Ammunition Market Size, Share, Trends, and Forecast by Product, Caliber, Guidance, Lethality, Application, and Region, 2026-2034

Ammunition Market Size and Share:

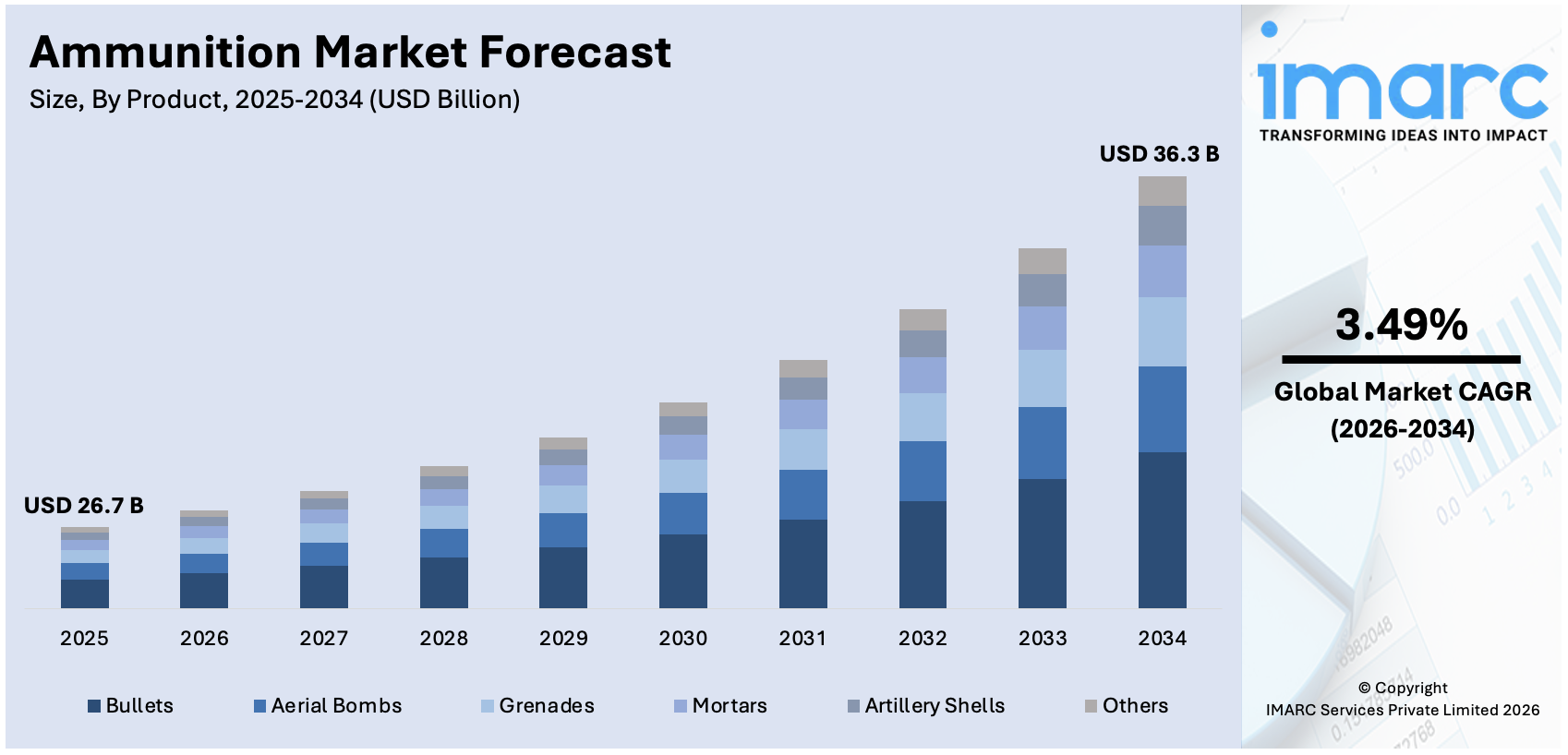

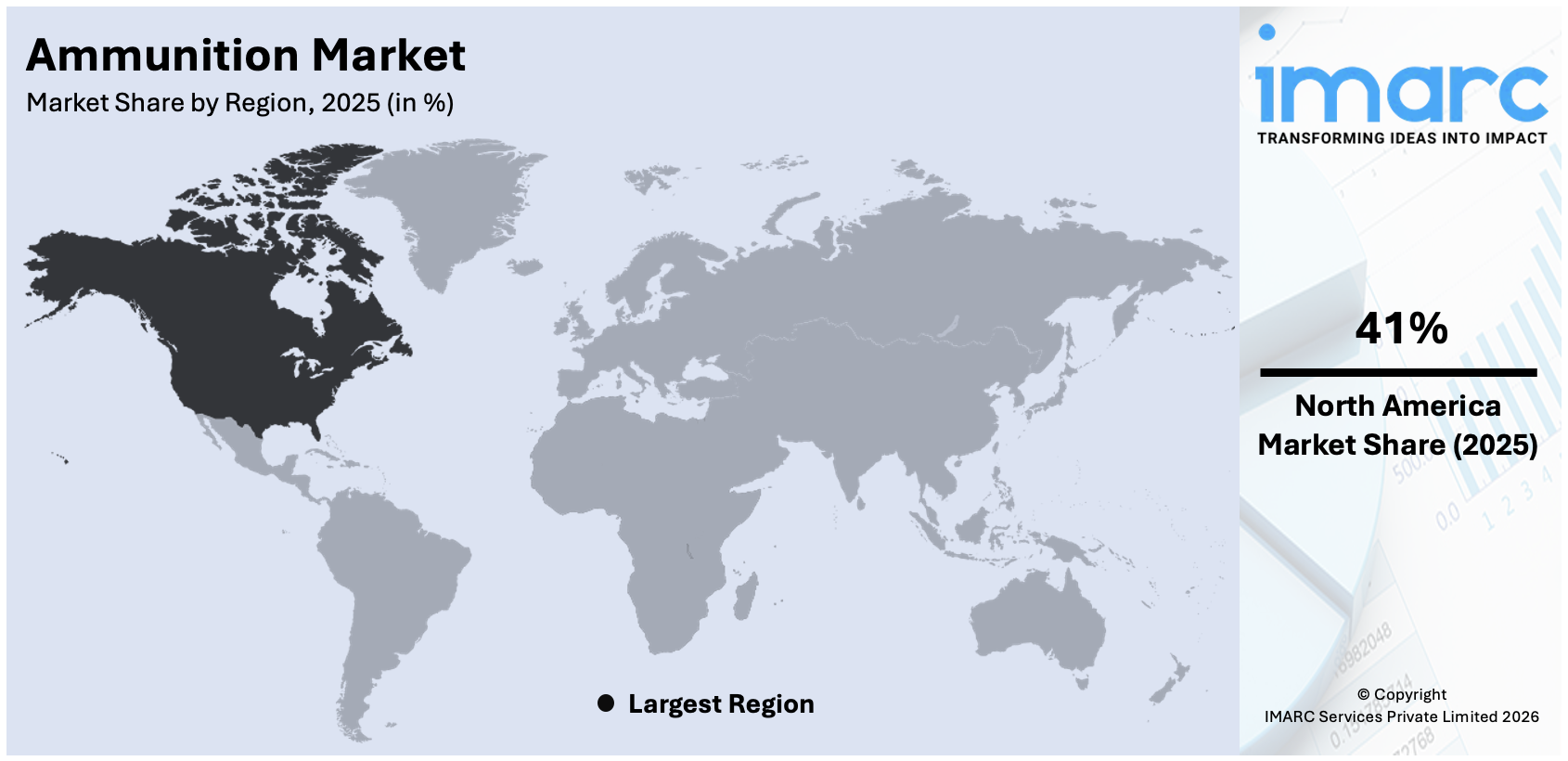

The global ammunition market size was valued at USD 26.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 36.3 Billion by 2034, exhibiting a CAGR of 3.49% from 2026-2034. The growing investments by government bodies in self-defense are fueling the market growth. At present, North America holds the largest market share, accounting for over 41% market share in 2025, owing to a significant surge in military investments and a robust presence of ammunition manufacturers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 26.7 Billion |

