Airborne ISR Market Size, Share, Trends and Forecast by Platform, System, Type, Fuel Type, Application, and Region, 2025-2033

Airborne ISR Market Size, Industry Share & Growth Analysis:

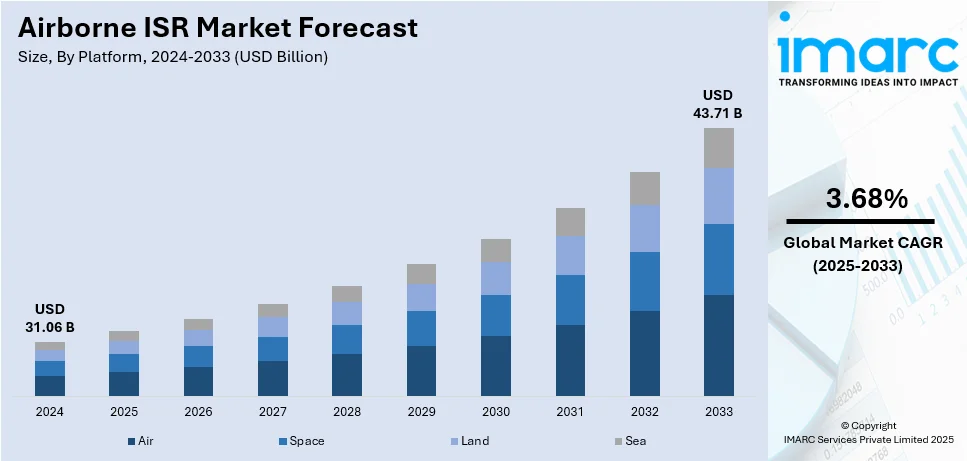

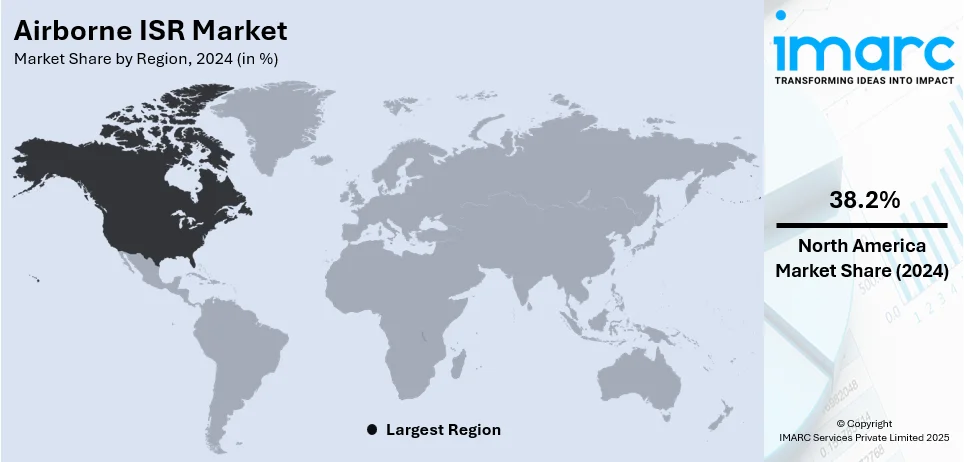

The global airborne ISR market size was valued at USD 31.06 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 43.71 Billion by 2033, exhibiting a CAGR of 3.68% during 2025-2033. North America currently dominates the market, holding a significant market share of over 38.2% in 2024. The market is experiencing steady growth driven by the rising focus on strengthening border security, the growing prevalence of organized crime and illegal activities, and the increasing integration of electro-optical and infrared (EO/IR) cameras for improving security measures.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 31.06 Billion |

|

Market Forecast in 2033

|

USD 43.71 Billion |

| Market Growth Rate (2025-2033) | 3.68% |

The global airborne ISR market is impacted by numerous key factors, encompassing heightening defense budget by countries actively navigating to improve their military attributes. The magnifying requirement for real-time situational awareness and intelligence in complicated operational scenarios further boosts airborne ISR market growth. In addition, technological innovations in analytics, sensor systems, and data processing, are facilitating more effective reconnaissance and surveillance missions. Besides this, the emerging threat of asymmetric terrorism and warfare necessitates enhanced ISR services for national security. The rapid incorporation of unmanned aerial vehicles (UAVs) into ISR operations also fosters the market's expansion, providing exceptional operational efficacy as well as flexibility.

