Alfalfa Hay Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Alfalfa Hay Market Size and Share:

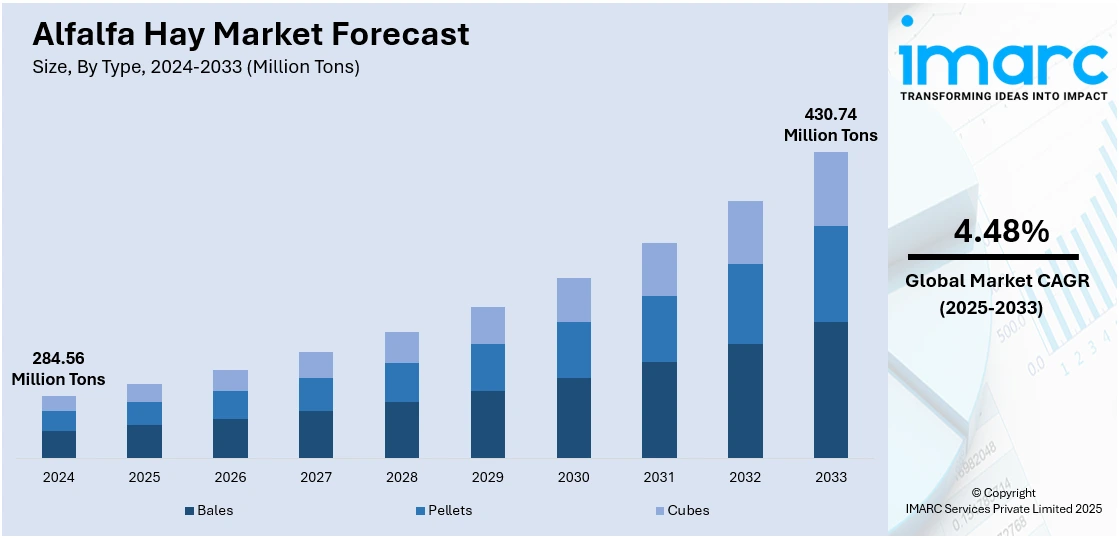

The global alfalfa hay market size was valued at 284.56 Million Metric Tons in 2024. It is projected to reach 430.74 Million Metric Tons by 2033, exhibiting a CAGR of 4.48% from 2025-2033. The market growth is driven by the increasing demand for high-quality forage in the livestock and dairy industries, advancements in farming practices, and rising exports.

Market Insights:

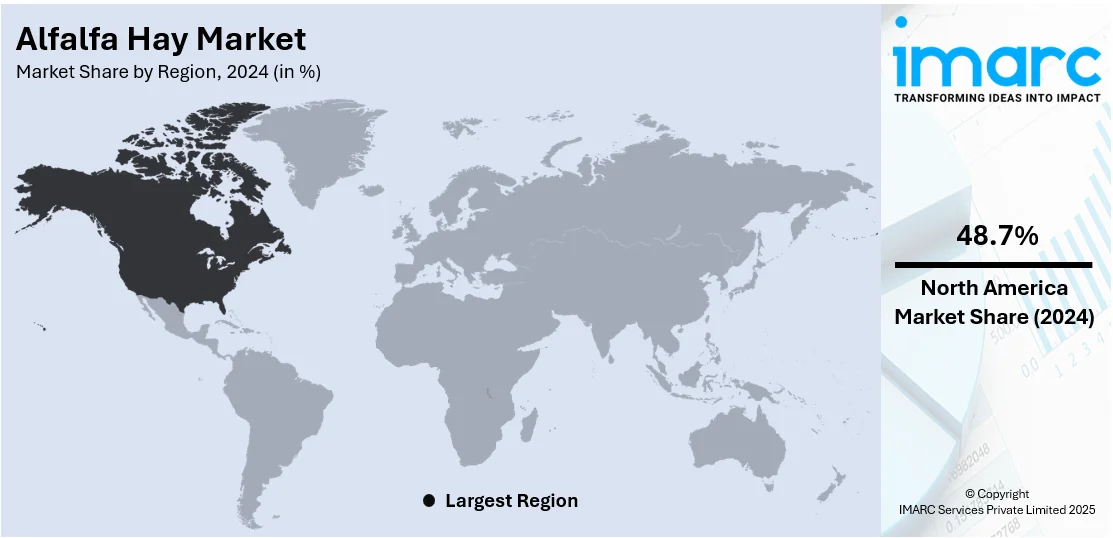

- North America holds the largest market share, accounting for 48.7% in 2024, driven by strong dairy and beef industries.

