Ammonium Sulphate Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Ammonium Sulphate Price Trend, Index and Forecast

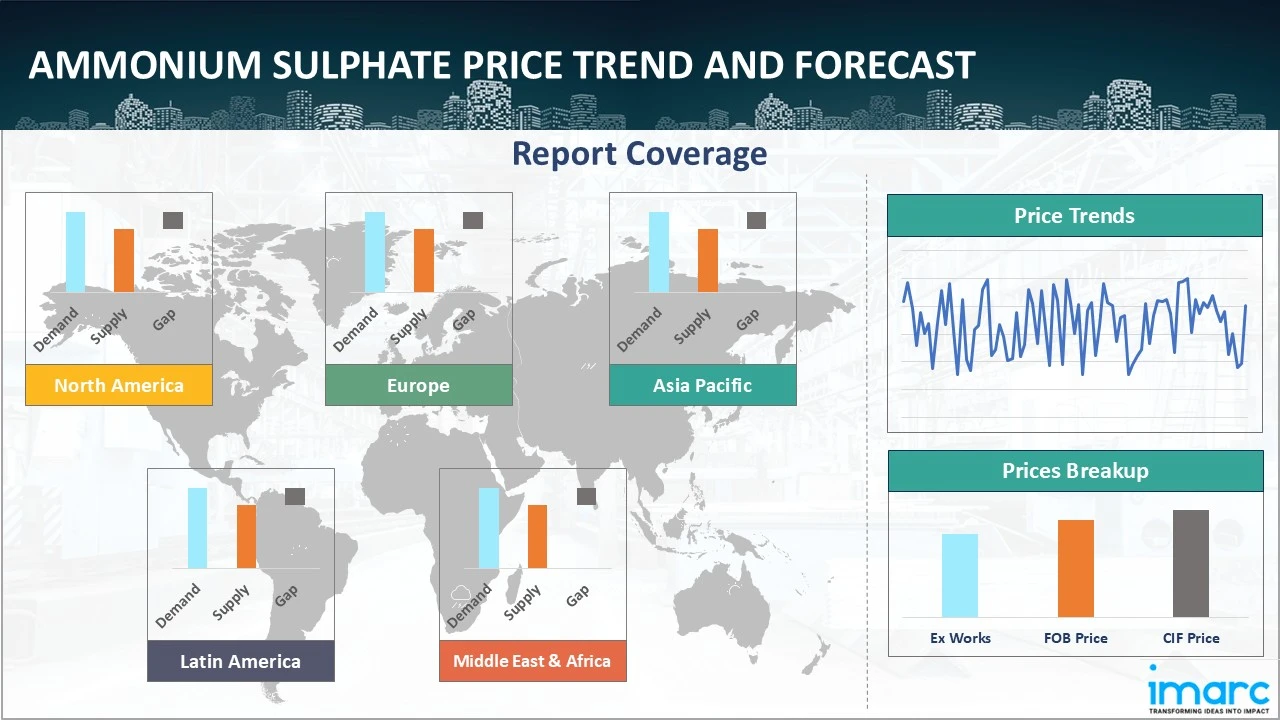

Track the latest insights on ammonium sulphate price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Ammonium Sulphate Prices Outlook Q2 2025

- USA: US$ 397/MT

- Canada: US$ 316/MT

- Japan: US$ 263/MT

- Germany: US$ 266/MT

- China: US$ 143/MT

Ammonium Sulphate Price Chart

Get real-time access to monthly/quaterly/yearly prices, Request Sample

During the second quarter of 2025, the ammonium sulphate prices in the USA reached 397 USD/MT in June. In Q2 2025, ammonium sulphate prices in the USA were influenced by sustained demand from the agricultural sector, particularly in the Midwest during the planting season. Planned outages at major ammonia production sites affected domestic supply. The prices of natural gas and ammonia served as key cost drivers. Import volumes from East Asia faced logistical challenges, impacting overall market availability and distribution timelines.

During the second quarter of 2025, ammonium sulphate prices in Canada reached 316 USD/MT in June. Ammonium sulphate pricing in Canada during Q2 2025 was impacted by rising demand from the agricultural sector in the Prairie Provinces. Domestic supply was limited by seasonal rail transport constraints and dependence on imports from the USA and Asia. Currency exchange fluctuations affected the competitiveness of foreign-sourced material. Additionally, weather-related delays in planting influenced purchasing cycles and distribution strategies across key farming regions.

