Airport Bus Market Size, Share, Trends and Forecast by Type, Sales Channel, Application, and Region, 2025-2033

Airport Bus Market Size and Share:

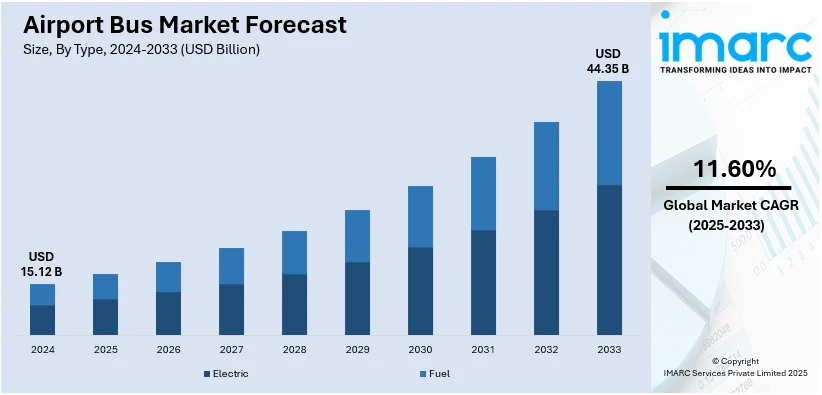

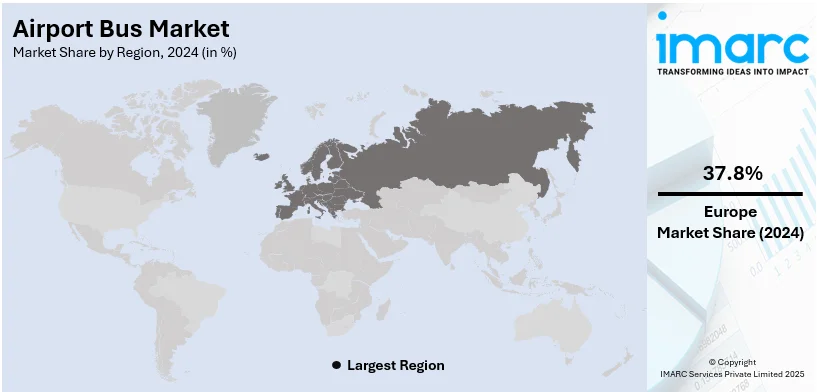

The global airport bus market size was valued at USD 15.12 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 44.35 Billion by 2033, exhibiting a CAGR of 11.60% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 37.8% in 2024. The market is driven by increasing air passenger traffic, urbanization, and expanding airport infrastructure, particularly in emerging economies. Additionally, the need for cost-effective, reliable, and eco-friendly airport connectivity supports airport bus market share, with recovery in air travel post-pandemic further enhancing demand for efficient ground transportation solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 15.12 Billion |

|

Market Forecast in 2033

|

USD 44.35 Billion |

| Market Growth Rate (2025-2033) | 11.60% |

The global airport bus market is driven by increasing air passenger traffic, fueled by rising disposable incomes and growing tourism. Urbanization and the expansion of airport infrastructure, particularly in emerging economies, further enhance demand. According to industry reports, infrastructure development at private Indian airports will exceed ₹60,000 Crores (approximately USD 7,317 Million) in the fiscal year 2027, up from ₹53,000 Crores (USD 6,463.41 Million) in the fiscal year 2022-2024, a 12% increase. This investment will help serve an additional 65 million travelers per year. Revenue is projected to grow 17%, driven by increased traffic volume, tariff hikes, and the expansion of services, which in turn will provide a raise to sectors involved with airport operations such as airport bus services. While 70% of the capex will be funded by debt, sound credit profiles and regulated tariff adjustments are likely to support stable long-term growth. Governments and private players are investing in efficient, eco-friendly transportation solutions to reduce congestion and emissions. Technological advancements, such as electric and hybrid buses, are gaining traction due to stringent environmental regulations. Additionally, the need for cost-effective and reliable airport connectivity enhances airport bus market growth. The COVID-19 pandemic temporarily impacted the market, but recovery in air travel and a focus on sustainable transport are expected to drive long-term growth.