|

Market Forecast in 2034

|

USD 36.3 Billion |

| Market Growth Rate 2026-2034 | 3.49% |

The ammunition market growth is driven by government policies and partnerships to boost research and innovation in ammunition technology. In addition, geopolitical tensions continue to encourage countries to prioritize self-sufficiency, while cross-border collaborations bring in advanced expertise and expand production capabilities. Consequently, these developments signal a clear shift towards independent, resilient defense supply chains and enhanced regional cooperation, positioning the ammunition market for strong growth in the coming years as the global demand for defense products remains high. Further, countries are actively supporting projects that strengthen ammunition supply chains and advance technological developments within their defense sectors. The market is witnessing a significant surge in product demand as nations ramp up local production capabilities to boost defense readiness.

To get more information on this market Request Sample

The United States is witnessing lucrative growth in market demand, driven by increasing defense initiatives and substantial investments in local production. Meanwhile, key players in the region are actively expanding manufacturing and forming partnerships to meet both domestic and international needs. For instance, in September 2024, Saab announced a new munitions facility in Grayling, Michigan, focusing on the assembly of shoulder-fired munitions and precision fire systems. This facility is aimed to significantly enhance U.S. ammunition production capacity and support national defense objectives. Such developments underscore the country’s strategic focus on bolstering ammunition output while catering to global security demands

Ammunition Market Trends:

Technological Advancements

A key factor driving the growth of the ammunition market is the escalating global security concerns, particularly in the context of terrorism and ongoing conflicts. As nations grapple with rising threats from insurgencies, cross-border tensions, and domestic unrest, governments are prioritizing military preparedness. This has led to a surge in defense budgets, fueling the demand for advanced ammunition and specialized weapons. The need for precise, reliable, and high-performance munitions, such as precision-guided munitions (PGMs), is becoming more pronounced, as they minimize collateral damage and improve operational efficiency. PGMs include missiles and guided bombs that are equipped with advanced targeting systems. In July 2024, the Israel Ministry of Defense signed an order worth over USD 220 Million for precision-guided mortar munitions from Elbit Systems. These munitions are designed to accurately destroy targets, utilizing both immune GPS and laser guidance technology. Such developments highlight the proliferating reliance on PGMs for effective and accurate military operations.

Escalating Demand for Precision-Guided Munitions (PGMs)

Smart ammunition, equipped with cutting-edge technologies including GPS, sensors, and data links is revolutionizing battlefield solutions. These munitions can communicate with launch platforms and other systems, allowing them to modify their trajectory mid-flight, thereby ensuring greater adaptability and accuracy in dynamic combat situations. Integration of automation and digitalization in ammunition management is further projected to create new growth opportunities for the market participants. For instance, in August 2024, police in Odisha, India, launched an e-module for inventory management of ammunition and munitions. The e-module enables the senior officers to monitor the stock levels of arms across all the police districts in the state. Moreover, the Indian Institute of Technology Madras has collaborated with Munitions India, a defense public sector enterprise, to develop 155 mm smart ammunition. The aim is to ensure the ammunition has 50% better accuracy than existing shells and improved range. These advancements reflect key ammunition market trends, indicating a shift towards more sophisticated, efficient, and digitalized ammunition solutions.