- By type, bales dominate the market, making up 55.8% of the share due to their cost-effectiveness and ease of handling.

- By application, daily animal feed leads the market with 70.7% share, driven by the nutritional needs of livestock, particularly dairy cattle.

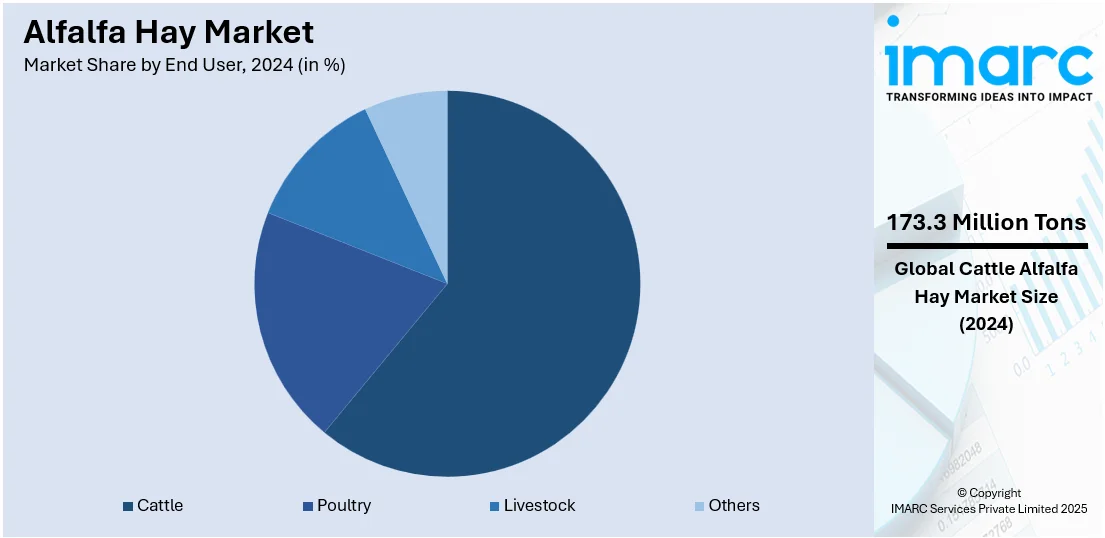

- By end-user, cattle hold the largest share (60.9%), with high demand in both dairy and beef production.

Market Size & Forecast:

- 2024 Market Size: 284.56 Million Metric Tons

- 2033 Projected Market Size: 430.74 Million Metric Tons

- CAGR (2025-2033): 4.48%

- North America: Largest market in 2024

Growing international demand for dairy and meat products has boosted demand for protein-rich animal feed, which has made alfalfa hay a desired forage given the high nutritional content of alfalfa hay. Expansion in the livestock sector, especially in developing markets, underpins this trend further. Progress in agricultural techniques, irrigation methods, and harvest technologies has enhanced crop yields and quality, reducing the availability and cost of alfalfa hay and making it more economical. Export opportunities, particularly to nations with restricted arable land or poor climate conditions, are also stimulating international trade. Additionally, growing knowledge among farmers about the advantages of alfalfa in animal health and performance continues to stimulate adoption, leading to continuous growth in the market for alfalfa hay.

