Asia Pacific Commercial Printing Market Size, Share, Trends and Forecast by Technology, Print Type, Application, and Country, 2025-2033

Asia Pacific Commercial Printing Market Size and Share:

The Asia Pacific commercial printing market size was valued at USD 291.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 319.7 Billion by 2033, exhibiting a CAGR of 1.10% from 2025-2033. The Asia Pacific commercial printing market growth is driven by the growing demand for packaging materials, rapid industrialization, and increasing e-commerce activity. Rising disposable incomes, technological advancements, and adoption of digital printing further contribute to the market's significant growth potential.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 291.3 Billion |

|

Market Forecast in 2033

|

USD 319.7 Billion |

| Market Growth Rate (2025-2033) | 1.10% |

The Asia Pacific commercial printing market is registering strong growth with factors such as growing demand for high-quality packaging solutions driving this growth. There is a growing demand for creative and durable packaging that allows products to differentiate themselves across the growing e-commerce and consumer goods landscape in the region and drive brand visibility. As per IMARC Group, Southeast Asia e-commerce market size is projected to exhibit a growth rate (CAGR) of 19.40% during 2024-2032. Sectors like food and beverages, pharmaceuticals, and retail are leading this charge, pushing for innovative printing options like flexible packaging, labels, and cartons. There is also an increasing emphasis on the use of sustainable and green printing materials, in line with greater worldwide environmental trends. Besides, with prevailing Asia Pacific commercial printing market trends such as advancements in printing technologies, including digital and 3D printing, businesses can now produce faster with customizable designs that cater to their varied needs.

.webp)

To get more information on this market, Request Sample

Commercial printing market is primarily driven by the expansion of advertising and branding activities throughout Asia Pacific. Effective campaigns are created using printed materials such as brochures, banners, and posters and are over-relying on printed marketing materials and businesses. In addition, the increasing number of small and medium-sized enterprises (SMEs) in the region contributes to the need for cost-effective and tailored printing solutions. Events, trade shows, and promotional campaigns also drive the need for visually appealing printed materials and positively impact Asia Pacific commercial printing market demand. As the region’s economies expand and consumer spending grows, businesses invest more in marketing and branding, driving the demand for innovative and cost-effective commercial printing services.

Asia Pacific Commercial Printing Market Trends:

Growth of publishing industry

The publishing industry in the Asia Pacific region is boosting the commercial printing market. Countries like India, China, and Japan have a strong demand for printed books, newspapers, and magazines, thanks to their large populations and high literacy rates. As per the World Bank, the literacy rate of adults aged 15 or above in East Asia Pacific was 96% in 2023. There's also a growing interest in publications in regional languages, which increases the need for a variety of localized printing options. Schools and government programs that promote literacy are contributing to the demand for textbooks and educational materials. Besides, the rise of hybrid publishing, which mixes print and digital formats, is encouraging investments in high-quality printing technologies to meet changing consumer preferences.

Economic growth and urbanization

Rapid economic growth and urbanization in Asia Pacific are fostering the expansion of industries that rely on commercial printing, such as retail, real estate, and hospitality. As per the Asian Development Bank, by 2030, more than 55% of the Asian population will be urban. Urbanization is driving the construction of shopping centers, restaurants, and hotels, which require printed materials like menus, signage, and promotional flyers. Additionally, economic growth has led to increased consumer spending on branded products, enhancing demand for visually appealing packaging and marketing materials. This trend is encouraging businesses to adopt advanced printing technologies to produce high-quality and cost-effective printed outputs, strengthening the commercial printing market in the region.

Green printing initiatives

As awareness about environmental issues grows in the Asia Pacific region, businesses are increasingly turning to sustainable printing practices. This shift is sparking innovation in the commercial printing market. Both consumers and companies are looking for eco-friendly options, like biodegradable inks, recycled paper, and energy-efficient processes. On top of that, governments and environmental groups are pacing up with regulations and incentives to assist greener printing methods. These efforts are prompting commercial printers to explore technologies like waterless printing and digital workflows, which help cut down on waste and energy use. By tackling environmental challenges, the move toward sustainable printing is opening up new opportunities and transforming the commercial printing landscape in the region.

