Almond Milk Market Size, Share, and Trends by Type, Category, Packaging Type, Application, Distribution Channel, Region, and Forecast 2025-2033

Almond Milk Market Size and Share:

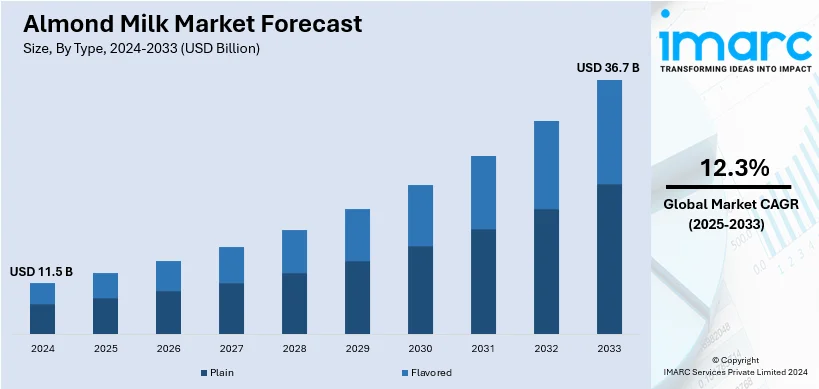

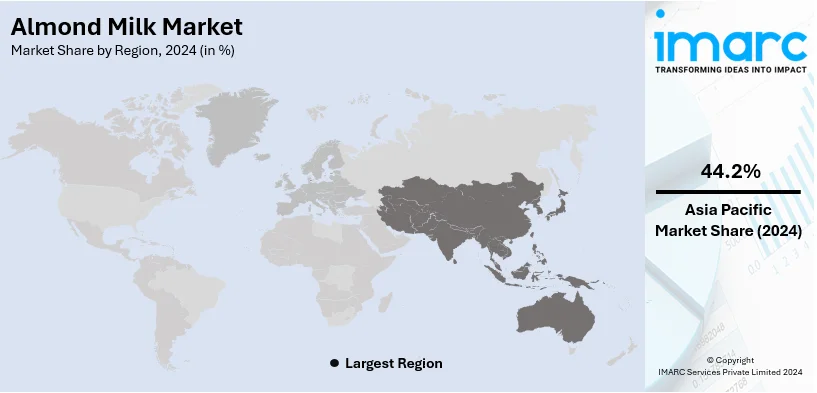

The global almond milk market size was valued at USD 11.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 36.7 Billion by 2033, exhibiting a CAGR of 12.3% from 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 44% in 2024. The market is driven by the increasing health awareness, escalating popularity of plant-based food and diets across the globe, rising trends in sustainable products, continuous improvements in flavors and formulations innovation, increasing environmental consciousness among consumers around the world along with significant demand for organic and clean-label foods.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.5 Billion |

|

Market Forecast in 2033

|

USD 36.7 Billion |

| Market Growth Rate (2025-2033) | 12.3% |

The high prevalence of lactose-intolerant individuals is one of the most significant drivers for market growth in the world. Getting some sort of suitable dairy alternatives to those suffering from lactose intolerance is much needed in order for them manage its symptoms. This illustrates that almond milk has an incredible potential across the world. Almond milk is suitable for individuals suffering with hypercholesterolemia, owing to its polyunsaturated fatty acid content, which also helps lessen blood cholesterol levels and inflammation. This significantly contributes to the revenue growth of the almond milk market. The versatility of almond milk is expected to further fuel the global almond milk market growth over the forecast period. The increasing production of almond milk beverages is creating growth opportunities for market players. Almond milk is a beneficial ingredient in many personal hygiene and organic cosmetic products, which expands the market scope.

The United States stands out as an important market due to significant development in product range and varieties. The manufacturers in the market are coming up with almond milk in vanilla and chocolate varieties to create diversities in formulation and taste. Besides, some others are trying to incorporate AI and other advanced technologies in the production processes. For instance, in June 2024 Hewlett Packard Enterprise (HPE) announced Blue Diamond Growers—the U.S. brand for almonds and almond milk production—modernized its wireless networking infrastructure with an HPE Aruba Networking Wi-Fi 6E-enabled solution. This in turn improves connectivity for mobile and IoT devices as part of its support for three manufacturing sites that handle one billion pounds of almonds annually for both domestic and international consumption.