The United States stands out as a key regional market, primarily driven by the growing emphasis on seamless connectivity between airports and urban centers, catering to the needs of business and leisure travelers. Increasing investments in smart city projects and public transit infrastructure are fostering demand for efficient airport shuttle services. Rising environmental concerns are encouraging the adoption of low-emission and electric buses, supported by federal and state-level incentives. According to industry reports, the USA recorded a 12% increase in the number of zero-emission buses on the road in 2023, with 6,147 units. Fuel cell buses specifically saw a 76% increase to 327 units. California continues to lead all states in zero-emission buses with 1,946 buses, while New York reported a 66% increase, adding more than 250 to its fleet. However, as airports work towards more sustainable ways of getting individuals around, electric buses at airports should also see similar growth, fitting into a national trend of fleet electrification. Additionally, the expansion of airport hubs and the need for affordable, reliable transportation options are key growth factors. Furthermore, the integration of advanced technologies, such as real-time tracking and booking systems, is also enhancing passenger experience and driving airport bus market demand.

Airport Bus Market Trends:

Rising Adoption of Eco-Friendly Technologies in Airport Transportation

Airports worldwide are increasingly integrating advanced technologies to minimize their carbon footprint. With total carbon dioxide (CO₂) emissions projected to reach 41.6 billion tonnes in 2024, compared to 40.6 billion tonnes in 2023, there is a strong push toward sustainable alternatives. A major trend driving this shift is the replacement of aging diesel-powered airport buses with electric alternatives. These eco-friendly buses not only reduce greenhouse gas emissions but also help airports comply with stringent environmental regulations. Governments and airport authorities are investing heavily in green initiatives, contributing to the expansion of the electric airport bus market. The move toward sustainable airport transportation aligns with global carbon neutrality goals, making this trend a crucial factor in shaping the airport bus market outlook.

Increasing Air Passenger Traffic

The growing number of air travelers is a significant factor fueling the demand for airport buses. In 2024, domestic air passenger traffic witnessed a 6.12% year-on-year increase, reaching 161.3 million passengers. This rise is attributed to the efficiency, reliability, and emergency response capabilities of airlines, leading to heightened transportation needs within airport premises. Additionally, as airport boarding bridges become increasingly limited, airlines and airport operators rely more on shuttle buses to transport passengers between terminals and aircraft. The rising frequency of flights and expanding airport operations further necessitate efficient ground transportation solutions. As a result, airport authorities are investing in larger fleets of high-capacity buses to accommodate the growing passenger volumes, fostering market expansion.

Expansion of Airport Infrastructure

The construction of new airports plays a vital role in the airport bus market trends. Governments and private investors are developing modern airport infrastructure to enhance regional connectivity, enhance tourism, and stimulate economic development. These new facilities require efficient ground transportation solutions to move passengers, airline crew, and cargo seamlessly. Furthermore, airports are ensuring the availability of highly trained and screened drivers to enhance passenger safety and travel experience. In addition, rapid advancements in the automotive sector, including autonomous and smart bus technologies, are creating lucrative investment opportunities. The increasing preference for luxury airport buses among high-end travelers is also contributing to market expansion as airports cater to changing consumer demands for premium transport services. On 11th September 2024, Air India SATS introduced three luxury electric coaches at Delhi Airport exclusively for Business and First-Class passengers for an enhanced tarmac transfer experience. Comfortable seating, ample legroom, and air conditioning are offered in these higher-quality buses, making a huge difference in your travel experience. It aims to offer the service to a few more airlines and tap into the growing trend for luxury airport transport in the country.

Airport Bus Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global airport bus market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, sales channel, and application.

Analysis by Type:

- Electric

- Fuel

Electric stands as the largest component in the market, driven by the increasing focus on sustainability and reducing carbon emissions. Governments and regulatory bodies worldwide are implementing stringent environmental policies, encouraging the adoption of electric vehicles (EVs) in public transportation. Airports, as major hubs of activity, are prioritizing eco-friendly solutions to align with global climate goals. Technological advancements in battery efficiency, charging infrastructure, and vehicle range have made electric buses more viable and cost-effective. Additionally, the operational cost savings and lower maintenance requirements of electric buses compared to traditional fuel-based models are compelling operators to transition. With rising investments in EV infrastructure and growing consumer preference for green transportation, electric airport buses are poised to dominate the market, reflecting a shift toward sustainable mobility solutions.