Asia Pacific Commercial Printing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific commercial printing market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on technology, print type and application.

Analysis by Technology:

- Lithographic Printing

- Digital Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

Lithographic printing holds the largest market share. Lithographic (offset) printing is highly versatile, making it ideal for a wide range of commercial printing applications, including books, newspapers, magazines, packaging, and marketing materials. Its ability to produce consistent, high-quality images at scale has positioned it as the preferred choice for large-volume printing requirements in Asia Pacific. This versatility enables it to cater to diverse industries, such as publishing, advertising, and retail, which are thriving in the region. Media Partners Asia (MPA) has released its most recent research, "ASIA PACIFIC ADVERTISING TRENDS 2024," which forecasts a 5.1% increase in net advertising revenue across 14 measured Asia Pacific economies in 2024, totaling US$ 238 Billion.

Analysis by Print Type:

- Image

- Painting

- Pattern

- Others

Image dominates the market due to its extensive use in advertising and branding activities. Businesses across industries rely on visually appealing printed images for promotional materials, such as banners, posters, and billboards, to attract customers. With rapid urbanization and the proliferation of shopping centers, events, and trade shows, the demand for high-quality image printing has surged significantly. Besides, key industries such as retail, packaging, and publishing heavily rely on image printing to enhance their visual appeal and brand identity. Packaging, in particular, benefits from eye-catching designs that improve product visibility and consumer engagement.

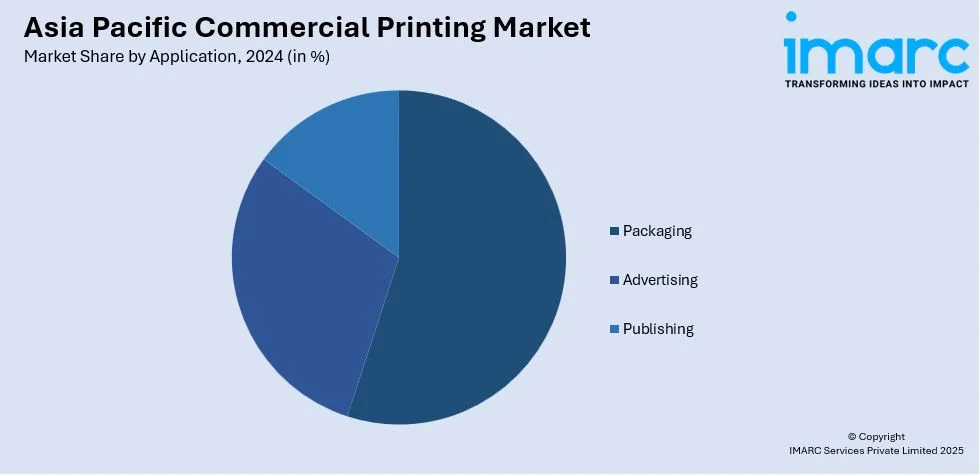

Analysis by Application:

- Packaging

- Advertising

- Publishing

Packaging holds the largest market share the rapid growth of e-commerce in countries like China, India, and Southeast Asia has significantly increased the demand for printed packaging. Packaging serves as a critical component for protecting goods during transportation while simultaneously enhancing brand visibility through eye-catching designs and logos. As online puchasing gained momentum, the need for innovative, high-quality packaging solutions has increased proportionally. Moreover, with economic growth and rising disposable incomes in Asia Pacific, consumers increasingly prefer branded and premium products. This trend has amplified the demand for aesthetically appealing and functional packaging, driving investments in advanced printing technologies such as digital and flexographic printing to meet diverse branding requirements.

