Air Freshener Market Size, Share, Trends, and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033

Air Freshener Market Size and Share:

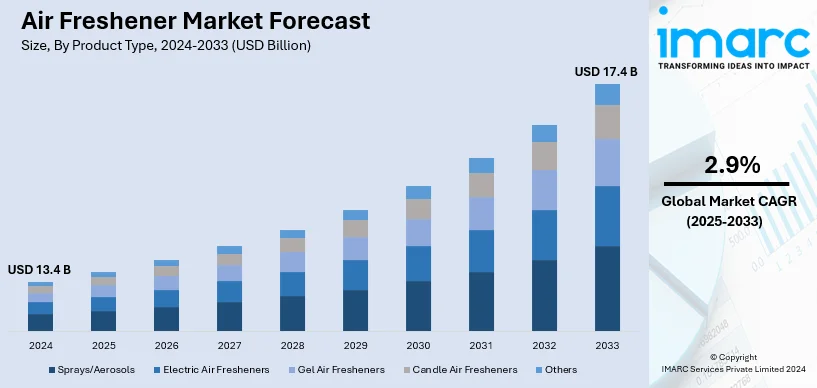

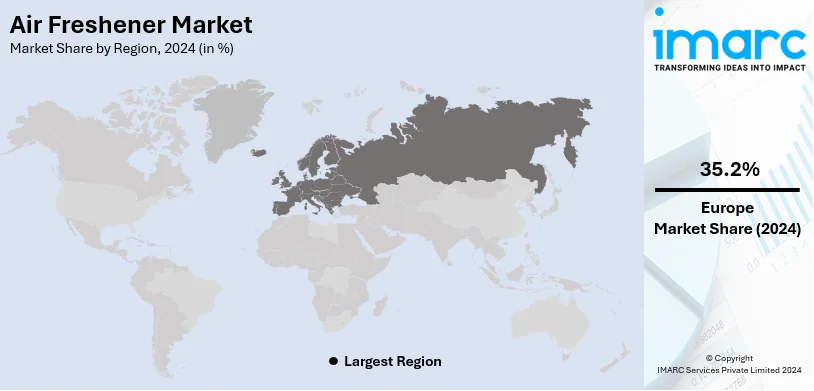

The global air freshener market size was valued at USD 13.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 17.4 Billion by 2033, exhibiting a CAGR of 2.9% from 2025-2033. Europe currently dominates the market, holding a market share of over 35.2% in 2024. The European region is experiencing steady growth driven by high individual awareness about indoor air quality, preference for premium and eco-friendly products, widespread adoption in commercial spaces, and a strong cultural association with maintaining fragrant and clean environments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.4 Billion |

| Market Forecast in 2033 | USD 17.4 Billion |

| Market Growth Rate (2025-2033) | 2.9% |

At present, the growing awareness about the importance of maintaining a fresh and pleasant indoor environment is driving the demand for air fresheners. Furthermore, manufacturers are introducing a wide range of products, including sprays, gels, candles, and plug-in diffusers, catering to diverse user preferences. Innovations like natural and eco-friendly ingredients and long-lasting formulations are appealing to environmentally conscious individuals. Additionally, advancements in delivery mechanisms, such as automated dispensers, rechargeable diffusers, and smart sensors that release fragrance based on room occupancy, are enhancing convenience and appeal. These technologies cater to tech-savvy users who prioritize functionality and efficiency.

The United States has emerged as a key regional market, driven by the increasing awareness about the importance of maintaining a clean and pleasant indoor environment. Individuals are purchasing air fresheners to tackle odors from cooking, pets, smoking, and dampness. Besides this, advanced technologies, such as motion-sensor air fresheners, rechargeable diffusers, and automatic spray systems, are appealing to tech-savvy individuals. These innovations enhance convenience and align with modern lifestyles. Moreover, the rising reliance on e-commerce platforms is making air fresheners more accessible in the US. Online channels allow buyers to explore a broader range of products, compare prices, and benefit from discounts. The IMARC Group anticipates that the United States e-commerce air freshener market share will reach USD 2,083.97 Billion by 2032, showing a growth rate (CAGR) of 6.80% from 2024 to 2032.

