Artillery Systems Market Size, Share, Trends and Forecast by Type, Component, Caliber, Range, End User, and Region, 2025-2033

Artillery Systems Market Size and Share:

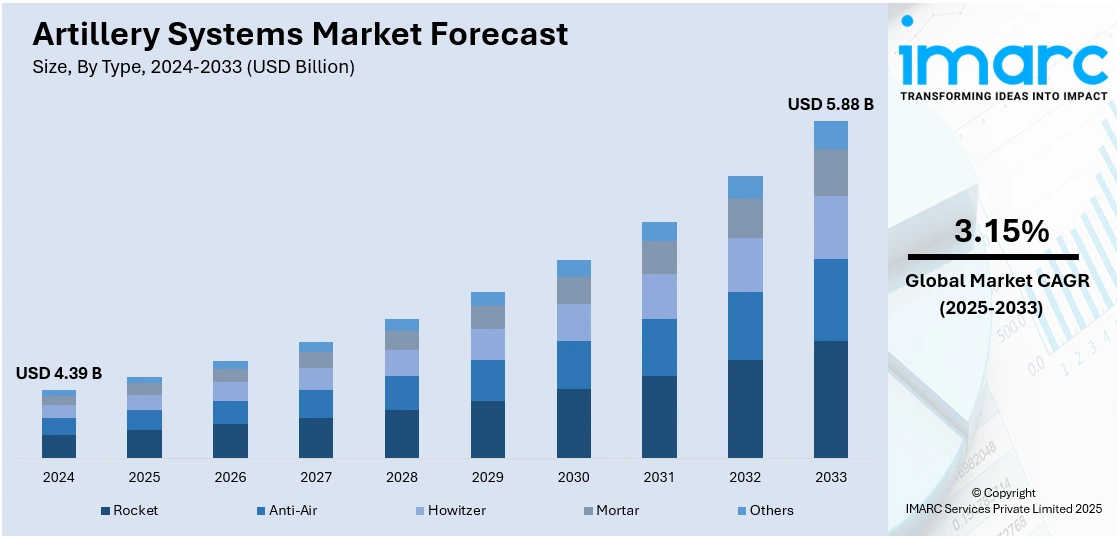

The global artillery systems market size was valued at USD 4.39 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.88 Billion by 2033, exhibiting a CAGR of 3.15% during 2025-2033. North America currently dominates the market, holding a significant market share of 35.0% in 2024. The increasing defense budgets, technological advancements in weaponry, rising need for modernized military equipment, and growing demand for long-range precision strike capabilities are some of the major factors contributing to increase the artillery systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.39 Billion |

|

Market Forecast in 2033

|

USD 5.88 Billion |

| Market Growth Rate (2025-2033) | 3.15% |

The market for artillery systems is influenced by changing defense doctrines and international tensions. With growing global security threats, countries are spending significant amounts to upgrade their military forces, and artillery is the key component of ground combat strength. The shift toward network-centric warfare and the adoption of highly advanced targeting and surveillance technology have also spurred demand for more advanced artillery systems. Furthermore, mobility and speed of deployment are increasingly important, and this has led to the design of light and self-propelled artillery systems. New threats in the form of hybrid warfare and asymmetric battles further highlight the need for responsive and accurate fire support systems. Modernization programs of defense, especially among emerging economies, are driving procurement processes at a faster pace. Simultaneously, innovations in automation, digital fire control systems, and extended-range munitions are remolding the competitive landscape, while further fueling the artillery systems market growth.

The United States stands out as a key market disruptor, driven by its investments on defense, technological innovation, and strategic power. With an emphasis on next-generation warfare capabilities, the US has made developing advanced artillery systems with precision-guided munitions, increased automation, and networked battlefield awareness a priority. This strategy sets the bar higher for international competitors and also speeds up innovation in allied and enemy nations. American defense companies are at the forefront of creating next-generation systems that provide greater range, precision, and interoperability with other military platforms. In addition, the US military's focus on multi-domain operations has created demand for artillery that enables joint-force integration and quick response. By way of foreign military sales and strategic alliances, the US extends its reach, influencing procurement globally. All these factors combined make the United States a leading player, and a transforming force in the artillery systems market.

