Air Filter Cartridges Market Report Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Air Filter Cartridges Market Size and Share:

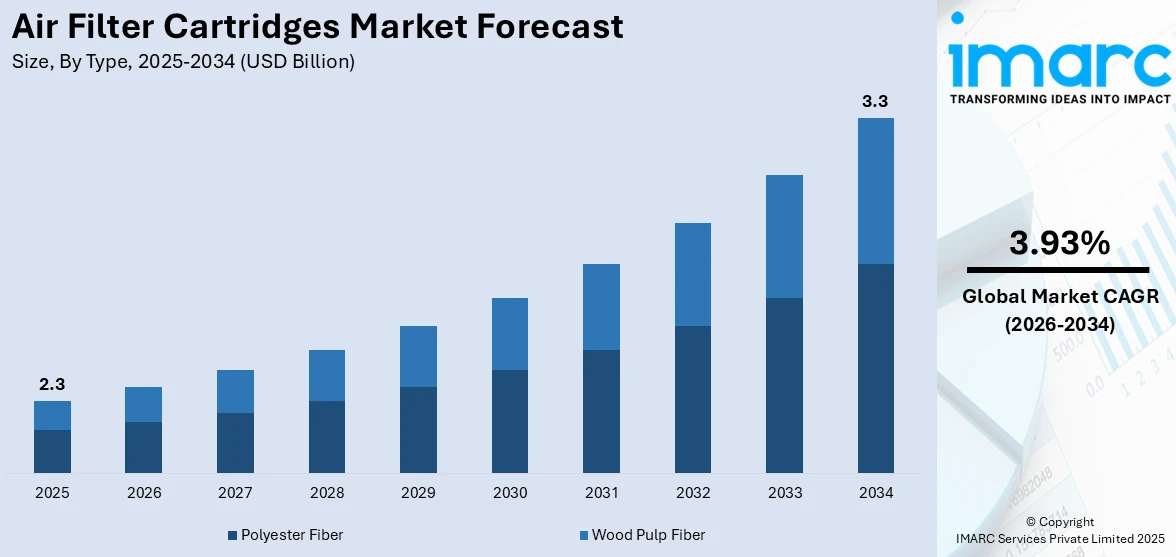

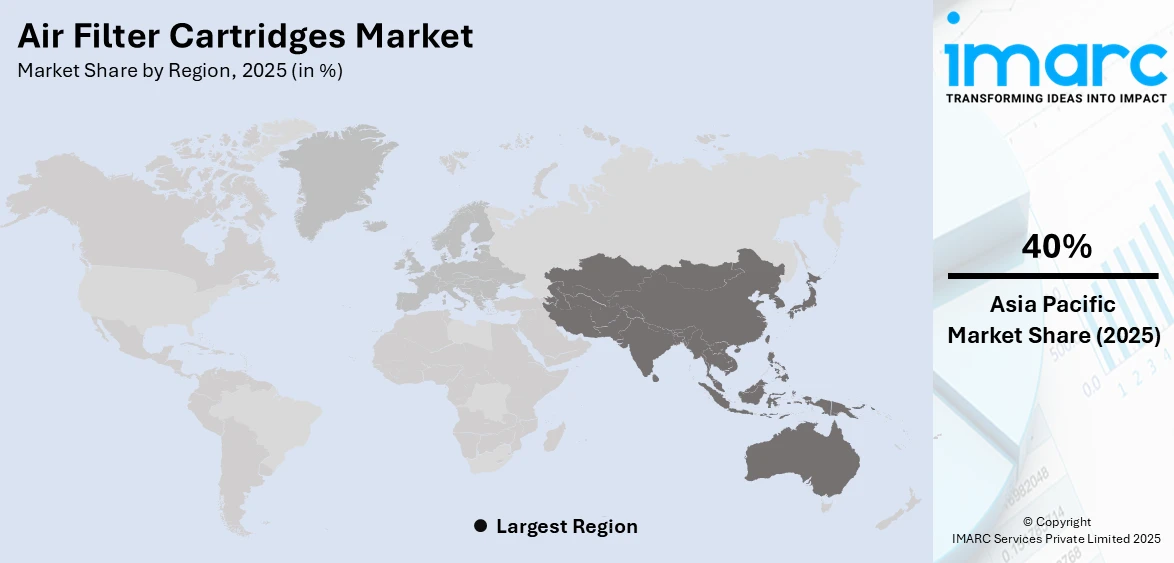

The global air filter cartridges market size was valued at USD 2.3 Billion in 2025. The market is projected to reach USD 3.3 Billion by 2034, exhibiting a CAGR of 3.93% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of around 40% in 2025. The market is fueled by increasing demand for effective air filtration systems in industrial and residential industries due to increasing air pollution concerns and strict environmental laws. In addition, technological improvements in filtration, including nanofiber and HEPA filters, are increasing the efficiency and lifespan of products. Further, the growth in manufacturing and processing industries, especially in developing countries, is significantly augmenting the air filter cartridges market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2.3 Billion |

|

Market Forecast in 2034

|

USD 3.3 Billion |

| Market Growth Rate 2026-2034 | 3.93% |

The global market is witnessing significant growth driven by the rising use of air filter cartridges in data centers and cleanrooms. According to industry reports, the global data center market reached USD 213.6 Billion in 2024 and is projected to reach USD 494.5 Billion by 2033. This expansion is fueling the demand for advanced air filtration systems, as even minimal airborne particles can compromise highly sensitive equipment and disrupt critical operations. Moreover, the increasing emphasis on energy-efficient HVAC systems in commercial and residential infrastructure is driving demand for advanced filtration solutions that maintain indoor air quality while optimizing airflow. Additionally, stringent occupational safety regulations in sectors such as pharmaceuticals and food processing are necessitating the installation of high-performance filtration systems. Also, technological advancements in filter media, including nanofiber coatings and electrostatically charged materials, are further enhancing the market's appeal by offering extended service life and improved dust-holding capacity across critical industrial settings.

To get more information on this market Request Sample