Analysis by Sales Channel:

- Direct Sales

- Distributor

Direct sales lead the market with around 78.6% of market share in 2024 due to the customized nature of these vehicles and the specific requirements of airport authorities and transportation operators. Manufacturers often engage directly with buyers to tailor buses to meet unique operational needs, such as passenger capacity, route efficiency, and compliance with environmental regulations. This channel ensures better communication, streamlined procurement processes, and faster delivery timelines. Additionally, direct sales enable manufacturers to offer after-sales services, maintenance support, and training, fostering long-term relationships with clients. The growing demand for specialized, high-quality airport buses, coupled with the need for cost-effective and efficient procurement, has solidified direct sales as the preferred channel in this market.

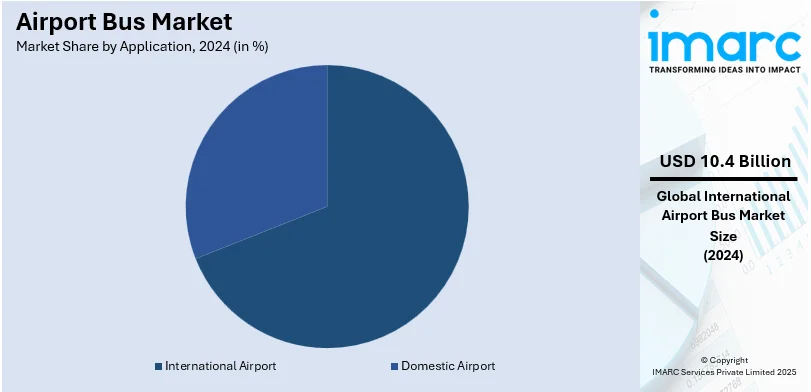

Analysis by Application:

- Domestic Airport

- International Airport

International airport leads the market with around 68.9% of market share in 2024, driven by the high volume of passenger traffic and the need for efficient ground transportation solutions. These airports serve as major hubs for global travel, requiring reliable and scalable shuttle services to connect terminals, parking areas, and nearby transit points. The increasing number of international flights and rising tourism have amplified the demand for airport buses to ensure seamless passenger mobility. Additionally, international airports often prioritize eco-friendly and technologically advanced buses to align with sustainability goals and enhance passenger experience. The expansion and modernization of airport infrastructure worldwide further reinforce the dominance of this segment, making international airports a key driver of growth in the global airport bus market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 37.8%, driven by its well-established aviation sector, robust public transportation infrastructure, and strong emphasis on sustainability. The region is home to some of the world’s busiest international airports, which require efficient and eco-friendly ground transportation solutions to manage high passenger volumes. Stringent environmental regulations and government initiatives promoting zero-emission vehicles have accelerated the adoption of electric and hybrid airport buses. Additionally, Europe’s focus on reducing carbon emissions and enhancing urban mobility aligns with the growing demand for sustainable airport transit options. Investments in modernizing airport infrastructure and the presence of leading bus manufacturers further solidify Europe’s dominance in the global airport bus market.

Key Regional Takeaways:

United States Airport Bus Market Analysis

US accounted for around 87.60% of the total North America airport bus market in 2024. United States is witnessing a rise in airport bus adoption due to growing investment in rapid technological advancements in the automotive industry manufacturing and the rising popularity of luxury airport buses. For instance, since the start of 2021, auto manufacturers have announced investments of more than USD 75 Billion in the U.S. Advanced features such as smart ticketing, real-time tracking, and enhanced safety systems are being integrated into modern airport buses, making them more efficient and passenger friendly. The demand for luxury airport buses is increasing as travellers seek premium services, including plush seating, high-speed internet, and onboard entertainment. These factors are encouraging airport authorities and transportation companies to expand their airport bus fleets with high-end models. Additionally, the automotive industry’s rapid technological advancements are enhancing fuel efficiency, reducing maintenance costs, and improving vehicle performance, further driving the preference for modern airport buses. Airport infrastructure developments and the need for seamless intermodal connectivity are also contributing to the expansion of airport bus networks. The combination of cutting-edge automotive advancements and the rising demand for luxury airport buses is shaping the growth of airport bus adoption in the region.

