Agricultural Biologicals Market Size, Share, Trends and Forecast by Type, Source, Mode of Application, Application, and Region, 2025-2033

Agricultural Biologicals Market Size and Share:

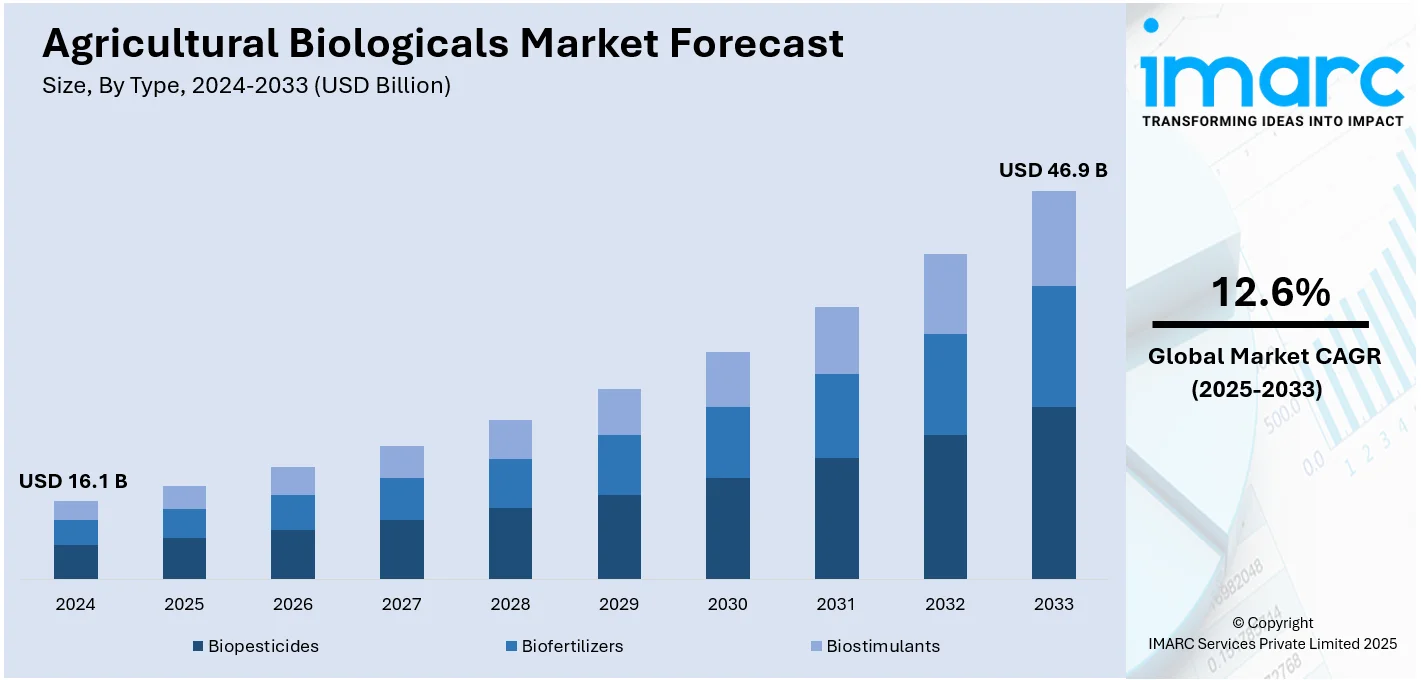

The global agricultural biologicals market size was valued at USD 16.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 46.9 Billion by 2033, exhibiting a CAGR of 12.6% from 2025-2033. North America currently dominates the market with 32.1% share in 2024. The increasing demand for sustainable farming practices, coupled with the rising awareness about consumers regarding the ill effects of chemical pesticides are the primary factors increasing the agricultural biologicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.1 Billion |

