Aircraft Sensors Market Size, Share, Trends and Forecast by Aircraft Type, Sensor Type, Connectivity, Application, End Use, and Region, 2025-2033

Aircraft Sensors Market 2024, Size and Trends:

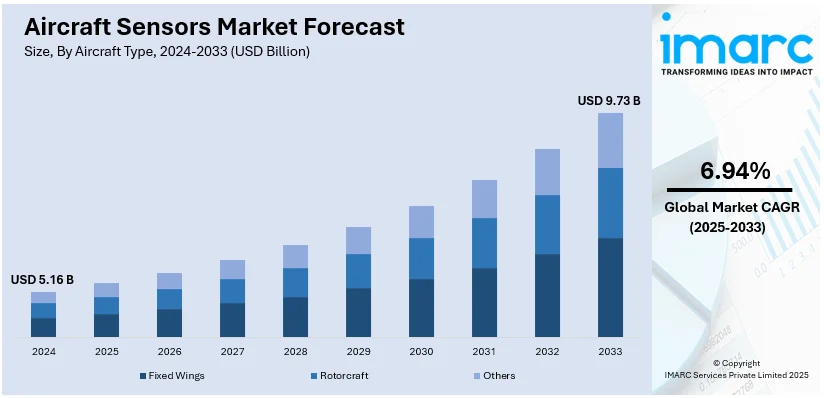

The global aircraft sensors market size reached USD 5.16 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.73 Billion by 2033, exhibiting a growth rate (CAGR) of 6.94% during 2025-2033. North America currently dominates the market, holding a market share of 36.0% in 2024. The growing number of cross-border terrorist activities and increasing cases of air accidents are driving the aircraft sensor market share. Besides this, aircraft sensors market share is driven by the growing demand for advanced sensor technologies and high defense budget that support sensor integration in military aircraft and UAVs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.16 Billion |

|

Market Forecast in 2033

|

USD 9.73 Billion |

| Market Growth Rate (2025-2033) | 6.94% |

Rising air passenger traffic is a major factor propelling the aircraft sensor market growth. Increased air travel creates higher demand for new commercial aircraft equipped with advanced sensor systems. Airlines prioritize safety and efficiency, leading to the integration of cutting-edge sensors in modern fleets. Sensors monitor critical parameters like engine performance, navigation, and environmental controls, ensuring passenger safety and comfort. The growing number of long-haul flights amplifies the need for reliable sensors to optimize fuel efficiency. Higher passenger volumes require advanced cabin sensors for maintaining air quality, temperature, and pressurization. Regulatory standards for emission reduction and safety compliance encourage airlines to invest in sensor-driven technologies. Emerging economies with rising middle-class populations contribute significantly to global air traffic growth, influencing sensor demand.

The United States aircraft sensors market demand is influenced by advancements in autonomous aircraft. Autonomous systems rely on an array of sensors for navigation, obstacle detection, and decision-making capabilities. High demand for unmanned aerial vehicles (UAVs) in military and commercial applications enhance sensor integration. The United States government supports autonomous aviation through various initiatives. Key advancements in artificial intelligence (AI) enhance sensor capabilities, enabling more reliable and efficient autonomous operations. For instance, in August 2024, NASA announced the development of the POD (Pilot Operator Decision Aid) system, an advanced autonomous flight support tool for aircraft operators. The system is designed to improve efficiency and safety by leveraging real-time data to assist in decision-making, allowing for more autonomous aircraft operations. This system relies on various sensors for navigation and decision-making, advancing the technology used in autonomous and sensor-driven aircraft systems. Moreover, advanced sensors improve communication between onboard systems and ground control, ensuring seamless and safe operations. Military modernization efforts, emphasizing autonomous drones and surveillance systems, drive significant demand for innovative sensor solutions.

Aircraft Sensors Market Trends:

Advancements for Aircraft Systems

Improvements in sensor technologies for aircraft systems are significantly enhancing precision and targeting capabilities. These improvements include the integration of advanced guidance systems, multi-mode seekers, and compatibility with uncrewed aerial vehicles (UAVs), thereby leading to more effective and reliable performance of air-launched weapons in modern military operations. For example, in June 2024, Lockheed Martin initiated upgrades to the sensor systems of JASSM, LRASM, JAGM, and Hellfire air-launched weapons to improve precision targeting and enable seamless operation with unmanned aerial vehicles (UAVs). Besides this, fly-by-wire technology has replaced traditional controls, requiring precise sensors for real-time monitoring and efficient operation. Electric and hybrid propulsion systems depend on advanced sensors to optimize performance and improve fuel efficiency. Predictive maintenance systems rely on data from sensors for minimizing downtime and preventing unexpected failures. Enhanced avionics systems rely on accurate sensor data for navigation, communication, and environmental monitoring.