During the second quarter of 2025, the ammonium sulphate prices in Japan reached 263 USD/MT in June. In Japan, ammonium sulphate prices in Q2 2025 were primarily influenced by reduced caprolactam production, which constrained domestic by-product supply. Import reliance increased due to tight regional inventories, and elevated freight costs added pressure. The agricultural sector maintained consistent demand, while procurement strategies were adjusted in response to supply concerns and currency movements that impacted import pricing from China and Southeast Asia.

During the second quarter of 2025, the ammonium sulphate prices in Germany reached 266 USD/MT in June. During Q2 2025, ammonium sulphate prices in Germany were affected by lower domestic output resulting from caprolactam production cutbacks amid high energy input costs. The agricultural sector showed fluctuating demand depending on regional weather conditions. Imports from Eastern Europe and Asia faced delays due to port and rail congestion. Furthermore, environmental regulations and compliance costs continued to influence production economics and supply availability.

During the second quarter of 2025, the ammonium sulphate prices in China reached 143 USD/MT in June. In Q2 2025, the pricing of ammonium sulphate in China was shaped by operating rates at caprolactam plants, which were influenced by energy pricing, feedstock availability, and government-mandated environmental controls. Export volumes shifted in response to overseas demand, especially from South Asia and Latin America. Domestic agricultural demand remained consistent, while inland logistics disruptions affected supply flows across key provinces.

Ammonium Sulphate Prices Outlook Q4 2024

- USA: US$ 410/MT

During the fourth quarter of 2024, ammonium sulphate prices in the United States reached 410 USD/MT in December. The market saw sharp drops because of an oversupply, a result of steady manufacturing levels. The agricultural sector's demand stayed low as farmers slowed purchases in anticipation of even lower prices. The situation was further complicated by labor negotiations at United States ports, which led to fears of disruptions and uncertainty. By December, prices recovered slightly, helped by higher ammonia prices and increased domestic demand, but the market remained volatile, affected by ongoing labor issues and supply chain challenges.

Ammonium Sulphate Prices Outlook Q3 2024

- USA: US$ 420/MT

- China: US$ 145/MT

- Germany: US$ 265/MT

The ammonium sulphate prices in the United States for Q3 2024 reached 420 USD/MT in September. The prices dropped, largely due to reduced usage in the fertilizer sector. Weather conditions across the country, including hurricanes and storms, disrupted agricultural activities and delayed the anticipated purchasing cycle for the next planting seasons. With the peak planting period over, immediate demand for fertilizers fell, contributing to market weakness. Additionally, crop progress was significantly impacted in some regions, creating further uncertainty in the market. The result was a continued downward pressure on prices throughout the quarter.

The price trend for ammonium sulphate in China for Q3 2024 reached 145 USD/MT in September. The market saw an increase in prices at the start of the quarter, largely due to supply shortages caused by extreme weather, including typhoons that disturbed manufacturing. Although prices dropped in the middle of the quarter, a recovery in the final months resulted in prices stabilizing. Domestic demand remained weak while logistical issues persisted. These factors, combined with external weather disruptions, created a fluctuating pricing environment for the region.

The price trend for ammonium sulphate in Germany for Q3 2024 reached 265 USD/MT in September. The market experienced a significant price rise attributed to increased feedstock costs and geopolitical instability in Eastern Europe. Rising ammonia and sulfuric acid prices placed upward pressure on prices, while disruptions in natural gas supply further exacerbated manufacturing costs. Despite lower agricultural activity, inconsistent usage in the fertilizer industry fueled the expenditure hike. As the quarter ended, Germany's market reflected broader European trends, with prices steadily increasing due to a tight supply-demand balance.

Ammonium Sulphate Prices Outlook Q2 2024

- Germany: US$ 249/MT

During the second quarter of 2024, ammonium sulphate prices in Germany reached 249 USD/MT. During Q2 2024, the ammonium sulphate market in Germany saw a notable drop in prices, primarily caused by harsh climate circumstances that disturbed farming operations. Repeated strong winds and intense downpour led to delays in planting, diminishing fertilizer demand. The downward trend was further exacerbated by subdued market demand and variable raw material costs.