| Market Forecast in 2033 | USD 46.9 Billion |

| Market Growth Rate (2025-2033) | 12.6% |

The agricultural biologicals market is growing due to the increasing awareness about sustainable farming practices and the adverse effects of chemical pesticides and fertilizers has led to a rising demand for eco-friendly alternatives. Consumers' preference for residue-free produce and organic products has further fueled the adoption of biological solutions. Government regulations and policies on the increase of sustainable agriculture and less adverse impact from traditional inputs enhance growth in this market. Advanced technological research into biotechnology and formulations related to microbial helps better biological effectiveness while enhancing their shelf life to an extent whereby their accessibility can become easier for the farmers. Growing needs to restore soil health degradation and crop resilience against the impact of climate change have increased demand for biopesticides, biofertilizers, and biostimulants. Additionally, expansion in integrated pest and nutrient management has opened avenues for the extensive application of agricultural biologicals as vital tools in modern farming systems.

The United States has emerged as a key market for agricultural biologicals. The market is growing, as many farmers are demanding sustainable and eco-friendly farming practices. The country has a robust agricultural sector with high-value crops like fruits, vegetables, and specialty grains, which has driven the adoption of biological solutions. With the growing demand for organic and residue-free produce, farmers are using biopesticides, biofertilizers, and biostimulants to ensure food safety and quality. Government initiatives and legislation in promoting sustainable agriculture-subsidies on biological inputs and prescription of selected chemical pesticides only add fuel to the market expansion. Advanced facilities for research and development, especially collaborations between agribusiness houses and research houses, have allowed innovations in terms of microbial formulation and application methodologies, thus having a positive impact on improved product efficacy as well as uptakes. In addition, the U.S. market also benefits from the trend of precision agriculture, where biologicals play a vital role in targeted pest control and nutrient management.

Agricultural Biologicals Market Trends:

Rising demand for natural pest control alternatives

The shift toward environmentally safe farming practices has driven a growing agricultural biologicals demand for natural pest control solutions. Agricultural biologicals, such as bio-insecticides, offer farmers effective alternatives to synthetic chemicals, ensuring pest management with minimal environmental harm. These biological solutions rely on natural microorganisms, plant-derived compounds, or biochemicals to target specific pests, preserving beneficial organisms and maintaining ecological balance. They are highly attractive in organic farming and sustainable agriculture systems where residue-free and eco-friendly products are of the utmost importance. The increasing regulatory pressure to reduce chemical pesticide use and the increasing consumer demand for sustainable, safe produce further drive the adoption of biopesticides. Notable advancements in product development and industry collaborations support this trend. For example, in April 2024, Bayer announced that it had entered an exclusive license with AlphaBio Control over a new biological insecticide targeting arable crops like oilseed rape and cereals. For instance, making a cleaner environment as close to the same as crop health and productivity without harming them, thus natural pest-control alternatives form one of the core tenets of modern agriculture.

Increasing concerns about sustainable soil health

The agricultural sector is gaining more interest in soil health sustainability practices. Soils have degraded due to the intensive chemical usage, which forces farmers to turn to biological methods that increase the fertility and resilience of soils. Bio-fertilizers and biostimulants are significant products in this change, increasing nutrient uptake, promoting microbial growth, and sustaining soils for a longer period. These practices improve crop productivity while minimizing the use of synthetic inputs, thus meeting the objectives of sustainable farming. According to a McKinsey survey, 90% of farmers are aware about sustainable farming practices, and this is increasing in acceptance. Advances in soil management tools continue to propel this trend. For instance, in January 2024, Bionema launched Soil-Jet BSP100, a biodegradable surfactant intended to enhance the performance of agricultural biologicals and agrochemicals. This, in turn, allows for more sustainable farming through better resource use, which helps to increase agricultural biologicals market growth significantly by addressing issues like soil water repellence and improving nutrient efficiency.

