Africa Mobile Money Market Report by Technology (USSD, Mobile Wallets, and Others), Business Model (Mobile Led Model, Bank Led Model), Transaction Type (Peer to Peer, Bill Payments, Airtime Top-ups, and Others), and Country 2026-2034

Africa Mobile Money Market Size:

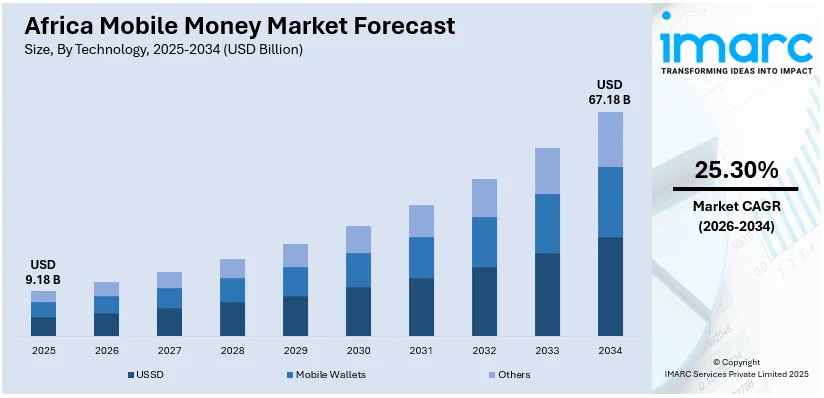

The Africa mobile money market size reached USD 9.18 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 67.18 Billion by 2034, exhibiting a growth rate (CAGR) of 25.30% during 2026-2034. The market is experiencing significant growth mainly driven by rising financial inclusion, innovative services, supportive regulations, technological advancements, strategic partnerships and expansion into ecommerce. These factors enhance service accessibility, security and user convenience, further contributing to the rapid adoption and evolution of mobile money services across the continent.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 9.18 Billion |

| Market Forecast in 2034 | USD 67.18 Billion |

| Market Growth Rate 2026-2034 | 25.30% |

Africa Mobile Money Market Analysis:

- Major Market Drivers: Key market drivers include the gradual increase in financial inclusion, innovative services like savings and credit along with supportive government regulations fostering a secure transaction environment. Various technological advancements like USSD and smartphone apps further improve the service delivery and user experience. Strategic partnerships between telecom operators, fintech companies and bank expands the reach and functionality. The rapid growth in remittances, integration with e-commerce and growing focus on security and data privacy further boosts Africa mobile money market growth.

- Key Market Trends: Key market trends include increasing financial inclusion through expanded services offerings like insurances and loans, integration with ecommerce platforms and significant growth in cross-border and digital remittances. Technological innovations are driving user friendly applications, further enhancing security measures to build trust and improving interoperability between different financial systems. There is also a gradual shift towards adopting eco-friendly practices and incorporating advanced technologies like blockchains to ensure transparency and security in transactions, thereby contributing positively to the Africa mobile money market growth.

- Competitive Landscape: Some of the major market players in the Africa mobile money industry include MTN, Orange, M-Pesa, Tigo-Pesa and Airtel Money, among many others.

- Challenges and Opportunities: The market faces various challenges including regulatory hurdles, infrastructure limitations and security concerns. Ensuring compliance with varying regulations across various countries and building robust network infrastructure in remote areas are one of the significant obstacles. In line with this, protecting users from fraud and ensuring data privacy remain a critical issue. However, there are abundant opportunities such as expanding financial inclusion mainly in rural regions and leveraging technological advancements like blockchain for enhanced security. The rise of ecommerce and integration of mobile money services with digital platforms also presents significant growth prospects in the Africa mobile money market growth, along with the increasing international remittances and cross-border transactions.

