Artificial Disc Market Size, Share, Trends and Forecast by Disc Type, Material Type, End User, and Region, 2025-2033

Artificial Disc Market Size and Share:

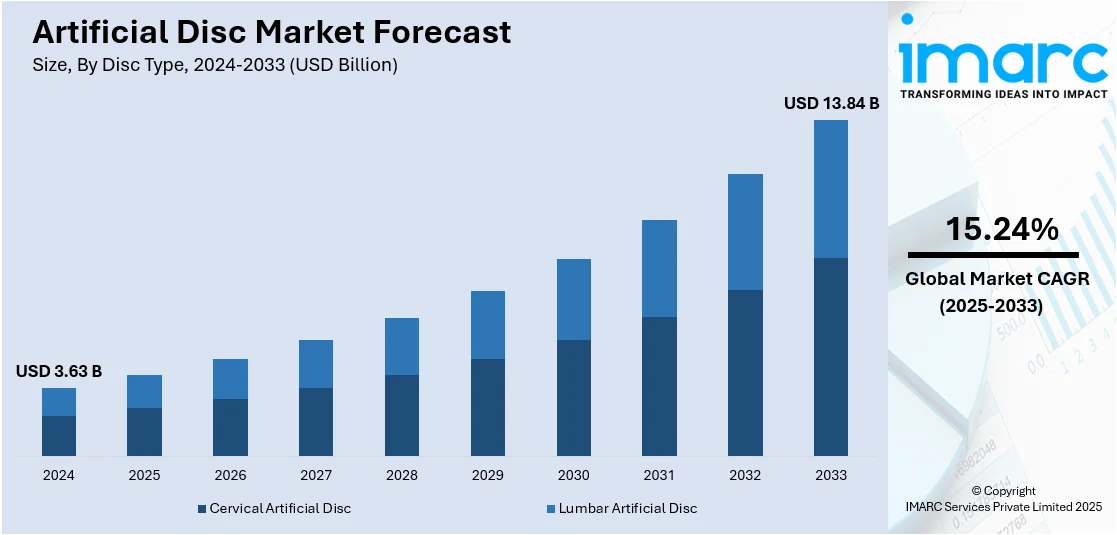

The global artificial disc market size was valued at USD 3.63 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.84 Billion by 2033, exhibiting a CAGR of 15.24% during 2025-2033. North America dominated the market, holding a significant market share of 56.2% in 2024. Aging population, advanced healthcare, favorable reimbursement, and strong medical device presence are some of the factors contributing to the artificial disc market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.63 Billion |

| Market Forecast in 2033 | USD 13.84 Billion |

| Market Growth Rate 2025-2033 | 15.24% |

The market is primarily driven by the growing prevalence of degenerative disc disease and related spinal disorders, especially among aging populations. Patients increasingly seek alternatives to spinal fusion, favoring motion-preserving procedures like total disc replacement. Advances in implant technology, such as improved biomaterials, anatomical designs, and multi-level compatibility, have significantly enhanced clinical outcomes and patient satisfaction. Strong long-term data demonstrating durability, low revision rates, and preservation of spinal mobility further support adoption. Surgeons are more confident in recommending these devices due to improved surgical techniques and growing clinical evidence. Favorable reimbursement frameworks in several regions and increasing healthcare investments also contribute to the artificial disc market growth. Additionally, patient awareness about newer, less invasive spinal treatments continues to rise, helping fuel demand for artificial discs as a long-term solution to chronic back pain and spinal instability.

Clinical research activity in the US is increasing for nucleus replacement devices aimed at treating degenerative disc conditions. New trials are focusing on minimally invasive options that preserve disc function, reflecting continued interest in expanding artificial disc technologies beyond traditional total disc replacements and offering more targeted treatment approaches. For instance, in March 2025, Spinal Stabilization Technologies, LLC announced the enrollment of the first U.S. individual in its Investigational Device Exemption (IDE) clinical trial for the PerQdisc Nucleus Replacement Device (NRD). This development marks the official commencement of SST's U.S.-based trial to assess its PerQdisc artificial disc device for patients with degenerative disc degeneration (DDD).