Growing Demand for Remote Sensors

Remote sensors are increasingly essential for enhancing surveillance, reconnaissance, and precision targeting capabilities in both military and commercial aviation, driven by the need for more accurate and reliable real-time data acquisition. For instance, in May 2024, China introduced four high-resolution Beijing-3C remote sensing satellites, enhancing data acquisition capabilities. These advancements in satellite technology contribute to the growing demand for more sophisticated and reliable sensors in aircraft systems for real-time data processing. Moreover, remote sensors are essential for measuring temperature, pressure, and vibration in inaccessible or hazardous areas. Increasing adoption of predictive maintenance technologies relies on remote sensors to identify potential issues early. Remote sensing technologies support advancements in environmental monitoring, enabling aircraft to measure atmospheric conditions during flights. The integration of remote sensors improves flight safety by providing real-time data for automated control systems.

Increasing Use of Wireless Sensors in Aircraft Systems

The trend of using wireless sensors in aircraft systems is growing as they offer reduced weight, easier installation, and greater flexibility in monitoring critical components. This shift enhances real-time data collection, streamlines maintenance, and contributes to overall aircraft performance and efficiency. For example, in January 2024, Uniform Sierra Aerospace launched the Panther outdoor tactical UAS, featuring advanced wireless sensors, including a 40x zoom camera and thermal imaging. These sensors enable precise, high-speed, long-range operations in challenging weather, enhancing search-and-rescue missions. Aircraft manufacturers adopt wireless sensors to enhance flexibility and simplify system integration during assembly processes. Wireless technology enables sensors to transmit data seamlessly, improving real-time monitoring and operational accuracy. Modern aircraft systems rely on wireless sensors for structural health monitoring, ensuring timely maintenance and safety.

Market Restraint: Frequent Sensor Calibration for System Efficiency

Sensors need regular calibration and maintenance to provide accurate data. For example, airspeed sensors must be frequently calibrated to support functions like auto-throttle and automatic landing. Pre-flight checks and calibration, typically every 500 flight hours, are common practices. Sensors in harsh environments, such as those on engines or aerostructures, face contamination risks and require more frequent testing to ensure proper functioning, as they are critical for flight safety.

Market Challenge: Cybersecurity Risks

The aviation industry is adopting digital technologies and interconnected systems, replacing older closed setups. Aircraft manufacturers and integrators use IoT to detect maintenance needs, order replacement parts, and notify ground crews during flights to minimize downtime. Modern aircraft have thousands of sensors transmitting real-time data to ground teams. For example, the F-35’s autonomic logistics information system (ALIS) monitors performance, predicts maintenance needs, and informs technicians through a global network. However, this rise in connectivity also makes systems more vulnerable to cybersecurity threats from across the globe.

Aircraft Sensors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global aircraft sensors market forecast at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on aircraft type, sensor type, connectivity, application, and end use.

Analysis by Aircraft Type:

- Fixed Wings

- Rotorcraft

- Others

As per the aircraft sensor market trends, fixed wings lead the market with 80.0% of market share in 2024. Fixed-wing aircraft are extensively utilized for passenger transportation, accounting for the majority of global air traffic. Airlines consistently demand new fixed-wing models, driven by increasing air travel and fleet upgrades. Fixed-wing designs require a variety of sensors for navigation, engine performance, and structural health monitoring. Military applications, including fighter jets and transport planes, also contribute significantly to fixed-wing aircraft demand. Fixed-wing aircraft rely on sensors for fuel management, ensuring optimal efficiency during long-haul operations. Advancements in autonomous and hybrid-electric fixed-wing aircraft further drive the integration of advanced sensor technologies. The cargo aviation sector’s growth influence demand for fixed-wing aircraft equipped with sophisticated sensors. Regulatory requirements for safety and emissions compel manufacturers to adopt advanced sensor systems in fixed-wing designs.

