Agricultural Robots Market Size, Share, Trends and Forecast by Product Type, Application, Offering, and Region, 2025-2033

Agricultural Robots Market, 2024 Size and Trends:

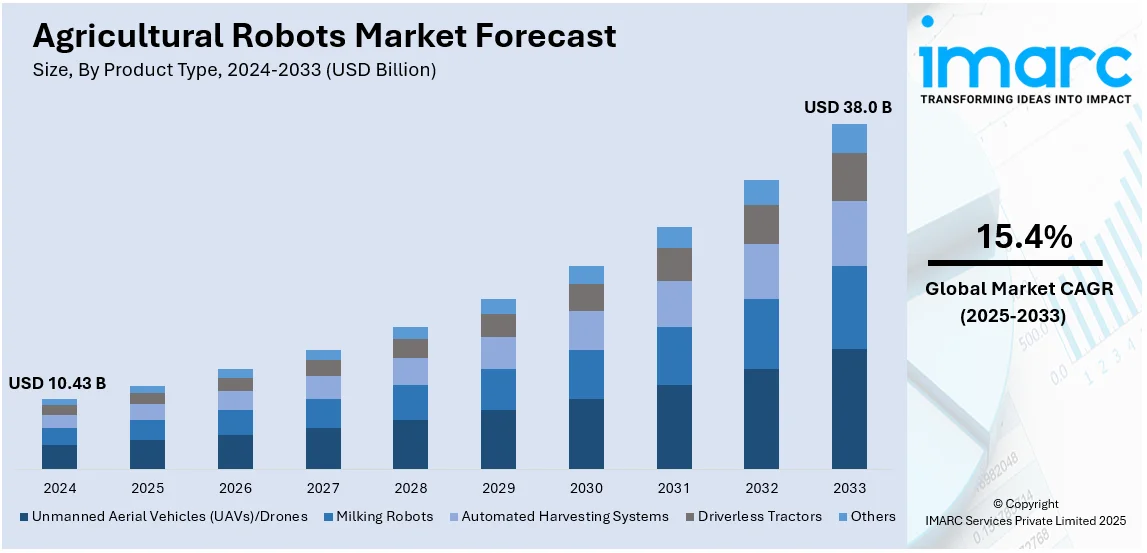

The global agricultural robots market size was valued at USD 10.43 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 38.0 Billion by 2033, exhibiting a CAGR of 15.4% from 2025-2033. North America currently dominates the market, holding a market share of 35.2% in 2024. The market is driven by the advanced technological infrastructure, which is leading to higher adoption of automation in agriculture. Alongside this, significant investments in innovations are bolstering the market growth across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10.43 Billion |

|

Market Forecast in 2033

|

USD 38.0 Billion |

|

Market Growth Rate (2025-2033)

|

15.4% |

By automating repetitive tasks, robots reduce the need for manual labor, lowering operational expenses. Agriculture technologies minimize resource wastage, ensuring optimal use of water, fertilizers, and pesticides. These savings on inputs contribute to reduced overall costs and increased profitability for farmers. Agricultural robots enhance efficiency, completing tasks faster and with greater accuracy than human labor. This improved productivity allows farmers to allocate resources more effectively, decreasing unnecessary expenditures. The capacity of robots to operate persistently without exhaustion removes expenses linked to overtime or extra shifts. The long-term savings from investing in durable robotic systems outweigh initial purchase costs. Technological innovations are making robots more affordable, reducing the entry barrier for smaller farms. Maintenance and repair costs of robots are often lower than those of traditional farming equipment, which is bolstering the market growth across the globe.

The rising need for precision farming is driving the market for agricultural robots in the United States. Farmers are looking for innovative technologies to improve crop yields while reducing resource consumption and environmental effects. Agricultural robots that come with sensors and artificial intelligence (AI) can accurately track soil conditions, plant development, and pest behavior. These robots provide immediate data, allowing farmers to better evaluate their resource deployment choices. For example, in June 2024, North Carolina State University’s N.C. Plant Sciences initiative advances AI technology in agriculture by creating the BenchBot 3.0 robot. The project sought to enhance harvest schedules, fertilizer use, and general agricultural choices. Tools powered by AI will increase the efficiency, sustainability, and decision-making in farming. These developments aid precision farming by concentrating on minimizing waste and improving productivity. Precision agriculture needs robotic systems that can precisely apply fertilizers, water, and pesticides. These specific applications aid in decreasing waste, lowering expenses, and minimizing environmental harm, thereby supporting sustainable agricultural practices. Robots enhance the effectiveness of activities like planting, harvesting, and weeding, making certain that crops develop optimally.