The United States plays a critical role in the global airborne ISR industry, boosted by its robust aim to fortify national security and boost development of innovative technology. The U.S. military is currently investing heavily in sophisticated ISR solutions, improving its capability to attain intelligence and carry out surveillance across several varying landscapes. This intensifying emphasis on enhancements is evident in the incorporation of unmanned aerial vehicles (UAVs), which substantially advance operational responsiveness as well as abilities. As a leader in defense technology, the U.S. continues to steer the prospects of airborne ISR, guaranteeing its tactical benefits in mission execution and intelligence gathering. For instance, in August 2024, the U.S. Army announced their collaboration with Sierra Nevada Corp to develop future fleet of high-altitude ISR aircraft. Sierra will be integrating its sensors and other requisite equipment in aircraft HADES and Bombardier Global 6500s.

Airborne ISR Market Trends:

Growing Security Concerns

The global security landscape is undergoing a profound shift, marked by a rise in asymmetric threats and cyber-attacks. For instance, as per an industrial report, the number of malware attacks worldwide reached 6.06 billion, marking a 10% increase from the previous year. In response to these evolving challenges, nations and defense organizations are increasingly turning to airborne ISR capabilities as a force multiplier. One of the paramount benefits of airborne ISR is its ability to provide persistent surveillance. This is particularly vital for countering unconventional threats, such as terrorism and insurgency, and monitoring the activities of rogue nations or groups engaged in illicit activities. The constant monitoring of areas of interest enables early threat detection and rapid response. Moreover, airborne ISR platforms contribute significantly to the intelligence cycle. They play a pivotal role in mission planning, target identification, and threat assessment. The timely and accurate information they provide is instrumental in shaping strategies and tactics, ensuring that security forces remain one step ahead of potential adversaries. As the world becomes more interconnected, threats can emerge from unexpected quarters, including cyberspace. Airborne ISR assets, with their multi-sensor capabilities, are increasingly used for monitoring and analyzing electromagnetic signals, contributing to the detection of cyber-attacks and electronic warfare threats. In this complex security landscape, such solutions are indispensable for maintaining national security and protecting against emerging threats, thereby elevating the airborne ISR market demand.

Geopolitical Tensions

Geopolitical tensions, regional conflicts, and territorial disputes are catalyzing the demand for airborne ISR solutions. Nations with strategic interests or disputes invest heavily in these capabilities to safeguard their sovereignty and protect their national interests. According to an industrial report, nations are investing heavily in airborne ISR systems, with defense budgets in countries like the U.S., China, and Russia exceeding USD 700 Billion annually, a significant portion of which is allocated to enhancing surveillance and intelligence capabilities in contested regions. Airborne ISR assets offer a strategic advantage by enabling nations to maintain continuous surveillance over sensitive areas, including borders, maritime territories, and contested regions. This persistent presence acts as a powerful deterrent to potential adversaries and provides early warning in the event of any hostile activities. Furthermore, these platforms play a vital role in supporting diplomatic efforts. They provide objective and verifiable data, which is essential for de-escalating conflicts and facilitating negotiations. By supplying unbiased intelligence, airborne ISR assets help build trust among parties involved in tense international situations. In regions with long-standing disputes, such as maritime boundary conflicts or territorial disagreements, airborne ISR assets are instrumental in upholding the claims of a nation and ensuring that their interests are protected. This proactive approach to monitoring and gathering intelligence is crucial in maintaining peace and stability in areas marked by geopolitical tensions, which, in turn, expands the airborne ISR market share.

