Air Purifier Market Report by Filter Technology (Activated Carbon, Electrostatic Precipitators, High Efficiency Particulate Air (HEPA), Ion and Ozone Generators, and Others), Size (Small Units, Large Units, HVAC Units), Application (Commercial, Industrial, Residential), Distribution Channel (Offline, Online), and Region 2025-2033

Global Air Purifier Market:

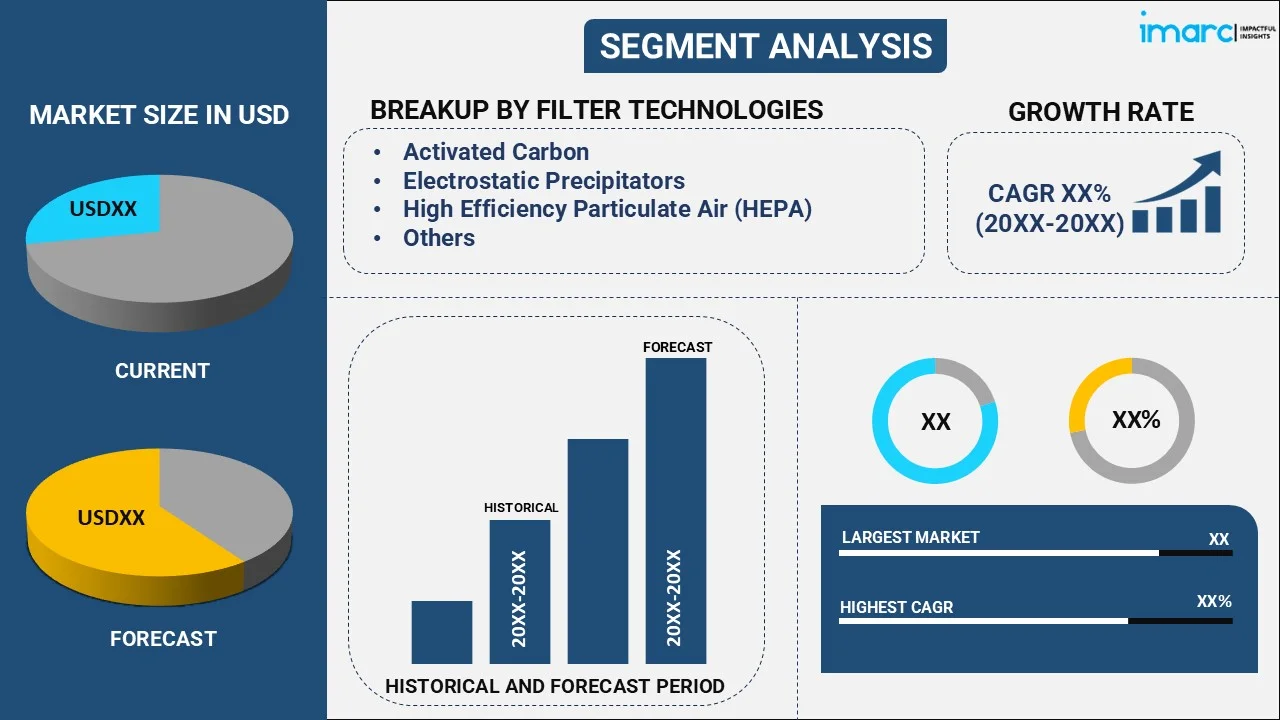

The global air purifier market size reached USD 14.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 27.3 Billion by 2033, exhibiting a growth rate (CAGR) of 6.95% during 2025-2033. The increasing consumer health consciousness, deteriorating air quality, and the rising prevalence of respiratory disorders and allergies are some of the primary factors stimulating the market.

Air Purifier Market Highlights:

- North America dominated the air purifier market with the largest market share.

- By filter technology, high efficiency particulate air (HEPA) represented the largest segment.

- By application, commercial applications represented the largest segment.

- By distribution channel, offline represented the largest segment.

- The air purifier market generated a revenue of USD 14.5 Billion in 2024 and is expected to reach USD 27.3 Billion by 2033.

- The air purifier market is expected to grow at a CAGR of 6.95% from 2025 to 2033.

- Some of the leading companies in the Air purifier market include, Atlanta Healthcare, Camfil AB, Daikin Industries, Ltd., Honeywell International, Inc., IQAir, Koninklijke Philips N.V., Panasonic Corporation, Samsung Electronics Co., Ltd., Sharp Corporation, Whirlpool Corporation, etc.