Agricultural Robots Market Trends:

Labor Shortage in Agriculture Sector

One of the major drivers for the market is the persistent shortage of skilled labor in the agricultural sector. According to a survey of over 300 companies, 76% reported a growing shortage of skilled labor, highlighting a significant workforce gap in the industry. Various regions are experiencing a decline in the availability of farm workers, leading to challenges in carrying out labor-intensive tasks. These robots provide a solution by reducing the reliance on human labor. These robots can work autonomously, without the need for constant supervision, and can perform repetitive tasks efficiently and accurately. By automating tasks, such as planting, weeding, and harvesting, agricultural robots help farmers overcome labor shortages, increase productivity, and reduce operational costs.

Technological Advancements

Rapid advancements in robotics, automation, and AI are driving the adoption of agriculture robots. These technologies have significantly improved the capabilities of agricultural robots, making them more versatile, efficient, and cost-effective. For instance, the integration of computer vision and machine learning algorithms allows robots to identify and differentiate between crops and weeds, enabling targeted and precise weed control. Navigation systems and sensors enable robots to maneuver through fields and avoid obstacles. The availability of advanced sensors, such as cameras and multispectral imaging, provides real-time data for crop monitoring and optimization. These technological advancements make agricultural robots more capable of performing complex tasks and decision-making, thus expanding the market size.

Rising Environmental Concerns

Increasing environmental concerns and the demand for sustainable agricultural methods are key factors influencing the adoption of the agricultural robots. Conventional agricultural methods frequently entail the overuse of fertilizers, pesticides, and water, resulting in environmental contamination and resource exhaustion. As stated by NIH, the absence of pesticides would lead to losses of up to 78% in fruits, 54% in vegetables, and 32% in cereals because of pests and diseases. Agricultural robots provide a more accurate and focused delivery of resources, leading to less chemical usage and enhanced resource efficiency. For instance, robots with precision spraying technology deliver pesticides solely in necessary areas, reducing chemical runoff and environmental effects. In the same way, robotic irrigation systems enhance water efficiency by supplying water straight to plant roots using real-time moisture information. By encouraging precision agriculture methods, these robots assist farmers in embracing more sustainable approaches, minimizing environmental impact, and alleviating the adverse effects of farming on ecosystems.

Agricultural robots Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global agricultural robots market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on product type, application, and offering.

Analysis by Product Type:

- Unmanned Aerial Vehicles (UAVs)/Drones

- Milking Robots

- Automated Harvesting Systems

- Driverless Tractors

- Others

Automated harvesting systems represent the biggest segment in 2024, accounting for 43.7% of the market. These systems are built to gather harvests swiftly and accurately like fruits, vegetables, and grains, thereby lowering labor expenses and minimizing time-consuming manual tasks. With labor shortages posing a major issue in agriculture, automated harvesting systems offer an effective remedy by functioning independently, thereby filling workforce voids. Additionally, the rising worldwide demand for fresh fruits and vegetables, along with the necessity for prompt harvesting, leads to the heightened utilization of these systems. Automated harvesting systems additionally reduce crop damage while harvesting, ensuring that the produce stays whole and maintains high quality. These robots come with sophisticated AI and vision technologies that can adjust to diverse crop varieties and settings, improving their adaptability for numerous agricultural uses. The increasing demand for sustainable agriculture and the necessity to decrease waste render automated harvesting systems appealing, as they enhance resource efficiency and reduce avoidable losses.

