Air Compressor Market Size, Share, Trends and Forecast by Type, Technology, Lubrication Method, Power Rating, End User, and Region, 2026-2034

Air Compressor Market Size and Share:

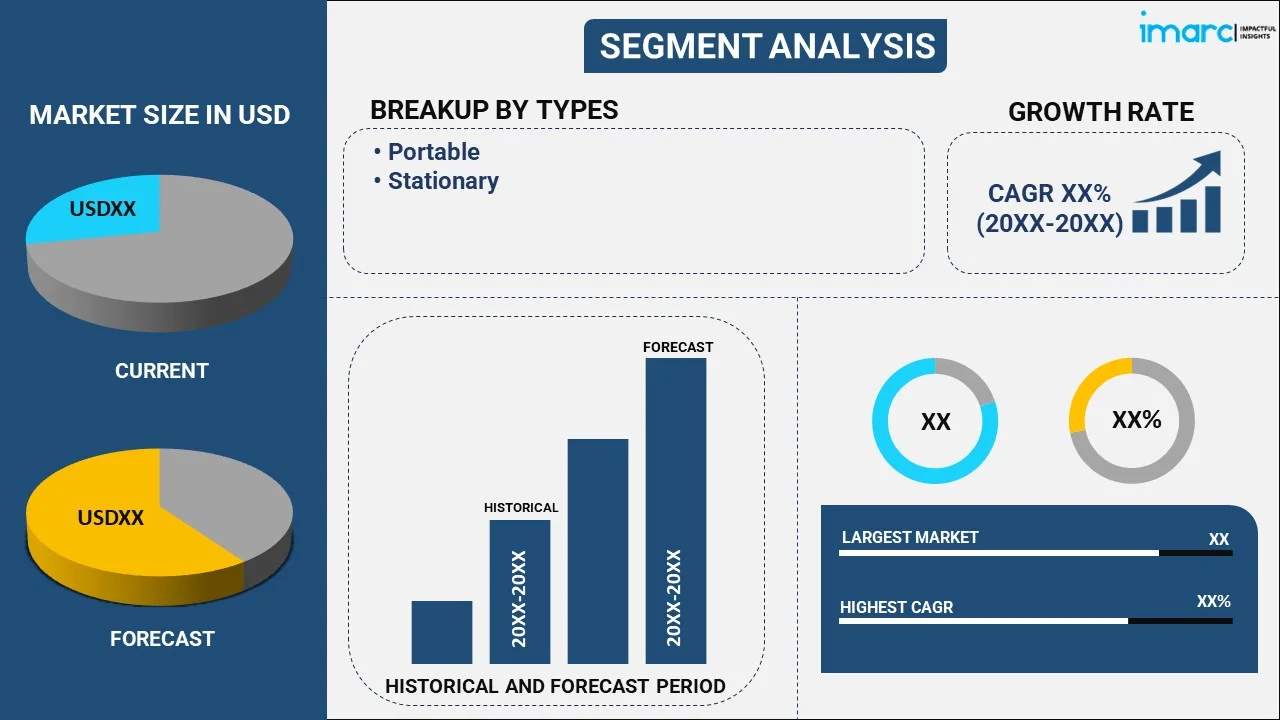

The global air compressor market size reached USD 19.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 25.6 Billion by 2034, exhibiting a growth rate (CAGR) of 3.12% during 2026-2034. The increasing industrial applications, emphasis on energy efficiency, growing adoption of automation and pneumatic systems, and significant advancements in IoT and smart technologies are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 19.1 Billion |

|

Market Forecast in 2034

|

USD 25.6 Billion |

| Market Growth Rate (2026-2034) | 3.12% |

An air compressor refers to a type of mechanical device that converts power from an electric motor or gasoline engine into potential energy stored in compressed air. It is designed to increase the air pressure, leading to the compression of gases. These compressors are utilized in various industries for tasks such as powering pneumatic tools, filling gas cylinders, and providing a continuous supply of compressed air for machinery. They play a vital role in facilitating processes that require high-pressure air, making them essential for diverse applications in manufacturing, construction, automotive, and other sectors.