Artificial Disc Market Trends:

Growing Preference for Motion-Preserving Spine Solutions

An aging global population is contributing to a steady rise in spinal conditions, particularly degenerative disc disorders. As more individuals seek solutions that maintain mobility and quality of life, artificial disc replacement is gaining traction over traditional fusion surgeries. A key feature of artificial disc market trends is the growing shift toward less invasive surgical techniques, driven by demand for faster recovery, reduced hospital stays, and lower complication rates. These procedures are becoming more accessible due to improvements in surgical tools and growing expertise among healthcare providers. The combination of an older patient base and advancements in minimally invasive methods is steadily increasing the appeal and use of artificial discs in both cervical and lumbar applications. According to the World Health Organization, the number of geriatric individuals aged 60 years and over is expected to account for 22% of the total global population by 2050. The global minimally invasive surgery market also reached USD 56.1 Billion in 2024 and is forecasted to grow at a CAGR of 5.72% during 2025-2033, as per a report by the IMARC Group.

Clinical Validation Strengthening Confidence in Lumbar Disc Implants

Recent long-term clinical findings have reinforced confidence in lumbar artificial disc replacements, especially in complex cases involving prior surgeries. A major study with extended follow-up demonstrated strong safety and durability outcomes for a widely used lumbar disc system. Patients showed consistently positive results in both single- and two-level procedures, with very few requiring revisions over time. These results help validate the role of artificial discs as a dependable option for treating degenerative disc disease, supporting their growing use in spine care. The artificial disc market outlook remains positive as surgeons and healthcare systems are likely to rely more on such proven devices, with long-term data continuing to support their effectiveness in preserving motion and reducing the need for secondary interventions. For example, a landmark study published online in December 2024 by the Journal of Bone & Joint Surgery confirmed the long-term success of Centinel Spine’s prodisc L lumbar artificial disc. Involving 1,187 patients with 7–21 years of follow-up, the study reported a low revision rate (0.67%) and strong outcomes across 1- and 2-level cases, including prior surgeries. These findings reinforce the durability and safety of prodisc L in treating degenerative disc disease.

Expanding Role of Cross-Border Spine Procedures

Medical travel is becoming a stronger influence on the artificial disc industry, as patients seek high-quality care at lower costs outside their home countries. With more individuals traveling for advanced spine procedures, the artificial disc market forecast reflects growing international demand, especially in regions offering skilled surgeons, modern facilities, and cost-effective treatment options. The growing appeal of cross-border treatment is supported by improved surgical standards, internationally accredited hospitals, and access to advanced procedures like artificial disc replacement. Individuals dealing with chronic back pain are increasingly exploring options abroad where skilled surgeons perform motion-preserving spine surgeries at competitive prices. This movement is not limited to elective procedures; it’s also shaping how and where complex spine treatments are delivered. As more countries position themselves as hubs for specialized care, artificial disc technologies are gaining visibility and adoption across new patient populations beyond traditional markets. For instance, the global medical tourism market reached USD 144.5 Billion in 2024 and is projected to grow at a CAGR of 19.08% from 2025-2033, according to the IMARC Group.

Artificial Disc Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global artificial disc market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on disc type, material type, and end user.

Analysis by Disc Type:

- Cervical Artificial Disc

- Lumbar Artificial Disc

Cervical artificial disc stood as the largest disc type in 2024, holding around 65.9% of the market due to rising demand for less invasive solutions to cervical spine degeneration. These discs are used to replace damaged intervertebral discs in the neck and help preserve natural motion, unlike spinal fusion, which restricts it. Increasing prevalence of cervical degenerative disc disease among the aging population and a growing preference for motion-preserving surgeries are pushing hospitals and surgeons to opt for artificial cervical discs. Technological advancements have improved implant materials and surgical techniques, reducing complication rates and speeding up recovery. Reimbursement support in developed countries and favorable long-term clinical outcomes are encouraging wider adoption. This segment is also gaining momentum due to expanding regulatory approvals and its proven ability to reduce adjacent segment degeneration compared to traditional methods.

Analysis by Material Type:

- Metal on Polymer

- Metal on Metal

Metal on polymer led the market with around 64.2% of market share in 2024, owing to its favorable clinical performance, durability, and cost-effectiveness. These implants typically use a metal endplate and a polymer core, offering smoother articulation and reducing wear compared to metal-on-metal designs. Surgeons favor this configuration because it mimics natural disc movement while minimizing the risk of metal ion release, a concern with some older implant types. Patients benefit from improved mobility and lower complication rates. Manufacturers continue refining polymer materials to enhance strength and longevity, making them more suitable for long-term implantation. The segment’s popularity is rising in both cervical and lumbar applications, especially in regions where price sensitivity matters. Regulatory approvals and clinical success stories are further boosting adoption, making metal-on-polymer a preferred option in artificial disc replacement procedures.