Almond Milk Market Trends:

Growing Demand for Organic and Non-GMO Almond Milk

The demand for organic and non-GMO almond milk is on the rise as consumers become more health-conscious and environmentally aware. Organic almond milk is perceived as a healthier option, free from synthetic pesticides and genetically modified organisms, appealing to consumers looking for clean-label products. According to Organic Trade Association, U.S. sales of certified organic products approached USD 70 Billion in 2023. Moreover, brands are increasingly offering organic variants to cater to this growing segment, emphasizing sustainable farming practices and transparent sourcing to build consumer trust and loyalty.

Innovations in Flavor and Nutritional Fortification

New trends in almond milk formulation, such as a range of flavors and the addition of nutrients, support the growth of this market. In order to meet differing tastes, companies are rolling out flavored and seasonally inspired products. Furthermore, adding vitamins A, B, D as well as protein and calcium to the almond milk expands its consumers by making it a viable dairy replacement. For instance, in 2024, Maiva Fresh launched Maiva Unsweetened Almond Milk, its flagship brand of unsweetened almond milk. This range of health drink contains no cholesterol, low G1, and is combined with Vitamin B12, and Vitamin D.

Adoption of Sustainable Packaging Solutions

The almond milk market is increasingly embracing sustainable packaging solutions in response to growing environmental concerns. Brands are shifting towards eco-friendly packaging materials, such as recyclable cartons and biodegradable plastics, to reduce their environmental footprint. This trend aligns with global sustainability goals and consumer demand for environmentally responsible products. According to reports, 60% of consumers are willing to pay more for sustainable packaging. This shift helps brands meet regulatory requirements and consumer expectations and enhances their market positioning as environmentally conscious companies. Almond milk market business opportunities are driven by sustainable packaging innovations, which are becoming a key differentiator in the competitive almond milk market.

Almond Milk Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global almond milk market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, category, packaging type, application, distribution channel, and region.

Analysis by Type:

- Plain

- Flavored

Flavored type stands as the largest type in 2024, holding around 56.2% market share. The growth of this segment is driven by consumer demand for taste and diversity. An extensive selection of flavors, including vanilla, chocolate, and seasonal favorites appeals to audiences from children to adults. As per the International Food Information Council, over 72% of consumers surveyed said their main concern while consuming any food or beverage is its taste. Flavored almond milk also contains fortifying nutrients which includes vitamins, and minerals therefore it is considered as a desirable substitute of regular cow’s milk. The innovation in flavors also aligns with the growing trend of personalized nutrition and indulgence, catering to health-conscious consumers looking for enjoyable and nutritious options. The increased availability of flavored almond milk in various retail channels further boosts its market share, solidifying its position as a preferred choice among consumers.

Analysis by Category:

- Organic

- Conventional

Organic leads the market with around 64.6% market share in 2024. The growth of the segment is primarily driven by rising consumer awareness about health and environmental sustainability. Organic products are perceived as healthier options, free from synthetic pesticides, hormones, and genetically modified organisms, which appeal to health-conscious consumers. According to the Organic Trade Association, the sales of organic beverages, including almond milk, surged by 12.4% in 2022, reflecting this growing preference. Additionally, the increasing trend toward clean label products, where consumers seek transparency in sourcing and production methods, further boosts the demand for organic almond milk. Almond milk market revenue is positively impacted by the commitment to sustainable farming practices associated with organic production also attracts environmentally conscious consumers who prioritize eco-friendly products. This shift toward organic options is supported by broader retail availability and marketing efforts highlighting the health and environmental benefits of organic almond milk, solidifying its dominance in the market.