Analysis by Sensor Type:

- Proximity Sensors

- Temperature Sensors

- Optical Sensors

- Pressure Sensors

- Force Sensors

- Flow Sensors

- Radar Sensors

- Others

Based on the aircraft sensor market forecast, temperature sensors dominate the market with 28.7% of market share in 2024. Aircraft systems rely on temperature sensors for engine monitoring, thereby preventing overheating and enhancing optimal performance. These sensors are critical in monitoring hydraulic systems, contributing to operational safety and efficiency. Advancements in fuel-efficient engines are fueling the requirement for precise temperature monitoring systems. Temperature sensors are vital for environmental control systems, maintaining passenger comfort during flights under varying conditions. Aircraft rely on these sensors to monitor de-icing systems, preventing ice formation during cold weather operations. Increasing adoption of hybrid and electric aircraft increase demand for temperature sensors in battery and power systems. Military aircraft require robust temperature sensors to withstand extreme conditions and ensure mission-critical reliability. Advancements in sensor technologies enhance temperature measurement accuracy, driving their adoption in modern aircraft designs. Rising regulatory demands for efficient and safe aircraft operations further encourage investment in temperature sensors. The growing focus on predictive maintenance also relies heavily on temperature data for condition monitoring, which is strengthening its market growth.

Analysis by Connectivity:

- Wired Sensors

- Wireless Sensors

As per the aircraft sensor market outlook, wired sensors dominate the market with 70.0% of market share in 2024. Wired sensors provide consistent, interference-free data transmission critical for safety and performance in aircraft systems. Wired connectivity ensures robust and secure communication, which is essential for flight-critical applications. Aircraft manufacturers favor wired sensors for their ability to function effectively under extreme environmental conditions. The use of wired sensors is widespread in legacy aircraft systems, maintaining their market dominance. Wired configurations offer cost efficiency and ease of integration with existing aircraft systems and infrastructure. The aerospace industry prioritizes the reliability of wired sensors for engine monitoring and flight control applications. Advanced avionics systems rely on wired sensors for seamless data transmission, ensuring operational accuracy and safety. Wired sensors also support long operational lifespans with minimal maintenance, reducing downtime for airlines. Regulatory requirements for safety and compliance further drive the preference for wired sensor systems.

Analysis by Application:

- Flight Decks

- Landing Gear Systems

- Weapon Systems

- Fuel, Hydraulic, and Pneumatic Systems

- Engine/Propulsion

- Cabin and Cargo Environmental Controls

- Aerostructures and Flight Control

- Others

Flight decks require advanced sensors to ensure accurate navigation, communication, and system monitoring for pilots. Sensors in this application provide critical data on altitude, airspeed, and system performance for safe operations. The increasing use of fly-by-wire technology further catalyzes the demand for sensors in flight decks. Enhanced avionics systems rely on these sensors to enhance automation and situational awareness.

Landing gear systems depend on sensors for monitoring load, pressure, and deployment during landing and takeoff. Sensors ensure smooth operation and prevent structural damage during high-stress scenarios like hard landings. Weight management and brake monitoring systems utilize sensors to improve reduce wear as well as overall performance. Increasing use of lightweight materials in landing gear systems drives demand for precise load-measuring sensors. Rising air traffic and new aircraft deliveries contribute to consistent growth in this segment.

Military aircraft weapon systems rely on sensors for targeting, navigation, and payload deployment. Sensors in this application ensure precision, reliability, and safety during critical missions. The development of advanced missile guidance systems significantly drives demand for sensors in weapon systems. Military modernization programs and rising defense budgets worldwide bolster this segment’s market growth.

These systems use sensors to monitor pressure, flow, and temperature for efficient and safe operations. Fuel systems rely on sensors to optimize fuel consumption and prevent potential leaks. Hydraulic and pneumatic systems depend on sensors for maintaining precise control of actuators and brakes. Rising demand for predictive maintenance systems is increasing the need for real-time monitoring sensors. Stringent safety regulations drive the integration of advanced sensors in these systems to prevent failures.

Engine and propulsion systems are the largest users of sensors, ensuring optimal performance and safety. Sensors in this application monitor parameters like temperature, pressure, and vibration to prevent engine failures. Fuel efficiency improvements rely heavily on advanced sensors for precise data collection and optimization. The increasing use of electric and hybrid engines is catalyzing the demand for sensors in propulsion systems. Military and commercial aircraft engines utilize sensors for durability and compliance with stringent emission norms.

