Asia Pacific Automotive Glass Market Size, Share, Trends and Forecast by Glass Type, Material Type, Vehicle Type, Application, End User, Technology, and Country, 2025-2033

Market Overview:

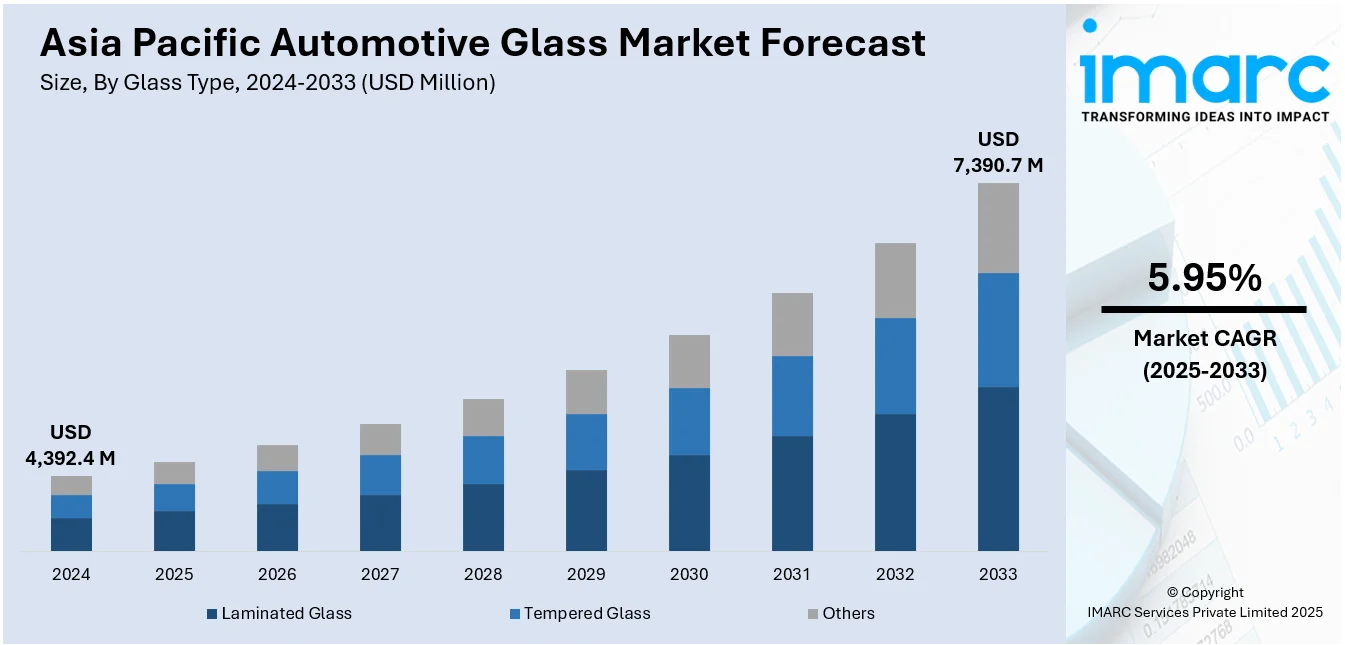

The Asia Pacific automotive glass market size reached USD 4,392.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 7,390.7 Million by 2033, exhibiting a growth rate (CAGR) of 5.95% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4,392.4 Million |

|

Market Forecast in 2033

|

USD 7,390.7 Million |

| Market Growth Rate (2025-2033) | 5.95% |

Automotive glass is employed in the manufacturing of windshields and windows of vehicles as it offers a clear view of the surroundings. Moreover, it exhibits superior aerodynamic features and protects against ultraviolet (UV) rays, rain, sun, dust, wind, and fog.

To get more information on this market, Request Sample

A significant presence of leading original equipment manufacturers (OEM) in different countries of the Asia Pacific region represents one of the key factors impelling the automotive glass market growth. Additionally, increasing road accidents have increased the utilization of automotive glass in vehicles, which is positively influencing the market. Furthermore, the introduction of head-up display (HUD) and smart glass, which allow windows to dim or tint from transparent to opaque, is positively influencing the market growth. However, the imposition of lockdown restrictions by governing agencies of several countries in the region due to the sudden outbreak of the coronavirus disease (COVID-19) has led to a temporary halt in the operations of manufacturing units, which has adversely affected the market growth. The market is expected to recover once lockdown relaxations are introduced.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific automotive glass market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on glass type, material type, vehicle type, application, end user, and technology.