Nutrient-efficient farming solutions gain prominence

Nutrient-efficient farming is now at the forefront of agricultural concerns as agriculture looks to tackle environmental issues while maximizing resource usage. Agricultural biologicals in the form of bio-fertilizers and endophytes, are gaining widespread acceptance due to their ability to enhance nutrient uptake and utilization for crops while minimizing the requirement for synthetic fertilizers, thereby, significantly influencing the agricultural biologicals market trends. In doing so, they enhance microbial activity in soils, aid solubilization of nutrients, and promote the health of roots in crops, therefore producing healthier, more productive, and environmentally clean plants. This demand is the key emphasis area, particularly regarding the solution to global challenges of soil degradation and overfertilization. In response, key industry players continue to innovate in this aspect to satisfy this requirement. For example, in July 2024, Syngenta Biologicals partnered with Intrinsyx Bio to introduce an endophyte-based biological formulation, where endophytes assimilate with the plants for nutrient uptake, making them efficient as well as sustainably producing the crop. This illustrates the place of nutrient-efficient biologicals in sustaining farming that promotes yield gain while reducing environmental footprint.

Agricultural Biologicals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global agricultural biologicals market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, source, mode of application, and application.

Analysis by Type:

- Biopesticides

- Biofertilizers

- Biostimulants

Biopesticides dominate the agricultural biologicals market due to being an environment-friendly and sustainable answer for controlling pests, thereby reducing environmental degradation, which synthetic pesticides trigger. The products utilize natural microorganisms, plant-derived compounds, or biochemical processes to be effective in controlling pests while maintaining ecological balance. Biopesticides, for example, bio-insecticides, are hugely sought after in organic farms, since they can control pest insects that damage crops, yet do not leave toxic residues. Their action focused on the reduction of damage to beneficial organisms as well as pollinators contributing to biodiversity. Formulation technology advancements and increased public awareness about sustainability in agriculture further support their use across different agricultural systems.

Analysis by Source:

- Microbials

- Macrobials

- Biochemicals

- Others

Microbials lead the market with 51.8% of the market share due to their multifunctional benefits in soil health improvement, nutrient uptake, and pest control. Bio-fertilizers, for example, use helpful microorganisms, such as nitrogen-fixing bacteria or phosphorus-solubilizing fungi, to make nutrients available to plants. This reduces the use of chemical fertilizers, making the environment more sustainable and resolving the problem of soil degradation brought about by the overuse of synthetic inputs. Microbial-based products, such as bio fungicides and bioinsecticides, also naturally combat pathogens and pests, which ensures crop health. Their versatility across diverse crops and growing conditions, along with rising consumer demand for chemical-free produce, drives the expansion of this segment.

Analysis by Mode of Application:

- Foliar Spray

- Soil Treatment

- Seed Treatment

- Post-harvest

Foliar spray has emerged as the leading application with 58.5% share of agricultural biologicals due to its efficiency in delivering nutrients, biostimulants, and biopesticides directly to plant foliage. This method ensures rapid absorption and response, making it ideal for addressing immediate nutrient deficiencies or pest outbreaks. Foliar sprays are more often used in horticulture and high-value crops, in which precision and efficiency are needed. They have more efficiency on biostimulants as they enhance plant resistance to stress, thus leading to better quality of crops. Improvements in spray technology along with the widespread implementation of precision farming have greatly supported the acceptance of foliar application, becoming one of the mainstays in modern farming systems.