Air Freshener Market Trends:

Growing Awareness About Indoor Air Quality

With more individuals spending extended hours indoors, there is a high demand for products that eliminate odors and create a pleasant environment. Concerns about pollutants, allergens, and bacteria in enclosed spaces are encouraging people to seek air fresheners with added benefits, such as antibacterial and allergen-reducing properties. Furthermore, advancements in air freshener technology, including smart diffusers and eco-friendly formulations, are meeting this demand while catering to health-conscious and environmentally aware individuals. These innovations are making air fresheners a staple in homes, offices, and public spaces. In line with this, in 2024, Swedish startup Adsorbi launched a cellulose-based air freshener made from Nordic wood, designed to eliminate household odors and air pollutants sustainably. This eco-friendly product outperforms activated carbon in durability and features a color-changing indicator for replacement. Adsorbi's innovation highlights its commitment to sustainable indoor air quality solutions.

Brand Collaborations and Themed Offerings

Companies are capitalizing on partnerships to blend iconic brand identities with innovative scent combinations, enhancing the appeal of air fresheners as lifestyle products. These collaborations often align with special occasions or celebrations, tapping into individual excitement and driving limited-time demand. By combining nostalgia with exclusivity, brands foster deeper client connections and encourage repeat purchases. Additionally, incorporating multi-sensory experiences through fragrances linked to familiar or cherished moments elevates air fresheners from functional items to coveted collectibles. These strategies not only drive sales but also strengthen brand loyalty, as buyers seek products that resonate with their tastes and lifestyles. This approach demonstrates how innovative marketing and cross-industry partnerships are offering a favorable air freshener market outlook by catering to evolving user preferences. In 2024, Dunkin’ introduced the Perfect Combo Car Freshener as part of its "Dunkin’ x Homesick Collection." Priced at $12, the air freshener combines the scents of a frosted strawberry sprinkle doughnut and iced coffee with cream.

Competitive Pricing and Value-Driven Promotions

Strategic pricing and promotional campaigns that prioritize affordability without compromising quality are positively influencing the market. Offering significant discounts during key shopping events encourages bulk purchases, catering to value-conscious shoppers who seek high-quality products at reduced costs. This approach not only increases immediate sales but also strengthens client loyalty by aligning with their budget preferences. By emphasizing long-lasting performance and advanced features, such as odor-clear technology, brands ensure that buyers perceive their products as cost-effective and efficient. These promotions also capitalize on the growing trend of purchasing essential household items online, leveraging the convenience and accessibility of e-commerce platforms. This focus on value-driven strategies addresses both individual needs and preferences for cost-efficient, effective solutions. In 2024, Amazon launched an offer on an eight-pack of Febreze Bathroom Air Fresheners in Vanilla, discounted to £16 ahead of Prime Day. These air fresheners, lasting up to 45 days, feature odor-clear technology and received positive reviews for their long-lasting, fresh scent.

Growing Popularity of Premium and Organic Products

The market for organic and premium air fresheners is increasing consistently as consumers become more health-aware and environmentally conscious. Conventional air fresheners tend to have synthetic chemicals and artificial perfumes, which others now consider detrimental to health and indoor air. Organic alternatives, on the other hand, are composed of plant ingredients, essential oils, and natural particles, resonating with those who desire safer and greener products. High-end air fresheners also focus on quality, durability, and high-end fragrances, which are usually drawn from aromatherapy or designer perfumes. High-end air fresheners usually come in environmentally friendly packaging and meet cruelty-free or vegan norms. As people become more concerned with well-being and environmental responsibility, the demand for high-end, natural air fresheners is seeing rapid growth, especially in developed markets.

Growing Automotive Sector

The expansion of the global auto industry is a primary driver of the increase in demand for air fresheners, particularly those used in automobiles. As car ownership rises in both advanced and developing economies, consumers purchase accessories that enhance their in-vehicle experience. Air fresheners ensure a pleasant indoor environment in enclosed car interiors, which can be compromised by frequent usage, odors from food, smoking, and pollution. Markets are reacting with innovative products like vent clip-ons, dashboard-mounted gel diffusers, and automatic scent dispensers. Other trends including ridesharing, increased commutes, and mobile offices are fueling demand for clean, fresh-smelling interiors. As the automotive market increases, so does the parallel market for vehicle-specific air care goods, supporting overall marketplace growth.

Air Freshener Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global air freshener market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, application, distribution channel, and region.