Increasing R&D Investments

Significant investments made by key manufacturers in R&D initiatives are opportunistic for market growth. As countries flex their military power to defend their sovereignty, neighboring nations continue to proactively take measures by investing in defense infrastructure and improving their capabilities to defend their borders. A large portion of these defense investments have been allocated for the procurement of ammunition and weapon systems. As of March 2024, the European Union Commission allocated USD 537.2 Million to ramp up ammunition production, aiming to strengthen their defense industry. This narrative is true across the globe, and it has led to an increased impetus towards the ammunition industry. These investments are driven by the increasing need to attain a competitive edge in technological advancements, meet fluctuating demands, and ensure product preciseness. For instance, in February 2024, Adani unveiled South Asia's largest ammunition and missile complex in Kanpur, India to cater to domestic demand, augment defense capabilities, and boost economic growth and employment. The inflating need for lighter weight, improved performance, and better lethality in military and law enforcement applications is contributing to the market demand. Besides this, extensive investments in R&D activities by key players will continue to stimulate market growth in the upcoming years.

Ammunition Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the ammunition market forecast at the global, regional, and country levels for 2026-2034. The report has categorized the market based on product, caliber, guidance, lethality, application, and region.

Analysis by Product:

- Bullets

- Aerial Bombs

- Grenades

- Mortars

- Artillery Shells

- Others

Bullets segment leads the market with 29.5% market share in 2025. The market growth is attributed to the rising use of bullets across numerous sectors, including law enforcement, military, and civilian shooting sports. The demand for bullets is driven by their essential role in a wide range of firearms, from rifles to shotguns, making them a critical component of the global ammunition supply. Companies like Federal Premium and Winchester Ammunition are key players in this segmentation.

Analysis by Caliber:

- Small

- Medium

- Large

Small caliber leads the market with around 28.5% market share in 2025. Small caliber ammunition represents the largest segment in the market due to its extensive use across multiple sectors, including law enforcement, military, and civilian applications like sport shooting, hunting, personal defense, etc. Some of the product launches include Winchester’s .308 Winchester and Remington’s .223 Remington.

Analysis by Guidance:

- Guided

- Non-Guided

Non-guided leads the market with a 68% market share in 2025. Non-guided ammunition includes traditional shells, bullets, and bombs. Companies like General Dynamics and Northrop Grumman have recently launched new non-guided ammunition products to meet evolving military needs.

Analysis by Lethality:

- Less-Lethal

- Lethal

Lethal leads the market with 72.1% market share in 2025. Lethal ammunition remains a core focus in the defense sector, driven by the need for effective and reliable munitions in both military and law enforcement applications. For example, BAE Systems launched its new family of 7.62mm and 5.56mm rounds, optimized for enhanced lethality and reduced environmental impact.