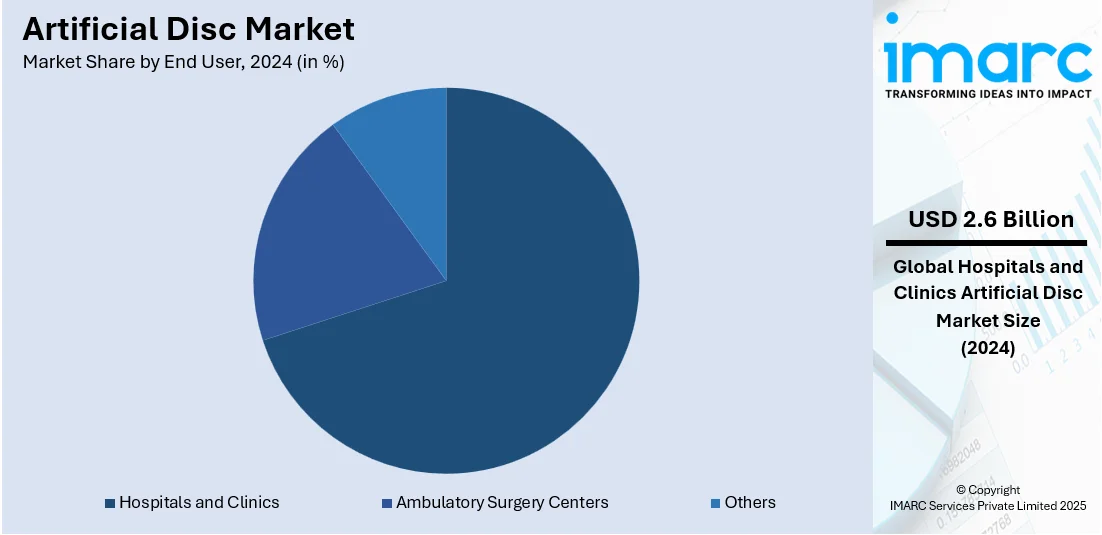

Analysis by End User:

- Hospitals and Clinics

- Ambulatory Surgery Centers

- Others

Hospitals and clinics led the market with around 70.8% of market share in 2024 because of increased patient volume, better surgical infrastructure, and access to advanced spinal procedures. These facilities are often the first choice for patients seeking treatment for degenerative disc disorders, especially as awareness grows about alternatives to spinal fusion. Hospitals and large clinics are equipped with skilled orthopedic and neurosurgeons, imaging systems, and post-operative care units that support complex procedures like artificial disc replacement. They also benefit from direct partnerships with device manufacturers, ensuring the timely availability of approved implants. With rising healthcare spending and government investments in surgical capabilities, particularly in urban areas, more hospitals are incorporating motion-preserving spinal surgeries into their standard offerings. Insurance coverage and reimbursement support are typically more accessible through hospital networks, making them central to the rising demand for artificial disc implants.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 56.2%. The region has a high volume of spinal surgeries, driven by a large aging population prone to degenerative disc disorders. Access to advanced healthcare facilities and skilled surgeons also plays a major role. Regulatory support and quicker approvals from authorities like the FDA have helped bring new technologies to market faster. Insurance coverage and favorable reimbursement policies make artificial disc replacement a viable option for more patients. Additionally, the presence of key medical device manufacturers in the U.S. ensures faster product availability and continued innovation. Public awareness of spinal health and early treatment has also improved adoption. Together, these factors have established North America as the leading region in the artificial disc market, with strong growth potential going forward.