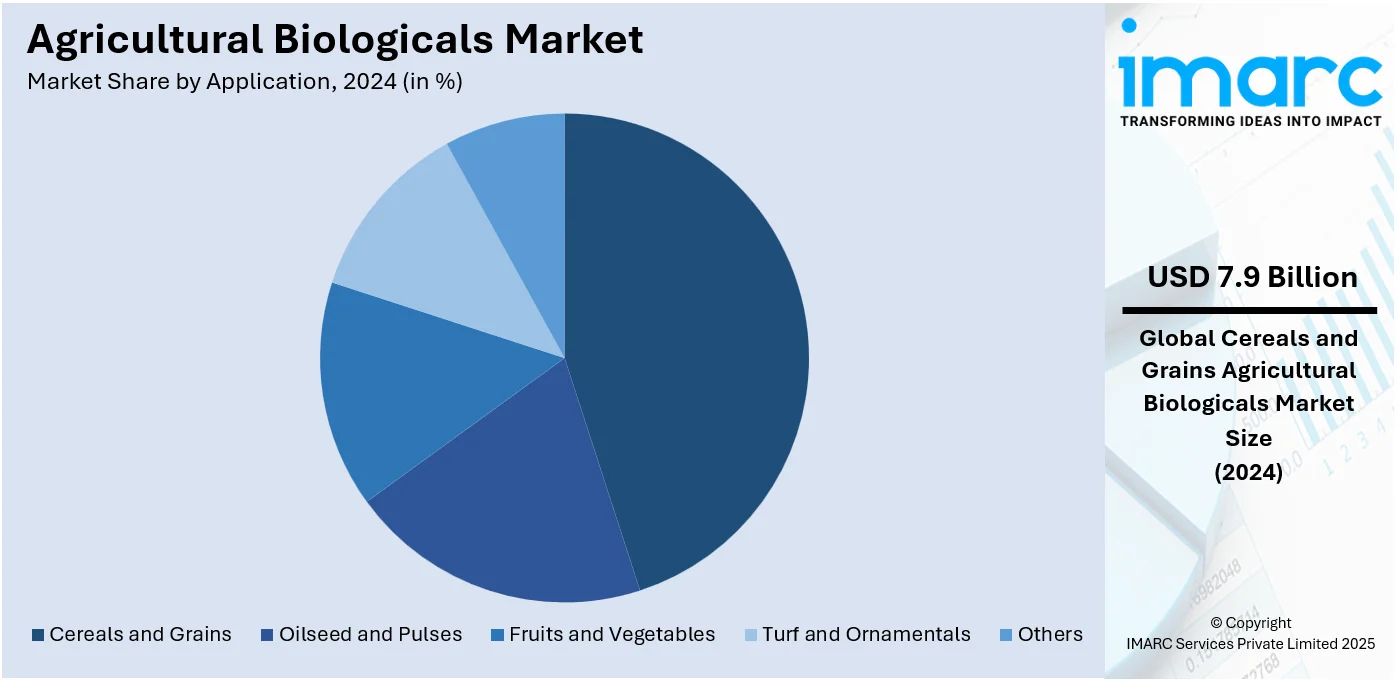

Analysis by Application:

- Cereals and Grains

- Oilseed and Pulses

- Fruits and Vegetables

- Turf and Ornamentals

- Others

Fruits and vegetables hold the highest market share of 48.7% in the application segment of agricultural biologicals as they are most vulnerable to pests, diseases, and environmental stressors. These high-value crops usually need intensive care to maintain yield and quality, so biological solutions like biopesticides and biofertilizers are essential tools for farmers. By using biopesticides, growers can ensure pest management without compromising food safety, catering to consumer demand for residue-free and sustainable produce. Biofertilizers also increase nutrient availability and soil health, leading to better crop productivity and quality. Global change toward organic and sustainable farming, combined with strict regulations on chemical residues, means that the use of agricultural biologicals in fruit and vegetable production has accelerated into an essential tool.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America leads the market with 32.1% share for agricultural biologicals, as there is strong governmental support, developed agricultural infrastructure, and awareness about sustainable farming practices. The region is further strengthened by strong support through policies, subsidies, and research funding to reduce dependence on synthetic chemicals and promote environmental sustainability. Organic Certification by the USDA and the drive for IPM in the United States supports biopesticides and biofertilizers. The similar regulatory structure that Canada provides helps support sustainable agriculture through the creation of standards on organic certification, funding of green agricultural technologies, and funding opportunities for projects using these green agricultural technologies. There is rapid growth in biological adoption by North American farmers concerning soil health and water quality concerns and loss of biodiversity resulting from excessive use of chemical inputs. Growing demand for organic and residue-free products from consumers also contributed to market growth, encouraging farmers to introduce biopesticides, biofertilizers, and biostimulants into their systems. Furthermore, the advanced agricultural infrastructure of the region, precision farming technologies, and research collaborations have supported the efficient application and development of biological products, making North America the market leader.