Analysis by Product Type:

- Sprays/Aerosols

- Electric Air Fresheners

- Gel Air Fresheners

- Candle Air Fresheners

- Others

Sprays/aerosols stand as the largest component in 2024, holding 46.7% of the market share. These products are popular among the masses due to their ease of use, offering instant odor elimination and fragrance enhancement with a simple spray. Their portable nature makes them suitable for various settings, including homes, offices, and vehicles. The dominance of the segment is also attributed to the wide variety of scents available, catering to diverse preferences, alongside options for specific applications like odor neutralization or sanitization. Innovations, such as non-toxic formulations and eco-friendly aerosol cans, further support their appeal, aligning with user demands for sustainable products. The affordability of sprays and their presence in both premium and budget categories ensure they reach a broad demographic. This combination of accessibility, effectiveness, and versatility makes sprays and aerosols as the leading product type in the air freshener market.

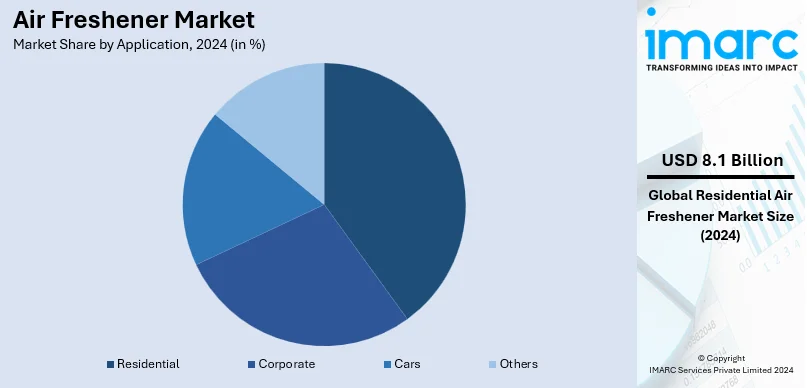

Analysis by Application:

- Residential

- Corporate

- Cars

- Others

Residential leads the market with 60.6% of the market share in 2024. Households use air fresheners to eliminate odors from cooking, pets, or damp areas, as well as to enhance overall ambiance. The wide variety of formats available, including sprays, plug-in diffusers, and gel-based products, cater to different room sizes and scent preferences, making them highly versatile for residential use. Increasing awareness about indoor air quality is supporting the market growth, particularly in urban areas where ventilation may be limited. Seasonal products and aromatherapy-inspired fragrances tailored for relaxation or energy are driving sales within this segment. Moreover, the trend of sustainable and natural ingredients in residential air care aligns with eco-conscious user preferences, ensuring continued market dominance for this application.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Pharmacies

- Others

Supermarkets and hypermarkets represent one of the most dominant distribution channels for air fresheners, accounting 42.5% of the market share in 2024. These retail formats provide a wide selection of air fresheners, including sprays, diffusers, and candles, catering to various user needs and budgets. The ability to browse multiple brands and compare products in a single location encourages higher sales volume. Supermarkets and hypermarkets also benefit from promotional strategies, such as discounts, bundle offers, and in-store displays, which attract cost-conscious and impulse buyers. Their established presence in urban and suburban areas ensures accessibility for a broad demographic, while the rise of large retail chains enhances availability across regions. Additionally, the integration of online shopping with in-store pick-up options further enhances their appeal, making supermarkets and hypermarkets the leading distribution channel in the air freshener market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of 35.2%. Europe holds the biggest market share owing to the rising awareness about indoor air quality, a strong preference for premium and eco-friendly products, and the cultural significance of maintaining pleasant indoor environments. Strict environmental regulations in the region are encouraging innovation in sustainable air fresheners. Individuals in Europe favor natural and organic fragrances, reflecting the growing demand for wellness-oriented and environmentally conscious products. The advanced retail infrastructure ensures widespread accessibility, while the hospitality and tourism industries contribute significantly through the consistent use of air fresheners to enhance guest experiences. In 2024, Initial Washroom Hygiene introduced Initial Essence, an advanced air freshener utilizing oxygen fuel cell technology for consistent and eco-friendly fragrance delivery in washrooms. It features four premium fragrances with odor-neutralizing Neutra-lox and recyclable cartridges. The product aims to enhance washroom environments and improve business impressions.