Advancements in Technology

Technological advancements to improve the functionalities of airborne ISR are propelling the growth of the market. Cutting-edge sensors, data analytics, and communication systems are increasing the efficiency of airborne ISR. Synthetic aperture radar (SAR) systems, for instance, are revolutionizing the ability to collect high-resolution imagery regardless of weather conditions or time of day. For instance, SAR systems can detect and identify small structures, vehicles, and terrain features with resolutions as fine as 25 centimeters, regardless of environmental factors. They provide unmatched situational awareness and target identification capabilities. Additionally, electro-optical and infrared (EO/IR) cameras are witnessing significant improvements in resolution, allowing for detailed imagery capture and subtle ground change detection. Furthermore, the miniaturization of electronics is facilitating the development of more agile and versatile airborne platforms. These platforms can be deployed in a variety of environments, making them adaptable to a wide range of mission profiles. The integration of artificial intelligence (AI) and machine learning (ML) in data processing is another noteworthy aspect. These technologies enhance data analysis speed and accuracy, enabling quicker and more informed decision-making, consequently shaping a positive airborne ISR market outlook.

Airborne ISR Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global airborne ISR market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on platform, system, type, fuel type, and application.

Analysis by Platform:

- Air

- Space

- Land

- Sea

Land leads the market with around 35.3% of market share in 2024, primarily due to their versatility and operational effectiveness. These systems are designed to provide real-time intelligence and situational awareness in various environments, including urban and rural settings. Equipped with advanced sensors and communication technologies, land-based ISR platforms can monitor troop movements, assess battlefield conditions, and gather critical data for decision-making. In addition to this, their ability to integrate with other military assets enhances their effectiveness, allowing for coordinated operations. Besides this, the increasing demand for border security and counter-terrorism initiatives has further propelled the adoption of land-based ISR solutions. As military tactics advance, the significance of these platforms in delivering valuable intelligence continues to be crucial.

Analysis by System:

- Maritime Patrol

- Electronic Warfare

- Airborne Early Warning and Control (AEWC)

- Airborne Ground Surveillance (AGS)

- Signals Intelligence (SIGNIT)

Airborne early warning and control (AEWC) leads the market with around 42.7 of market share in 2024, primarily due to their critical role in enhancing situational awareness and threat detection. These platforms are equipped with advanced radar and sensor technologies that enable them to monitor vast areas and identify potential threats in real-time. Moreover, AEWC systems are essential for military operations, providing commanders with comprehensive battlefield information and facilitating timely decision-making. Besides this, their capacity to collaborate with other military resources, including fighter aircraft and ground troops, improves overall mission effectiveness. In addition to this, as geopolitical tensions rise, the demand for AEWC capabilities continues to grow, solidifying their position as a vital component of modern military strategy.

Analysis by Type:

- Surveillance

- Reconnaissance

- Intelligence

Surveillance leads the market with around 41.1% of market share in 2024, driven by the increasing need for comprehensive monitoring and intelligence gathering. These platforms are equipped with high-resolution cameras, sensors, and data processing technologies that enable them to capture detailed imagery and information from the air. Furthermore, surveillance ISR plays a vital role across multiple sectors, such as border protection, emergency management, and defense operations. In addition, the ability to provide real-time data enhances situational awareness and supports informed decision-making. Moreover, as threats evolve and the complexity of operational environments increases, the demand for advanced surveillance capabilities continues to rise, positioning this segment as a key player in the airborne ISR market.

Analysis by Fuel Type:

- Hydrogen Fuel-Cells

- Solar Powered

- Alternate Fuel

- Battery Operated

- Gas-Electric Hybrids

Battery operated leads the market with around 43.5% of market share in 2024. Battery-operated ISR systems are gaining momentum in the global airborne ISR market due to their operational flexibility and reduced logistical requirements. These platforms, often in the form of small unmanned aerial vehicles (UAVs), offer the advantage of silent operation and ease of deployment in various environments. Furthermore, their battery-powered design allows for extended flight times and the ability to conduct missions in areas where traditional fuel-based systems may be impractical. Besides, the growing emphasis on low-cost, efficient surveillance solutions has led to increased adoption of battery-operated ISR technologies. In line with this, as military and civilian applications expand, these systems are becoming integral to modern intelligence-gathering efforts, enhancing situational awareness and operational efficiency.