Artillery Systems Market Trends:

Increasing Defense Budgets

The increased defense budgets across various nations are fueling investments in advanced military technologies, including artillery systems. According to industry reports, total global military expenditure reached USD 2443 Billion in 2023, an increase of 6.8% in real terms from 2022. This was the steepest year-on-year increase since 2009. The 10 largest spenders in 2023—led by the United States, China, and Russia—all increased their military spending. For instance, in April 2024, the UK government announced the biggest strengthening of the UK’s national defense in a generation, with a fully funded plan to grow the defense budget to 2.5% of GDP by 2030. In line with this, governments are allocating substantial funds to modernize their armed forces, focusing on enhancing long-range strike capabilities and ensuring military readiness which in turn is expected to boost the artillery systems market growth over the coming years.

Significant Technological Advancements

Technological advancements in precision-guided munitions, automation, and artificial intelligence (AI) are transforming the artillery systems market outlook, making it more accurate, efficient, and adaptable to modern warfare scenarios. For instance, in January 2024, the French Ministry announced a coalition launch in Paris, highlighting that France is taking a significant leap in military technology. The enhancement of the CAESAR self-propelled howitzer's firing precision is now in the hands of Helsing AI, a leading startup specializing in artificial intelligence for military applications. These innovations are particularly important for minimizing collateral damage and improving operational effectiveness in complex environments, thereby creating a positive artillery systems market outlook.

Rising Geopolitical Tensions

The growing geopolitical tensions and regional conflicts are escalating the demand for robust artillery systems. Nations are prioritizing the development and acquisition of advanced artillery to strengthen their military capabilities and maintain strategic advantages in volatile regions. This need for enhanced defense systems is driving the continuous evolution and expansion of the artillery systems market globally. For instance, in March 2024, states in Europe almost doubled their imports of major arms (+94%) between 2014–18 and 2019–23. Far larger volumes of arms flowed to Asia and Oceania and the Middle East in 2019–23, where nine of the 10 largest arms importers are. The United States increased its arms exports by 17% between 2014–18 and 2019–23, while Russia’s arms exports halved. Russia was for the first time the third largest arms exporter, falling just behind France.

Artillery Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global artillery systems market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, component, caliber, range, and end user.

Analysis by Type:

- Rocket

- Anti-Air

- Howitzer

- Mortar

- Others

Howitzer stands as the largest component in 2024, holding around 43.2% of the market. The demand for Howitzers is driven by their versatility and effectiveness in modern warfare. Howitzers offer a unique combination of high mobility, long-range firepower, and the ability to deliver precision strikes, making them essential for both offensive and defensive operations. The increasing focus on network-centric warfare and the need for adaptable, responsive fire support in diverse combat environments further boost their demand. Additionally, ongoing geopolitical tensions and military modernization programs are leading countries to invest in advanced Howitzer systems, enhancing their artillery capabilities and overall combat readiness. According to the artillery systems market forecast, these extensive investments will serve as a pivotal factor contributing to the overall market growth.

Analysis by Component:

- Fire Control System

- Chassis

- Engine

- Gun Turret

- Others

The demand for fire control systems in the market is driven by the need for precision targeting and improved accuracy in modern warfare. These systems integrate advanced sensors, AI, and real-time data processing, enabling more effective and timely responses. As militaries prioritize precision strikes and reduced collateral damage, fire control systems have become essential for optimizing artillery effectiveness.

The demand for robust chassis in artillery systems is fueled by the need for mobility and durability in diverse combat environments. A reliable chassis supports the heavy load of artillery components while ensuring stability and maneuverability. As modern warfare requires rapid deployment and adaptability across terrains, advanced chassis designs are critical for enhancing the operational effectiveness of artillery systems.

The demand for powerful engines in artillery systems is driven by the need for enhanced mobility and quick repositioning in combat scenarios. High-performance engines enable artillery units to move swiftly across varying terrains, ensuring they can provide timely support and evade counterattacks. As military operations increasingly require speed and flexibility, the role of reliable, efficient engines in artillery systems is crucial.

The demand for advanced gun turrets in artillery systems is driven by the need for greater firepower, precision, and adaptability in combat. Gun turrets enable rapid target acquisition, smooth firing operations, and the ability to engage multiple targets. As militaries seek to enhance their strike capabilities with modern, multi-functional artillery systems, the importance of innovative gun turret designs continues to grow which in turn is expected to drive the artillery systems demand.

Analysis by Caliber:

- Small

- Medium

- Heavy

The demand for small caliber artillery is driven by the need for lightweight, portable, and rapid-firing systems suitable for close-range support and urban warfare. These calibers are ideal for quick deployment and provide infantry units with essential firepower in confined or rapidly changing environments, where mobility and precision are critical for effective operations.