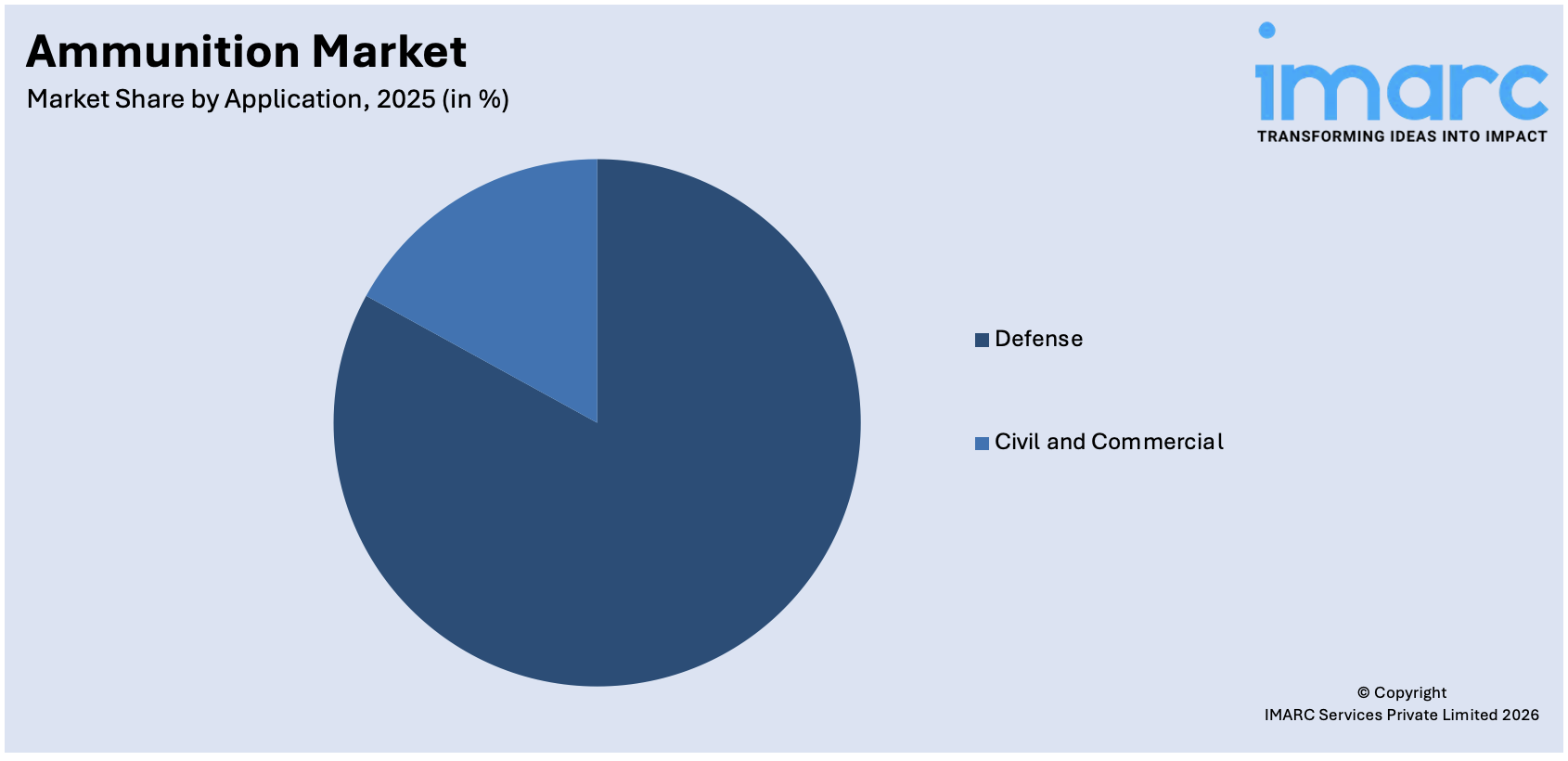

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Defense

- Military

- Homeland Security

- Civil and Commercial

- Sporting

- Hunting

- Self-Defense

- Others

Defense leads the market with 88.2% market share in 2025. Ammunition for defense continues to be a critical area of innovation, as nations seek to equip their armed forces with reliable munitions capable of addressing modern security threats. This is positively influencing the ammunition market outlook.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest ammunition market share of 40.8%. North America exhibits a clear dominance in the market, driven by high ammunition market demand from the military sector. The region is home to several leading ammunition manufacturers who continue to innovate and launch new products to meet the diverse needs of the market. In July 2024, the regulatory authority in the U.S. introduced vending machines for bullets to make ammunition more available.

Key Regional Takeaways:

United States Ammunition Market Analysis

The U.S. ammunition market is thriving due to its strong defense budget and high civilian firearm ownership. According to the USA Facts organization, in 2023, the U.S. military budget was around USD 820.3 Billion, with significant allocations for ammunition to support modernization and global military operations. Civilian demand is stable due to a consistent market in firearms, with about 16.7 million sold during 2023. Significant gun ownership and active hunters and shooters ensure ammunition demand. New technologies, like "green" ammunition and precision-guided munitions, are also fueling growth in the market. Vista Outdoor and Olin Corporation are the leaders, serving military and civilian customers. The domestic production push helps reduce imports and thereby ensures consistent market growth. Federal policies and increasing awareness about the safety of ammunition also stimulate innovation. The U.S.-based manufacturers are now venturing abroad to take advantage of export opportunities and thereby place the country at the top of the ammunition industry globally.