In the United States, the market is driven by growing industrial automation and the expansion of precision manufacturing sectors, including semiconductors and aerospace. These environments require controlled air quality to prevent product defects and ensure process reliability. One of the emerging air filter cartridges market trends is the increasing public and governmental focus on workplace health standards, reinforced by OSHA and EPA mandates, which is compelling industries to adopt high-efficiency filtration systems. As per industry reports, in 2024, the U.S. experienced 64,897 wildfires, marking a 14.7% increase from the wildfires reported in 2023. The increased wildfire events and their impact on air quality are boosting adoption in commercial buildings and institutions seeking to maintain healthy indoor environments. Moreover, the retrofitting of aging industrial infrastructure with modern air filtration technologies, especially in older manufacturing hubs, is adding momentum to market expansion.

Air Filter Cartridges Market Trends:

Prevalence of Numerous Airborne Diseases

The increasing occurrence of airborne diseases, including asthma, chronic obstructive pulmonary disease (COPD), and respiratory infections, is playing a significant role in elevating the demand for air filtration solutions across various sectors. Asthma is a prevalent long-term non-communicable disease that affects over 260 Million people around the world. Each year, it leads to over 450,000 deaths, as per industry reports. With rising public health concerns and growing awareness about the role of indoor air quality in disease transmission, both commercial and industrial facilities are integrating air filter cartridges into their ventilation systems. Healthcare facilities, in particular, are intensifying their focus on infection control, using filtration systems to prevent the spread of pathogens such as bacteria, viruses, and fungal spores. Furthermore, the global COVID-19 pandemic has heightened awareness of airborne disease transmission, catalyzing a shift toward advanced air purification technologies. Air filter cartridges, known for their reliability and customizable filtration properties, are becoming essential components in maintaining hygienic environments. This health-driven trend is positively impacting the air filter cartridges market outlook.