Asia Pacific Airport Bus Market Analysis

Asia-Pacific is experiencing significant growth in airport bus adoption due to the growing number of airports, leading to an increased need for efficient passenger transportation solutions. According to Ministry of Information and Broadcasting of India, the number of operational airports in the country has doubled from 74 in 2014 to 148 in 2023. Expanding airport infrastructure projects and the development of new international and domestic terminals are driving the demand for airport buses to provide seamless connectivity. With air travel increasing, airport authorities are focusing on enhancing ground transportation services to improve passenger mobility between terminals, hotels, and parking areas. The growing number of airports in the region is pushing transportation providers to invest in modern airport bus fleets that offer enhanced comfort and accessibility. Additionally, airport expansions in major cities are creating opportunities for advanced shuttle services, catering to the rising influx of domestic and international travellers. The integration of digital services, such as mobile ticketing and automated scheduling, is further improving operational efficiency. As more airports are constructed and upgraded, the demand for reliable and high-capacity airport buses continues to rise, solidifying their role in the region’s aviation ecosystem.

Europe Airport Bus Market Analysis

Europe is witnessing increasing airport bus adoption due to the growing adoption of electric buses to reduce carbon footprint, aligning with sustainability goals and stringent emission regulations. For instance, the EU has a set target for 2030 of a 55 % net reduction in greenhouse gas emissions. Airport authorities and transportation operators are investing in electric airport buses to lower greenhouse gas emissions and meet environmental targets. The push for eco-friendly transportation is leading to the replacement of conventional diesel buses with battery-powered alternatives, reducing air pollution in airport vicinities. The growing adoption of electric buses to reduce carbon footprint is also supported by government incentives and funding for green mobility projects. Charging infrastructure developments are accelerating the transition, ensuring seamless airport bus operations with minimal downtime. Additionally, advancements in battery technology are enhancing range and efficiency, making electric airport buses a viable and sustainable choice. With airports prioritizing low-emission solutions, the shift toward electric airport buses is reshaping ground transportation strategies, contributing to a cleaner and more sustainable travel experience for air passengers across the region.

Latin America Airport Bus Market Analysis

Latin America is experiencing growing airport bus adoption due to growing air passenger traffic, necessitating efficient and scalable ground transportation solutions. For instance, passenger traffic in Latin America and the Caribbean grew 7.6% in January of this year, an increase that translates into almost 3 Million additional passengers compared to January 2023. The increasing number of domestic and international flights is driving demand for airport buses to facilitate smooth passenger transfers. Airport authorities are expanding transportation networks to accommodate rising air passenger traffic and minimize congestion in terminals. Modern airport buses with larger seating capacities and enhanced comfort features are being introduced to streamline transit operations. Additionally, improvements in airport infrastructure and terminal expansions are reinforcing the need for well-coordinated shuttle services. With air passenger traffic continuing to grow, airport bus fleets are being optimized to enhance travel convenience.

Middle East and Africa Airport Bus Market Analysis

Middle East and Africa are seeing rising airport bus adoption due to growing tourism, creating higher demand for seamless ground transportation services. For instance, Dubai welcomed 14.96 Million overnight visitors from January to October 2024, marking an 8% increase compared to the same period in 2023, highlighting a strong growth in tourism. The influx of international visitors is driving the need for airport buses to provide efficient connectivity between terminals, hotels, and tourist destinations. Expanding hospitality and entertainment hubs are further amplifying airport bus usage. The growing tourism sector is pushing airport authorities to enhance transportation networks, introducing modern buses with advanced amenities. Improved road infrastructure is also facilitating smooth airport bus operations. As tourism flourishes, airport buses play a crucial role in ensuring hassle-free passenger movement across key travel hubs.

Competitive Landscape:

The competitive landscape of the market is headed toward a competitive environment among the major players functioning in the market. They are focusing on innovation, the establishment of sustainable practices, and strategic alliances to gain competitive advantage. If companies want to meet strict green credentials and an ever-growing requirement for green transport, they are placing massive investments in the production of pure electric and hybrid buses. In addition, companies are improving their product offerings by integrating advanced technologies, including real-time tracking, autonomous driving capabilities, and energy-efficient systems. Manufacturers partner with airports, governmental bodies, and technology providers to expand their market reach and bring tailored solutions. Moreover, the focus on after-sales services, maintenance support, and training programs is paramount for establishing long-term customer relationships and guaranteeing operational effectiveness.

