Application Security Market Size, Share, Trends and Forecast by Component, Type, Testing Type, Deployment Mode, Organization Size, Industry Vertical, and Region, 2025-2033

Application Security Market Size and Share:

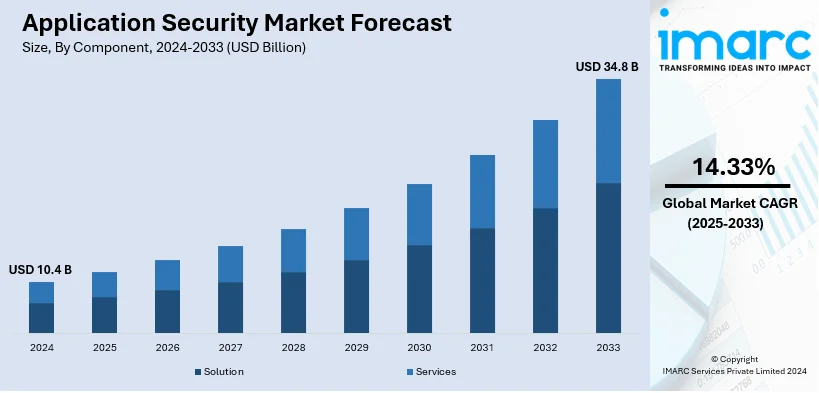

The global application security market size was valued at USD 10.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 34.8 Billion by 2033, exhibiting a CAGR of 14.33% during 2025-2033. North America currently dominates the market, holding a significant market share of 40.5% in 2024. Because of its sophisticated technological infrastructure, broad adoption of digital transformation, and plenty of top cybersecurity companies, North America leads the market. Market expansion is also fueled by a high amount of cyberthreats, strict regulatory compliance requirements, and large industry investments in security solutions. Furthermore, the region’s strong emphasis on innovation encourages ongoing advancements in application security technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10.4 Billion |

|

Market Forecast in 2033

|

USD 34.8 Billion |

| Market Growth Rate 2025-2033 | 14.33% |

The market is experiencing growth as more businesses are embracing digital change and cybercriminals are targeting corporate applications like never before. This involves the use of cloud applications as well as the displacement of security practices across the software development lifecycle using DevSecOps. There are legal requirements like the CCPA and GDPR that mandate privacy and data security, which is driving the demand even more. In addition, the integration of machine learning (ML) and artificial intelligence (AI) in application security solutions enhances threat detection and response. Occupational trends like remote work as well as the use of mobile and web applications are increasing the attack surface, and so vigorous security strategies are needed.

To get more information on this market, Request Sample

The United States stands out as a key market disruptor, driven by the nation's highly developed technical environment and the rising number of cyberattacks that target applications in industries like retail, healthcare, and finance. Adoption is accelerated by strict regulatory frameworks like HIPAA, PCI DSS, and CCPA that require strong security measures. The need for sophisticated application security solutions is being driven by the quick transition to cloud-based apps and remote work settings, which increases risks. Innovations in threat detection and prevention technology is encouraged by the existence of top cybersecurity firms and significant R&D expenditures. Furthermore, the incorporation of AI and ML in security technologies and the spread of DevSecOps practices is fueling the market expansion. The growing enterprise awareness about application security is positively influencing the market. The IMARC Group’s report shows that the United States application security market is expected to reach US$ 8.68 Billion by 2032.

Application Security Market Trends:

Increasing Cyber Threats

In most cases, the need for application security services arises from the growing cyber risks as the companies continue to sustain a number of complex and sophisticated attacks that target apps. These dangers, which include distributed denial-of-service (DDoS) attacks, SQL injections, and cross-site scripting, take advantage of software flaws to steal confidential information, interfere with business operations, or result in monetary loss. Due to more people relying on internet, mobile, and cloud-based apps, there is an increase in the attack surface for hackers. Companies also seem to understand the requirement of strong application security measures due to famous breaches and ransomware incident. Companies in the e-commerce, healthcare and banking sectors, which process sensitive consumer data are extremely at risk and therefore they are investing heavily in appropriate security measures.