Ammonium Sulphate Prices Outlook Q1 2024

- USA: US$ 346/MT

- South Korea: US$ 157/MT

Ammonium sulphate prices in the United States for Q1 2024 reached 346 USD/MT. The market in ammonium sulphate saw price increases due to heightened domestic and South American demand, driven by improved agricultural conditions. However, production setbacks from winter storms and ammonia shortages, due to a pipeline issue, significantly impacted supply and increased costs.

The price trend for ammonium sulphate in South Korea for Q1 2024 reached 157 USD/MT. The ammonium sulphate market experienced a price rise, primarily due to strong fertilizer demand and supply chain disruptions. Flooding at key facilities and China's absence from the export market forced buyers to seek new suppliers, elevating production costs and prices.

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing the ammonium sulphate prices.

Global Ammonium Sulphate Price Trend

The report offers a holistic view of the global ammonium sulphate pricing trends in the form of ammonium sulphate price charts, reflecting the worldwide interplay of supply-demand balances, international trade policies, and overarching economic factors that shape the market on a macro level. This comprehensive analysis not only highlights current price levels but also provides insights into historical price of ammonium sulphate, enabling stakeholders to understand past fluctuations and their underlying causes. The report also delves into price forecast models, projecting future price movements based on a variety of indicators such as expected changes in supply chain dynamics, anticipated policy shifts, and emerging market trends. By examining these factors, the report equips industry participants with the necessary tools to make informed strategic decisions, manage risks, and capitalize on market opportunities. Furthermore, it includes a detailed ammonium sulphate demand analysis, breaking down regional variations and identifying key drivers specific to each geographic market, thus offering a nuanced understanding of the global pricing landscape.

Europe Ammonium Sulphate Price Trend

Q2 2025:

As per the ammonium sulphate price index, prices in Europe were influenced by fluctuating natural gas feedstock costs, which affected ammonia production economics. Reduced caprolactam plant operating rates constrained ammonium sulphate availability. Agricultural demand varied across Western and Eastern Europe due to differing rainfall patterns. Additionally, changes in import volumes from Asia, affected by logistical delays and freight rate adjustments, contributed to regional supply imbalances.

Q4 2024:

In Europe, the fourth quarter of 2024 saw a decrease in ammonium sulphate prices because of weak demand from the agricultural sector and an oversupply of the product. This was exacerbated by logistical challenges and disruptions in supply chains, especially in the wake of production shutdowns in certain regions, including a significant gas platform in Norway. Despite rising costs for feedstocks like Ammonia, price declines persisted due to abundant inventories in the market. The UK, however, experienced a price surge in December, largely caused by delays in exports and supply chain hiccups. Buyer interest remained inconsistent, as unpredictable weather conditions and uncertainty surrounding planting seasons weighed on agricultural demand, making the market susceptible to further fluctuations.

Q3 2024:

In Europe, Q3 of 2024 saw a considerable increase in ammonium sulphate prices due to the rising expenses for essential raw materials like ammonia and sulphuric acid. The persistent lack of natural gas in the area, worsened by geopolitical conflicts, added more pressure on supply chains and production expenses. Although agricultural demand was somewhat subdued at this time, anticipations of upcoming market trends contributed to maintaining cost increases. Variable demand from the fertilizer industry, along with limited supply, propelled the upward trend. Germany, especially, experienced a substantial increase in expense as seasonal fertilizer demand helped create a favorable pricing climate. As the quarter ended, prices showed an increase, indicating a robust market.

Q2 2024:

In the second quarter of 2024, the ammonium sulphate prices in Europe witnessed a drop, primarily due to weakened demand alongside unfavorable weather conditions, which hindered agricultural operations. Extreme weather events, such as windstorms and torrential rain, resulted in flooded fields and postponed sowing timelines, which decreased the demand for fertilizers such as ammonium sulphate. Despite inconsistent charges of raw materials such as sulfuric acid and ammonia, the overall impact on prices was muted on account of low demand. Germany, notably, saw the steepest decline, with bad weather and altered agricultural timetables contributing to a substantial yearly decrease, reflecting the overall regional market downturn.