To get more information on this market Request Sample

Africa Mobile Money Market Trends:

Technological Advancements

Technological advancements like Unstructured Supplementary Service Data (USSD) technology and smartphone apps are significantly enhancing mobile money services in Africa. USSD allows users to access financial services on basic mobile phones without internet connectivity, making it accessible in remote areas. Smartphone apps offer a richer user experience with features like real-time transaction tracking, easy fund transfers, and bill payments. These innovations improve service delivery by making financial transactions faster, more convenient, and user-friendly, thereby increasing the adoption and effectiveness of mobile money platforms. For instance, PalmPay, a leading pan-African fintech, was recognized in 'The State of the Industry Report on Mobile Money 2024' by GSMA for driving mobile money adoption in Nigeria. With over 30 million accounts and a vast network of agents, PalmPay has been commended for its significant role in promoting financial inclusion and economic empowerment in Africa's mobile money sector. The report also highlighted Sub-Saharan Africa as a key driver of mobile money growth, particularly in Nigeria, Ghana, and Senegal.

Expansion of E-Commerce

Expansion into e-commerce is significantly driving the growth of mobile money in Africa. Mobile money platforms are increasingly integrated with online marketplaces, enabling seamless transactions for goods and services. This integration facilitates secure and convenient payments, enhances user experience, and broadens access to digital shopping. By linking mobile wallets to e-commerce sites, customers can easily pay for products, boosting online sales and supporting the digital economy. This synergy between mobile money and e-commerce is propelling the expansion of digital marketplaces across the continent. For instance, according to a report published by International Trade Administration (ITA), in Africa, mobile-driven growth is shaping the e-commerce landscape. By 2025, the continent is expected to see over 500 million e-commerce users, with a projected 40% penetration rate. As of 2021, Africa leads in mobile web traffic with 69% of total web traffic coming from mobile internet users. Online sales for groceries and personal care products are on the rise, while fashion and electronics are set to generate significant revenues, reaching $13.4 billion and $11.2 billion, respectively, by 2025.

Favorable Regulatory Support

Governments of various countries across Africa are implementing favorable regulations to support mobile money growth, ensuring security and trust in the system. These regulations include measures to enhance consumer protection, combat fraud, and ensure data privacy. By creating a robust regulatory framework, authorities are fostering a secure environment for mobile transactions, encouraging both users and service providers. Additionally, tax incentives and supportive policies are driving the adoption of digital payments, further promoting financial inclusion and the overall growth of the mobile money market across the continent. For instance, tax administrations in African countries are actively exploring the positive impact of tax incentives for digital payments on increasing tax revenue. Various incentives such as VAT rebates, POS subsidies, and mobile money tax exemptions have shown promising results in boosting cashless transactions and tax revenues in different countries. These initiatives aim to create a digital paper trail for economic transactions, ease taxpayers' compliance, and foster business formalization, thus contributing to increased tax revenues.

Africa Mobile Money Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on technology, business model and transaction type.

Breakup by Technology:

- USSD

- Mobile Wallets

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes USSD, mobile wallets and others.

USSD, or Unstructured Supplementary Service Data, is a critical technology in Africa's mobile money market. It allows users to access financial services via simple text commands on basic feature phones, making it highly accessible across the continent. This technology bypasses the need for internet connectivity, enabling even those in remote or underserved areas to conduct transactions, check balances, and perform other banking activities. USSD's low cost and widespread compatibility have driven financial inclusion, particularly in rural regions, contributing significantly to the growth and reach of mobile money services in Africa.

Mobile wallets represent a significant innovation in Africa's mobile money market, providing a digital solution for managing money via smartphones. These wallets allow users to store funds, transfer money, pay bills, and purchase goods and services with ease. The proliferation of mobile wallets has been facilitated by the increasing smartphone penetration and improving internet connectivity across the continent. Mobile wallets offer enhanced security features, convenience, and a range of financial services that extend beyond basic transactions, fostering economic empowerment and inclusion. Their role in digitizing the economy has been pivotal, driving the evolution of financial services in Africa.