To get more information on this market, Request Sample

The alfalfa hay market growth in the United States is driven by increasing demand for high-protein animal feed due to growth in dairy and beef production. According to the United States Department of Agriculture (USDA), the output estimate for 2025 has been reduced from last month to 26.423 Billion Pounds due to a slower anticipated rate of fed cow slaughter. Predictions for 2025 cattle prices have increased since last month, and 2026 prices are expected to hit all-time highs. It is anticipated that 2026 exports will drop by more than 6%, while 2026 imports will fall from the record prediction for 2025. It is anticipated that the amount of beef consumed per person on the domestic market will drop by 4.6% to 56.4 pounds in 2026. Advanced farming technologies, including improved irrigation and harvesting methods, boost yield and quality. Favorable climatic conditions in key producing states further support cultivation. Additionally, strong export demand, particularly from countries with limited forage production, enhances market potential. Rising awareness of animal nutrition and the shift toward processed alfalfa products, like pellets and cubes, also contribute to growth.

Alfalfa Hay Market Trends:

Proliferating Demand from Dairy and Meat Industries

The global dairy industry is witnessing a rapid growth, driven by changing dietary preferences and increasing income levels in emerging economies. According to a report by the IMARC Group, the global dairy market reached USD 991.5 Billion in 2024 and is projected to reach USD 1,505.8 Billion by 2033, growing at a CAGR of 4.75% during 2025-2033. Alfalfa hay is nutritious and one of the most preferred feeds for cows in dairy industry as it aids in improving milk production and boosts cow health. Dairy farmers are increasingly expanding their operational capacities as an increasing number of individuals are consuming milk products. Consequently, in the meat industry, countries including China, Brazil, and the United States, are experiencing rapid growth in consumption of poultry, beef, and pork. Alfalfa hay plays a crucial role in the meat industry as it is a nutritious feed for livestock, including cattle, horses, and sheep among others.

Increasing Use of Alfalfa Hay in Organic Agriculture

Consumers are becoming gradually aware of the environmental and health benefits of organic food, resulting in a growing demand for organic alfalfa hay. For instance, in 2021, organic retail sales in the United States were estimated to be more than USD 52 Billion, accounting for 5.5% of all retail food sales, as per the U.S. Department of Agriculture (USDA). Organic hay is produced without any fertilizer, pesticide, or other synthetic chemicals, making it a preferred feed option for organic livestock. Alfalfa hay is advantageous in suppressing weeds without using herbicides, thereby creating a positive alfalfa hay market outlook. Furthermore, it also helps enhance soil quality, conserve water, and protect biodiversity. As per the alfalfa hay market forecast, the uptrend toward organic farming practices, paired with the exceptional benefits of alfalfa hay, is projected to create growth opportunities for the market participants.

Innovation in Alfalfa Hay Processing and Storage

The increasing technological advancements in the processing and storage capabilities of alfalfa hay are revolutionizing the market dynamics. Advanced technologies, including dehydration, baling, and ensiling, are being developed to enhance the nutritional value, shelf life, and quality of alfalfa hay. Furthermore, there is a surge in interest in the implementation of precision agriculture solutions for streamlining the production of alfalfa hay. According to the IMARC Group, the global precision agriculture market is expected to reach USD 21.47 Billion by 2033, growing at a CAGR of 9.66% from 2025-2033. According to the alfalfa hay market forecast, these solutions include data analytics for efficient harvest and storage operations and drones for tracking field conditions. Further, product manufacturers are utilizing innovative harvesting and processing machinery to produce long-fiber hay products and cubes with enhanced fiber content. Such innovations are projected to augment sustainability and efficiency in production.

Alfalfa Hay Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global alfalfa hay market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end user.

Analysis by Type:

- Bales

- Pellets

- Cubes

Bales stand as the largest type in 2024, holding 55.8% of the market share. Bales hold the largest share in the alfalfa hay market due to their widespread use, ease of handling, and cost-effectiveness. They are ideal for storage and transportation, especially over long distances, making them a preferred format for both domestic use and international trade. Baled alfalfa retains its nutritional quality and is available in various sizes to suit different livestock needs, including dairy and beef cattle. Their compatibility with existing feeding equipment and infrastructure further increases their adoption. Their versatility in handling various livestock types, such as sheep, goats, and horses, also adds to their popularity. Moreover, the ease of mechanized handling and efficient storage systems, such as plastic wrapping, prolongs the shelf life, making it a preferred choice for both farmers and traders. Bales are also a reliable option for feeding in automated feeding systems due to their consistent sizing, which makes them easier to incorporate into feeding machinery. With the global focus on cost-efficient, scalable farming operations, bales continue to lead the market.