The increasing demand for compressed air in various industrial applications, such as manufacturing, oil and gas, automotive, and construction, represents one of the key factors fueling the market growth. Besides this, the rising need for efficient power tools and equipment that rely on compressed air for operation is propelling the market growth. Moreover, the rising focus on energy efficiency and sustainable practices is urging manufacturers to develop advanced air compressors that consume less power and reduce carbon emissions, thereby strengthening the market growth. In addition to this, the expanding adoption of automation across various industries is driving the employment of pneumatic systems, thereby boosting the demand for air compressors. Furthermore, rapid industrialization in emerging economies and the expansion of the manufacturing sector are creating lucrative opportunities for air compressor providers.

Air Compressor Market Trends/Drivers:

Increasing industrial applications

One of the key factors driving the air compressor market growth is the rising demand for compressed air in various industrial applications. Industries such as manufacturing, oil and gas, automotive, construction, and mining heavily rely on compressed air for a wide range of processes, which, in turn, is creating a positive outlook for market expansion. In addition to this, the surging need for compressed air to power pneumatic tools and equipment, control valves, and operate conveyor systems is presenting remunerative growth opportunities for the market. As industrial activities continue to expand and diversify globally, the demand for air compressors is steadily increasing.

Rising emphasis on energy efficiency

With growing concerns about environmental sustainability and energy conservation, there is a strong emphasis on developing energy-efficient solutions in the industrial sector. Air compressors, being power-hungry devices, have drawn attention to their energy consumption. In response, manufacturers are focusing on the design and development of energy-efficient air compressors that minimize power usage and reduce carbon emissions, thereby contributing to the market's growth. Furthermore, these energy-efficient models not only help industries meet their sustainability goals but also result in cost savings for end-users, making them an attractive choice.

Expanding automation and rising demand for pneumatic systems

The rising adoption of automation in various industries is another crucial factor driving the air compressor market. Automated systems rely on pneumatic components and controls that require compressed air to function effectively. As a result, with expanding automation, there is a surging demand for air compressors as a reliable source of compressed air, which, in turn, is acting as another significant growth-inducing factor. Concurrent with this, the shifting consumer preference for pneumatic systems in industries due to their safety, versatility, and ease of maintenance is bolstering the demand for air compressors.

Air Compressor Market Opportunities:

The air compressor market offers promising opportunities in different sectors of the industry owing to growing demand for energy-saving and technologically superior systems. With increasing activities in manufacturing, automotive, food and beverage, healthcare, and construction industries globally, demand for compressed air solutions in operations such as powering pneumatic tools, automation, and material handling is on the rise. The move towards sustainable production methods and the use of oil-free and variable-speed drive (VSD) compressors in an effort to minimize energy consumption is also opening up innovation and differentiation opportunities in terms of products. Additionally, the expansion of small and medium enterprises (SMEs) in developing economies presents a huge market for affordable and compact air compressor systems. Moreover, the convergence of IoT and remote monitoring technologies is driving operational efficiency and predictive maintenance, propelling end-users in need of reliable and low-maintenance applications. These, together, present strong growth opportunities and strategic opportunities for expansion across the global air compressor market.

Air Compressor Market Challenges:

The air compressor market size is growing considerably, also has its challenges. Among the key issues is the significant upfront investment and maintenance expenses of sophisticated air compressor systems, especially those that are energy-efficient and industrial-strength. This could be a limiting factor for small and medium-sized companies looking to embrace cutting-edge solutions. The market also has technical challenges related to overheating, pressure fluctuations, and efficiency loss when the systems are not well-maintained, which could affect long-term reliability. Raw material price fluctuations, especially of metals and parts critical to compressor production, also translate into production cost variations. Furthermore, compliance with noise, emissions, and energy performance regulations demands ongoing technology improvements, which puts added pressure on producers. Managing such issues with innovation and customer-centric support is crucial to achieving user satisfaction and continued growth in the air compressor market alongside the maintenance of compliance with safety and environmental standards.

