AI in Fintech Market Size, Share, Trends and Forecast by Type, Deployment Model, Application, and Region, 2026-2034

AI in Fintech Market Size and Share:

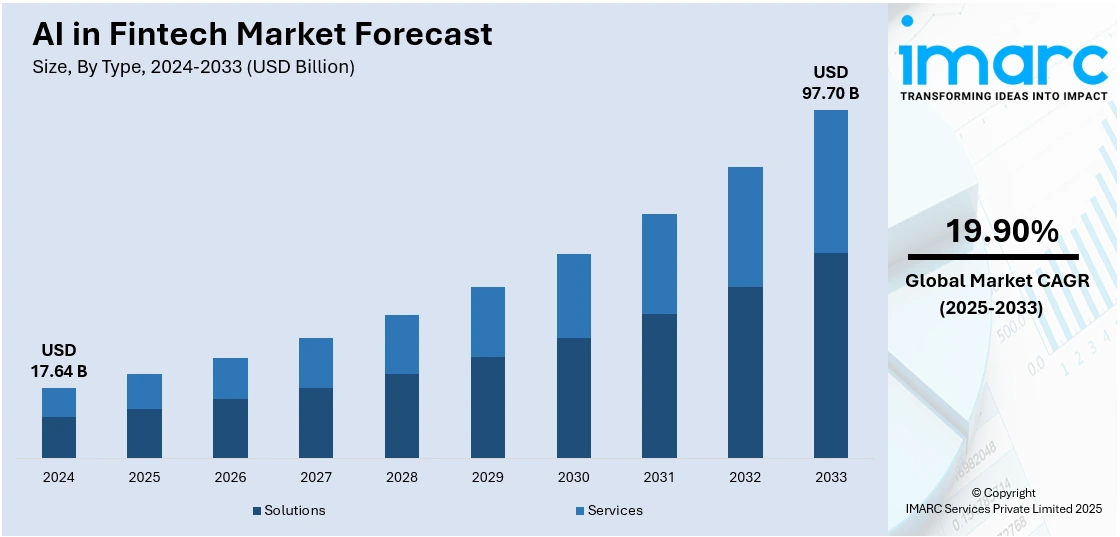

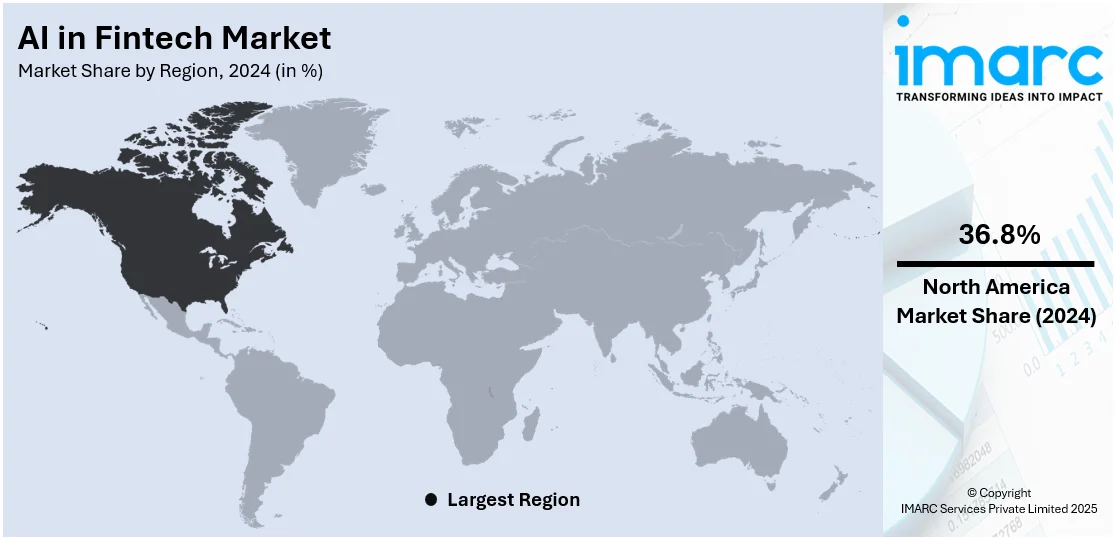

The global AI in fintech market size was valued at USD 17.64 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 97.70 Billion by 2034, exhibiting a CAGR of 19.90% during 2026-2034. North America currently dominates the market, holding a significant market share of over 36.8% in 2024. The rapid technological advancements, rising demand for regulatory compliance, growing demand for personalized services, widespread adoption of AI in fintech to mitigate financial risks, increasing incidence of cyber fraud, and rising utilization of AI in fintech to automate financial processes are some of the major factors propelling the AI in fintech market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 17.64 Billion |