Cabin and cargo systems use sensors to maintain temperature, pressure, and air quality for passenger comfort. Sensors play a pivotal role in monitoring environmental conditions and ensuring safe transportation of sensitive cargo. Rising aim on passenger safety and comfort is catalyzing the demand for sensors in this segment. Advanced systems use sensors for noise reduction, air purification, and real-time cabin monitoring. Rising air travel and premium cabin offerings contribute to the growth of this application.

Aerostructures and flight control systems utilize sensors for real-time monitoring of structural integrity and performance. These sensors are essential for controlling flaps, slats, and rudders, ensuring precise maneuverability. Advanced composite materials in aerostructures increase the demand for sensors to monitor stress and deformation. Predictive maintenance technologies rely on these sensors to enhance operational safety and reduce repair costs. Increasing production of modern aircraft with complex aerostructures fuels this segment’s market share.

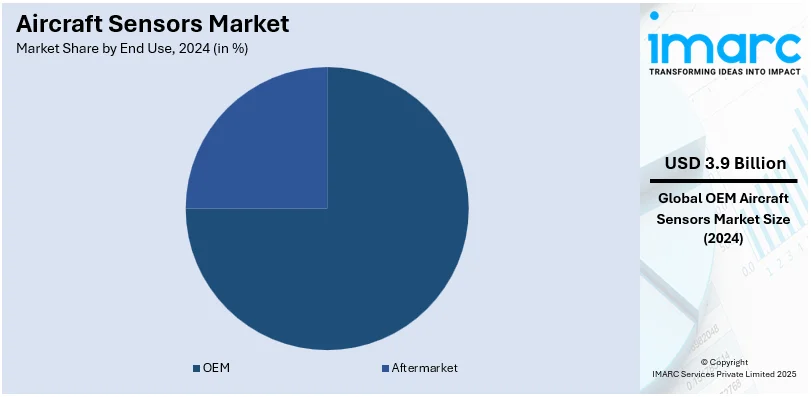

Analysis by End Use:

- OEM

- Aftermarket

OEM leads the market with 75.0% of market share in 2024. Aircraft manufacturers incorporate sensors during the assembly phase, ensuring system integration and optimal functionality. The escalating demand for new aircraft on account of rising air traffic is driving the OEM sensor installation. OEMs collaborate with sensor manufacturers to develop customized solutions tailored to modern aircraft requirements. OEMs are key players in adopting advancements like electric and hybrid propulsion systems, catalyzing demand for aircraft sensors. Increasing production rates of commercial aircraft significantly contribute to OEMs’ dominance in the sensors market. OEM-installed sensors offer better performance and integration compared to retrofitted systems, enhancing operational reliability. Aircraft modernization programs also rely heavily on OEM partnerships to upgrade systems with advanced sensors. OEMs meet stringent regulatory standards for safety and emissions, driving the adoption of innovative sensor technologies. Their ability to integrate next-generation sensors during design and manufacturing ensures superior performance and reliability.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 36.0%. North America is home to leading aircraft manufacturers and key sensor technology providers. Rising demand for new commercial and military aircraft drives sensor adoption in North America’s aerospace sector. The United States defense budget, among the largest worldwide, supports significant advancements in sensor technologies. North America’s emphasis on innovation fosters the development and integration of advanced sensors in aircraft systems. Increasing demand for electric and autonomous aircraft further contributes to sensor market growth in the region. The region’s well-established MRO (Maintenance, Repair, and Overhaul) network ensures consistent demand for replacement sensors. For example, in December 2024, GA-ATS delivered the first Do228 NG aircraft to North America, now owned by General Atomics Aeronautical Systems (GA-ASI). The aircraft, refurbished and upgraded with new wings and sensor payload capabilities, will be used for sensor research and flight testing. The delivery emphasizes its suitability for advanced technology development in the aerospace sector. Moreover, regulatory standards and safety requirements in North America encourage the adoption of cutting-edge sensor technologies.