Analysis by Application:

- Daily Animal Feed

- Poultry Feed

- Horse Feed

- Others

Daily animal feeds lead the market with 70.7% in 2024. Daily animal feeds hold the largest share in the alfalfa hay market due to the consistent and high nutritional demand of livestock, especially dairy cattle. Alfalfa hay is rich in protein, fiber, and essential nutrients, making it a preferred daily feed for boosting milk yield and maintaining animal health. Its digestibility and palatability support optimal livestock performance. Regular feeding with alfalfa improves reproductive efficiency and weight gain, which is critical for both dairy and beef operations. The steady, daily requirement for quality forage in large-scale farming operations ensures sustained demand, solidifying daily animal feeds as the dominant application in the alfalfa hay market. Moreover, alfalfa’s role in enhancing the immune system of livestock, due to its antioxidant properties, makes it indispensable in maintaining long-term health and preventing diseases. This ensures that farmers and producers rely on it for consistent, healthy growth in livestock. The rising trend of organic farming has further pushed the demand for high-quality, natural feeds like alfalfa hay. As a result, the market for daily animal feeds continues to see steady growth, especially as global meat and dairy consumption rises, underscoring the central role that alfalfa hay plays in livestock diets.

Analysis by End User:

- Poultry

- Cattle

- Livestock

- Others

Cattle lead the market with 60.9% of market share in 2024. Cattle, especially dairy cows, are primary consumers of alfalfa hay due to its high protein and calcium content, which are essential for milk production and overall health. It enhances feed efficiency, supports rumen function, and increases milk yield. Alfalfa is also suitable for beef cattle during the growth and finishing phases. Cattle, especially in large-scale operations, rely on the high digestibility of alfalfa to maximize feed intake and optimize growth, leading to healthier animals and higher productivity. The significant role alfalfa plays in optimizing cattle feed conversion rates makes it indispensable for maximizing profitability in both dairy and beef sectors. Alfalfa hay’s ability to support optimal reproductive performance in cattle also contributes to its popularity in livestock management, as maintaining herd health and fertility is vital for consistent milk production and meat yield. As demand for beef and dairy grows, particularly in emerging markets, alfalfa continues to be a dominant choice in cattle diets, positioning this segment as a key driver of market share.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 48.7%. The alfalfa hay market demand in North America is driven by the region’s strong dairy and beef industries that require consistent supplies of high-protein forage, with alfalfa hay being a preferred choice due to its nutritional profile. Technological advancements in farming, such as precision irrigation, improved harvesting equipment, and efficient storage techniques, have increased both yield and quality. Favorable climatic conditions, particularly in the western United States and parts of Canada, further support large-scale cultivation. Moreover, rising demand from export markets like China, Japan, and Saudi Arabia encourages production expansion. The growing trend of processed alfalfa products, including pellets and cubes, for ease of transportation and feeding also supports market growth. The United States benefits from the high level of mechanization in its agricultural sector, which allows for large-scale, efficient production. Canada’s farming practices, especially in the western provinces, have also contributed significantly to North America’s market share, driven by its extensive livestock sector and favorable growing conditions. The North American market is also supported by strong trade agreements, such as the USMCA, that encourage cross-border sales and shipments, boosting the region’s position in the global alfalfa market. As technological innovations in farming continue to evolve, North America is likely to maintain its dominant share due to its efficient production systems, strategic export relationships, and a stable internal demand from the dairy and beef industries.