Europe Ammunition Market Analysis

The ammunition market in Europe is growing because of an increase in defense budgets, military readiness, and civilian interest in hunting and shooting sports. Military procurement in Germany, France, and Poland is leading because of NATO commitments and a heightened sense of security due to the Ukraine conflict. Modernization, including ammunition stockpiles, is in focus as Germany has allocated a USD 107.2 Billion defense fund, which was announced in 2022. According to the German Society for the prevention of cruelty to animals, on the non-military front, over 430,000 licensed hunters in Germany contribute to the demand for superior-quality ammunition. High-technology items that are currently very popular include smart munition and non-lethal bullets. Rheinmetall and Nexter are prime movers of these new developments to NATO forces, and strict EU regulations put in place all measures relating to the production of ammunition under safety and sustainable criteria to promote the development of green products. Apart from the previous advantages, government-backed R&D activities in countries like the UK ensure precision and efficiency to contribute toward Europe's significant part of ammunition production and technological enhancement throughout the world.

Asia Pacific Ammunition Market Analysis

The Asia Pacific ammunition market is growing rapidly, driven by rising defense budgets and geopolitical tensions. According to the military budget of China, its defense spending reached USD 230 Billion in 2022, focusing on advanced ammunition and military modernization. Also, according to the industrial news article, India allocated USD 72.6 Billion in its 2023-2024 defense budget, with a strong emphasis on indigenous production under the "Make in India" initiative. Civilian demand is also increasing, with shooting sports popular in countries like Australia and Japan. The region is seeing major investments in R&D for advanced ammunition, including smart and precision-guided munitions. The partnerships between local and global players are encouraging innovation, with the example of Bharat Dynamics collaborating with international firms to gain advanced technology transfer. Non-lethal ammunition adoption is also on the rise among law enforcement agencies, which shows market dynamics are changing. Government-backed infrastructure development and rising disposable incomes further contribute to market growth, positioning the Asia Pacific as a key player in the global ammunition industry.

Latin America Ammunition Market Analysis

Latin America's ammunition market is experiencing growth with increasing defense budgets, rising civilian firearm ownership, and growing security concerns. According to an industrial report, Brazil is the region's largest economy, and its defense budget for 2022 totaled USD 21.8 billion, with an emphasis on modernizing its military arsenal and ammunition. Civilian demand is substantial, fueled by liberalized gun ownership regulations: over 1.6 million firearm licenses have been issued in Brazil. Countries such as Mexico and Colombia are investing in advanced ammunition to combat organized crime and ensure national security. Furthermore, the region's rising middle class and smartphone penetration facilitate the development of digital platforms for ammunition sales. Brazil's Companhia Brasileira de Cartuchos (CBC) leads the industry, exporting ammunition to more than 100 countries. Medical tourism in countries like Costa Rica indirectly boosts demand for non-lethal ammunition for security personnel. Latin America's market growth is backed by government-led programs and partnerships with international producers to improve local manufacturing capacity.

Middle East and Africa Ammunition Market Analysis

In the Middle East and Africa, the demand for ammunition varies with defense spending and security issues. According to the International Trade Administration, the defense budget of Saudi Arabia was projected at USD 75.01 Billion in 2022, which has been channeled toward military modernization, which includes ammunition purchases. Africa has some countries with developed defense industries, such as South Africa, where firms like Denel manufacture ammunition for local consumption and exports

Competitive Landscape:

The key players in the market are driving growth through strategic initiatives that prioritize innovation, research and development, and strategic collaborations. These industry leaders continually invest in the development of cutting-edge technologies, enhancing the lethality, accuracy, and versatility of ammunition. By forging partnerships with defense agencies and law enforcement bodies, these key players ensure the alignment of their products with the rising needs of security forces globally. Moreover, a strong emphasis on sustainability and ethical manufacturing practices contributes to the market's expansion, resonating with the increasing global awareness of environmental and social responsibilities.