Key Regional Takeaways:

United States Aircraft Sensors Market Analysis

The United States hold 80.00% of the market share in North America. The United States' dominance in the aviation and defense sectors drives its substantial contribution to the global aircraft sensors market share. High domestic and international air travel rates, along with the presence of large aircraft manufacturers, increases demand for cutting-edge sensor technologies. The Air Traffic Organization of the Federal Aviation Administration provides service for over 45,000 flights and 2.9 million airline passengers per day over an airspace of over 29 million square miles. There has been increased use of sensors like pressure, temperature, and inertial sensors in military and commercial aircraft due to enhanced safety and real-time monitoring requirements. The investments made by the US Department of Defense in the development of the next-generation fighter jets, for instance, F-35 program are also contributing to the market. There is also the enhancement of the prospects of sensor integration through autonomous and unmanned aerial vehicles (UAVs) applied in commercial as well as in defense-related usage, like the delivery drones. Another factor compelling the airlines to make use of state-of-the-art sensors is that of developments made in the application of Internet of Things (IoT)-enabled aircraft systems to achieve predictive maintenance.

Europe Aircraft Sensors Market Analysis

The robust aerospace industry in Europe, supported by leading aircraft manufacturing companies is what drives the market. Airbus, headquartered in France, showcased the region's production strength in 2023 when it delivered 735 aircraft. The European Union's goal of reducing carbon emissions through programs, such as the Clean Sky 2 program encourages the adoption of fuel-efficient aircraft, which require advanced sensors for monitoring and optimizing fuel consumption. In addition, Europe's massive military spending in countries like the UK, Germany, and France is driving the demand for sophisticated sensor technology in military aircraft and UAVs. The region is further pioneering urban air mobility solutions through electric vertical takeoff and landing aircraft, such as those from firm Volocopter, which rely extensively on advanced sensors for safety and navigation. Predictive maintenance systems are dependent on sensors, which are is expanding the industry in Europe.

Asia Pacific Aircraft Sensors Market Analysis

The market for aircraft sensors is growing rapidly in Asia-Pacific because of increased investment in domestic aircraft manufacturing programs. The market is dominated by countries like China and India, in 2023, COMAC of China delivered the C919, a narrow-body aircraft made in the country. India, through partnerships with international OEMs and the HAL Tejas program, is also investing hugely to support domestic aerospace capabilities. The Asia-Pacific region improved by its air traffic from 171% to 130% by the end of September 2023. According to Centre for Aviation data, in all other regions, capacity and traffic grew by less than 40%. As the fleet size grows, the low-cost carriers like Indigo and AirAsia would need advanced sensors for efficiency as well as safety. In countries like South Korea and Japan, there has been an upswing in UAV utilization for surveillance, logistics, and agricultural purposes. Market is experiencing a shift towards smart airports that operate on aircraft systems enabled by IoT sensors.

Latin America Aircraft Sensors Market Analysis

Regional airlines and government spending on aviation infrastructure are the main drivers of the Latin American market for aircraft sensors. Brazil and Mexico are the two largest contributors to the market, with Embraer as the aerospace giant driving the regional aircraft manufacturing. In 2024, Embraer delivered 206 aircraft, most of which came with highly complex sensor systems, as per industry reports. With more low-cost carriers like Azul and Viva Aerobus gaining prominence, the demand for safer and more efficient aircraft systems will also expand. The rising needs for air travel due to an increase in tourism in countries like Argentina, Peru, and Colombia is indirectly influencing the market of aircraft sensors. For its part, the region is beginning to research the usage of UAVs in environmental as well as agriculture surveillance, most probably to utilize these sensors better.

Middle East and Africa Aircraft Sensors Market Analysis

According to reports, regional hubs like Dubai, Abu Dhabi, and Doha handle over 150 million passengers combined every year, and thus these hubs are propelling the regions market of aircraft sensors. Etihad Airways and Qatar Airways, among others, invest heavily in next-generation aircraft with complex sensors that enhance security, monitoring, and navigation capabilities. The region's defense spending, primarily in Saudi Arabia and the United Arab Emirates, is fueling the adoption of military aircraft and UAVs, which mostly depend on advanced sensor technologies. Single African air transport market (SAATM) and other measures are helping Africa's aviation industry grow, promoting fleet expansions and the use of modern aircraft systems. Furthermore, the expansion of Africa into drones for applications such as agricultural purposes, logistics, and surveillance further drives the demand for an affordable sensor solution.