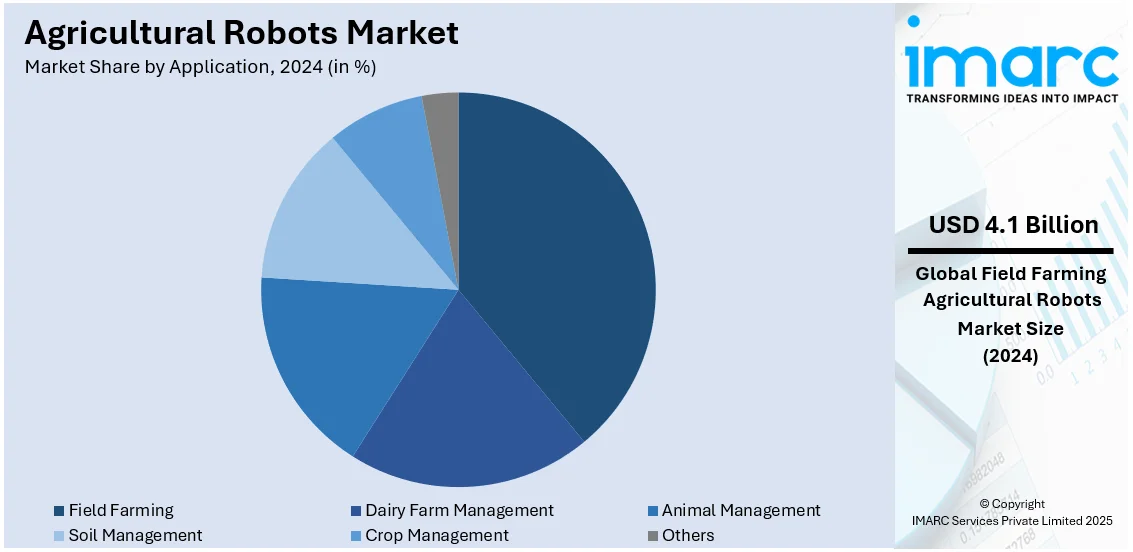

Analysis by Application:

- Field Farming

- Dairy Farm Management

- Animal Management

- Soil Management

- Crop Management

- Others

Field farming leads the market with 39.2% of market share in 2024. Robots in the field farming sector execute tasks like planting, weeding, and harvesting, enhancing efficiency and the quality of yield. Large farmers gain considerable advantages from automation, since manual labor is expensive and requires a lot of time. Sophisticated robots integrated with AI and sensors guarantee accurate resource management, reducing the waste of water and fertilizers. They track soil health and crop status in real time, allowing farmers to make informed decisions. The increasing need for high-yield crops and eco-friendly farming methods drives the implementation of robotic solutions in agricultural fields. Government incentives for precision farming further motivate farmers to utilize robots for extensive operations. Field farming practices focus on essential crops such as wheat, rice, and corn, which are vital for food security worldwide. Automation lessens reliance on labor, tackling workforce shortages and boosting productivity, particularly in busy farming periods. Robots improve productivity in pest management and irrigation control, promoting sustainable agricultural practices. Ongoing improvements in robotics technology lower expenses, enhancing accessibility of these systems for farmers.

Analysis by Offering:

- Hardware

- Software

- Services

In 2024, hardware dominates the market, capturing 71.7% of the market share. Hardware elements constitute the foundation of agribots, including the physical framework and equipment necessary for their functioning. These elements consist of drones, robotic milking machines, automated crop harvesters, autonomous tractors, and different types of sensors and robotic limbs. These hardware solutions are crucial for executing particular activities in the agriculture sector, including planting, harvesting, and monitoring. Additionally, the demand for hardware components is driven by the diverse range of applications and tasks that agribots are designed to perform. Different types of robots and equipment are required for various agricultural operations like field farming, dairy farming, and soil management. Farmers and agricultural businesses rely on these hardware components to carry out tasks efficiently, improve productivity, and optimize resource utilization. Other than this, hardware components often involve significant investment and represent a substantial portion of the overall cost associated with implementing agricultural robots. As the market for these robots continues to grow, advancements in hardware technologies, such as improved sensors, better robotic arms, and more precise navigation systems, further drive the demand for these components.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

North America held the highest market share, exceeding 35.2% in 2024. North America boasts a highly advanced and technologically sophisticated agricultural industry. This advantageous setting is promoting the swift integration of agricultural robots in the area. Additionally, labor shortages in certain agricultural sectors are becoming a significant challenge in North America. This is creating a strong demand for agribots as a solution to address the labor gap and increase operational efficiency. North America hosts numerous leading agricultural robot manufacturers and research organizations. These firms and institutions are leading the way in creating and marketing cutting-edge agricultural robots. Their presence in the region not only contributes to the availability of a wide range of robotic solutions but also fosters an ecosystem of innovation, knowledge sharing, and expertise in the field. For instance, in September 2024, Niqo Robotics launched its AI-driven RoboThinner for lettuce thinning in North America. The robot uses AI cameras to achieve 97% accuracy in thinning lettuce. It can cover up to 7 acres per hour, offering significant labor savings.