Key Regional Takeaways:

United States Air Freshener Market Analysis

The United States plays a pivotal role in the air freshener market, accounting for 85.8%. The growth of the region is attributed to its advanced technologies, innovative product offerings, and strategic geographic positioning. The growing focus on sustainable solutions is encouraging manufacturers to integrate eco-friendly components such as natural essential oils and biodegradable packaging, appealing to environmentally conscious users. For instance, the United States imported 1,555 shipments of air fresheners between March 2023 and February 2024, with a 42% decline from the previous year. The country’s innovation hubs, including states like California and Texas, are fostering advancements in smart air fresheners with IoT-enabled devices, enabling personalized and automated scent control. Major urban centers like New York and Los Angeles exhibit robust demand due to high living standards and a preference for premium products. Additionally, the U.S. market benefits from strong retail networks and e-commerce platforms, ensuring widespread availability across states. Companies are also leveraging regional preferences, offering variants like citrus scents in Florida and pine fragrances in northern states. This combination of technological progress, consumer-centric innovation, and extensive distribution channels solidifies the U.S. as a leader in shaping the air freshener market.

Europe Air Freshener Market Analysis

Europe's air freshener market is experiencing significant growth, driven by advancements in product innovation and a heightened focus on indoor air quality. Manufacturers are introducing eco-friendly and natural formulations to meet user demand for sustainable options. For instance, ELiX, a leading European air freshener manufacturer based in Poland, offers private label and contract manufacturing services, emphasizing natural ingredients and sustainable practices. Additionally, retailers like Aldi Ireland are expanding their product lines to include affordable, high-quality air fresheners. In October 2024, Aldi introduced the Bin Buddy Freshener in three scents, including happy mango, pink grapefruit, and spiced orange, priced at USD 4.70, catering to budget-conscious buyers seeking effective odor solutions. These developments underscore Europe's commitment to enhancing indoor environments through innovative and accessible air freshening products.

Asia Pacific Air Freshener Market Analysis

The Asia Pacific is emerging as a key region in the market, driven by the growing emphasis on home and office hygiene. Countries like China, India, and Japan are witnessing increased air freshener market demand due to rising disposable incomes and shifting lifestyle preferences. According to trade data, India imported 256 air freshener shipments from March 2023 to February 2024, primarily from China, reflecting a -26% annual growth, while global leaders in air freshener imports include the United States (15,140 shipments), Peru, and Ecuador. Innovations, such as natural and aromatherapy-based air fresheners, are gaining traction across metropolitan cities like Tokyo, Shanghai, and Mumbai. Additionally, air freshener manufacturers are strategically positioning themselves in markets across Southeast Asia, leveraging retail expansions and e-commerce channels. Asia Pacific’s diverse user base and evolving preferences are cementing its position as a dynamic hub for air freshener innovation and growth.

Latin America Air Freshener Market Analysis

Latin America is emerging as a key segment in the air freshener market, supported by the growing demand for innovative, eco-friendly, and region-specific fragrances. Countries like Brazil and Mexico are leveraging advancements in natural and organic air freshener formulations to meet rising user preferences for sustainable products. For instance, Brazil's household cleaners and laundry care market is projected to generate USD 1.9 Billion in revenue in 2024, showcasing robust growth potential. Rising user focus on home hygiene, and a preference for fragrant cleaning solutions are strengthening market growth. This trend highlights positive opportunities for scent-based household products in Brazil. For example, aerosol-based fresheners and plug-in diffusers tailored to regional scents like citrus and floral varieties dominate sales, showcasing Latin America's pivotal role in driving this industry forward.

Middle East and Africa Air Freshener Market Analysis

The Middle East and Africa are emerging as key players in the air freshener market due to advancements in fragrance technology and increasing individual demand for innovative, eco-friendly solutions. For instance, The Saudi Arabia air freshener market is set to grow by USD 59.7 Million from 2024 to 2029, driven by rising urbanization, home hygiene trends, and eco-friendly preferences. This dynamic growth reflects a young, affluent population prioritizing indoor air quality. The focus of the sector on innovation and sustainability highlights its positive impact on wellness and lifestyle. Countries like the UAE and South Africa are witnessing increased adoption of premium air fresheners, driven by the rising preference for natural and long-lasting scents. Innovations, such as automated air freshening systems and customizable fragrances, are gaining traction in states across Nigeria and Saudi Arabia. Examples include locally inspired scents like oud-based air fresheners in the Gulf countries.