Breakup by Glass Type:

- Laminated Glass

- Tempered Glass

- Others

Breakup by Material Type:

- IR PVB

- Metal Coated Glass

- Tinted Glass

- Others

Breakup by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Trucks

- Buses

- Others

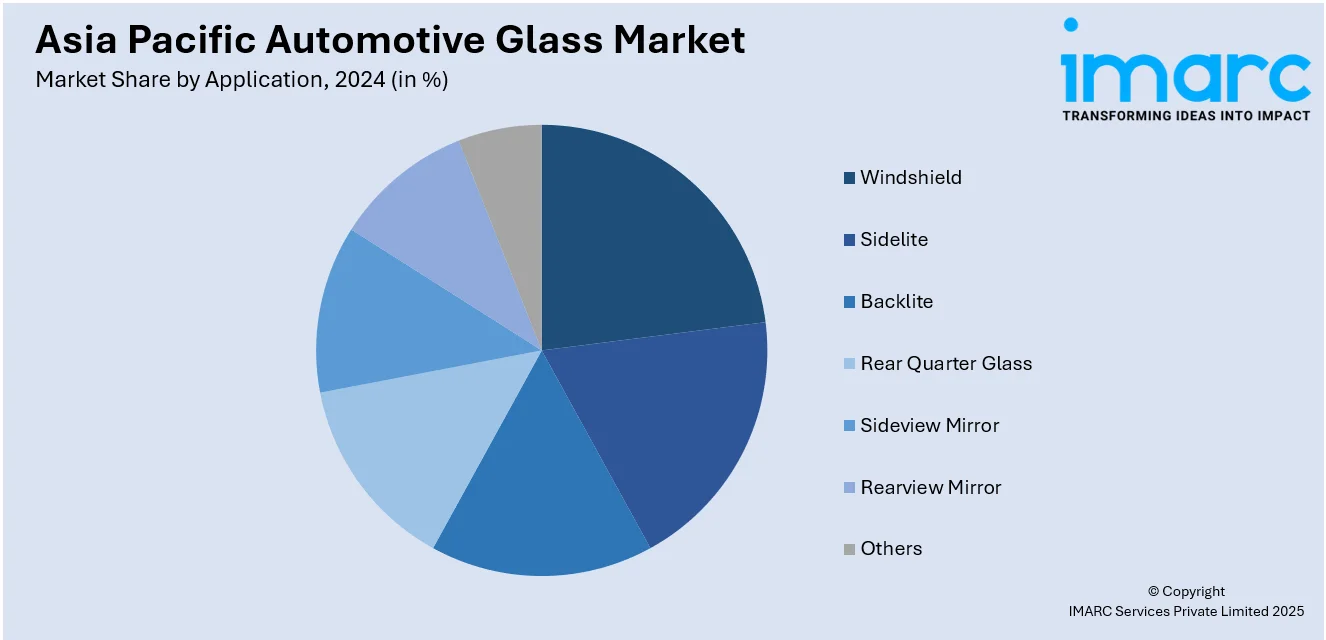

Breakup by Application:

- Windshield

- Sidelite

- Backlite

- Rear Quarter Glass

- Sideview Mirror

- Rearview Mirror

- Others

Breakup by End User:

- OEMs

- Aftermarket Suppliers

Breakup by Technology:

- Active Smart Glass

- Suspended Particle Glass

- Electrochromic Glass

- Liquid Crystal Glass

- Passive Glass

- Thermochromic

- Photochromic

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

|

Scope of the Report

|

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Glass Types Covered | Laminated Glass, Tempered Glass, Others |

| Material Types Covered | IR PVB, Metal Coated Glass, Tinted Glass, Others |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Trucks, Buses, Others |

| Applications Covered | Windshield, Sidelite, Backlite, Rear Quarter Glass, Sideview Mirror, Rearview Mirror, Others |

| End Users Covered | OEMs, Aftermarket Suppliers |

| Technologies Covered |

|

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Asia Pacific automotive glass market was valued at USD 4,392.4 Million in 2024.

We expect the Asia Pacific automotive glass market to exhibit a CAGR of 5.95% during 2025-2033.

The rising demand for automotive glasses, as they provide a clear and undistorted view of surroundings and roads during adverse weather conditions, while safeguarding the automobile from Ultraviolet (UV) rays, is primarily driving the Asia Pacific automotive glass market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several Asia Pacific nations, resulting in the temporary closure of numerous automobile manufacturing units, thereby negatively impacting the regional market for automotive glass.

Based on the glass type, the Asia Pacific automotive glass market has been segmented into laminated glass, tempered glass, and others, where laminated glass currently holds the majority of the total market share.

Based on the vehicle type, the Asia Pacific automotive glass market can be divided into passenger cars, light commercial vehicles, trucks, buses, and others. Currently, passenger cars account for the largest market share.

Based on the application, the Asia Pacific automotive glass market has been segregated into windshield, sidelite, backlite, rear quarter glass, sideview mirror, rearview mirror, and others. Among these, windshield currently exhibits a clear dominance in the market.

Based on the end-user, the Asia Pacific automotive glass market can be categorized into OEMs and aftermarket suppliers. Currently, OEMs hold the majority of the total market share.

On a regional level, the market has been classified into China, Japan, India, South Korea, Australia, Indonesia, and others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)