Key Regional Takeaways:

United States Artificial Disc Market Analysis

In 2024, the United States accounted for 87.7% of the market share in North America. The growth of the US artificial disc market is primarily driven by the increasing prevalence of spine-related disorders, such as degenerative disc disease and other spinal disorders, which require advanced treatment solutions. According to the National Spine Health Foundation, evidence of disc degeneration is found in approximately 90% of individuals aged 60 years and older. The rising geriatric population is a significant factor, as age-related spinal issues are more common among older adults, creating a greater demand for artificial disc replacement (ADR) procedures. Additionally, the growing preference for minimally invasive procedures over traditional spinal fusion surgeries is contributing substantially to market growth, as ADR offers benefits such as faster recovery times, less pain, and improved range of motion. The rise in healthcare expenditure and investment in the healthcare sector, along with the availability of advanced surgical techniques, is also supporting the market. According to the Centers for Medicare and Medicaid Services (CMS), healthcare expenditures in the United States increased by 7.5% in 2023, reaching USD 4.9 Trillion or USD 14,570 per person and accounting for 17.6% of the GDP of the country. Other than this, reimbursement policies for spine surgeries and ADR procedures are becoming more favorable, which boosts the accessibility of artificial disc surgeries, further driving market growth.

Asia Pacific Artificial Disc Market Analysis

The Asia Pacific artificial disc market is expanding due to a rising incidence of spinal injuries, particularly related to lifestyle changes, high mobility in urban populations, and sports-related trauma, which has led to greater demand for artificial disc replacement (ADR) procedures. For instance, the incidence of spinal cord injuries (SCI) in China reached 99,363 cases in 2021, marking an increase of 43.27% since 1990. The prevalence of SCI reached 2,766,277 cases, recording a growth of 63.27% since 1990. Additionally, the region's growing focus on healthcare modernization and the adoption of advanced medical technologies is making ADR more accessible. Increased investments in healthcare infrastructure and the establishment of specialized spinal surgery centers across emerging markets are contributing substantially to industry expansion. For instance, in August 2023, the specialized Institute of Brain & Spine was established at Radial Road's Kauvery Hospital in India. The Institute provides exceptional facilities, cutting-edge technologies, and a skilled group of specialized physicians that achieve the intended clinical results, enhancing the quality of life for each and every one of its patients.

Europe Artificial Disc Market Analysis

The growth of the Europe artificial disc market is largely fueled by the rising demand for advanced spinal treatments. A notable growth-inducing factor is the increasing incidence of degenerative disc diseases, herniated discs, and spinal disorders, particularly among the geriatric population, which is more susceptible to such conditions. For instance, over 50% of the average population suffers from a non-symptomatic herniated disc. Moreover, in European nations, the percentage of hospital discharges connected to spine disorders ranged from 0.8% to 4.3% of all hospital discharges and from 14.2% to 45.6% of all discharges related to musculoskeletal disorders in 2019, according to a study by the National Institutes of Health. Furthermore, in Europe, intervertebral disc problems alone were responsible for 4.9% to 21.1% of all hospital discharges resulting from musculoskeletal disorders. Additionally, the growing preference for patient-centric treatment options, focused on enhancing quality of life and long-term mobility, is significantly propelling the widespread adoption of ADR. Collaborative research and development (R&D) between European medical institutions and manufacturers have also led to more refined, patient-friendly products, further encouraging the adoption of ADR. The expansion of clinical evidence supporting the long-term benefits of ADR, along with the endorsement of professional medical societies, is further fostering market confidence and adoption.

Latin America Artificial Disc Market Analysis

The Latin America artificial disc market is significantly influenced by the growing incidence of spinal conditions. For instance, 19% of individuals in Brazil aged 18 years and above reported suffering from chronic spinal pain. Moreover, the demand for minimally invasive surgeries is rising as patients seek less invasive treatments with quicker recovery times, making artificial disc replacement (ADR) an attractive alternative to traditional spinal fusion surgeries. Improvements in healthcare infrastructure and access to advanced medical technologies in countries such as Brazil and Mexico are also making ADR procedures more available. Besides this, increasing awareness about the benefits of ADR, along with favorable reimbursement policies and rising disposable incomes, are substantially driving market growth, allowing more patients to afford advanced spinal care solutions.

Middle East and Africa Artificial Disc Market Analysis

The Middle East and Africa artificial disc market is experiencing robust growth, driven by the increasing demand for advanced spinal treatments due to a higher incidence of lifestyle-related spinal issues and injuries. Moreover, the region’s expanding healthcare infrastructure is making ADR procedures more accessible. Growing healthcare investments and expenditures, particularly in countries such as the UAE and Saudi Arabia, are further contributing to better availability of specialized treatments. For instance, the Government of Saudi Arabia allocated SR 86,253,063 to the Ministry of Health for FY25, equating to 7% of the state budget. Besides this, increased awareness and education about ADR benefits, along with favorable healthcare policies and insurance coverage, are also driving industry expansion in the region.