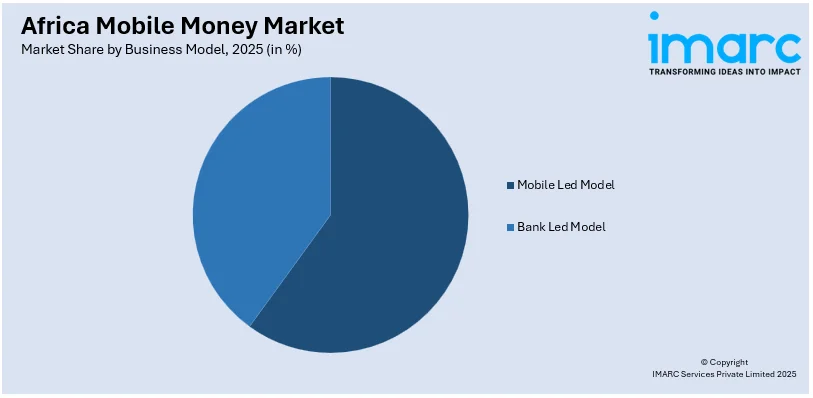

Breakup by Business Model:

Access the comprehensive market breakdown Request Sample

- Mobile Led Model

- Bank Led Model

A detailed breakup and analysis of the market based on the business model have also been provided in the report. This includes mobile led model and bank led model.

The mobile-led model in Africa's mobile money market is driven primarily by mobile network operators (MNOs). In this model, MNOs provide mobile financial services directly to users through their extensive network infrastructure. This approach leverages the widespread availability and usage of mobile phones, allowing customers to perform transactions, save money, and access credit without needing traditional bank accounts. Mobile-led models have been instrumental in reaching unbanked populations, particularly in rural areas, and have contributed significantly to financial inclusion by offering accessible, affordable, and user-friendly financial services.

The bank-led model in Africa's mobile money market involves traditional financial institutions spearheading the provision of mobile financial services. In this model, banks collaborate with mobile network operators to extend their banking services to mobile users. Customers can link their bank accounts to mobile platforms, enabling them to perform banking activities such as transferring funds, paying bills, and checking account balances via mobile devices. This model ensures regulatory compliance and integrates mobile services with existing banking infrastructure, enhancing security and trust. The bank-led approach aims to deepen financial inclusion by leveraging the established trust and resources of traditional banks.

Breakup by Transaction Type:

- Peer to Peer

- Bill Payments

- Airtime Top-ups

- Others

Bill Payments represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the transaction type. This includes peer to peer, bill payments, airtime top-ups and others. According to the report, bill payments represented the largest segment.

Bill payments lead the market accounting for the largest of Africa's mobile money market share, driving significant adoption and usage. This service allows users to conveniently pay for utilities such as electricity, water, and internet directly from their mobile devices. The ease and accessibility of mobile bill payments have made them immensely popular, reducing the need for physical visits to payment centers and fostering financial inclusion. This segment's growth reflects the increasing reliance on mobile financial solutions to simplify everyday transactions across the continent. In February 2023, Cellulant, a leading African payments provider, partnered with Dubai-based fintech company Money Q to launch KrosPayz, a digital payments platform for expatriates in Africa. This collaboration aims to facilitate online payments for goods and services, as well as mobile remittances, contributing to financial inclusion and economic stability. The KrosPayz digital wallet will initially be available in Malawi, offering utility bill payments, airtime recharge, fund transfers, and QR code-based purchases.

Breakup by Country:

- Tanzania

- Kenya

- Uganda

- Ghana

- Others

Kenya leads the market, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major markets in the country, which include Tanzania, Kenya, Uganda, Ghana and others. According to the report, Kenya was the largest market for mobile money in the Africa.