Increase in Air Pollution

The global market is primarily driven by the significant increase in air pollution levels due to rising emissions from industries and urban regions. According to the World Meteorological Organization (WMO), total carbon dioxide emissions were expected to reach 41.6 Billion Tonnes in 2024, recording a significant increase in comparison to 2023 at 40.6 Billion Tonnes. Additionally, according to an industry report, an estimated 99% of people worldwide live in environments where air pollution levels are significantly more than the WHO guideline limits. In 2019, exposure to household and ambient air pollution was directly responsible for 6.7 Million deaths worldwide. As a result, industries are compelled to deploy advanced air filtration systems to safeguard employee health, maintain indoor air quality, and adhere to environmental sustainability goals. The problem is particularly acute in developing economies, where rapid urbanization and industrialization outpace environmental infrastructure. Moreover, the increasing use of fossil fuels in energy-intensive sectors further exacerbates pollutant levels, driving the need for efficient particulate removal technologies. These cartridges, with their high dust-holding capacity and easy maintenance, are becoming a preferred solution for mitigating airborne contaminants. This trend is expected to continue gaining traction as pollution levels remain a critical public and industrial concern globally.

Stringent Regulations and Emission Standards

One of the significant factors facilitating the air filter cartridges market growth is the tightening of air quality regulations and emission standards to address environmental and health-related risks associated with airborne pollutants. This is resulting in a higher uptake of effective air filtration systems to ensure compliance. For instance, in July 2025, the European Commission presented a revision to the EU Climate Law that would set a 90% reduction in net greenhouse gas (GHG) emissions by 2040 compared to 1990 levels, as proposed by the Commission's Political Guidelines for 2024-2029. This proposal expands on the EU's legally binding target of lowering net greenhouse gas emissions by at least 55% by 2030 and establishes a more flexible and realistic approach to achieving the goal. Furthermore, these developments have spurred industries to invest in high-efficiency air filtration systems, with air filter cartridges gaining prominence for their compliance-ready design, efficiency, and cost-effectiveness. In addition, manufacturers of air filter cartridges are responding by developing products that meet evolving regulatory criteria, such as HEPA-grade performance or multi-stage filtration systems. This trend is fostering continuous innovation and quality enhancement, reinforcing regulatory compliance as a pivotal driver of market demand.

Air Filter Cartridges Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global air filter cartridges market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on type and application.

Analysis by Type:

- Polyester Fiber

- Wood Pulp Fiber

Polyester fiber leads the market with around 60.7% of market share in 2025. It is long-lasting, chemical-resistant, and affordable. Its high tensile strength, together with moisture and abrasion resistance, makes it very common in industrial settings where air filtration equipment must endure rough operating conditions. Polyester fiber finds special application in uses that include high temperatures and contact with oils, solvents, and other airborne pollutants. Moreover, the reusability of the material and its compatibility with many coating treatments improve its filtration performance, which explains its desirability in applications including metal processing, food and beverage, drugs, and electricity generation. Its easy maintenance needs and long service life lower its operational costs, sustaining its demand. As industries look to efficiently and sustainably filter increasingly, polyester fiber is a leading material type, fueling innovation and product development within the market.