The demand for medium caliber artillery is fueled by the balance they offer between range, firepower, and mobility. These calibers are versatile, providing effective support in both offensive and defensive operations. Their adaptability across various combat scenarios makes them valuable for modern militaries seeking a flexible and responsive artillery option capable of engaging targets at intermediate distances.

The demand for heavy caliber artillery is driven by the need for long-range firepower and the ability to deliver devastating strikes against fortified positions. Heavy calibers are essential for strategic bombardments, providing deep penetration and extensive damage in high-intensity conflicts. As militaries focus on enhancing their long-range capabilities, the role of heavy caliber artillery becomes increasingly significant.

Analysis by Range:

- Short-range

- Medium range

- Long-range

Short-range leads the market share in 2024. The demand for short-range artillery in the market is driven by its effectiveness in close combat and urban warfare scenarios. Short-range systems provide quick, responsive fire support, essential for engaging targets at close distances where precision and speed are crucial. Their mobility and ease of deployment make them ideal for rapidly changing battlefields, particularly in confined environments like cities or rugged terrain. Additionally, short-range artillery is valued for its ability to provide immediate support to infantry units, enhancing their operational effectiveness during assaults or defensive operations. This versatility makes short-range systems a critical component in modern military strategies which is further boosting the artillery systems market growth.

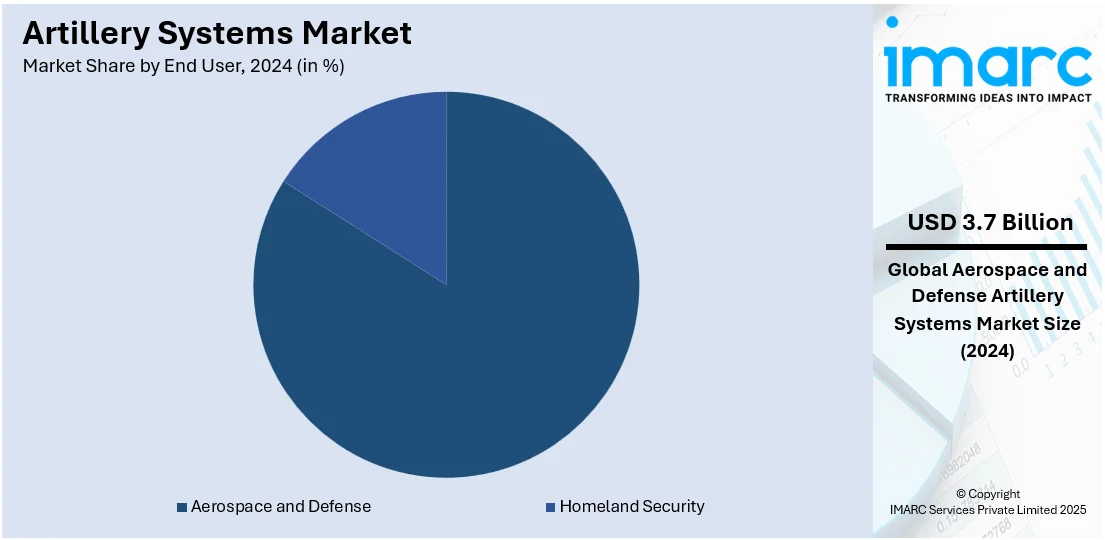

Analysis by End User:

- Aerospace and Defense

- Homeland Security

Aerospace and defense leads the market with around 83.8% of market share in 2024. The demand for artillery systems in aerospace and defense is driven by the need for advanced, precision-strike capabilities in modern warfare. These systems support military operations with enhanced firepower, range, and accuracy, crucial for maintaining air superiority and ground dominance. Additionally, ongoing global tensions and defense modernization programs are fueling investments in cutting-edge artillery technologies within this sector.

In homeland security, the demand for artillery systems is driven by the need to strengthen national defense capabilities and respond effectively to potential threats. These systems provide critical support for border protection, counter-terrorism efforts, and crisis management. The emphasis on safeguarding infrastructure and ensuring public safety has led to increased investment in versatile and rapid-response artillery solutions for homeland security operations.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35.0%. The market in North America is primarily driven by increased defense spending, with the U.S. Department of Defense investing heavily in modernizing military capabilities. According to the Office of Management and Budget, the United States spent USD 820 Billion on national defense during fiscal year (FY) 2023 which amounted to 13 percent of federal spending. Defense spending in 2023 was less than the average for the last decade, which was 15 percent of the budget. Such spending indicates that lawmakers have prioritized national defense as a key part of our budget; indeed, the United States spends more on defense, relative to the size of its economy, than any other member of the G7 (a group of the world’s largest advanced economies, the members of which are shown in the chart below). This explainer looks at the components of the U.S. defense budget. The focus on developing next-generation artillery systems, including precision-guided munitions and automated platforms, is also significant, driven by the need for advanced strike capabilities. Additionally, ongoing military engagements and the demand for maintaining a technological edge over potential adversaries propel continuous innovation and procurement in the region. The integration of AI and autonomous systems further enhances the operational effectiveness of artillery, thereby increasing the overall artillery systems market revenue across the region.