The report provides a comprehensive analysis of the competitive landscape in the airport bus market with detailed profiles of all major companies, including:

- AB Volvo

- BMC Otomotiv Sanayi ve Ticaret A.S.

- BYD Company Ltd.

- COBUS Industries GmbH

- KIITOKORI OY

- Mallaghan

- Proterra

- Solaris Bus & Coach sp. z o.o. (Construcciones y Auxiliar de Ferrocarriles S.A.)

- TAM-Europe

- Weihai Guangtai Airport Equipment Co. Ltd.

- Yutong Bus Co. Ltd.

Latest News and Developments:

- February 2025: Noida International Airport (NIA), set to open in April 2025, has partnered with Uttarakhand Transport Corporation (UTC) to launch direct bus services. This initiative will connect NIA with major cities including Dehradun, Rishikesh, Haridwar, and Haldwani. The move aims to improve accessibility and enhance tourism between Uttarakhand and Uttar Pradesh.

- February 2025: TSRTC has launched Pushpak Electric Buses in Hyderabad, offering a comfortable and eco-friendly commute to Rajiv Gandhi International Airport. The service covers key city areas, enhancing travel convenience for passengers. This move marks a significant step towards sustainable public transport.

- February 2025: BATA has launched a pilot early morning bus service to Cherry Capital Airport, addressing traveler concerns about parking and transportation. This initiative, based on community feedback, aims to provide a convenient and affordable option. Interim Executive Director Chris Davis emphasized BATA’s commitment to meeting passenger needs.

- December 2024: Sardar Vallabhbhai Patel International Airport (SVPI) in Ahmedabad has introduced two free electric shuttle buses connecting Terminals 1 and 2, operating 24/7. The buses run every 30 minutes, with hourly service during off-peak hours. Equipped with Wi-Fi, climate control, CCTV, and accessibility features, they enhance passenger convenience and security.

- May 2024: Uber to Launch Airport Shuttle Service in the U.S. this summer, expanding its Uber Shuttle offering beyond Egypt and India. The company is collaborating with airport partners and officials to provide convenient, affordable transportation. Riders can book up to five seats in advance and track their shuttle in the Uber app.

- April 2024: Honolulu's Daniel K. Inouye International Airport launched the autonomous electric shuttle fleet “Miki” on April 17 for an 18-month pilot. Operating from 6 a.m. to 10 p.m., Miki shuttles run between C and G gates and Terminals 1 and 2. Each shuttle accommodates 11 passengers, including a wheelchair space, aiming to enhance airport mobility and sustainability.

Airport Bus Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Electric, Fuel |

| Sales Channels Covered | Direct Sales, Distributor |

| Applications Covered | Domestic Airport, International Airport |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Volvo, BMC Otomotiv Sanayi ve Ticaret A.S., BYD Company Ltd., COBUS Industries GmbH, KIITOKORI OY, Mallaghan, Proterra, Solaris Bus & Coach sp. z o.o. (Construcciones y Auxiliar de Ferrocarriles S.A.), TAM-Europe., Weihai Guangtai Airport Equipment Co. Ltd., Yutong Bus Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the airport bus market from 2019-2033.

- The airport bus market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the airport bus industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The airport bus market was valued at USD 15.12 Billion in 2024.

IMARC estimates the airport bus market to exhibit a CAGR of 11.60% during 2025-2033, reaching a value of USD 44.35 Billion by 2033.

The airport bus market is driven by increasing air passenger traffic, rapid urbanization, and expanding airport infrastructure, especially in emerging economies. Additionally, rising investments in eco-friendly and cost-effective transportation solutions, along with the growing adoption of electric and hybrid buses due to environmental regulations, are fueling market growth.

Europe currently dominates the airport bus market, accounting for a share exceeding 37.8% in 2024. This dominance is fueled by a well-established aviation sector, stringent environmental regulations, and strong government initiatives promoting the adoption of electric and hybrid buses.

Some of the major players in the airport bus market include AB Volvo, BMC Otomotiv Sanayi ve Ticaret A.S., BYD Company Ltd., COBUS Industries GmbH, KIITOKORI OY, Mallaghan, Proterra, Solaris Bus & Coach sp. z o.o. (Construcciones y Auxiliar de Ferrocarriles S.A.), TAM-Europe., Weihai Guangtai Airport Equipment Co. Ltd. and Yutong Bus Co. Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)