|

Market Forecast in 2034

|

USD 97.70 Billion |

| Market Growth Rate 2026-2034 | 19.90% |

The global artificial intelligence in the financial technology market is driven by an expanding requirement for automation, enhanced customer experiences, and affordable financial services. Big data analytics and cloud computing pave the way for advanced AI applications such as fraud detection, risk management, and personalized banking solutions. Regulatory support for digital change, as well as the rising adoption of AI-powered chatbots and robo-advisors, also play critical roles in driving the growth of this market. Additionally, the need for real-time decision-making and improved security in financial transactions are further expanding the AI in fintech market share. Fintech startups and traditional banks alike are investing in AI to stay competitive, while rising smartphone penetration and digital payment trends create new opportunities for AI-driven solutions. On 6th January’2025, Accel launched its eighth fund, which is worth USD 650 Million, for investments in India and Southeast Asia. The fund focuses heavily on early-stage companies in the areas of artificial intelligence, financial technology, and manufacturing. It is particularly interested in supporting innovations in AI-based fintech, such as digital wealth management, fintech infrastructure, and digital distribution solutions. With overall commitments nearing USD 3 Billion, Accel is well-positioned to lead the next generation of AI-driven financial innovation in an up-and-coming USD 8 Trillion economy.

The United States stands out as a key regional market, primarily driven by rising demand for data-driven financial solutions that enhance efficiency and reduce operational costs. The proliferation of digital banking and mobile payment platforms is accelerating AI adoption for fraud prevention, credit scoring, and algorithmic trading. A 2024 nationwide survey shows that 55% of United States bank customers prefer mobile apps to other channels of banking, with Generation Z (64%) and Millennials (68%) leading the way in digital adoption. A significant 96% of the sample assess their bank's digital experience as "good" or better, showing a very high level of consumer confidence. As artificial intelligence redefines the financial technology space, all these trends highlight the growing prospects for customized and smart banking experiences across the U.S. market. Artificial intelligence gained considerable momentum with large technology companies and financial institutions, mainly because of its power to improve compliance and automate back-office functions. Furthermore, the growing complexity of financial regulations demands the implementation of AI-based solutions for real-time monitoring and reporting. Additionally, the competitive market in the fintech sector, along with consumers' need for instant and intelligent services, drives the widespread use of AI across lending, wealth management, and insurance sectors.

AI in Fintech Market Trends:

The rapid technological advancements

The integration of AI in fintech is heavily influenced by ongoing technological advancements. In line with this, the integration of machine learning (ML) algorithms to refine big data analytics and expand its potential applications within the financial sector is enhancing the market growth. Furthermore, these innovations enable the accurate processing and interpretation of vast amounts of data at high speeds, providing real-time insights and automation capabilities. Moreover, the development of quantum computing and cloud technologies, which further enhance the computational power necessary for complex financial modeling, is fueling the AI in fintech market growth. As per Quantum Gov, the new investment of USD 65 million by the U.S. Department of Energy for quantum computing initiatives reflects the mounting relevance of these emerging technologies in shaping numerous industries, more notably fintech. In addition, fintech companies are leveraging these technologies to create custom banking solutions, automate trading functions, and improve risk management with stunning precision. Moreover, these technologies are improving operational efficiency and also opening doors to the creation of new products and services.

The rising demand for regulatory compliance

The financial industry operates under a complex set of regulations that vary across jurisdictions. Compliance with these regulations is not just mandatory but also critical to maintaining consumer trust and the overall integrity of the financial system. In line with this, AI in fintech plays a vital role in ensuring regulatory compliance and automatically monitoring and analyzing millions of transactions to detect anomalies or non-compliance with relevant laws. According to IMARC Group, the global RegTech market, which leverages AI for regulatory compliance, was valued at USD 15.8 Billion in 2024 and is projected to grow to USD 70.8 Billion by 2033, exhibiting a CAGR of 18% from 2025 to 2033. Along with this, the integration of natural language processing (NLP) to interpret the ever-changing regulatory texts, ensuring that financial institutions are always up-to-date with the latest requirements, is positively influencing the AI in fintech market demand. Additionally, the automation of compliance processes reduces the potential for human error and enables a more responsive and adaptable approach to regulatory changes.