Regional Analysis:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China leads the Asia Pacific commercial printing market due to its robust manufacturing infrastructure, large consumer base, and growing demand for printed materials across various industries. The country benefits from a well-established supply chain and access to cost-effective raw materials, which enhance production efficiency and competitiveness. The rise of e-commerce and retail in China has significantly boosted demand for packaging, labels, and promotional materials, further driving the commercial printing sector. Additionally, advancements in digital and 3D printing technologies have enabled businesses to meet diverse customer needs, such as customized and high-quality prints.

Competitive Landscape:

Key players are stepping up their game by investing in the latest printing technologies like digital printing, offset printing, and 3D printing. These advancements are boosting efficiency, cutting costs, and improving the quality of their output. With these technologies, businesses can offer personalized and short-run printing, which is perfect for the growing demand for customized packaging and marketing materials. Innovations such as UV printing and hybrid printing systems are also helping companies deliver quicker, high-quality results that cater to a wide range of customer needs. Sustainability is becoming a big deal in the commercial printing industry. Many leading companies are embracing eco-friendly practices, like using biodegradable inks, recyclable materials, and energy-efficient processes, to meet environmental regulations and align with what consumers want. By positioning themselves as leaders in green printing, they attract environmentally conscious clients and gain a competitive advantage, thus creating a favorable Asia Pacific commercial printing market outlook.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific commercial printing market with detailed profiles of all major companies.

Latest News and Developments:

- November 2024: 3D Systems (NYSE:DDD) has announced numerous new products that will be showcased at Formnext 2024, including sophisticated printing processes and materials designed to assist customers fulfill a wide range of application needs and speed innovation. The business is publishing next generation solutions in its Stereolithography (SLA) and Figure 4 portfolios: PSLA 270 comprehensive solution, containing the Wash 400/Wash 400F and Cure 400, Figure 4 Rigid Composite White, and Accura® AMX Rigid Composite White.

- August 2024: Canon U.S.A., Inc., a digital imaging solutions provider, has invited participants to Booth #C348 at PRINTING United Expo 2024 in Central Hall, which will be held at the Las Vegas Convention Center from September 10 to 12. The varioPRINT iX1700 color inkjet manufacturing press, as well as the imagePRESS V1350 and imagePROGRAF GP-4600S, the Arizona 2380GTF high-performance flatbed printer, and the return of the Colorado M-series printer, were among the highlights of the PRINTING United Expo 2023.

- March 2024: HP has introduced the latest lineup of HP digital printing presses. The new HP Indigo 120K Digital Press provides best-in-class productivity1, while the 18K Digital Press can handle the broadest variety of print applications created with a single B2 digital press2.

- September 2024: Proto Labs, Inc. (PRLB) announced the launch of Axtra3D Hybrid PhotoSynthesis (HPS) technology, which increases its 3D printing capabilities. The introduction of HPS compliments Proto Labs' objective of meeting additional customer needs and expanding into production use cases.

- March 2024: Manroland Goss, the leading supplier of web offset printing and digital finishing solutions, will present a wide range of innovations and pioneering solutions at this year's drupa, which will take place from May 28 to June 7, 2024. The Augsburg-based machine maker will highlight its pioneering role in the branch in Hall 16 / F02, with the theme "WE ARE PRINT. WE ARE WEB OFFSET. WE ARE MORE."

Asia Pacific Commercial Printing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Lithographic Printing, Digital Printing, Flexographic Printing, Screen Printing, Gravure Printing, Others |

| Print Types Covered | Image, Painting, Pattern, Others |

| Applications Covered | Packaging, Advertising, Publishing |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific commercial printing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific commercial printing market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific commercial printing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific commercial printing market in the region was valued at USD 291.3 Billion in 2024.

The Asia Pacific commercial printing market growth is driven by growing demand for packaging materials, rapid industrialization, and increasing e-commerce activity. Rising disposable incomes, technological advancements, and adoption of digital printing further contribute to the market's significant growth potential.

IMARC estimates the Asia Pacific commercial printing market to exhibit a CAGR of 1.10% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)