Digital transformation

Because more sectors are depending on digital apps and technology, the market for application security is being driven by digital transformation. The attack surface is growing as businesses use cloud computing, IoT, AI, and big data analytics, making applications more vulnerable to cyberattacks. Strong security solutions are necessary to safeguard sensitive data and stop breaches as a result of the quick development and rollout of online and mobile applications to improve customer experiences and optimize operations. Furthermore, using microservices architecture and integrating third-party APIs is creating additional vulnerabilities that call for sophisticated application security solutions. Businesses are further compelled to give application security top priority in their digital initiatives because of regulatory compliance requirements like the CCPA and GDPR.

Remote work trends

Because of the growing dependence on cloud-based apps and collaboration tools, which are easy targets for cyberattacks, remote work trends are positively influencing the market. Employees can access company resources from a variety of devices and places, frequently via unprotected networks, as a result of the shift to remote and hybrid work patterns. Strong security measures are now more important than ever to safeguard private information and apps. Organizations must invest in application security solutions since remote work settings are more vulnerable to threats like phishing, credential theft, and illegal access. Furthermore, application security measures are integrated with the use of secure online gateways, virtual private networks (VPNs), and identity and access management (IAM) systems.

Application Security Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global application security market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on component, type, testing type, deployment mode, organization size, and industry vertical.

Analysis by Component:

- Solution

- Services

Solution stands as the largest component in 2024, holding 67.2% of the market. Because it plays a vital role in protecting applications from constantly changing cyberthreats, the solution sector leads the application security market. To proactively identify, stop, and mitigate vulnerabilities, organizations place a high priority on implementing complete security solutions, such as web application firewalls (WAF), runtime application self-protection (RASP), and static and dynamic application security testing (SAST and DAST) technologies. Strong solutions are more in demand as companies embrace digital transformation and become more dependent on cloud-based apps and secure software. These systems are more successful because they incorporate cutting-edge technology like artificial intelligence (AI) and machine learning (ML), which allow for automatic response and real-time threat identification. In order to meet data protection standards, innovative application security solutions are also adopted due to regulatory compliance requirements.

Analysis by Type:

- Web Application Security

- Mobile Application Security

Due to the extensive use of web applications across industries and their high susceptibility to cyber threats, web application security is the most popular type in the market. Because of their heavy reliance on online applications for data interchange, customer interaction, and operational efficiency, organizations are particularly vulnerable to attacks like distributed denial-of-service (DDoS), SQL injection, and cross-site scripting (XSS). The need for strong online application security measures is increased by the expanding use of digital platforms, cloud-based services, and e-commerce. Secure web application environments are also required for compliance with laws like GDPR, PCI DSS, and HIPAA. The adoption of advanced solutions like runtime application self-protection (RASP) and web application firewalls (WAFs) is fueled by their ability to identify and neutralize real-time threats.

Analysis by Testing Type:

- Static Application Security Testing (SAST)

- Dynamic Application Security Testing (DAST)

- Interactive Application Security Testing (IAST)

- Runtime Application Self-Protection (RASP)

Static application security testing (SAST) leads the market with 38.6% of market share in 2024. Because it can find vulnerabilities early in the development lifecycle, lowering costs and increasing productivity, static application security testing (SAST) is the most popular testing type in the market. SAST ensures strong code quality by assisting developers in identifying security vulnerabilities at the root level through source code, binaries, or bytecode analysis prior to application deployment. Its proactive strategy fits nicely with the increasing use of DevSecOps techniques, which include security into the development process. Because it offers thorough coverage across programming languages and frameworks, it is popular and appropriate for a wide range of applications. Organizations are also encouraged to implement comprehensive code analysis to prevent breaches by regulatory compliance standards like GDPR and PCI DSS.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

On-premises stand as the largest component in 2024, holding 62.5% of the market. Because it appeals to companies that value control, security, and compliance, on-premises deployment is the most popular deployment mode in the application security industry. On-premises solutions are preferred by businesses managing sensitive data, especially those in sectors like government, healthcare, and finance, because they offer direct control over data management and storage. By minimizing dependency on outside vendors, this deployment approach lowers the possibility of security flaws in cloud services. Organizations also employ on-premises solutions to protect data sovereignty and compliance with local laws due to strict regulatory requirements like GDPR and HIPAA. These solutions are highly regarded because they enable firms to customize security measures to meet their unique requirements. Moreover, on-premises deployment is frequently chosen by businesses with outdated systems or poor internet access to guarantee smooth integration.