The growing demand for personalized services

Rising consumer expectation for personalization across all service sectors, such as finance, provides great market impetus. Meeting this demand requires AI, which analyses lots of customer data and determines the preferences, spending habits, and financial needs of each customer. Furthermore, it is used to design appropriate financial products, offers, and advice for each customer. AI allows financial institutions to offer a personalized investment strategy or personalized offers on loans at levels of customization. The global market for the use of AI for providing the help of customer service, comes to USD 6.95 Billion in 2024, has a CAGR of 20.4% from 2025 to 2033, and reaches USD 44.49 Billion in 2033. This highlights that AI-based fintech solutions are transforming the fintech landscape by furnishing a marketplace with tailored financial services and maintaining a benchmark of regulatory compliance at scale. Apart from this, the widespread utilization of AI is aiding in enhancing customer loyalty, increasing engagement, and improving overall satisfaction. Therefore, this is further creating a positive AI in fintech market outlook.

AI in Fintech Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global AI in fintech market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, deployment model, and application.

Analysis by Type:

- Solutions

- Services

Solutions stand as the largest component in 2024, holding around 66.6% of the market. The demand for AI solutions is increasing in the market as they are designed to resolve different issues in the financial sector, including fraud detection, risk control, and customer service improvement, among others. These solutions provide customer-specific services that affect customer engagement and customer satisfaction. In addition, they help in understanding customer behavior as well as anticipating the customers' needs, which in turn helps in designing customized items and services. In addition, AI solutions are programmed to be seamlessly integrated into the existing financial systems so that organizations can implement AI with the least disruption, thereby minimizing resistance and gaining acceptance. Furthermore, these solutions can grow to accommodate businesses’ need and the changes made in the market without requiring companies to add significant costs to technology. In addition, AI solutions help with cost efficiency through routine task automation and streamlining operational processes.

Analysis by Deployment Model:

- Cloud-based

- On-premises

Cloud-based leads the market with around 75.7% of market share in 2024. They are cloud-based models that offer a cost-efficient alternative with minimized reliance on the physical infrastructure, leading to the switch of the management to operational expenditure. They also enable financial institutions to scale the AI apps in accordance with demand fluctuations effortlessly. These cloud-based AI solutions, in addition, provide an opportunity at any location to have access to the internet for any employee to work easily and collaborate in time with an employee at any place around the world. They support swift implementation and iteration, thereby giving financial institutions an edge in a fast-paced industry. In addition, many cloud providers enforce strong security methods and can match compliance requirements. Additionally, cloud AI solutions guarantee a more seamless integration of existing systems and cloud services, thus granting businesses from the field of finances the opportunity to work within one unified ecosystem of technologies without having to deal with a lot of customization or compatibility issues.