The Asia Pacific market for agricultural biologicals is growing rapidly as the demand for food is growing, the agriculture base is enormous, and many consumers are becoming environmentally conscious. India and China provide subsidies and information to promote the use of biofertilizers and biopesticides. As consumers become healthier, organic products are in huge demand, driving the adoption of biological products. The growing interest of farmers toward alternative solutions beyond synthetic chemicals that help in attaining healthy soils and increasing crops in the presence of issues related to soil erosion and water stress is driving this market further ahead.

The European agricultural biologicals market benefits from stringent regulations related to the environment, the European Green Deal, and the need to promote sustainable agricultural practices. To achieve residue-free standards and address greenhouse gas emissions, farmers resort to biopesticides and biofertilizers. Moreover, demand for organic products and eco-friendly agricultural production processes also increases growth. Countries like Germany, France, and the Netherlands are leading in the adoption of such solutions, driven by research initiatives and government programs that put out policies to reduce chemical pesticides, as well as promote biodiversity.

Latin America's agricultural biologicals market is driven by the region's reliance on agriculture, particularly for exports like coffee, soybeans, and fruits. Farmers have been adopting more biopesticides and biofertilizers for pest infestations and enhancing soil health as they meet international residue-free standards. Incentives are provided by governments, and alliances with global companies help in its adoption. Large-scale farming has been the hub of countries such as Brazil and Argentina, along with a developing interest in sustainability in agriculture so that productivity goes hand in hand with environmental protection.

The market for agricultural biologicals in the Middle East and Africa is rising due to the increasing concerns about soil degradation, water scarcity, and the necessity of sustainable food production. Governments and NGOs are encouraging the use of eco-friendly solutions for improving crop yield and soil health in arid and semi-arid regions. The growing demand for organic produce along with efforts toward food security drives the adoption of biopesticides and biofertilizers. Markets like South Africa and the UAE are also rising in importance, due to investments in sustainable agricultural technologies.

Key Regional Takeaways:

United States Agricultural Biologicals Market Analysis

The United States accounts for 86.90% of agricultural biologicals market share in North America driven by growing consumer interest in organic and sustainably grown produce which has profoundly influenced the uptake of agricultural biologicals as safer, environment-friendly alternatives to chemical-based solutions. According to the Organic Trade Association, U.S. sales of certified organic products came close to USD 70 Billion in 2023. According to this, technological developments have been crucial to the market's growth. Biotechnology and microbial innovation are bringing about highly effective bio-based products, like biofertilizers, biopesticides, and biostimulants, specific to crop type. These advancements ensure better efficacy, enhancing their appeal among farmers and agricultural businesses seeking sustainable and efficient solutions. Additionally, the growing emphasis on soil health and crop productivity is offering a favorable agricultural biologicals market outlook. Agricultural biologicals help improve soil fertility and plant health, offering long-term benefits, such as higher yields and reduced dependency on chemical inputs. This resonates with farmers aiming to balance productivity with environmental stewardship. Moreover, the country's governing agencies are engaged in several initiatives and subsidies that encourage sustainable farming, which is fueling the growth of the market. There are several programs, which are advocating the use of eco-friendly inputs and financial incentives for farmers who adopt biologicals.

Europe Agricultural Biologicals Market Analysis

The adoption of biological alternatives is being highly driven by stringent regulations on chemical pesticides and fertilizers under frameworks, such as the European Green Deal and Farm to Fork Strategy. These policies reduce chemical usage in agriculture, promote biodiversity, and ensure sustainable food production, thereby creating a conducive environment for the agricultural biological market. Consumer preference for organic and sustainably produced food is another major driver. According to the IMARC Group, the European organic food market has reached USD 57.5 Billion in 2024. European consumers are increasingly concerned about food safety and environmental sustainability, prompting farmers and agribusinesses to adopt bio-based solutions such as biopesticides, biofertilizers, and biostimulants. This trend is coupled with the fast-growing organic agriculture sector in this region, which is expanding due to higher demand. Furthermore, technological research and development on biologicals is on the move in Europe for developing innovative and tailored agricultural products for various crops and soil types. These make the biologicals more effective while compatible with previous farming practices to increase yields by sustainable means and thus are much sought after by farmers. Apart from this, integrated pest management (IPM) practices that are widely advocated in Europe enhance agricultural biological adoption even more. What's more, biological products play a key role in IPM, which includes effective and safe pest control from chemicals.