Q1 2024:

During Q1 2024, the market in Europe faced significant challenges, with Germany experiencing a notable price decline due to decreased need from the fertilizer market coupled with a supply surplus. Adverse climate patterns throughout Europe, varying from cold snaps, heavy rain, and periods of drought, impacted farming, further weakening market demand. Despite a Brief closure of the Novomoskovskiy Azot plant, prices remained unaffected. Traders employed numerous strategies to manage inventory, but prices persistently fell across the quarter.

This analysis can be extended to include detailed ammonium sulphate price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Ammonium Sulphate Price Trend

Q2 2025:

As per the ammonium sulphate price index, in North America, the market was shaped by steady demand from the agricultural sector, particularly during peak crop fertilization months. Domestic production levels were impacted by planned maintenance at key ammonia facilities. The influence of urea ammonium nitrate and other nitrogen-based fertilizer price movements also played a role. Port congestion and inland transportation disruptions further constrained supply chains.

Q4 2024:

In Q4 2024, the prices of ammonium sulphate in North America saw significant variations. At the beginning of the quarter, prices dropped significantly because consistent manufacturing rates in the United States caused an excess of chemicals. Demand from the agriculture industry stayed weak as numerous growers slowed their investments, expecting additional price declines even with the harvest season underway. By December, prices experienced a slight increase because of elevated ammonia expenses and a recovery in domestic demand. Nonetheless, the market stayed erratic, with ongoing issues related to supply chain interruptions and workforce uncertainty influencing pricing patterns.

Q3 2024:

In Q3 of 2024, the North American ammonium sulphate prices trended downward, driven by various factors. Demand from the fertilizer sector softened, largely due to unfavorable weather conditions across the region. With the peak planting season completed, the rapid need for fertilizers dropped. Although there were expectations of increased purchases in anticipation of upcoming planting seasons for crops like wheat and rice, adverse weather, including hurricanes and storms, disrupted these plans. As a result, crop progress was significantly hindered, particularly in certain states, adding to the market’s uncertainty. Overall, by the end of the quarter, prices continued to reflect the subdued demand and the unpredictable weather.

Q2 2024:

In the second quarter of 2024, the product prices in North America rose at the start of the quarter's two months, mainly due to robust demand from the farming sector in response to beneficial cultivation environment and increased fertilizer usage. Higher costs of key ingredients, including sulfuric acid and ammonia, drove production expenses up, further elevating prices. Supply constraints were exacerbated by logistical disruptions and decreased export operations as a result of shallow water in key shipping lanes. Nevertheless, during the last month, prices experienced a slight decline due to planting delays brought on by geomagnetic storms and atypical weather patterns. Along with sufficient supply and restrained buying patterns, this helped to ease the market constraints.

Q1 2024:

During Q1 2024, the market in North America saw positive trends, primarily due to increased demand from both local and Latin American fertilizer industries. Improved climatic conditions spurred domestic agricultural activities, while a rebound in Latin American crop planting further boosted demand. However, severe winter weather, including bitter cold and heavy snowstorms, resulted in significant production disruptions, such as plant shutdowns in Tennessee and Texas. Moreover, a malfunction in an ammonia pipeline exacerbated the scarcity of this crucial raw material, pushing up production costs and causing a notable increase in product prices from last year.

Specific ammonium sulphate historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Ammonium Sulphate Price Trend

Q2 2025:

As per the ammonium sulphate price chart, the prices in the Middle East and Africa fluctuated due to a complex interplay of factors, primarily driven by supply chain disruptions, seasonal demand shifts, and geopolitical influences. A tight supply from refineries, exacerbated by maintenance rounds and unplanned outages, put pressure on prices. Simultaneously, demand from the agrochemical sector during the planting season contributed to price changes.

The report explores the ammonium sulphate pricing trends in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

In addition to region-wise data, information on ammonium sulphate prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Ammonium Sulphate Price Trend

Q2 2025:

In the Asia Pacific region, ammonium sulphate pricing in Q2 2025 was primarily affected by production trends in China, where operational rates at caprolactam units fluctuated due to environmental controls and raw material availability. Export activity was influenced by overseas demand and evolving trade policies. Monsoon-related procurement patterns in South Asia and stockpiling by agricultural distributors in Southeast Asia added to demand-side pressures.