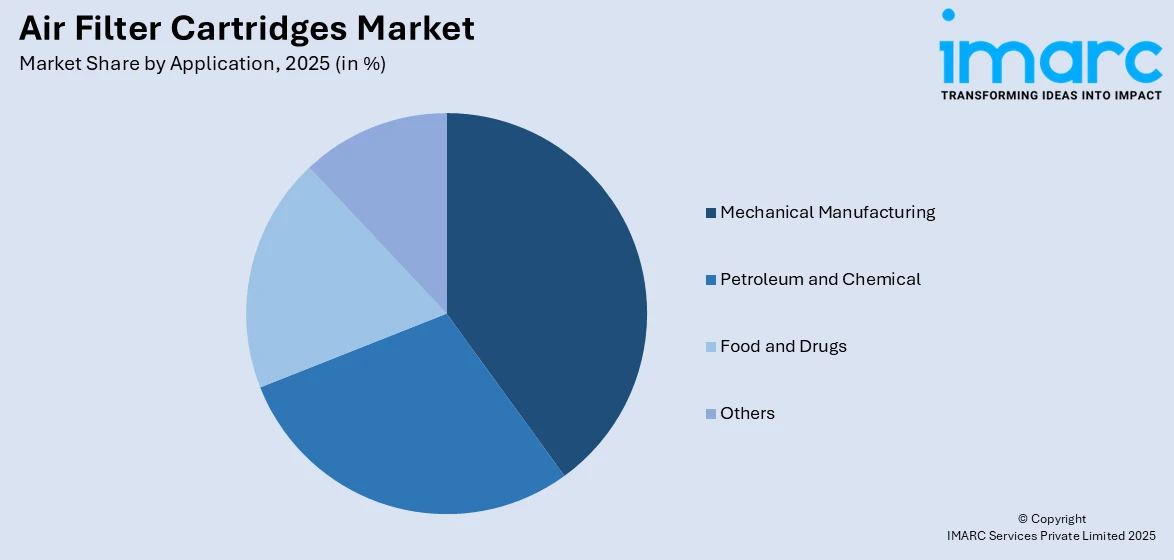

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Petroleum and Chemical

- Mechanical Manufacturing

- Food and Drugs

- Others

Mechanical manufacturing leads the market with around 38.5% of market share in 2025. The segment is driven by the need to maintain clean and safe working environments in manufacturing facilities. Processes such as welding, grinding, machining, and metal cutting release large volumes of airborne contaminants, including dust, fumes, oil mist, and metal particles. Therefore, air filter cartridges play a critical role in capturing these pollutants, protecting workers' health, reducing equipment wear, and ensuring regulatory compliance with workplace safety standards. Effective filtration systems also help maintain product quality by minimizing the risk of contamination in precision manufacturing. With growing emphasis on workplace safety, operational efficiency, and environmental responsibility, the demand for high-performance, long-life filter cartridges is increasing across mechanical workshops and industrial plants. As automation and precision engineering continue to expand, air filtration becomes even more essential, reinforcing the importance of air filter cartridges in supporting productivity and sustainable operations within the mechanical manufacturing sector.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of around 40%, driven by rapid industrialization, urbanization, and growing environmental awareness across emerging economies like China, India, and Southeast Asian countries. The region is witnessing robust demand for air filtration solutions due to expanding manufacturing sectors, including automotive, electronics, metalworking, and pharmaceuticals, that require efficient air quality management to ensure operational safety and regulatory compliance. Additionally, government initiatives aimed at curbing industrial emissions and improving air quality standards are accelerating the adoption of advanced filtration technologies. The presence of large-scale industrial clusters, coupled with increasing infrastructure investments, further supports market growth. Asia Pacific also benefits from a strong manufacturing base for filtration components, enabling cost-effective production and faster deployment. As the region continues to prioritize sustainable industrial practices and stricter environmental regulations, Asia-Pacific is expected to remain a key driver of innovation and demand in the global market.

Key Regional Takeaways:

United States Air Filter Cartridges Market Analysis

In 2025, the United States holds a substantial share of around 83.80% of the air filter cartridges market share in North America. The market in the United States is primarily driven by health-conscious consumer behaviors and increasingly stringent regulatory standards. Growing public awareness regarding indoor air quality, particularly due to concerns about allergens, volatile organic compounds (VOCs), and airborne pathogens, is driving the demand for high-efficiency and specialty filters capable of capturing finer particulates and microbial contaminants. In response, manufacturers are innovating with advanced filter media, such as HEPA, activated carbon, electrostatic fibers, and nanofiber composites, offering superior filtration performance while addressing energy efficiency demands. Stricter environmental and clean air regulations at federal, state, and local levels are also prompting upgrades in HVAC systems, industrial dust collection units, and cleanroom facilities, thereby boosting demand for compliant cartridges. Additionally, the increasing number of construction activities in both commercial and residential real estate is significantly contributing to market demand, as new buildings integrate advanced HVAC systems that require high-efficiency filtration. As per an industry report, construction spending in the United States reached a seasonally adjusted annual rate of USD 2,138.2 Billion in May 2025. Within this total, private construction accounted for USD 1,626.6 Billion, while spending on public construction was estimated at an annualized rate of USD 511.6 Billion. Other than this, the demand for enhanced air quality in schools, office spaces, and public transit systems is also increasing government and private investment in modern filtration solutions, facilitating industry expansion.