Air Compressor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global air compressor market report, along with forecasts at the global, regional and country levels from 2026-2034. Our report has categorized the market based on type, technology, lubrication method, power rating and end user.

Breakup by Type:

- Portable

- Stationary

Stationary dominates the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes portable and stationary. According to the report, stationary represented the largest segment.

The demand for stationary air compressors is being propelled by their suitability for long-term and continuous applications in various industries. Unlike portable compressors, stationary models are installed in fixed locations and provide a constant and reliable supply of compressed air, which propels their adoption. Moreover, they are highly preferred for tasks that require a consistent source of compressed air, such as powering industrial machinery, pneumatic systems, and assembly lines. In addition to this, stationary compressors often have higher capacity and efficiency, making them well-suited for heavy-duty applications and contributing to their increasing demand in industrial settings.

Breakup by Technology:

- Reciprocating/Piston

- Rotary/Screw

- Centrifugal

Rotary/screw holds the largest share in the market

A detailed breakup and analysis of the market based on technology has also been provided in the report. This includes reciprocating/piston, rotary/screw, and centrifugal. According to the report, rotary/screw accounted for the largest market share.

The surging demand for rotary/screw air compressors can be attributed to their high efficiency and reliability in meeting industrial compressed air requirements. Additionally, these compressors utilize a continuous rotary motion, resulting in smooth and pulsation-free air delivery, making them ideal for applications demanding constant air pressure. Moreover, their ability to operate continuously without the need for frequent starts and stops improves overall energy efficiency and reduces maintenance costs, thus aiding in market expansion. Besides this, rotary/screw air compressors are favored in industries where a steady supply of compressed air is essential, such as manufacturing, food processing, pharmaceuticals, and automotive, further driving their demand in the market.

Breakup by Lubrication Method:

- Oil-filled

- Oil-free

Oil-filled dominates the market

The report has provided a detailed breakup and analysis of the market based on the lubrication method. This includes oil-filled and oil-free. According to the report, oil-filled represented the largest segment.

The expanding demand for oil-filled air compressors driven by their superior performance in heavy-duty and high-pressure applications is strengthening the market growth. These compressors use oil as a lubricant, which not only reduces friction but also helps dissipate heat effectively, ensuring smooth and efficient operation even under demanding conditions. Moreover, the presence of oil provides better sealing between components, leading to improved efficiency and a longer lifespan. Consequently, industries requiring consistent and high-pressure compressed air, such as construction, mining, and manufacturing, are increasingly opting for oil-filled air compressors for their reliability and ability to withstand rigorous working environments.

Breakup by Power Rating:

- 0-100 kW

- 101-300 kW

- 301-500 kW

- 501 kW and Above

101-300 kW holds the largest share in the market

A detailed breakup and analysis of the market based on the power rating has also been provided in the report. This includes 0-100 kW, 101-300 kW, 301-500 kW, and 501 kW and above. According to the report, 101-300 kW accounted for the largest market share.

The demand for 101-300 kW air compressors is being propelled by their ability to cater to medium to large-scale industrial operations with higher compressed air requirements. These powerful compressors offer greater capacity and efficiency, making them suitable for heavy-duty applications in industries such as mining, petrochemicals, and steel manufacturing. As these sectors continue to expand, the need for reliable and high-performance air compressors in the specified power range has increased, contributing to the market's growth. In addition to this, significant advancements in technology have led to more energy-efficient models, further boosting the demand for 101-300 kW air compressors among businesses seeking cost-effective and sustainable solutions.

Breakup by End User:

- Manufacturing

- Semiconductors and Electronics

- Food and Beverages

- Healthcare/Medical

- Home Appliances

- Energy

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes manufacturing, semiconductors and electronics, food and beverages, healthcare/medical, home appliances, energy, oil and gas, and others.