Key Regional Takeaways:

United States Artillery Systems Market Analysis

In 2024, the United States accounted for 88.30% of the artillery systems market in North America. The increasing investment in defense has led to a significant rise in artillery systems adoption across the United States. For instance, in 2022, US defense spending amounted to 6% of GDP. As military modernization becomes a priority, there is a clear drive toward upgrading and expanding artillery capabilities to ensure strategic superiority. Enhanced funding and a focus on advanced technologies have boosted research and development in artillery systems. The demand for precision and high-performance weaponry has accelerated, with defense contractors investing heavily in innovation. Additionally, military forces are integrating these systems into their existing infrastructure to maintain a competitive edge in both conventional and asymmetric warfare scenarios. This growing commitment to defense spending ensures a continued push for advanced artillery solutions.

Asia Pacific Artillery Systems Market Analysis

In Asia-Pacific, the growing aerospace and defense sectors are driving the adoption of artillery systems. According to reports, the Indian Aerospace and Defense (A&D) market is estimated to reach around USD 70 Billion by 2030. With a strong emphasis on bolstering military capabilities, regional nations are investing in modernizing their artillery forces to improve operational efficiency and firepower. The aerospace and defense industries contribute directly to developing advanced artillery systems, enhancing their effectiveness and deployment capabilities. As nations in this region prioritize military readiness, artillery systems have become a critical component in the overall defense strategy. Consequently, technological advancements in the field are accelerating, providing militaries with more precise and capable artillery solutions.

Europe Artillery Systems Market Analysis

In Europe, growing security concerns and rising geopolitical tensions between countries have significantly contributed to the increasing adoption of artillery systems. For instance, as of 2024, according to NATO intelligence assessments shared with CNN, Russia is generating approximately 250,000 artillery shells each month, totaling around 3 million annually. As countries seek to strengthen their defense capabilities amid unpredictable political landscapes, artillery has become a critical asset. The demand for advanced systems is propelled by the need for rapid mobilization and precision strikes in conflict zones. With an ongoing focus on defense spending, countries are increasingly investing in artillery modernization to deter potential threats and maintain military deterrence. This surge in artillery adoption reflects Europe's commitment to addressing the evolving security challenges it faces.

Latin America Artillery Systems Market Analysis

The rise in military expenditure in Latin America has driven a surge in the adoption of artillery systems. For example, military expenditures in Central America and the Caribbean in 2023 were 54% greater than in 2014. As nations focus on improving their defense capabilities, artillery systems have become integral to enhancing military strength. Investment in modern weaponry and defense infrastructure has facilitated the development of more efficient artillery solutions. This uptick in military expenditure signals a shift towards greater preparedness, ensuring these nations can maintain defense sovereignty in an increasingly volatile global landscape.

Middle East and Africa Artillery Systems Market Analysis

In the Middle East and Africa, growing investments in security have led to a notable rise in artillery systems adoption. For instance, on the ground level, the Egyptian army has more than 4,500 tanks and 11,000 armoured vehicles, in addition to 1,165 self-propelled artillery and more than 2,200 field artillery. As regional instability and conflict continue to pose security challenges, nations are prioritizing defense investments to protect their borders and maintain strategic military capabilities. Artillery systems play a crucial role in this strategy, providing enhanced firepower and precision in diverse conflict scenarios. This increasing focus on security ensures the continued expansion and modernization of artillery forces in the region.

Competitive Landscape:

Several major players in the artillery systems industry are investing heavily in research and development to improve the precision, range, and mobility of their products in response to the changing needs of contemporary warfare. These companies are committed to incorporating new technology including GPS-guided munitions, automated fire control systems, and digital battlefield communication networks to enhance targeting precision and operational effectiveness. Focus is also being put into building self-powered and light-weight artillery systems in support of fast deployment and maneuverability across different environments. Strategic collaborations, mergers, and acquisitions are being pursued to grow technology capabilities and open up new markets. Further, major players are also forging associations with defense ministries and militaries for co-development programs suited to individual country-level defense needs. Enhancements to current platforms are an area of focus, providing cost-efficient modernization options for forces with limited budgets. Environmental responsibility and logistical effectiveness are new factors to consider, driving innovation in fuel efficiency and maintenance-friendly technologies. Moreover, export strategy is being honed through long-term service agreements and offset obligations, enhancing worldwide competitiveness.