Analysis by Packaging Type:

- Carton

- Glass

- Others

Carton leads the market with around 57.5% market share in 2024, driven by its convenience, sustainability, and ability to preserve product freshness. Cartons are lightweight, making them cost-effective for transportation and reducing the overall carbon footprint. Their design also offers extended shelf life without refrigeration until opened, which appeals to both retailers and consumers. Moreover, increasing consumer awareness about environmentally friendly packaging has further boosted the preference for carton-based options, as they are often made from recyclable and renewable materials. These factors combined make carton packaging a dominant choice in the almond milk market.

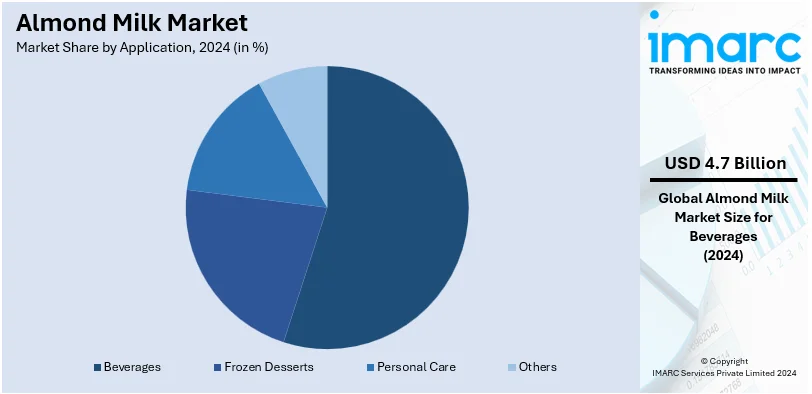

Analysis by Application:

- Beverages

- Frozen Desserts

- Personal Care

- Others

The beverages segment leads the market with around 40.8% market share in 2024. This is attributed to the increasing consumer shift towards plant-based drinks for health and dietary reasons. Almond milk, known for being lactose-free, low in calories, and rich in vitamins, has gained popularity as a substitute for traditional dairy milk in beverages. This trend is supported by data from the Plant Based Foods Association, which reported a 20% increase in sales of plant-based beverages in 2022, highlighting growing consumer interest. Almond milk industry overview shows that almond milk's versatility in various beverages, including smoothies, coffees, and teas, enhances its appeal across different demographics. The increasing prevalence of veganism, lactose intolerance, and health-conscious lifestyles drives the demand for almond milk in the beverage segment. Additionally, the continuous innovation in flavors and formulations, such as unsweetened and fortified options, caters to diverse consumer preferences, further solidifying the dominance of beverages in the almond milk market.

Analysis by Distribution Channel:

- Hypermarkets and Supermarkets

- Convenience Stores

- Online Stores

- Others

Hypermarkets and supermarkets segment leads the market with around 42.8% market share in 2024. The growth is driven by their extensive reach, convenience, and ability to offer a wide variety of products. These retail giants provide a one-stop shopping experience, attracting many consumers. The accessibility of almond milk in such outlets ensures that it reaches a broad audience, including both regular shoppers and those looking for specific dietary products. According to the Food Industry Association, 95% of consumers reported shopping at supermarkets in 2021, underscoring the dominance of this distribution channel. Almond milk market research report indicates that hypermarkets and supermarkets also can stock diverse brands and varieties of almond milk, from organic to flavored options, catering to varied consumer preferences. Their ability to run promotions and offer competitive pricing further boosts sales. Additionally, the trust and familiarity associated with established supermarket chains enhance consumer confidence in purchasing almond milk from these outlets.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 44%. The region is composed of developing countries like India, China, etc, where veganism is a new trend, thereby increasing the demand for dairy alternatives. According to a report by the United Nations Food and Agriculture Organization (UN FAO), India has around 500 million vegetarians and around five million being strict vegans in 2020. Besides, the entry of new players through strategic activities like new launches or collaborations is further emerging as a growth-inducing factor for the industry. For instance, in October 2020, Farm Fresh, a prominent dairy company in Malaysia, introduced its newest plant-based alternatives, excluding soy, to the domestic market. Complementing the earlier launch of chilled fresh soy milk, Farm Fresh now offers UHT oat milk and UHT almond milk, strategically positioning itself to tap into the growing potential of the plant-based market segment.