Air compressors' versatility and critical role in diverse applications primarily drive their demand across manufacturing, semiconductors and electronics, food and beverages, healthcare/medical, home appliances, energy, oil, and gas industries. In manufacturing, air compressors enable efficient production processes by powering pneumatic tools and equipment. They supply clean air and are used in precision applications in the semiconductors and electronics industry. They assist in packaging and processing in the food and beverages industry. In healthcare/medical, air compressors support medical device operations. They are utilized in air conditioning and refrigeration units in home appliances. In the energy, oil, and gas sectors, air compressors facilitate various drilling, transportation, and processing tasks, marking them as essential equipment for these industries.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

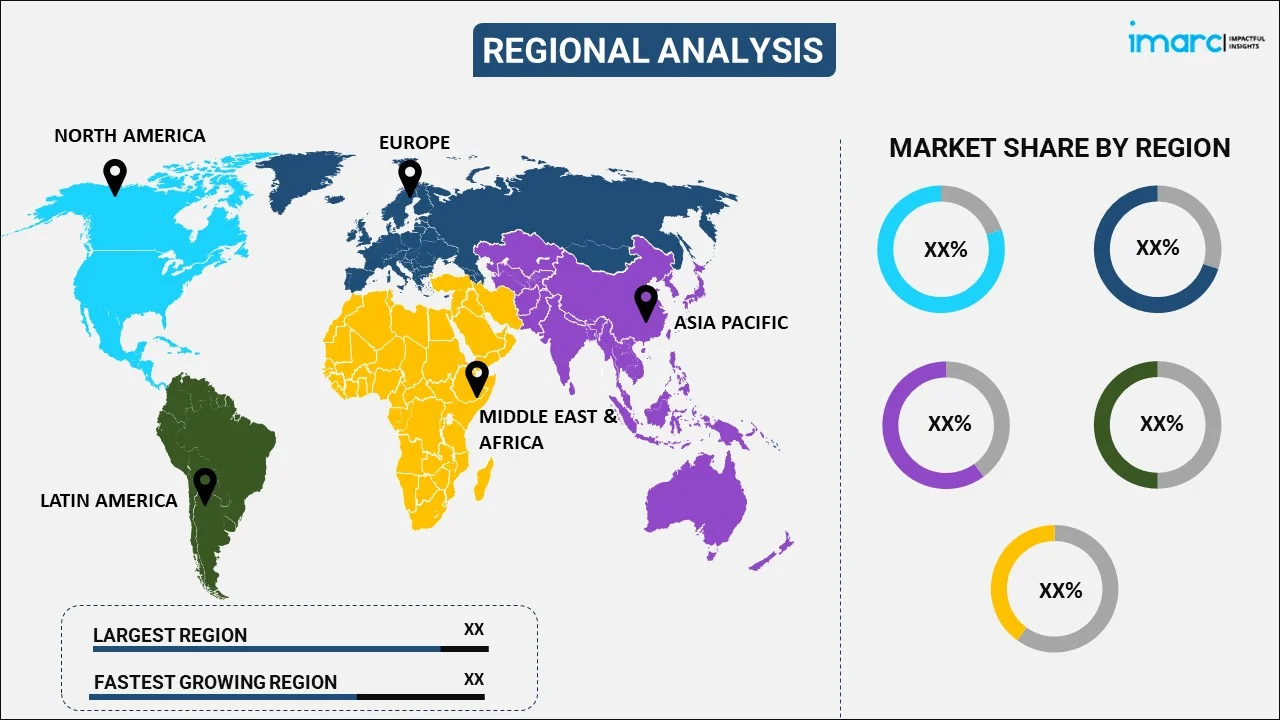

Asia-Pacific exhibits a clear dominance, accounting for the largest air compressor market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest market share.

The demand for air compressors in the Asia Pacific region is being propelled by rapid industrialization and infrastructural development. Moreover, as the region witnesses significant economic growth, various industries such as manufacturing, construction, automotive, and electronics are expanding their operations. This, in turn, leads to an increasing need for compressed air to power pneumatic machinery, tools, and equipment. Apart from this, the growing focus on energy efficiency and sustainability in emerging economies such as China and India is driving the adoption of advanced air compressors that offer higher efficiency and reduced carbon emissions, further fueling the demand in the Asia Pacific air compressor market.