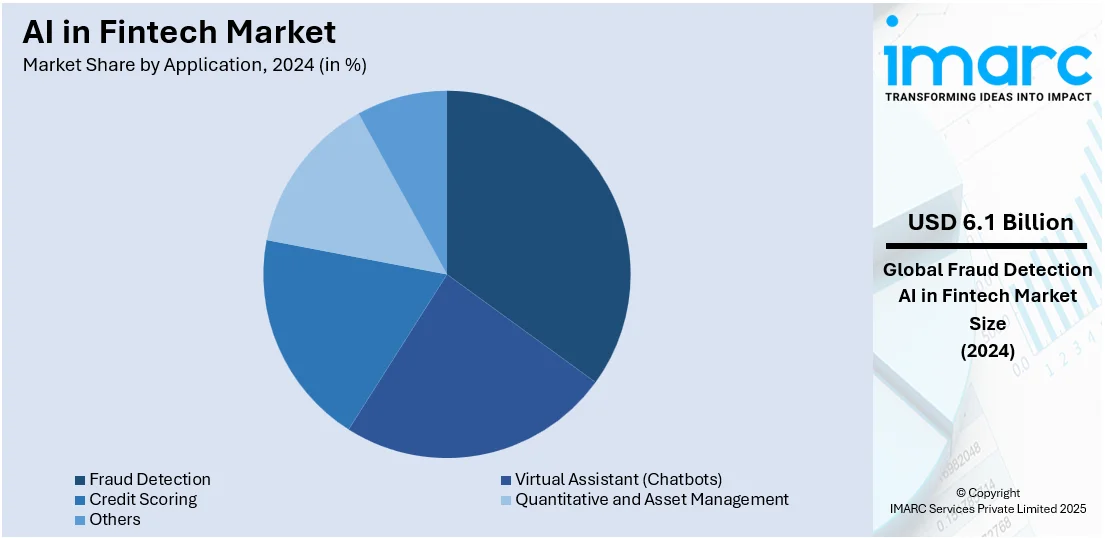

Analysis by Application:

- Virtual Assistant (Chatbots)

- Credit Scoring

- Quantitative and Asset Management

- Fraud Detection

- Others

Fraud detection leads the market with around 34.6% of market share in 2024. The global AI in the fintech market shows fraud detection as its main application sector as financial crimes are becoming complex while companies urgently need security measures. The analytic systems using AI technologies detect fraudulent transactions more accurately than conventional approaches through their combination of machine learning analytics, behavioral analytics, and anomaly detection systems. The rise of digital payments, together with e-commerce and international transactions, now requires highly advanced fraud prevention technologies. The rising implementation of AI by financial institutions alongside fintech companies helps both entities achieve minimal false negatives as well as financial loss reduction in addition to maintaining conformity with rigorous regulatory standards. The utilization of AI, together with big data and cloud computing, enables organizations to predict threats better, which enables proactive threat management. The foremost segment in the AI fintech domain now focuses on AI-driven fraud detection as cybercriminals continuously develop complex strategies.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.8%. Many technology innovation centers cater to an environment of innovation and entrepreneurship for the development of AI technology in North America. Furthermore, the region has seen the increased investments in R&D efforts from the private and public sides to trigger technological development and facilitate the commercialization of AI in fintech. Besides this, where North America's financial industry has a good foothold, the well-established financial industry has helped the market to grow. Additionally, the favorable conditions for market growth include the regional governments imposing supportive policies and regulations to allow the application of the responsible use of AI. Furthermore, the market is growing due to the availability of talented specialists with a specialized character in AI, ML, and data science without difficulty.

Key Regional Takeaways:

United States AI in Fintech Market Analysis

In 2024, the US accounted for around 88.50% of the total North America AI in fintech market. The United States is at the forefront of applying advanced artificial intelligence in the fintech sector due to the presence of a large amount of digital infrastructure, high rates of fintech adoption, and significant institutional investment. AI is being adopted in banking, asset management, insurance, and lending services that are making operations much more efficient, more tailored to the customer’s needs, and better at detecting fraud. Credit risk assessment and financial forecasting are being done using AI-driven algorithms. Increasing amounts of financial data and powerful cloud infrastructure, together with a growing demand for automated advisory services and intelligent customer engagement tools, are enhancing. All the while, the market is growing steadily and advancing in accordance with the advent of machine learning, natural language processing, as well as predictive analytics developed specifically for financial use. AI is being used in fintech platforms to fine-tune trading strategies, identify anomalies in real time, as well as maintain regulatory compliance. Using AI with mobile financial services is enhancing the user experience and opening market penetration to deeper levels. Additionally, the acceleration of strategic partnerships between financial institutions and AI technology providers is being accelerated. The U.S. National Science Foundation has also said it will invest USD 140 Million to develop seven new national artificial intelligence research institutes 'to ensure AI innovation throughout the country.