Key Regional Takeaways:

North America Almond Milk Market Analysis

The North America almond milk market is driven by high consumer awareness and increasing demand for plant-based alternatives. The region's robust market growth is largely attributed to the widespread adoption of vegan and flexitarian diets, coupled with a growing prevalence of lactose intolerance and dairy allergies. According to the National Institutes of Health, approximately 65% of the human population has a reduced ability to digest lactose after infancy, with significant numbers in the United States. The presence of major almond milk brands, coupled with continuous product innovations and marketing efforts, further propels the market in North America. The region also benefits from a well-established retail infrastructure, including supermarkets, hypermarkets, and online platforms, ensuring widespread availability and accessibility of almond milk products. Additionally, strong consumer trends toward health and wellness, supported by a high disposable income, contribute to the dominance of North America in the almond milk market.

United States Almond Milk Market Analysis

The demand for almond milk witnessed incredible growth in North America, and this growth can be attributed to strategic initiatives like acquisitions and mergers by key industry players. For instance, in April 2021, SunOpta announced the acquisition of Dream and WestSoy from the Hain Celestial Group – two of the largest and established brands in the shelf-stable plant-based dairy space – in an agreement worth USD 33 Million. Besides, in North American countries, online demand constitute for a significant market share for almond milk owing to the high internet penetration in the region. As per GSMA, mobile internet penetration is expected to expand from 76% in 2019 to 80% by 2025. In addition, 5G internet broadband will account for nearly two-thirds of total mobile connections by 2025. Thus, increasing internet penetration is aiding in the expanding demand for almond milk in the region.

To gain a competitive edge in the market, many new products are being introduced by the key operating players of the market, which in turn is expected to contribute towards the market growth. For instance, in December 2023, Blue Diamond, one of the regional renowned players of almond marketers and processors, expanded its selection by announcing a new addition to its selection of Almond Breeze products with the launch of Almond Breeze Original Almond & Oat Blend. Also, many players are collaborating with local companies in the region to cater to the rising demand for almond milk among lactose-intolerant consumers. According to the National Institutes of Health (NIH), around 36% of the population in the country were lactose intolerant in 2017. This in turn is expected to bolster the demand in the forecast period.

Europe Almond Milk Market Analysis

Europe’s almond milk market is expanding on the backdrop of increasing vegan adoption in European countries like Germany, Italy, France, etc. According to the “Good Food Institute Europe” reports, a 22% increase was observed in plant-based food sales across 13 European countries, reaching € 5.7 Million in 2022, thereby posing a positive impact on the market’s growth. Moreover, the increasing penetration of newly developed smartphones with fast internet connections is further proliferating the market growth. In addition, the strategic activities implemented by the key players, along with the rise in new player penetration, are catapulting the market in the region. For example, in 2019, Nestle brand launched its branded line of almond milk products in the European market under the brand name “Nesquik”. Through this, the company was able to expand the variety of almond milk options that are available in European countries for consumers.

The introduction of new innovative products to cater to the rising demand for almond milk in Europe is expected to drive the growth of the market in the coming years. For instance, the prominent dairy alternative brand "Silk" reported that 73% of consumers interested in plant-based foods begin their journey by purchasing almond milk. In January 2022, the company further expanded its offerings by introducing a new almond milk line, showcasing three different almond varieties.

Latin America Almond Milk Market Analysis

Growing vegetarianism, health consciousness, and worries about lactose intolerance are driving the almond milk business in Latin America. The main markets are Brazil and Mexico, where consumers are choosing plant-based substitutes because of dietary trends and their health advantages. The expanding middle class in the area is becoming increasingly interested in high-end, healthful foods like almond milk. Additionally, local production and product marketing improvements are lowering the cost and expanding the availability of almond milk.