The report provides a comprehensive analysis of the competitive landscape in the artillery systems market with detailed profiles of all major companies, including:

- Avibras Industria Aeroespacial

- BAE Systems plc

- Denel Soc Ltd

- Elbit Systems Ltd.

- General Dynamics Corporation

- Hanwha Group

- Leonardo SpA

- Lockheed Martin Corporation

- Nexter group KNDS

- Rostec

- RUAG Holding

- Singapore Technologies Engineering

Latest News and Developments:

- April 2025: India ordered 100 additional K9 Vajra-T self-propelled artillery systems to modernize its forces, following a new USD 253 Million deal signed between Hanwha Aerospace and Larsen & Toubro. The contract signing ceremony took place at the Embassy of the Republic of Korea in New Delhi, reinforcing the growing defense partnership between South Korea and India.

- April 2025: Ukraine increased production of its 155mm Bohdana 2S22 artillery system from six units per month in 2023 to over 20 units in 2025. The boost in production was made possible through support from European partners investing in Ukraine's defense sector. Some sources suggested that as many as 36 units were being delivered per month.

- March 2025: India's Cabinet Committee on Security sanctioned a ₹7,000 crore agreement to acquire 307 advanced towed artillery gun systems (ATAGS) along with 327 gun-towing vehicles for the Army. The ATAGS, created by DRDO, feature a strike range of 45-48 km and will be manufactured by Bharat Forge and Tata Advanced Systems. This agreement represents a major enhancement for India's indigenous artillery production abilities.

- January 2025: The US Army selected BAE Systems to develop a prototype of the Multi-Domain Artillery Cannon (MDAC) system, designed to fire hypersonic projectiles. The contract, announced late last year, was awarded without a competitive bidding process and included plans for eight artillery systems, precision radars, and battle management systems. BAE Systems also began prototyping a minimum of 144 Hypervelocity Projectiles, with the MDAC set for live-fire tests and an operational assessment by 2028.

- January 2025: Armenia signed a deal to procure an Indo-French artillery gun system, strengthening its defense capabilities amid regional tensions. The country selected the mounted gun system developed jointly by India’s Bharat Forge and France’s Nexter Systems. The agreement marked a significant step for Indo-French defense exports and Armenia’s military modernization efforts.

Artillery Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Rocket, Anti-Air, Howitzer, Mortar, Others |

| Components Covered | Fire Control System, Chassis, Engine, Gun Turret, Others |

| Calibers Covered | Small, Medium, Heavy |

| Ranges Covered | Short-Range, Medium Range, Long Range |

| End Users Covered | Aerospace and Defense, Homeland Security |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Avibras Industria Aeroespacial, BAE Systems plc, Denel Soc Ltd, Elbit Systems Ltd., General Dynamics Corporation, Hanwha Group, Leonardo SpA, Lockheed Martin Corporation, Nexter group KNDS, Rostec, RUAG Holding, Singapore Technologies Engineering, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the artillery systems market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global artillery systems market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the artillery systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The artillery systems market was valued at USD 4.39 Billion in 2024.

The artillery systems market is projected to exhibit a CAGR of 3.15% during 2025-2033, reaching a value of USD 5.88 Billion by 2033.

The artillery systems market is driven by rising global security threats, military modernization programs, and advancements in targeting, mobility, and automation technologies. Increasing demand for precision, extended-range capabilities, and integrated battlefield systems further fuels growth, as nations seek to strengthen ground-based firepower and enhance operational readiness across various terrains.

North America currently dominates the artillery systems market, driven by ongoing military modernization, increased defense budgets, and a focus on advanced technologies like precision-guided munitions and automated targeting. Geopolitical tensions and the need for rapid-response capabilities further support demand, alongside strong domestic defense manufacturing and sustained government investment in innovation.

Some of the major players in the artillery systems market include Avibras Industria Aeroespacial, BAE Systems plc, Denel Soc Ltd, Elbit Systems Ltd., General Dynamics Corporation, Hanwha Group, Leonardo SpA, Lockheed Martin Corporation, Nexter group KNDS, Rostec, RUAG Holding, Singapore Technologies Engineering, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)