The market research report provides a comprehensive analysis of the competitive landscape. Detailed profiles of all major market ammunition companies have also been provided. Some of the key players in the market include:

- Ammo Inc.

- Arsenal 2000 AD

- BAE Systems PLC

- CBC Ammo LLC

- Denel SOC Ltd

- Hanwha Corporation

- Herstal Group

- Hornady Manufacturing Company

- Nammo AS

- Nexter Group KNDS

- Northrop Grumman Corporation

- Nosler Inc.

- Remington Outdoor Company Inc

- Rheinmetall AG

- Sierra Bullets (Clarus Corporation)

Latest News and Developments:

- October 2024: Ultra Intelligence & Communications (Ultra I&C) and Hanwha signed an MOU to improve global defense capabilities. The partnership will integrate Ultra I&C's ADSI C2 gateway with Hanwha's K239 Chunmoo rocket launcher, supporting Five Eyes interoperability and CJADC2 initiatives through innovative command and control architectures.

- August 2024: BAE Systems announced that they won a USD 493 Million contract to produce M109A7 Self-Propelled Howitzers and M992A3 Ammunition Carriers. The production will continue up until July 2026 as the US Army continues to execute its artillery modernization plan.

- August 2024: Police in Odisha, India, launched an e-module for inventory management of its ammunition and munitions. The e-module will help the senior officers monitor the stock of arms of all the police districts in the state.

- July 2024: The Israel Ministry of Defense signed an order worth over USD 220 Million for precision-guided mortar munitions from Elbit Systems. They are designed to accurately destroy objectives, utilizing both immune GPS and laser guidance technology.

- April 2024: AMMO, Inc. acquired a tooling manufacturer to in-source over 90% of tooling manufacturing at its Manitowoc, Wisconsin factory and is expected to save more than USD 1 Million per year.

Ammunition Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bullets, Aerial Bombs, Grenades, Mortars, Artillery Shells, Others |

| Calibers Covered | Small, Medium, Large |

| Guidances Covered | Guided, Non-Guided |

| Lethalities Covered | Less-Lethal, Lethal |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ammo Inc., Arsenal 2000 AD, BAE Systems PLC, CBC Ammo LLC, Denel SOC Ltd, Hanwha Corporation, Herstal Group, Hornady Manufacturing Company, Nammo AS, Nexter group KNDS, Northrop Grumman Corporation, Nosler Inc., Remington Outdoor Company Inc, Rheinmetall AG, Sierra Bullets (Clarus Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, ammunition market forecast, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global ammunition market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the ammunition industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ammunition market was valued at USD 26.7 Billion in 2025.

IMARC estimates the ammunition market to exhibit a CAGR of 3.49% during 2026-2034, reaching a value of USD 36.3 Billion by 2034.

The ammunition market is driven by rising defense budgets, growing geopolitical tensions, technological advancements, and increased civilian demand for hunting and sport shooting. Additionally, security concerns, the proliferation of firearms, and military modernization programs further boost demand. These factors collectively contribute to market expansion, shaping a diverse and evolving global ammunition industry.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the ammunition market include Ammo Inc., Arsenal 2000 AD, BAE Systems PLC, CBC Ammo LLC, Denel SOC Ltd, Hanwha Corporation, Herstal Group, Hornady Manufacturing Company, Nammo AS, Nexter group KNDS, Northrop Grumman Corporation, Nosler Inc., Remington Outdoor Company Inc, Rheinmetall AG, Sierra Bullets (Clarus Corporation), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)