Competitive Landscape:

The artificial disc market is experiencing notable growth, driven by technological advancements and strategic initiatives. Recent developments include the introduction of innovative products like NGMedical's MOVE-C cervical disc and Orthofix's M6-C, which have demonstrated superior clinical outcomes. Companies such as NuVasive and Centinel Spine are actively engaging in partnerships and acquisitions to enhance their product offerings and market presence. Research and development efforts are focused on new biomaterials and 3D printing techniques to create customized implants, improving patient outcomes. Government initiatives, including increased funding and supportive reimbursement policies, are facilitating the adoption of artificial disc procedures. Among these activities, product launches and strategic collaborations are currently the most prevalent practices, reflecting the industry's emphasis on innovation and market expansion.

The report provides a comprehensive analysis of the competitive landscape in the artificial disc market with detailed profiles of all major companies, including:

- B. Braun Melsungen Aktiengesellschaft (B. Braun Holding GmbH & Co. KG)

- Depuy Synthes Inc. (Johnson & Johnson)

- Globus Medical Inc.

- Medtronic plc

- Nuvasive Inc.

- Orthofix Medical Inc.

- Paradigm Spine LLC (RTI Surgical Holdings Inc.)

- Smith & Nephew Plc

- Stryker Corporation

- Zimmer Biomet Holdings Inc.

Latest News and Developments:

- March 2025: NGMedical Gmbh successfully secured TGA approval for its revolutionary MOVE-C artificial disc prosthesis for sale in Australia. This represents a major turning point for the company in its efforts to transform the spinal care sector in Australia. The accomplishment is the result of more than three years of diligent research, cooperation, and dedication by the company’s outstanding team.

- February 2025: Centinel Spine, LLC, revealed the successful completion of its 10,000th case in the United States with its Match-the-Disc prodisc Cervical TDR System. The novel artificial disc system consists of three newly released devices in the U.S.: the prodisc C SK, the prodisc C Vivo, and the Prodisc C Nova.

- October 2024: Centinel Spine, LLC, announced the first successful implantation of its prodisc C Nova cervical total disc replacement (TDR) product in the United States. The company first secured FDA approval for its 1-level indications for its novel artificial disc prodisc C Nova device in July 2022.

Artificial Disc Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Disc Types Covered | Cervical Artificial Disc, Lumbar Artificial Disc |

| Material Types Covered | Metal on Polymer, Metal on Metal |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgery Centers, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | B. Braun Melsungen Aktiengesellschaft (B. Braun Holding GmbH & Co. KG), Depuy Synthes Inc. (Johnson & Johnson), Globus Medical Inc., Medtronic plc, Nuvasive Inc., Orthofix Medical Inc., Paradigm Spine LLC (RTI Surgical Holdings Inc.), Smith & Nephew Plc, Stryker Corporation, Zimmer Biomet Holdings Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the artificial disc market from 2019-2033.

- The artificial disc market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the artificial disc industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The artificial disc market was valued at USD 3.63 Billion in 2024.

The artificial disc market is projected to exhibit a CAGR of 15.24% during 2025-2033, reaching a value of USD 13.84 Billion by 2033.

The rising prevalence of Degenerative Disc Disease (DDD), along with the growing consumer awareness regarding the benefits of arthroplasty or artificial disc replacement, as it helps to relieve back pain while retaining movement and flexibility, is primarily driving the global artificial disc market.

North America dominated the artificial disc market in 2024, accounting for a share of 56.2% due to high adoption of advanced spinal procedures, favorable reimbursement, strong presence of medical device companies, and growing demand from an aging population.

Some of the major players in the artificial disc market include B. Braun Melsungen Aktiengesellschaft (B. Braun Holding GmbH & Co. KG), Depuy Synthes Inc. (Johnson & Johnson), Globus Medical Inc., Medtronic plc, Nuvasive Inc., Orthofix Medical Inc., Paradigm Spine LLC (RTI Surgical Holdings Inc.), Smith & Nephew Plc, Stryker Corporation, Zimmer Biomet Holdings Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)