Asia Pacific Agricultural Biologicals Market Analysis

The Asia Pacific agricultural biologicals market is growing substantially due to the increasing need for sustainable and organic farming. The farmers are shifting toward bio-based inputs like biopesticides, biofertilizers, and biostimulants to meet the market expectations for eco-friendly products. Moreover, governing agencies across the region are crucial for further market expansion. Policies supporting organic farming, sustainable agriculture, and reduced usage of chemical inputs are enhancing the growth rate of agricultural biologicals. The governments in India, China, and Japan provide subsidies and training programs that stimulate farmers to adopt biological solutions. In addition, the region has a vast and diversified agricultural sector that favors agricultural biological growth. Asia Pacific is home to a wide variety of crops, and the demand for crop-specific biological products tailored to local conditions is driving innovation. Moreover, the growing demand for crops due to population growth is offering a favorable market outlook. The Indian population reached 1,395 Million in March 2024, as per the CEIC. The increase in the resistance of pests to chemical pesticides is an emerging trend within the region and has further solidified the market growth. Rapid advancement in biotechnology and research into microbes will lead to agricultural biologicals of great effectiveness in managing crop challenges, such as reduced soil fertility and decreased productivity of crops, thereby being in great demand from farmers seeking solutions for the long-term and sustainability.

Latin America Agricultural Biologicals Market Analysis

The Latin America agricultural biologicals market is influenced by a growing emphasis on sustainable farming practices and increasing consumer demand for organic produce. There is a rise in the demand for sustainable crops owing to the changing consumption patterns of individuals as well as the growing population. In Brazil, the population is 211,140,729 as of 2023 with a projected increase of 3% to 217,489,299 by 2050, according to the World Health Organization (WHO). With agriculture being a cornerstone of the region’s economy, the need to balance productivity with environmental stewardship is encouraging farmers to adopt bio-based solutions like biopesticides, biofertilizers, and biostimulants. Moreover, the governing bodies in the region are engaging themselves in activities toward sustainable agriculture. In combination with regulatory controls over chemical pesticides, these actions provide a further boost to market growth. Such moves are part of the initiatives undertaken to deal with soil degradation and loss of biodiversity. Pest resistance to conventional agrochemicals is another major growth driver since biologicals offer unique and environment-friendly modes of action. Moreover, it becomes more effective and available through the development of biotechnology as well as increases in funds allocated to research.

Middle East and Africa Agricultural Biologicals Market Analysis

The increasing sustainable agriculture focus within the region of water scarcity and soil degradation against food security in the region accelerates the agricultural biologicals demand in the Middle East and African region. As stated in the report 'Economics of Water Scarcity in MENA: Institutional Solutions' by the end of this decade, the quantity of water per capita available every year will go below the absolute water scarcity threshold of 500 cubic meters per person, per year. Additionally, the use of bio-based solutions, including biopesticides, biofertilizers, and biostimulants, is increasing as they provide eco-friendly alternatives to chemical inputs while improving soil health and crop resilience. Climate change vulnerability in the region has increased the demand for resilient and sustainable agricultural systems. Agricultural biologicals enhance crop productivity and reduce dependency on synthetic chemicals, thus meeting these objectives.