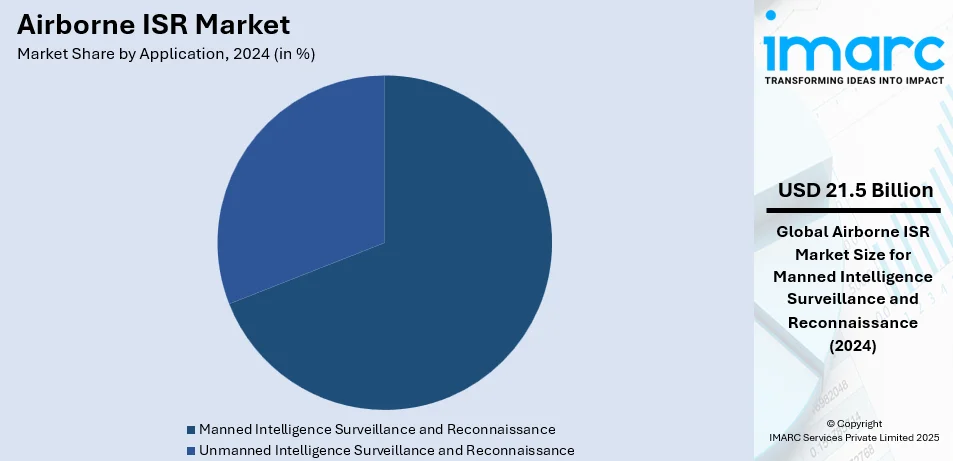

Analysis by Application:

- Manned Intelligence Surveillance and Reconnaissance

- Unmanned Intelligence Surveillance and Reconnaissance

Manned ISR leads the market with around 69.1% of market share in 2024, primarily due to their operational capabilities and versatility. These aircraft are equipped with advanced sensors and communication systems, allowing for comprehensive intelligence gathering and real-time data analysis. Moreover, manned ISR platforms are particularly effective in complex operational environments, where human operators can make critical decisions based on situational awareness. In addition to this, their ability to conduct extended missions and adapt to evolving threats makes them invaluable for military operations, border security, and disaster response. Furthermore, as the demand for reliable and effective ISR solutions continues to grow, manned platforms remain a cornerstone of airborne intelligence-gathering strategies.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.2%. North America’s dominance is principally propelled by the United States, which is a crucial investor in innovative technologies pertaining to defense. For instance, in November 2024, Chaos Industries, a major U.S.-based defense tech startup, announced the securing of USD 145 million funds, reflecting the boost in defense technology investment. In addition, the region heavily profits from a robust focus on national security and a resilient military infrastructure, boosting requirement for upgraded ISR systems. In addition to this, key innovations in UAS, sensor technology, and data analytics are significantly improving operational abilities. Moreover, the escalating emphasis on border security and counter-terrorism ventures is bolstering the implementation of airborne ISR solutions. Furthermore, as geopolitical complications transform, North America's objective to sustaining technological leadership guarantees its continued domination in the airborne ISR industry.

Airborne ISR Market Regional Takeaways:

United States Airborne ISR Market

In 2024, the United States accounted for 83.40% of the market share in North America. Substantial defense spending and developments in surveillance technology are driving growth in the U.S. airborne ISR market. According to the Department of Defense, the military budget for 2023 was approximately USD 916 Billion, with a considerable percentage allocated to ISR systems in support of global operations. Innovation is being driven by an increased demand for UAVs that integrate high-resolution sensors and AI-based analytics. These systems constitute the forefront of defense strategies: They contribute to battlefield and real-time intelligence to promote effective combat and counterterror initiatives. Key industry competitors include the U.S.-based producers Northrop Grumman and Lockheed Martin, providing cutting-edge versions like RQ-4 Global Hawk and U-2 Dragon Lady to the U.S. market and promoting export opportunities where the federal government allows U.S.-based manufacturers to aggressively grow around the world. Federal initiatives to incorporate leading-edge technologies such as machine learning and big data analytics ensure sustained growth and leadership in the global market.

Europe Airborne ISR Market

The European airborne ISR market is growing due to an increase in defense budgets, NATO modernization initiatives, and a focus on advanced surveillance systems. The defense fund of USD 107.2 Billion allocated by Germany for the year 2022, according to Eurostat, clearly points to the region's emphasis on improving ISR capabilities. Amongst NATO members, France and Poland are highly emphasizing ISR platforms for border security and military preparedness in the wake of geopolitical tensions. AI-powered analytics and multi-domain ISR systems will be adopted at a faster pace than before to catalyse innovations. Major players like Airbus and Leonardo are pushing the envelope with newer solutions, such as integrated reconnaissance on Eurofighter Typhoon. EU R&D support for more precision, sustainability, and interoperability of ISR technologies will be augmented. Collaborative projects supported by the European Defense Fund ensure a competitive edge for regional players in global markets. These advances continue to confirm the role of Europe as a key player in ISR airborne innovation and strengthen its ability to meet future security challenges.