Key Regional Takeaways:

United States Agricultural Robots Market Analysis

The United States market is growing due to the rising adoption of drones and unmanned aerial vehicles (UAVs) in agriculture. For instance, Baibars, a startup developing agricultural UAVs, has secured a 15 Million USD investment. This funding will accelerate the development of UAVs for agricultural use, enhancing the capabilities of agricultural robots for tasks like spraying and monitoring. This surge in UAV availability benefits agricultural robots by enhancing precision farming, crop monitoring, and resource management. The ability of UAVs to capture detailed data, map terrain, and monitor crop health is enhancing farming practices by improving decision-making and productivity. Drones are enabling farmers to perform tasks like seeding, irrigation, and pest control with high precision. These advancements in aerial technology are being integrated into agricultural robotics, streamlining tasks, such as field monitoring, crop spraying, and soil analysis. As agricultural robots adopt more sophisticated UAV capabilities, they are reducing labor costs and improving the efficiency of farming operations.

Europe Agricultural Robots Market Analysis

The growing demand for automation in the dairy industry is propelling the adoption of agricultural robots, particularly in areas requiring dairy farm management. According to reports, in 2020, there were approximately 467,000 dairy farms in the EU, the growing dairy sector presents significant opportunities for agricultural robots. Robotic systems streamline operations, such as milking, feeding, and monitoring animal health. These technologies enhance productivity by reducing time-intensive tasks and improving milk quality through consistent processes. Automated feeding systems and robotic milking machines are becoming commonplace, offering farmers precise control over dairy production. Innovations in sensor technologies and real-time data collection are helping monitor livestock conditions, ensuring healthier herds and improved outputs. By implementing robots, farmers can better address challenges like herd expansion and efficiency in resource use.

Asia Pacific Agricultural Robots Market Analysis

The growing adoption of agricultural robots in the Asia Pacific region is supported by a surge in investments aimed at modernizing agricultural practices. According to India Brand Equity Foundation, private investment in agriculture surged by 9.3% in 2020-21, complemented by institutional credit growth that reached USD 226 Billion in 2021-22. This growing financial support fosters innovation, driving the adoption of agricultural robots to enhance productivity and efficiency. The demand for increased efficiency and sustainable farming methods is driving governing agencies, investors, and research institutions to fund innovations in agriculture, including robotics. These investments are making advanced farming technology more accessible, particularly in regions where labor shortages and the need for higher crop yields are becoming more apparent. Robotics is being adopted to optimize various agricultural processes, such as planting, harvesting, and crop monitoring, improving output and reducing operational costs.

Middle East and Africa Agricultural Robots Market Analysis

In the Middle East and Africa, the growing adoption of agricultural robots is being fueled by advancements in agriculture and government support. For instance, UAE's USD 500 Million program, unveiled by the Advanced Technology Research Council at the World Governments Summit, aims to accelerate AI and emerging tech research. This initiative is set to enhance agricultural robots, improving efficiency and innovation in farming. Governments in this region are increasingly recognizing the importance of modernizing agriculture to ensure food security and improve agricultural productivity. As part of these efforts, robots are being integrated into farming practices to optimize resources, conserve water, and enhance crop yields. The rise of precision agriculture technologies is helping farmers reduce the environmental impact of farming while increasing efficiency.

Latin America Agricultural Robots Market Analysis

Rapid technological advancements and increasing investments in automation largely drive the adoption of agricultural robots in Latin America. For instance, Venture investment in the Latin America region reached USD 4 Billion for a second consecutive year, with a record of 488 deals in 2020. This growth highlights the region's increasing focus on technological advancements and investments in innovative sectors. As technology continues to evolve, agricultural robots are becoming more sophisticated, offering improved precision, efficiency, and scalability for farming operations. The growing interest in enhancing crop yield, reducing labor costs, and improving sustainability are encouraging investment in automation technologies. This shift towards automation is also fueled by the need for more effective resource management, including water and fertilizers, as well as the pressure to meet the expanding demand for food production.

Competitive Landscape:

Key players play a crucial role in the market due to growing innovations and strategic collaborations. Major companies are developing cutting-edge robotics solutions that address labor shortages, improve efficiency, and enhance crop yields. These players are investing heavily in research and development (R&D) to create autonomous robots capable of performing a wide range of tasks, from planting and harvesting to monitoring crop health. Their role also includes forming partnerships with farming organizations, technology firms, and research institutions to accelerate the adoption of agricultural robots. By introducing AI, machine learning, and IoT into their robotic systems, these companies are enabling more precise and sustainable farming practices. In April 2024, AGCO Corporation and Trimble finalized a joint venture, forming PTx Trimble to advance precision agriculture. This new company integrates Trimble's expertise in precision agriculture and AGCO's JCA Technologies, offering factory-fit and retrofit solutions for mixed-fleet farming applications.