Asia-Pacific Air Filter Cartridges Market Analysis

The market in the Asia-Pacific is expanding due to rapid urbanization, increasing air pollution, and expanding industrialization across economies such as China, India, Southeast Asia, and Australia. According to the World Bank Group, air pollution was responsible for 1.67 Million deaths in India in 2019, representing 17.8% of all fatalities in the country that year. In addition, premature deaths and pollution-related illnesses led to output losses of USD 28.8 Billion and USD 8 Billion, respectively. Combined, these losses amounted to USD 36.8 billion, equivalent to 1.36% of India’s GDP in 2019. Severe smog episodes and rising public health concerns are, thereby, prompting governments and consumers to invest in clean air solutions, driving demand for high-efficiency cartridges in residential and commercial HVAC units. The growth of manufacturing sectors, such as electronics, automotive, food processing, and mining, is also propelling the need for robust industrial filtration to protect equipment, ensure worker safety, and comply with environmental regulations.

Europe Air Filter Cartridges Market Analysis

The growth of the market in Europe is largely fueled by regulatory, industrial, and consumer trends that emphasize clean air, energy performance, and sustainability. Updated EU regulations and emissions standards are propelling industrial operators to install advanced filtration systems in sectors such as automotive manufacturing, petrochemicals, and food processing, driving demand for specialized cartridges designed to capture ultrafine particles, solvents, and volatile compounds. Growth in renewable energy facilities, including biomass, biogas, and wind-turbine manufacturing, requires robust filtration solutions to protect equipment and ensure regulatory compliance. For instance, domestic biogas production in the European Union reached 14.9 Million Tonnes of oil equivalent (mtoe) in 2021, recording 1.7% growth in comparison to the previous year, according to the European Commission. Germany emerged as the leading producer of biogas, accounting for 50.4% of total EU production. Additionally, the increasing prevalence of urban congestion charges and low-emission zones is also influencing building developers and public transit authorities to upgrade HVAC systems with high-grade cartridges that enhance indoor air quality in schools, hospitals, and offices. As smart building technologies expand across the region, integrated sensor-driven filtration systems with predictive maintenance capabilities are also emerging, providing the market with differentiated value in terms of performance, compliance, and sustainability.

Latin America Air Filter Cartridges Market Analysis

In Latin America, the market is significantly influenced by rising concerns about poor air quality in rapidly urbanizing areas, where industrial pollution and vehicle emissions have a major impact on public health. For instance, in Brazil, greenhouse gas emissions from transportation reached 204 million tCO2e in 2021, accounting for 8.5% of total emissions in the country and recording a growth of 10.5% in comparison to the previous year, as per the World Bank Group. Governments and regulatory agencies are responding with stricter air quality standards, prompting commercial and residential buildings to upgrade filtration systems. Rising consumer health awareness, combined with increasing disposable incomes, is also driving strong growth in residential air purifiers that utilize replaceable cartridges, supporting overall market growth.

Middle East and Africa Air Filter Cartridges Market Analysis

The market in the Middle East and Africa is experiencing robust growth due to numerous environmental, industrial, and public health factors. Escalating dust storms, desertification, and high ambient pollution in GCC countries, North Africa, and parts of Sub-Saharan Africa are driving the installation of heavy-duty cartridges in residential, commercial, and public buildings. Rapid growth in sectors such as oil and gas, petrochemicals, and mining is also boosting demand for industrial-grade filtration to protect sensitive equipment and maintain safety standards. For instance, the UAE produces approximately 3.2 Million barrels of petroleum and liquids daily on average, according to an industry report. By 2030, the Abu Dhabi National Oil Company (ADNOC) is projected to reach 5 Million barrels of sustainable production capacity. Other than this, a strategic shift toward localizing filter media production is enabling cost-effective sourcing and greater market responsiveness across the region.

Competitive Landscape:

The market features a competitive and dynamic landscape, driven by technological advancements and rising environmental concerns. A mix of global and regional manufacturers compete intensely to offer high-performance, durable filtration solutions tailored for diverse industrial applications, including manufacturing, power generation, and automotive sectors. Moreover, players continuously focus on product innovations, efficiency optimization, and regulatory compliance to gain a competitive edge. Additionally, the increasing emphasis on energy-efficient and low-maintenance filtration systems is shaping product development strategies. Besides, strategic partnerships, vertical integration, and expansion into emerging markets are common tactics adopted to enhance market penetration. Pricing pressures and raw material volatility also influence competitive positioning, pushing companies to streamline operations and adopt sustainable production methods. According to the air filter cartridges market forecast, the growing demand for clean air in industrial facilities and stricter emission standards will significantly intensify competition over the next few years, prompting companies to differentiate through innovation, reliability, and after-sales services in order to retain and grow their customer base.