Analysis by Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises lead the market with 60.0% of market share in 2024. Due to their enormous IT infrastructure, massive data volumes, and increased susceptibility to cyber threats, large organizations hold a dominant position in the market. These companies frequently work in a variety of sectors and regions, which makes them appealing targets for sophisticated cyberattacks like ransomware, data breaches, and advanced persistent threats (APTs). Large corporations make significant investments in complete application security solutions, such as web application firewalls (WAFs), runtime application self-protection (RASP), and static and dynamic application security testing (SAST and DAST), to protect important consumer and corporate data. Adopting strong security measures is additionally required for these firms by regulatory compliance, including GDPR, HIPAA, and PCI DSS. Their operational and financial size also makes it possible for them to spend heavily in cutting-edge technology like artificial intelligence (AI) and machine learning (ML) for real-time threat identification.

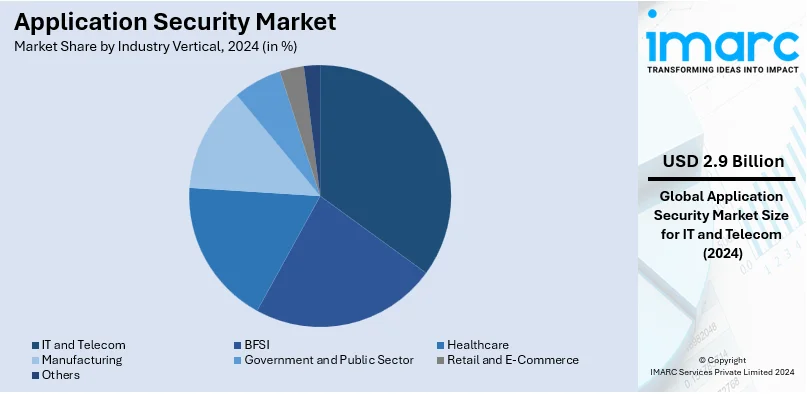

Analysis by Industry Vertical:

- BFSI

- Healthcare

- IT and Telecom

- Manufacturing

- Government and Public Sector

- Retail and E-Commerce

- Others

IT and telecom leads the market with 27.5% of market share in 2024. Because of its vital role in managing enormous volumes of sensitive data and enabling worldwide communication, the IT and telecom sector is the largest industry vertical in the application security market. Since these sectors deal with consumer information, financial transactions, and communication networks, they are frequently the targets of cyberattacks, such as ransomware, DDoS attacks, and data breaches. The requirement for strong application security solutions is increasing due to the quick adoption of cloud computing, 5G networks, and IoT technologies, which are further increasing their attack surface. IT and telecom firms are also required to give data protection top priority under regulatory frameworks, such as the CCPA and GDPR. Additionally, the need for web application firewalls and static and dynamic application security testing (SAST and DAST) is fueled by their reliance on sophisticated software and web applications for operations and consumer interaction.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounts for the largest market share of 40.5%. Because of its highly developed technological infrastructure, widespread adoption of digital transformation, and concentration of top cybersecurity companies, North America leads the market. There are a number of significant enterprises and various organizations in industries, including information technology, healthcare, and finance in this region, which call for robust application security measures because the threats keep evolving. The increase in the number of cyberattacks and stringent data protection regulations, such as CCPA and GDPR, is also creating a demand for such integrated security solutions. In North America, the application security products are also complemented by the competitive landscape of the security solutions providers and continuous innovations like artificial intelligence (AI) and machine learning (ML).