Global Air Purifier Market Analysis:

- Major Market Drivers: The rising indoor air pollution levels and their adverse effects on human health are among the key drivers catalyzing the global air purifier industry report. Besides this, government bodies across countries are implementing stricter regulations, which is escalating the demand for efficient and certified smart air purifiers.

- Key Market Trends: One of the air purifier industry's latest trends includes air purification technologies to create safer and cleaner indoor environments. Furthermore, the elevating adoption of portable air purifiers by businesses operating in commercial sectors, such as healthcare, hospitality, office spaces, etc., is positively influencing the air purifier market outlook.

- Geographical Trends: According to the air purifier industry research, North America accounts for the majority of the market share, owing to the rising consumer concerns related to allergies, asthma, and respiratory issues. Additionally, stringent air quality standards set by government bodies to combat outdoor air pollution are also propelling the air filter market growth.

- Competitive Landscape: Some of the major players in the global air purifier market include Atlanta Healthcare, Camfil AB, Daikin Industries, Ltd., Honeywell International, Inc., IQAir, Koninklijke Philips N.V., Panasonic Corporation, Samsung Electronics Co., Ltd., Sharp Corporation, and Whirlpool Corporation, among many others.

- Challenges and Opportunities: According to the air purifier industry growth analysis, the escalating competition, price sensitivity, and regulatory compliance are some of the key challenges hampering the market growth. However, continued advancements in air purification technology, such as improved filtration systems, sensors for real-time monitoring, and smart features, present opportunities for manufacturers to develop innovative air purifiers that address consumer needs more effectively, which is one of the air purification market recent developments.

To get more information on this market, Request Sample

Global Air Purifier Market Trends:

Launch of Advanced Air Purifiers

Prominent key players are introducing novel air purifiers, which is elevating the air purifier market revenue. Moreover, as individuals seek more personalization, convenience, and automation in their daily lives, the demand for smart home devices has increased significantly. Consequently, leading manufacturers are integrating advanced technologies, including car air purifiers, which is one of their air purifier marketing strategies. For example, in December 2021, Secure Connection, an electronic product manufacturer based in Hong Kong, announced the launch of Honeywell Branded Air Purifiers. The air purifier line is segmented into three categories, namely Platinum Series, Value Series, and Ultimate Series, with features, including ionizer, UV LED, and humidifier. The series was commonly available in Southeast Asia via all major shops and online e-commerce platforms. In addition to this, Rentokil Initial plc developed its VIRUSKILLER air purifier, which is proven to kill 99.99% of viruses with a single air pass. Additionally, the VIRUSKILLER technology utilizes patented UV reactor chambers. This product is easily accessible in numerous sizes. Besides this, in August 2022, IQAir introduced the smart slim bionic residential air purifier Atem X that provides low energy consumption, quiet operation, cost-effectiveness, etc., and has a beautiful design.

Growing Air Pollution Concerns

The rising awareness among individuals regarding the adverse effects associated with indoor air pollution levels on human health is one of the prominent factors adding to the air purifier market demand. Moreover, with rapid industrialization and urbanization, indoor spaces are becoming more prone to pollutants, such as dust, allergens, and fine particulate matter, increasing the need for efficient industrial air purifiers. According to the report published by the World Bank in 2023, pollution is the cause of more than 9 million premature deaths every year. In addition, every year, 1.2 trillion gallons of untreated industrial waste are poured back into the American water system. Besides this, the increasing number of patients with respiratory problems, owing to unhealthy lifestyles and growing smoking habits, is further acting as another significant growth-inducing factor. For instance, according to the Centers for Disease Control and Prevention (CDC), 4.6% of adults have been diagnosed with COPD, emphysema, and chronic bronchitis. Consequently, consumers across commercial establishments, households, healthcare facilities, etc., are extensively investing in air purifiers to mitigate the risk of airborne transmission of pathogens and viruses, driving demand for effective industrial air cleaners. For example, in January 2021, Energy Efficiency Services Ltd (EESL), a joint venture between NTPC Ltd., Power Finance Corporation Ltd., Power Grid Corporation of India Ltd., and REC Limited, introduced an air purification system that filters out pathogens from indoor spaces. Additionally, the company also applied for certification for this air purification system from the Council of Scientific and Industrial Research (CSIR).