Europe AI in Fintech Market Analysis

With the advent of the digitalization of financial services and the pro-innovation regulatory framework in Europe, the development of AI in the fintech market is growing. As AI powers more simple humans to waves of prosperity, financial institutions are beginning to use it to improve customer experience, automate back office operations, and make better risk assessment decisions. AI integration with the financial platform is making the personalization more advanced and real-time data analysis. The increasing remarks regarding data privacy issues are motivating firms to go for manageable and secure AI models. Incorporating AI to onboard faster, give intelligent financial advice, and prevent fraud is the new discernible for financial platforms. The European Central Bank found that 64 percent of businesses believe AI will boost their productivity, which is a very positive sign, covering a great deal of confidence in using this technology in order to drive efficiency and results. In comparison, 40 percent of business owners describe growing technology dependence as worrying. Opening up the financial services industry to AI integrations is encouraged by regulatory initiatives that enhance broader open finance. Portfolio management is also getting better with the help of AI to make the overall transaction process better and more efficient in terms of cost. With the convergence of AI with advanced analytics, organizations are able to refine their strategic decision-making further.

Asia Pacific AI in Fintech Market Analysis

As part of the AI adoption journey, the Asia Pacific region is embraced by fintech using AI to personalize services, optimize underwriting, detect fraud, as well as provide efficient digital lending, wealth management, and mobile payment solutions. Big data is spooling up the accuracy of AI-driven insights within financial services. Chatbots, virtual assistants, or even algorithmic trading systems are also deployed by financial platforms in order to improve customer engagement and operational performance. This is causing AI to be increasingly adopted as more and more contactless, app-based financial transactions are rising. A key growth indicator comes from the National Payments Corporation of India, which states that India’s fintech sector is projected to expand from USD 110 Billion in 2024 to USD 420 Billion over the next five years, with a CAGR of 31%, underscoring the region’s rapid digital and financial transformation. Cloud-based AI tools are enabling agile innovation and helping fintech firms scale services across diverse markets.

Latin America AI in Fintech Market Analysis

AI is helping Latin America’s fintech rapidly automate processes including customer onboarding, credit scoring, and transaction monitoring, among others, by helping with operational efficiency. Fintech platforms across the globe are offering more financial products and services with the inclusion of AI into the operations. More accurate risk assessment and better service delivery on digital platforms are being enabled through real-time analytics and intelligent automation. Additionally, fraud prevention is better, and customer interactions are improved via the adoption of AI tools. Yet, with the advancement of digitization in the field of financial services, there has been a rise to automate increasingly complex business processes in a very cost-effective manner and internally to optimize Human capital to ensure future survival while externally seeking revenue advantage. The International Trade Administration reports that the launch of the National Plan for AI in 2024, including about USD 4 Billion in funding for the development of the AI infrastructure and business innovation in Brazil, shows a strong regional commitment to increasing AI capabilities.

Middle East and Africa AI in Fintech Market Analysis

The Middle East and Africa demonstrate steady growth in the AI fintech market due to digital infrastructure development alongside escalating mobile financial operations. The adoption of AI technology automates financial operations. It enhances customer interaction and provides data-based choices through its demand for chatbots together with analytics systems and transaction monitoring tools which result from digital expansion. AI integration supports platform growth by providing better adaptation to changing customer requirements, which strengthens market performance.

Competitive Landscape:

Leading companies are grappling with the issue of emerging algorithms, techniques, and technologies to propel financial services efficiency, security, and customization. To foster innovation, they are making strategic alliances with fintech startups and technology companies to develop inventive responses and to take advantage of the opportunities offered by opportunities. Further, some high-profile game publishing companies are using predictive analytics and ML models to deliver customer behavior, market trends, and risk management intelligence. Additionally, many high-end market firms are creating personalized services and products for this purpose (customized banking, investment consulting, etc.) to be delivered in the categories mentioned above. Apart from this, major firms are making efforts towards developing transparent and impartial AI models and proactively working on ethical AI practices. They are also using AI to bring financial products to the unbanked using algorithms to either determine creditworthiness to some or extend financial literacy with AI-empowered solutions.

The report provides a comprehensive analysis of the competitive landscape in the AI in fintech market with detailed profiles of all major companies, including:

- Amazon Web Services Inc. (Amazon.com Inc)

- Google LLC (Alphabet Inc.)

- Inbenta Technologies Inc.

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- Salesforce.com Inc.

- Samsung Electronics Co. Ltd.

- TIBCO Software Inc.

- Trifacta

- Verint Systems Inc.

Latest News and Developments:

- May 2025: Sage, a SMB accounting and financial technology firm, announced plans to leverage AWS AI services like Amazon Bedrock and specialized AI chips for developing tailored Large and Small Language Models to enhance accounting accuracy, compliance, and automation. These models power Sage Copilot, an AI assistant available in multiple countries, improving financial decision-making and efficiency. Additionally, Sage uses AWS-powered Semantic Search to deliver faster, relevant financial insights globally, emphasizing trusted, secure, and practical AI solutions for SMBs.