The report provides a comprehensive analysis of the competitive landscape in the agricultural robots market with detailed profiles of all major companies, including:

- Deere & Company

- Trimble Inc.

- Agco Corporation

- Lely Holding S.À.R.L

- AG Eagle LLC

- Agribotix LLC

- Agrobot

- Harvest Automation

- Naio Technologies

- Precision Hawk

- IBM

- Agjunction, Inc.

- DJI

- Boumatic Robotics, B.V.

- AG Leader Technology

- Topcon Positioning Systems, Inc.

- Autocopter Corp

- Auroras S.R.L.

- Grownetics Inc.

- Autonomous Tractor Corporation

Latest News and Developments:

- November 2024: Fieldwork Robotics Ltd. partnered with Burro to launch the Fieldworker 1 robot, an innovative harvesting solution for raspberry growers facing labor shortages. This adaptable robot integrates Burro's autonomous platform and other systems, providing a flexible, interoperable technology to support efficient harvesting. The collaboration addresses the increasing demand for labor-saving agricultural solutions.

- July 2024: The Agricobots project is developing the VinyA ST-4030, a specialized vineyard spraying robot designed to tackle challenging landscapes. Engineered to navigate steep slopes and slippery terrains, this robot enhances safety and efficiency in viticulture. The VinyA ST-4030 is poised to revolutionize vineyard management, reducing human labor in hazardous conditions. Its advanced design addresses the unique challenges of agricultural robotics in difficult environments.

- March 2024: SIZA Robotics has introduced TOOGO, an autonomous agricultural robot designed for vegetable and beet crops. Set for commercial release in 2025, the fully electric robot aims to alleviate labor shortages and reduce rising agricultural costs. TOOGO represents a significant step towards automation in farming, enhancing efficiency and sustainability.

- February 2024: A Kota teen developed the AgRobot, an AI-powered agricultural robot to assist farmers in assessing soil health, crop conditions, and water requirements, while detecting pests. Built over four years in his school’s Atal Tinkering Lab, the robot earned him the Pradhan Mantri Rashtriya Bal Puraskar in the science and technology category. Aryan's achievement makes him the sole awardee from Rajasthan among winners from 18 states and Union Territories. The innovation aims to enhance farming efficiency through technology.

Agricultural Robots Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Unmanned Aerial Vehicles (UAVs)/Drones, Milking Robots, Automated Harvesting Systems, Driverless Tractors, Others |

| Applications Covered | Field Farming, Dairy Farm Management, Animal Management, Soil Management, Crop Management, Others |

| Offerings Covered | Hardware, Software, Services |

| Regions Covered | North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

| Companies Covered | Deere & Company, Trimble Inc., Agco Corporation, Lely Holding S.À.R.L, AG Eagle LLC, Agribotix LLC, Agrobot, Harvest Automation, Naio Technologies, Precision Hawk, IBM, Agjunction, Inc., DJI, Boumatic Robotics, B.V., AG Leader Technology, Topcon Positioning Systems, Inc., Autocopter Corp, Auroras S.R.L., Grownetics Inc., Autonomous Tractor Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the agricultural robots market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global agricultural robots market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the agricultural robots industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global agricultural robots market was valued at USD 10.43 Billion in 2024.

The global agricultural robots market is estimated to reach USD 38.0 Billion by 2033, exhibiting a CAGR of 15.4% from 2025-2033.

Technological advancements in artificial intelligence (AI) and Internet of Things (IoT) are enabling precise, efficient, and autonomous farming solutions. Increased focus on sustainable practices is encouraging adoption of resource-optimizing robotic systems. Rising global food demand is encouraging farmers toward productivity-enhancing technologies. Additionally, government incentives and declining costs of robotic systems are expanding accessibility to small and medium-sized farms.

North America currently dominates the market, holding a market share of 35.2% in 2024. The market is driven by the advanced technological infrastructure, which is leading to higher adoption of automation in agriculture.

Some of the major players in the global Agricultural Robots market include Deere & Company, Trimble Inc., Agco Corporation, Lely Holding S.À.R.L, AG Eagle LLC, Agribotix LLC, Agrobot, Harvest Automation, Naio Technologies, Precision Hawk, IBM, Agjunction, Inc., DJI, Boumatic Robotics, B.V., AG Leader Technology, Topcon Positioning Systems, Inc., Autocopter Corp, Auroras S.R.L., Grownetics Inc., and Autonomous Tractor Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)