Key Regional Takeaways:

Asia Pacific Air Compressor Market Analysis

Asia Pacific is the leading region in the air compressor market outlook, with the driver being fast industrialization, infrastructure growth, and growth in automotive, manufacturing, and construction industries. China, India, and Southeast Asia economies are investing immensely in smart factories and power-saving industrial equipment, promoting demand for sophisticated air compressors. Government policies aimed at increasing local production and energy savings are also promoting the use of oil-free and variable speed drive compressors. Moreover, the increasing presence of manufacturing clusters and the spread of small and medium-sized enterprises (SMEs) favor ongoing market growth. In such a dynamic climate, firms are emphasizing portable and low-maintenance designs to cater to varying end-users' requirements. The good economic environment, low labor costs, and ongoing technological advancements make Asia Pacific a crucial driver of global air compressor market growth, with a consistently rising proportion in various industrial uses.

Europe Air Compressor Market Analysis

The air compressor market size in Europe is driven by a high focus on sustainability, efficiency, and adherence to very stringent environmental standards. The region's emphasis on decarbonizing industrial processes has promoted the use of oil-free and energy-saving air compressors in industries like pharmaceuticals, food and beverages, and automotive production. Germany, Italy, and the UK are at the forefront in adopting smart factory ideas, which involve the use of intelligent air compression systems to maximize performance and reduce energy loss. In addition, compressed air system innovation combined with IoT and predictive maintenance is becoming more prominent. Although the European industries' mature status induces competition, there are still investment opportunities in green technologies and retrofit initiatives for market participants. The Ecodesign Directive is an example of a regulatory scheme that continues to influence product development strategies. Together, Europe has a solid and innovation-focused position in the global air compressor market that contributes to its technological leadership.

North America Air Compressor Market Analysis

The North American market for air compressors is underpinned by mature industrial base industries such as oil and gas, automobiles, aerospace, and healthcare. The United States particularly leads regional demand through ongoing investment in infrastructure modernization, shale gas exploration, and automated manufacturing systems. There is an increasing move toward energy-efficient and eco-friendly compressors, spurred by corporate sustainability initiatives and federal regulation. Also on the rise is the use of digital and networked compressor technologies, which will provide real-time monitoring, predictive maintenance, and improved control over operation. This reflects the increased uptake of Industry 4.0 principles throughout the region. Technological innovation, coupled with growing demand for durable and lightweight air compressors in home and service use, further supports the market. While competitive, the region's emphasis on innovation, quality, and automation insures solid growth. North America remains conducive to good opportunities for air compressor producers, supported by a positive air compressors market forecast for long-term success and product differentiation.

Latin America Air Compressor Market Analysis

The Latin American air compressor market is slowly growing due to the industrialization and construction industries in the region. Brazil, Mexico, and Argentina are experiencing heavier investments in manufacturing, mining, and energy facilities, all of which use compressed air systems for vital operations. Amid economic uncertainty and infrastructure issues, the region is poised for moderate growth, particularly with the efforts of the government in supporting industrial growth and sustainable technologies. Demand is increasing for low-cost, energy-saving air compressors, especially by small- and medium-sized companies. The spare parts and maintenance service aftermarket is also becoming increasingly significant, with firms focusing on equipment reliability and operation efficiency. Though penetration in the market for cutting-edge technologies is quite slow in comparison to more developed countries, there is an increasing awareness of automation and energy-saving technologies. Latin America is a developing but prospective part of the world air compressor market, with space for innovation, strategic alliances, and capacity-building.

Middle East and Africa Air Compressor Market Analysis

The Middle East and Africa (MEA) region is increasingly strategically significant in the air compressor market, mainly owing to its booming oil and gas industry and increasing construction and mining activities. The Gulf Cooperation Council (GCC) nations remain committed to investing in mega-size infrastructure projects, industrial diversification, and energy-efficient solutions under long-term economic development plans. These projects drive demand for stationary and portable air compressors. On the other hand, sub-Saharan Africa is experiencing increasing growth in domestic manufacturing, agriculture processing, and small-scale industries, hence the increased adoption of compressors. While the region encounters constraints including constrained access to newer technology and varying capital investments, growing attention on sustainable industrialization and renewable energy is creating new opportunities. Air compressors with low maintenance, fuel economy, and resilience in harsh environmental conditions are highly desired. MEA's gradual industrialization and infrastructure development reinforce its emerging position in the global air compressor market landscape