Key Regional Takeaways:

United States Alfalfa Hay Market Analysis

In 2024, the United States accounted for 89.7% of the alfalfa hay market in North America. The United States alfalfa hay market is primarily driven by growing demand in the livestock and dairy farming sectors. Alfalfa hay is a key feed component for cattle, particularly dairy cows, as it supports high-quality milk production and overall animal health. The expansion of the dairy industry, along with rising meat consumption, has contributed substantially to this demand. According to industry reports, in 2022, per capita consumption of beef in the United States reached 37.65 kg. Furthermore, the increasing prevalence of intensive farming practices and the adoption of higher-yielding varieties of alfalfa have significantly boosted production levels. Another notable growth-inducing factor is the export potential of U.S. alfalfa hay, particularly to regions such as the Middle East, China, and Japan, where it is in high demand for both livestock feed and pet food industries. Environmental factors are also influencing the industry as farmers are increasingly adopting water-efficient irrigation techniques due to concerns over water scarcity in certain U.S. regions, which in turn influences alfalfa cultivation. Other than this, the growing awareness about sustainable farming practices and the use of organic alfalfa hay to meet consumer preferences for natural products further drives market growth.

Asia Pacific Alfalfa Hay Market Analysis

The Asia Pacific alfalfa hay market is expanding due to the region's growing focus on animal health and nutrition, which is driving the demand for high-quality feed such as alfalfa hay. With increasing attention on the nutritional value of livestock feed, farmers are turning to alfalfa for its rich protein and fiber content, which is essential for improving meat and milk production. Moreover, growing export opportunities to regions such as the Middle East and Southeast Asia are providing additional market support, encouraging greater production and investment in the alfalfa hay sector. For instance, in India, exports of meat, dairy, and poultry products increased by 12.57% from USD 4.53 Billion in FY 2023-24 to USD 5.1 Billion in FY 2024-25, as per the Press Information Bureau (PIB). Government initiatives promoting sustainable agriculture and the integration of better farming practices, along with favorable trade policies, are further supporting market growth.

Europe Alfalfa Hay Market Analysis

The Europe alfalfa hay market is experiencing robust growth, fueled by the strong livestock and dairy industry in the region. Alfalfa hay is crucial for feeding dairy cattle, as it promotes high milk yields and supports overall animal health. According to Eurostat, in 2023, 160.8 million tons of raw milk were produced in the European Union. Moreover, the average apparent milk yield per cow reached 7,791kg. The growing demand for dairy products, driven by both domestic consumption and exports, is a significant driver of alfalfa hay consumption. Additionally, the increasing focus on sustainable farming practices across Europe is contributing substantially to the demand for organic and high-quality alfalfa hay. With heightened consumer awareness about the environmental impact of farming, numerous European farmers are shifting toward eco-friendly and organic farming techniques, further stimulating the market for organic alfalfa hay. The region's emphasis on animal welfare and the need for high-quality animal feed to ensure optimal livestock productivity is also driving industry expansion. Trade policies and cross-border demand, particularly from countries, such as the Middle East and North Africa, also provide a strong export market for European alfalfa hay, further enhancing its market potential.

Latin America Alfalfa Hay Market Analysis

The Latin America alfalfa hay market is significantly influenced by the growing demand from the livestock and dairy sectors. As meat and dairy consumption increases across the region, particularly in countries such as Brazil and Argentina, the need for high-quality feed such as alfalfa hay is rising. In 2023, beef and veal consumption in Argentina reached 34.4 kilograms per capita, as per the Organization for Economic Cooperation and Development. Furthermore, the region’s expanding commercial farming operations are also contributing to greater alfalfa production and consumption. Additionally, the adoption of modern farming practices and improved irrigation techniques is enhancing the efficiency and yield of alfalfa cultivation. The rising awareness about sustainable farming and animal welfare standards is also propelling the demand for organic alfalfa hay.

Middle East and Africa Alfalfa Hay Market Analysis

The Middle East and Africa alfalfa hay market is being increasingly propelled by the increasing government support for agricultural development and livestock industries. Countries in the region are investing in infrastructure to improve feed production and ensure a steady supply of quality hay. Rising investments in livestock farming and the expansion of large-scale commercial farms are also boosting the demand for efficient animal nutrition, further supporting the alfalfa hay market. For instance, in 2023, Saudi Arabia had a total of 29.4 million sheep, 7.4 million goats, and 2.2 million camels, indicating a flourishing livestock industry, according to the General Authority for Statistics (GASTAT). The growing popularity of dairy products and a shift toward healthier diets are also increasing the need for premium livestock feed.