Asia Pacific Airborne ISR Market

The airborne ISR market in the Asia Pacific region is experiencing rapid growth driven by rising defense expenditures and escalating geopolitical uncertainties. China's defense spending rose to USD 230 Billion in 2022, according to the Stockholm International Peace Research Institute, with major investments in ISR capabilities and UAV developments. India's 2023-2024 defense budget was USD 75 billion, which focuses on indigenous ISR development under the "Make in India" initiative. Regional governments have increasingly used UAVs and satellite-based systems with modern sensors to enhance surveillance and intelligence-gathering capabilities. Technology transfer and innovation are propelled by local and global firms' partnership, such as the Bharat Electronics' collaborative work with international firms. With AI-driven analytics and real-time data processing, operational efficiency further improves. Modernization programs of Japan and South Korea have become a significant need for ISR solutions. The dynamic growth region makes it a significant player in the global airborne ISR market.

Latin America Airborne ISR Market

Latin America's airborne ISR market is steadily on the rise with growing security threats, defense spending, and regional cooperation. A market research report says that Brazil's defense budget in 2022 was at USD 21.8 Billion and that the country was to continue with ISR modernization efforts against organized crime and for better national security. Mexico and Colombia also invest in surveillance systems for securing borders and battling internal threats. The adoption of UAVs for ISR missions has grown rapidly, with encouragement by government initiatives to build enhanced operational capabilities. In a global context, there has been increased cooperation among both international and domestic players. Brazilian Embraer contributes toward exportation of ISR platforms to the region, exemplifying regional potential in the international marketplace. Technological improvement, on the other hand, comes from AI integration into sensors, enhancing efficiency of airborne ISR systems. The increasing demand for precision intelligence and surveillance underpins the market's growth, ensuring Latin America's growing importance in the global ISR landscape.

Middle East and Africa Airborne ISR Market

This aerial ISR market in the Middle East and Africa is increasing with developing defense budgets and growing demands of security. The International Trade Administration states that Saudi has released USD 75.01 Billion for defense in the year 2022 which would specifically go into ISR modernization. Advanced ISR platforms encompass UAVs and satellite-based systems, increasingly being utilised for border security as well as counterterrorism. A high level of adoption regarding state-of-the-art ISR technology by the UAE is fuelling regional capabilities. Denel from South Africa is the one that specifically specializes in developing ISR systems for local use and export to fulfill regional defense needs. Governments and international manufacturers collaborate to develop technologies and build capacity. AI and machine learning are integrated into ISR systems to ensure proper data analysis and decision-making processes. Government-backed R&D projects and increased regional cooperation put the market on a better footing for long-term growth, driving the Middle East and Africa to a promising position in the global airborne ISR sector.

Leading Airborne ISR Companies:

Key players in the airborne intelligence, surveillance, and reconnaissance (ISR) market are actively engaged in several strategic initiatives to maintain their competitive edge. They are investing heavily in research and development advanced technology, focusing on miniaturization, enhanced sensor capabilities, and data analytics. Additionally, these companies are emphasizing the integration of artificial intelligence (AI) and machine learning (ML) into ISR systems for real-time data analysis. Furthermore, they are expanding their product portfolios to offer a diverse range of ISR platforms, including unmanned aerial vehicles (UAVs), to meet evolving needs. These players are also strengthening their global presence through partnerships, collaborations, and acquisitions to tap into emerging markets and secure contracts with defense and security agencies worldwide. For instance, in October 2024, MAG Aerospace, a prominent ISR services company, announced strategic partnership with Zapata AI to facilitate next-gen ISR depending on sensor technology, blending ground-based and airborne sources with broad range of sensor and signal types to automate target tracking, acquisition, or identification.

The report provides a comprehensive analysis of the competitive landscape in the airborne ISR market with detailed profiles of all major companies, including:

- BAE Systems PLC

- L3Harris Technologies Inc.