The report provides a comprehensive analysis of the competitive landscape in the air filter cartridges market with detailed profiles of all major companies, including:

- Camfil

- Donaldson Company Inc.

- Eaton Corporation plc

- Festo SE & Co KG

- Filter Concept Private Limited

- Freudenberg Filtration Technologies GmbH & Co. KG (Freudenberg & Co. KG)

- Micronics Engineered Filtration Group Inc.

- Parker Hannifin Corporation

- U.S. Air Filtration Inc.

Latest News and Developments:

- June 2025: Filterbuy established a strategic partnership with Roadie, a UPS business, for the provision of same-day deliveries for its entire product portfolio of various air filtration solutions. Through this partnership, Roadie's cross-docking system, RoadieXD, will enable Filterbuy to deliver its air filtration solutions to customers quickly and effectively.

- April 2025: Filtrete Brand announced the launch of the new Filtrete Refillable Air Filter Kit. With a long-lasting frame capable of being reused for up to two decades and a foldable filter that lasts up to 12 months, this creative kit solves numerous common customer issues. Compared to conventional filters, the refills are more cost-effective, take up 75% less storage space, and produce 20% less disposable waste.

- April 2025: Camfil, an international provider of air filtration solutions based in Sweden, officially expanded its operations into Nepal. This is an important development in Camfil's dedication to providing clean air solutions internationally, reaffirming the company's dedication to promoting healthier and more sustainable surroundings everywhere.

- March 2025: The Micronics Engineered Filtration Group officially launched a new India Center of Excellence for Industrial Filtration Solutions in Chennai. Spanning 133,000 square feet, the novel facility offers a range of solutions for clients across India, including air filtration capabilities.

- January 2025: Rensa Filtration, a renowned provider of consumable, mission-critical air filtration components, successfully completed the acquisition of Air Filtration Co., Inc. Air Filtration Co. manufactures and distributes air filtration equipment and accessories for the paint and finishings sector, with manufacturing sites in Corydon, Iowa, and Lancaster, California.

- January 2025: Blade Air successfully acquired InnerEco Environmental Inc., a renowned provider of various residential HVAC filtration solutions. This acquisition significantly strengthens Blade Air's position in both the commercial and residential sectors and represents a major milestone in the company's mission to provide sustainable clean air filtration solutions throughout North America.

Air Filter Cartridges Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Polyester Fiber, Wood Pulp Fiber |

| Applications Covered | Petroleum and Chemical, Mechanical Manufacturing, Food and Drugs, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Camfil, Donaldson Company Inc., Eaton Corporation plc, Festo SE & Co KG, Filter Concept Private Limited, Freudenberg Filtration Technologies GmbH & Co. KG (Freudenberg & Co. KG), Micronics Engineered Filtration Group Inc., Parker Hannifin Corporation, U.S. Air Filtration Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the air filter cartridges market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global air filter cartridges market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the air filter cartridges industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The air filter cartridges market was valued at USD 2.3 Billion in 2025.

The air filter cartridges market is projected to exhibit a CAGR of 3.93% during 2026-2034, reaching a value of USD 3.3 Billion by 2034.

The market is driven by growing industrialization, rising concerns over air quality, and stricter emission control standards. Manufacturing plants, power facilities, and commercial buildings are adopting advanced filtration systems to ensure worker safety and regulatory compliance. Increasing awareness of airborne pollutants and demand for clean indoor environments further support widespread application of filter cartridges.

Asia-Pacific currently dominates the air filter cartridges market with a market share of around 40%. The dominance is fueled by strong industrial infrastructure, stringent environmental regulations, and heightened awareness of workplace air safety. The region also benefits from steady investment in HVAC systems and technological upgrades in pollution control across multiple end-user sectors.

Some of the major players in the air filter cartridges market include Camfil, Donaldson Company Inc., Eaton Corporation plc, Festo SE & Co KG, Filter Concept Private Limited, Freudenberg Filtration Technologies GmbH & Co. KG (Freudenberg & Co. KG), Micronics Engineered Filtration Group Inc., Parker Hannifin Corporation, and U.S. Air Filtration Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)