Q4 2024:

In the last quarter of 2024, ammonium sulphate prices in the Asia-Pacific region rose, particularly in South Korea and China, due to robust global demand, notably from India. China faced significant logistical hurdles, such as congestion of ports and adverse weather conditions like typhoons, which disturbed supply chains and resulted in manufacturing slowdowns. South Korea also saw supply issues as heavy rainfall caused disruptions. Additionally, several production sites in the region declared force majeure, reducing the outcome and exacerbating the supply shortage. The mixture of these challenges, coupled with steady global demand and an intermediate local appetite, resulted in a severe supply-demand unevenness, keeping expenses elevated throughout the area.

Q3 2024:

Ammonium sulphate prices in the Asia-Pacific displayed mixed trends in the third quarter of 2024. Early in the quarter, prices rose due to a domestic shortage in key markets like China, caused by extreme weather events that disturbed manufacturing. Typhoons and windstorms, particularly in September, significantly hampered manufacturing and logistics. These weather conditions created supply shortages, which in turn pushed prices higher. Despite this, demand remained weak, both domestically and internationally, leading to a dip in prices during the second month of the quarter. By the end of the quarter, the market still faced challenges, with inventories tight and little relief in sight, though prices remained higher compared to earlier in the year.

Q2 2024:

In Q2 2024, the Asia-Pacific market faced a significant rates downturn initially. This is supported byreduced freight rates and a surplus supply exceeding demand due to export limitations by key suppliers. Lower need from the agricultural sector, following peak seasonal consumption, further pressured prices downwards. Weather disruptions, including intense rainfall and snowstorms, restricted farming operations, decreasing the demand for fertilizers. However, in the latter part of the quarter, prices rose as stable demand amid excess supply and limited international inquiries created a surplus, adding decreasing pressure on market prices, particularly in China, where bearish market sentiment prevailed.

Q1 2024:

During Q1 2024, the Asia-Pacific market, particularly in South Korea, experienced a sharp rise in prices. This rise was driven by strong, ongoing requirement from the fertilizer industry amid economic instability and was further intensified by supply chain interruptions. Key factors included a lack of exports from China, forcing buyers to seek alternative suppliers. These issues resulted in increased production prices and prompted changes in sourcing approaches, contributing to the overall price hike in the region by the end of the quarter.

This ammonium sulphate price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Ammonium Sulphate Price Trend

Q2 2025:

Latin America's ammonium sulphate market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in ammonium sulphate prices. Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting the region's ability to meet international demand consistently. Moreover, the ammonium sulphate price index, economic fluctuations, and currency devaluation are critical factors that need to be considered when analyzing ammonium sulphate pricing trends in this region.

The analysis of ammonium sulphate prices in Latin America provides a detailed overview, reflecting the unique market dynamics in the region influenced by economic policies, industrial growth, and trade frameworks.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Ammonium Sulphate Price Trend, Market Analysis, and News

IMARC's latest publication, “Ammonium Sulphate Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025Edition,” presents a detailed examination of the ammonium sulphate market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of ammonium sulphate at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed ammonium sulphate prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting ammonium sulphate pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Ammonium Sulphate Industry Analysis

The global ammonium sulphate market size reached 23.7 Million Tons in 2024. By 2033, IMARC Group expects the market to reach 33.7 Million Tons, at a projected CAGR of 3.80% during 2025-2033.

- The widespread product application of ammonium sulphate as a nitrogen fertilizer in agriculture is one of the main factors propelling the market's expansion. It provides essential nutrients, promoting plant growth and enhancing soil fertility. The rising global population has increased food demand, necessitating higher agricultural productivity. With the agrochemical business forecast to develop at a projected 3.3% annual rate between 2024 and 2032, important chemicals like ammonium sulphate are expected to be in high demand. The worldwide agriculture sector's rapid growth has increased the demand for agrochemicals containing this chemical. For instance, this sector is expected to generate 220.7 billion euros in gross value added in Europe by 2022.

- This chemical is also widely used in a variety of industrial applications. It is used in the chemical industry for water treatment, where it aids in the coagulation process that removes pollutants. This chemical is also used in the leather and textile industries for tanning and dyeing procedures. The increasing textile industry is driving up the need for ammonium sulphate, which is an essential ingredient in manufacturing processes. This industry is predicted to increase at a rate of 3.8% between 2024 and 2032, reaching USD 1445.4 billion.