Middle East and Africa Almond Milk Market Analysis

The growth of the Middle East and Africa almond milk industry can be accredited to the growing expenditure on the dairy alternatives sector by consumers in the region. This situation has created a demand for different dairy alternatives in the food and beverage sector, including almond milk. In addition, the market is growing in the Middle East due to the demand from the region’s increasing expatriate population for healthy dairy-alternative milk. Moreover, the international brands are collaborating with local players and distributors in order to penetrate in the region. For example, a European almond milk manufacturer named “Nutriops”, exports and sells its products in the UAE through Al Accad C & G Trading, in Kuwait through Nab General Trading & Contracting Establishment, in Lebanon through Eatwell Sarl, and in Saudi Arabia through Organic Food Trading Establishment. Such developments are automatically supporting the market growth.

Competitive Landscape:

The competitive landscape of the almond milk market is characterized by a mix of established players and innovative newcomers, driving market growth through continuous product development and strategic initiatives. The diverse competitive landscape fosters a dynamic market environment, promoting consumer choice and market expansion.

The market research report provides a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the almond milk industry include:

- Blue Diamond Growers

- Califia Farms LLC

- Daiya Foods Inc

- Earth's Own Food Company

- Hain Celestial Group

- Hiland Dairy Foods

- Malk Organics LLC

- Pacific Foods of Oregon LLC,

- Sanitarium

- SunOpta Inc

- The WhiteWave Foods Company

Latest News and Developments:

- In 2024, Glico unveiled its health and wellness portfolio in Southeast Asia with the launch of Japan’s best-selling almond milk, Almond Koka, in Singapore.

- In 2023, Califia Farms LLC, a prominent, premium plant-based beverage brand, expanded its award-winning line of dairy-free products with the introduction of United States Department of Agriculture (USDA) certified organic oat milk and almond milk to meet the needs of consumers seeking products with fewer ingredients, yet at an accessible price point that is available at Kroger Co., Whole Foods Market, Sprouts Farmers Market, and other retailers nationwide.

- In 2022, Only Earth, a sustainable plant-based/vegan milk brand introduced almond milk in its portfolio of vegan beverages among other options.

- In 2022, ESW Beauty brand launched its newest collection of “Plant-Based Milk Sheet Masks”, to expand its cruelty-free beauty line. The masks, such as Avocado Banana Milk, Blueberry Coconut Milk, Matcha Almond Milk, and Vanilla Oat Milk, feature almond milk as a key ingredient.

- In 2021, Starbucks Corp. revealed the launch of its new holiday food and drink lineup, along with its festive cups, for its stores in the US and Canada. The lineup includes a newly introduced “Iced Sugar Cookie Almondmilk Latte”, along with others.

Almond Milk Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Plain, Flavored |

| Categories Covered | Organic, Conventional |

| Packaging Types Covered | Carton, Glass, Others |

| Applications Covered | Beverages, Frozen Desserts, Personal Care, Others |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Blue Diamond Growers, Califia Farms LLC, Daiya Foods Inc., Earth's Own Food Company Inc., Hain Celestial Group, Hiland Dairy Foods, Malk Organics LLC, Pacific Foods of Oregon LLC, Sanitarium, SunOpta Inc., The WhiteWave Foods Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecast, and dynamics of the Almond Milk market from 2019-2033.

- The Almond Milk market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders analyze the level of competition within the Almond Milk industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The almond milk market was valued at USD 11.5 Billion in 2024.

The almond milk market is projected to exhibit a CAGR of 12.3% during 2025-2033, reaching a value of USD 36.7 Billion by 2033.

The market is driven by rising health consciousness, growing popularity of plant-based diets, escalating demand for sustainable products, ongoing innovations in flavors and formulations, heightening environmental awareness, and consumer preferences for dairy alternatives and organic, clean-label options.

Asia Pacific currently dominates the almond milk market, accounting for a share of 44% in 2024. The dominance is fueled by rising vegan and lactose-free diets, increasing health consciousness, growing disposable incomes, and expanding plant-based product availability in the region.

Some of the major players in the almond milk market include Blue Diamond Growers, Califia Farms LLC, Daiya Foods Inc., Earth's Own Food Company Inc., Hain Celestial Group, Hiland Dairy Foods, Malk Organics LLC, Pacific Foods of Oregon LLC, Sanitarium, SunOpta Inc., and The WhiteWave Foods Company, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)