- May 2025: UniCredit and Google Cloud signed a 10-year Memorandum of Understanding to accelerate UniCredit’s digital transformation across 13 European markets. The partnership focuses on migrating UniCredit’s applications, including legacy systems, to Google Cloud’s secure, scalable platform, enhancing technology modernization, AI adoption via Vertex AI and Gemini models, and data analytics. This collaboration aims to improve customer experiences, operational efficiency, and innovation in banking services. Additionally, Google Cloud will provide digital skills training to UniCredit employees, supporting sustainable growth and future-ready banking.

- April 2025: Apex Fintech Solutions partnered with Google Cloud to modernize capital markets technology through its cloud-native platform, Apex Ascend. Launched in January 2024, Ascend leverages Google Cloud's AI, data, and security tools-including AlloyDB, BigQuery, Looker, and Vertex AI-to provide real-time data, advanced analytics, and automated trading, clearing, and custody services. This scalable, secure platform accelerates innovation, reduces processing delays, and supports fintech, wealth management, and institutional clients globally, enabling rapid onboarding and streamlined operations with robust, next-generation investment infrastructure.

- March 2025: Deloitte launched AI Advantage for CFOs, an AI-powered analytics platform developed with AWS and Anthropic, integrating advanced AI models like Anthropic’s Claude 3.7 Sonnet and AWS technologies such as Amazon Bedrock. This solution automates finance processes, enhances insights from diverse data types, and supports strategic growth. Deloitte’s $2 billion IndustryAdvantage™ investment and Trustworthy AI™ framework ensure responsible AI use. The initiative includes a Center of Excellence to accelerate AI-driven finance innovation, backed by extensive training and global expertise.

- February 2025: FintechOS launched Evolv, a major AI-driven platform upgrade for banks and insurers, enhancing digital transformation, operational efficiency, and personalized customer experiences. Evolv integrates Agentic AI, Generative AI, and automation to modernize processes and decision-making. Key features include the Journey Designer for no-code digital journeys, Data Core for seamless legacy system integration with compliance to industry standards, AI-powered product configuration, and a Back Office Workflow Designer for automating operations. This scalable, secure platform empowers financial institutions to innovate rapidly, stay competitive, and deliver exceptional, personalized services without replacing core systems.

AI in Fintech Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solutions, Services |

| Deployment Models Covered | Cloud-based, On-premises |

| Applications Covered | Virtual Assistant (Chatbots), Credit Scoring, Quantitative and Asset Management, Fraud Detection, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amazon Web Services Inc. (Amazon.com Inc), Google LLC (Alphabet Inc.), Inbenta Technologies Inc., Intel Corporation, International Business Machines Corporation, Microsoft Corporation, Salesforce.com Inc., Samsung Electronics Co. Ltd., TIBCO Software Inc., Trifacta, Verint Systems Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the AI in fintech market from 2020-2034.

- The AI in fintech market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the AI in fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The AI in fintech market was valued at USD 17.64 Billion in 2024.

IMARC estimates the AI in fintech market to exhibit a CAGR of 19.90% during 2025-2033, reaching a value of USD 97.70 Billion by 2033.

The market is driven by rapid technological advancements, rising regulatory compliance needs, increasing cyber fraud, demand for personalized services, real-time decision-making, and widespread adoption of AI for automating financial processes and enhancing customer experiences.

North America currently dominates the AI in fintech market, accounting for a share exceeding 36.8% in 2024. This dominance is fueled by strong technological infrastructure, large-scale investments in AI, a highly developed financial ecosystem, and rising adoption of AI for fraud detection, compliance, and personalized services.

The names of specific companies were not provided in the given content. However, major players in the global AI in fintech market typically include Amazon Web Services Inc. (Amazon.com Inc), Google LLC (Alphabet Inc.), Inbenta Technologies Inc., Intel Corporation, International Business Machines Corporation, Microsoft Corporation, Salesforce.com Inc., Samsung Electronics Co. Ltd., TIBCO Software Inc., Trifacta, and Verint Systems Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)