- Ammonium sulphate also has various environmental benefits, which is driving up its demand. It helps to reduce soil pH levels, making it ideal for alkaline soils. Furthermore, the compound's low volatility increases crop nitrogen utilization efficiency by reducing nitrogen loss to the atmosphere. When compared to alternative nitrogen sources, this feature makes it a more environmentally friendly fertilizer choice. The demand for this chemical is increasing because of the growing popularity of sustainable agriculture methods, as it improves soil health and reduces environmental impact.

- Government initiatives and subsidies are supporting the use of fertilizers in agriculture, which is significantly driving the market expansion. Various governments provide financial incentives and support programs to farmers to encourage the use of effective fertilizers. These subsidies lower the cost burden on farmers, promoting higher adoption rates. Policies aimed at enhancing agricultural productivity and ensuring food security further reinforce the market expansion, as they make ammonium sulphate more accessible and affordable for the farming community.

Ammonium Sulphate News

The report covers the latest developments, updates, and trends impacting the global ammonium sulphate industry, providing stakeholders with timely and relevant information. This segment covers a wide array of news items, including the inauguration of new production facilities, advancements in ammonium sulphate production technologies, strategic market expansions by key industry players, and significant mergers and acquisitions that impact the ammonium sulphate price trend.

Latest developments in the ammonium sulphate industry:

- November 2024: Pupuk Indonesia introduced the global first hybrid green ammonia project, the Green Ammonia Initiative from Aceh (GAIA), at COP29 held in Baku, Azerbaijan. This initiative integrates water electrolysis to generate both traditional ammonia and green ammonia, utilized in fertilizers like ammonium sulphate.

- October 2024: Daphne Technology launched Daphne Solutions SA to focus on sustainable technologies for sulfur removal and carbon management. The spin-off will handle projects like SulPure® technology, which converts harmful H2S waste into ammonium sulphate fertilizer.

- September 2024: AdvanSix obtained a US$12 million grant from the USDA to increase its ammonium sulphate output by 200,000 tons per year. The funding will aid the company's SUSTAIN program, boosting fertilizer production and preserving environmental sustainability.

- August 2024: Kazakhstan announced eight chemical industry projects worth $27 million, including a plant for ammonium sulphate production in the Mangystau Region. These projects aim to create nearly 350 jobs, with up to 70% of the output meeting domestic demand. In addition, 22 ongoing projects, valued at $1.6 billion, are expected to generate 4,700 jobs and enhance exports.

- March 2023: Enva, a leading expert in recycling and resource recovery, started building a new plant that will be used to produce agricultural fertilizer pellets that contain ammonium sulphate (AMS), which it has recovered from industrial liquid wastes. The groundbreaking €5 million investment at Enva's EPA licensed facility in Greenogue, Dublin, will employ a cutting-edge procedure that Enva has created internally and will be the first of its type globally.

Product Description

Ammonium sulphate (NH₄)₂SO₄ a white, crystalline inorganic salt with high solubility in water, making it an efficient source of nitrogen and sulfur for agricultural applications. Its physical and chemical properties include molecular mass (132.14 g/mol), density (1.77 g/cm³), melting point (decomposes at 235-280°C), and pH of 1% solution (approx. 5.5).

It is produced by a reaction between sulfuric acid and ammonia. This process involves several steps, such as reaction, crystallization, separation, and drying. It is used extensively in agriculture, water treatment, food additives, pharmaceutical formulations, dyeing, and tanning processes.

This compound provides a reliable supply of nitrogen and sulfur, helps lower soil pH, and ensures quick and effective nutrient uptake by plants. Additionally, it is known for its cost-effectiveness, efficiency, versatility, and positive environmental impact.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Ammonium Sulphate |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Ammonium Sulphate Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, Greece* North America: United States, Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of ammonium sulphate pricing, covering global and regional trends, spot prices at key ports, and a breakdown of Ex Works, FOB, and CIF prices.

- The study examines factors affecting ammonium sulphate price trend, including raw material costs, supply-demand shifts, geopolitical impacts, and industry developments, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The ammonium sulphate price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)