Competitive Landscape:

Key players focus on developing advanced sensor technologies to meet continuously evolving industry requirements. Collaborations between sensor manufacturers and aircraft OEMs ensure seamless integration and optimized system performance. Leading companies are heavily finding research and development (R&D) projects to make lightweight, accurate, and durable sensor solutions. For instance, in April 2024, Honeywell International Inc. announced the development of a lightweight sensor technology for the Lilium Jet, designed to enhance its performance and safety. This innovation focuses on miniaturized sensors that are crucial for efficient flight operations in emerging electric vertical takeoff and landing (eVTOL) aircraft. The technology supports the jet's integration with modern avionics systems. Besides this, key players actively work to improve sensor efficiency, reliability, and accuracy in harsh environmental conditions. They drive advancements in wireless and connected sensor technologies to enhance aircraft system connectivity. Partnerships with regulatory bodies help ensure compliance with stringent safety and environmental standards. Major players support predictive maintenance by offering sensors capable of delivering real-time data for aircraft monitoring. Strategic acquisitions and mergers by key players strengthen their market presence and expand technological capabilities. Regional expansion efforts enable key players to address growing sensor demand in emerging aviation markets. By focusing on cost-effective production, key players make advanced sensors accessible to various market segments.

The report provides a comprehensive analysis of the competitive landscape in the aircraft sensors market with detailed profiles of all major companies, including:

- Ametek, Inc.

- Amphenol Corporation

- BAE Systems

- Curtiss-Wright Corporation

- Eaton Corporation

- General Atomics Corporation

- Honeywell International Inc.

- Parker Meggitt (Parker Hannifin Corporation)

- Safran Electronics & Defense

- TE Connectivity Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- June 2024: Lockheed Martin initiated upgrades to the sensor systems of JASSM, LRASM, JAGM, and Hellfire air-launched weapons, integrating advanced sensors to improve precision targeting and enable seamless operation with unmanned aerial vehicles (UAVs).

- June 2024: China introduced four high-resolution Beijing-3C remote sensing satellites that aid in enhancing data acquisition capabilities.

- January 2024: Uniform Sierra Aerospace launched the Panther outdoor tactical UAS, featuring advanced wireless sensors, including a 40x zoom camera and thermal imaging. These sensors enable precise, high-speed, long-range operations in challenging weather, enhancing search-and-rescue missions.

Aircraft Sensors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Aircraft Types Covered | Fixed Wings, Rotorcraft, Others |

| Sensor Types Covered | Proximity Sensors, Temperature Sensors, Optical Sensors, Pressure Sensors, Force Sensors, Flow Sensors, Radar Sensors, Others |

| Connectivities Covered | Wired Sensors, Wireless Sensors |

| Applications Covered | Flight Decks, Landing Gear Systems, Weapon Systems, Fuel, Hydraulic, and Pneumatic Systems, Engine/Propulsion, Cabin and Cargo Environmental Controls, Aerostructures and Flight Control, Others |

| End Uses Covered | OEM, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ametek, Inc., Amphenol Corporation, BAE Systems, Curtiss-Wright Corporation, Eaton Corporation, General Atomics Corporation, Honeywell International Inc., Parker Meggitt (Parker Hannifin Corporation), Safran Electronics & Defense, TE Connectivity Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, aircraft sensors market outlook, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global aircraft sensors market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aircraft sensors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aircraft sensors market was valued at USD 5.16 Billion in 2024.

The aircraft sensors market is projected to exhibit a CAGR of 6.94% during 2025-2033, reaching a value of USD 9.73 Billion by 2033.

The aircraft sensors market growth is driven by increasing air travel, fueling demand for advanced aircraft systems. Rising adoption of fly-by-wire, electric, and hybrid technologies necessitates reliable sensors for monitoring and control. Enhanced focus on safety, emissions reduction, and fuel efficiency drives the need for advanced sensor integration. Growth in unmanned aerial vehicles (UAVs) and autonomous aircraft further expands sensor applications. Predictive maintenance systems leveraging sensor data minimize downtime and operational costs. Additionally, regulatory compliance and advancements in connectivity accelerate the adoption of sophisticated sensor technologies in aviation.

North America currently dominates the market due to its strong aerospace industry. The region is home to major aircraft manufacturers, such as Boeing, and leading sensor technology developers. High defense spending supports military aircraft advancements, catalyzing demand for sensors in weapon systems and UAVs. The rise in air travel and ongoing fleet modernization drive adoption of advanced sensors in commercial aviation.

Some of the major players in the aircraft sensors market include Ametek, Inc., Amphenol Corporation, BAE Systems, Curtiss-Wright Corporation, Eaton Corporation, General Atomics Corporation, Honeywell International Inc., Parker Meggitt (Parker Hannifin Corporation), Safran Electronics & Defense, TE Connectivity Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)