Key Regional Takeaways:

United States Application Security Market Analysis

In 2024, United States accounts for 79.40% of the total North America IT services market share. In the USA, due to the growing need for a digital presence in all areas and the rising threats, the application security market is expanding at a rapid pace. The demand for security service providers indicates an increased need for protection of digital assets. The rapid growth of cloud computing, mobile apps and IoT devices is resulting in increased attack surfaces for enterprises and thus, enhanced application security is required. In addition, organizations are required to strengthen their security measures on account of compliance issues, such as the California Consumer Privacy Act (CCPA) and the Health Insurance Portability and Accountability Act (HIPAA). Also, the growing complexity of cyber threats, including AI-led attacks, is motivating a lot of organizations to implement newer systems and devices. Moreover, industries, such as healthcare, finance, and retail, that contain sensitive information are more focused in application securing. Thus, the US application security market is increasing in the background of growing complexity of the cyber environment, for robust protection of data breaches as well as compliance with critical regulations.

Asia Pacific Application Security Market Analysis

In the Asia-Pacific region, the market is primarily driven by the rapid expansion of digitalization and the increasing frequency of cyber threats. This heightened threat environment is pushing businesses to invest in stronger application security measures. The region’s rapid growth in sectors like banking, telecommunications, and e-commerce, combined with the proliferation of mobile applications and IoT devices, makes enterprises more vulnerable to cyberattacks. Stricter data protection regulations in countries like India and China are further driving the demand for secure application solutions. Additionally, the rise of advanced persistent threats (APTs) and the growing awareness among the masses about data privacy risks are motivating businesses to adopt proactive security measures, ensuring they protect sensitive customer data and comply with regulatory standards.

Europe Application Security Market Analysis

The application security market in Europe is experiencing strong growth, driven by stringent data protection regulations like the General Data Protection Regulation (GDPR) and the increasing prevalence of cyberattacks. As European companies adapt to these regulatory demands, securing applications is becoming a critical focus. Additionally, the rapid adoption of artificial intelligence (AI) is contributing to the need for more advanced security measures. As AI integration accelerates, so does the complexity of securing applications, particularly in sectors like finance, healthcare, and retail, which handle large volumes of sensitive data. The rise of digital transformation initiatives, coupled with the increasing sophistication of cyber threats, is driving the demand for comprehensive application security solutions that protect against emerging risks and ensure compliance with evolving regulations.

Latin America Application Security Market Analysis

Latin America is increasingly focused on strengthening application security due to the rapid adoption of digital technologies and rising cyber threats. Over the past year, the region has seen a rise in cyberattacks, with industries like banking, healthcare, and telecommunications facing significant risks due to their handling of sensitive data. As digital adoption is accelerating, businesses are prioritizing enhanced application security to mitigate these risks. Stricter regional data protection regulations are also encouraging organizations to adopt advanced security solutions to ensure compliance and safeguard their operations.

Middle East and Africa Application Security Market Analysis

The Middle East and Africa region is witnessing a significant rise in demand for application security solutions, driven by increasing cyber threats. This growing threat landscape is encouraging businesses, particularly in sectors like banking, energy, and government, to strengthen their security frameworks. As digital transformation is accelerating, the need to protect applications against cyberattacks is becoming more critical. Additionally, with tightening regulations in countries like the UAE and Saudi Arabia, organizations are prioritizing secure application solutions to mitigate risks and ensure compliance with emerging data protection laws.

Competitive Landscape:

To handle evolving cyberthreats and satisfy the rising need for strong security solutions, major competitors in the market are constantly developing. To offer thorough protection throughout the application lifetime, they concentrate on creating cutting-edge solutions including web application firewalls (WAFs), runtime application self-protection (RASP), static application security testing (SAST), and dynamic application security testing (DAST). To improve real-time threat identification and response capabilities, many are utilizing machine learning (ML) and artificial intelligence (AI). Common tactics to guarantee smooth deployment and scalability include cooperation with cloud service providers and integration with DevSecOps procedures. To keep ahead of new risks and legal requirements, these businesses also make significant investments in research and development (R&D) activities.

The report provides a comprehensive analysis of the competitive landscape in the application security market with detailed profiles of all major companies, including:

- Black Duck Software, Inc.