Competitive Landscape:

The global air compressor market is distinguished by a highly competitive landscape with numerous key players vying for market share. Established companies continuously invest in research and development to introduce innovative and energy-efficient air compressor solutions, catering to various industries and customer needs. Besides the major players, there is also a presence of numerous regional and local manufacturers offering cost-effective air compressor solutions, particularly in emerging economies. These companies often focus on specific market segments or niche applications to gain a competitive edge. Besides this, technological advancements, such as the integration of IoT and smart technologies in air compressors, are reshaping the competitive landscape. Market competition is also driven by factors like product pricing, after-sales service, warranty, and customer support.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Atlas Copco AB

- Bauer Compressors Inc.

- Berkshire Hathaway Inc.

- Ciasons Industrial Inc.

- Desran Compressor (Shanghai) Co. Ltd

- Doosan Corporation

- ELGi Equipments Limited

- Hitachi Ltd.

- Ingersoll Rand Inc. (Trane Technologies plc)

- Rolair Systems

- Suzler Ltd.

Recent Developments:

- In July 2023, Atlas Copco announced the acquisition of cryopump service provider and distributor of ZEUS Co., Ltd. that provides service and sales distribution for the Vacuum Technique business area’s CTI and Polycold products in South Korea.

- In July 2023, Doosan Enerbility announced a collaboration agreement with Johnson Matthey (JM), a UK-based company specializing in ammonia cracking solutions, on pursuing joint research in the ammonia cracking business.

- In April 2023, Bauer Compressors Inc. announced the launch of three new K22, BK 23, and BM series, featuring directly coupled units, representing the perfect synthesis of performance and compact design.

Air Compressor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Portable, Stationary |

| Technologies Covered | Reciprocating/Piston, Rotary/Screw, Centrifugal |

| Lubrication Methods Covered | Oil-Filled, Oil-Free |

| Power Ratings Covered | 0-100 kW, 101-300 kW, 301-500 kW, 501 kW and above |

| End Users Covered | Manufacturing, Semiconductors and Electronics, Food and Beverages, Healthcare/Medical, Home Appliances, Energy, Oil and Gas, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Atlas Copco AB, Bauer Compressors Inc., Berkshire Hathaway Inc., Ciasons Industrial Inc., Desran Compressor (Shanghai) Co. Ltd, Doosan Corporation, ELGi Equipments Limited, Hitachi Ltd., Ingersoll Rand Inc. (Trane Technologies plc), Rolair Systems, Suzler Ltd. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the air compressor market from 2020-2034

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global air compressor market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the air compressor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global air compressor market was valued at USD 19.1 Billion in 2024.

We expect the global air compressor market to exhibit a CAGR of 3.12% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary closure of numerous end-use industries for air compressors.

The rising demand for effective and affordable compressors to meet the energy and power demand as well as enhance their operational outputs, is primarily driving the global air compressor market.

Based on the type, the global air compressor market has been divided into portable and stationary. Currently, stationary exhibits a clear dominance in the market.

Based on the technology, the global air compressor market can be categorized into reciprocating/piston, rotary/screw and centrifugal, where rotary/screw currently accounts for the majority of the total market share.

Based on the lubrication method, the global air compressor market has been segregated into oil-filled and oil-free. Currently, oil-filled holds the largest market share.

Based on the power rating, the global air compressor market can be bifurcated into 0-100 kW, 101-300 kW, 301-500 kW and 501 kW and above. Among these, 101-300 kW exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global air compressor market include Atlas Copco AB, Bauer Compressors Inc., Berkshire Hathaway Inc., Ciasons Industrial Inc., Desran Compressor (Shanghai) Co. Ltd, Doosan Corporation, ELGi Equipments Limited, Hitachi Ltd., Ingersoll Rand Inc. (Trane Technologies plc), Rolair Systems and Suzler Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)