Kenya leads the market, accounting for the largest Africa mobile money market share. The country's widespread adoption of mobile money services, primarily driven by the success of M-Pesa, has revolutionized financial transactions. Kenya's mobile money ecosystem facilitates various services, including peer-to-peer transfers, bill payments, and business transactions, contributing to financial inclusion and economic growth. The robust regulatory framework and supportive government policies have further bolstered the market, positioning Kenya as a leader in mobile financial services on the continent. For instance, in July 2024, the Association of Fintechs in Kenya announced its partnership with the Africa Fintech Summit (AFTS) 2024. This collaboration aims to promote fintech innovation and create new opportunities in Africa's financial technology landscape.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided. Some of the major market players in the Africa mobile money industry include MTN, Orange, M-Pesa, Tigo-Pesa and Airtel Money, among many others.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The Africa Mobile Money Market is highly competitive, with key players like M-Pesa, Tigo Pesa, and MTN Mobile Money leading the charge. These services dominate due to their widespread adoption, extensive agent networks, and innovative offerings. For instance, in March 2024, Mastercard and MTN Group joined forces to introduce mobile payment solutions for consumers and small businesses across Africa. The collaboration will integrate Mastercard's technology with MTN's FinTech platform, enhancing the capabilities of 60 million active monthly MTN Mobile Money wallets. The partnership aims to expand access to digital commerce and financial services across 13 African markets. Smaller players and new entrants face challenges in gaining market share due to regulatory hurdles, infrastructural limitations, and consumer trust issues. However, the market is evolving with increasing investments in fintech innovations and strategic partnerships, fostering a dynamic environment with opportunities for growth and diversification.

Africa Mobile Money Market News:

- In April 2024, MTN South Africa collaborated with banking and financial services companies to integrate the digital payments solution PayShap into its mobile money platform MoMo. This move aims to provide accessibility and convenience to the unbanked community. The integration is expected to increase financial inclusivity and revolutionize digital finance in South Africa. This partnership with Investec and Electrum reflects a major milestone in the world of mobile payments.

- In November 2023, Orange launched Max it, a super-app designed for users in Africa and the Middle East, integrating telecommunications, financial services, and e-commerce. The app, initially available in five countries, aims to simplify daily activities by offering account management, Orange Money services, and an e-commerce platform. With a goal of 45 million users by 2025, it is set to cater to the rapidly growing smartphone user base in the region.

Africa Mobile Money Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | USSD, Mobile Wallets, Others |

| Business Models Covered | Mobile Led Model, Bank Led Model |

| Transaction Types Covered | Peer to Peer, Bill Payments, Airtime Top-ups, Others |

| Countries Covered | Tanzania, Kenya, Uganda, Ghana, Others |

| Companies Covered | MTN, Orange, M-Pesa, Tigo-Pesa, Airtel Money, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Africa mobile money market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Africa mobile money market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Africa mobile money industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Africa mobile money market was valued at USD 9.18 Billion in 2025.

We expect the Africa mobile money market to exhibit a CAGR of 25.30% during 2026-2034.

The sudden outbreak of the COVID-19 pandemic has led to the growing adoption of mobile money over conventional cash-based methods across several African nations to administer the financial transactions with minimal human interaction, thereby mitigating the risk of the coronavirus infection.

The rising internet penetration, along with the increasing awareness towards the associated benefits of mobile money, such as ease of accessibility, 24/7 availability, security, lower transaction costs, etc., is primarily driving the Africa mobile money market.

Based on the technology, the Africa mobile money market can be categorized into USSD, mobile wallets, and others.

Based on the business model, the Africa mobile money market has been segregated into mobile led model and bank led model.

Based on the transaction type, the Africa mobile money market can be bifurcated into peer to peer, bill payments, airtime top-ups, and others. Currently, bill payments transaction type exhibits a clear dominance in the market.

On a regional level, the market has been classified into Tanzania, Kenya, Uganda, Ghana, and others, where kenya currently dominates the Africa mobile money market.

Some of the major players in the Africa mobile money market MTN, Orange, M-Pesa, Tigo-Pesa, Airtel Money, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)