Competitive Landscape:

Key players in the market are focusing on product innovation, introducing eco-friendly and natural formulations to meet user demand for sustainable options. They are expanding their product lines to include various formats such as sprays, gels, and electric diffusers, catering to diverse preferences. Strategic mergers and acquisitions (M&A) are being pursued to enhance market presence and distribution networks. Companies are also investing in advanced technologies for smart air fresheners that integrate with home automation systems. Additionally, leading companies are creating holiday-themed fragrances and limited-edition products to attract users seeking seasonal ambiance or unique gifts. For example, in 2024, Godrej aer announced its collaboration with five iconic Ganesh pandals in Mumbai to create immersive fragrance experiences during Ganeshostav. The initiative includes fragrance tunnels and integrated air fresheners, engaging over 10 million devotees. This campaign aims to enhance festive celebrations while promoting Godrej aer's offerings.

The report provides a comprehensive analysis of the competitive landscape in the air freshener market with detailed profiles of all major companies, including:

- California Scents (Energizer Holdings Inc)

- Church & Dwight Inc.

- Farcent Enterprise Co. Ltd.

- Godrej Consumer Products Limited (The Godrej Group)

- Henkel AG & Co. KGaA

- Kobayashi Pharmaceutical Co. Ltd.

- Newell Brands

- Procter & Gamble

- Reckitt Benckiser Group plc.

- S. C. Johnson & Son Inc.

Latest News and Developments:

- November 2024: California Scents (Energizer Holdings Inc) announced the Armor All Podium Series, a premium auto care line created in partnership with Oracle Red Bull Racing. The range features innovative ceramic technology, high-performance detailing products, and racing-themed air fresheners.

- July 2024: Soapy Joe’s Car Wash launched its "Build a Ballpark" promotion, featuring limited-edition Joe Musgrove air fresheners available at 24 locations through September 30. The collectible air fresheners form a puzzle image of Petco Park and offer chances to win prizes.

- July 2024: Everspray has introduced an innovative air freshener that enhances aerosol-based products. The company's technology produces nanoparticles that persist longer in the air, ensuring extended fragrance duration.

Air Freshener Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sprays/Aerosols, Electric Air Fresheners, Gel Air Fresheners, Candle Air Fresheners, Others |

| Applications Covered | Residential, Corporate, Cars, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Pharmacies, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | California Scents (Energizer Holdings Inc), Church & Dwight Inc., Farcent Enterprise Co. Ltd., Godrej Consumer Products Limited (The Godrej Group), Henkel AG & Co. KGaA, Kobayashi Pharmaceutical Co. Ltd., Newell Brands, Procter & Gamble, Reckitt Benckiser Group plc., S. C. Johnson & Son Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the air freshener market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global air freshener market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the air freshener industry and its attractiveness.

Key Questions Answered in This Report

An air freshener is a product designed to neutralize odors and introduce pleasant scents into indoor spaces. It is available in numerous forms like sprays, gels, candles, and diffusers, catering to residential, commercial, and automotive needs. Many modern variants feature eco-friendly ingredients and smart technologies, enhancing convenience and aligning with user preferences for healthier and more sustainable environments.

The global air freshener market was valued at USD 13.4 Billion in 2024.

IMARC estimates the global air freshener market to exhibit a CAGR of 2.9% during 2025-2033.

The market is driven by the growing awareness about indoor air quality and rising demand for eco-friendly products. Advancements in smart and automated air fresheners, including motion-sensor devices and app-controlled diffusers, are enhancing convenience and appeal among tech-savvy users. Additionally, the increasing adoption of air fresheners in residential spaces to tackle odors from cooking, pets, and dampness, as well as their widespread use in corporate and commercial settings, is propelling the market growth.

In 2024, sprays/aerosols represented the largest segment by product type, driven by their instant odor-eliminating properties, wide variety of scents, portability, and affordability, making them versatile for multiple settings.

Residential leads the market by application owing to its use in addressing odors from cooking, pets, and dampness. The availability of diverse formats and the rising focus on indoor air quality further bolster this segment's dominance.

Supermarkets and hypermarkets are the leading segment by distribution channel, driven by driven by their wide product variety, competitive pricing, and promotional offers, ensuring convenience for a broad user base.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global air freshener market include California Scents (Energizer Holdings Inc), Church & Dwight Inc., Farcent Enterprise Co. Ltd., Godrej Consumer Products Limited (The Godrej Group), Henkel AG & Co. KGaA, Kobayashi Pharmaceutical Co. Ltd., Newell Brands, Procter & Gamble, Reckitt Benckiser Group plc., S. C. Johnson & Son Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)