Competitive Landscape:

The alfalfa hay market is moderately fragmented, with a mix of global and regional players competing across key producing regions. Major companies focus on high-quality production, efficient supply chains, and expanding international exports to maintain market share. Leading players include Al Dahra ACX, Anderson Hay & Grain Co., SL Follen Company, and Bailey Farms, which emphasize premium forage and customized hay blends. Technological advancements in harvesting and storage, along with strategic partnerships and export contracts, are key competitive strategies. Regional suppliers often cater to domestic livestock needs, creating a dynamic between large-scale exporters and local producers. As demand rises from the dairy, beef, and equine sectors globally, companies that offer consistent quality, reliability, and logistical efficiency are best positioned in the competitive landscape.

The report provides a comprehensive analysis of the competitive landscape in the alfalfa hay market with detailed profiles of all major companies, including:

- Al Dahra ACX Inc.

- Alfalfa Monegros

- Anderson Hay & Grain Co., Inc.

- Bailey Farms International

- Green Prairie International Inc.

- Hay USA Inc.

- Oxbow Animal Health

- Riverina (Mitsubishi Corporation)

- Sacate Pellet Mills Inc.

- SL Follen Company

- Standlee Premium Products LLC

- Zille S.A.

Latest News and Developments:

- April 2025: DLF's North American business segment revealed the opening of specialized Product Knowledge Centers in Philomath, Oregon and Port Hope, Ontario. These locations will showcase all offerings of the DLF portfolio, including alfalfa and the latest advancements in seed modification.

- January 2025: Norden Manufacturing launched the Norden AlfaTed, a brand-new reel-style tedder that can assist farmers in preserving the quality of harvested alfalfa before baling it. Compared to conventional rotating tedders, these tedders provide a dependable and gentle solution with faster working speeds.

- September 2024: Renovo Seed announced that its 2025 product range will include three of the company’s well-known AlfaGrass mixtures along with eight premium alfalfa cultivars. These alfalfa options offer enhanced yield, persistence, and pest resistance.

- April 2024: Mayak, a Siberian agricultural firm, announced that it would invest USD 60 million to build an alfalfa feed mill, with a significant focus on exporting to China. The project includes USD 28 million for land reclamation and advanced irrigation systems to optimize alfalfa cultivation in Siberia.

Alfalfa Hay Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Metric Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bales, Pellets, Cubes |

| Applications Covered | Daily Animal Feed, Poultry Feed, Horse Feed, Others |

| End Users Covered | Poultry, Cattle, Livestock, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Al Dahra ACX Inc., Alfalfa Monegros, Anderson Hay & Grain Co Inc., Bailey Farms International, Green Prairie International Inc., Hay USA Inc., Oxbow Animal Health, Riverina (Mitsubishi Corporation), Sacate Pellet Mills Inc., SL Follen Company, Standlee Premium Products LLC, and Zille S.A |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the alfalfa hay market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global alfalfa hay market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the alfalfa hay industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The alfalfa hay market was valued at 284.56 Million Metric Tons in 2024.

The alfalfa hay market is projected to exhibit a CAGR of 4.48% during 2025-2033, reaching a value of 430.74 Million Metric Tons by 2033.

Key factors driving the alfalfa hay market include rising demand for high-protein animal feed, growth in dairy and beef industries, technological advancements in cultivation and harvesting, and expanding export opportunities. Increasing awareness of animal nutrition and adoption of processed alfalfa products also contribute significantly to the market’s continued growth.

North America currently dominates the alfalfa hay market due to strong livestock demand, advanced farming practices, favorable climate, and rising exports.

Some of the major players in the alfalfa hay market include Al Dahra ACX Inc., Alfalfa Monegros, Anderson Hay & Grain Co Inc., Bailey Farms International, Green Prairie International Inc., Hay USA Inc., Oxbow Animal Health, Riverina (Mitsubishi Corporation), Sacate Pellet Mills Inc., SL Follen Company, Standlee Premium Products LLC, Zille S.A, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)