Competitive Landscape:

Market players are actively driving innovation and expanding offerings in the sector of agricultural biologicals, looking to capture growth in demand for sustainable solutions for farming from across the world. Companies have invested significantly in research and development to improve the efficacy, stability, and shelf life of biological products such as biopesticides, biofertilizers, and biostimulants. The common prevalent strategies are partnership, acquisition, and collaboration, which enable firms to enhance their portfolio and reach out to new markets. Regional expansion becomes a focus area of players engaged in the market since growing awareness about sustainable agriculture continues to be on the rise among emerging economies. Localized production facilities along with tailored solutions are developed, which address specific crop and climate needs. Integrated digital platforms and precision farming technologies focus on improving the application of biological products thereby enhancing their adoption. Regulatory approvals and certifications are still on the list, as companies ensure that their products meet stringent safety and efficacy standards. This proactive approach positions market players as key contributors to advancing sustainable agriculture globally.

The report provides a comprehensive analysis of the competitive landscape in the agricultural biologicals market with detailed profiles of all major companies, including:

- Agricen

- Agrinos Inc.

- Corteva Agriscience

- Dhanuka Agritech Ltd.

- Kiwa Bio-Tech Products Group Corporation

- Lallemand Inc.

- Locus Ag Solutions

- Mapleton Agri Biotec Pt Ltd

- Novozymes A/S

- Sigma AgriScience, LLC

- UPL Limited

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- May 2024: Bioceres Crop Solutions Corp. announced Brazil's Ministry of Agriculture has approved three new bio-insecticidal and bio-nematicidal products derived from its proprietary Burkholderia platform. This marks a significant milestone as Brazil becomes the first market to endorse biological products from inactivated microorganisms. These solutions offer enhanced effectiveness and cost competitiveness compared to traditional chemicals. With Brazil's bio-control market growing rapidly, the approval allows Bioceres to expand its product offerings, aligning with its growth strategy following the acquisition of Marrone Bio Innovations.

- April 2024: Bayer has agreed to an exclusive license with UK company AlphaBio Control for a novel biological insecticide, the first on the market available for arable crops, such as oilseed rape and cereals.

- February 2024: Syngenta Crop Protection and Lavie Bio Ltd. formed a partnership aimed at discovering and developing novel biological insecticides. This collaboration will utilize Lavie Bio's advanced technology platform to quickly identify and optimize bio-insecticide candidates. Additionally, Syngenta will contribute its extensive global research, development, and commercialization expertise to enhance the project.

- January 2024: Bionema Group launched Soil-Jet® BSP100, a biodegradable surfactant designed to enhance crop protection and plant health. Utilizing patented Polyether-Modified Polysiloxane technology, it improves the efficacy of biologicals and agrochemicals by optimizing water and nutrient use while addressing soil water repellence. Field trials show a 20-30% increase in effectiveness. Suitable for various agricultural applications, it promotes robust plant growth and efficient moisture distribution, with recommended application rates of 1 to 2 L/ha every 10 days during the growing season.

Agricultural Biologicals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Biopesticides, Biofertilizers, Biostimulants |

| Sources Covered | Microbials, Macrobials, Biochemicals, Others |

| Modes of Applications Covered | Foliar Spray, Soil Treatment, Seed Treatment, Post-harvest |

| Applications Covered | Cereals and Grains, Oilseed and Pulses, Fruits and Vegetables, Turf and Ornamentals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agricen, Agrinos Inc., Corteva Agriscience, Dhanuka Agritech Ltd., Kiwa Bio-Tech Products Group Corporation, Lallemand Inc., Locus Ag Solutions, Mapleton Agri Biotec Pt Ltd, Novozymes A/S, Sigma AgriScience, LLC, UPL Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the agricultural biologicals market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global agricultural biologicals market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the agricultural biologicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global agricultural biologicals market was valued at USD 16.1 Billion in 2024.

IMARC estimates the global agricultural biologicals market to exhibit a CAGR of 12.6% during 2025-2033.

The market is driven by the increasing demand for sustainable farming practices, coupled with the rising awareness about consumers regarding the ill effects of chemical pesticides.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global agricultural biologicals market include Agricen, Agrinos Inc., Corteva Agriscience, Dhanuka Agritech Ltd., Kiwa Bio-Tech Products Group Corporation, Lallemand Inc., Locus Ag Solutions, Mapleton Agri Biotec Pt Ltd, Novozymes A/S, Sigma AgriScience, LLC, UPL Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)