- Capgemini

- Checkmarx Ltd

- Cisco Systems, Inc.

- Cloudflare, Inc.

- Contrast Security

- International Business Machines Corporation

- NTT DATA, Inc.

- Open Text Corporation

- Qualys, Inc.

- Rapid7

- Veracode

Latest News and Developments:

- November 2024: Noma launched a comprehensive application security platform focused on the Data and AI Lifecycle, following a USD 32 Million funding round led by Ballistic Ventures. The company, exiting stealth mode, aims to address the security risks arising from AI adoption in organizations. Noma's platform targets security gaps in the Data & AI Lifecycle, which differs from traditional software development, incorporating unique supply chains and open-source components not covered by conventional security tools.

- September 2024: F5 launched F5 NGINX One, a unified solution combining load balancing, web/app server, API gateway, and security features. It allows customers to manage F5 NGINX instances and NGINX Open Source from a single interface. The NGINX One Console simplifies policy compliance and provides end-to-end visibility, reducing deployment complexity and accelerating app delivery.

- September 2024: Wiz introduced Wiz Code, a cloud application security product designed to help security and development teams identify and resolve cloud risks in code before they escalate. Integrated with developer environments, Wiz Code traces issues back to their source in code and CI/CD pipelines, enabling faster threat detection and resolution by linking security issues to the responsible developer. This enhances collaboration between teams and improves security posture.

Application Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Types Covered | Web Application Security, Mobile Application Security |

| Testing Types Covered | Static Application Security Testing (SAST), Dynamic Application Security Testing (DAST), Interactive Application Security Testing (IAST), Runtime Application Self-Protection (RASP) |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

|

Industry Verticals Covered |

BFSI, Healthcare, IT and Telecom, Manufacturing, Government and Public Sector, Retail and E-Commerce, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Black Duck Software, Inc., Capgemini, Checkmarx Ltd, Cisco Systems, Inc., Cloudflare, Inc., Contrast Security, International Business Machines Corporation, NTT DATA, Inc., Open Text Corporation, Qualys, Inc., Rapid7, Veracode, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the application security market from 2019-2033.

- The application security market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the application security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Application security involves the use of tools, processes, and practices to protect applications from cyber threats throughout their lifecycle. It includes identifying, mitigating, and preventing vulnerabilities in software, such as code flaws and configuration issues, to safeguard sensitive data and ensure functionality. Key techniques include static and dynamic application security testing (SAST and DAST) and runtime application self-protection (RASP).

The Application Security market was valued at USD 10.4 Billion in 2024.

IMARC estimates the global application security market to exhibit a CAGR of 14.33% during 2025-2033.

The application security market is driven by increasing cyber threats, rising adoption of digital transformation, and stringent regulatory requirements like GDPR and HIPAA. The integration of AI and ML enhances threat detection, while the shift towards remote work expands attack surfaces. Additionally, the adoption of DevSecOps and the growing demand for cloud-based applications is offering a favorable market outlook.

Solutions represent the largest segment because organizations prioritize deploying comprehensive security tools like web application firewalls and vulnerability scanners to protect applications from evolving threats.

Web application security accounts for the majority of the market share as web applications are widely used and frequently targeted by cyberattacks, necessitating robust protective measures.

Static application security testing (SAST) exhibits a clear dominance in the market due to its ability to identify vulnerabilities early in the development lifecycle, reducing risks and costs.

On-premises hold the biggest market share owing to the requirement of greater control and security for sensitive data, appealing to industries with stringent compliance requirements.

Large enterprises hold the biggest market share as they possess extensive IT infrastructures and are prime targets for sophisticated cyber threats, driving the demand for advanced security solutions.

Large enterprises hold the biggest market share as they possess extensive IT infrastructures and are prime targets for sophisticated cyber threats, driving the demand for advanced security solutions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global application security market include Black Duck Software, Inc., Capgemini, Checkmarx Ltd, Cisco Systems, Inc., Cloudflare, Inc., Contrast Security, International Business Machines Corporation, NTT DATA, Inc., Open Text Corporation, Qualys, Inc., Rapid7, Veracode, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)