- Kratos Defense & Security Solutions Inc.

- Thales Raytheon Systems

- Elbit Systems Ltd

- UTC Aerospace Systems (United Technologies Corporation)

- General Dynamics

- CACI International Inc.

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- FLIR Systems Inc.

- Airbus

- General Atomics

Latest News and Developments:

- December 2024: Lockheed Martin's announced that its ISR spacecraft demonstrator, TacSat, is scheduled for launch in 2025 via a Firefly Aerospace Alpha rocket. The satellite will carry a demonstrated infrared sensor and Lockheed Martin's first 5G.MIL payload to enhance military connectivity. TacSat will support joint exercises and CJADC2.

- October 2024: According to Northrop Grumman, the demonstration of phase two of the Deep Sensing and Targeting system took place at Vanguard 24. The airborne system combines space-based sensor data with targeting intelligence to enable long-range precision fires to achieve better mission effectiveness and standoff range, using automation and intelligence services for greater accuracy and speed.

- August 2024: Air Force Research Laboratory announced that BAE Systems won a USD 48 Million deal to further develop its Insight system. The system strengthens military ISR capabilities, in the main, with airborne applications, like Resolute Sentry. Integration of machine learning and autonomy will enhance intelligence analysis to provide real-time multi-domain battlespace awareness.

- June 2024: L3Harris delivered three integrated King Air 350ER ISR aircraft for the Canadian Armed Forces on the MAISR project. The aircraft, modified at the Greenville, Texas center, enhance Canada's ISR capabilities, increasing security and the effectiveness of its missions. The delivery strengthens U.S.-Canada defense collaboration.

- October 2021: Kratos Defense & Security Solutions Inc. announced securing a USD 17.7 Million contract to design and build an Off Board Sensing Station (OBSS) Unmanned Aerial System (UAS) to support the Air Force Research Laboratory's Autonomous Collaborative Platforms (ACP) technology maturation portfolio.

Airborne ISR Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Air, Space, Land, Sea |

| Systems Covered | Maritime Patrol, Electronic Warfare, Airborne Early Warning and Control (AEWC), Airborne Ground Surveillance (AGS), Signals Intelligence (SIGINT) |

| Types Covered | Surveillance, Reconnaissance, Intelligence |

| Fuel Types Covered | Hydrogen Fuel-Cells, Solar Powered, Alternate Fuel, Battery Operated, Gas-Electric Hybrids |

| Applications Covered | Manned Intelligence Surveillance and Reconnaissance, Unmanned Intelligence Surveillance and Reconnaissance |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | BAE Systems PLC, L3Harris Technologies, Inc., Kratos Defense & Security Solutions Inc., Thales Raytheon Systems, Elbit Systems Ltd, UTC Aerospace Systems (United Technologies Corporation), General Dynamics, CACI International Inc., Northrop Grumman Corporation, Lockheed Martin Corporation, FLIR Systems Inc., Airbus, General Atomics, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the airborne ISR market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global airborne ISR market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the airborne ISR industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The airborne ISR market was valued at USD 31.06 Billion in 2024.

IMARC estimates the airborne ISR market to reach USD 43.71 Billion by 2033, exhibiting a CAGR of 3.68% during 2025-2033.

Key factors driving market encompass elevating defense budgets, the escalating need for innovative surveillance attributes, and the rapid increase in demand for real-time intelligence in military tasks. Furthermore, innovations in sensor technology and the incorporation of unmanned aerial vehicles (UAVs) are improving ISR efficacy and operational effectiveness.

North America currently dominates the airborne ISR market, accounting for a share exceeding 38.2%. This dominance is fueled by its heavy defense budgets, technological enhancements, and a robust emphasis on military dominance as well as national security.

Some of the major players in the airborne ISR market include BAE Systems PLC, L3Harris Technologies, Inc., Kratos Defense & Security Solutions Inc., Thales Raytheon Systems, Elbit Systems Ltd, UTC Aerospace Systems (United Technologies Corporation), General Dynamics, CACI International Inc., Northrop Grumman Corporation, Lockheed Martin Corporation, FLIR Systems Inc., Airbus, General Atomics, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)