Overseas) Company Limited, Travers & Associates , Malayan Insurance, Axa S.A., ING Group, Old Republic Aerospace, Hiscox Ltd., Wells Fargo & Company, Avion Insurance, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)