Implementation of Stringent Regulatory Initiatives

Government bodies across countries are enforcing stringent norms and guidelines to address elevating air pollution levels and ensure healthier indoor environments. In addition to this, they are implementing regulatory mandates and certifications that require commercial buildings to adhere to specific indoor air quality standards, increasing the demand for air disinfection and purification machines. For example, the U.S. Department of Energy has established standards for quality assurance and specifications related to HEPA filters. Similarly, the Association of Home Appliance Manufacturers (AHAM) has established the Clean Air Delivery Rate (CADR), which is utilized to measure the effectiveness of air purifiers, thereby enabling individuals to compare the performance of air purifiers in eliminating pollen, dust, and tobacco smoke. Furthermore, the "Guide to Air Cleaners in the Home" by the U.S. Environmental Protection Agency (EPA) provides advice on how to choose furnace filters, HVAC filters, portable air cleaners, and other details on air cleaners. In addition to this, the World Health Organization (WHO) has also released some recommendations on the quality of indoor air. Compliance with these regulations not only fosters enhanced air quality but also improves the reputation of businesses as socially responsible entities, thereby bolstering air purifier business opportunities over the forecasted period.

Global Air Purifier Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global air purifier market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on filter technology, size, application, and distribution channel.

Breakup by Filter Technology:

- Activated Carbon

- Electrostatic Precipitators

- High Efficiency Particulate Air (HEPA)

- Ion and Ozone Generators

- Other

High efficiency particulate air represents the leading segment

The report has provided a detailed breakup and analysis of the market based on filter technology. This includes activated carbon, electrostatic precipitators, high efficiency particulate air (HEPA), ion and ozone generators, and others. According to the report, the high efficiency particulate air (HEPA) represented the largest segment.

According to the air purifier market analysis, HEPA filters are gaining immense popularity, as they remove particles as small as 0.3 microns by capturing them on filters. Additionally, they are highly effective in enhancing indoor air quality and creating a healthier environment for occupants. These filters are gaining extensive traction among consumers and businesses, owing to their long-standing track record of reliable performance. In line with this, various professional engineering organizations recommend HEPA filters in infection control clinics, hospitals, and other healthcare facilities to eliminate microbes and other dangerous particles. Numerous key players are also launching enhanced product variants, thereby stimulating the market growth in this segmentation. For example, in December 2022, the Camfil group announced the development of its latest range of V-bank HEPA filters, which have a longer lifespan and reduced maintenance costs.

Breakup by Size:

- Small Units

- Large Units

- HVAC Units

The report has provided a detailed breakup and analysis of the market based on the size. This includes small units, large units, and HVAC units.

Small units represent portable and compact air purifiers designed for individual rooms or small spaces. These air purifiers are generally easy to move around, lightweight, and suitable for personal use or targeted air purification in specific areas, driving growth in the market for air purifiers. Besides this, large units are air purifiers specifically designed for more extensive coverage and purification of larger rooms or entire living areas. Moreover, these air purifiers are capable of handling larger volumes of air and have higher airflow capacity, making them suitable for use in open-concept spaces, living rooms, commercial environments, etc. On the other hand, HVAC units, also called whole-house or central air purifiers, are integrated into the existing HVAC system of a building. Instead of purifying air in specific rooms, they purify the air throughout the entire building, providing an efficient and centralized solution for maintaining indoor air quality.

Breakup by Application:

- Commercial

- Industrial

- Residential

Commercial applications account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes commercial, industrial, and residential. According to the report, commercial applications represented the largest segment.

Commercial establishments, such as hospitals, hotels, schools, offices, restaurants, etc., are subject to strict regulatory standards and guidelines implemented by government bodies, which, in turn, augment the need for air purifiers. Air purifiers can efficiently remove airborne pollutants and allergens, ensuring a healthier and safer indoor environment for occupants.

Breakup by Distribution Channel:

- Offline

- Online

Air purifiers are widely distributed through offline channels

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline and online. According to the report, the offline represented the largest segment.

Air purifiers are considered relatively high-involvement products, as they directly impact the indoor air quality and health of users. Consumers often prefer to see, touch, and experience the product before making a purchase decision. Offline channels, such as brick-and-mortar stores, allow customers to interact with air purifiers physically, understand their features, and experience the filtration efficiency. The ability to witness product demonstrations and compare different models in person enhances consumer confidence, thereby stimulating the market growth in this segmentation.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Egypt

- Others

North America accounts for the majority of market share

The report has also provided a comprehensive analysis of all the major regional markets, which includes North America (the United States and Canada); Europe (Germany, France, Italy, Spain, the United Kingdom, Russia, Others); Asia Pacific (Japan, China, Australia, South Korea, India, Others); Latin America (Mexico, Brazil, Others); Middle East and Africa (Turkey, Saudi Arabia, Egypt, Others). According to the report, North America represents the largest market for air purifiers.

The rising consumer environmental awareness is elevating the demand for air purifiers as a preventive measure, which is one of the primary factors stimulating the air purifier market in North America. Additionally, the growing number of residential, commercial, and institutional spaces across the region is also acting as another significant growth-inducing factor. Apart from this, air quality legislation, including the United States Environmental Protection Agency's establishment of national ambient air quality standards, Environment Canada's comprehensive emission reduction programs, the U.S. Clean Air Act, etc., are anticipated to create new opportunities for air purifier manufacturers in North America over the forecasted period.

Top Players in Air Purifier Market:

The competitive landscape of the market is characterized by a diverse array of players, ranging from well-established multinational corporations to emerging startups and regional manufacturers. Nowadays, key players are investing heavily in research and development to introduce advanced technologies, improved filtration systems, smart features, and energy-efficient models. Innovations such as hybrid air purifiers, the Internet of Things (IoT)-enabled devices, and smart air quality monitoring have gained traction. They are also establishing a widespread network of offline retail stores, online platforms, and authorized dealerships, enabling them to reach a broader consumer base. Moreover, several companies are offering excellent after-sales service, warranty, and customer support which is crucial for building customer loyalty and satisfaction.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Atlanta Healthcare

- Camfil AB

- Daikin Industries, Ltd.

- Honeywell International, Inc.

- IQAir

- Koninklijke Philips N.V.

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Whirlpool Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Global Air Purifier Market News:

- November 2024: Qubo launched its Q600 and Q1000 smart air purifiers, designed for large spaces up to 1,000 sq. ft. Featuring 15,000-hour filter life, QSensAI tech, and voice/app control, the launch strengthened India’s premium smart air purifier segment and addressed urban air concerns.

- October 2024: Secure Connection launched Honeywell-branded Air Touch V1 and V5 purifiers in India, featuring advanced filtration, filter change alerts, and 9,000-hour filter life. Priced competitively on Amazon, the launch expanded consumer access and stimulated price-driven growth in air purifier market.

- August 2024: Daikin introduced two advanced air purifiers, MCK70Z and MC80Z, featuring real-time air quality monitoring via the Onecta app. Equipped with Streamer technology, they addressed rising indoor air concerns, boosting innovation and demand in the growing air purifier market across Europe.

- March 2024: Samsung Electronics launched Bespoke Cube Air Infinite Line, a cutting-edge purifier that supports AI functionality. Using 4-way surround cleaning technology, the Samsung Bespoke Cube Air Infinite Line cleanses contaminated air 360 degrees on each of the sides of a room.

- January 2024: Airthings, one of the key producers of indoor air quality and radon monitors, launched Airthings Renew, the company’s first smart air purifier, and Airthings Wave Enhance, a battery-operated and compact indoor air quality monitor specifically built for the bedroom.

- January 2024: Researchers at the University of Bath have invented a new form of high-performance air purifier with zero harmful waste.

Air purifier Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Filter Technologies Covered | Activated Carbon, Electrostatic Precipitators, High Efficiency Particulate Air (HEPA), Ion and Ozone Generators, Others |

| Sizes Covered | Small Units, Large Units, HVAC Units |

| Applications Covered | Commercial, Industrial, Residential |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Brazil, Mexico, Saudi Arabia, Turkey, Egypt |

| Companies Covered | Atlanta Healthcare, Camfil AB, Daikin Industries, Ltd., Honeywell International, Inc., IQAir, Koninklijke Philips N.V., Panasonic Corporation, Samsung Electronics Co., Ltd., Sharp Corporation, Whirlpool Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the air purifier market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global air purifier market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the air purifier industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The air purifier market was valued at USD 14.5 Billion in 2024.

The air purifier market is projected to exhibit a CAGR of 6.95% during 2025-2033, reaching a value of USD 27.3 Billion by 2033.

The air purifier market is primarily driven by worsening air quality, rising public awareness of health issues, and an increase in respiratory conditions. Advances in technology, integration of smart features, and stricter environmental regulations are also boosting demand for air purification solutions globally.

In 2024, North America dominated the air purifier market, driven by due to growing concern over indoor pollution, a rise in respiratory health issues, and increased interest in connected home devices. Supportive regulations and a shift toward energy-saving products further encouraged widespread use across the region.

The future of air purifiers lies in smarter, more energy-efficient devices with enhanced filtration and real-time air quality monitoring. Integration with IoT and AI will enable personalized purification, while growing health awareness and stricter regulations will drive widespread adoption globally.

Some of the major players in the global air purifier market include Atlanta Healthcare, Camfil AB, Daikin Industries, Ltd., Honeywell International, Inc., IQAir, Koninklijke Philips N.V., Panasonic Corporation, Samsung Electronics Co., Ltd., Sharp Corporation, Whirlpool Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)